Eric client investment deck

-

Upload

ennovateresearch -

Category

Business

-

view

134 -

download

0

Transcript of Eric client investment deck

ENNOVATE RESEARCH INVESTMENT &

CAPITAL

1

ENNOVATE RESEARCH INVESTMENT & CAPITAL

Creating Wealth With A Non-

Traditional Approach .

2 CONFIDENTIAL DOCUMENT

“The traditional approach relies on human

forecasting, ours forbids the Human Element”

VISION & MILESTONES

ERIC has the vision to create value to the investor in the long term by creating wealth .We believe in keeping complete transparency in all our investment processes. ERIC follows disciplined investing methods which are inspired by proven mechanism used in the CTA sector of investment management in the U.S

• Phase 1-Raised 25 lacs from 4 Investors ( 40.1% Return over 15 months)

• Phase 2- Expansion- Raised 1.5 Cr

• Current Objective - Reach 5Cr by March 2016

• Medium Term Goal-20 Cr Fund Value with 20 Investors in 3 Years

• Long term Goal- Global Institutional Fund Management

CONFIDENTIAL DOCUMENT 3

PERFORMANCE COMPARISON

2008 2009 2010 2011 2012 2013 2014 Annualized

Gold –

26.49%

Gold-

19.07%

Gold-

24.4%

Gold-

31.25%

Gold-

10.14%

Gold-

(-19%)

Gold-

7.4%

12.21%

Silver

(-8%)

Silver

43.2%

Silver

75.8%

Silver-

7.19%

Silver-

12.37%

Silver-

(-27.8%)

Silver-

5.55%

12.9%

INR-

23.5%

INR

(-4.4%)

INR

(-3.94%)

INR-

19.13%

INR-

2.39%

INR-

12.6%

INT

-2.64%

6.5%

Real Est-

N/A

Real Est-

N/A

Real Est-

N/A

Real Est-

18.35%

Real Est-

8.5%

Real Est-

3.45%

Real Est-

1.89%

12.27%

CONFIDENTIAL DOCUMENT 4

Nifty-

(-64.14%)

Nifty-

94.14%

Nifty-

18.72%

Nifty-

(-38.05%)

Nifty-

23.33%

Nifty-

4.06%

Nifty-

45.9%

10.6%

FD-

9%

FD-

9%

FD-

9.50%

FD-

10%

FD-

9.75%

FD-

8.03%

FD-

8%

8.50%

Traditional

Non-Traditional

Real Estate Silver

Gold Currency

Major Non- Traditional Assets

ERIC DIVERSIFIED PROGRAM`

• ERIC’s Diversified Trend-Following Program is systematic and technical.

• Researched and Tested mathematical algorithm to analyze technical data in

order to generate trading signals.

• These signals are applied to a diversified portfolio comprising of commodities,

equity & currency in a predominantly quantitative or mechanical fashion.

• The program does not necessarily expect profitability over the short-term but

is, instead, geared to generate competitive returns over the long-run.

• A strict money management discipline is in place, the design of which is

intended to maximize return while diminishing volatility.

5 CONFIDENTIAL DOCUMENT

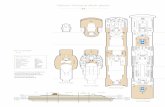

EQUITY INDICES

NIFTY

BANKNIFTY

19% Max Exposure

METALS

GOLD

SILVER

COPPER

NICKEL

ZINC

31% Max Exposure

ENERGY CRUDE OIL

NATURAL GAS

19% Max Exposure

AGRI COMMOD

I-TIES

CHANNA

COTTON

MUSTARD

SOYBEAN

17% Max Exposure

CURRENCY

USD-INR

GBP-INR

14% Max Exposure

STRATEGY

ERIC follows the basic strategy of trend-following

across uncorrelated markets

Entry and Exit are only 30% of the strategy

At ERIC we focus on managing a position after the

trade is entered

The idea is to increase the size of average winner

by letting the profits run and cutting short the losses

by strict stop loss regime

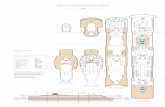

• Chart: A shows the percentage of trades which

are winners or losers and then the return

generated per losing trade and winning trade

3

CONFIDENTIAL DOCUMENT

70% Losing Trades 1X Loser

30% Winning

4 X Winner

Trades Return Per Trade

Chart A

Loosing Trades Winning Trades

7

Year Beginning Balance Return % VAAI (Pre Tax) VAAI (Post Tax)

2,007 1,000

2,008 1,000,000 53.6% 1,536 1,376

2,009 1,536,454 40.0% 2,151 1,761

2,010 2,151,136 25.6% 2,701 2,076

2,011 2,700,890 39.1% 3,758 2,644

2,012 3,757,839 21.0% 4,547 3,033

2,013 4,546,709 30.5% 5,935 3,681

2,014 5,934,890 10.2% 6,539 3,943

Annual Returns

(CAGR%) 30.8% 21.7%

BACKTESTED & LIVE PERFORMANCE

Date Beginning Balance Ending Balance Return% VAQI

1000

30-Sep-13 2,500,000 3,093,900 24% 1237.56

31-Dec-13 3,093,900 2,682,438 -13% 1072.98

31-Mar-14 2,682,438 2,903,202 8% 1161.28

30-Jun-14 2,903,202 3,535,820 22% 1414.33

30-Sep-14 3,535,820 3,502,986 -1% 1401.19

31-Oct-14 3,502,986 3,022,657 0.30% 1405.40

Annual (CAGR) 41%

VAAI (Post Tax)

RISK

14 CONFIDENTIAL DOCUMENT

•Long periods of drawdown are expected

•Maximum back tested drawdown (36%)

•Drawdown of 40% will lead to trading suspension

•Trading resumption only after committing extra capital

•Trading discontinuation due to risk parameter instability

WE sell RISK not Return

BACKTESTED DRAWDOWN CHART

(400,000)

(350,000)

(300,000)

(250,000)

(200,000)

(150,000)

(100,000)

(50,000)

-

Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14

INVESTMENT PROCESS

•Minimum account size needed is Rs.10,00,000 with additional Rs.2,50,000 committed capital

• Investment horizon should be minimum 2 years

•Maximum risk taken would be 40% of the committed capital i.e. Rs.5,00,000 (If base capital reduces by Rs. 5,00,000 then account trading will be suspended and remaining amount will be returned back to investor)

•Post Tax Net Return targeted is 25%

•Hurdle rate of return will be 8% of AUM

•Fees will be 2% of AUM

•Lock In period – 2 years

•Performance

• Incentive and Fees will be withdrawn every quarter calculated on the quarterly performance

9 CONFIDENTIAL DOCUMENT

Investor Bank Account

Funds to Investor’s Broker Account

Trades ordered as per ERIC Diversified Trend

Program

Required funds withdrawn from Broker

A/C

ERIC Advisory Services

MANAGEMENT TEAM Sameer Gunjal-CEO

Sameer has a varied experience of 8 years in capital markets. He is the

managing partner of Ennovate Solutions, which advises clients on fund

management.. Prior he has worked with Credit pointe Services as Sector

Lead, and with CRISIL Irevna Research for a team of 4 Analysts from a

premier Investment bank, to do equity research aligned to the US Business

Services sector and Canadian Metals & Mining sector. Sameer has done his

MBA from NITIE, Mumbai and Mechanical Engineering from VJTI, Mumbai.

He has cleared all 3 levels of the CFA, USA Program.

Vinit Desai

As a lead Trader with ERIC, Vinit has a diverse experience in trading

Internationl (primarily US ) and Indian Capital Markets for past 8

years. Prior, he has managed trading accounts for clients with

Religare Securities and Indiabulls Securities in Indian Stock Market.

Vinit has done his MBA from Wellingkar, Mumbai and Computer

Science Engineering from Pune

CONFIDENTIAL DOCUMENT 10

Yogesh Thakur

Yogesh takes care of Strategy and Operations at ERIC.

He has an experience of 6 years in financial modeling and

derivatives strategy development.. Yogesh is a Computer Science

Graduate and as a Masters of Business Administration (MBA) form

ICFAI Business School.

Hrushikesh Kale Hrushikesh has 3 years of experience in equity research. He was also a

full time faculty in Management and now he is visiting faculty. Hrushikesh

has done his MBA from SIMCA , Pune and Mechanical Engineering from

GCOE. Amravati. He has cleared 2 levels of CFA, USA Program.

Allen is a CFA level 3 candidate with experience in Advertising with Mc

Cann Erikson and Financial Training at IMS Proschool, as a Center Head .

He took the Pune Region for a 100% growth in one years time and had

increased the quality of education given till date.

Allen Aravindan

Tejas leads Sales and Strategy team at ERIC. Having a vast

experience in Sales and Strategic development at India’s top startup

companies such as MindTickle and TouchMagix. Handled sales over

500k USD leading top client acquisitions such as Walmart brazil and

MakeMyTrip etc. Tejas has done B.E Computers from Pune University.

He has cleared CFA Level 1 and FRM Level 1, USA

Tejas Doshi

DISCLAIMER This presentation has been prepared solely for informational purposes and may not be relied on in any manner as legal, tax or investment advice or as an offer to sell or the solicitation of an offer to buy an interest in any fund.

This presentation should be considered confidential as it contains important information about the fund’s risks, fees and expenses and may not be reproduced in whole or in part, and may not be circulated or redelivered to any person without the prior written consent of Ennovate Solutions.

Certain information contained herein constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is not a guide to or otherwise indicative of future results .

Except where otherwise indicated herein, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date here of.

None of the information contained herein shall constitute, or be construed as constituting or be deemed to constitute “investment advice”.

The investments in Systematic products/strategy rely on various economic factors and are subject to market risks and forces affecting the capital markets. The value of the portfolio under products/strategy can go up or down depending on the various factors that affect the capital market.

11 CONFIDENTIAL DOCUMENT

Contact Details

Office No. 1, Gunjal Complex, Off. J M Road, Deccan Gymkhana, Pulachiwadi, Pune – 411004

Website: www.ericap.in,

email: [email protected] ,

Mob.: 9158582792

“ Beyond Numbers, Value We Create” -ERIC