amn - makowalczyk.files.wordpress.com · amn . Title: MODEL Created Date: 20150821092552Z

Equity Research Report: AMN Healthcare (NYSE: AMN)

-

Upload

jay-t-anderson -

Category

Documents

-

view

233 -

download

2

Transcript of Equity Research Report: AMN Healthcare (NYSE: AMN)

0

Prepared by:

Jay T Anderson Liyang Cai

Steven Goodwill Dana Huynh

Chase Lindsey Nirvon Mahdavi

Mark Storey Travis Warner

University of Utah Student Investment Fund

April 5, 2016

Table of ContentsCompany Overview.....................................................................................................................................................5

Historical Stock Performance...................................................................................................................................5

Investment Thesis.......................................................................................................................................................6

Business Model...........................................................................................................................................................7

Customer Value Proposition....................................................................................................................................7

Reportable Segments..............................................................................................................................................8

Products.................................................................................................................................................................. 8

Staffing and Recruitment.....................................................................................................................................9

Workforce Solutions..........................................................................................................................................10

Executive Leadership.........................................................................................................................................10

Advisory Services...............................................................................................................................................10

Revenue Model.....................................................................................................................................................10

Cost Model............................................................................................................................................................11

Market Segment....................................................................................................................................................11

Competitive Strategy.............................................................................................................................................11

Industry and Competitive Positioning......................................................................................................................13

Industry Outlook....................................................................................................................................................13

Major Industry Players...........................................................................................................................................13

Industry Trends......................................................................................................................................................14

Supply Shortages...............................................................................................................................................14

Increased Healthcare Utilization.......................................................................................................................14

Industry Competitive Structure.............................................................................................................................15

Threat of New Entrants and Substitutes............................................................................................................15

Threat of Suppliers............................................................................................................................................15

Comparable Ratios................................................................................................................................................16

Return on Assets...............................................................................................................................................16

Current Ratio.....................................................................................................................................................16

Total Liabilities to Total Assets..........................................................................................................................16

Executive Management and Corporate Governance................................................................................................17

Management Team...............................................................................................................................................17

Management Performance...............................................................................................................................18

Insider Stock Holdings.......................................................................................................................................18

Board of Directors.................................................................................................................................................19

ISS Governance Quickscore...............................................................................................................................20

General Employees...................................................................................................................................................21

Employee Value Proposition..................................................................................................................................21

Competitive Pay................................................................................................................................................21

Placement in Top Facilities................................................................................................................................21

Flexibility...........................................................................................................................................................21

1

Employee Satisfaction...........................................................................................................................................21

Licensing Requirements.........................................................................................................................................22

Financial Analysis......................................................................................................................................................24

Income Statement.................................................................................................................................................24

Cash Flow...............................................................................................................................................................25

Organic Growth Strategy...........................................................................................................................................26

Further Develop Processes to Achieve Market-leading Efficiency.........................................................................26

Continue to Invest in Infrastructure......................................................................................................................26

Acquisitive Growth Strategy.....................................................................................................................................27

Acquisitions...........................................................................................................................................................28

Valuation...................................................................................................................................................................30

Valuation Methods................................................................................................................................................30

Hybrid DCF.............................................................................................................................................................30

Peer Group Multiple Analysis................................................................................................................................30

Valuation Summary...............................................................................................................................................31

Sensitivity Analysis.................................................................................................................................................31

Economic Downturn..........................................................................................................................................31

Acquisition.........................................................................................................................................................31

Risks...........................................................................................................................................................................33

Firm-Specific Risks.................................................................................................................................................33

Contracts...........................................................................................................................................................33

Acquisition Integration Failure..........................................................................................................................33

Medical Personnel Shortage Inhibits Recruiting................................................................................................33

Industry and Macro Risks.......................................................................................................................................34

Healthcare Policy Changes................................................................................................................................34

Vulnerability to Market Downturns...................................................................................................................34

Recommendation......................................................................................................................................................34

Appendix I: Historical and Projected Income Statements..........................................................................................35

Appendix II: Historical and Projected Balance Sheets................................................................................................36

Appendix III: Projected Statements of Cash Flows.....................................................................................................37

Appendix IV: Model Assumptions..............................................................................................................................38

Appendix V: Debt Schedule........................................................................................................................................39

Appendix VI: Market Share Projections.....................................................................................................................40

Appendix VII: Depreciation Schedule.........................................................................................................................41

Appendix VIII: WACC Calculation...............................................................................................................................42

Appendix IX: Discounted Cash Flow Valuation...........................................................................................................43

Appendix X: AMN Healthcare Comp Set....................................................................................................................44

Appendix XI: Selected Competitor Ratio Comparisons...............................................................................................45

Appendix XII: Selected Competitor Stock Performance.............................................................................................46

2

Executive Summary

AMN Healthcare is a healthcare staffing and workplace solutions company that operates throughout the United States. The company primarily serves acute-care hospitals and is partnered with some of the largest and most prestigious hospitals in the country, such as Kaiser Foundation Hospitals, Johns Hopkins Health System, and Stanford Hospital and Clinics. AMN’s staffing services include travel nurses, locum tenens physicians, and other allied professionals, which includes non-physician health professionals such as chiropractors and dentists. In the workplace solutions segment of the business, AMN offers recruitment outsourcing, medical executive placement services, and various software products that optimize the staffing function.

AMN’s most important non-staffing products are its managed services program (MSP) and vendor management software (VMS). MSP is a suite of workplace management services that allows AMN to coordinate all staffing and workforce needs of its clients using predictive analytics, allowing the clients to focus on caregiving. VMS is a SaaS-based program which allows clients to search for and place orders for staffers on an as-needed basis. MSP has been an especially important growth driver for the company, increasing from just 1% of company revenues in 2008 to 35% in 2015. These services are the most comprehensive in the industry, which we believe will assist the company as it seeks to gain market share. Hospitals will be able to replace their current disparate workforce services vendor in favor of AMN as a single point of contact.

AMN derives a competitive advantage from its wide geographic network and high quality staffers. The company operates in all 50 states, allowing it to match the right staffers to the right hospitals no matter where they are located. AMN’s staffers are widely recognized as the best in the healthcare staffing industry, with the company winning several awards and getting recognized for staffer credentials, efficiency, and education.

AMN grew very quickly over the last two years, fueled by a string of successful acquisitions. AMN management has shown great ability to find high-value acquisition targets and integrate them into a larger company effectively. As the healthcare staffing industry is highly fragmented and AMN still appears to have an appetite for acquisition, we believe that this bolt-on strategy could be a potential growth driver into the future and complement the firm’s healthy organic growth rates.

These company characteristics combine with favorable trends in the healthcare industry to further the attractiveness of the company. The implementation of the Affordable Care Act and the subsequent increase in the number of individuals with health insurance has led to an increase in demand for healthcare services. This has driven an increase in demand for both healthcare staffers and workplace optimizing programs like AMN’s MSP.

Due to these factors, we recommend a BUY on AMN Healthcare with a target price of $50.05. This represents an upside of 45% over the closing price on April 4, 2016.

3

Company Overview

AMN Healthcare (NYSE: AHS) began in 1985 as a travel nursing company, placing nurses nationwide in medical facilities experiencing staffing shortages. The company, now headquartered in San Diego, California, has grown to provide various healthcare workforce solutions and staffing services through twenty brand names. The company provides clients with access to the largest network of qualified clinicians in the country through temporary and permanent staffing, workforce optimization services, recruitment outsourcing and consulting, and vendor management systems (VMS), which allow clients to manage their staffing services independently. The company held its initial public offering in November 2001, where it raised $170 million.

AMN Healthcare operates in all 50 states, with over half of its professional assignments at acute-care hospitals. The company’s clients include some of the largest healthcare companies in the nation, including Kaiser Foundation Hospitals, MedStar Health, NYU Medical Center, and Stanford Hospitals and Clinics.

As of December 31, 2015, AMN Healthcare had 2,550 corporate employees and an average of 8,091 healthcare professionals on contract, not including locum tenens—short-term, temporary staffers—who are hired as independent contractors.

Historical Stock Performance

Figure 1: AHS Stock Chart since IPO

4

AMN went public in 2001 with an offering of 10,000,000 shares at a price of $17 per share. Since then, the stock price has experienced fluctuations driven, at least in part, by supply and demand trends for nurses and physicians.

Following the IPO, the stock did well as the temporary healthcare staffing industry grew at a compounded annual growth rate of 21% from 2000 to 2002. The stock price declined steeply from $35 a share to $9 a share by first quarter of 2003 as demand for temporary healthcare professionals declined. During this period, hospitals increased nurse recruiting efforts and healthcare clients were less likely to leave their positions which decreased demand for AMN’s temporary healthcare professionals. The downward decline in demand and stock price continued through 2004. By 2004, demand began to increase each quarter and in 2005, AMN made an acquisition to extend its services to temporary and permanent physician staffing to cater to a growing physician shortage and take advantage of the immature temporary physician market. AMN’s stock price trend improved through 2006 as the industry experienced strong demand in the nursing staffing sector and the stock reached $28 per share. Demand continued to exceed supply through 2007, but with lower hospital admission levels and aggressive hiring of new graduates in key states such as California, AMN suffered again and the stock price fell to $5 per share in 2008. This stemmed from a disastrous combination of the demand issues as well as cost issues, Medicare reimbursement problems, and an overall slump in the economy. The stock remained around $7 per share until the end of 2012 when demand for the travel nurse business began to rebound. By 2013, demand improved substantially and AHS reaped the benefits of new service extension offerings it implemented in 2010, as well as more recurring revenue sources such as managed services programs and recruitment process outsourcing. The healthcare environment continued to pick up in 2014 and, by 2015, the stock price reached $34 a share with robust demand in service offerings and high level of demand in workforce solutions programs.

Investment Thesis

Our investment thesis for AMN is crafted around three main pillars:

1. AMN’s nationwide network of high-quality healthcare professionals creates a competitive advantage.

2. AMN has a strong management team which has correctly responded to the needs of the market to create a compelling product mix.

3. AMN’s Managed Service Program has created numerous cross-selling opportunities for the company as it builds strong relationships with clients.

These thesis points will be explored throughout this report to illustrate the strength of AMN as an investment opportunity.

5

Business ModelCustomer Value Proposition

The number one priority of healthcare industry personnel, both caregivers and executives, is the quality of patient care.1 A successful patient interaction begins with having caregivers available when they are needed. For a variety of reasons—mainly staff turnover, a long hiring process, and seasonal surges in demand—hospitals may not have the requisite number of nurses or physicians on staff to adequately handle the inflow of patients.2 In these situations, hospitals need extra healthcare professionals to step in to help. The temporary healthcare staffing industry exists to bridge this gap between supply and demand and prevent the quality of patient care from being compromised.

Unfortunately, temporary staffing does not always meet this goal. The average U.S. hospital utilizes three different staffing services with three different points of contact, which means that coordination between the services is difficult and can lead to an improper scheduling of temporary staff.3 As a result, quality of care suffers. AMN Healthcare provides a comprehensive solution: quality temporary healthcare personnel provided in conjunction with a solution for staffing logistics. AMN makes it simple for hospitals to maintain a high quality of care by providing the highest quality medical professionals at any time.

It is impossible for hospitals to fill these temporary positions themselves as they do not have the networks necessary to overcome the geographic inefficiencies of the healthcare labor market. Healthcare providers would have to rely on nearby members of the labor supply and hope that qualified staffers are available. Healthcare staffing companies have the distinct advantage of drawing from a nationwide pool of qualified staffers immediately using their networks. AMN has the largest geographic network in the industry with staffers in all 50 states.

In addition to meeting the need for continuity of care, the temporary healthcare staffing industry assists healthcare providers in controlling costs. If temporary staffing were unavailable, hospitals, if demand is to be met, would be forced to hire permanent staff. The problem here is that demand for healthcare is variable due to seasonality, epidemics, and natural disasters, among other things. If hospitals maintained the staff necessary to meet these demand peaks at all times—not to mention specialists whose services are needed only occasionally—they would be forced to pay excess staff during the ebbs in the demand cycle. For this reason, hospitals do not mind paying a premium to an intermediary for temporary staffing because that premium is offset by the savings of not hiring excess permanent staff. The service provided is a form of risk pooling. Staffing agencies specialize in maintaining relationships with a large number of professionals with a variety of specialties which lowers their cost of finding a professional to fill a temporary vacancy.

1 KPMG U.S. Hospital Nursing Labor Costs Study 2 KPMG U.S. Hospital Nursing Labor Costs Study3 AMN Healthcare Q4 2015 Earnings Call

6

Reportable Segments

AMN reports its operations in three segments: nurse and allied solutions, locum tenens solutions, and other workforce solutions.

The nurse and allied solutions segment provides nurses, therapists, radiology technicians and other non-physician medical staff to work temporary assignments in medical facilities and with healthcare providers nationwide. It also includes MSP services. In the fourth quarter of 2015, nurses and allied solutions accounted for 63% of AMN’s revenues, with nearly half of that total coming from MSP services.

The locum tenens solutions segment specializes in placing “specialized and advanced practice” physicians, clinicians and dentists on temporary assignments with all types of healthcare providers nationwide. This segment accounted for 22% of AMN’s revenue during the most recent quarter.

The other workforce solutions segment consists of healthcare executive search and advisory services, vendor management systems (VMS), recruitment process outsourcing (RPO), and workforce optimization services. This segment accounted for 15% of the firm’s revenues in the most recent quarter.

It is difficult to determine the change in these segments’ performance and the resulting revenue mix due to a change in reporting segments in the first quarter of 2016.

Products

AMN’s offerings can be broken up into four main categories: staffing and recruitment, workforce solutions, executive leadership, and advisory services. AMN is able to offer an integrated product suite to its clients by providing a diverse range of nurse and physician staffing services as well as software offerings to manage staffing and other human resource functions.

7

(Source: February 2016 Investor Presentation)

Staffing and Recruitment

Within staffing and recruitment, AMN caters to acute-care hospitals, teaching institutions, trauma centers, and other healthcare facilities by providing staffing and recruitment of nurses, physicians, and allied health professionals. Nurse staffing encompasses travel staffing, rapid response staffing, and per diem staffing. Physicians are staffed on a locum tenens basis as well as permanent placement. Allied healthcare professionals such as physical therapists and pharmacists are staffed on a full spectrum of permanent placement, travel, temporary and local needs.

Travel nurse staffing places nurses on temporary assignments that typically last 13 weeks. With a three to five week lead time, clients are able to fill vacancies with a cost effective and quick solution. AMN’s brands include American Mobile, Onward Healthcare, Nurses Rx, and O’Grady-Peyton, which focuses on recruiting nurses from other countries. The typical cost of an AMN travel nurse is an all-in (payroll, taxes, insurance, meals, housing, etc.) hourly rate of $58 to $64 as compared to a national average of $59.67 hourly rate for a full-time staff on a hospital staff.

AMN also addresses shorter-term staffing needs. Rapid response nurse staffing, with a shorter lead time of one to two weeks, places nurses for shorter assignments that typically last four to eight weeks. NurseChoice is the brand that facilitates this service which commands a 4% premium over traditional travel nursing to compensate for its shorter lead times.

Per diem, or local, staffing places locally-based healthcare professionals on a daily shift on an as-needed basis. Local staffing agencies can turnaround staffing requests in less than 24 hours. NurseFinders provides local staffing for nurses in 30 local areas. Local staffing can command substantial premiums above traditional travel nursing depending on the location, position, and other supply and demand factors.

8

Staffing and Recruiment

Travel nursingLocal staffingLocum tenensAllied staffingPhysician placementRapid response and crisis staffingMid- to senior level leadership placementEMR implementationLabor disruption

Workforce Solutions

Managed services programs (MSP)Recruitment process outsorcing (RPO)Vendor management systems (VMS)Scheduling and labor managementEducation servicesFloat pool managementTelehealth - Pharmacy

Executive Leadership

Interim leadershipExecutive searchPhysician leadership searchNurse leadership searchExecutive coachingLeadership training and development

Advisory Services

Workforce analysis and optimizationPredictive modeling and analyticsStrategy consultingFinancial and operational performance improvementRegulatory compliance

AMN places physicians on a locum tenens and permanent staffing basis. Locum tenens staffing allows AMN to place independent contractor physicians on assignments that can last from a few days up to one year. Contracts are made through the AMN brands Staff Care, Linde Healthcare, and Locum Leaders. Permanent placement services to clients are done on a retained basis—meaning fees are paid upfront—via Merritt Hawkins and MilicanSolutions and a contingent basis—meaning fees are paid after placement—via Kendall & Davis.

Additionally, AMN also provides allied health professionals staffing on a travel, local, and permanent basis. Through Med Travelers, Club Staffing, and Rx Pro Health, physical therapists, occupational therapists, pharmacists, and other allied professionals are matched with a client’s needs. Workforce Solutions

Workforce Solutions encompasses various programs that allow clients to manage their staffing needs. The Managed Services Program (MSP) is a service that manages all of a client’s staffing needs by automatically assigning healthcare professionals from AMN to clients as the system’s predictive analytics software determines a need exists. AMN offers Vendor Management Systems (VMS) through its MSP as well as a vendor-neutral VMS that allows the client to manage the procurement on its own. ShiftWise and Medefis are the two technologies that are offered to control personnel tasks on a single system and consolidate reporting. AMN earns a 3-4% fee, calculated from the total spent on staffing, from these programs. Recruitment Process Outsourcing (RPO) replaces a client’s internal recruiting. Under an RPO contract, AMN facilitates the entire recruiting and onboarding process for all temporary and permanent staff of the client. Executive Leadership

AMN also provides medical executive placement services. Through its recent acquisitions of B.E. Smith and TFS, AMN can provide executive and clinical leadership interim staffing and headhunting services for permanent placement of senior healthcare executives, physician executives, and chief nursing officers. This allows for improved relationships with clients since AMN employees will be decision makers, allowing for opportunities to cross-sell products such as the workforce solutions and staffing and recruitment services outlined above. Advisory Services

The advisory services segment provides workforce optimization software such as Smart Square and Avantas. These scheduling software and predictive analytics programs create staffing plans for a client which reduces a client’s overall clinical labor expenditures.

Revenue Model

AMN’s staffing and recruitment services primarily generate revenue on a per traveler per day basis. The company bills the client for the number of hours its assigned staffers work at a client’s

9

facility each day. AMN generates profit though the difference in the amount it bills the client for its services and the amount it pays out in salary to that staffer.

Additionally, through workforce solutions and advisory services, the company provides SaaS-based solutions which allows healthcare providers to manage their own temporary workforce. Called a Vendor Management System (VMS), revenue from this system is collected each time the client uses the system to book its own clinician. AMN collects a 3-4% fee on each filled posting.

The Managed Service Program (MSP) is a comprehensive suite of products and services that allow a healthcare provider to completely outsource the management and analysis of its temporary workforce to AMN. While billing under the MSP is still primarily based upon a per traveler per day basis, these MSP contracts are generally exclusive contracts that last for three or more years.

Cost Model

AMN does not disclose its cost structure in detail for any of its segments. It is clear, however, that the main expense for the company is staffer compensation. This is mainly wage expenses, but there are a few other components, depending on the type of staffer. Those who are not independent contractors—essentially any non-locum tenens staffer—receive benefits. In addition, traveling nurses receive housing paid for by AMN. The staffing segments average a gross margin of just over 30%.

The non-staffing segments are much less cost-intensive. In these segments, the primary cost is sales expenditures. Beyond mentioning a sales team and an in-house research and development team for its software products, AMN does not disclose what other expenses may be included in this segment’s cost structure. We do, however, believe that these services have higher margins. This is reaffirmed by management’s guidance that the company’s overall gross margin will grow to 33% as this segment becomes a greater portion of the company’s business.

Market Segment

AMN serves a diverse national client base of healthcare systems of all disciplines. Half of its temporary healthcare professional assignments are for acute-care hospitals. Beyond this, the company services sub-acute healthcare facilities, physician groups, rehab centers, pharmacies, and surgery centers.

Some of the largest and most prestigious healthcare systems in the United States employ AMN services, including Kaiser Foundation Hospitals (which makes up 11% of AHS’s 2015 consolidated revenue), New York Presbyterian Health System, NYU Medical Center, Stanford Hospitals and Clinics, and Johns Hopkins Health System. Relationships with these clients continue to strengthen as AMN successfully integrates its new software offerings to add further value to the partnerships.

10

Competitive Strategy

AMN works to build lasting relationships by supplying what healthcare providers want most: quality healthcare professionals as staffers. Through its permanent placement and headhunting services, AMN also aims to cross-sell those same clients on other workforce management services. This is distinctive within the industry as there are few companies that function in both the staffing and workforce management segments. AMN’s comprehensive approach gives the company a competitive advantage.

AMN is well-known within the industry for its quality staffers and is one of the few companies in the healthcare staffing industry to be certified by the National Committee for Quality Assurance, a non-profit group that evaluates and ranks healthcare facilities and suppliers based on numerous quality metrics.4 AMN’s nurses are more educated than the general nurse population, with 50% of AMN nurses holding a bachelor’s degree in nursing compared to just 34% for nurses at large.5 Additionally, AMN is the only medical staffing company with its own competency testing procedures for its staffers.6 70% of AMN’s traveling staffers have been specially requested to return to facilities to which they were previously assigned.7 AMN can, and has, leveraged its strong network of staffers to gain a competitive advantage. The geographic reach of this staff network across all 50 states greatly enhances this advantage. Other healthcare staffing companies simply cannot match the quality nor the reach.

AMN’s cross-selling strategy has shown great potential for building lasting relationships with its clients. The average AMN client purchases four different services from the company, entrenching the company within its clients’ operations.8 This integration assists clients by creating specialized product suites that meets their needs while also increasing switching costs since more operations are tied to AMN’s products, thus making switching more disruptive.

4 National Committee for Quality Assurance5 AMN Corporate Website6 Ibid.7 Ibid.8 AMN Healthcare 2015 Annual Report

11

Industry and Competitive Positioning

Industry Outlook

The healthcare staffing industry is expected to grow through the end of the decade, with a CAGR of 4.2% through 2020. This is down slightly from the 5.4% growth CAGR between 2010 and 2015.9 Based on these projections, the healthcare staffing market should reach $18.3 billion by 2020, up from $14.9 billion today.10 Firms with service offerings beyond simple staffing, like AMN, have grown more quickly than industry average in the last five years and are expected to continue to do so throughout the decade.

Major Industry Players

CHG Healthcare Services is the second largest healthcare staffing agency in the United States, with a market share of 6.0%. CHG is the leading supplier of locum tenens and also provides temporary and permanent placement services in Utah, Connecticut, Florida and Michigan. CHG provides these services through the CompHealth, Weatherby Healthcare, and RNnetwork brands. Since its recent acquisition of Foundation Medical Staffing, CHG also offers temporary and permanent dialysis staffing services nationwide.11

Cross Country Healthcare is a leading healthcare staffing agency for acute care, with an overall market share of 4.4%. As of December 31, 2015, Cross Country has more than 70 local office and 7 operation centers in Florida, California, Georgia and Missouri. These national and local resources allow the company to offer alternative solutions including outpatient and ambulatory care centers. The company offers temporary and permanent placements, managed service programs, and other services including education, retained search, and contingent search. Cross Country has more than 6,000 nurses and allied professionals and 1,500 independent physician contractors.12

RightSourcing, a privately held company, specializes in vendor management services. The company only offers two different products: managed services and locum tenens managed services. The managed services segment connects clients with temporary

9 IBISWorld Industry Report: US Healthcare Staff Recruitment Agencies10 Ibid.11 CHG Healthcare 2015 Annual Report12 Cross Country 2015 Annual Report

12

nursing and allied staffing agency services, while the locum tenens managed services helps clients coordinate with locum tenens providers.13

Jackson Healthcare is a privately held medical staffing company with more than 1,800 facilities in the United States. Jackson Healthcare offers various staffing services in the traveling, locum tenens, and permanent placement segments. Its subsidiary, Jackson Surgical Assistants, is the first nationwide staffing company exclusively focused on the surgical assistant professions. In addition, Jackson Healthcare also provides advisory, management service provider and education services.14

Industry Trends

Supply Shortages

Throughout the United States, there is a shortage of healthcare practitioners. A region is designated a Health Professional Shortage Area (HPSA) by the federal government when it does not meet a minimum level of one practitioner per 3,500 residents (or one per 3,000 residents in particularly high-need areas). Nationally, an average of 60% of needs are met with only one state, Delaware, reaching over 80%.15 California, New York, and Texas average only 45% of need met and need the second-, third-, and fourth-most professionals, respectively, to shed their HPSA designations.16 This makes sense given that they are three of the most populous states in the nation. Future staffing demand will likely be centered in these states. AMN has a presence in each of these states and is positioned to capitalize on the extreme need for nurses as it can relocate nurses from less needy areas to these severe HPSAs.

Increased Healthcare Utilization

While the number of active physicians is expected to fall dramatically, the number of individuals regularly using healthcare services has risen considerably over the past two years as a result of changes in healthcare policy. For example, since the implementation of the Affordable Care Act, the number of uninsured Americans fell from 18 percent in 2013 to 11.9 percent in 2015. As healthcare is made more affordable, millions who previously did not regularly visit hospitals, doctor offices or

13 RightSourcing Company Website14 Jackson Healthcare Company Website15 Kaiser Family Foundation16 Ibid.

13

2013 20150%

5%

10%

15%

20% 18.0%

11.9%

% of Uninsured Americans Since Af-fordable Care Act Implementation

nursing facilities will start to utilize these services more frequently, stretching the limited supply of healthcare providers. Furthermore, longer lifespans and an aging “baby boomer” generation are expected to double the number of individuals in the US ages 65 or older within the next 25 years.17 More than two-thirds of these individuals have multiple chronic conditions and treating these conditions accounts for roughly 66 percent of healthcare spending in the US.18 This means that not only are more individuals likely to regularly use the healthcare system in the next decade, but older, more expensive patients are due to come into the system as well. From a physician and nursing perspective, this means more patients that require more care. From an industry perspective, this means fewer professionals relative to demand. Since demand for healthcare services is relatively inelastic, healthcare staffing companies should be able to pass on increases in labor costs arising from high demand and low supply to their clients. AMN will be able to capitalize in the form of higher revenues.

Industry Competitive Structure

The medical staffing industry is highly fragmented, with an industry C4 of 21.6% and an HHI score of just 126.74. Some rivalry exists, but competitors do not typically compete on pricing. Instead, companies compete by leveraging quality and geography and by using MSP contracts to create exclusivity and increase switching costs in an otherwise non-exclusive contract market.

Threat of New Entrants and Substitutes

The threat of new entrants in the industry is fairly low. While capital requirements would not be intense, the threat is diminished by the need for a strong network of both associated professionals and clients. It would be difficult for a new entrant to attract a critical mass of professionals given the already stretched labor market. It would also be difficult for a new firm with little reputational sway to convince clients to switch to its service. The market is characterized by a focus on quality, so a strong brand is essential.

The threat of substitutes is marginal. The only real substitute is hiring a full-time medical professional, which is not feasible for many of the purposes of temporary staffing, namely filling vacancies during variable periods of high demand. It takes an average of 82 days to fill a permanent nursing position, and clients of temporary staffing agencies cannot wait that long when demand exists in the short-term.19

Threat of Suppliers

The supplier of the healthcare staffing industry is the labor market of medical professionals. In terms of leverage by the professionals, the threat is relatively low since many are independent contractors with little leverage. The greater threat is that there simply are not enough individuals to fill demand, as outlined previously.

17 Centers for Disease Control and Prevention, 201318 Ibid.19 KPMG U.S. Hospital Nursing Labor Costs Study

14

Comparable RatiosReturn on Assets

Return on Assets 2013 2014 2015

AMN Healthcare 7.3% 6.4% 10.7%Cross Country 0.0% 1.8% 4.9%On Assignment 6.1% 7.1% 6.9%

AMN significantly outperforms its industry peers in terms of return on assets. This is a testament to management’s ability to run the company efficiently. AMN generates much more income from its assets than its competitors, more than doubling what we view as its most similar competitor, Cross Country Healthcare.

Current Ratio

Current Ratio 2013 2014 2015

AMN Healthcare 1.6x 1.6x 1.5xCross Country 1.9x 2.0x 1.8xOn Assignment 2.1x 2.2x 2.6x

AMN is healthy in terms of liquidity, maintaining a current ratio well above one over the past three years. While it is outpaced by its peers, we do not believe this is a reason to be concerned about AMN’s liquidity. The lower liquidity can be explained by the amount of debt required for AMN’s recent acquisitions. As long as AMN maintains enough liquid assets to keep this ratio above one, liquidity worries are minor.

Total Liabilities to Total Assets

Total Liabilities/Total Assets 2013 2014 2015

AMN Healthcare 64.0% 62.3% 60.5%Cross Country 35.3% 59.9% 61.4%On Assignment 49.1% 49.3% 55.6%

Historically, AMN has a much higher level of total liabilities to total assets than its competitors. This is not surprising when considering the company’s acquisitiveness, which is financed in large part through debt. In recent years, however, AMN’s competitors have also begun to take on debt. This has created an upward movement in competitors’ leverage ratios while AMN’s has slowly declined. This trend of declining company leverage combined with increasing competitor leverage has evened the playing field, bringing the industry together at an approximately 60% leverage level.

15

Executive Management and Corporate Governance

Management Team

Susan SalkaTitles: Chief Executive Officer and President

Susan Salka began at AMN in 1990. She started in an entry-level position and worked her way up through such positions as Vice President of Business Development, Chief Operating Officer, Secretary, and Executive Vice President. She became the President and CEO in May 2005. She was recently named the 2016 Most Admired CEO by the San Diego Business Journal. Here is a quotation from the article about her win that shows her character:

“It is quite an honor to for me to receive this award, but it's really a reflection of our entire team and a testament to the fantastic talent and passion they bring to our clients every day," Salka said. "We've had a truly incredible year, and I've never been so proud of our company as I am today. But just wait -- our future is even brighter."20

Brian ScottTitles: Chief Financial Officer, Chief Accounting Officer, and Treasurer

Brian Scott started at AMN in 2003. He ascended to his current position as CFO, CAO, and Treasurer in January 2011. He previously served as AMN’s Vice President of Finance. Before joining the firm, Scott previously worked as a controller at a small biotech firm and in accounting with KPMG.

Jeanette SanchezTitle: Chief Information Officer

Jeanette Sanchez joined AMN as Senior Vice President of IT in 2013. She was subsequently promoted to her current position, CIO, in July 2014. Prior to her time at AMN, Sanchez worked at several other healthcare-related firms.

Ralph HendersonTitle: President of Healthcare Staffing

Ralph Henderson joined AMN in 2007 and ascended to his current position in February 2012. Prior to joining AMN, he worked for Spherion, a premier staffing company. Henderson is a

20 PR News

16

three-time HRO Today Superstar and also a three-time honoree of the Staffing Industry Analysts’ (SIA) Staffing 100 list of industry leaders.

Marcia FallerTitles: Chief Clinical Officer and Senior Vice President, Operations

Marcia Faller began with AMN in 1989. She is widely credited with implementing rigorous screening and quality control processes for AMN’s associated healthcare professionals. Dr. Faller is also a faculty member at the University of San Diego.

Management Performance

AMN’s management team has performed admirably over the past several years. The company has exceeded analysts’ earnings estimates for 19 of the previous 20 quarters.21 Management has also met several key goals, such as expanding the company’s MSP spend, during its tenure as well.22 Finally, management has made acquisitions that not only grow the company, but do so intelligently. Overall, this is an effective management team that is well-equipped to continue leading the company.

Insider Stock Holdings

Top Insider HoldersInsider % Shares Outstanding

Susan Salka 0.79

Jeffrey Harris 0.14

Brian Scott 0.14

Paul Weaver 0.13

Ralph Henderson 0.11

AMN insiders hold a fairly small amount of the company’s stock, owning approximately 1.6% of the company’s equity. CEO Susan Salka is by far the largest insider holder of AMN stock at 0.79% of shares outstanding. While it would be encouraging to see management hold a greater share of the firm’s equity, AMN management has tended to hold only a small position. No major buys or sells have occurred in the recent past, giving no indication of management’s views on the company’s future performance.

21 Bloomberg22 AMN Healthcare 2015 Annual Report

17

Board of Directors

Douglas WheatChairman of the Board

Douglas Wheat has been AMN’s board chairman since 1999. He serves on the executive committee. Wheat is experienced in healthcare staffing industry mergers and acquisitions as well as corporate finance. He also serves on the boards of several other companies, including Challenger Capital Group and Dex Media.

Susan Salka

Susan Salka has been a director since 2003. She serves on the executive committee. Salka held numerous executive positions in the company prior to joining the board and, as outlined previously, is currently the CEO. Andrew Stern

Andrew Stern has served as a director since 2001. He is on the audit and corporate governance committees. Stern is currently the CEO of Sunwest Communications Inc. He is also a director on two other companies’ boards. R. Jeffrey Harris

R. Jeffrey Harris has been a member of the AMN board since 2005. He is on the compensation and corporate governance committees. He has experience with mergers and acquisitions and has served on the board for several other healthcare and biotechnology companies. Paul Weaver

Paul Weaver joined AMN’s board in 2006. He is the chair of the audit committee and is also on the executive committee. He has extensive international audit and finance experience. Weaver concurrently serves on the boards of several other companies and is the former vice chairman of PwC.

Dr. Michael M.E. Johns

Michael Johns has been a director since 2008. He is the chair for the corporate governance committee and is also on the compensation committee. He has extensive experience in the healthcare industry. He is a professor at the School of Medicine at Emory University and is also a member of the National Academy of Medicine of the National Academy of Science. Additionally, Johns serves on the boards of several other companies. He previously served as the Dean of the Johns Hopkins School of Medicine and Vice President of Medical Faculty at Johns Hopkins University.

18

Martha H. Marsh

Martha Marsh became a member of the AMN board in 2010. She is the chair of the compensation committee and is also on the corporate governance committee. She has served on the boards of numerous healthcare companies. Marsh was the CEO of Stanford Hospital and Clinics for 8 years and, prior to that, she was the CEO of UC Davis Health Systems for three years. Mark G. Foletta

Mark Foletta joined the board in 2012. He is on the audit committee. He has significant audit, financial, and healthcare experience. He was previously the CFO of Biocept, Inc. and Senior VP of Finance and CFO of Amylin Pharmaceuticals, Inc. He has served on the boards of numerous healthcare companies. He is a CPA (inactive license).

Overall, the board of directors is very independent and experience. Below is a chart showing the committees and who is on each committee. Members Audit

CommitteeCompensation Committee

Corporate Governance Committee

ExecutiveCommittee

Douglas Wheat X (Chair)Susan Salka XAndrew Stern X XR. Jeffrey Harris

X X

Paul Weaver X (Chair) XDr. Michael Johns

X X (Chair)

Martha Marsh X (Chair) XMark Foletta X

ISS Governance Quickscore

AMN Healthcare Services has an ISS Quickscore of 1, on a ten-point scale where 1 is the best score. Of the component pieces, AMN scores a 2 on Board Structure, 1 on Shareholder Rights, 1 on Compensation, and a 1 on Audit & Risk Oversight. This speaks to the company’s exceptional corporate governance.

19

General Employees

As of December 31, 2015, AMN had 10,639 employees, split between 2,550 corporate employees and an average of 8,091 contracted practitioners. This does not include the large network of locum tenens physicians that AMN maintains as independent contractors. There are no unionized employees.

Employee Value Proposition

Competitive Pay

AMN compensates its temporary staffers very fairly in terms of industry norms. While traveling staff are often paid slightly less than their permanently employed counterparts, the pay ends up being equivalent or better in most cases because AMN also pays for staffers’ housing while they are on-assignment.

Placement in Top Facilities

As a leader in the industry, AMN works with some of the top medical systems in the country, such as the Johns Hopkins Health System and Stanford Hospitals and Clinics. This means that AMN staffers are placed at these prestigious facilities, allowing the staffers to get a valuable, internship-like experience. In some cases, an AMN assignment is the catalyst for an offer for a permanent position.

Flexibility

Flexibility is a key consideration for traveling temporary staffers. Staffers are able to travel the country very easily thanks to AMN’s wide geographic network. This is a helpful recruiting tool as 38% of travel nurses say that traveling to many different places is their number one reason for being a temporary staffer. Besides geographic flexibility, AMN also provides great flexibility in terms of employee schedules. Unassigned staffers may sign up for a new assignment at any time, with an assignment length of just a few weeks up to a year. This allows employees to work on-and-off and customize their schedules without necessarily locking themselves in for significant periods of time.

Employee Satisfaction

AMN earned a rating of 3.1 stars—on a five-star scale—on Glassdoor from 209 employee reviews. The lowest ratings seem to come from traveling nurses. 84% approve of CEO and 51% would recommend the company to a friend. The traveling nurses complained of being

20

overworked and underpaid.23 Despite this, AMN does outscore Cross Country Healthcare. Cross Country’s rating is only 2.7 stars with 53% CEO approval and a 37% recommendation level.24

On Indeed.com, AMN has a higher rating of 3.6 stars. This site’s rating is broken up into several categories, also on a five-star scale. Employees rated work/life balance at 3.7 stars, compensation and benefits at 3.3 stars, and job security and advancement at 3.0 stars. In terms of more subjective issues, management earns 3.0 stars and the company culture earns 3.7 stars.25 The reviews on Indeed are much more positive than on Glassdoor. The sample size, however, is smaller, with only 93 employee reviews. Cross Country has not been reviewed on this site, so comparison is not possible.

Licensing Requirements

Since a great deal of AMN’s nurses and physicians travel from hospital to hospital, it is possible that they will be asked to travel over state lines. This does, however, present some problems as different states have different licensing requirements for medical professionals before they may practice medicine.

Thanks to coordination between the states, nurses may practice across state lines relatively easily. Every state has “nursing license reciprocity,” which allows registered nurses to apply for licenses in other states without repeating qualifying examinations.26 Typically, nurses will simply complete a background check and submit fingerprints to the non-home state to receive a license. These licenses are valid for 90 days.27 In addition, 25 states, which are displayed in the above map, are party to the Nursing Licensure Compact (NLC), which allows RNs and some specialized nurses who are licensed in one of the member states to practice in any of the other 24

23 Glassdoor24 Ibid25 Indeed.com26 RNLicensing.org27 Ibid.

21

with no additional requirements.28 Unfortunately, two of AMN’s largest markets, California and New York, have not yet joined the NLC.

Physicians face a more difficult path to practicing in states other than the one in which they were originally licensed. The process is time-consuming as physicians may have to take additional exams in addition to the incidental processes that nurses must go through. An expedited process has been created through the Interstate Medical Licensure Compact (IMLC), but it is not yet in effect. Once the IMLC is implemented, physicians will be able to apply for medical licenses in other IMLC states without taking additional exams.29 There are currently 12 member states of the IMLC and 12 more states with membership legislation pending, as seen in the above map.30

28 National Council of State Boards of Nursing29 LicensePortability.org30 Ibid.

22

Financial AnalysisIncome Statement

After experiencing a modest 3.35% CAGR in revenue from 2012 through 2014, AMN Healthcare’s revenue increased 41.2% in 2015. This is the company’s highest year-over-year revenue growth since 2011 when it experienced 32.5% growth. The company’s revenue growth in 2015 marks an industry-leading performance. The company’s EBITDA was also up 81% in 2014 to an 11.3% margin, which beat management’s expectations by 1.3%. Revenue was driven up by 26% organic growth and 74% from acquisitions. The company successfully amassed benefits from its acquisitions, as it has expanded and deepened the extent of its operations while also improving margins.

Revenue for the company’s largest segment, nurse and allied staffing, increased at 47.3% during 2015, over half of which was a result of organic revenue growth as the company continued to add supply to the travel market and increase staff placement levels. 39% of the revenue growth was attributable to the acquisitions of Onward Healthcare, First String Healthcare, and Avantas. Locum tenens staffing and physician permanent placement services experienced 30% and 21% revenue growth, respectively, in 2015, driven by increased demand for business through MSP contracts and record-high physician search and placement levels. 37% of the increase in revenue for the locum tenens staffing segment is traced to the Onward Healthcare acquisition.

After studying AMN’s past income statements, it is apparent that the company is trending in a positive direction. The company has increased its gross margin every year since 2010, moving from 27.1% in 2010 to 32.1%. This is attributable to both AMN’s relentless pursuit of efficiencies in the staffing sector and the acquisition of higher-margin business intelligence and SaaS companies like Medefis. Thanks to tight control over expenses, which have been stagnant over the period, AMN has also increased its net margin consistently, from -7.8% in 2010 to 5.6%.

23

AMN has fared better in terms of income items than two of its closest public competitors, Cross Country and On Assignment. Both companies reported deteriorating net margins over the same period, with Cross Country moving from 28.1% to 25.8% and On Assignment decreasing slightly from 34.1% to 32.9%. This shows that AMN has been more effective than its competitors at gaining efficiencies in the marketplace, which is even more impressive considering how many acquisitions AMN has made over the period. The company has done well to integrate these new businesses while also increasing its margins.

AMN also compares favorably to its competitors in terms of net income margin and growth. Cross Country’s 2015 net margin was only 0.6% and it has fluctuated wildly over the past five years, sinking deeply into negative territory for three years, including a low of -12.4% in 2013. On Assignment performed better, but did not exhibit growth. The firm’s net margin fluctuated in a band of about 90 basis points, but ended the period exactly where it started at 4.7%. It appears that these firms were unable to cut costs to cope with their decreasing gross margins, especially in Cross Country’s case.

Cash Flow

Net cash provided by operating activities increased substantially from $27.7 million in 2014 to $56.3 million in 2015. This stems from the company’s solid organic and inorganic revenue growth and an increase in accounts payable and accrued expenses. AMN notes that an increase in accounts receivable slightly offset these increases. This increase was attributed to slower payments by a few large customers, MSP clients adjusting to new software, and extended billing processes for clients utilizing third-party VMS technology.

AMN experienced a large increase in cash used by investing activities. Capital expenditures to foster organic growth and cash used for acquisitions increased cash used for investing to $116.1 million in 2015 from $28.2 million in 2014. Capital expenditures were $27 million and $19.1 million for those years, respectively, to support business growth and improve front and back office technology. The company utilized cash of $77.5 million, $4.5 million, and $3.1 million to acquire Onward Healthcare (including Locum Leaders and Medefis), the First String Healthcare, and Millican Solutions in 2015.

Cash flows of $56.2 million were provided by financing activities in 2015, driven by an increase in borrowing from the company’s revolver and reduced by payments to its term loan. Overall, the company has lost cash the last two years. This is reasonable, because of the company’s aggressive acquisition strategy. Regardless, AMN still maintained growth in operational cash flow.

24

Organic Growth Strategy

AMN Healthcare aims to strengthen its business by reducing staffing complexity, increasing efficiency, and enhancing the patient experience. In 2015, the Company experienced organic revenue growth of 26% compared to 2014. Revenue growth was driven by double digit growth in each of the company’s business divisions. The demand for temporary healthcare professionals increased significantly in 2015, resulting in larger billing rates for the Company to attract a sufficient supply of healthcare professionals to meet the demand, contributing to the increase in organic revenue.

Further Develop Processes to Achieve Market-leading Efficiency

The company plans to continue developing its systems to achieve market leading efficiency and scalability beyond temporary staffing services. AMN believes by expanding its core capabilities and complementary offerings (MSP, RPO, VMS, etc.), this will provide additional leverage for clients to use its services instead of its competitors31. For 2016, the company is implementing its interim leadership and executive search and crisis/labor disruption staffing offerings.

Continue to Invest in Infrastructure

AMN Healthcare intends to continue investing in recruiting technology and infrastructure to access and utilize effectively its network of qualified healthcare professionals. By increasing efficiency in recruiting, the company can capitalize on the demand growth currently being experienced. The company anticipates demand to rise due to the combined effects of the aging population, healthcare reform, and the labor shortages within its operating regions. AMN recently began a multi-year investment in strengthening its infrastructure domains32. The company plans to launch more subsidiary domains that provide information resources and online job network platforms.

31 AMN Healthcare 2015 Annual Report32 Ibid.

25

The needs of clients

Alignment with core expertise of recruitment, credentialing, and access

to healthcare professionals

Strenghthening and broadening of client

relationships

Reduction in exposure to economic cycles

Enhancement of long-term sustainable business model

Return on invested capital

Acquisitive Growth Strategy

With increasing demand for healthcare services, a growing physician shortage, increasing adoption of workforce services, and an aging population, AMN Healthcare’s growth strategy aims to access these lucrative market drivers. The company strives to drive organic and inorganic growth through broadening its offerings and investing. The firm has complimented its flagship nursing staffing services with innovative workforce solutions such as RPO, VMS, and MSP workforce optimization services. Through the diversification of offerings, the company operates at higher margins, expands its relationships with clients, creates new recurring revenue sources, and solidifies its position as a market-leading innovator. AMN Healthcare’s 35.1% 3-year EBITDA CAGR is a remarkable product of the firm’s growth strategy.

When considering an investment or acquisition in a new service or product line, AMN Healthcare considers the following factors33:

33 AMN Healthcare 2015 Annual Report

26

Acquisitions AMN Healthcare’s growth strategy in the recent past and near future is largely driven by successful acquisitions, which increase industry leading market share for the firm and diversify the portfolio of the business. AMN has an excellent track record of integrating acquisitions into the company. Since going public in 2002, the company has acquired 12 firms, and all but one have been successfully integrated. Below is a summary of acquisitions since 2013.

AMN Healthcare, Acquisitions 2013-2016Company Date

AnnouncedB.E. Smith January 2016

MillicanSolutions October 2015

The First String Healthcare September 2015

Onward Healthcare, Locum Leaders, Medefis

December 2014

Avantas December 2014

ShiftWise November 2013

27

The firm’s Nurse and Allied Solutions and Local Tenens Solutions have seen positive effects from acquisitions. The Nurse and Allied Solutions segment experienced 47% revenue growth from 2014 to 2015. 39% of this growth is attributable to the Onward Healthcare, First String Healthcare, and Avantas. $128.1 million in additional revenue was received from these firms. Considering the company only paid cash of $96.5 million to acquire these companies, it is clear that AMN Healthcare’s acquisitions are immediately accretive to the company’s growth. The acquisition of Onward Healthcare also attributed $32.9 million in additional revenue to the Locum Tenens Staffing segment, which accounts for 37% of the 30% increase in revenue for the division from 2014-2015.

Gross margin also received a bump from 30.5% to 32.1%, which was propelled the higher margin of SaaS-companies Medefis and Avantas. The 2011 Pacific Crest Private SaaS Company survey details that private SaaS generally maintain a gross margin around 70%. Hence, as the company looks to continue to expand its offerings though innovative workforce solutions and optimization services in the SaaS sphere, AMN Healthcare’s gross margin should continue to rise.

28

ValuationValuation Methods We determined our target price using two valuation methods: a hybrid discounted cash flow analysis and a peer group multiple analysis, which itself involved two different methods. These valuation methods provided target prices based on expected future cash flows and multiples derived from operating results over a one-year time horizon. Finally, the resulting price targets were weighted to give what we feel is a conservative, yet reliable, price target.

Hybrid DCF The hybrid DCF analysis incorporates both the perpetual growth rate method and the exit

multiple method, weighted equally to arrive at a target price. Both methods use the free cash flows from the projected financial statements, which can be found in the appendices.

The perpetual growth rate method grows 2020 cash flows in perpetuity using the company’s WACC less the discount rate, 8.2% and 2.0%, respectively, for a final discounting rate of 6.2%. This resulted in a terminal value of $3.78 billion. To contrast, the exit multiple method uses a mean enterprise value to EBITDA multiple of the comp set in conjunction with the 2020 EBITDA to determine a terminal value of $3.48 billion. These terminal value figures were averaged, discounted back to 2016 levels, and added to the 2016 present value of all free cash flows over the period to determine an enterprise value of $3.01 billion. The enterprise value is then stripped of cash and debt is added back to determine the implied market value of AMN’s equity, divided by the expected diluted number of shares outstanding, 48.8 million, resulting in a target price of

$55.86.

Peer Group Multiple Analysis For the purposes of this multiples analysis, we used enterprise value to EBITDA and forward price to earnings ratios to estimate the company’s value. We compared AMN Healthcare’s current trading multiples to those of its publicly traded peers in the healthcare and general staffing industries, including Cross Country Healthcare, Team Health Holdings, On Assignment, Inc., Robert Half International, and ManpowerGroup. As a secondary benchmark, we also compared the current average trading multiples for the comp set to AMN Healthcare’s own 3-year historical trading multiples. This revealed that the average forward price to earnings multiple for the comp set was significantly below AMN’s own historical average. We therefore calculated a new

29

average forward price to earnings multiple which factored in the higher historical figure as well. In the enterprise value to EBITDA case, we use the company’s projected 2017 EBITDA and the multiple to come to an implied value of equity, then divide by the number of shares outstanding. In the forward price to earnings case, we use our projected 2017 earnings per share and multiply by the adjusted average forward price to earnings multiple to determine a price. The enterprise value to EBITDA and forward price to earnings multiples resulted in price targets of $47.13 and $47.16, respectively.

Valuation Summary We combined all of the valuation methods in an equally weighted average. This resulted in a final target price of $50.05. This represents an implied upside of just over 45% over the closing price on April 4, 2016.

Sensitivity Analysis

To account for potential risks to our valuation, a sensitivity analysis was conducted. We valued the company under several different scenarios that could materially affect the company’s value, particularly the possibility of an economic downturn in the coming 18 months or an accretive acquisition.

Economic Downturn

To account for potential economic turbulence, we analyze mild, medium, and severe downturns. To determine how these situations could play out, we looked to the past to see the dips in revenue and the subsequent recovery patterns for AMN after a downturn. The severity was changed by adjusting the initial drop in revenues and the speed at which revenues recover. The effect on AMN’s value in these scenarios is summarized in the table below. The downside is much less than AMN’s actual loss during the previous economic downturn. This is because we believe the diversification to MSP and other workforce solutions will insulate the business somewhat from the certain decline in temporary hiring in a downturn.

Economic Downturn and AMN Target PriceDegree of Downturn Downside from Current Price

Mild -9.4%Medium -13.3%Severe -17.0%

Acquisition

While we cannot predict an acquisition with certainty, we believe that it is highly probable that AMN will make at least one acquisition within our investment horizon. To account for this potential for extra upside, varying sizes of acquisitions were added to our model to determine the

30

Valuation SummaryValue Weight

DCF 55.86$ 33.33% 18.62$ EV/EBITDA 47.13$ 33.33% 15.71$ Forward P/E 47.16$ 33.33% 15.72$ Average 50.05$ 100% 50.05$

Weighted Average Target Price 50.05$ Current Share Price 34.51$ Potential Upside/Downside 45.02%

effect on AMN’s value. We used three scenarios: a small acquisition of $50 million, a medium acquisition of $100 million, and an aggressive acquisition of $200 million. The accretive effects of these acquisitions on revenue was determined by using the average multiple of revenues to purchase price for AMN acquisitions over the past two years. The results are summarized in the table below. The results show a significant increase in upside for the investment compared to our base case, which did not include inorganic growth in the interest of conservatism.

Acquisitions and AMN Target PriceSize of Acquisition Upside from Current Price

Small 50.3%Medium 52.6%Large 54.4%

31

RisksFirm-Specific RisksContracts

AMN’s service offerings are typically sold to its clients via contracted sales agreements. While this does lock clients in for a period of time, concerns arise with the terms of these contracts. For certain services, such as travel nursing, clients are free to utilize other staffing agencies concurrently, even if AMN could potentially meet their needs individually (MSP offerings are exclusive contracts which typically last three years).

This risk, however, is not cause for alarm. There is nothing to suggest that clients have regularly shifted to competitors to fill capacity when AMN has available practitioners and many of AMN’s largest clients, such as Stanford Hospitals and Kaiser Permanente, do work exclusively with the company. This is a major portion of AMN’s competitive advantage and largely mitigates the risk of provider mixing through loose contracts.

Acquisition Integration Failure

AMN grew rapidly in the last two years, partly due to its successful acquisition strategy. While these acquisitions were easily integrated into the existing structure of AMN, there is risk that future acquisitions will not integrate so smoothly. Failed acquisitions would lead to major losses for the firm as they would not realize growth from the significant acquisition expenditures.

After speaking with AMN CFO Brian Scott, we believe that the company has a strong evaluation process for potential acquisitions. This appears to be attributable to the company’s failed acquisition of Rx Pro Health in 2007. Management determined post-acquisition that, despite its accretive potential, Rx Pro Health did not have the leadership necessary to make the acquisition a success. Leadership and management have now become the cornerstone of AMN’s evaluation process. Scott went as far as to say the company had turned down what it believed would be profitable acquisitions due to the potential for a leadership vacuum. While it does not eliminate the risk, the careful acquisition process reduces the risk significantly and reduces our concerns.

Medical Personnel Shortage Inhibits Recruiting

The aforementioned shortage in medical professionals could hurt AMN’s recruitment, thus severely hampering its ability to maintain its high fill rates. This is a major portion of the firm’s competitive advantage. Assuming AMN remains committed to its extensive recruitment efforts and the differences it provides from traditional employment remain appealing to medical professionals, this risk is low. Whether that remains the case is uncertain, so we are somewhat concerned and would monitor this situation closely.

32

Industry and Macro Risks

Healthcare Policy Changes

The Affordable Care Act, while effectively reducing the uninsured rate and thus increasing demand for healthcare services, has proven politically controversial. The law has been repeatedly targeted for repeal by its opponents and these efforts would become much more likely to succeed if a Republican candidate is elected president in 2016. Repeal of the ACA—the implementation of any replacement policies not withstanding—would derail much of the momentum on AMN’s side from industry trends. We believe this poses a serious risk to the company, but view the prospect of a complete repeal as fairly low, considering how the presidential race looks today.

Vulnerability to Market Downturns

As outlined with the historical stock chart, the healthcare staffing industry is highly vulnerable to economic downturns. Hospitals, much like other businesses who use temporary staffers, tend to part ways their temporary staff as part of quick cost-cutting maneuvers during the onset of recessions. AMN has dealt with this risk previously, seeing revenues fall dramatically in 2009 as the most recent recession ravaged the economy.

Thanks to AMN’s diversification into non-staffing products, such as MSP and executive search services, we believe that the potential impact from economic downturns has been significantly reduced. While the company would still see a revenue dip, our research indicates that hospitals would remain customers of AMN’s MSP during recessions since the benefits it provides for the quality of patient care exceed the cost.

RecommendationBased on our analysis of the company, we recommend a BUY on AMN Healthcare with a price target of $50.05, representing an upside of 45% over the closing price on April 4, 2016. We believe AMN is a company whose management understands the favorable industry it competes in at a high level, allowing it exploit its superior product offerings and wide network to create advantageous relationships with its clients. We believe that investors are underestimating the company’s ability to leverage this competitive advantage into future growth, leading to its undervaluation on the market.

33

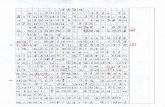

HISTORICAL INCOME STATEMENT PROJECTED INCOME STATEMENTFiscal year 2011A 2012A 2013A 2014A 2015A 2016P 2017P 2018P 2019P 2020PFiscal year end date 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 12/31/2020

Revenue 887,466 953,951 1,011,816 1,036,027 1,463,065 1,855,678 2,104,663 2,273,036 2,432,149 2,578,078Cost of sales (enter as -) (638,147) (683,554) (714,536) (719,910) (993,702) (1,243,304) (1,410,124) (1,522,934) (1,629,540) (1,727,312)

Gross Profit 249,319 270,397 297,280 316,117 469,363 612,374 694,539 750,102 802,609 850,766Selling, general & administrative (enter as -) (195,348) (202,904) (218,233) (232,221) (319,531) (397,115) (439,875) (463,699) (483,998) (505,303)Depreciation & amortization (16,324) (14,151) (13,545) (15,993) (20,953) (37,402) (40,853) (44,317) (48,740) (42,479)Total Operating Expense (211,672) (217,055) (231,778) (248,214) (340,484) (434,517) (480,728) (508,017) (532,737) (547,783)