E-Newsletter Vol. 3 • No. 2...

Transcript of E-Newsletter Vol. 3 • No. 2...

GARDEN CITY PUBLIC SCHOOLS

On The LineOn The Line E-Newsletter www.gardencity.k12.ny.us Vol. 3 • No. 2

Online...Online

Inspiring Minds, Empowering Achievement, Building Community

(continued on page 4)

Superintendent Proposes 2013-2014 Budget 2013-2014 Budget Calendar

NOTE: Revised on 2/26/13

March 5: Budget/Work Session # 3ReservesMarch 19: Regular Board Meeting/ Budget Work Session # 4Instructional Components - Part IApril 10: Budget/Work Session # 5Instructional Components - Part IIApril 16: Regular Board MeetingDistrict and BOCES Budget AdoptionMay 7: Regular Work SessionBudget HearingMay 21, 6 a.m. - 10 p.m.: Budget Vote and Election

Residents, please join us for upcoming Board meetings to add your input during the 2013-

2014 budget formulation process. All meetings are held at 8:15 p.m. at

Garden City High School.

At the February 12th Budget Work Ses-sion #1 and Regular Meeting of the Board of Education, Superintendent of Schools Dr. Robert Feirsen presented the “Overview and Revenue Projections” for the proposed 2013-2014 school district budget - “the first step in a long process” to arrive at the budget to be adopted by the Board in April and presented for public vote on May 21st, 2013. Dr. Feirsen framed this year’s budget chal-lenges as those faced not only by Garden City, but as “a regional problem, . . . a state-wide problem, [and] . . . a serious problem.” He noted State Education Commissioner King’s recent statement that he “was particularly concerned about ‘programmatic insolvency,’ where districts are not able to provide a qual-ity education because they have to cut back on academics so much.”1 New York State’s tax levy cap legislation signed into law by the Governor on June 24, 2011 and implemented for the current fiscal school year, places a strict limit on the growth of a school district’s total tax levy or “maximum allowable property tax levy limit” as determined by a complex formula. Below that limit, a simple majority vote (50% + 1) is sufficient for budget approval. If a budget is presented that exceeds the cap, a “supermajority” (60% of the voters) is required for passage. This component of the legislation effectively changes the weight of a “no” vote to 1.2. In other words, in a bud-get requiring a supermajority, 10 “no” votes would require 12 “yes” votes to remain equal. The State’s formula has “exemptions and adjustments” with a sliding 1%-1.02% adjust-ment for inflation. Garden City Public Schools finds little financial relief in these, however, when calculating its levy limit outside the mandated increases above the 2% allowable for pension contributions (this year’s Teacher’s Retirement System rate increase is 4.41%) and debt service for the capi-tal projects (bonds). A confounding issue all state public school districts have dealt with since the implemen-

1. Scott Waldman, Capitol Confidential, posted on 1/23/12.

tation of the tax levy limit is the misunder-standing caused by the “2%” figure included in publicity for the cap. The tax levy cap is not a 2% limit on the property tax (or any tax increase) an owner might pay, a limit on assessment changes, direct control of the tax rate, an effective way to control costs, or an end to voting on school budgets. Another financial stressor for Garden City is the small amount (4.38%) of federal and state aid the district receives. Unlike our comparator districts whose demographics qualify them for higher aid (the formula re-lies heavily on the percentage of a district’s students enrolled in free-and-reduced-price meal programs), Garden City will receive only an additional $25,000, or a one-half of one percent increase, under the Gover-nor’s budget. In fact, “the district has seen a 20% decrease in state aid since 2008,” explained Dr. Feirsen. Although Garden City and all public school districts must comply with costly mandates such as Race To The Top (RTTT), and hundreds of other state and federal mandates, the district receives no RTTT aid, and little or no aid for other recent mandates. The Superintendent noted that although some mandate relief has taken place, these cost savings are minimal, and new man-dates are on the horizon, most notably, the technology needs driven by the state’s

push to administer all student assessments online as early as 2015. To assist the district with the technology challenges

to come, the Board and Superintendent are creating a Technology Task Force and

Three School Additions Completed

$107,930,252 = 3.86% (with STAR) Budget Stays Below Tax Levy Limit

“The proposed budget preserves programs and instruction to the

greatest extent possible in this fiscal environment.”

Click on the image above to view the video. Construction of the additions at Homestead, Garden City Middle School and Garden City High School, part of the community-approved 2009 School Investment Bond, culminated in ribbon cutting ceremonies attended by Board of Education members, district and building administration, teachers, students, parents, and local and regional officials. The new spaces are in use virtually every minute of the school day, providing students and staff with beautiful new learning and work spaces.

`

2

Call for Technology Experts Do you or does someone you know have an expertise in the field of technol-ogy? If you are a Garden City

resident with a depth of knowledge and experience in technology and are interested in guiding its future use in the district, the Board of Education and Superintendent of Schools are forming a Technology Task Force. The Task Force will evaluate the cur-rent status of technology in the school dis-

trict, conduct research, review mandates, identify best practic-es, estimate costs, suggest possible funding mechanisms, assess return on investment, and recommend strategies, plans, and policies for Board of Education consider-ation. Subcommittees of the Task Force will include Devices and Social Media, Digital Content, and Technical Issues. Garden City residents interested in volunteering to serve on the Task Force should email a resume highlighting their qualifications to the Su-perintendent of Schools, Dr. Robert Feirsen: [email protected] by Friday, March 1st.

Please join us at 7 p.m. on Friday, March 1st or Saturday, March 2nd as Garden City High School presents “The Pajama Game.” Call 478-2531 or click here for more information and the ticket order form. Attention Senior Citizens: On Thursday, February 28th, residents are invited to a GCTA-sponsored buffet dinner in the high school cafeteria starting at 3:15 p.m. fol-lowed by a special performance of “The Pajama Game.” Both events are FREE to Garden City seniors. Please register your attendance by calling 478-2531.

The Music Box Players at Garden City Middle School will present “Bye Bye Birdie” on Friday, March 15th and Saturday, March 16th at 7 p.m. Tickets are $10. For more information or to purchase tick-ets, please contact director Kristen Aguilo: [email protected]. Attention Senior Citizens: Residents are invited to special FREE performance of the musical with refreshments starting at 4 p.m. on Thursday, March 14th. Garden City seniors, please join us to enjoy coffee and cookies and this lively musical!

APPR and CCLS Implementation Updates “Garden City is the model for doing it right: introducing the process, learning about it, and continuously honing administrators’ skills - this is the way it should be done everywhere,” explained Dr. Bernie Cleland at a recent annual professional performance review (APPR) training for district administra-tors. Along with Dr. Duffy Miller (right), nationally recognized expert on the state-approved Danielson Framework for Teaching model of teacher evaluation, the team worked with small groups of admin-istrators to hone the evidence collection and alignment process conducted during classroom observations. “Inter-rater reliabil-ity” - the ability to develop an independent consensus among observers evaluating the same teacher’s lesson - was explored by watching a video of a sample classroom les-son, scoring the teacher’s performance, and then comparing the results. New York State Education Law §3012-c mandated annual professional performance reviews of classroom teachers and principals starting in September, 2012. Garden City has utilized the Danielson model since 2007, so staff development is more focused on honing existing skills. “In so many places it’s a com-pliance issue. Garden City has been very seri-ous about deepening the work and improving the practice,” said Dr. Cleland. Miller and Cleland have led evaluation workshops across the country, including many for the State Education Department and the Los Angeles school district. They periodically work with district staff, and reference Garden City when providing a “best practice” example to other school districts.

This year marked the move to the CCLS (Common Core Learning Standards) for all New York State public schools. In Garden City, groundwork, information sharing, and ongoing staff development have supported the shift to internationally benchmarked standards designed to deeply explore fewer

topics than previous state learning standards. “Our teachers and adminis-trators have been on the

forefront,” said Assistant Superintendent Dr. Teresa Prendergast. “The New York State English Language Arts and mathematics as-sessments will be directly correlated to the much more rigorous CCLS standards.” In mathematics, the standards emphasize focus and coherence of work, depth over breadth, and a balance of concept and skills. They foster reasoning and “sense-making.” In a recent mathematics workshop, Dr. Patricia Scavuzzo-Despagni (above) shared methods to teach the concept of volume. Teachers used different shapes of index card contain-ers to determine which held the most rice. In English Language Arts (ELA), the stan-dards emphasize balancing informational and literary texts, fostering informative, explana-tory and evidence-based writing, reading and writing across the curriculum, and utilizing academic and domain-specific vocabulary. In a recent workshop for the district’s third grade teachers, Erica Pecorale (below) led a

spirited dis-cussion about the alignment of CCLS and the current ELA curricu-lum maps.

Blood Drive Stewart School is holding a blood drive in conjunction with the American Red Cross on Wednesday, March 13th. Please consider stopping in and donating the gift of life. For more information, con-tact the school at 478-1400.

Recent Achievements

3

Congratulations to Garden City’s 2013 National Merit Scholarship finalists. Pic-tured above are (left to right) high school guidance counselor Jim Malone, finalists Jacquelyn N. Seskin and Neil T. Quigley, Director of Guidance Gina Christel, and high school Principal Nanine McLaughlin. Jackie and Neil were chosen from a pool of 1.5 million entrants who took the PSAT/National Merit Scholarship Qualifying Test. Garden City High School has had 17 finalists and 40 Commended Students named in the highly competitive program since 2009.

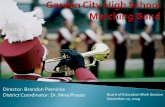

Garden City High School’s music pro-gram was selected as a GRAMMY Signa-ture Schools Semifinalist - one of only 129 schools so-named nationwide and the sec-ond consecutive year the program achieved national semifinalist status. Growth in the music program was one driver for the beauti-ful new music addition opened this year at the high school. Next month, the GRAMMY Foundation will announce the 2013 finalists. These schools will receive a custom award and a monetary grant to benefit their music programs.

National Merit Scholarship Finalists GRAMMY Signature School Semifinalist High school senior Tiffany Liang, pictured here with Shawn Uttendorfer, Advanced Placement Studio Art teacher, was selected to receive a Gold Key Award for her painting, Galatea Of The Cubes (inset), in the 2013 Scholastic Art & Writing Awards. Tiffany will accept her award at a ceremony on March 9th in NYC. In its 90th year, this year’s competition received almost 230,000 entries nationwide.

Gold Key Award Recipient

Four Advanced Placement (AP) Studio Art students were accepted to the Art League of Long Island’s annual “Go APe” exhibit held in Dix Hills. Recognized at the February 12th Board Meeting were (left to right) Toni-Ann Giammona with Board Vice President Barbara Trapasso, Victoria D’Antone, Kylie Mara and Kate Polinsky with AP art teacher Shawn Uttendorfer and Dr. Robert Feirsen.

Art League of Long Island ExhibitionAdvanced Visions at LIU Post Annie Foxen, pictured here with (left to right), Board President Colleen Foley, teacher Shawn Uttendorfer and Dr. Robert Feirsen, received an Honorable Mention in “Advanced Visions,” an exhibit of Advanced Placement students’ work at LIU Post. A painting by Tiffany Liang was also selected for the show. Works by art students from 35 Long Island high schools were included.

Congratulations to Nina Bangalore and Conor Sproat for placing first in Marketing and Parliamentary Procedures, respectively, in the Future Business Leaders of America (FBLA) District Competition. Garden City was the top achiever, with 14 students placing. Pictured here are Nina and Conor with (left to right) Board President Colleen Foley, teacher Erin McKinstry and Dr. Robert Feirsen.

FBLA First Place

Garden City’s team has advanced to the next level in “The Challenge,” a game show that tests knowledge, speed and accuracy. Garden City will face Valley Stream North on March 10th, 6:30 p.m. on Channel 14. Pictured here are (left to right): teacher Kevin O’Hagan, Steve Menelly, Zachary Naglieri, host Jared Cotter, Jon Toto, Nikhil Patel and alternates Thomas Mage and Timothy Josephs.

Challenge Team Advances

Community Achievement Award

Garden City’s girls la-crosse and field hockey coach Diane Chapman was selected to receive the 2013 Community Achievement Award at this year’s Pineapple Ball to be held at the

Garden City Hotel on April 19th. “With a field hockey coaching record of 357 wins and a lacrosse coaching record of 203 wins, Diane has been a remarkable asset to the Garden City community,” explained Athletic Direc-tor Nancy Kalafus. “She is the consummate professional who has been an inspirational role model for countless young athletes.” Congratulations, Coach Chapman!

Quiz Bowl Champions Garden City High School crowned the 2013 Quiz Bowl team on February 21st. The annual competition was begun in 1996 by then social studies chair Doug Sheer. This year, 24 teams vied for the title. Finishing first with the highest number of correct answers to 150 general knowledge questions was James Dunleavy’s team (left to right): Matthew Conway, Nikhil Patel and Brendan Quinn.

Courtesy Cablevision

Colleen E. FoleyPresident

Barbara TrapassoVice President

Angela HeinemanTrustee

Tom PinouTrustee

Robert MartinTrustee

Robert Feirsen, Ed. D.Superintendent of Schools

Catherine KnightCoordinator of Public Information

Garden City Public Schools56 Cathedral Avenue Garden City, New York 11530www.gardencity.k12.ny.us

Inspiring Minds Empowering AchievementBuilding Community

4

(continued from page 1)

seeking resident experts. If you or someone you know who resides in Garden City has an expertise in technology and would like to volunteer, please review the request for volunteers on page 2. Additionally, continued Dr. Feirsen, “there has been a shifting of liability.” Tax certiorari settlements, formerly the responsibility of Nassau County as laid out in 1938 as the “County Guaranty,” have now been shifted by the County Executive and legislature to school districts. Even though, correctly or incorrectly, the County determines a property owner’s assessment, Nassau County school districts are now responsible for court settle-ments won by incorrectly taxed owners. “It’s something clearly we did not want, it’s some-thing we didn’t have time to save for, it’s something we couldn’t build into our budget over a number of years, and those liabilities are now the responsibility of the school dis-trict. This has a very, very substantial impact on our budget this year.” A second cost-shifted fee new this year to school districts has been the Nassau County Sewer Tax, a water usage fee of approximate-ly $100,000 for Garden City schools. “These costs, the sewer tax and the tax cer-tiorari, cannot be exempted from the tax levy limit,” explained Dr. Feirsen, “so, into that figure of what we are allowed to go forth to the voters with that requires only a 50% ma-jority, are those substantial increases which have nothing to do with the school district, that are certainly nothing that the Board of Education ever voted for and never agreed to, and which we cannot exempt from the tax levy limit.” In spite of the tremendous cost pressures the district faces, the proposed budget of $107,930,252 represents a budget-to-budget increase of 3.56% and a projected tax levy increase (with STAR) of 3.86%, an increase below the maximum allowable tax levy limit for the school district - 3.91%. Dr. Feirsen summarized the 2013-2014 bud-get drivers as two-fold: the new tax certiorari settlements and the legally required contri-butions to the Teachers Retirement System (TRS), for which the district cannot establish a reserve fund, and the Employees Retire-ment System (ERS). Together, these result in a 3.78% increase, “even though the school district has done nothing different than the year before.” The difference between the proposed 3.86% tax levy and the 3.78% increase required by the two budget drivers is a mere 0.08%. That is the “zone of Board of Educa-tion decision-making.” Breaking out district revenues over a three year period and basing projected num-bers for the 2013-2014 school year on the

Governor’s Executive Budget, As-sistant Super-intendent for Business Al Chase (right) illustrated the revenue components of the budget in-cluding state aid, charges for services, other local revenues, the portion of the budget supported by local property taxes - more than 85% - and the $2.8 million Fund Balance allocation to offset future tax increases. Mr. Chase reiterated the 20% reduction in state aid to Garden City (-$1,148,354) in the past seven years during which the district’s expenditures grew by 19%. Presented in this way, the accelerating financial stress placed on Garden City’s budget is obvious. More budget details will be provided in up-coming Board of Education budget meetings. Residents are encouraged to attend to pose questions and offer input to the Board and administration during the budget formula-tion process. Dr. Feirsen emphasized that the overview he presented “is not a budget set in stone,” but a work in progress. The calendar of budget meetings is listed on page 1 and all budget-related information is posted to the district’s website. Click here to link to “Budget Information.” Click here to view the superintendent’s presentation in its entirety.

* The Village of Garden City and Garden City Public Schools are separate entities.* New York State’s “2%” tax levy cap does not limit school districts’ “maximum allowable tax levy limit” to 2%.* Garden City’s maximum allowable tax levy limit for 2013-2014 as calculated by the State formula is 3.91%.* At a proposed 3.86%, the school district is below its tax levy limit and, therefore, a simple majority (50% + 1) is required for budget approval.* If a tax levy above Garden City’s maxi-mum allowable limit was put to public vote on May 21st, a “supermajority” of 60% of the vote would be required for approval.* Under a “supermajority” vote, a “no” vote carries more weight than a “yes” vote (1.2 versus 1.0, respectively).* The May, 2012 budget vote was ap-proved by a 63.5% majority. * To the greatest extent possible in this fiscal environment, the proposed budget preserves programs and instruction.

Budget Fast Facts

* The proposed budget is a first step in a comprehensive review - resident input is encouraged.* State aid to Garden City has decreased by 20% since in seven years.* Foundation aid, the state’s basic aid to schools, was frozen for the fourth year in a row.* Property taxes make up the largest portion of revenues for Garden City Pub-lic Schools (over 85%).* Individual property owners’ tax rates are based on assessments assigned by the Nassau County Tax Assessor.* Even though Garden City Public Schoolshas no role in the property assessment process, the liability for assessment errors settled in tax certiorari cases has been shifted to the school district. * Tax certiorari settlements are not be exempted from the tax levy cap.* Budget drivers for 2013-2014 include tax certiorari settlements and mandatory pension contributions, resulting in 3.78% of the proposed 3.86% increase.* School districts cannot initiate special fees to supplement revenues. Borrowing is strictly limited for school districts. * Although mandate relief was promised, school districts have seen little helpful change. In fact, new mandates are on the horizon, including a move to require online testing for student assessments.* Garden City remains a “Destination Lo-cation,” a desirable community that of-fers a high level of return-on-investment.* The 2013-2014 Budget Vote will be held on May 21st, 6 a.m. - 10 p.m. at Garden City High School.