Disclosures on capital adequacy of the Bank Pekao S.A...

Transcript of Disclosures on capital adequacy of the Bank Pekao S.A...

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

Warsaw, August 2019

This document is a free translation of the Polish original.

Terminology current in Anglo-Saxon countries has been

used where practicable for the purposes of this translation

in order to aid understanding. The binding Polish original

should be referred to in matters of interpretation.

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

2

Table of content

Introduction ................................................................................................................................................................................. 3

1. Own funds and prudential consolidation ................................................................................................................................ 3

1.1. Outline of the differences in consolidation .................................................................................................................... 4

1.2. Own funds ..................................................................................................................................................................... 6

1.3. Common Equity Tier 1 capital ..................................................................................................................................... 12

1.4. Common Equity Tier 1 capital – regulatory adjustments ............................................................................................. 12

1.5. Tier 2 capital ................................................................................................................................................................ 13

2. Capital adequacy assessment ............................................................................................................................................. 14

3. Macroprudential supervisory measures................................................................................................................................ 16

4. Information on risk ................................................................................................................................................................ 20

4.1. Risk management objectives and strategies ............................................................................................................... 20

4.2. Credit risk, including counterparty risks....................................................................................................................... 20

4.3. Market risk, including interest rate risk ........................................................................................................................ 32

4.4. Operational risk ........................................................................................................................................................... 33

4.5. Liquidity risk ................................................................................................................................................................ 33

4.6. Risk of excessive financial leverage ........................................................................................................................... 35

4.7. Internal capital adequacy assessment ........................................................................................................................ 38

5. Impact of IFRS 9 implementation on capital adequacy ........................................................................................................ 40

6. Subsequent events ............................................................................................................................................................... 41

7. Declaration of the Management Board of Bank Pekao S.A. ................................................................................................ 42

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

3

Introduction

Capital adequacy is defined as an extent to which risks taken by Bank Pekao S.A. (hereinafter: “Bank”) (measured through capital requirement) can be absorbed by risk coverage capital (measured by own funds) at given significance level (a risk appetite) and at given time horizon. The Bank plans and monitors capital adequacy at two levels:

1. Regulatory requirement (Pillar I) where regulatory capital requirement is compared with regulatory own funds (regulatory capital),

2. Internal models (Pillar II) where internal capital calculated using internal methods is compared with available financial resources specified by Bank.

„Information Policy of Bank Pekao S.A.” (hereinafter: “Information policy”) defines scope and principles of publishing information on capital adequacy specified in Regulation (EU) No. 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No. 648/2012, with further amendments as well as Commission Implementing and Delegated Regulations (EU) (hereinafter: “CRR” or “Regulation 575/2013”). The information policy introduced by a resolution of the Bank’s Management Board and approved by the Supervisory Board, is published on the website of Bank. Bank is EU parent institution and according to Information policy disclosures information in this document according to requirements laid-down in Article 13 of Regulation 575/2013 on consolidated basis (prudential consolidation).

Disclosures are published on the website of Bank at the time of the Bank Pekao S.A. Group’s (hereinafter: “Group”) financial statements publication and present information defined in Information policy. Disclosures reflects also the EBA/GL/2016/11 Guidelines on discloser requirements under Part Eight of Regulation (EU) No. 575/2013 (hereinafter: „EBA/GL/2016/11 Guidelines”).

This document includes information based on calculations made according to the law binding at 30 June 2019.

The published information is verified by an auditor, then the information is approved by the Management Board of the Bank and acknowledged by the Supervisory Board.

1. Own funds and prudential consolidation

Bank determines own funds in line with the law binding at 30 June 2018, particularly with Regulation 575/2013 and The Banking Law Act of 29 August 1997 with further amendments (hereinafter: “Banking Act”). Bank disclose information about own funds according to Regulation 575/2013, requirements presented in Commission Implementing Regulation (EU) No. 1423/2013 of 20 December 2013 laying down implementing technical standards with regard to disclosure of own funds requirements for institutions according to Regulation 575/2013 (hereinafter: “Regulation 1423/2013”) and Guidelines EBA/GL/2018/01 on uniform disclosures under Article 473a of Regulation (EU) No 575/2013 as regards the transitional period for mitigating the impact of the introduction of IFRS 9 on own funds (hereinafter: “Guidelines EBA/GL/2018/01”) connected with application of transitional arrangements of introduction of IFRS 9.

According to these regulations, own funds comprise of the following items:

• Common Equity Tier 1 capital which includes i.e.: capital instruments and related share premium, retained earnings, accumulated other comprehensive income, other reserves, funds for general banking risk,

• Additional Tier 1 capital which includes i.e.: capital instruments, where the conditions laid down in Article 52 of Regulation 575/2013 are met and the share premium related to these instruments,

• Tier 2 capital which includes i.e.: capital instruments and subordinated loans where the conditions laid down in Article 63 of Regulation 575/2013 are met, the share premium related to these capital instruments and subordinated loans, general credit risk adjustments.

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

4

All mentioned capitals are subject to deduction adjustments and application of prudential filters.

Own funds consist of capital and funds raised by subsidiaries of the Group in line with the binding law.

1.1. Outline of the differences in consolidation

Table no. 1 presents differences between accounting and regulatory scopes of consolidation.

The carrying amounts disclosed in the statement of financial position in regulatory approach are different from the values presented in the statement of financial position presented in the Condensed Consolidated Interim Financial Statements of Bank Pekao S.A. Group for the period from 1 January 2019 to 30 June 2019 only due to the application of various consolidation rules.

Table 1. Differences between accounting and regulatory scopes of consolidation (in PLN thousand).

ITEM

CARRYING VALUES AS REPORTED IN

PUBLISHED FINANCIAL STATEMENTS

CARRYING VALUES UNDER SCOPE OF

REGULATORY CONSOLIDATION

Assets

A.1 Cash and due from Central Bank 4 324 663 4 324 663

A.2 Loans and advances to banks 2 703 944 2 703 686

A.3 Financial assets held for trading 2 231 752 2 231 752

A.4 Derivative financial instruments (held for trading) 1 776 568 1 776 568

A.5 Loans and advances to customers 129 362 995 129 365 643

A.6 Receivables from finance leases 6 029 421 6 029 421

A.7 Hedging instruments 395 136 395 136

A.8 Investments (placement) securities 44 131 368 44 131 368

A.9 Assets held for sale 45 881 45 881

A.10 Investments in subsidiaries - 69 165

A.11 Investments in associates - -

A.12 Intangible assets 1 497 894 1 497 894

A.13 Property, plant and equipment 1 924 651 1 924 651

A.14 Investment properties 11 022 11 022

A.15 Income tax assets 1 153 456 1 154 617

A.15.1 Deferred tax assets that rely on future profitability excluding temporary differences assets 18 198 18 198

A.17 Other assets 1 322 107 1 321 564

TOTAL ASSETS 196 910 858 196 983 031

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

5

ITEM

CARRYING VALUES AS REPORTED IN

PUBLISHED FINANCIAL STATEMENTS

CARRYING VALUES UNDER SCOPE OF

REGULATORY CONSOLIDATION

Liabilities

L.1 Amounts due to Central Bank 5 019 5 019

L.2 Amounts due to other banks 6 578 800 6 578 697

L.3 Financial liabilities held for trading 540 620 540 620

L.4 Derivative financial instruments (held for trading) 2 277 344 2 277 344

L.5 Amounts due to customers 150 363 387 150 442 189

L.6 Hedging instruments 666 327 666 327

L.7 Debt securities issued 5 952 237 5 952 237

L.8 Subordinated liabilities 2 363 319 2 363 319

L.9 Income tax liabilities 173 783 173 779

L.9.1 Deferred tax liabilities on intangible assets 66 066 66 066

L.10 Provisions 747 292 747 243

L.11 Other liabilities 5 161 875 5 166 422

TOTAL LIABILITIES 174 830 003 174 913 196

Equity

L.12 Share capital 262 470 262 470

L.13 Other capital and reserves 20 688 871 20 684 710

L.13.1 Share premium 9 137 221 9 137 221

L.13.2 Other reserve capital 9 185 912 9 181 751

L.13.3 General banking risk fund 1 982 459 1 982 459

L.13.4 Accumulated other comprehensive income 383 279 383 279

L.13.4.1 Revaluation of hedging financial instruments 116 325 116 325

L.13.4.2 Valuation of debt securities and loans measured at fair value through other comprehensive income 186 538 186 538

L.13.4.3 Valuation or sale of equity securities measured at fair value through other comprehensive income 152 716 152 716

L.13.4.4 Remeasurements of the defined benefit liabilities (72 300) (72 300)

L.14 Profit from current year and previous years 1 117 787 1 110 928

L.14.1 Retained earnings from previous years 293 340 286 533

L.14.2 Profit of the current year 824 447 824 395

L.15 Non - controlling interests 11 727 11 727

TOTAL EQUITY 22 080 855 22 069 835

TOTAL LIABILITIES AND EQUITY 196 910 858 196 983 031

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

6

1.2. Own funds

Table no. 2, according to Regulation 1423/2013, presents information about own funds components used to calculate total capital ratio as at 30 June 2019. Given the clarity and value in use of the document for the readers, the disclosure in table no. 2 is limited to non-zero positions, while maintaining the numbering of the lines with the template presented in the Annex IV of the Regulation 1423/2013.

Additionally in table no. 2 are presented references between positions of Group’s own funds, as well as used filters and deductions on own funds and statement of financial position items in financial statement.

Table 2. Own funds used to calculate consolidated capital ratios (in PLN thousand).

30.06.2019 REFERENCE

COMMON EQUITY TIER 1 CAPITAL: INSTRUMENTS AND RESERVES

1 Capital instruments and the related share premium accounts 9 399 691 Tab. 1 point L.12 and point L.13.1

2 Retained earnings (adjusted), of which: 1 048 068 Tab. 1 point L.14.1

Retained earnings 286 533 Tab. 1 point L.14.1

Adjustments regarding the mitigation of the impact of introduction IFRS 9 in the transition period

761 535

3 Accumulated other comprehensive income (and other reserves) 9 565 030 Tab. 1 point L.13.2 and point L.13.4

3a Funds for general banking risk 1 982 459 Tab. 1 point L.13.3

6 Common Equity Tier 1 (CET1) capital before regulatory adjustments

21 995 248

COMMON EQUITY TIER 1 (CET1) CAPITAL: REGULATORY ADJUSTMENTS

7 Additional value adjustments (negative amount) (38 434)

8 Intangible assets (net of related tax liability) (negative amount) (1 431 828) Tab. 1 point A.12 and L.9.1

10 Deferred tax assets that rely on future profitability excluding those arising from temporary differences (net of related tax liability where the conditions in Article 38(3) are met)

(18 198) Tab. 1 point A.15.1

11 Fair value reserves related to gains or losses on cash flow hedges

(116 325) Tab. 1 point L.13.4.1

28 Total regulatory adjustment to Common Equity Tier 1 (CET1)

(1 604 785)

29 Common Equity Tier 1 (CET1) capital 20 390 463

ADJUSTMENTS ADDITIONAL TIER 1 (AT1) CAPITAL: INSTRUMENTS

36 Additional Tier 1 (AT1) capital before regulatory adjustments

-

ADDITIONAL TIER 1 (AT1) CAPITAL: REGULATORY ADJUSTMENTS

43 Total regulatory adjustments to Additional Tier 1 (AT1) capital

-

44 Additional Tier 1 (AT1) capital -

45 Tier 1 capital (T1= CET1+AT1) 20 390 463

ADJUSTMENTS TIER 2 (T2) CAPITAL: INSTRUMENTS AND PROVISIONS

46 Capital instruments and the related share premium accounts 2 000 000 Tab. 1 point L.8

51 Tier 2 (T2) capital before regulatory adjustments 2 000 000

TIER 2 (T2) CAPITAL: REGULATORY ADJUSTMENTS

57 Total regulatory adjustments to Tier 2 (T2) capital -

58 Tier 2 (T2) capital 2 000 000

59 Total capital (TC=T1+T2) 22 390 463

60 Total risk weighted assets 129 395 538

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

7

30.06.2019 REFERENCE

CAPITAL RATIOS AND BUFFERS

61 Common Equity Tier 1 (as a percentage of risk exposure amount)

15.76

62 Tier 1 (as a percentage of risk exposure amount) 15.76

63 Total capital (as a percentage of risk exposure amount) 17.30

64

Institution specific buffer requirement (CET1 requirement in accordance with Article 92(1)(a) plus capital conservation and countercyclical buffer requirements, plus systemic risk buffer, plus the systemically important institution buffer (G-SII or O-SII buffer), expressed as a percentage of risk exposure amount)

6.16

65 of which: capital conservation buffer requirements 2.50

66 of which: countercyclical buffer requirements 0.01

67 of which: systemic risk buffer requirements 2.90

67a of which: Global Systemically Important Institution (G-SII) or Other Systemically Important Institution (O-SII) buffer

0.75

68 Common Equity Tier 1 available to meet buffers (as a percentage of risk exposure amount

9.29

AMOUNTS BELOW THE THRESHOLDS FOR DEDUCTION (BEFORE RISK WEIGHTING)

72

Direct and indirect holdings of the capital of financial sector entities where the institution does not have a significant investment in those entities (amount below 10% threshold and net of eligible short positions)

101 321 Tab. 1 point A.8, point A.10 and point A.11

75 Deferred tax assets arising from temporary differences (amount below 10% threshold, net of related tax liability where the conditions in Article 38(3) are met)

1 134 887 Tab. 1 point A.15

Detailed description of main characteristics of capital instruments are presented in table no. 3.

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

8

Table 3. Capital instruments main characteristics.

SERIES A SERIES B SERIES C

1 Issuer Bank Pekao S.A. Bank Pekao S.A. Bank Pekao S.A.

2 Unique identifier (e.g. CUSIP, ISIN or Bloomberg identifier for private placement) ISIN: PLPEKAO00016 ISIN: PLPEKAO00016 ISIN: PLPEKAO00016

3 Governing law(s) of the instrument Polish law Polish law Polish law

Regulatory treatment

4 Transitional CRR rules Tier 1 Tier 1 Tier 1

5 Post-transitional CRR rules Tier 1 Tier 1 Tier 1

6 Eligible at solo/(sub-)consolidated / solo & (sub-)consolidated Solo / Consolidated Solo / Consolidated Solo / Consolidated

7 Instrument type (types to be specified by each jurisdiction) Ordinary shares,

Art. 50 CRR Ordinary shares,

Art. 50 CRR Ordinary shares,

Art. 50 CRR

8 Amount recognised in regulatory capital (currency in million, as of most recent reporting date)

PLN 137 650 000 PLN 7 690 000 PLN 10 630 632

9 Nominal amount of instrument PLN 1.00 PLN 1.00 PLN 1.00

9a Issue price PLN 1.00 PLN 45.00 PLN 49.00

9b Redemption price - - -

10 Accounting classification Share capital Share capital Share capital

11 Original date of issuance 21.12.1997 6.10.1998 12.12.2000

12 Perpetual or dated Perpetual Perpetual Perpetual

13 Original maturity date Without maturity Without maturity Without maturity

14 Issuer call subject to prior supervisory approval - - -

15 Optional call date, contingent call dates and redemption amount - - -

16 Subsequent call dates, if applicable - - -

Coupons / dividends - - -

17 Fixed or floating dividend/coupon Variable dividend Variable dividend Variable dividend

18 Coupon rate and any related index - - -

19 Existence of a dividend stopper No No No

20a Fully discretionary, partially discretionary or mandatory (in terms of timing) - - -

20b Fully discretionary, partially discretionary or mandatory (in terms of amount) - - -

21 Existence of step-up or other incentive to redeem No No No

22 Noncumulative or cumulative Not accumulated Not accumulated Not accumulated

23 Convertible or non-convertible Interchangeable Interchangeable Interchangeable

24 If convertible, conversion trigger(s) - - -

25 If convertible, fully or partially - - -

26 If convertible, conversion rate - - -

27 If convertible, mandatory or optional conversion - - -

28 If convertible, specify instrument type convertible into - - -

29 If convertible, specify issuer of instrument it converts into - - -

30 Write-down features No No No

31 If write-down, write-down trigger(s) - - -

32 If write-down, full or partial - - -

33 If write-down, permanent or temporary - - -

34 If temporary write-down, description of write-up mechanism - - -

35 Position in subordination hierarchy in liquidation (specify instrument type immediately senior to instrument)

- - -

36 Non-compliant transitioned features No No No

37 If yes, specify non-compliant features - - -

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

9

SERIES D SERIES E SERIES F

1 Issuer Bank Pekao S.A. Bank Pekao S.A. Bank Pekao S.A.

2 Unique identifier (e.g. CUSIP, ISIN or Bloomberg identifier for private placement) ISIN: PLPEKAO00016 ISIN: PLPEKAO00016 ISIN: PLPEKAO00016

3 Governing law(s) of the instrument UK / US law Polish law Polish law

Regulatory treatment

4 Transitional CRR rules Tier 1 Tier 1 Tier 1

5 Post-transitional CRR rules Tier 1 Tier 1 Tier 1

6 Eligible at solo/(sub-)consolidated / solo & (sub-)consolidated Solo / Consolidated Solo / Consolidated Solo / Consolidated

7 Instrument type (types to be specified by each jurisdiction) Ordinary shares,

Art. 50 CRR Ordinary shares,

Art. 50 CRR Ordinary shares,

Art. 50 CRR

8 Amount recognised in regulatory capital (currency in million, as of most recent reporting date)

PLN 9 777 571 PLN 373 644 PLN 621 411

9 Nominal amount of instrument PLN 1.00 PLN 1.00 PLN 1.00

9a Issue price PLN 49.00 PLN 55.00 PLN 108.37

9b Redemption price - - -

10 Accounting classification Share capital Share capital Share capital

11 Original date of issuance 12.12.2000 29.08.2003 9.03.2006-14.05.2007

12 Perpetual or dated Perpetual Perpetual Perpetual

13 Original maturity date Without maturity Without maturity Without maturity

14 Issuer call subject to prior supervisory approval - - -

15 Optional call date, contingent call dates and redemption amount - - -

16 Subsequent call dates, if applicable - - -

Coupons / dividends - - -

17 Fixed or floating dividend/coupon Variable dividend Variable dividend Variable dividend

18 Coupon rate and any related index - - -

19 Existence of a dividend stopper No No No

20a Fully discretionary, partially discretionary or mandatory (in terms of timing) - - -

20b Fully discretionary, partially discretionary or mandatory (in terms of amount) - - -

21 Existence of step-up or other incentive to redeem No No No

22 Noncumulative or cumulative Not accumulated Not accumulated Not accumulated

23 Convertible or non-convertible Interchangeable Interchangeable Interchangeable

24 If convertible, conversion trigger(s) - - -

25 If convertible, fully or partially - - -

26 If convertible, conversion rate - - -

27 If convertible, mandatory or optional conversion - - -

28 If convertible, specify instrument type convertible into - - -

29 If convertible, specify issuer of instrument it converts into - - -

30 Write-down features No No No

31 If write-down, write-down trigger(s) - - -

32 If write-down, full or partial - - -

33 If write-down, permanent or temporary - - -

34 If temporary write-down, description of write-up mechanism - - -

35 Position in subordination hierarchy in liquidation (specify instrument type immediately senior to instrument)

- - -

36 Non-compliant transitioned features No No No

37 If yes, specify non-compliant features - - -

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

10

SERIES G SERIES H SERIES I

1 Issuer Bank Pekao S.A. Bank Pekao S.A. Bank Pekao S.A.

2 Unique identifier (e.g. CUSIP, ISIN or Bloomberg identifier for private placement) ISIN: PLPEKAO00016 ISIN: PLPEKAO00016 ISIN: PLPEKAO00016

3 Governing law(s) of the instrument Polish law Polish law Polish law

Regulatory treatment

4 Transitional CRR rules Tier 1 Tier 1 Tier 1

5 Post-transitional CRR rules Tier 1 Tier 1 Tier 1

6 Eligible at solo/(sub-)consolidated / solo & (sub-)consolidated Solo / Consolidated Solo / Consolidated Solo / Consolidated

7 Instrument type (types to be specified by each jurisdiction) Ordinary shares,

Art. 50 CRR Ordinary shares,

Art. 50 CRR Ordinary shares,

Art. 50 CRR

8 Amount recognised in regulatory capital (currency in million, as of most recent reporting date)

PLN 603 377 PLN 359 840 PLN 94 763 559

9 Nominal amount of instrument PLN 1.00 PLN 1.00 PLN 1.00

9a Issue price PLN 123.06 PLN 66.00 PLN 256.69

9b Redemption price - - -

10 Accounting classification Share capital Share capital Share capital

11 Original date of issuance 6.02.2008-24.01.2013 12.08.2004 29.11.2007

12 Perpetual or dated Perpetual Perpetual Perpetual

13 Original maturity date Without maturity Without maturity Without maturity

14 Issuer call subject to prior supervisory approval - - -

15 Optional call date, contingent call dates and redemption amount - - -

16 Subsequent call dates, if applicable - - -

Coupons / dividends - - -

17 Fixed or floating dividend/coupon Variable dividend Variable dividend Variable dividend

18 Coupon rate and any related index - - -

19 Existence of a dividend stopper No No No

20a Fully discretionary, partially discretionary or mandatory (in terms of timing) - - -

20b Fully discretionary, partially discretionary or mandatory (in terms of amount) - - -

21 Existence of step-up or other incentive to redeem No No No

22 Noncumulative or cumulative Not accumulated Not accumulated Not accumulated

23 Convertible or non-convertible Interchangeable Interchangeable Interchangeable

24 If convertible, conversion trigger(s) - - -

25 If convertible, fully or partially - - -

26 If convertible, conversion rate - - -

27 If convertible, mandatory or optional conversion - - -

28 If convertible, specify instrument type convertible into - - -

29 If convertible, specify issuer of instrument it converts into - - -

30 Write-down features No No No

31 If write-down, write-down trigger(s) - - -

32 If write-down, full or partial - - -

33 If write-down, permanent or temporary - - -

34 If temporary write-down, description of write-up mechanism - - -

35 Position in subordination hierarchy in liquidation (specify instrument type immediately senior to instrument)

- - -

36 Non-compliant transitioned features No No No

37 If yes, specify non-compliant features - - -

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

11

BONDS SERIES A BONDS SERIES B BONDS SERIES C

1 Issuer Bank Pekao S.A. Bank Pekao S.A. Bank Pekao S.A.

2 Unique identifier (e.g. CUSIP, ISIN or Bloomberg identifier for private placement)

ISIN: PLPEKAO00289 ISIN: PLPEKAO00297 ISIN: PLPEKAO00305

3 Governing law(s) of the instrument Polish law Polish law Polish law

Regulatory treatment

4 Transitional CRR rules Tier 2 Tier 2 Tier 2

5 Post-transitional CRR rules Tier 2 Tier 2 Tier 2

6 Eligible at solo/(sub-)consolidated / solo & (sub-)consolidated Solo / Consolidated Solo / Consolidated Solo / Consolidated

7 Instrument type (types to be specified by each jurisdiction) Subordinated bonds,

Art. 62 CRR Subordinated bonds,

Art. 62 CRR Subordinated bonds,

Art. 62 CRR

8 Amount recognised in regulatory capital (currency in million, as of most recent reporting date)

PLN 1 250 000 000 PLN 550 000 000 PLN 200 000 000

9 Nominal amount of instrument PLN 1 000.00 PLN 500 000.00 PLN 500 000.00

9a Issue price PLN 1 000.00 PLN 500 000.00 PLN 500 000.00

9b Redemption price PLN 1 000.00 PLN 500 000.00 PLN 500 000.00

10 Accounting classification Financial liabilities –

amortized cost Financial liabilities –

amortized cost Financial liabilities –

amortized cost

11 Original date of issuance 30.10.2017 15.10.2018 15.10.2018

12 Perpetual or dated Dated Dated Dated

13 Original maturity date 29.10.2027 16.10.2028 14.10.2033

14 Issuer call subject to prior supervisory approval Yes Yes Yes

15 Optional call date, contingent call dates and redemption amount 29.10.2022,

PLN 1 250 000 000 15.10.2023,

PLN 550 000 000 15.10.2028,

PLN 200 000 000

16 Subsequent call dates, if applicable - - -

Coupons / dividends - - -

17 Fixed or floating dividend/coupon Floating coupon Floating coupon Floating coupon

18 Coupon rate and any related index Wibor 6M + margin Wibor 6M + margin Wibor 6M + margin

19 Existence of a dividend stopper - - -

20a Fully discretionary, partially discretionary or mandatory (in terms of timing)

Mandatory Mandatory Mandatory

20b Fully discretionary, partially discretionary or mandatory (in terms of amount)

Mandatory Mandatory Mandatory

21 Existence of step-up or other incentive to redeem No No No

22 Noncumulative or cumulative Not accumulated Not accumulated Not accumulated

23 Convertible or non-convertible Interchangeable Interchangeable Interchangeable

24 If convertible, conversion trigger(s) - - -

25 If convertible, fully or partially - - -

26 If convertible, conversion rate - - -

27 If convertible, mandatory or optional conversion - - -

28 If convertible, specify instrument type convertible into - - -

29 If convertible, specify issuer of instrument it converts into - - -

30 Write-down features No No No

31 If write-down, write-down trigger(s) - - -

32 If write-down, full or partial - - -

33 If write-down, permanent or temporary - - -

34 If temporary write-down, description of write-up mechanism - - -

35 Position in subordination hierarchy in liquidation (specify instrument type immediately senior to instrument)

Gratification last in the event of the Issuer's

bankruptcy or its liquidation

Gratification last in the event of the Issuer's bankruptcy or

its liquidation

Gratification last in the event of the Issuer's bankruptcy or

its liquidation

36 Non-compliant transitioned features No No No

37 If yes, specify non-compliant features - - -

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

12

In next chapters main positions of Common Equity Tier 1 capital and Tier 2 capital are described. The Group has no Additional Tier 1 capital.

1.3. Common Equity Tier 1 capital

Capital instruments in Common Equity Tier 1 capital in amount of PLN 262 470 thousand apply only to Bank’s share capital as parent undertaking and its value is shown according to statute and an entry in the register of entrepreneurs by nominal value. The number of shares is 262 470 034, all shares are ordinary bearer shares, entirely paid, with nominal value per one share equals PLN 1. Share premium related to these capital instruments arose with their issuance above their nominal value equals to PLN 9 137 221 thousand.

Retained earnings defined as previous year retained earnings plus the eligible interim or year-end profits according to International Accounting Standards amount PLN 286 533 thousand.

Adjustments in transitional period in amount PLN 761 535 thousand resulting from introduction of IFRS 9, increase Common Equity Tier 1 capital.

Current reporting period net profit verified by the statutory auditor, reduced by all foreseeable charges and dividend, can be included into Common Equity Tier 1 capital only with the permission of Polish Financial Supervision Authority (hereinafter: “KNF”). At 30 June 2019, Bank’s current profit for 2019 was not included into this position.

Accumulated other comprehensive income defined according to International Accounting Standards, amounted to PLN 383 278 thousand are presented after deduction of any tax charge foreseeable at the moment of its calculation and before use of prudential filters.

Other reserves defined as capital in the meaning of applicable accounting standards, are required to be disclosed under that applicable accounting standard, excluding any amounts already included in accumulated other comprehensive income or retained earnings. Other reserves are presented net of any tax charge foreseeable at the moment of the calculation and amount PLN 9 181 752 thousand.

Funds for general banking risk in amount PLN 1 982 459 thousand is created from profit after tax according to Banking Act.

1.4. Common Equity Tier 1 capital – regulatory adjustments

Intangible assets (after reduction by the amount of associated deferred tax liabilities), which amount to PLN 1 431 828 thousand, decrease Common Equity Tier 1 capital.

Reserves related to gains or losses on cash flow hedges of financial instruments that are not valued at fair value, including projected cash flows in amount of PLN 116 325 thousand are excluded from the accumulated other comprehensive income, according to Article 33(a) of Regulation 575/2013.

Additional value adjustments due to prudential valuation are applied for every asset measured at fair value, according to Article 34 of Regulation 575/2013 and amount to PLN 38 434 thousand.

Deferred tax assets that rely on future profitability and do not arise from temporary differences, decrease Common Equity Tier 1 capital according to Article 36 of Regulation 575/2013 in the amount of PLN 18 198 thousand.

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

13

1.5. Tier 2 capital

Subordinated bonds series A were issued on 30 October 2017 and are included in the Tier 2 capital, according to the approval of the KNF of 21 December 2017. As at 30 June 2019 their value of PLN 1 250 000 thousand was recognized in own funds.

Subordinated bonds series B were issued on 15 October 2018 and are included in the Tier 2 capital, according to the approval of the KNF of 16 November 2018. As at 30 June 2019 their value of PLN 550 000 thousand was recognized in own funds.

Subordinated bonds series C were issued on 15 October 2018 and are included in the Tier 2 capital, according to the approval of the KNF of 18 October 2018. As at 30 June 2019 their value of PLN 200 000 thousand was recognized in own funds.

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

14

2. Capital adequacy assessment

The objective of capital adequacy assessment is to meet requirements of applicable external regulations to ensure that banks maintain required minimum capital levels calculated using common framework. Capital requirements were calculated at the consolidated level as at 30 June 2019, according to Regulation 575/2013 using the following approaches (particular articles of Regulation 575/2013 are presented in brackets):

• Standardised Approach for credit risk (Part III, Title II, Chapter 2),

• Financial Collateral Comprehensive Method for credit risk mitigation (Part III, Title II, Chapter 4),

• Mark-to-Market Method for counterparty credit risk (Part III, Title II, Chapter 6),

• Standardised Approach for specific risk and duration-based calculation for general risk of debt instruments (Part III, Title IV, Chapter 2, Section 2),

• Standardised Approach for general and specific risk of equity instruments (Part III, Title IV, Chapter 2, Section 3),

• Standardised Approach for pre-funded contributions to the default fund of a qualifying central counterparty (Part III, Title II, Chapter 6),

• Standardised Approach for foreign-exchange risk (Part III, Title IV, Chapter 3),

• Simplified Approach for commodities risk (Part III, Title IV, Chapter 4),

• Standardised Approach for credit risk valuation adjustment risk (Part III, Title VI),

• Advanced Measurement Approach for operational risk (Part III, Title III, Chapter 4) for the Bank and Standardised Approach (Part III, Title III, Chapter 3) for the subsidiaries of the Bank.

According to law, the Group is required to maintain minimal values of capital ratios on the regulatory Pillar I level resulting from art. 92 of Regulation 575/2013, capital requirement of Pillar II resulting from art. 138.1 point. 2a of The Banking Act and combined buffer requirement defined in Act of 5 August 2015 on macroprudential supervision over the financial system and crisis management in the financial system.

Pillar II buffer referred to above, results from recommendation of KNF to banks with significant CHF mortgage loans exposure to maintain additional capital requirements. Pekao Bank Hipoteczny S.A., which is subsidiary of Bank, on 22 October 2018 was recommended to maintain a buffer in order to hedge risk arising from mortgage loans denominated in foreign currency to households – 0.56 p.p., which should consist at least 75% of Tier 1 capital (which corresponds to 0.42 p.p.). Due to the low exposure of mortgage loans denominated in foreign currency in total credit portfolio, Bank did not receive such recommendation from the KNF. The additional capital requirement imposed on Pekao Bank Hipoteczny S.A. effects on consolidated capital requirement by 0.01 p.p. for total capital ratio and 0.0075 p.p. for Tier 1 capital ratio.

Details of the combined buffer requirement are presented in Chapter 3 of Disclosures.

Minimum capital ratios which the Group is required to maintain are:

• Common Equity Tier 1 ratio (CET 1): 10.66%.

• Capital Tier 1 ratio (T1): 12.16%,

• Total capital ratio (TCR): 14.16%.

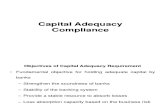

The risk weighted assets and the regulatory capital requirements for above-mentioned risks as at 30 June 2019 are presented in the table no. 4 (in accordance with the EU OV1 template shown in the EBA/GL/2016/11 Guidelines) and the chart no. 1.

The values of the regulatory capital ratios are presented in the table no. 5.

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

15

Table 4. Risk weighted amounts and capital requirements (in PLN thousand).

TITLE RISK-WEIGHTED AMOUNTS

MINIMUM CAPITAL REQUIREMENTS

30.06.2019 31.03.2019 30.06.2019

1 Credit risk (excluding CCR) 121 032 614 118 602 338 9 682 609

2 of which the standardised approach 121 032 614 118 602 338 9 682 609

3 of which the foundation IRB (FIRB) approach - - -

4 of which the advanced IRB (AIRB) approach - - -

5 of which equity IRB under the simple risk-weighted approach or the IMA - - -

6 CCR 1 312 174 1 142 358 104 974

7 of which mark to market 1 208 861 1 015 189 96 709

8 of which original exposure - - -

9 of which the standardised approach - - -

10 of which internal model method (IMM) - - -

11 of which risk exposure amount for contributions to the default fund of a CCP

1 760 1 545 141

12 of which CVA 101 553 125 624 8 124

13 Settlement risk 218 - 17

14 Securitisation exposures in the banking book (after the cap) - - -

15 of which IRB approach - - -

16 of which IRB supervisory formula approach (SFA) - - -

17 of which internal assessment approach (IAA) - - -

18 of which standardised approach - - -

19 Market risk 857 167 867 970 68 573

20 of which the standardised approach 857 167 867 970 68 573

21 of which IMA - - -

22 Large exposures - - -

23 Operational risk 6 193 365 6 412 129 495 469

24 of which basic indicator approach - - -

25 of which standardised approach 1 453 928 1 453 928 116 315

26 of which advanced measurement approach (*) 4 739 437 4 958 202 379 155

27 Amounts below the thresholds for deduction (subject to 250% risk weight) 2 390 638 2 420 939 191 251

28 Floor adjustment - - -

29 Total 129 395 538 127 024 795 10 351 642

Table 5. Capital ratios (in PLN thousand).

30.06.2018

Total amount of risk exposure 129 395 538

Common Equity Tier 1 (CET1) 20 390 463

Tier 2 (T2) capital 2 000 000

Total capital (TC=T1+T2) 22 390 463

CET1 ratio (%) 15.76

T1 ratio (%) 15.76

TCR (%) 17.30

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

16

Chart 1. Regulatory capital requirements.

3. Macroprudential supervisory measures

On 1 January 2016 entered into force since Act on macroprudential supervision. According to this act, on 30 June 2019 Group has following buffers:

1. Capital conservation buffer of 2.5% which is based on Article 84 of Act on macroprudential supervision, 2. Other Systemically Important Institution (O-SII) buffer of 0.75%, 3. Institution specific countercyclical capital buffer of 0.0062%, 4. Systemic risk buffer in amount of 2.90% (the systemic risk buffer rate is 3% of the total risk exposure amount for all

exposures located only on the territory of the Republic of Poland).

On 31 July 2018 KNF, pursuant to Article 46 of Act on macroprudential supervision, has imposed on the Bank, on the individual and consolidated basis, the Other Systemically Important Institution (O-SII) buffer in the amount of 0.75% of the total risk exposure, calculated in accordance to Article 92(3) of Regulation 575/2013.

Since 1 January 2016 countercyclical capital buffer amounts 0% for credit exposures in Poland. This rate is in force until minister competent for financial institutions will change it via regulation. On 30 June 2019 such regulation has not been published.

Group calculates institution specific countercyclical capital buffer taking into account credit exposures in other countries and theirs buffer rates.

According to Minister of Finance Regulation of 1 September 2017, regarding systemic risk buffer, systemic risk buffer in amount of 3% of the total risk exposure is calculated in accordance to Article 92(3) of Regulation 575/2013 and applies only for credit exposures in Poland. Systemic risk buffer applies since 1st January 2018.

Table no. 6 presents information on geographical location of the relevant credit exposures, according to Commission Delegated Regulation (EU) 2015/1555 of 28 May 2015 supplementing Regulation No. 575/2013 of the European Parliament and of the Council with regard to regulatory technical standards for the disclosure of information in relation to the compliance of institutions with the requirement for a countercyclical capital buffer (art. 440 of Regulation 575/2013).

93.5%

4.8%

0.7% 1.0%

Credit risk Operational risk Market risk Counterparty credit risk

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

17

Table 6. Geographical distribution of credit exposures relevant for the calculation of the countercyclical capital buffer (in PLN thousand).

30.06.2019

GENERAL CREDIT EXPOSURES

TRADING BOOK EXPOSURE

SECURITISATION EXPOSURE

OWN FUNDS REQUIREMENTS

OWN FUNDS REQUIRE-

MENTS WEIGHTS

COUNTERCYCLICAL CAPITAL BUFFER

RATE (%) EXPOSURE VALUE

FOR STANDARDISED APPROACH

EXPOSURE VALUE IRB

SUM OF LONG AND SHORT

POSITION OF TRADING

BOOK

VALUE OF TRADING BOOK EXPOSURE FOR

INTERNAL MODELS

EXPOSURE VALUE FOR

STANDARDISED APPROACH

EXPOSURE VALUE IRB

OF WHICH: GENERAL

CREDIT EXPOSURES

OF WHICH: TRADING BOOK

EXPOSURES

OF WHICH: SECURITISATION

EXPOSURES TOTAL

010 020 030 040 050 060 070 080 090 100 110 120

010 Breakdown by country

PL Poland 152 996 363 - 4 138 360 - - - 8 972 583 16 042 - 8 988 626 0.97 0.00

LU Luxembourg 1 091 176 - - - - - 87 285 - - 87 285 0.01 0.00

ES Spain 502 152 - - - - - 40 164 - - 40 164 0.00 0.00

DE Germany 419 608 - - - - - 32 817 - - 32 817 0.00 0.00

HR Croatia 247 045 - - - - - 19 764 - - 19 764 0.00 -

IT Italy 211 821 - - - - - 17 254 - - 17 254 0.00 0.00

SE Sweden 205 116 - - - - - 16 408 - - 16 408 0.00 2.00

GB United Kingdom 195 642 - - - - - 15 506 - - 15 506 0.00 1.00

CH Switzerland 125 438 - - - - - 10 013 - - 10 013 0.00 0.00

US United States 110 910 - - - - - 8 869 - - 8 869 0.00 0.00

FR France 93 716 - - - - - 7 471 - - 7 471 0.00 0.00

IE Ireland 90 778 - - - - - 7 231 - - 7 231 0.00 -

NL Netherlands 79 599 - - - - - 6 351 - - 6 351 0.00 0.00

CN China 76 865 - - - - - 6 149 - - 6 149 0.00 -

BE Belgium 67 887 - - - - - 5 420 - - 5 420 0.00 0.00

NO Norway 37 917 - - - - - 2 997 - - 2 997 0.00 2.00

CY Cyprus 31 449 - - - - - 2 510 - - 2 510 0.00 -

BS Bahama Islands 27 218 - - - - - 2 177 - - 2 177 0.00 -

CZ Czech Republic 26 809 - - - - - 2 142 - - 2 142 0.00 1.25

BY Belarus 23 245 - - - - - 1 858 - - 1 858 0.00 -

TR Turkey 23 040 - - - - - 1 843 - - 1 843 0.00 0.00

SI Slovenia 22 558 - - - - - 1 805 - - 1 805 0.00 -

AT Austria 18 410 - - - - - 1 490 - - 1 490 0.00 0.00

RU Russia 8 658 - - - - - 691 - - 691 0.00 0.00

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

18

30.06.2019

GENERAL CREDIT EXPOSURES

TRADING BOOK EXPOSURE

SECURITISATION EXPOSURE

OWN FUNDS REQUIREMENTS

OWN FUNDS REQUIRE-

MENTS WEIGHTS

COUNTERCYCLICAL CAPITAL BUFFER

RATE (%) EXPOSURE VALUE

FOR STANDARDISED APPROACH

EXPOSURE VALUE IRB

SUM OF LONG AND SHORT

POSITION OF TRADING

BOOK

VALUE OF TRADING BOOK EXPOSURE FOR

INTERNAL MODELS

EXPOSURE VALUE FOR

STANDARDISED APPROACH

EXPOSURE VALUE IRB

OF WHICH: GENERAL

CREDIT EXPOSURES

OF WHICH: TRADING BOOK

EXPOSURES

OF WHICH: SECURITISATION

EXPOSURES TOTAL

010 020 030 040 050 060 070 080 090 100 110 120

UA Ukraine 6 788 - - - - - 420 - - 420 0.00 -

RO Romania 3 836 - - - - - 307 - - 307 0.00 -

LT Lithuania 2 874 - - - - - 230 - - 230 0.00 1.00

SK Slovakia 2 470 - - - - - 196 - - 196 0.00 1.25

EE Estonia 1 799 - - - - - 144 - - 144 0.00 -

KR South Korea 1 736 - - - - - 137 - - 137 0.00 0.00

JP Japan 1 708 - - - - - 137 - - 137 0.00 -

FI Finland 1 671 - - - - - 134 - - 134 0.00 -

DK Denmark 1 640 - - - - - 131 - - 131 0.00 0.5

HU Hungary 1 345 - - - - - 112 - - 112 0.00 -

RS Serbia 1 179 - - - - - 94 - - 94 0.00 -

TW Taiwan 1 176 - - - - - 94 - - 94 0.00 -

BG Bulgaria 861 - - - - - 69 - - 69 0.00 -

LV Latvia 725 - - - - - 59 - - 59 0.00 -

ID Indonesia 549 - - - - - 44 - - 44 0.00 0.00

BA Bosnia and Hercegovina 510 - - - - - 41 - - 41 0.00 -

TH Thailand 453 - - - - - 36 - - 36 0.00 -

MT Malta 298 - - - - - 18 - - 18 0.00 -

GR Greece 280 - - - - - 22 - - 22 0.00 -

MC Monaco 222 - - - - - 13 - - 13 0.00 -

TN Tunisia 204 - - - - - 16 - - 16 0.00 -

CA Canada 194 - - - - - 21 - - 21 0.00 -

EC Ecuador 145 - - - - - 12 - - 12 0.00 -

IS Iceland 123 - - - - - 7 - - 7 0.00 1.75

LI Liechtenstein 106 - - - - - 8 - - 8 0.00 -

PT Portugal 98 - - - - - 7 - - 7 0.00 -

IN India 90 - - - - - 10 - - 10 0.00 -

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

19

30.06.2019

GENERAL CREDIT EXPOSURES

TRADING BOOK EXPOSURE

SECURITISATION EXPOSURE

OWN FUNDS REQUIREMENTS

OWN FUNDS REQUIRE-

MENTS WEIGHTS

COUNTERCYCLICAL CAPITAL BUFFER

RATE (%) EXPOSURE VALUE

FOR STANDARDISED APPROACH

EXPOSURE VALUE IRB

SUM OF LONG AND SHORT

POSITION OF TRADING

BOOK

VALUE OF TRADING BOOK EXPOSURE FOR

INTERNAL MODELS

EXPOSURE VALUE FOR

STANDARDISED APPROACH

EXPOSURE VALUE IRB

OF WHICH: GENERAL

CREDIT EXPOSURES

OF WHICH: TRADING BOOK

EXPOSURES

OF WHICH: SECURITISATION

EXPOSURES TOTAL

010 020 030 040 050 060 070 080 090 100 110 120

ZA South African Republic 57 - - - - - 4 - - 4 0.00 0.00

IL Israel 55 - - - - - 4 - - 4 0.00 -

AE United Arab Emirates 41 - - - - - 3 - - 3 0.00 -

NG Nigeria 39 - - - - - 2 - - 2 0.00 -

VG British Virgin Islands 35 - - - - - 3 - - 3 0.00 -

AU Australia 30 - - - - - 2 - - 2 0.00 -

GE Georgia 27 - - - - - 2 - - 2 0.00 -

MD Moldova 24 - - - - - 2 - - 2 0.00 -

DZ Algeria 23 - - - - - 1 - - 1 0.00 -

GG Guernsey - Channel Islands 19 - - - - - 1 - - 1 0.00 -

AD Andorra 18 - - - - - 1 - - 1 0.00 -

BZ Belize 11 - - - - - 1 - - 1 0.00 -

AF Afghanistan 10 - - - - - 1 - - 1 0.00 -

CG Congo 9 - - - - - 1 - - 1 0.00 -

NZ New Zealand 7 - - - - - - - - - 0.00 -

EG Egypt 6 - - - - - - - - - 0.00 -

CL Chile 5 - - - - - - - - - 0.00 -

BR Brazil 4 - - - - - - - - - 0.00 0.00

CO Colombia 4 - - - - - - - - - 0.00 -

SC Seychelles 3 - - - - - - - - - 0.00 -

AM Armenia 2 - - - - - - - - - 0.00 -

AL Albania 1 - - - - - - - - - 0.00 -

AZ Azerbaijan 1 - - - - - - - - - 0.00 -

KZ Kazakhstan 1 - - - - - - - - - 0.00 -

LY Libya 1 - - - - - - - - - 0.00 -

UZ Uzbekistan 1 - - - - - - - - - 0.00 -

020 Total 156 766 934 - 4 138 360 - - - 9 273 345 16 042 - 9 289 388 1.00

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

20

Table no. 7 presents amount of institution-specific countercyclical capital buffer.

Table 7. Amount of institution-specific countercyclical capital buffer (in PLN thousand).

30.06.2019

010 Total risk exposure amount 129 395 538

020 Institution specific countercyclical buffer rate (%) 0.0062%

030 Institution specific countercyclical buffer requirement 8 015

4. Information on risk

4.1. Risk management objectives and strategies

Risk management strategy determines main elements of the risk approach for the Bank and Group resulting from adopted business strategy. Risk management strategy covers objectives of risk management with accompanying key principles of risk treatment, target structure of risk connected with business activities and acceptable risk levels (risk appetite).

The aim of risk management framework applied by the Bank and Group is to assure achievement of business goals while preserving stability of capital returns. In order to assure this, the Bank/Group hedges itself against the realization of risk by identifying, and where justifiable, avoiding, or – where not – taking and mitigating each risk influencing its activity. New products, business and projects are launched only after analysis of inherent risks. It is worth highlighting that the Bank/Group focuses its activities on lines of business where they possess considerable experience enabling to assess risks related to them.

The risk management system, ensuing directly from the adopted risk management strategy, has been described in detail in the Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 31 December, 2018 and in the Condensed Consolidated Interim Financial Statements of Bank Pekao S.A. Group for the period from 1 January 2019 to 30 June 2019.

4.2. Credit risk, including counterparty risks

Credit risk is the risk of an unexpected change in the borrower's creditworthiness, which could cause a change in the credit exposure to that borrower. The change in the exposure value may result from insolvency of the borrower or a decrease in the borrower's creditworthiness. Counterparty credit risk is the risk of insolvency of the of derivative transaction party.

The main objective of credit risk and counterparty risk management is to ensure the Bank's sustainable growth while maintaining the quality of assets, compliant with the risk appetite.

In the credit risk management process, no significant modifications were introduced compared to the solutions described in the Disclosures on capital adequacy of Bank Pekao S.A. Capital Group as of 31 December 2018.

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

21

The quantitative information

Capital requirement – standardized approach

The Group uses only the standardized approach for calculation of the credit risk capital requirement.

Tables no. 8 and 9 present detailed information on the use of standardized approach, in accordance with the templates of EU CR4 and EU CR5 presented in EBA/GL/2016/11 Guidelines.

Table 8. Standardised approach – credit risk exposure and CRM effects (in PLN thousand).

EXPOSURE CLASSES

EXPOSURES BEFORE CCF AND CRM EXPOSURES POST CCF AND CRM RWA AND RWA DENSITY

ON-BALANCE-SHEET AMOUNT

OFF-BALANCE-SHEET AMOUNT

ON-BALANCE-SHEET AMOUNT

OFF-BALANCE-SHEET AMOUNT

RWA RWA DENSITY

1 Central governments or central banks 31 220 267 750 32 251 170 42 470 2 950 527 9.14%

2 Regional governments or local authorities 8 144 662 583 773 9 183 076 121 422 1 877 167 20.17%

3 Public sector entities 2 306 300 293 509 1 935 905 73 639 958 509 47.70%

4 Multilateral development banks 3 430 468 - 3 713 925 2 095 - 0.00%

5 International organisations - - - - - -

6 Institutions 1 429 044 1 588 220 1 898 069 438 427 658 825 28.20%

7 Corporates 50 777 107 40 218 795 48 187 539 10 452 570 56 744 681 96.77%

8 Retail 38 558 022 6 675 226 37 878 369 1 256 045 28 479 746 72.77%

9 Secured by mortgages on immovable property 44 994 242 1 265 492 44 993 821 507 626 21 826 133 47.97%

10 Exposures in default 3 754 781 416 237 3 724 673 92 217 4 505 788 118.05%

11 Items associated with particularly high risk - - - - - -

12 Covered bonds - - - - - -

13 Claims on institutions and corporates with a short-term credit assessment - - - - - -

14 Collective investments undertakings - - - - - -

15 Equity exposures 404 734 - 404 734 - 404 734 100.00%

16 Other exposures 5 787 785 90 5 787 785 90 2 626 505 45.38%

17 Total 190 807 412 51 042 092 189 959 066 12 986 601 121 032 615 59.64%

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

22

Table 9. Standardised approach – breakdown of credit risk exposure (post conversion factor and post risk mitigation techniques) by asset class and risk weight (in PLN thousand).

EXPOSURE CLASSES

RISK WEIGHT

TOTAL OF WHICH UNRATED 0% 2% 4% 10% 20% 35% 50% 70% 75% 100% 150% 250% 370% 1250% OTHERS

DEDUC-TED

1 Central governments or central banks

27 527 405 - - 2 021 068 1 788 912 - - - - - - 956 255 - - - - 32 293 640 3 609 027

2 Regional governments or local authorities

- - - - 9 284 070 - - - - 20 428 - - - - - - 9 304 498 9 304 498

3 Public sector entities - - - - 154 211 - 1 855 334 - - - - - - - - - 2 009 545 2 009 545

4 Multilateral development banks

3 716 020 - - - - - - - - - - - - - - - 3 716 020 3 716 020

5 International organisations

- - - - - - - - - - - - - - - - - -

6 Institutions - - - - 1 726 104 - 591 955 - - 18 437 - - - - - - 2 336 496 1 011 654

7 Corporates - - - - 554 198 - 1 667 726 - - 56 417 920 264 - - - - - 58 640 108 53 109 929

8 Retail - - - - - - - - 39 134 414 - - - - - - - 39 134 414 39 134 414

9 Secured by mortgages on immovable property

- - - - - 38 355 363 - - - 4 404 385 2 741 699 - - - - - 45 501 447 45 501 447

10 Exposures in default - - - - - - - - - 2 439 094 1 377 796 - - - - - 3 816 890 3 816 890

11 Items associated with particularly high risk

- - - - - - - - - - - - - - - - - -

12 Covered bonds - - - - - - - - - - - - - - - - - -

13

Claims on institutions and corporates with a short-term credit assessment

- - - - - - - - - - - - - - - - - -

14 Collective investments undertakings

- - - - - - - - - - - - - - - - - -

15 Equity exposures - - - - - - - - - 404 734 - - - - - - 404 734 404 734

16 Other exposures 2 646 091 - - - 644 102 - - - - 2 497 682 - - - - - - 5 787 875 5 787 875

17 Total 33 889 516 - - 2 021 068 14 151 597 38 355 363 4 115 015 - 39 134 414 66 202 680 4 119 759 956 255 - - - - 202 945 667 167 406 033

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

23

Table no. 10 presents extents of the use of CRM techniques, in accordance with the EU CR3 template shown in the EBA/GL/2016/11 Guidelines.

Table 10. CRM techniques – overview (in PLN thousand).

EXPOSURES UNSECURED

EXPOSURES SECURED

EXPOSURES SECURED BY COLLATERAL

EXPOSURES SECURED BY

FINANCIAL GUARANTEES

EXPOSURES SECURED BY

CREDIT DERIVATIVES

1 Total loans 135 732 735 3 667 884 848 347 2 819 537 -

2 Total debt securities 42 870 933 916 960 - 916 960 -

3 Total exposures (*) 236 546 344 5 303 159 879 767 4 423 392 -

4 Of which defaulted 4 140 822 30 196 1 311 28 885 -

(*) Item includes balance sheet and off-balance sheet exposure.

Within the calculation of its own funds requirements for credit risk, the Group uses the credit assessments assigned by the external credit assessment institutions (ECAI). The process of carrying the issuer's and issue’s rating to individual Group’s exposures complies with the Regulation 575/2013 (Part III, Title II, Chapter 2). The Group's internal regulations govern the use of external ratings and define the names of external credit rating institutions whose ratings may be used.

As at 30 June 2019, the Group used external ratings issued by Fitch Ratings.

Credit quality of exposures

In accordance with the EBA/GL/2016/11 Guidelines the following tables contain information on credit quality, past-due exposures, non-performing and forborne exposures.

• table no. 11 – credit quality of on-balance-sheet and off-balance-sheet exposures (EU CR1-A template),

• table no. 12 – credit quality of on-balance-sheet and off-balance-sheet exposures by industry (EU CR1-B template),

• table no. 13 – credit quality of on-balance-sheet and off-balance-sheet exposures by geographical areas (EU CR1-C template),

• table no. 14 – analysis of accounting on-balance-sheet past-due exposures regardless of their impairment status (EU CR1-D template),

• table no. 15 – overview of non-performing and forborne exposures as per the Commission Implementing Regulation (EU) 680/2014 (EU CR1-E template),

• table no. 16 – identify the changes in stock of general and specific credit risk adjustments held against loans and debt securities that are defaulted or impaired (EU CR2-A template),

• table no. 17 – identify the changes in stock of defaulted loans and debt securities (EU CR2-B template).

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

24

Table 11. Credit quality of exposures by exposure class and instrument (in PLN thousand).

GROSS CARRYING VALUES OF SPECIFIC CREDIT

RISK ADJUSTMENT GENERAL CREDIT

RISK ADJUSTMENT ACCUMULATED

WRITE-OFFS NET VALUES (1+2-3-4) DEFAULTED

EXPOSURES NON-DEFAULTED

EXPOSURES

1 2 3 4 5

1 Central governments or central banks - 31 221 822 805 31 221 017

2 Regional governments or local authorities - 8 735 454 7 019 8 728 435

3 Public sector entities - 2 613 142 13 333 2 599 809

4 Multilateral development banks - 3 430 468 - 3 430 468

5 International organisations - - - -

6 Institutions - 3 019 571 2 307 3 017 264

7 Corporates - 91 250 852 254 951 90 995 901

8 of which: SMEs - 3 599 898 23 445 3 576 453

9 Retail - 45 747 239 513 990 45 233 249

10 of which: SMEs - 7 533 629 44 019 7 489 610

11 Secured by mortgages on immovable property - 46 382 838 123 104 46 259 734

12 of which: SMEs - 1 071 898 4 070 1 067 828

13 Exposures in default 8 965 435 - 4 794 417 4 171 018

14 Items associated with particularly high risk - - - -

15 Covered bonds - - - -

16 Claims on institutions and corporates with a short-term credit assessment

- - - -

17 Collective investments undertakings - - - -

18 Equity exposures - 404 734 - 404 734

20 Other exposures - 5 788 012 137 5 787 875

21 Total standardised approach 8 965 435 238 594 132 5 710 063 241 849 504

22 Total 8 965 435 238 594 132 5 710 063 9 553 803 241 849 504

23 of which: Loans 8 331 936 136 510 789 5 442 106 9 553 803 139 400 619

24 of which: Debt securities 143 514 43 733 888 89 509 - 43 787 893

25 of which: Off-balance-sheet exposures 510 607 50 709 929 178 444 - 51 042 092

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

25

Table 12. Credit quality of exposures by industry (in PLN thousand).

GROSS CARRYING VALUES OF SPECIFIC CREDIT

RISK ADJUSTMENT GENERAL CREDIT

RISK ADJUSTMENT ACCUMULATED

WRITE-OFFS NET VALUES (1+2-3-4) DEFAULTED

EXPOSURES NON-DEFAULTED

EXPOSURES

1 2 3 4 5

A Agriculture, forestry and fishing 187 797 904 481 123 661 233 725 968 617

B Minning and quarrying 3 202 2 621 277 11 425 89 817 2 613 054

C Manufacturing 1 502 740 25 086 921 980 364 1 874 677 25 609 297

D Electricity, gas, steam and air conditioning supply 31 118 6 007 498 30 391 124 956 6 008 225

E Water supply 15 548 1 670 279 19 331 10 561 1 666 496

F Construction 1 718 591 8 004 661 900 601 997 396 8 822 651

G Wholesale and retail trade 919 396 24 093 856 633 141 1 229 124 24 380 111

H Transport and storage 141 727 5 361 475 75 109 105 333 5 428 093

I Accomodation and food service activities 278 982 2 599 285 148 977 44 910 2 729 290

J Information and communication 34 344 2 717 558 24 014 46 887 2 727 888

K Financial and insurance activities 59 166 9 682 216 64 655 55 103 9 676 727

L Real estate activities 907 088 8 760 623 384 608 485 891 9 283 103

M Professional, scientific and technical activities 154 328 10 812 902 108 427 84 997 10 858 803

N Administrative and support service activities 31 934 1 858 245 27 522 39 949 1 862 657

O Public administration and defence, compulsory social security

- 36 061 623 6 802 3 36 054 821

P Education 2 205 382 986 2 760 10 347 382 431

Q Human health services and social work activities 4 812 827 603 5 992 19 224 826 423

R Arts, entertainment and recreation 9 033 932 245 12 400 11 976 928 878

Other services, other 2 963 424 90 208 398 2 149 883 4 088 927 91 021 939

Total 8 965 435 238 594 132 5 710 063 9 553 803 241 849 504

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

26

Table 13. Credit quality of exposures by geography (in PLN thousand).

GROSS CARRYING VALUES OF SPECIFIC CREDIT

RISK ADJUSTMENT GENERAL CREDIT

RISK ADJUSTMENT ACCUMULATED

WRITE-OFFS NET VALUES (1+2-3-4) DEFAULTED

EXPOSURES DEFAULTED EXPOSURES

1 2 3 4 5

1 Poland 8 421 528 226 250 180 5 487 958 9 435 020 229 183 750

2 Luxemburg 38 593 4 810 898 35 428 1 291 4 814 063

3 Germany 53 389 1 465 347 46 306 41 896 1 472 430

4 United Kingdom 1 369 905 103 1 007 320 905 465

5 United States 3 877 825 106 3 802 5 941 825 181

6 Italy 428 909 341 837 114 080 6 785 656 666

7 Nederlands 43 568 626 2 276 29 566 393

8 Spain - 520 079 1 969 23 518 110

9 China - 445 491 - 30 445 491

10 Austria 259 381 081 214 16 381 126

11 Other countries 17 468 2 080 384 17 023 62 452 2 080 829

12 Total 8 965 435 238 594 132 5 710 063 9 553 803 241 849 504

The Group classifies the exposure as past due if the borrower did not make a principal and / or interest payment in the contractual due date. The Group presents the entire exposition as past due regardless of whether the payment delay applies to the entire exposure or only parts of it (installments).

Table 14. Ageing of past-due exposures (in PLN thousand).

GROSS CARRYING VALUES

≤ 30 DAYS > 30 DAYS ≤ 90 DAYS > 90 DAYS ≤ 180 DAYS > 180 DAYS ≤ 1 YEAR > 1 YEAR

1 Loans 3 006 596 635 074 294 041 717 144 5 073 110

2 Debt securities - - - - 31 825

3 Total exposures 3 006 596 635 074 294 041 717 144 5 104 935

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

27

Table 15. Non-performing and forborne exposures (in PLN thousand).

GROSS CARRYING VALUES OF PERFORMING AND NON-PERFORMING EXPOSURES ACCUMULATED IMPAIRMENT AND PROVISIONS AND NEGATIVE FAIR

VALUE ADJUSTMENTS DUE TO CREDIT RISK COLLATERALS AND FINANCIAL

GUARANTEES RECEIVED

TOTAL

OF WHICH PERFORMING BUT

PAST DUE > 30 DAYS AND <= 90

DAYS

OF WHICH PERFORMING FORBORNE

OF WHICH NON-PERFORMING ON PERFORMING EXPOSURES ON NON-PERFORMING EXPOSURES ON NON-

PERFORMING EXPOSURES

OF WHICH FORBORNE

TOTAL OF WHICH

DEFAULTED OF WHICH IMPAIRED

OF WHICH FORBORNE

TOTAL OF WHICH

FORBORNE TOTAL

OF WHICH FORBORNE

010 Debt securities 43 877 766 - - 31 825 31 825 31 825 - (70 570) - (31 825) - - -

020 Loans and advances

146 053 681 510 449 513 674 7 809 808 7 809 808 7 809 808 2 995 611 (1 071 071) (14 463) (5 211 882) (1 653 786) 1 572 576 1 371 021

030 Off-balance sheet exposures

49 693 065 280 510 607 510 607 510 607 1 543 (126 468) (6) (156 642) (639) 12 212 521

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

28

Table 16. Changes in the stock of general and specific credit risk adjustments, for defaulted and impaired exposures (in PLN thousand).

ACCUMULATED SPECIFIC

CREDIT RISK ADJUSTMENT (*)

OF WHICH: FOR EXPOSURES IN DEFAULT

ACCUMULATED GENERAL CREDIT RISK ADJUSTMENT

1 Opening balance (4 430 149) (3 609 157)

2 Increases due to amounts set aside for estimated loan losses during the period

(1 872 395) (937 894)

3 Decreases due to amounts reversed for estimated loan losses during the period

1 361 396 539 844

4 Decreases due to amounts taken against accumulated credit risk adjustments

3 487 833 3 487 083

5 Transfers between credit risk adjustments - -

6 Impact of exchange rate differences (35 354) (30 911)

7 Business combinations, including acquisitions and disposals of subsidiaries

- -

8 Other adjustments (**) (4 221 394) (4 243 382)

9 Closing balance (5 710 063) (4 794 417)

10 Recoveries on credit risk adjustments recorded directly to the statement of profit or loss

20 841 20 841

11 Specific credit risk adjustments directly recorded to the statement of profit or loss

(11) (11)

(*) The Group, in calculation of exposures for credit risk, calculates the credit risk adjustments in accordance with Article 1 of the Commission Delegated Regulation (EU) 183/2014 of 20 December 2013 supplementing Regulation (EU) No. 575/2013 of the European Parliament and of the Council on prudential requirements for credit institutions and investment firms, with regard to regulatory technical standards for specifying the calculation of specific and general credit risk adjustments.

(**) Contains amount included in specific credit risk adjustment due to opening balance of expected credit losses determined in accordance with the IFRS 9 as at 1 January 2018, taking into account transitional period.

Table 17. Changes in the stock of defaulted and impaired loans and debt securities (in PLN thousand).

GROSS CARRYING

VALUE DEFAULTED EXPOSURES

1 Opening balance 7 886 550

2 Loans and debt securities that have defaulted or impaired since the last reporting period 571 433

3 Returned to non-defaulted status (126 862)

4 Amounts written off (323 151)

5 Other changes (149 317)

6 Closing balance 7 858 653

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

29

Counterparty credit risk and CVA

Tables no. 18-23 present detailed information on the Group's exposure to counterparty credit risk, in accordance with the requirements set out in Article 439 of Regulation 575/2013 and the EBA/GL/2016/11 Guidelines.

The content of each tables and references to the relevant formulas provided in EBA/GL/2016/11 Guidelines are as follows:

• table no. 18 – methods used to calculate CCR regulatory requirements and the main parameters used within each method (EU CCR1 template),

• table no. 19 – breakdown of all types of collateral (cash, sovereign debt, corporate bonds, etc.) posted or received by banks to support or reduce CCR exposures related to derivative transactions or to SFTs, including transactions cleared through a CCP (EU CCR5-B template)

• table no. 20 – breakdown of CCR exposures by portfolio (type of counterparties) and by risk weight (riskiness attributed according to the standardised approach) – (EU CCR3 template)

• table no. 21 – CVA regulatory calculations (EU CCR2 template),

• table no. 22 – exposures to CCPs (template EU CCR8 template),

• table no. 23 – impact of netting and collateral held on exposure values (EU CCR5-A template).

Table 18. Analysis of CCR exposure (excluding exposures to CCPs) by approach (in PLN thousand).

METHOD NOTIONAL REPLACEMENT

COST/ CURRENT MARKET VALUE

POTENTIAL FUTURE CREDIT

EXPOSURE

EEPE MULTIPLIER EAD POST

CRM RWA

1 Mark to market 433 913 961 673 1 395 831 1 149 658

2 Original exposure - - -

3 Standardised approach - - - -

4 IMM (for derivatives and SFTs) - - - -

5 Of which securities financing transactions - - - -

6 Of which derivatives and long settlement transactions

- - - -

7 Of which from contractual cross-product netting

- - - -

8 Financial collateral simple method (for SFTs) - -

9 Financial collateral comprehensive method (for SFTs)

2 835 93

10 VaR for SFTs - -

11 Total 1 149 751

Table 19. Composition of collateral for exposures to CCR (in PLN thousand).

COLLATERAL USED IN DERIVATIVE TRANSACTIONS COLLATERAL USED IN SFT

FAIR VALUE OF COLLATERAL RECEIVED

FAIR VALUE OF POSTED COLLATERAL FAIR VALUE OF

COLLATERAL RECEIVED

FAIR VALUE OF POSTED

COLLATERAL SEGREGATED

UNSEGRE-GATED

SEGREGATED UNSEGRE-

GATED

1 Cash deposits - 124 415 - 503 299 - -

2 Debt securities - - - - 1 185 146 1 367 578

3 Total - 124 415 - 503 299 1 185 146 1 367 578

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

30

Table 20. Standardised approach – CCR exposures by regulatory portfolio and risk (in PLN thousand).

EXPOSURE CLASSES RISK WEIGHT

TOTAL OF WHICH UNRATED 0% 2% 4% 10% 20% 50% 70% 75% 100% 150% OTHERS

1 Central governments or central banks

9 918 - - - - - - - - - - 9 918 -

2 Regional government or local authorities

- - - - - - - - - - - - -

3 Public sector entities - - - - - - - - - - - - -

4 Multilateral development banks

- - - - - - - - - - - - -

5 International organisations - - - - - - - - - - - - -

6 Institutions - 894 041 1 030 729 - 144 348 247 032 - - 504 - - 2 316 654 80 269

7 Corporates - - - - - 3 - - 996 851 - - 996 854 780 590

8 Retail - - - - - - - - - - - - -

9 Institutions and corporates with a short-term credit assessment

- - - - - - - - - - - - -

10 Other items - - - - - - - - 9 - - 9 -

11 Total 9 918 894 041 1 030 729 - 144 348 247 035 - - 997 364 - - 3 323 435 860 859

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

31

Table 21. CVA capital charge (in PLN thousand).

EXPOSURE VALUE RWA

1 Total portfolios subject to the advanced method - -

2 (i) VaR component (including the 3× multiplier) -

3 (ii) SVaR component (including the 3× multiplier) -

4 All portfolios subject to the standardised method 462 513 101 553

EU4 Based on the original exposure method - -

5 Total subject to the CVA capital charge 462 513 101 553

Table 22. Exposures to CCPs (in PLN thousand).

EAD POST CRM RWA

1 Exposures to QCCPs (total) 60 870

2 Exposures for trades at QCCPs (excluding initial margin and default fund contributions); of which

1 924 770 59 110

3 (i) OTC derivatives 1 924 770 59 110

4 (ii) Exchange-traded derivatives - -

5 (iii) SFTs - -

6 (iv) Netting sets where cross-product netting has been approved - -

7 Segregated initial margin 318 269

8 Non-segregated initial margin - -

9 Prefunded default fund contributions 41 558 1 760

10 Alternative calculation of own funds requirements for exposures -

11 Exposures to non-QCCPs (total) -

12 Exposures for trades at non-QCCPs (excluding initial margin and default fund contributions); of which

- -

13 (i) OTC derivatives - -

14 (ii) Exchange-traded derivatives - -

15 (iii) SFTs - -

16 (iv) Netting sets where cross-product netting has been approved - -

17 Segregated initial margin -

18 Non-segregated initial margin - -

19 Prefunded default fund contributions - -

20 Unfunded default fund contributions - -

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

32

Table 23. Impact of netting and collateral held on exposure values (in PLN thousand).

GROSS POSITIVE FAIR VALUE OR NET CARRYING

AMOUNT

NETTING BENEFITS

NETTED CURRENT CREDIT EXPOSURE

COLLATERAL HELD

NET CREDIT EXPOSURE

1 Derivatives 1 765 226 514 182 9 753 378 793 1 641 342

2 SFTs (180 438) - - (183 272) 2 835

3 Cross-product netting - - - - -

4 Total 1 584 788 514 182 9 753 195 521 1 644 177

4.3. Market risk, including interest rate risk

Market risk is the risk that affects the size of the Bank's results and capital due to changes in the value of financial instruments resulting from changes in market prices. It takes into account such factors as: changes in foreign exchange rates (exchange rate risk),changes in market interest rates (general interest rates risk), changes in prices and credit spreads of debt securities (specific risk of debt instruments), changes in equity prices (general and specific equity risk), changes in commodity prices (commodity risk), changes in implied volatility of underlying instruments for option contracts (vega and gamma risks).

The main objective of market risk management, including interest rate risk, is to achieve the Bank's business objectives while maintaining exposure to market risk within the risk appetite set by the limits approved by the Management Board and the Supervisory Board. The process of banking book interest rate risk management is aimed, in particular, at securing the economic value of the Bank's equity as well as stable implementation of the assumed interest result within the accepted limits.

The market risk management process has been described in detail in the Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 31 December, 2018. The solutions in this area have not changed materially compared to those described at the end of last year except for implementation of the EBA “Guidelines on the management of interest rate risk arising from non-trading activities" (EBA/GL/2018/02 of July 19, 2018).

The quantitative information

Table no. 24 presents the components of own funds requirements under the standardised approach for market risk, in accordance with the EU MR1 template shown in the EBA/GL/2016/11 Guidelines.

Table 24. Market risk under the standardised approach (in PLN thousand).

RWA CAPITAL REQUIREMENTS

Outright products

1 Interest rate risk (general and specific) 853 317 68 265

2 Equity risk (general and specific) 3 850 308

3 Foreign exchange risk - -

4 Commodity risk - -

Options

5 Simplified approach - -

6 Delta-plus method - -

7 Scenario approach - -

8 Securitisation (specific risk) - -

9 Total 857 167 68 573

Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 30 June, 2019

33

4.4. Operational risk

Operational risk is the risk of loss due to inadequacy or failure of internal processes, people, systems or from external events. Operational risk includes legal risk. Strategic risk, business risk and reputation risk are separate risk categories.

The objective of proper operational risk management is to maintain the operational risk the Bank takes on the level consistent with a specific risk appetite.

The operational risk management process has been described in detail in the Disclosures on capital adequacy of the Bank Pekao S.A. Capital Group as at 31 December, 2018. The solutions in this area have not changed compared to those described at the end of last year.

In March 2019, the Bank received confirmation from the Polish Financial Supervision Authority (KNF) that the conditions set out in the decision of 22 December 2017 regarding the application of the AMA method were met. The KNF also informed that the necessity for the Bank to maintain – for the purpose of calculating the capital requirements under the AMA method – the lower level of the requirement in the form of 50% of the capital requirement calculated in accordance with the standard method ceased.

4.5. Liquidity risk

Liquidity risk stands for a risk that the Bank may find itself unable to fulfil its payment obligations (by cash or delivery), whether expected or unexpected, without jeopardizing its day-to-day operations or its financial condition. Liquidity risk covers market/product liquidity risk, funding risk and liquidity concentration risk.

Liquidity risk management is adjusted to the nature, scale and complexity of the Bank’s activities and includes both the Bank, as well as the Group. An objective of liquidity risk management is to:

• Ensure and maintain the Bank’s and Group’s capability to meet both current and future liabilities, including costs of acquiring liquidity and profitability of equity,

• Preventing the occurrence of a crisis situations, and

• Determine the solutions for the survival of a crisis situation when it possibly occurs.