Capital Adequacy Norms

Transcript of Capital Adequacy Norms

-

8/8/2019 Capital Adequacy Norms

1/38

Capital Adequacy Norms

Basel II norms

-

8/8/2019 Capital Adequacy Norms

2/38

Introduction

With a view to adopting the Basel Committee on BankingSupervision (BCBS) framework on capital adequacywhich takes into account the elements of credit risk invarious types of assets in the balance sheet as well as

off-balance sheet business and also to strengthen thecapital base of banks, Reserve Bank of India decided inApril 1992 to introduce a risk asset ratio system forbanks (including foreign banks) in India as a capitaladequacy measure.

Essentially, under the above system the balance sheet

assets, non-funded items and other off-balance sheetexposures are assigned prescribed risk weights andbanks have to maintain unimpaired minimum capitalfunds equivalent to the prescribed ratio on the aggregateof the risk weighted assets and other exposures on anongoing basis.

-

8/8/2019 Capital Adequacy Norms

3/38

Introduction

The Revised Framework provides a range of options fordetermining the capital requirements for credit risk andoperational risk to allow banks and supervisors to selectapproaches that are most appropriate for their

operations and financial markets. The Revised Framework consists of three-mutuallyreinforcing Pillars, viz. minimum capital requirements,supervisory review of capital adequacy, and marketdiscipline. Under Pillar 1, the Framework offers threedistinct options for computing capital requirement for

credit risk and three other options for computing capitalrequirement for operational risk. These options for creditand operational risks are based on increasing risksensitivity and allow banks to select an approach that ismost appropriate to the stage of development of bank'soperations.

-

8/8/2019 Capital Adequacy Norms

4/38

Capital Funds

Banks are required to maintain a minimum Capital to Risk-weighted Assets Ratio (CRAR) of 9 percent on an ongoingbasis. The RBI will take into account the relevant risk factorsand the internal capital adequacy assessments of each bankto ensure that the capital held by a bank is commensurate

with the banks overall risk profile. This would include, amongothers, the effectiveness of the banks risk managementsystems in identifying, assessing / measuring, monitoring andmanaging various risks.

Accordingly, the Reserve Bank will consider prescribing ahigher level of minimum capital ratio for each bank under the

Pillar 2 framework on the basis of their respective risk profilesand their risk management systems. Further, in terms of thePillar 2 requirements of the New Capital AdequacyFramework, banks are expected to operate at a level wellabove the minimum requirement.

-

8/8/2019 Capital Adequacy Norms

5/38

Pillar 1

Calculation of the total minimum capital

requirements for credit, market and operational

risks.

The minimum capital requirements arecomposed of three fundamental elements:

a definition of regulatory capital,

risk weighted assets and

the minimum ratio of capital to risk weighted assets(CRAR/CAR).

-

8/8/2019 Capital Adequacy Norms

6/38

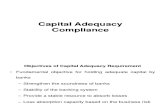

26-Nov-1026-Nov-10

Three Basic Pillars

Minimum

Capital

Requirement

Market

Discipline

Market RiskCredit Risk

Definition ofCapital

Weighted Risks

Operational Risk

Standardised

Approach (SA)

Internal Ratings Based

Approach (IRBA) Basic

Indicator

Approach

(BIA)

Standardiz

ed

Approach

(SA)

Advanced

Measurement

Approach

(AMA)Foundation

Approach(FIRB)

Advanced

Approach (AIRB)

Basel IIBasel II

-

8/8/2019 Capital Adequacy Norms

7/38

Elements of Tier 1 capital

For Indian banks, Tier 1 capital would include thefollowing elements:

i) Paid-up equity capital, statutory reserves, and otherdisclosed free reserves, if any;

ii) Capital reserves representing surplus arising out ofsale proceeds of assets;

iii) Innovative perpetual debt instruments eligible forinclusion in Tier 1 capital, which comply with theregulatory requirements as specified;

iv) Perpetual Non-Cumulative Preference Shares(PNCPS), which comply with the regulatory requirementsas specified; and

v) Any other type of instrument generally notified by theReserve Bank from time to time for inclusion in Tier 1capital.

-

8/8/2019 Capital Adequacy Norms

8/38

Limits on Eligible Tier I Capital

(i) The Innovative perpetual debt instruments(IPDIs),eligible to be reckoned as Tier 1 capital, will be limited to15 percent of total Tier 1 capital as on March 31 of theprevious financial year.

(ii) The outstanding amount of Tier 1 preference sharesi.e. Perpetual Non-Cumulative Preference Shares alongwith Innovative Tier 1 instruments shall not exceed 40per cent of total Tier 1 capital at any point of time.

(iii) Innovative instruments / PNCPS, in excess of thelimit shall be eligible for inclusion under Tier 2, subject tolimits prescribed for Tier 2 capital.

-

8/8/2019 Capital Adequacy Norms

9/38

Elements of Tier 2 capital

(i) Revaluation reserves

These reserves often serve as a cushion againstunexpected losses, but they are less permanent innature and cannot be considered as Core Capital.

Revaluation reserves arise from revaluation of assetsthat are undervalued on the banks books, typically bankpremises. As there may be subsequent deterioration invalue on account of difficult market conditions or forcedsale, revaluation reserves is considered at a discount of

55 percent while determining their value for inclusion inTier 2 capital. Such reserves will have to be reflected onthe face of the Balance Sheet as revaluation reserves.

-

8/8/2019 Capital Adequacy Norms

10/38

Elements of Tier 2 capital

(ii) General provisions and loss reserves

Such reserves, if they are not attributable to the actualdiminution in value or identifiable potential loss in anyspecific asset and are available to meet unexpected

losses, can be included in Tier 2 capital. Adequate caremust be taken to see that sufficient provisions havebeen made to meet all known losses and foreseeablepotential losses before considering general provisionsand loss reserves to be part of Tier 2 capital.

Banks are allowed to include the General Provisions on

Standard Assets', Floating Provisions, Provisions heldfor Country Exposures, and Investment Reserve

Account in Tier 2 capital.

However, these four items will be admitted as Tier 2capital up to a maximum of 1.25 per cent of the total risk-

weighted assets.

-

8/8/2019 Capital Adequacy Norms

11/38

Elements of Tier 2 capital

(iii) Hybrid debt capital instruments

In this category, fall a number of debt capitalinstruments, which combine certain characteristics ofequity and certain characteristics of debt. Banks in India

are allowed to recognise funds raised through debtcapital instrument which has a combination ofcharacteristics of both equity and debt, as Upper Tier 2capital provided the instrument complies with theregulatory requirements specified.

Indian Banks are also allowed to issue Perpetual

Cumulative Preference Shares (PCPS), RedeemableNon-Cumulative Preference Shares (RNCPS) andRedeemable Cumulative Preference Shares (RCPS), asUpper Tier 2 Capital, subject to extant legal provisionsas per guidelines.

-

8/8/2019 Capital Adequacy Norms

12/38

Elements of Tier 2 capital

(iv) Subordinated debt

To be eligible for inclusion in Tier 2 capital, theinstrument should be fully paid-up, unsecured,subordinated to the claims of other creditors, free of

restrictive clauses, and should not be redeemable at theinitiative of the holder or without the consent of theReserve Bank of India. They often carry a fixed maturity,and as they approach maturity, they should be subjectedto progressive discount, for inclusion in Tier 2 capital.

Instruments with an initial maturity of less than 5 years orwith a remaining maturity of one year should not beincluded as part of Tier 2 capital.

-

8/8/2019 Capital Adequacy Norms

13/38

Elements of Tier 2 capital

(v) Innovative Perpetual Debt Instruments (IPDI)and Perpetual Non-Cumulative PreferenceShares (PNCPS)

IPDI in excess of 15 per cent of Tier 1 capitalmay be included in Tier 2, and PNCPS in excessof the overall ceiling of 40 per cent ceiling maybe included under Upper Tier 2 capital.

(vi) Any other type of instrument generallynotified by the Reserve Bank from time to timefor inclusion in Tier 2 capital.

-

8/8/2019 Capital Adequacy Norms

14/38

Capital Charge for Credit Risk

General

Under the Standardised Approach, the ratingassigned by the eligible external credit ratingagencies will largely support the measure ofcredit risk. The Reserve Bank has identified theexternal credit rating agencies that meet theeligibility criteria specified under the revisedFramework. Banks may rely upon the ratingsassigned by the external credit rating agencieschosen by the Reserve Bank for assigning riskweights for capital adequacy purposes as perthe mapping furnished in these guidelines.

-

8/8/2019 Capital Adequacy Norms

15/38

Rating is applicable to exposures on

Foreign Sovereigns

Foreign Banks

Domestic Public Sector Entities

Foreign Public Sector Entities

Domestic Primary Dealers

Non-Resident Primary Dealers

Domestic Corporate Exposures

Non-Resident Corporate Exposures

-

8/8/2019 Capital Adequacy Norms

16/38

Claims on Domestic Sovereigns

Both fund based and non fund based claims onthe central government will attract a zero riskweight. Central Government guaranteed claims

will attract a zero risk weight. The Direct loan / credit / overdraft exposure, if

any, of banks to the State Governments and theinvestment in State Government securities will

attract zero risk weight. State Governmentguaranteed claims will attract 20 per cent riskweight

-

8/8/2019 Capital Adequacy Norms

17/38

Claims on Domestic Sovereigns

The risk weight applicable to claims on centralgovernment exposures will also apply to theclaims on the Reserve Bank of India, DICGCand Credit Guarantee Fund Trust for Small

Industries (CGTSI). The claims on ECGC willattract a risk weight of 20 per cent.

The above risk weights for both direct claimsand guarantee claims will be applicable as longas they are classified as standard/ performingassets. Where these sovereign exposures areclassified as non-performing, they would attractrisk weights as applicable to NPAs.

-

8/8/2019 Capital Adequacy Norms

18/38

Claims on Foreign Sovereigns

Claims on foreign sovereigns will attract risk weights as

per the rating assigned to those sovereigns / sovereign

claims by international rating agencies as follows:

-

8/8/2019 Capital Adequacy Norms

19/38

Claims on public sector entities (PSEs)

Claims on domestic public sector entities will be riskweighted in a manner similar to claims on Corporates.

Claims on foreign PSEs will be risk weighted as per the

rating assigned by the international rating agencies as

under:

-

8/8/2019 Capital Adequacy Norms

20/38

Claims on banks incorporated in India

and foreign bank branches in India

-

8/8/2019 Capital Adequacy Norms

21/38

Claims on Foreign Banks

The claims on foreign banks will be risk weighted as under

as per the ratings assigned by international rating

agencies.

-

8/8/2019 Capital Adequacy Norms

22/38

Claims on corporate Risk weights

-

8/8/2019 Capital Adequacy Norms

23/38

Claims on corporate Risk weights

The Reserve Bank may increase the standard riskweight for unrated claims where a higher risk weight iswarranted by the overall default experience. As part ofthe supervisory review process, the Reserve Bank wouldalso consider whether the credit quality of unrated

corporate claims held by individual banks should warranta standard risk weight higher than 100 per cent.

To begin with, for the financial year 2008-09, all freshsanctions or renewals in respect of unrated claims oncorporates in excess of Rs.50 crore will attract a riskweight of 150 per cent. With effect from April 1, 2009, all

fresh sanctions or renewals in respect of unrated claimson corporates in excess of Rs. 10 crore will attract a riskweight of 150 per cent. The threshold of Rs. 50 crore(and Rs. 10 crore) will be with reference to the aggregateexposure on a single counterparty for the bank as awhole.

-

8/8/2019 Capital Adequacy Norms

24/38

Claims on non-resident corporates

Risk weights

-

8/8/2019 Capital Adequacy Norms

25/38

Claims secured by residential property

Lending to individuals meant for acquiring residentialproperty which are fully secured by mortgages on theresidential property that is or will be occupied by theborrower, or that is rented, shall be risk weighted asindicated below, provided the loan to value ratio (LTV) is

not more than 75 per cent, based on Board approvedvaluation policy. Lending for acquiring residentialproperty, which meets the above criteria but have LTVratio of more than 75 per cent, will attract a risk weight of100 per cent.

-

8/8/2019 Capital Adequacy Norms

26/38

Claims secured by commercial real

estate

Claims secured by commercial real estate is defined asfund based and non-fund based exposures secured bymortgages on commercial real estates (office buildings,retail space, multi-purpose commercial premises, multi-

family residential buildings, multi-tenanted commercialpremises, industrial or warehouse space, hotels, landacquisition, development and construction etc.)Exposures to entities for setting up Special EconomicZones (SEZs) or for acquiring units in SEZs which

includes real estate would also be treated as commercialreal estate exposure.

Claims secured by commercial real estate as definedabove will attract a risk weight of 150 per cent.

-

8/8/2019 Capital Adequacy Norms

27/38

Specified categories

Fund based and non-fund based claims on the followingsegments which are considered as high risk exposureswill attract a higher risk weight of 150 per cent:

a) Venture capital funds; and b) Commercial real estate.

Consumer credit, including personal loans and creditcard receivables but excluding educational loans, willattract a higher risk weight of 125 per cent or higher, ifwarranted by the external rating (or, the lack of it) of thecounterparty.

Capital market exposures will attract a 125 per cent riskweight or risk weight warranted by external rating (orlack of it) of the counterparty.

-

8/8/2019 Capital Adequacy Norms

28/38

Off-balance sheet items

i) The total risk weighted off-balance sheet creditexposure is calculated as the sum of the risk weightedamount of the market related and non-market related off-balance sheet items. The risk-weighted amount of an off-balance sheet item that gives rise to credit exposure isgenerally calculated by means of a two-step process:

(a) the notional amount of the transaction is convertedinto a credit equivalent amount, by multiplying theamount by the specified credit conversion factor or byapplying the current exposure method, and

(b) the resulting credit equivalent amount is multiplied by

the risk weight applicable to the counterparty or to thepurpose for which the bank has extended finance or thetype of asset, whichever is higher.

ii) Where the off-balance sheet item is secured byeligible collateral or guarantee, the credit risk mitigationguidelines may be applied.

-

8/8/2019 Capital Adequacy Norms

29/38

Off-Balance Sheet Exposures Credit

Conversion Factor (CCF)

Sl Type of Off-Balance Sheet Exposure CCF (%)

1 Financial Guarantees 100%

2 Performance Guarantees 50%

3 Letters of Credit (Documentary) 20%

4 Letters of Credit (Non-Documentary) 100%

5Standby Facilities and Committed Credit Lines with anoriginal maturity up to 1 year

20%

6Standby Facilities and Committed Credit Lines with anoriginal maturity over 1 year

50%

7 Acceptances/Endorsements/OtherObligations 100%

8 Underwriting (including Revolving) 50%9 Conditional Take-out Finance 50%

10 Unconditional Take-out Finance 100%

11(a)Unutilized Limits of CC/OD/Revolving Credit and Term Loanwith Draw-down schedule upto 1 year

20%

11(b)Unutilized Limits of DL and TL with Draw-down schedule

more than 1 year

50%

CCF is used to convert a Contingent Liability (Off-Balance Sheet Exposure) into aCredit Substitute/ Equivalent.

-

8/8/2019 Capital Adequacy Norms

30/38

External credit assessments

Eligible Credit Rating Agencies

Reserve Bank has undertaken the detailed process ofidentifying the eligible credit rating agencies, whoseratings may be used by banks for assigning risk weights

for credit risk. In line with the provisions of the RevisedFramework, where the facility provided by the bankpossesses rating assigned by an eligible credit ratingagency, the risk weight of the claim will be based on thisrating.

Domestic credit rating agencies:

a) Credit Analysis and Research Limited; b) CRISILLimited; c) FITCH India; and d) ICRA Limited.

International credit rating agencies:

a) Fitch; b) Moodys; and c) Standard & Poors

-

8/8/2019 Capital Adequacy Norms

31/38

General Market Risk

As duration method is a more accurate method ofmeasuring interest rate risk, it has been decided to adoptstandardised duration method to arrive at the capitalcharge. Accordingly, banks are required to measure thegeneral market risk charge by calculating the pricesensitivity (modified duration) of each positionseparately.

Under this method, the mechanics are as follows:

(i) first calculate the price sensitivity (modified duration)of each instrument;

(ii) next apply the assumed change in yield to themodified duration of each instrument between 0.6 and1.0 percentage points depending on the maturity of theinstrument

(iii) slot the resulting capital charge measures into a

maturity ladder with the fifteen time bands

-

8/8/2019 Capital Adequacy Norms

32/38

Measurement of capital charge for

equity risk

The capital charge for equities would apply on theircurrent market value in banks trading book. Minimumcapital requirement to cover the risk of holding or takingpositions in equities in the trading book is set out below.

This is applied to all instruments that exhibit marketbehaviour similar to equities but not to non-convertiblepreference shares (which are covered by the interestrate risk requirements described earlier).

The instruments covered include equity shares, whether

voting or non-voting, convertible securities that behavelike equities, for example: units of mutual funds, andcommitments to buy or sell equity.

-

8/8/2019 Capital Adequacy Norms

33/38

Measurement of capital charge for

equity risk

Specific and general market risk:

Capital charge for specific risk (akin to credit

risk) will be 9 per cent and specific risk is

computed on the banks gross equity positions(i.e. the sum of all long equity positions and of all

short equity positions short equity position is,

however, not allowed for banks in India). The

general market risk charge will also be 9 percent on the gross equity positions.

-

8/8/2019 Capital Adequacy Norms

34/38

Measurement of capital charge for

foreign exchange risk

Foreign exchange open positions and gold openpositions are at present risk-weighted at 100 percent. Thus, capital charge for market risks inforeign exchange and gold open position is 9 per

cent. These open positions, limits or actual

whichever is higher, would continue to attractcapital charge at 9 per cent. This capital chargeis in addition to the capital charge for credit riskon the on-balance sheet and off-balance sheetitems pertaining to foreign exchange and goldtransactions.

-

8/8/2019 Capital Adequacy Norms

35/38

Capital Charge forOperational risk

Operational risk is defined as the risk of loss resultingfrom inadequate or failed internal processes, people andsystems or from external events. This definition includeslegal risk, but excludes strategic and reputational risk.Legal risk includes, but is not limited to, exposure tofines, penalties, or punitive damages resulting fromsupervisory actions, as well as private settlements.

The New Capital Adequacy Framework outlines threemethods for calculating operational risk capital chargesin a continuum of increasing sophistication and risksensitivity: (i) the Basic Indicator Approach (BIA); (ii) the

Standardised Approach (TSA); and (iii) AdvancedMeasurement Approaches (AMA).

Banks are encouraged to move along the spectrum ofavailable approaches as they develop moresophisticated operational risk measurement systems andpractices.

-

8/8/2019 Capital Adequacy Norms

36/38

Capital Charge forOperational risk

Banks are advised to compute capital charge foroperational risk under the Basic Indicator

Approach as follows:

a) Average of [Gross Income * alpha] for each ofthe last three financial years, excluding years ofnegative or zero gross income

b) Gross income = Netprofit (+) Provisions &

contingencies (+) operating expenses (Schedule16) () items (i) to (vi) listed below

c) Alpha = 15 per cent

-

8/8/2019 Capital Adequacy Norms

37/38

Capital Charge forOperational risk

i) Exclude reversal during the year in respect ofprovisions and write-offs made during the previousyear(s);

ii) Exclude income recognised from the disposal of items

of movable and immovable property; iii) Exclude realised profits/losses from the sale ofsecurities in the held to maturity category;

iv) Exclude income from legal settlements in favour ofthe bank;

v) Exclude other extraordinary or irregular items ofincome and expenditure; and

vi) Exclude income derived from insurance activities (i.e.income derived by writing insurance policies) andinsurance claims in favour of the bank.

-

8/8/2019 Capital Adequacy Norms

38/38