Digital Lending Infographic - KenticoSherpatech · 2019. 12. 20. · DIGITAL LENDING Introduction...

Transcript of Digital Lending Infographic - KenticoSherpatech · 2019. 12. 20. · DIGITAL LENDING Introduction...

DIGITALLENDING

Introduction

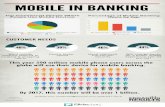

MOBILEBANKING

HAPPYUSERS

59% of payments are now online and mobile.

Mobile banking =

access to efficient financial management

(Credit Union Times “Mobile Banking Optimal for Lending Growth” February 2017)

24 7

27%of millennials are “COMPLETELY

RELIANT” on a mobile

banking app.

45%of consumers use DESKTOP to surf the web.

Mobile use is up

30%

(Hootsuite, January 2017)

Desktop use is down

20%

50%of consumers use MOBILE to surf the web.

81% of consumers are either “LIKELY”or “SOMEWHAT LIKELY” to apply for a loan online.

$$

$$

$$

$$

Digital Lending Opportunities

$

$

$

6%of mortgage loan

applications go to credit unions.

BIGOPPORTUNITY

STRATEGIZEPLAN

for

SUCCESS

EVALUATE

ENGAGE

the functionality of digital lending applications and how those applications can enhance the service delivery and efficiency of your loan operations.

how to leverage advanced analytics to enhance the digital lending experience. Review your lending services priorities and determine a path to digitize the user experience. Analyze how to compete with Fintech solutions.

with Corporate One to discuss future digital lending services innovations.

Plan for Success

Almost gone are the old days of cumbersome, time-consuming paper processes for managing your financial accounts. As

financial institutions continue to leverage technology to offer consumers a better user experience, one of the exciting results is

the growth of specific services, such as lending.

The opportunity to develop an appropriate digital engagement plan for mortgages would yield significant revenue opportunity.

(Salesforce 2016 Special Report)

(The Financial Brand, April 2017)

Financial institutions are expected to earn

$30 BILLION in the next

8 YEARS by using digital technology.

(Goldman Sachs and Ernst & Young studies)

Financial institutions that don’t adopt

digital lending could

LOSE 60% OF PROFITS

from retail and small businesses in the

NEXT 5 YEARS.

(McKinsey & Company)

THE CASE FOR

$

$

$

$

$

Corporate One is where America’s credit unions belong.Visit www.corporateone.coop to learn more.Layout and data accumulation 2017 Corporate One Federal Credit Union

(Fiserv)

1. Pay bills

2. Transfer money

3. Receive bills

4. Receive alerts on account activity

5. Make loan payments

Making loan payments online is one of the

TOP 5online banking uses.

(Fiserv’s quarterly Expectations & Experiences survey)

Industry DisruptionWith so many digital financial services available from Fintech

providers these days, more and more consumers seek streamlined application experiences and approvals as soon as they are ready to borrow. These Fintech offerings, also called “disruptors,” have

had a MAJOR impact on the financial marketplace.

LARGEBanks

Rocket Mortgage funded more than

$5 BILLION in loans in

Quarters 1 & 2 in 2016.

(Quicken Loans)

Banks are

LOSING LOANS to non-depository lenders.(Mortgage Bankers Association)

NON-DEPOSITORY Lenders

(Ernst & Young, May 2017, The Financial Brand)

INVESTone-click

Investing in new customer-facing technology is a

PRIORITY for banks.

1¢

1¢ 1¢