Destin Brass

description

Transcript of Destin Brass

ACCOUNTS CASE STUDY:DESTIN BRASS PRODUCTS CO.

(Group -1)

THE COMPANY Established in 1984 by Abbott, Guidry, & Scott Then selected Peggy Alford, accountant with

manufacturing experience to join them. Steve Abott sensed opportunity in a conversation with

the president of a large manufacturer of water purification equipment who was dissatisfied with the quality of brass valves available

Company grew quickly due to water purification equipment demand & it became sole supplier of valves to its customers

Expanded their business to pumps and flow controllers Gets supplies from foundries via JIT deliveries Brass is then precisely machined and assembled in

Destin Brass’ facility.

THE PRODUCTS Valves

24% of company revenues Created from 4 components Each machinist could operate 2 machines and assemble

valves as machining was taking place Expense of precise machining made the cost of valves high All monthly production took place in single production run,

shipped to single customer upon completion Pumps

55% of company revenues Created from 5 components Shipped to 7 distributors Scheduled for 5 production runs each month Price under pressure-felt that Destin had no choice but to

match the lower prices as quoted by competitors or give up

THE PRODUCTS(CONTD.)

Flow Controllers 21% of company revenues Created from 10 components 22 shipments More components needed for each finished unit

and more labor required 4000 FC in 10 production runs They felt-No competition in market.

THE MEETING-COST ISSUES Valves

Several competitors could match their quality but none had tried to gain market share by cutting price and gross margins had been maintained.

Pumps Their competitors’ sales prices were below their pump-

cost calculation even when they had a much better manuf. Process.

Could not figure out how competitors making profit unless being subsidized by other products

Flow Controllers They increased prices by 12.5% with no apparent

effect on demand. Why aren’t others entering the market?

PEGGY-THE ACCOUNTANT

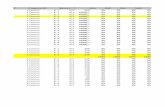

Currently using traditional costing-Allocation done in 2 stages: first to production then on the basis of total run labor cost

Introduced revised cost system

-Allocation in 3 cost pools:

a. material related overheads: receiving and handling

b. setup labor cost

c. machine hours related overheads: remaining overheads

Proposed Activity based costing

-Allocation on the basis of transactions

QUESTIONS

ABC Costing Comparison Of ABC Costing with Standard Method. Comparison Of ABC Costing With the Revised

Method Of Costing.

Use the overhead cost activity analysis in Use the overhead cost activity analysis in exhibit5 and other data on manufacturing costs exhibit5 and other data on manufacturing costs to estimate product costs for valves, pumps and to estimate product costs for valves, pumps and flow controllersflow controllers

QUESTION 1

Compare the estimated costs you calculated to Compare the estimated costs you calculated to existing standard unit costs (exhibit-3) and existing standard unit costs (exhibit-3) and the revised unit costs (exhibit-4). What causes the revised unit costs (exhibit-4). What causes the different product costing to produce such the different product costing to produce such resultsresults

QUESTION 2

What are the strategic implications of your What are the strategic implications of your analysis? What actions would you recommend to analysis? What actions would you recommend to the managers at destin brass products co.? the managers at destin brass products co.?

QUESTION 3

IMPLICATIONS

No change necessary for valves

a. Cost reallocation did not change profit margin (35%)

b. Revised method is not a good method of allocation of overheads, hence allocation should be based on the activities.

Pump prices can be lowered

a. Using ABC, pump profit margin is 40% that is why the competitors were sustaining the market by lowering their prices

b. If priced as low as $75.06, profit margin would be 35%. Hence price can be decreased also to survive the competition.

c. Implementation of ABC is justified Raise flow controller price or get out of market

a. ABC revealed that there is a -4% margin at a price of $ 97.07 that is why even by increasing the price to 12.5% there was no increase in demand.

b. $155.25, they reach the 35% profit margin otherwise with current prices company is suffering

How much higher or lower would the net income How much higher or lower would the net income reported under the activity-transaction-based reported under the activity-transaction-based system be than the net income that will be system be than the net income that will be reported under the present, more traditional reported under the present, more traditional system? Why?system? Why?

QUESTION 4

There should be no difference in NET INCOME They are reallocating total expenses differently

amongst the products There will be no differences in total expenses But if according to ABC, they change the target

selling price then, they will get better profit margin

Whereas with the same “actual selling price”, they can get- Profit margin for valves w.r.t traditional remains same Profit margin for pumps w.r.t traditional increases Profit margin for flow controller w.r.t traditional

decreases

CRITICAL ANALYSIS

THANKYOU