Customers' Services and Influencing Factors

Transcript of Customers' Services and Influencing Factors

Chapter IV

Customers’ Services and Influencing Factors

4.1 Introduction

Retail banking in India has seen a dramatic change over the

years. It has evolved from a time when the mindset of a traditional

middle class Indians used to be debt averse, which preferred

managing under their thrifty means to the current mindset which

doesn’t hesitate to take loans for spending. The changing

customer demographics compel to create a differentiated platform

based on latest technology, improved service and banking

convenience. Services offered include savings and transactional

accounts, mortgages, personal loans, debit cards and credit cards.

In this chapter, the researcher describes the various services

provided by the select retail banks in Cuddalore district and

analyses the influential factors in selection of bank for its

services.

4.2 Services of Select Retail Banks

There are 16 public sector and 11 private sector banks in

Cuddalore district. The following are some of the important

services provided by the select retail banks in Cuddalore district.

80

4.2.1 Indian Bank

Indian Bank, a premier bank owned by the Government of

India, was established on 15th August 1907 as part of the

Swadeshi movement. It is serving the nation with a team of over

18782 dedicated staff. Its business crossed � 2,11,988 crores as

on 31.03.2012. Its operating profit increased to � 3,463.17 crores

as on 31.03.2012. Its net profit increased to � 1746.97 crores as

on 31.03.2012. It provides core banking solution (CBS) in all 2089

branches�

as on 31.03.2013. It has overseas branches in

Singapore and Colombo including a Foreign Currency Banking

Unit at Colombo and Jaffna. It has two subsidiary companies

namely Indbank Merchant Banking Services Ltd. and IndBank

Housing Ltd. It provides the following services to its customers.

Deposits

Indian Bank mobilizes deposits from savings bank account,

current deposit account, term deposit account and NRI account.

Besides normal savings account, it has SB Vikas Khatha, SB

Platinum, SB power, IB Smart Kid, SB Silver and SB Gold with

some salient features to suit the needs of the respondents. It has

normal current and premium current account. It has four types of

NRI accounts namely Non-resident ordinary account, NRE SB � www.indianbank.in

81

account, NRE FD/RIP/RD account, Resident Foreign currency

account for returning Indians.

SHG – Vidhya Shoba

This loan is provided to meet educational expenses of the

children of SHG members. The members of SHGs with a good

track record /repayment, which are in existence for more than

two years can avail this loan. Under this loan, the repayment

period is 12 -24 months.

Loans

Indian Bank provides various types of agriculture loan, group

loan, personal loan, SME loan, Education loan and NRI loan.

IB Home Loan Plus

IB home loan plus is provided for any bona fide purpose other

than speculative purpose. All existing home loan customers have

repaid a minimum of 36 EMI’s regularly. NRIs and Staff Members

of our Bank including retired staff members may also be

considered by the sanctioning authority. This loan provides a

minimum of � 1.00 lakh and maximum of � 10.00 lakhs.

IB Vehicle Loan

All salaried class individuals, businessmen, professionals,

self-employed and pensioners with repayment capacity are eligible

to avail this loan. The minimum gross monthly income for

82

purchase of four wheelers is � 20000. The amount of loan is

provided at 20 times of gross monthly income. The maximum loan

amount for purchase of two wheeler is � 75,000 and for four

wheeler is � 15,00,000.

Loan for Agriculture Godowns / Cold Storage

This loan is provided for construction of new Agri godowns or

cold storages, market yards, silos / expansion of existing units /

modernisation of existing units, irrespective of their location and

takeover of standard accounts of such units from other banks.

IB Pension Loan

Those who are having pension SB accounts can avail this

loan. All Central and State government pensioners, family

pensioners, re-employed pensioners, Indian bank retirees both

under VRS and superannuation are beneficiaries of this loan.

SME Loan

The Indian Bank is providing various types of SME loan to

professional and non-professional individuals. Doctor plus, IB

professional special, Ind SME secure, Ind STAR Rice city and IB

trade well are some of the familiar schemes of Indian Bank.

Money Gram

Under this scheme unlike various types of remittances from

abroad, the beneficiary under Money Gram will always be a

83

resident. Money Gram is a new Internet based remittance

product, being introduced in our bank to augment the facilities

available to NRIs to remit money to India. Money Gram is one of

the money transfer services offered by M/s. Money Gram

International Inc. Under the arrangement, money transfers made

at any overseas agent location across the world become available

at the destination location in India in the very next instant. The

transfer is affected using software / internet based technology.

Xpress Money

Xpress Money service is offered in arrangement with

M/s. UAE Exchange Financial Services Ltd for remitting money to

India. The scheme is operative from 15.02.2006. The remittance

facility is available to receive the money through all our branches.

Under the arrangement, money transfers to India can be made at

any overseas agent location of UAE Exchange across the world.

Money can be remitted from 180 countries across the globe.

Around 35000 outlets are available outside India for remittance.

IB Swarna Mudra

It is a scheme for selling gold coins. There are currently seven

product variants viz. 2gms, 4gms, 5gms, 8gms, 10gms, 20gms

and 50gms gold coins/bars. 24 carat and 999.99 pure gold are

imported from Switzerland. Coins/bars are packed in a tamper-

proof see-through packet. It is accompanied with an International

84

Quality Certification (Assay Certificate). It is available at select

Indian Bank branches in all major centres across India at a very

competitive price.

Premium Services

Indian bank provides various premium services like Ind Net

Banking, Ind Phone Banking, RTGS (IndJet Remit), NEFT,

Multicity cheque facility, Credit Cards, ATM/Debit card,

e-payment of direct taxes, e-payment of indirect taxes, etc.

4.2.2. Indian Overseas Bank

Savings Bank Account

Savings bank account is a form of demand deposit account

suitable for those who are in need of normal banking

transactions. It is opened mainly for the purpose of saving and

not for any business purpose, subject to restrictions on the

number of withdrawals during any specific period. If the number

of withdrawals exceeds the permitted limit, a nominal amount is

charged by the bank from the concerned account holders.

Savings Bank Gold

All individuals including professionals such as doctors,

lawyers, Chartered Accountant, Executives working in MNC,

software companies, Public/private sector and business people,

High Net Worth individuals, CEOs, IAS and IPS can open this

account. The average daily balance over the last three months

85

should not be less than � 50000. If the quarterly average balance

is between � 50,000 and � 100000, the balance exceeding � 65,000 will be swept out and kept in TD in units of � 2000. As

and when the minimum balance goes down, the adequate units in

TD will be closed and transferred to SB, on a last in –first out

basis.

IOB Student

IOB believes in inculcating the value of savings to the

students. The bank gives them financial awareness while teaching

them the value of savings to the student. It brings customized

savings scheme for students that help them become responsible.

This account is having value additions like free internet banking

registration, SMS alerts for all transactions in the account, free

multipurpose card with facilities to operate in ATM, Pos & ECOM,

free standing instructions, free personal accident insurance cover

of one lakh and free cheque book facility.

Current Account

IOB is providing current account facility to its customers.

Proprietary concern, Partnership firm, HUF, Limited companies,

corporations, SMEs, Trusts, Societies, clubs, Association, Local

Bodies and Government departments can open this account. The

average daily balance in the current account during last three

months should not be less than � one lakh. This account provides

86

facilities like Internet banking, anywhere Banking, transfer of

funds thro' NEFT free, personal accident insurance cover of � One

lakh free of cost, waiver of demat account opening charges,

named printed cheque books free of cost upto 100 leaves, folio

charges @ 50% concession, international debit card without

charges to all employees and owners, online tax payment facility,

customised multi city cheques issued at MICR centres at 50%

concession and utility bills payment facility.

Retail Loan

IOB is giving retail loan to employees in Government, public

sector undertakings, reputed private enterprises, firms,

companies, etc. and confirmed in service. The take home pay,

after deduction of the proposed loan instalment, should be more

than 50% of the gross pay. LIC agents are also eligible to apply for

the loan subject to conditions. It is provided for any purpose

including any social / financial commitment. Repayment is

allowed in a maximum of 60 months in case the loan is for 10

month salary and 36 months in case the loan is for five months

salary. The security for this loan is two third party personal

guarantees, the salary of each guarantor being at least equal to

that of the borrower.

87

Term Deposits

Moneys deposited for specific periods come under the

category of Term Deposits. The Depositor invests the money with

the bank for a specific period to mature on a specific future date

as required by the depositor. Term deposits can be made for

periods ranging from seven days to one hundred and twenty

months. IOB has Reinvestment deposit, Fixed deposit, Recurring

deposit, Gold deposit, Education deposit, Easy deposit, Vardhan

deposit and Floating deposit schemes.

IOB Subha Gruha

This loan is provided to buy, build or renovate flat/house. It is

provided to salaried individual and self-employed professional.

Group of individuals, members of Co-operative Societies and

individuals not more than 55 years of age are the beneficiaries

under this scheme. A maximum of 80% of the cost of the

house/flat or � 500 lakh whichever is less is given as loan. The

amount depends on one’s age and repayment capacity. The

minimum margin is 20% of the estimated cost (including the cost

of the land) for new as well as old houses/flats. It is repayable in

equated monthly installments for a maximum period of 25 years.

IOB Fine Gold

IOB is selling gold coins to cater to the needs of investors as a

safe-alternate source of investment and for gifting to dear ones.

88

It is purchasing from Switzerland. It is available in 4, 8, 20, 50

and 100 Grams. 2, 4, 8 and 20 Grams are in round shape and 50

and 100 Grams are in rectangular shapes. They are assayed and

packed in tamper proof certicards by PAMP, Switzerland. It is

available at select Branches of IOB.

IOB Health Care

The scheme provides for Mediclaim insurance cover, which is

available to all account holders maintaining a savings bank or

current account in the age group of 18-65 years. The scheme is

available to NRI customers also. However, the cover is available

for treatment in hospitals in India. The Mediclaim insurance cover

is provided by Universal Sompo General Insurance Company Ltd

(USGI). The Scheme takes care of the hospitalization expenses,

subject to maximum Sum Insured, in respect of sudden illness,

an accident and any surgery that is required in respect of any

disease. The health insurance cover is available for a very low

premium, which is far below the normal premium if the policy is

taken individually by the account holder, directly from Insurance

Company. Coverage option from � 50,000 to � 5 lakh is available.

International Visa Debit Cards

Indian Overseas Bank has tied up with Visa for its

International Debit Card Program. A large segment of the Bank’s

customers still prefer to spend from their income and savings

89

rather than availing credit. With the introduction of Debit cards,

this long felt desire of customers to pay for the purchases at

shops and business establishments directly from their account

would be fulfilled. It would no longer be required for the customer

to draw cash either from the ATM or from the branch counters to

pay for their expenditure. No charges would be levied by the Bank

on such Point of Sale transactions, except for using in Petrol

Bunks. In addition, the cards can also be used through secured

electronic payment gateways for e-commerce / Internet payments.

RTGS

Real Time Gross Settlement (RTGS) System is set up,

operated and maintained by Reserve Bank of India to enable

funds settlement on real-time basis across banks in the country.

Indian Overseas Bank is a member of RTGS. IOB offers

InstaRemit - a remittance solution on RTGS to both corporate

customers and individual customers for transfer of funds from

their accounts with the bank to other customers of other bank

branches which are RTGS enabled. Incidentally, IOB customers

can also receive funds from others who are having accounts with

other RTGS enabled bank branches.

4.2.3. Canara Bank

Widely known for customer centricity, Canara Bank was

founded by Shri Ammembal Subba Rao Pai, a great visionary and

90

philanthropist, in July 1906, at Mangalore, then a small port

town in Karnataka. The Bank has gone through the various

phases of its growth trajectory over hundred years of its existence.

Growth of Canara Bank was phenomenal, especially after

nationalization in the year 1969, attaining the status of a national

level player in terms of geographical reach and clientele segments.

Eighties was characterized by business diversification for the

Bank. In June 2006, the Bank completed a century of operation

in the Indian banking industry. The eventful journey of the Bank

has been characterized by several memorable milestones. Today,

it occupies a premier position in the comity of Indian banks. The

bank offers the following to its customers.

Deposits

The Canara Bank offers the following types of deposits and

accounts to its customers:

Savings bank account

Current Account

Fixed Deposit

Recurring deposits

Kamadhenu deposit (re-investment plan)

Canara tax saver scheme

Ashraya deposit scheme (for senior citizens)

91

Term Loans

Term Loan is normally extended for acquisition of land,

building and machinery, purchase of vehicles, etc. and also along

with working capital finance as composite loans. It is given to

both industrial and non-industrial borrowers i.e. both for

projects/ activities involved in manufacture/processing/repairing

and business / trading activities, etc.

Export Finance

Canara Bank offers the following export finance facilities to

units who undertake or desirous of undertaking export business.

It is granted in the name of Pre-shipment Finance, Packing Credit

(PC), Clean Packing Credit (CPC), Pre-shipment Credit on Foreign

Currency (PCFC), Post-shipment Finance, Foreign Bank

Guarantee (FBG) and Foreign Letters of Credit (FLC).

Working Capital Finance

Working Capital is basically the investment in current assets

like raw materials, stores, semi-finished goods, finished goods,

sundry debtors, etc. It represents the money that is required for

purchase / stocking of raw materials, payment of salary, wages,

power charges, etc. and also for financing the interval between the

supply of goods and the receipt of payment thereafter.

92

Swarna Loan (Gold Loan)

This loan is provided to meet medical expenses and other

unforeseen commitments / contingencies and investment /

domestic purposes. The entire loan is to be repaid in 24 equated

monthly installments (EMI) subject to repayment of monthly

interest and when debited. The savings bank account holders with

satisfactory dealings or new customers properly introduced and

credit-worthy can make use of this loan.

Canara Credit Card

Canara Credit Card is designed to meet one’s life style with

anything one might need to make one experience a sheer

pleasure. No matter where one is across the world, luxury and

comfort is always at hand.

Mutual Funds

Canara Bank has tie up with Canara Robeco and HDFC AMC

for cross selling of their mutual fund products through their

branches. Investment can be made in Canara Robeco Mutual

Fund Products and HDFC Mutual Fund Products.

Ancillary Services

Canara Bank is providing various ancillary services to its

customers like retail sale of gold coins, providing safe deposit

lockers, safe custody services, nomination facilities, etc. It is open

93

on all days in a week. It has extended business hours for the

convenience of the customers.

4.2.4. State Bank of India

State Bank of India (SBI) is a government-owned bank with its

headquarters in Mumbai, Maharashtra. As on December 2012, it

had assets of US $501 billion and 15,003 branches, including 157

foreign offices, making it the largest banking and financial

services company in India by assets. SBI provides a range of

banking products through its network of branches in India and

overseas, including products aimed at non-resident Indians

(NRIs). SBI has 14 regional hubs and 57 Zonal Offices that are

located at important cities throughout the country. State Bank of

India has an extensive administrative structure to oversee the

large network of branches in India and abroad. The Corporate

Centre is in Mumbai and 14 Local Head Offices and 57 Zonal

Offices are located at important cities spread throughout the

country. The Corporate Centre has several other establishments

in and outside Mumbai, designated to cater to various functions.

State Bank of India has 157 foreign offices in 32 countries across

the globe. It offers the following services.

94

Deposits and Accounts

SBI has the following types of accounts to serve its customers:

Current Account

Savings Bank Account

Term Deposits

Recurring Deposit Account

Premium Savings Account

Multi Option Deposit Scheme

Demat Account

SBI Car Loan

SBI provides car loan to individuals between the age of 21-65

years of age, regular employees of State / Central Government,

public sector undertaking, private company or a reputed

establishment, professionals, self-employed, businessmen and

proprietary/partnership firms which are income tax assessees. No

Advance EMI, longest repayment tenure (7 years), lowest interest

rates, lowest EMI, LTV 85% of 'On Road Price' of car (includes

registration, insurance and cost of accessories worth � 25000 are

some of the salient features of SBI car loan. It is provided for

purchase of new passenger cars, Multi Utility Vehicles (MUVs) and

SUVs.

95

SHG-Bank Credit Linkage

SBI is maintaining its position as a leader among Commercial

Banks in credit linking of SHGs and is a prime driver for the

movement. As at the end of March 2011, SBI, with a share of

approximately 26% of total SHGs financed by Commercial Banks,

is the leader among banks. 82% of these SHGs are women SHGs.

SBI has successfully initiated various measures toward widening

its SHG network. The bank has introduced a system for providing

cash credit to SHGs in ratio of saving corpus for 3-5 years to

make easy availability of finance to meet contingent needs and

provide flexibility in operation.

Agriculture Loan

State Bank of India has covered a whole gamut of agricultural

activities like crop production, horticulture, plantation crops,

farm mechanization, land development and reclamation, digging

of wells, tube wells and irrigation projects, forestry, construction

of cold storages and godowns, processing of agri-products, finance

to agri-input dealers, allied activities like dairy, fisheries, poultry,

sheep-goat, piggery refurbished second hand tractors, loans

against pledge of warehouse receipts, loans against produce

stored by the farmer at his own premises, mulberry cultivation,

rearing of silk worms and grainages.

96

DEMAT Services

SBI is a Depository Participant registered with both National

Securities Depositories Limited (NSDL) and Central Depository

Services Limited (CDSL) and is operating its DP activity through

more than 1000 branches. SBI Demat Account offers account

maintenance and safe custody of security, dematerialization,

rematerialization, Account transfers, Pledge/Hypothecation,

facilitates faster and direct credit of security balance into DP

account on account of non-monetary corporate benefits as bonus

and rights issues and security lending.

ATM Services

SBI offers the convenience of over 26,000 ATMs in India, the

largest network in the country. About 40000 ATMs of other banks

are under multi-lateral sharing viz. Andhra Bank, Axis Bank,

Bank of India, The Bank of Rajasthan Ltd. Canara Bank,

Corporation Bank, Dena Bank, HDFC Bank, ICICI Bank, Indian

Bank, IndusInd Bank, Punjab National Bank, UCO Bank and

Union Bank of India apart from ATMs displaying Master Card/

Maestro/Cirrus logo for free upto first 5 transactions in a

calendar month.

Foreign Inward Remittance

Sending remittances to India for credit to SBI account is very

simple and convenient with wide foreign offices network and

97

correspondent banking arrangement with about 600 banks

worldwide. SBI provides the various remittance facilities like SBI

Express Remit Facility, Demand Drafts in Rupees, Telegraphic/

wire transfers, Personal cheques/ traveller’s cheques (in person

only)/ DDs in foreign currency.

NRI Services

State Bank of India is the bank of choice for Indians wherever

they live. It has a vast network of over 15,000 domestic branches,

69 dedicated NRI Branches in India, 186 Foreign Offices in

34 countries, Correspondent Banking relations with over 400

global banks and tie up with 26 Exchange Houses and 5 Banks

across Middle East, NRIs can enjoy “anywhere – anytime” banking

facilities. The product suite for NRIs ranges from Bank Deposits,

Loans and Remittances to Investments, Online Equity Trading,

Structured Products, Mutual Funds and Insurance.

4.2.5. ICICI Bank

ICICI Bank is India's second-largest bank with total assets of � 4,736.47 billion (US$ 93 billion) at March 31,2012 and profit

after tax � 64.65 billion (US$ 1,271 million)� for the year ended

March 31,2012. The Bank has a network of 3,130 branches and

10,486 ATMs in India and has a presence in 19 countries, � www.icicibank.com

98

including India. ICICI Bank offers a wide range of banking

products and financial services to corporate and retail customers

through a variety of delivery channels and through its specialised

subsidiaries in the areas of investment banking, life and non-life

insurance, venture capital and asset management. The Bank

currently has subsidiaries in the United Kingdom, Russia and

Canada, branches in United States, Singapore, Bahrain, Hong

Kong, Sri Lanka, Qatar and Dubai International Finance Centre

and representative offices in United Arab Emirates, China, South

Africa, Bangladesh, Thailand, Malaysia and Indonesia. It offers

the following services to its customers.

Account and Deposits

ICICI Bank has designed a gamut of accounts and deposits to

cater to customers’ unique banking needs. It has extensive

branches and ATM networks and facilities like mobile, phone,

internet and doorstep banking and experience banking at its best.

It has Flexible Recurring Deposit, Dream Deposits, Fixed Deposit,

Recurring Deposit, Savings Account, Silver Savings Account,

Professional Savings Account, Privilege Banking and Salary

Account.

Loans

ICICI Bank offers a wide variety of Loans Products to suit

customers’ requirements. ICICI Bank brings banking at the

99

customers’ doorstep through networked branches/ ATMs and

facility of E-channels like Internet and Mobile Banking. It provides

Home loans, Personal Loans, Commercial Vehicle Loans, Car

Loans and Loans against Securities.

ICICI Cards

ICICI provides different types of cards to suit the needs of the

customers. Its credit cards provide exclusive privileges and

superior value. Its debit cards facilitate the convenience of

cashless shopping with enhanced security and higher rewards. Its

prepaid cards provide the world of smart payment solutions that

offer convenience and secure ways to spend anytime and

anywhere. Its corporate cards provide comprehensive expense

management solution for business travel and vendor payments.

Insurance

ICICI Bank, along with deposit and loan products, offers the

facility to invest in Life Insurance and General Insurance. Its “Buy

Online” feature provides customers the ease and convenience of

completing their transactions entirely online without having to

move out of their desk. Its general insurance secures family's

health, insure against medical emergencies when travelling

abroad, insure vehicle. Its life insurance gives the promise of

protection and secures their future. Its Card Protection Plan (CPP)

is the India's first comprehensive card protection service. It can be

100

used in the event of card loss, theft, any related fraud and

emergencies. The customer can safeguard all financial and

non-financial cards including credit, debit, loyalty and

membership Cards with CPP Card Protection.

Demat Service

ICICI Bank Demat services boasts of an ever-growing

customer base of over 18.39 lack customer base as on 31st March

2012. Under this scheme the account holder can transfer

securities 24 hours a day, 7 days a week through internet and

Interactive Voice Response (IVR) at a lower cost. The customer can

receive his/her account statement and bill by email. They can

track their dividend, interest and bonus through their account

statement. They can enquire Holdings, Transactions, bill and ISIN

details through mobile request.

Cash Credit

ICICI Bank recognises the role of prompt finance and stable

cash flows for a business. It offers a range of products tailored to

customers unique needs.

NRI Services

ICICI Bank NRI Services subgroup was formally launched in

2001 to provide a one stop shop to address the home linked

financial needs of the NRI population. This was a time when most

101

banks in India did not consider NRI as a segment warranting any

significant or focused attention. At a Bank level, establishment of

the NRI Services group was a key step in adding international

revenue streams and diversify risks across geographies. The NRI

product suite quickly evolved to include a variety of savings and

deposit products, investment options, online remittances,

mortgages, insurance and equity-linked products addressing the

entire gamut of financial needs of this overseas community.

4.2.6. Laxmi Vilas Bank

The Lakshmi Vilas Bank Limited (LVB) was founded eight

decades ago (in 1926) by seven people of Karur under the

leadership of Shri V.S.N. Ramalinga Chettiar, mainly to cater to

the financial needs of varied customer segments. The bank was

incorporated on November 03,1926 under the Indian Companies

Act, 1913 and obtained the certificate to commence business on

November 10,1926, The Bank obtained its license from RBI in

June 1958 and in August 1958 it became a Scheduled

Commercial Bank.

During 1961-65 LVB took over nine Banks and raised its

branch network considerably. To meet the emerging challenges in

the competitive business world, the bank started expanding its

boundaries beyond Tamil Nadu from 1974 by opening branches in

102

the states of Andhra Pradesh, Karnataka, Kerala, Maharashtra,

Madhya Pradesh, Gujarat, West Bengal, Uttar Pradesh, Delhi and

Pondicherry. Mechanization was introduced in the Head office of

the Bank as early as 1977. At present, with a network of 299

branches and 6 extension counters, spread over 15 states and the

union territory of Puducherry, the Bank's focus is on customer

delight, by maintaining high standards of customer service and

amidst all these new challenges, the bank is progressing

admirably. The LVB offers the following services to its customers.

Savings Bank

LVB Savings Bank is intended to promote the healthy habit of

saving and for the steady growth of one's money in the bank. It

has “No-Frills SB account” also. It is available primarily to low

income group people of the society, downtrodden men and

women, students, senior citizens, weaker sections of the society,

financially and economically backward people, who are mainly

residing in rural and semi-urban centers of our country.

Fixed Deposit

Fixed Deposit accounts may be opened for a person after

proper identification of the prospective depositor. The minimum

amount of deposit shall be in accordance with the guidelines

issued by the bank then and there. Interest at the prevailing rate

as on the date of deposit shall be applicable to each deposit.

103

Different interest rates are fixed for different maturity periods.

Deposits are accepted for a minimum period of 15 days and a

maximum period of 120 months.

Recurring Deposit

Recurring Deposit accounts may be opened for persons after

proper introduction and identification of prospective customers.

Minimum monthly installment will be in accordance with the

guidelines issued by the bank then and there. The minimum

period of RD is 12 months and maximum is 120 months. Monthly

installments should be remitted before the last working day of

every month. The due date for RD is only an ostensible due date

i.e a date on which the RD account completes the contracted

period of deposit (say completed 24/36/48 months as the case

may be) from the date of opening of the account.

Lakshmi Savings Star Gold

Lakshmi Savings Gold account offers special privileges to

customers who maintain an Average Monthly Minimum Balance

of � 20,000 and above.

Lakshmi Home Loan

LVB is providing loan for construction of a new house/flat,

purchase of a new house/flat constructed by a reputed

promoter/contractor, additional construction or alterations

104

carried out by the owners of the houses, repairs done by owners

of the houses, purchase of old houses, purchase of approved

plots. Individuals and HUFs (operating through Kartas) with

sufficient income and who can produce satisfactory proof of such

income by way of salary certificates, Income Tax certificates, etc.

can avail loans under the scheme.

Lakshmi Business Credit

LVB is providing credit to its customers doing business.

Those who are having credit worthiness can avail loan under this

scheme up to � 2 crores. It has many advantages to customers

lime quick processing, minimum formalities, operational

convenience, competitive interest rates, against security of stock

and book-debts/ immovable property/ NSC / KVP / LIC Policies/

Deposits in LVB. It is suitable for traders with good track record.

Vidhya Lakshmi Loan

LVB is providing loan to students to meet expenses connected

with the pursuit of specific courses of study at recognized

institutions, including professional/job-oriented courses, which

offer reasonable opportunity for employment and loan repayment

capacity on successful completion.

105

Cards

LVB has VISA International Debit Card and ATM cards. LVB

VISA International debit card allows customers to purchase goods

at merchant establishments through POS and also gives the

freedom to withdraw cash from ATMs anywhere across the globe

and to do e-commerce transactions. ATM cards are more

convenient to carry, use and less risky. Besides the above card, it

is also issuing Prepaid Gift Card. It has multiple functionalities

from unbanked to gift, etc. The various types of Prepaid card

prevalent in the country are Travel prepaid (Forex card), Gift,

payroll, etc.

NRI Services

KVB is an authorised dealer in foreign exchange and extend

full-fledged for ex-services through select branches in the country.

All 299 branches are authorised to extend service to our brethren

living abroad and to accept deposit accounts, both in Indian

Rupees and also in select foreign currency. KVB has modern

infrastructure including SWIFT connectivity for instant transfer of

funds.

Online Services

LVB is offering plenty of online services. Internet Banking

allows customers to conduct financial transactions on a secure

website operated by their retail or corporate services. It has online

106

mobile payment service, National Electronic Fund Transfer (NEFT)

facilities and Real Time Gross Settlement System (RTGS) facility.

Its NEFT and RTGS facilities enable an efficient, secure,

economical and reliable system of transfer of funds between

accounts of customers of different Banks.

4.2.7. Karur Vysya Bank

The Karur Vysya Bank Ltd. was started in the year 1916 in

Karur, then a small textile town with a vast agricultural

background, by two illustrious sons of the soil – Sri M.A.

Venkatarama Chettiar and Sri Athi Krishna Chettiar. What

started as a venture with a seed capital of � 1 lakh has grown into

a leading financial institution that offers a wide gamut of financial

services to millions of its customers under one roof. Total

business of the bank was at � 56316 cr. with total deposits at � 32111 cr. and total advances at � 24205 cr. The net profit of the

bank for fiscal 2011-12 was � 501.72 cr. The net owned funds of

the bank are � 2708.22 cr�.

Savings Accounts

KVB offers a range of savings bank account which gives the

customers the freedom to choose a solution that meets their

needs. It has different types of accounts namely KVB Shakthi � www.kvb.co.in

107

Account, Jumbo Kids Savings Account, Prestige Savings Account,

Freedom Saving Account, Student Savings Account, Rainbow

Savings Bank Scheme, Yuvashakti SB Account and Regular

Savings Account. KVB offers Savings accounts for the purpose of

inculcating the habit of savings among general public so that a

portion of one's earnings can be set apart for future needs.

Swarnamitra

KVB offers loans against Gold Jewelleries. It is one of the

easiest means of finance that can be availed from any branches.

KVB offers jewel loans in the form of overdraft (Swarnamitra) and

short term loans (Jewel Loan � Non-Agri / Personal). It is specific

to individuals who own gold jewellery. The maximum loan amount

is � 20 Lakhs.

Home Loan

This loan is provided for construction of independent houses,

outright purchase of independent houses and flats (not older than

15 years). KVB offers this loan even for improvement/ repairs/

additional construction / renovation of existing houses or flats.

It is provided to resident Indian’s, non-resident Indians or HUF.

Professional Loan

KVB offers this loan for professionals to help them with

business expansion and development expenses and for travel

108

expenses for business purposes. This is a term loan. Doctors,

Dentists, Chartered Accountants, Lawyers, Chartered Engineers,

Architects, Proprietorship firms, Partnership firms, etc. are

eligible for this loan. It can be taken for the purchase of

machinery, equipment, apparatus, computers, tools, vehicles,

furniture, interiors and office equipment. This loan can also be

used to finance foreign trips, seminars and conferences.

Individuals/ Firms should be engaged in practice of

profession/business for at least 3 years. The maximum loan

amount is � 15 Lakhs.

Educational Loan

KVB offers educational loan to students to pursue education

of their choice either in India and abroad. It is a term loan given

for studies in India and abroad: Students who are Indian

nationals and have secured admission to professional/ technical

courses in India through a common Entrance Test, or who have

secured admission to a foreign University or Institution. The

father or guardian of the student will be the guarantor in case of

individual applicants. The maximum loan amount for studies in

India is � 10 lakhs and for studies abroad is � 20 Lakhs.

109

KVB - Mortgage Loan

The mortgage loan shall be granted for general purposes like

Personal, Consumption, Education, Health, Business, etc., other

than speculative purposes. Only resident individuals are eligible

for this loan. The property should be owned by individuals.

The loan shall be availed both as term loan (EMI) and as an

overdraft facility.

KVB Cards

For the convenience of customers, Karur Vysya Bank offers

internationally accepted VISA debit card services that give them

great convenience, whether it is to access an ATM, book travel

tickets through the internet or shop online. The verified by VISA

security-enabled feature ensures that customers get peace of

mind when using KVB cards. KVB offers international VISA debit

cards to its savings account customers. Besides it offers Gift

Card and Travel Card to its customers.

Thirumagal Thirumana Thittam

KVB's Tirumagal Tirumana Thittam (TTT) is a long term

investment plan which helps the customers to plan for their long

term financial requirements like children's education and

daughter's marriage.

110

Fixed Deposits

KVB's fixed deposit scheme provides the customers with the

convenience on receiving interest at regular intervals (half-yearly /

quarterly / monthly) and is ideally suited for persons who depend

on regular interest income.

Senior Citizen Deposits

KVB offers term deposits with both cumulative and non-

cumulative options for the senior citizens. Moreover, senior

citizens are eligible for preferential rate of interest.

KVB Manimala

KVB Manimala is an attractive monthly deposit scheme

meant for persons who wish to invest a fixed sum of money every

month with an intention to get a lump sum amount on the

maturity of the deposit.

Mutual Funds

As part of their financial planning process customers explore

various financial instruments while arriving at their investment

decisions. Acknowledging this requirement, KVB offers a range of

financial services under one roof. Since mutual funds is a desired

investment option of the customers, KVB has entered into tie-ups with

111

leading mutual fund companies for the convenience of customers so

that they can enjoy the experience of convenience banking.

Demat Account

Demat stands for dematerialization. The dematerialization

process converts physical shares into electronic

(dematerialized) shares, which eliminates all the problems

associated with physical securities. A Demat account has to be

opened if the customer wants to buy and sell shares, securities

and debentures. KVB is a registered member (Depository

Participant) of National Securities Depository Ltd. (NSDL). It

has been enrolled as a Depository Participant by NSDL, India's

first depository.

From the description of the services offered by the select

banks, it can be understood that all retail banks are characterized

by multiple products, multiple delivery channels and multiple

customer segments. The multiple products may include financial

products such as deposits, insurance products (agency),

investments, etc. The multiple delivery channels may include

customer service centers, internet kiosks, etc. They are different

deposits products, loan products and card products. The delivery

112

channels have got various names such as home banking, internet

banking, mobile banking, ATM Cards and so on. Retail banking

provides the banks an opportunity to do cross selling and provides

the ancillary services. So, retail banking gives them an opportunity

to create a customer base and optimum leverage of the

resources.

4.3 Demographic Profile of the Respondents

The demographic profile of the respondents is analysed based

on their gender, age, marital status, education, occupation,

income and area of residency. Table 4.1 exhibits the demographic

details of the respondents.

113

TABLE 4.1

DEMOGRAPHIC PROFILE OF THE RESPONDENTS

Demographic

Variables Category

Public Sector

Banks

Private Sector

Banks Total

Gender

Count % Count % Count %

Male 211 70.33 162 72.00 373 71.05

Female 89 29.67 63 28.00 152 28.95

Total 300 100 225 100 525 100

Age

Below 20 23 7.67 20 8.89 43 8.19

21 to 30 years 45 15.00 42 18.67 87 16.57

31 to 40 years 113 37.67 76 33.78 189 36.00

41 to 50 years 75 25.00 35 15.56 110 20.95

50 and above 44 14.66 52 23.10 96 18.29

Total 300 100 225 100 525 100

Marital Status

Single 86 28.67 61 27.11 147 28.00

Married 208 69.33 154 68.45 362 68.95

Widow and others 6 2.00 10 4.44 16 3.05

Total 300 100 225 100 525 100

Education

Up to SSLC 21 7.00 18 8.00 39 7.43

HSC 65 21.67 33 14.67 98 18.67

Graduation 130 43.33 96 42.67 226 43.05

Post graduation 64 21.33 44 19.55 108 20.57

Diploma and others 20 6.67 34 15.11 54 10.28

Total 300 100 225 100 525 100

Occupation

Self employed 27 9.00 16 7.11 43 8.19

Salaried 89 29.67 97 43.11 186 35.43

Business 93 31.00 50 22.22 143 27.24

Housewife and

Students

14

4.67

17

7.56

31

5.90

Retired 65 21.67 31 13.78 96 18.29

Agriculture and allied 12 4.00 14 6.22 26 4.95

Total 300 100 225 100 525 100

Monthly

Income

Below � 10000 34 11.33 20 8.89 54 10.29 � 10001 to � 20000 52 17.33 26 11.56 78 14.86 � 20001 to 30000 102 34.00 71 31.56 173 32.95 � 30001 to 40000 70 23.34 69 30.67 139 26.47 � 40001 and above 42 14.00 39 17.32 81 15.43

Total 300 100 225 100 525 100

Area of

Residence

Rural 64 21.33 25 11.11 89 16.95

Semi -Urban 98 32.67 94 41.78 192 36.57

Urban 138 46.00 106 47.11 244 46.48

Total 300 100 225 100 525 100

114

Table 4.1 shows the demographic profile of the respondents.

Out of 525 respondents 300 respondents are customers of public

sector banks and 225 respondents are customers of private sector

banks. In public sector banks 70.33 per cent are male and 29.67

per cent are female. In case of private sector banks 72 per cent

are male and 28 per cent are female.

Majority of the respondents (36 per cent) are in the age group

of 31-40 years. In public sector banks, 113 respondents (37.67

per cent) are in the age group of 31-40 years and 7.67 per cent of

the respondents are in the age group of below 20 years. In case of

private sector banks, 76 respondents (33.78 per cent) are in the

age group of 31-40 years. 52 respondents (23.10 per cent) are in

the age group of 51 years and above and 20 respondents (8.89 per

cent) are in the age group of below 20 years.

Out of 525 respondents 362 respondents (68.95 per cent) are

married, 147 respondents (28 per cent) are unmarried and 16

respondents (3.05 per cent) are widows and others. The

respondents who are married are 69.33 per cent and unmarried

are 28.67 per cent in public sector banks. In case of private sector

banks, 154 respondents (68.45 per cent) are married and 61

respondents (27.11 per cent) are unmarried and 10 respondents

(4.44 per cent) are widows and others.

115

Out of 525 total respondents, 226 respondents (43.05 per

cent) are graduates and 39 respondents (7.23 per cent) are

studied upto S.S.L.C only. In case of public sector banks 43.33

per cent of the respondents are graduates and it is 42.67 per cent

of private sector banks. 6.67 per cent of the public sector bank

respondents and 15.11 per cent of the private sector banks have

diploma and other qualifications.

Out of 525 total respondents 186 respondents (35.43 per

cent) are salaried customers. In public sector banks 31 per cent of

the respondents are doing business, 29.67 per cent are salaried

class and only 4 per cent are doing agriculture. In case of private

sector banks 97 respondents (43.11 per cent) are salaried class,

50 respondents (22.22 per cent) are doing business and 14

respondents (6.22 per cent) are doing agriculture. 4.67 per cent of

the public sector banks respondents are housewives and

students. 21.67 per cent of the public sector banks respondents

and 13.78 per cent of the private sector banks respondents are

retired persons.

116

Out of 525 total respondents 173 respondents (32.95 per

cent) have monthly income of � 20001 – � 30000 and

54 respondents (10.29 per cent) have below � 10000 monthly

income. The majority of the respondents (34 per cent in public

sector banks and 31.56 per cent in the private sector banks) have

monthly income of � 20001 – � 30000. In case of public sector

banks 11.33 per cent have below � 10000 and 14 per cent have

above � 40,000 as their monthly income. In case of private sector

banks 30.67 per cent of the respondents are having monthly

income of � 30001 – � 40000, 8.89 per cent of the respondents are

having below � 10000 as monthly income.

Out of 525 total respondents 244 are having urban residency,

192 respondents (36.57 per cent) are from semi-urban and 89

respondents (16.95 per cent) are from rural area. In case of public

sector bank, 138 respondents (46 per cent) are from urban area,

98 respondents (32.67 per cent) are from semi urban area and 64

respondents (21.33 per cent) are from rural area. In case of

private sector bank, 106 respondents (47.11 per cent) are from

urban area, 94 respondents (41.78 per cent) are from semi-urban

area and 25 respondents (11.11 per cent) are from rural area.

117

4.4 Details of Bank Transactions

The information related to type of banks, source of

information to prefer a bank for their banking operation, types of

accounts held by the respondents, type of loan availed, frequency

of bank visit and purpose of visits are analysed in Table 4.2.

TABLE 4.2

DETAILS OF BANK TRANSACTIONS

Details Category

Public Sector

Bank

Private Sector

Bank Total

Count % Count % Count %

Type of Bank

Total 300 57.14 225 42.85 525 100

Source of Information

Friends and relatives 92 30.67 44 19.56 136 25.90

Bank employees 51 17.00 39 17.33 90 17.14

Journals and magazines 23 7.67 20 8.89 43 8.19

Brochure 49 16.33 54 24.00 103 19.62

Newspaper , TV

advertising and Internet

37

12.33

41

18.22

78

14.86

Employer and collogues 48 16.00 27 12.00 75 14.30

Total 300 100 225 100 525 100

Pre-bank Selection Information Collection Period

Less than 2 weeks 84 28.0 79 35.11 163 31.05

2 weeks-1 month 186 62.0 93 41.33 279 53.14

More than one month 30 10.0 53 23.56 83 15.81

Total 300 100 225 100 525 100

Type of Accounts Held

Fixed Deposit A/c 57 19.00 34 15.12 91 17.33

Saving Bank A/c 100 33.33 75 33.33 175 33.33

Current A/c 100 33.33 75 33.33 175 33.33

Recurring Deposit A/c 32 10.67 19 8.45 51 9.72

Demat A/c 11 3.67 22 9.77 33 6.29

Total 300 100 225 100 525 100

Period of Account Held

Below 3 years 86 28.67 72 32.00 158 30.09

3 to 5 years 167 55.67 116 51.56 283 53.91

5 years and above 47 15.66 37 16.44 84 16.00

Total 300 100 225 100 525 100

118

Details Category

Public Sector

Bank

Private Sector

Bank Total

Count % Count % Count %

Availed Loan

Yes 246 82.00 190 84.44 436 83.05

No 54 18.00 35 15.56 89 16.95

Total 300 100 225 100 525 100

If Yes, State Type of Loan Availed

Housing Loan 27 10.98 11 5.79 38 8.72

Personal Loan 82 33.33 74 38.94 156 35.78

Business Loan 25 10.16 26 13.68 51 11.70

Jewel Loan 66 26.83 55 28.95 121 27.74

Vehicle Loan 35 14.23 17 8.95 52 11.93

Agricultural Loan 11 4.47 7 3.69 18 4.13

Total 246 100 190 100 436 100

Frequency of Visit to the Bank

Daily 42 14.00 31 13.78 73 13.90

Once in a week 59 19.67 40 17.78 99 18.86

2-3 times in a week 73 24.33 67 29.78 140 26.67

Once in a month 39 13.00 24 10.67 63 12.00

2-3 times in a month 67 22.33 51 22.67 118 22.48

Occasionally 20 6.67 12 5.32 32 6.09

Total 300 100 225 100 525 100

Prime Purpose for Visit

Make Deposit 124 41.33 98 43.55 222 42.29

Cash withdraw 102 34.00 64 28.44 166 31.62

Avail loan 34 11.33 37 16.44 71 13.52

Repayment of loan 8 2.67 6 2.67 14 2.67

Fund transfer 10 3.33 12 5.33 22 4.19

Other 22 7.34 8 3.57 30 5.71

Total 300 100 225 100 525 100

In Table 4.2, an attempt is made to find out respondents’

bank transaction details. Out of 525 respondents, 300

respondents (57.14 per cent) are using public sector banks for

their banking transactions while 225 respondents (42.85 per cent)

are using private sector banks.

119

Majority of the respondents (92 out of 300) in public sector

banks state that friends and relatives are their source of

information. Bank employees (17 per cent), brochures (16.33 per

cent), employer and colleagues (16 per cent) are also the source of

information in case of public sector of banks. In case of private

sector banks 54 respondents (24 per cent) have stated that

brochures are their source of information. 12.33 per cent of the

respondents in public sector banks and 18.22 per cent of the

private sector banks respondents’ state newspaper and

advertisement are their source of information.

In case of public sector banks, the majority of respondents

(186) collected pre-bank selection information, in 2 weeks to

1 month, 84 respondents ((28 per cent) collected information

within 2 weeks time and 30 respondents (10 per cent) took more

than one month to collect the pre-bank information. In case of

private sector bank 93 respondents (41.33 per cent) took 2 weeks

to 1 month to collect information, 79 respondents (35.11 per cent)

took less than 2 weeks and 53 respondents (23.55 per cent)

collect the pre-bank selection information.

Out of 525 respondents, 175 respondents (33.33 per cent) are

having Savings bank accounts, another 175 respondents (33.33

per cent) are having current accounts. 91 respondents (17.33 per

120

cent) are having fixed deposit accounts. In case of public sector

banks 100 respondents (33.33 per cent) are having Savings bank

accounts, another 100 respondents (33.33 per cent) are having

current accounts. 57 respondents (19.00 per cent) are having

fixed deposit account, 32 respondents (10.67 per cent) are having

recurring deposit and 11 respondents (3.67 per cent) only are

having demat account. In case of private sector banks 75

respondents (33.33 per cent) are having Savings bank accounts,

another 75 respondents (33.33 per cent) are having current

accounts. 34 respondents (15.12 per cent) are having fixed

deposit, 22 respondents (9.77 per cent) are having demat account

and 19 respondents (8.45 per cent) are having recurring deposit

account. It can be concluded that the majority of the customers

are savings bank and current account holders.

Out of 525 total respondents, the majority of the respondents

(283 respondents) are having 3-5 years of account holding and

158 respondents (30.09 per cent) are having accounts for less

than 3 years. Only 84 respondents (16 per cent) are having the

account for more than 5 years. In case public sector banks, 167

respondents (55.67 per cent) are holding account for 3-5 years, 86

respondents (28.67 per cent) are holding account for below

3 years and 47 respondents (15.66 per cent) are holding account

for more than 5 years. In case of private sector banks,

121

116 respondents (51.56 per cent) are holding account for 3-5

years, 72 respondents (32 per cent) are holding below 3 years and

37 respondents (16.44 per cent) are holding account for more

than 5 years.

Out of 525 total respondents, 436 respondents (83.05 per

cent) availed loan from banks and 89 respondents (16.95 per cent)

did not avail any loan from banks. In case of public sector banks,

out of 300 respondents, 246 respondents (82 per cent) availed

loan and 54 respondents (18 per cent) did not avail loan from

banks. Out of 225 private sector banks respondents, 190

respondents (84.44 per cent) availed loan from banks and 35

respondents (15.56 per cent) did not avail loan from banks.

Out of 436 total respondents who availed loan from banks,

156 respondents (35.78 per cent) availed personal loan. 121

respondents (27.74 per cent) availed jewel loan and only 18

respondents (4.13 per cent) availed agricultural loan. In case of

public sector banks, 82 respondents (33.33 per cent) availed

personal loan, 66 respondents (26.83 per cent) availed jewel loan,

35 respondents (14.23 per cent) availed vehicle loan, 27

respondents (10.98 per cent) availed housing loan, 25

respondents (10.16 per cent) availed business loan and 11

respondents (4.47 per cent) availed agricultural loan. In case of

122

private sector banks, 74 respondents (38.94 per cent) availed

personal loan, 55 respondents (28.95 per cent) availed jewel loan,

26 respondents (13.68 per cent) availed business loan,

17 respondents (8.95 per cent) availed vehicle loan,

11 respondents (5.79 per cent) availed housing loan and

7 respondents (3.69 per cent) availed agricultural loan.

When an enquiry about frequency of visit to the bank was

made, majority of the total respondents (140 out of 525) stated

that they visited the bank 2-3 times in a week and 118

respondents (22.48 per cent) visited 2-3 times in a month. Only

32 respondents (6.09 per cent) visited the bank occasionally. In

case of public sector banks, 73 respondents (24.33 per cent)

visited 2-3 times in a week, 67 respondents (22.33 per cent)

visited 2-3 times in a month, 59 respondents (19.67 per cent)

visited once in a week. Only 20 respondents (6.67 per cent) visited

the bank occasionally. In case of private sector banks 67

respondents (29.78 per cent) visited 2-3 times in a week, 51

respondents (22.67 per cent) visited 2-3 times in a month, 40

respondents (17.78 per cent) once in a week, 31 respondents

(13.78 per cent) visited daily and 12 respondents (5.32 per cent)

visited the bank occasionally.

123

Out of 525 total respondents, 222 respondents (42.29 per

cent) visited the bank for the purpose of deposit, 166 respondents

(31.62 per cent) visited for the purpose of cash withdrawal, 71

respondents (13.52 per cent) visited for loan purpose and 14

respondents (2.67 per cent) visited for repayment of loan. In case

of public sector banks 124 respondents (41.33 per cent) visited

the banks to deposit amount, 102 respondents (34 per cent)

visited banks for cash withdrawal, 34 respondents (11.33 per

cent) visited for availing loan, 10 respondents (3.33 per cent)

visited for fund transfer and 22 respondents (7.34 per cent) for

other purposes. In case of private sector banks, 98 respondents

(43.55 per cent) visited the banks to deposit amount, 64

respondents (28.44 per cent) visited banks for cash withdrawal,

37 respondents (16.44 per cent) visited for availing loan, 12

respondents (5.33 per cent) visited for fund transfer, 8

respondents (3.57 per cent) for other purposes and

6 respondents (2.67 per cent) for repayment of loan.

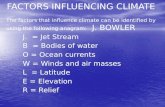

4.5 Factors influencing Selection of Bank

Considerable numbers of studies related to the factors

effective in consumer bank selection are observed. This

information is essential for banks to identify the appropriate

marketing strategies needed to attract new customers and retain

the existing ones. With growing competitiveness in the banking

124

industry and similarity of services offered by banks, it has become

increasingly important that banks identify the factors that

determine the basis upon which customers choose between

providers of financial services.

The general purpose of factor analysis is to find a method of

summarizing the information contained in a number of original

variables into a smaller set of new composite dimensions (Factors)

with minimum loss of information. The appropriateness of the

factor model can be calculated. Next to factor extraction, the

number of factors necessary to represent the data and the method

of calculating them must be determined. At this step, how well the

chosen model fits the data is also ascertained. Rotation focuses

on transforming the factors to make them more interpretable and

following this, scores for each factor can be computed for each

case. These scores are then used for further analysis. For the

present study, it is interesting to study the factors which can be

derived out of several variables which contribute to influencing

the customers in selection of the bank. From the in-depth

interviews, a list of 36 items was identified under the heading

“Factors influencing in selection of banks” and to measure the

level of importance assigned to bank selection variables with the

help of five point Likert scale ranging from 1 = not important at

125

all, 2 = unimportant, 3 = undecided, 4 = important and 5 = very

important. Selected factors are presented in Table 4.3.

TABLE 4.3

INFLUENCING FACTORS IN SELECTION OF THE BANK

Sl.

No. Variables

1 The interior designs are attractive and the bank is clean.

2 Bank employees provide quality and variability of services at the promised time

3 Availability of locker facility

4 Competitive prices for products and services

5 Bank employees are consistently courteous

6 Availability of large number of branches with phone and internet banking

7 Bank employees are trustworthy.

8 The employees are aware of special product rates (Interest, CD, savings)

9 Granting loans at the lowest rate of interest

10 Comfortable lobby area and adequate parking space

11 The employees are knowledgeable about usage of new and contemporary technologies

12 The employees adapt well to handle peak customer traffic

13 Customers’ feel safe in their transactions

14 Bank provides error-free records

15 Availability of ATM in several convenient locations

16 Bank employees are always willing to help customers

17 Efficiency in its day-to-day operations

18 The bank performs a service exactly as promised

19 Beforehand knowledge of customers’ needs and wants

20 Banks’ advertisements are effective

21 Not delay to responds to queries and wait times are satisfactory

22 Bank employees deal with customers in a caring fashion

23 Customers’ requests are handled promptly

24 The bank considers customers wishes and needs

25 Appropriate communication to all customers

26 Convenient location and pleasant atmosphere of bank and its main branches

27 Ease of opening account and obtaining loans

126

Sl.

No. Variables

28 Employees showing sincere interest in solving customers’ complaints

29 Low service charges

30 Recommendations of friends and relatives

31 Bank working hours convenient to all customers

32 Employees give prompt service to customers

33 Paying highest interest rates on saving accounts

34 Bank employees have the customers’ best interest at heart

35 Bank employees give personal and individual attention

36 Banks’ reputation

Source: Based on reviews

All the selected influential factors were tested to check if they

were parametric or not. In order to prove the selected variables

that are normally distributed, parametric tests have been applied

in the study. Respondents’ ratings on the importance level of bank

selection variables also called motivational items were subjected

to principal factor analysis to identify a small number of

motivational factors that may be used to represent relationship

among sets of interrelated variables. In this context, the

researcher has framed the following null hypothesis:

H01: “All the selected influencing variables are not effective in

consumer bank selection”.

To prove that the selected variables are normally distributed,

One-sample Kolmogorov - Smirnov test has been applied and the

results are presented in the following Table 4.4.

127

TABLE 4.4

ONE-SAMPLE STATISTICS TEST FOR MOTIVATIONAL ITEMS IN CONSUMER

BANK SELECTION

S.

No Variables Mean SD

Sig.

(2-tailed)

Test value

= 3 (p)

1 The interior designs are attractive and the bank is clean 3.68 .884 .000

2 Bank employees provide quality and variability of services

at the promised time

4.23 .719 .000

3 Availability of locker facility 4.03 .586 .000

4 Competitive prices for products and services 3.85 .793 .000

5 Bank employees are consistently courteous 4.11 .775 .000

6 Availability of large number of branches with phone and

internet banking

4.16 1.263 .000

7 Bank employees are trustworthy. 3.88 .778 .000

8 The employees are aware of special product rates

(Interest, CD, savings)

4.07 .676 .000

9 Granting loans at the lowest rate of interest 4.08 .667 .000

10 Comfortable lobby area and adequate parking space 3.98 .598 .000

11 The employees are knowledgeable about usage of new

and contemporary technologies

3.86 .759 .000

12 The employees adapt well to handle peak customer

traffic

3.83 .852 .000

13 Customers feel safe in their transitions 4.15 .758 .000

14 Bank provide error-free records 3.87 .673 .000

15 Availability of ATM in several convenient locations 4.07 .621 .000

16 Bank employees are always willing to help customers 4.05 .533 .000

17 Efficiency in its day-to-day operations 3.80 .853 .000

18 The bank performs a service exactly as promised 3.90 .727 .000

19 Beforehand knowledge of customers’ needs and wants 3.80 .578 .000

20 Banks’ advertisements are effective 4.09 .957 .000

21 Not delay to respond to queries and wait times are

satisfactory

3.89 .763 .000

22 Bank employees deal with customers in a caring fashion 3.88 .793 .000

23 Customers requests are handled promptly 4.04 .703 .000

24 The bank considers customers’ wishes and needs 4.08 .849 .000

128

S.

No Variables Mean SD

Sig.

(2-tailed)

Test value

= 3 (p)

25 Appropriate communication to all customers 3.83 .943 .000

26 Convenient location and pleasant atmosphere of bank and

its main branches

4.06 .597 .000

27 Ease of opening account and obtaining loans 4.19 .675 .000

28 Employees showing sincere interest in solving customers’

complaints

4.11 .735 .000

29 Low service charges 3.89 .693 .000

30 Recommendations of friends and relatives 3.78 .993 .000

31 Bank working hours convenient to all customers 3.92 .598 .000

32 Employees give prompt service to customers 4.12 .786 .000

33 Paying highest interest rates on saving accounts 4.10 .589 .000

34 Bank employees have the customers’ best interest at

heart

3.89 .592 .000

35 Bank employees give personal and individual attention 4.13 .776 .000

36 Bank’s reputation 4.03 .428 .000

Source: Computed from Primary Data

It is inferred from the Table 4.4 that means of all selection

variables are significantly greater than 3 which is decided as a

yardstick. Since ‘p’ values are less than 0.05. In other words, all

of the variables are effective in consumer bank selection decision.

Hence, the null hypothesis is rejected.

However, the most important ones in descending order can be

cited as: “Bank employees provide quality and variability of

services at the promised time” (4.23), “Ease of opening account

and obtaining loans” (4.19), “Availability of large number of

branches with phone and internet banking” (4.16), “Customer feel

129

safe in their transistion” (4.15) and “Bank employees give personal

and individual attention” (4.13). On the other hand, the least

important ones having values between decided and important are

“Recommendation of friends and relatives” (3.78) and “The interior

designs are attractive and the bank is clean” (3.68).

Factor Analysis

After the “one-sample t-test” for selection items, a factor

analysis was conducted using varimax rotation. The following

table 4.5 shows the results of factor analysis.

130

TABLE 4.5

RESULTS OF FACTOR ANALYSIS ON

Variables Factor

Loading

Eigen

Value

% of

Variance Reliability

TANGIBILITY:

The interior designs are attractive and the bank is clean 0.843

6.749 22.42 0.862

Availability of large number of branches with phone and

internet banking

0.798

Comfortable lobby area and adequate parking space 0.759

Availability of locker facility 0.753

Convenient location and pleasant atmosphere of bank and

its main branches

0.741

Availability of ATM in several convenient locations 0.732

RELIABILITY:

Bank provides error-free records 0.903

4.274 19.55 0.816

Efficiency in its day-to-day operations 0.822

Bank employees provide quality and variability of services

at the promised time

0.791

Ease of opening account and obtaining loans 0.739

Paying highest interest rates on saving accounts 0.788

Granting loans at the lowest rate of interest 0.759

The bank performs a service exactly as promised 0.748

EMPATHY:

Bank employees give personal and individual attention 0.861

3.982 18.31 0.798

Bank working hours convenient to all customers 0.797

Recommendations of friends and relatives 0.762

The bank considers customers’ wishes and needs 0.721

Low service charges 0.703

Bank’s reputation 0.683

Bank employees have the customers’ best interest at heart 0.661

Appropriate communication to all customers 0.643

Bank employees deal with customers in a caring fashion

0.621

131

Variables Factor

Loading

Eigen

Value

% of

Variance Reliability

ASSURANCE :

Bank employees are trustworthy 0.842

3.102 10.42 0.788

Beforehand knowledge of customers’ needs and wants 0.836

Banks’ advertisements are effective 0.797

Customers feel safe in their transactions 0.763

The employees are knowledgeable about usage of new and

contemporary technologies

0.789

The employees are aware of special product rates (Interest,

CD, savings)

0.752

Competitive prices for products and services 0.740

Bank employees are consistently courteous 0.733

RESPONSIVENESS:

The employees give prompt service to customers 0.816

2.231 8.65 0.771

Customers’ requests are handled promptly 0.792

Bank employees are always willing to help customers 0.762

Not delay to respond queries and wait times are

satisfactory

0.752

The employees adapt well to handle peak customer traffic 0.731

Employees showing sincere interest in solving customers’

complaints

0.711

Source: Based on reviews

Extraction method: Principal Component Analysis.

Rotation method: Varimax with Kaiser Normalization. Rotation in five iteration.

Range 1= not at all important; 5 = extremely important.

Regarding the pre-analysis testing for the suitability of the

entire sample for factor analysis, the Kaiser-Meyer-Olkin measure

of sampling adequacy was 0.768 and the Bartlet test of sphericity

(2371.431) was significant at p < 0.01, thus, indicating that the

sample was suitable for factor analytic procedures.

132

According to the analysis, factors with Eigen values greater

than 1.0 and factor loadings that are equal to or greater than 0.70

were retained. 36 items, loading under five dimensions were

extracted from the analysis except six items and these items

explained 79.35 per cent of the overall variance. Overall alpha

coefficient as the reliability analysis is 0.875. Items for each

subscale were also subjected to reliability analysis. The alpha

coefficients for the total scale were 0.862, 0.816, 0.798, 0.788 and

0.771 respectively for the five dimensions. Reliability coefficient

above 0.5 is acceptable even though alpha above 0.7 is considered

sufficient (George and Maller�, 2001, p. 217).

The five factors determined according to factor analysis are

named as “Tangibility”, “Reliability”, “Empathy”, “Assurance” and

“Responsiveness”. These factors as shown in Table 4.6 were

subjected to “one-sample t test” with the null hypothesis:

Ho2: Motivational Factors are not effective in consumer bank

selection decision.

� George and Maller

�, 2001

133

TABLE 4.6

EFFECTIVE FACTORS IN CONSUMER BANK SELECTION

Factors Mean Std.

Deviation

Sig. (2-tailed)

Test value = 3

(p)

Ranking of mean

Tangibility 4.0161 0.631 0.000 4

Reliability 4.6412 0.512 0.000 1

Empathy 3.8942 0.698 0.000 5

Assurance 4.4513 0.565 0.000 2

Responsiveness 4.2417 0.597 0.000 3

Source: Calculated from Primary Data

All of these factors are represented by the average value of the

means of respective items seen in Table 4.6 and it proves to be

effective in consumer bank selection decision since p values for

the test value of 3 are less than 0.05. Therefore, Ho2 is rejected

for all of these factors. Among these factors, the most effective one

is “Reliability”, while the least important one is “Empathy”.

134

TABLE 4.7

AVERAGE SCORES OF THE FACTORS FOR DIFFERENT GENDER GROUPS

Factor Statistics Gender T

Value Male Female

Tangibility Mean 3.11 3.20

1.18 SD 0.93 0.84

Reliability Mean 3.15 4.91

2.21** SD 0.86 0.82

Empathy Mean 3.93 3.95

1.31 SD 0.81 0.95

Assurance Mean 4.22 3.47

2.43** SD 0.98 0.85

Responsiveness Mean 3.09 3.12

1.85 SD 0.88 0.97

Source: Calculated from Primary Data

(Degrees of freedom = 1, 523 for t values. Table value for 1, 523 df @5%=

1.78 **Significant at 5% level)

An attempt is made in the table 4.7 to compare the

influencing factors between male and female respondents. The

perception of the respondents on the influence of service quality

factors on gender has been measured by using t test. Accordingly

it is evident from the average score and t value that there is no

significant difference between male and female respondents in

respect of tangibility, empathy and responsiveness. However, it is

found from the results of t test that male respondents differ

significantly in respect of assurance and female respondents differ

significantly in respect of reliability. It is concluded that the

service quality dimension of reliability and assurance differ

significantly based on the gender of the respondents.

135

TABLE 4.8

AVERAGE SCORES OF THE FACTORS FOR DIFFERENT AGE GROUPS OF

RESPONDENTS

Factor Statis

tics

Age (in Years) F

Value Below

20 20-30 30-40 40-50

50 and

Above

Tangibility Mean 4.45 4.16 3.23 4.31 4.32

3.96** SD 0.71 1.08 0.79 0.87 0.70

Reliability Mean 4.24 4.00 3.69 4.41 3.48

4.22** SD 0.78 1.07 1.20 1.13 1.19

Empathy Mean 4.63 4.01 4.03 4.00 3.99

2.52 SD 0.67 1.11 1.00 0.97 1.07

Assurance Mean 3.09 3.89 3.97 3.29 3.91

1.46 SD 0.90 0.95 0.89 0.77 0.78

Responsiveness Mean 4.14 4.10 3.99 4.05 3.97

1.15 SD 0.63 0.73 0.86 1.14 0.94

Source: Calculated from Primary Data

(Degrees of freedom = 4, 520 for F values. Table value for 4,520 df @5% = 2.35 **Significant at 5% level)

An attempt is made to analyse the influence of various service

quality dimension amount for different age groups of the

respondents. There is no significant difference in service quality

dimension of empathy, assurance and responsiveness with regard

to different age groups of respondents. The tangibility and

reliability service quality dimensions differ significantly in case of

below 20 years age group, 20-30 years age group and 40-50 years

age group of respondents. It is concluded that tangibility and

reliability service quality dimensions differ significantly based on

the age groups of the respondents.

136

TABLE 4.9

AVERAGE SCORES OF THE FACTORS FOR DIFFERENT MARITAL

STATUS OF THE RESPONDENTS

Factor Statistics

Marital Status F

Value Single Married Widow

Tangibility Mean 3.93 3.92 4.35 1.430

SD 0.95 1.01 1.22

Reliability Mean 4.14 4.10 4.11 1.881

SD 1.48 0.97 1.61

Empathy Mean 3.67 3.52 3.69 1.512

SD 1.02 1.52 1.44

Assurance Mean 3.19 3.96 3.91 1.226

SD 1.22 1.62 1.43

Responsiveness Mean 3.72 3.71 3.42

1.524 SD 1.13 1.14 1.06

Source: Calculated from Primary Data

(Degrees of freedom = 2, 522 for F values. Table value for 2, 522 df @5%= 2.18 **Significant at 5% level)

An analysis is made regarding the influence of service quality

dimension among the marital status of the respondents.

Accordingly it is evident from the F value and average scores that

there is no significant difference in all influencing factors on the

marital status of the respondents.

137

TABLE 4.10

AVERAGE SCORES OF THE FACTORS FOR DIFFERENT EDUCATIONAL

QUALIFICATIONS OF THE RESPONDENTS

Factor Statis

tics

Educational Status

F

Value Up to

SSLC HSC Graduation

Post

Gradu

ation

Diploma

and