Cry Stall Ball

-

Upload

madalyna1985 -

Category

Documents

-

view

218 -

download

0

Transcript of Cry Stall Ball

-

8/3/2019 Cry Stall Ball

1/26

Introducing Oracle Crystal Ball Predictor: a new approach toforecasting in MS Excel Environment

Samik Raychaudhuri, Ph. D.Principal Member of Technical Staff

ISF 2010

-

8/3/2019 Cry Stall Ball

2/26

Oracle Crystal Ball

An add-in to Microsoft Excel for performing:

Monte Carlo simulation

Stochastic optimization

Time series forecasting

The focus of the software has been historically on

Monte Carlo simulation, with basic time-seriesforecasting capabilities

The current version finally provides much-needed

attention to the forecasting capabilities by introducingan array of features to the tool

-

8/3/2019 Cry Stall Ball

3/26

Oracle Crystal Ball Predictor Features

The time-series forecasting tool in Oracle Crystal Ball is calledPredictor. We will refer to it henceforth as CB Predictor

The tool has an interesting set of usability features which sets it apartfrom other forecasting software:

Works completely in the familiar Microsoft Excel spreadsheet environment:no data import or result export required

Officially supported on MS Excel XP, 2003 and 2007. Excel 2010 will be

supported soon Usual analytical features available (details follow)

Ease of use, with non-intimidating dialogs and sensible defaults for theuninitiated and providing array of configuration options for power users

Professional forecasting charts and reports

Seamlessly integrates with Monte Carlo simulation for conducting riskanalysis along with time-series forecasting

Can definitely be the forecasting software of choice for the rest of us !!

-

8/3/2019 Cry Stall Ball

4/26

CB Predictor Analytical Feature List

CB Predictor has an extensive list of featuresdesigned to make the forecasting experience easy

and productive

The tool sports a wizard like interface to guide usersthrough the forecasting process

The features can be broadly subdivided into twocategories:

Data preparation and forecasting

Result analysis and reporting

-

8/3/2019 Cry Stall Ball

5/26

CB Predictor Analytical Feature List: DataPreparation and Forecasting

Data preparation and forecasting is performed overfour feature-rich screens

Identifying input data

Describing data characteristics

Selecting models to run

Choosing forecasting options

-

8/3/2019 Cry Stall Ball

6/26

Data Preparation and Forecasting: The WelcomeScreen

CB Predictor starts off at the Welcome screen

Talks about the basic forecasting procedure

-

8/3/2019 Cry Stall Ball

7/26

Data Preparation and Forecasting: Identifying InputData

-

8/3/2019 Cry Stall Ball

8/26

Data Preparation and Forecasting: Identifying InputData (Contd.)

The hidden features

Intelligent data selection

Select one cell in a contiguous range of series and startCB Predictor

Identifies the complete range of data, orientation of the

data, and the position of header and date ranges if exist Supports discontinuous data range (e.g., alternate rows or

columns of data)

Supports logical aligning of data: pre-data gaps

Automatically identify various type of periods like months inan year, dates, or quarters etc.

-

8/3/2019 Cry Stall Ball

9/26

Data Preparation and Forecasting: Describing DataCharacteristics

[Planned Screen]

Seasonality detection

Events modeling (New)

Missing value imputationOutlier detection

-

8/3/2019 Cry Stall Ball

10/26

Data Preparation and Forecasting: Describing DataCharacteristics (Contd.)

Seasonality detection

We automatically detect seasonality for input series

One can override the seasonality of each series or set them to non-seasonal

The detection algorithm uses threshold-based analysis of autocorrelation andtheir probabilities at various lags in the data

Has been tested extensively on M1-competition and M3-competition data

-

8/3/2019 Cry Stall Ball

11/26

Data Preparation and Forecasting: Describing DataCharacteristics (Contd.)

Data screening

Missing value imputation: CB Predictor can

impute the missing values in the dataset Uses nearest neighbor interpolation or cubic

spline interpolation

Options to control the interpolation scheme

Outlier detection: detects outliers specific to eachforecasting method

Suggests replacing values

Options to control the method and the

aggressiveness of the detection algorithm In each case, charts are available to ease the

decision making process

Defaults work great for majority of scenarios

-

8/3/2019 Cry Stall Ball

12/26

Data Preparation and Forecasting: Describing DataCharacteristics (Contd.)

Events modeling

Still in the works, slated for a future release

-

8/3/2019 Cry Stall Ball

13/26

Data Preparation and Forecasting: SelectingForecasting Models

[Planned Screen]

-

8/3/2019 Cry Stall Ball

14/26

Data Preparation and Forecasting: SelectingForecasting Models (Contd.)

Non-seasonal Models Single moving average

Single exponential smoothing Double moving average

Double exponential smoothing

Seasonal Models Seasonal Additive

Seasonal Multiplicative

Holt-Winters Seasonal Additive

Holt-Winters Seasonal Multiplicative

Order and other parameters are automaticallydetected or can be overridden by the user

-

8/3/2019 Cry Stall Ball

15/26

Data Preparation and Forecasting: SelectingForecasting Models (Contd.)

Multiple Linear Regression

Supports lagged dependent variables

Supports multiple dependent variables

Stepwise regression (forward and iterative) for choosingimportant independent variables from a pool

Performs automatic forecasting of the dependent variableusing regression equation and forecasts from independentvariable

ARIMA (New)

Still in the works, slated for a future release

-

8/3/2019 Cry Stall Ball

16/26

Data Preparation and Forecasting: ForecastingOptions

-

8/3/2019 Cry Stall Ball

17/26

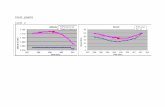

CB Predictor Analytical Feature List: ResultAnalysis and Reporting

Features:

Displays forecast andconfidence intervals

Displays the best methodfor each series with easybrowsing for other seriesand methods

Important statistics for each

method Seasonal bands for visual

identification of patterns inthe historical andforecasting horizon

Adjust forecasting horizonand CI on-the-fly

-

8/3/2019 Cry Stall Ball

18/26

CB Predictor Analytical Feature List: ResultAnalysis and Reporting (Contd.)

Manual adjustment of forecasts

Supports various type of adjustments

-

8/3/2019 Cry Stall Ball

19/26

CB Predictor Analytical Feature List: ResultAnalysis and Reporting (Contd.)

Access to reports and data extraction from the resultswindow menu

Integration with CB Monte Carlo simulation

Forecasts are treated as normal probability distributions withforecast value as the mean and standard error as the

standard deviation Can then be used for risk analysis

-

8/3/2019 Cry Stall Ball

20/26

Example: Using CB Predictor for Forecasting andRisk Analysis: Monicas Bakery

A rapidly-growing boutique bakery inTaos, New Mexico

The owner, Monica, has keptrecords of sales of her three mainproducts: French bread, Italian

bread and pizza Wants to analyze the cash flow of

the business to purchase fixed

assets

-

8/3/2019 Cry Stall Ball

21/26

Example: Monicas Bakery (Contd.)

Demonstration

Reports

-

8/3/2019 Cry Stall Ball

22/26

Example: Monicas Bakery (Contd.)

Static analysis shows:

Doesnt look good as per the minimum cash targetgoes

But is it really the true picture? Risk analysis thinking in ranges

-

8/3/2019 Cry Stall Ball

23/26

Example: Monicas Bakery (Contd.)

The risk analysis of the cash flow

Lot of uncertain variables in the spreadsheet model

The numbers really represent the likely scenario or the best guess scenario

Lets try to analyze the uncertainty in some of these variables and seethe interaction effect

Set probability distributions on top of input variables (calledassumptions)

COGS Overhead

Financing

Taxes

Set the target variables in which we are interested (called forecasts)

Run a Monte Carlo Simulation

5000 trials

Get the probability distribution for the target variables

-

8/3/2019 Cry Stall Ball

24/26

Example: Monicas Bakery (Contd.)

Use the forecast chartstofind out the probability of

hitting the minimum cashtargets

Probability for July: 65.37%

Probability for August:30.97%

Probability for September:97.17%

-

8/3/2019 Cry Stall Ball

25/26

Example: Monicas Bakery (Contd.)

How about considering the uncertainty in the forecast valuesthemselves?

Have those as assumptions as well New probability of hitting the minimum cash targets

Probability for July: 64.42%

Probability for August: 33.24%

Probability for September: 96.55%

These are when you have chosen to use the best forecastingmethod, which has a reasonably narrow CI

Choose another forecasting methods having wider forecast CIsand verify that the risk spread increases for target variables

-

8/3/2019 Cry Stall Ball

26/26

Questions?

Presenter:

Samik Raychaudhuri

mailto:[email protected]:[email protected]

![14 Stall Parallel Operation [Kompatibilitätsmodus] · PDF filePiston Effect Axial Fans (none stall-free) Stall operation likely for none stall-free fans due to piston ... Stall &](https://static.fdocuments.in/doc/165x107/5a9dccd97f8b9abd0a8d46cf/14-stall-parallel-operation-kompatibilittsmodus-effect-axial-fans-none-stall-free.jpg)