Credible Mechanisms · 2017. 12. 8. · Credible Mechanisms Mohammad Akbarpoury Shengwu Liz...

Transcript of Credible Mechanisms · 2017. 12. 8. · Credible Mechanisms Mohammad Akbarpoury Shengwu Liz...

Credible Mechanisms∗

Mohammad Akbarpour† Shengwu Li‡

December 8, 2017

Abstract

Consider an extensive-form mechanism, run by an auctioneer who communicatessequentially and privately with agents. Suppose the auctioneer can make any de-viation that no single agent can detect. We study the mechanisms such that it isincentive-compatible for the auctioneer not to deviate – the credible mechanisms.Consider the optimal auctions in which only winners make transfers. The first-priceauction is the unique credible sealed-bid mechanism. The ascending auction is theunique credible strategy-proof mechanism.

Keywords: Mechanism design, auction, credible, strategy-proof, sealed-bid.

JEL classification codes: D44, D47, D82

∗This paper has been previously distributed with the title “Credible Mechanism Design”. We thankBen Brooks, Jeremy Bulow, Alex Frankel, Ben Golub, Scott Kominers, David Kreps, Elliot Lipnowski,Erik Madsen, Eric Maskin, Paul Milgrom, Roger Myerson, Michael Ostrovsky, Doron Ravid, Ilya Segal,Andy Skrzypacz, Cameron Taylor, Alex Teytelboym, Bob Wilson, Alex Wolitzky, and several seminarparticipants for valuable comments and advice. All errors remain our own.†Graduate School of Business, Stanford University. Email: [email protected]‡Society of Fellows, Harvard University. Email: [email protected]

1

1 Introduction

Auctions are used to sell a wide variety of goods - art, fish, real estate, treasury bonds,

internet advertising, wireless spectrum, and, in 193 AD, the entire Roman Empire (Shubik,

2004). The theory of optimal auctions pins down only a few features of the auction format.

Under the standard assumptions, if bidders with higher values submit higher bids, and the

reserve price is optimally chosen, then the auction is optimal (Myerson, 1981). Despite

this, most real-world auctions are variations on just a few classic formats - the first-price

auction, the ascending auction, and (more recently) the second-price auction (Cassady,

1967; McAfee and McMillan, 1987).1 Why?

In this paper, we shed light on this question by proposing a framework for mechanism

design under partial commitment. The standard mechanism design paradigm assumes

full commitment on behalf of the auctioneer:

[In the standard paradigm] it is assumed that the organizer of the auction

has the ability to commit himself in advance to a set of policies. He binds

himself in such a way that all the bidders know that he cannot change his

procedures after observing the bids, even though it might be in his interest

ex post to renege. In other words, the organizer of the auction acts as the

Stackelberg leader or first mover. (McAfee and McMillan, 1987)

In real-world auctions, however, the auctioneer may have various opportunities to

deviate that are difficult for bidders to detect. The auctioneer could secretly inspect and

tamper with sealed bids. She could hire confederates to pose as bidders to manipulate the

outcome. She could call out nonexistent bids in order to give the impression of greater

demand - a practice known as “chandelier bidding”:

Under New York City regulations auctioneers can fabricate bids up to an item’s

reserve price. Because a reserve price is secret and not listed in the catalog,

bidders have no way of knowing which offers are real. (The New York Times,

April 24 2000)

Which deviations are feasible plainly depends on the auction format. Instead of con-

sidering deviations in an ad hoc manner, it would be useful to model the feasible deviations

as a function of the format. This paper provides one systematic framework to do so.

Consider any protocol ; a tuple consisting of an extensive-form mechanism and a strat-

egy profile for the agents. We can think of the auctioneer running the mechanism by

engaging in a sequence of private communication with the agents. Upon encountering an

information set, she picks up the telephone and conveys that information to the agent who

1The Dutch (descending) auction, in which the price falls until one bidder claims the object, is lessprevalent (Krishna, 2010, p.2).

2

is called to play, along with a set of acceptable replies (actions). The agent then chooses

a reply. The auctioneer keeps making telephone calls, sending information and receiving

replies, until she reaches a terminal history, whereupon she chooses the corresponding

outcome and the game ends.

Suppose some utility function for the auctioneer. For instance, assume that the auc-

tioneer wants revenue. Suppose that each agent intrinsically observes certain features of

the outcome. For instance, each agent observes whether or not he wins the object, and

how much he pays, but not how much other agents pay.

By participating in the mechanism, each agent observes a sequence of communica-

tion between himself and the auctioneer and some features of the outcome. Even if the

auctioneer deviates from her assigned strategy, agent i’s observation could still have an

innocent explanation. That is, when the auctioneer plays by the rules, there exist types

for the other agents that result in that same observation for i.

For any given protocol, there may be some deviations that are safe, in the sense that

for every type profile, each agent’s observation has an innocent explanation. That is,

every observation that an agent might have (under the deviation) is also an observation

he might have when the auctioneer is running the mechanism. For instance, when a

bidder bids $100 in a second-price auction, receives the object, and is charged $99, that

observation has an innocent explanation - it could be that the second-highest value was

$99. Thus, in a second-price auction, the auctioneer can safely deviate by exaggerating

the second-highest bid.2

Instead of just choosing a different outcome, the auctioneer may also alter the way she

communicates with agents. For example, consider a mechanism in which the auctioneer

acts as a middleman between one seller and one buyer. The seller chooses a price for the

object, which the auctioneer tells to the buyer. The object is sold to the buyer at that

price if and only if the buyer accepts, and the auctioneer takes a 10% commission. The

auctioneer has a safe deviation - she can quote a higher price to the buyer, and pocket

the difference if the buyer accepts.

A protocol is credible if running the mechanism is incentive-compatible for the auc-

tioneer; that is, if the auctioneer prefers playing by the book to any safe deviation. This is

a way to think about partial commitment power for any extensive-form mechanism. For

instance, if the auctioneer wants revenue, then the second-price auction is not credible.

Our model assumes that the auctioneer is the nexus of communication, exchanging pri-

vate messages with individual agents. Sometimes, this is literally the case: Large auction

2Such deviations are not purely hypothetical. An auctioneer running second-price auctions in Con-necticut admitted, “I assured prospective bidders they could bid with confidence since all mail bids“would be reduced to one advance over the next highest bid.” And in the beginning, that is what we did.But I found there are inherent conflicts of interest every auctioneer must deal with in his role as agentfor both the consignors and the bidders, and I’m ashamed to admit I did not handle those conflicts verywell.” (Lucking-Reiley, 2000)

3

houses, such as Sotheby’s and Christie’s, convey information and solicit bids over multiple

telephone lines and the Internet; most of Christie’s auctions are won by bidders who are

not in the room (Grant, 2014). Sometimes, the law forbids bidders from communicat-

ing with each other, as in the 2017 US Federal Communications Commission Incentive

Auction for wireless spectrum.3 Of course, many auctions involve other communication

procedures.4 We see our definition of a “safe deviation” as a tractable shorthand for a

rich set of real-world deviations, such as tampering with sealed bids, altering the relative

speed of price clocks, or hiring confederates to influence the outcome.

Having defined the framework, we now turn to our main application. Consider three

canonical auction formats. The first-price auction is sealed-bid - each agent is called to

play exactly once, and has no information about the history of play when selecting his

action. This yields a substantial advantage: Sealed-bid auctions can be conducted rapidly

and asynchronously, thus saving logistical costs.5 The ascending auction is strategy-

proof. Thus, it demands less strategic sophistication from bidders, and does not depend

sensitively on bidders’ beliefs (Wilson, 1987; Bergemann and Morris, 2005; Chung and Ely,

2007). The second-price auction is sealed-bid and strategy-proof; it combines the virtues

of the first-price auction and the ascending auction (Vickrey, 1961). However, many real-

world auctioneers persist in running first-price auctions and ascending auctions, despite

the invention of this (apparently) superior format (Rothkopf et al., 1990). Why is this

so?

Credibility illuminates the relationship between these three canonical auctions. Sup-

pose the classic assumptions: Private values, with symmetric independent regular dis-

tributions (Myerson, 1981). We restrict attention to auctions in which only winning

bidders make (or receive) transfers. Thus, the second-price auction (with reserve) is the

unique strategy-proof sealed-bid optimal auction, by the Green-Laffont-Holmstrom theo-

rem (Green and Laffont, 1977; Holmstrom, 1979).

The results that follow require us to bridge the discrete world of extensive game forms

and the continuous world of optimal auctions. We suppress these technicalities in the

introduction, but the reader should be aware that the first result holds ‘in the limit’, as

a finite grid type space becomes arbitrarily fine.

Our first result is as follows: The first-price auction (with reserve) is the unique credible

sealed-bid optimal auction. This implies that, in the class of sealed-bid mechanisms,

there is a sharp trade-off between incentive-compatibility for the auctioneer and dominant

3The Incentive Auction’s rules state that bidders “are prohibited from communicating directly orindirectly any incentive auction applicant’s bids or bidding strategies” (Section 1.2205(b)).

4Cryptographic techniques could allow bidders to allocate the object by communicating directly witheach other, rather than via a centralized auctioneer (Bogetoft et al., 2009). These techniques are a usefulalternative to standard auctions, but may be costly to set up and explain to bidders.

5Using data from U.S. Forest Service timber auctions, Athey et al. (2011) find that “sealed bidauctions attract more small bidders, shift the allocation toward these bidders, and can also generatehigher revenue”.

4

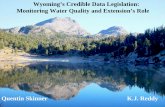

sealed-bid strategy-proof

credible

2nd price

ascending1st price

Figure 1: An auction trilemma: In the class of optimal auctions in which only the winnermakes transfers, no auction is sealed-bid, strategy-proof, and credible. Picking two out ofthree properties uniquely characterizes each classic format.

strategies for the agents.

Sealed-bid mechanisms include the direct revelation mechanisms, in which each agent

simply reports his type. Thus, when designing credible protocols, restricting attention to

revelation mechanisms loses generality. The problem is that revelation mechanisms reveal

too much, too soon. For a bidder to have a dominant strategy, his payment must depend

on the other bidders’ types. If the auctioneer knows the entire type profile, and the

winning bidder’s payment depends on the other bidders’ types, then the auctioneer can

safely deviate to raise revenue. This makes it impossible to run a credible strategy-proof

optimal auction. What happens when we look outside the class of revelation mechanisms

- when we use the full richness of extensive forms to regulate who knows what, and when?

Our second result is as follows: The ascending auction (with an optimal reserve) is

credible. Moreover, it is the unique credible strategy-proof optimal auction. No other

extensive forms satisfy these criteria.

These results imply an auction trilemma. Sealed bids, strategy-proofness, and credibil-

ity are all desirable properties. An optimal auction can have any two of these properties,

but not all three at once. Moreover, picking two out of three characterizes each of the

canonical auction formats (first-price, second-price, and ascending). Figure 1 illustrates.

1.1 Related work

In the literature on mechanism design with an informed principal, the principal has ex-

ogenous private information and cannot commit to how she uses it. Thus, the mechanism

must give the principal incentives to report that information to a neutral mediator (My-

erson, 1983; Maskin and Tirole, 1990, 1992). In this paper, we study a case of endogenous

5

private information. Our principal is the mediator - she learns, in the course of run-

ning the mechanism, private information about each agent’s type, and needs incentives

to follow the rules.

There has been substantial prior work on auction design under limited commitment.

The main approaches are as follows: Some papers consider models in which an auctioneer

runs auctions over multiple periods, but cannot commit today to the mechanism used to-

morrow (Milgrom, 1987; McAfee and Vincent, 1997; Caillaud and Mezzetti, 2004; Bester

and Strausz, 2001; Liu et al., 2014; Skreta, 2015). (This approach often relies on equi-

librium refinements to yield interesting results.) Other papers consider bargaining games

in which the auctioneer cannot commit to end the auction - she can continue to make or

solicit offers in defiance of the rules (Burguet and Sakovics, 1996; McAdams and Schwarz,

2007; Vartiainen, 2013; Lobel and Paes Leme, 2017). Some papers consider mechanisms

in which each agent reports his type to the principal, and the principal’s contract with

each agent can only directly depend on that bidder’s report (Rothkopf and Harstad, 1995;

Porter and Shoham, 2005; Dequiedt and Martimort, 2015). Finally, Loertscher and Marx

(2017) consider a clock auction in which the auctioneer chooses whether to keep the clocks

running or to end the auction.

Our current approach is distinct in a few ways. Firstly, we consider a non-repeated

interaction, and thus do not rely on equilibrium refinements. Secondly, our auctioneer’s

commitment power depends on what agents can observe, not on the passage of calendar

time. We thus rule out flagrant rule-breaking - for instance, the auctioneer cannot make

new offers to a bidder who knows that the auction should already be over. Thirdly, instead

of assuming that each bidder makes a single report, or assuming that every bidder makes

one offer in every period, we study the class of extensive game forms with perfect recall.

We show that credibility is a defining characteristic of the first-price auction and the

ascending auction. As far as we know, no prior work has produced a desirable criterion

that selects these two formats.

Li (2017) introduces a notion of bilateral commitment power, to characterize the choice

rules that are implementable in obviously dominant strategies. Our paper builds on that

formalism, with two key differences. Firstly, the notion of partial commitment in Li

(2017) is only for dominant-strategy mechanisms, whereas credibility allows for Bayes-

Nash mechanisms. Secondly, obvious dominance is a stronger incentive requirement for

the agents, but is silent on the incentives of the auctioneer. Credibility imposes no novel

restrictions on the incentives of agents. Instead, it explicitly requires the mechanism to

be incentive-compatible for the auctioneer.

6

2 The Model

2.1 Definitions

The environment consists of:

1. A finite set of agents, N .

2. A set of outcomes, X.

3. A finite type space, ΘN = ×i∈NΘi.

4. A joint probability distribution D : ΘN → [0, 1].

5. Agent utilities ui : X ×ΘN → R

6. A partition Ωi of X for each i ∈ N . (ωi denotes a cell of Ωi.)

The partition Ωi represents what agent i intrinsically observes about the outcome.

Conceptually, these partitions represent physical facts about the world, which are not

objects of design. They capture the bare minimum that each agent observes about the

outcome, regardless of the choice of mechanism.6

A mechanism is an extensive game form with consequences in X. This is an extensive

game form for which each terminal history is associated with some outcome. Formally,

a mechanism G is a tuple (H,≺, P, A,A, (Ii)i∈N , g), where each part of the tuple is as

specified in Table 1. The full definition of extensive forms is familiar to most readers,

so we relegate further detail to Appendix A. Let G denote the set of all extensive game

forms with consequences in X with finitely many histories and perfect recall.

Table 1: Notation for Extensive Game Forms

Name Notation Representative elementhistories H hprecedence relation over histories ≺initial history h∅terminal histories Z zplayer called to play at h P (h)actions A amost recent action at h A(h)information sets for agent i Ii Iioutcome resulting from z g(z)immediate successors of h σ(h)actions available at Ii A(Ii)

6In the application that follows, we will assume that each bidder in an auction knows how much hepaid and whether he receives the object. In effect, this rules out the possibility that the auctioneer couldhire pickpockets to raise revenue, or sell the object to multiple bidders by producing counterfeit copies.

7

Si denotes a (pure) strategy: For each information set where agent i is called to play

and each type of i , Si chooses an action Si(Ii, θi) ∈ A(Ii). (Si)i∈N ≡ SN denotes a

strategy profile for the agents, for some G ∈ G. We refer to a pair (G,SN) as a protocol.

Let xG(SN , θN) denote the outcome in G, when agents play according to SN and the type

profile is θN . Let uGi (SN , θN) ≡ ui(xG(SN , θN), θN).

Definition 1. (G,SN) is Bayesian incentive-compatible (BIC) if, for all i ∈ N ,

Si ∈ argmaxS′i

EθN [uGi (S ′i, S−i, θN)] (1)

We explicitly model the auctioneer7 as a player (denoted 0) . The auctioneer has

utility u0 : X ×ΘN → R.

2.2 Pruning

We restrict attention to the class of pruned protocols.8 This technique allows us to remove

redundant parts of the game tree, and implies cleaner definitions for the theorems that

follow. In words, a pruned protocol has three properties.

1. For every history h, there exists some type profile such that h is on the path of play.

2. At every information set, there are at least two actions available (equivalently, every

non-terminal history has at least two immediate successors).

3. If agent i is called to play at history h, then there are two types of i compatible

with his actions so far, that could lead to different eventual outcomes.

Let zG(SN , θN) denote the terminal history that results from (SN , θN). Formally,

Definition 2. (G,SN) is pruned if, for any history h:

1. There exists θN such that h zG(SN , θN)

2. If h /∈ Z, then |σ(h)| ≥ 2.

3. If h /∈ Z, then for i = P (h), there exist θi, θ′i, θ−i such that

(a) h ≺ zG(SN , (θi, θ−i))

(b) h ≺ zG(SN , (θ′i, θ−i))

(c) xG(SN , (θi, θ−i)) 6= xG(SN , (θ′i, θ−i))

7We use the term ‘auctioneer’ to refer to the mediator, but this could be any mediator who runs amechanism, such as a school choice authority or the National Resident Matching Program.

8This is stronger than the notion of pruning used in Li (2017), which includes only the first requirement.

8

By the next proposition, when our concern is BIC implementation, it is without loss

of generality to consider only pruned protocols.

Proposition 1. If (G,SN) is BIC, then there exists (G′, S ′N) such that (G′, S ′N) is pruned

and BIC and for all θN , xG′(S ′N , θN) = xG(SN , θN).

Hence, from this point onwards we restrict attention to pruned (G,SN).

2.3 A messaging game

Our goal is to study surreptitious deviations by the auctioneer. To do so, we must first

take a stand on what each player knows at each point in the mechanism. Consider the

messaging game, defined thus:

1. The auctioneer chooses to:

(a) Either: Select x ∈ X and end the game.

(b) Or: Go to step 2.

2. The auctioneer chooses some agent i ∈ N and sends a message along with a set of

acceptable replies (m,R).

3. Agent i privately observes (m,R) and chooses r ∈ R.

4. The auctioneer privately observes r.

5. Go to step 1.

Assume the auctioneer has an arbitrarily rich message space M . At any prior round

k, the auctioneer messaged ik ∈ N with (mk, Rk), and received reply rk ∈ Rk.

Let S0 denote the set of auctioneer pure strategies; we restrict these to be of finite

length. A strategy for the auctioneer specifies what to do next, as a function of the entire

history of communications: S0((ik,mk, Rk, rk)tk=1) ∈ (N ×M × (2M \ ∅)) ∪X.

A strategy for agent i specifies what reply to give, as a function of the previous com-

munications between agent i and the auctioneer, and the agent’s type. Let mki denote the

kth message that the auctioneer sent to agent i, and similarly for Rki and rki . Let ti denote

the total number of messages sent to agent i so far. Si((mki , R

ki , r

ki )ti−1k=1 ,m

ti , Rti , θi) ∈ Rti .9

For any S0 ∈ S0 and any SN , (S0, SN) results in some sequence of communication

between the auctioneer and agent i, oci ≡ (mki , R

ki , r

ki )Tik=1 and some outcome x. Let oxi

denote ωi ∈ Ωi | x ∈ ωi. oi = (oci , oxi ) denotes an observation for agent i. φi(S0, SN , θN)

denotes the unique observation resulting from (S0, SN), when the type profile is θN .

9Note the lack of calendar time: The agent observes the sequence of past communications betweenhimself and the auctioneer, not a sequence of periods in which he either sees some communication ornone.

9

Definition 3. Take any G = 〈H,≺, P, A,A, (Ii)i∈N , g〉. S0 runs G if there exists a one-

to-one function λ : (∪i∈NIi)∪A→M such that S0 is described by the following algorithm,

where we initialize h := h∅.

1. If h ∈ Z, terminate and select x = g(h).

2. Else:

(a) Choose agent P (h) and send (m,R) = λ(Ii, A(Ii)) for Ii such that h ∈ Ii.

(b) Upon receiving r ∈ R, choose h′ such that A(h′) = λ−1(r) and h′ ∈ σ(h). Set

h := h′ and go to step 1.

We use SG0 to denote an auctioneer strategy that runs G.

Given SG0 , for any Si, we can define an equivalent strategy Si for agent i in the

messaging game. Given any (m,R), Si selects reply λ(Si(λ−1(m))).10 We abuse notation

and use Si to denote both a strategy for agent i in G, and the equivalent strategy for

agent i in the messaging game.

2.4 Credible mechanisms

We now define feasible deviations for the auctioneer. First, we say that some observation oi

has an “innocent explanation” (with respect to S0) if there exist some types of other agents

such that if they had those types and the auctioneer played S0, oi was the observation of

agent i.

Definition 4. Suppose the auctioneer promises to play S0 and the type profile is θN .

i’s observation oi has an innocent explanation if there exists θ′−i such that oi =

φi(S0, SN , (θi, θ′−i)).

Definition 5. Suppose the auctioneer promises to play S0. Then, an auctioneer strategy

S ′0 ∈ S0 is safe if for all agents i ∈ N and all type profiles θN ∈ ΘN , φi(S′0, SN , θN) has

an innocent explanation.

Let S∗0 (S0) ≡ S ′0 | S ′0 is safe given promise S0 be the set of all safe strategies of the

auctioneer. The function S∗0 (.) takes an auctioneer strategy as an input and outputs the

set of all possible strategies that the auctioneer can deviate to without being detected by

a single agent.

Let u0(S0, SN , θN) denote the auctioneer’s utility in the messaging game, when the

strategy profile is (S0, SN) and the type profile is θN . A protocol is credible if playing ‘by

the book’ maximizes the auctioneer’s expected utility.

10We specify Si arbitrarily for communication sequences that are never observed under S0.

10

1

2

mechanism

3

a c b c bc

1

3

2a c a

c b

safe deviation

Figure 2: A mechanism and a deviation. If agent 1 cannot distinguish outcomes a and b,then the deviation is safe.

Definition 6. (G,SN) is credible if:

SG0 ∈ argmaxS0∈S∗0 (SG

0 )

EθN [u0(S0, SN , θN)] (2)

Definition 6 permits the auctioneer to misrepresent agents’ actions to each other mid-

way through the mechanism. The following example illustrates.

Example 1. Consider the mechanism on the left side of Figure 2. Each agent has one

information set, two moves (left and right), and two types (li and ri) that play the corre-

sponding moves. By assumption, agent 1 observes whether the outcome is in the set a, bor in c. Agents 2 and 3 perfectly observe the outcome.

The right side of Figure 2 illustrates a safe deviation: If agent 1 plays left, then the

auctioneer plays ‘by the book’. If agent 1 plays right, then instead of querying agent 2, the

auctioneer queries agent 3. If agent 3 then plays left, the auctioneer chooses outcome a.

If agent 3 plays right, only then does the auctioneer query agent 2, choosing c if 2 plays

left and b if 2 plays right.

For every type profile, each agent’s observation has an innocent explanation. The most

interesting case is when the type profile is (r1, l2, l3). In this case, playing by the book results

in outcome b, but the deviation results in outcome a. Agent 1 cannot distinguish between

a and b, so (l2, l3) is an innocent explanation for 1. (l1, l3) is an innocent explanation for

2, and (l1, l2) is an innocent explanation for 3. Thus, if the auctioneer prefers outcome a

to any other outcome, then the mechanism is not credible.

Notably, this deviation involves not just choosing different outcomes, but communi-

cating differently even before a terminal history is reached. Indeed, when the type profile

is (r1, l2, l3), the auctioneer can only get outcome a by deviating midway. If she waited

until the end and then deviated to choose a, then agent 2’s observation would not have an

innocent explanation. Once agent 2 is called to play, he knows that outcome a should not

occur.

11

Definition 6 takes the expectation of θN with respect to the joint distribution D, but

it implicitly requires the auctioneer to best-respond to her updated beliefs in the course

of running G. Recall that a strategy for the auctioneer is a complete contingent plan.

Suppose that in the course of running G, the auctioneer discovers new information about

agents’ types, such that she can profitably change her continuation strategy. There exists

a deviating strategy that adopts this new course of action contingent on the auctioneer

discovering this information, and plays by the book otherwise.

We can extend our pruning proposition to credible implementation as well.

Proposition 2. If (G,SN) is credible and BIC, then there exists (G′, S ′N) such that

(G′, S ′N) is pruned, credible, and BIC, and for all θN , xG′(S ′N , θN) = xG(SN , θN).

By Proposition 2, when our concern is credible implementation, it is without loss of

generality to consider only pruned mechanisms.

Observation 1. (G,SN) is credible and BIC if and only if (SG0 , SN) is a Bayes-Nash

equilibrium of the messaging game in which the auctioneer is constrained to play strategies

in S∗0 (SG0 ).

Credibility restricts attention to ‘promise-keeping’ equilibria of the messaging game.

This is without loss of generality, in the sense that any equilibrium can be turned into a

promise-keeping equilibrium by altering the promise.

Observation 2. If S ′0 ∈ S∗0 (S0), then S∗0 (S ′0) ⊆ S∗0 (S0). Thus, if (S ′0, SN) is a Bayes-Nash

equilibrium given promise S0, then (S ′0, SN) is a Bayes-Nash equilibrium given promise S ′0.

Credibility is neither weaker nor stronger than the definition of bilateral commitment

studied in Li (2017). That definition essentially requires that each agent’s strategy Si

is weakly dominant, even when the auctioneer can deviate to strategies that produce

identical observations for i. By contrast, credibility requires SG0 to be incentive-compatible

for the auctioneer, when the auctioneer can make any safe deviation.

3 Credible Optimal Auctions

We consider an auction for a single object. We study the independent private values

model of Myerson (1981), but with discrete type spaces. The use of discrete type spaces

allows us to bypass the known paradoxes of extensive game forms with continuous time

or infinite actions (Simon and Stinchcombe, 1989; Myerson and Reny, 2016).

We restrict attention to mechanisms in which losing bidders neither make nor receive

transfers.11 An outcome x = (y, t) consists of a winner y ∈ N ∪ 0 and a payment t ∈ Rby the winner, so X = (N ∪ 0)× R. Assume there are at least two bidders.

11This restriction matters for the results that follow. Otherwise, the set of credible sealed-bid auctionsincludes all-pay auctions, and the set of strategy-proof sealed-bid auctions includes second-price auctionsin which each agent also pays some mean-zero function of the other agents’ bids.

12

Type spaces are discrete: Θi = θ0i , θ1i , . . . , θKi . We associate each type with a non-

negative real number, v(θki ). Assume v(θKi ) > 0. For all i, j, k, v(θki ) = v(θkj ), and

v(θk+1i )− v(θki ) = ε for all k. We will abuse notation slightly, and use θki to refer both to

i’s kth type, and to the real number associated with that type. It will be clear from context

which is intended. Types are independently and identically distributed, with probability

mass function p : Θi → [0, 1]. Every type has positive probability. Let F (θk) ≡∑k

l=0 p(θl)

and f(θk) ≡ p(θk)ε

.

Agents have private values, that is:

ui((y, t), θN) = 1i=y(θi − t) (3)

Ωi is as follows: Each bidder observes whether he wins the object and observes his

own payment. That is, (y, t), (y′, t′) ∈ ωi if and only if:

1. y 6= i and y′ 6= i

2. or y = y′ = i and t = t′.

The auctioneer desires revenue12:

u0((y, t), θN) = 1y∈N t (4)

Let π(G,SN) denote the expected revenue of (G,SN).

The virtual values machinery in Myerson (1981) applies mutatis mutandis to the

discrete setting. Suppose we choose (G,SN) to maximize expected revenue subject to

(interim) individual rationality and incentive compatibility. That is maxG,SNπ(G,SN)

subject to:

1. (G,SN) is BIC.

2. For all i, θi, Eθ−i[uGi (SN , θN) | θi] ≥ 0.

Definition 7. (G,SN) is optimal if it is a solution to the above maximization problem.

(G,SN) is ε-optimal if it satisfies the constraints and the difference between π(G,SN)

and the optimal expected revenue is no more than ε.

We uG,SNi (k, k′) to denote the expected utility of agent i in G when his type is θki and

he plays as though his type is θk′i . In order for a protocol to be optimal, certain individual

rationality (IR) and incentive compatibility (IC) constraints must bind.

Proposition 3. (Elkind, 2007) If (G,SN) is optimal, then:

12The results that follow would require only small modifications if the auctioneer’s payoff was a convexcombination of revenue and social welfare.

13

1. IR-0 binds: ∀i : uG,SNi (0, 0) = 0

2. IC binds locally downward: ∀i : ∀k ≥ 1 : uG,SNi (k, k) = uG,SN

i (k, k − 1)

Proposition 4. If IR-0 binds and IC binds locally downward, then:

π(G,SN) = EθN

[∑i∈N

yG,SNi (θN)

(θi −

1− F (θi)

f(θi)

)](5)

where yG,SNi (θN) is an indicator equal to 1 if i wins the object when the type profile is θN

(under (G,SN)), and 0 otherwise.

We use η(θi) ≡ θi − 1−F (θi)f(θi)

to denote the virtual value of type θi. By Proposition

4, if IR-0 binds and IC binds locally downward, then π(G,SN) is equal to the expected

virtual value of the winning bidder. Even when the local IC constraints are slack, the

expected revenue is within ε of the expected virtual value of the winning bidder.

Proposition 5. If (G,SN) is BIC, then:

0 ≤ EθN

[∑i∈N

yG,SNi (θN)η(θi)

]︸ ︷︷ ︸

expected virtual value

−π(G,SN)−∑i∈N

uG,SNi (0, 0)︸ ︷︷ ︸

slack in IR-0

≤ ε (6)

Definition 8. F is regular if η(θi) is strictly increasing in θi.

For regular F , let ρ∗ denote an optimal reserve price, with the property that if

η(θk) < 0 then θk < ρ∗ and if η(θk) > 0 then θk ≥ ρ∗.

Definition 9. Consider a strict tie-breaking order B on N . This generates a strict total

order on all agent types, as follows: θiB θj if and only if θi ≥ θj and either θi > θj or

iB j. We also include a reserve ρ in this total order: θiB ρ if and only if θi ≥ ρ. We useB

min to denote the minimum of a set with respect to this B, andB

max similarly.

(G,SN) is orderly if, for some strict total order B on N and some reserve price

ρ ≤ θKi , i wins the object if and only if for all j 6= i, θiBB

maxj 6=i

θj and θiB ρ.

3.1 Credible and sealed-bid ε-optimal auctions

We now characterize credible and sealed-bid ε-optimal auctions. Our characterization uses

ε-optimality rather than optimality. This is because the revenue equivalence theorem does

not hold in our setting; there may not exist optimal first-price auctions, but there exist

ε-optimal first-price auctions.

Definition 10. (G,SN) is sealed-bid if every agent has exactly one information set and

for every terminal history z, there exists h ≺ z such that P (h) = i.

14

Definition 11. (G,SN) is an quasi-first-price auction if (G,SN) is sealed-bid, and

each agent i chooses either to place a bid in a finite feasible set Bi ⊂ R or to decline13,

and:

1. Some bidder wins the object if and only if some bidder places a bid.

2. If i wins the object, then i pays his bid.

3. If i wins the object then:

(a) Either: i has the highest bid, which is non-negative.

(b) Or: i has type θKi , has the highest tie-breaking priority according to B, and for

all j ∈ N , i’s bid is greater than or equal to the bid that would be placed by

type θKj − ε (if it exists).

We represent a reserve price by restricting the feasible bids Bi for each agent i. Clause

3(b) deals with a corner case: The highest-priority bidder can win the object for sure by

placing a very high bid, even if this is slightly less than the highest bid. However, this

bid must be almost the highest bid, in the sense that it must exceed the bid placed by

type θKj − ε. This anomaly vanishes as ε goes to 0.

Now we can state the main result of this section:

Theorem 1. Assume F is regular and (G,SN) is orderly and BIC. (G,SN) is credible

and sealed-bid if and only if (G,SN) is a quasi-first-price auction. There exists a quasi-

first-price auction that is ε-optimal.

Proof. Suppose (G,SN) is a quasi-first-price auction. (G,SN) is sealed-bid by definition.

If the highest-priority bidder has bid as though his type is θKi , then the auctioneer has

no discretion; every safe deviation sells the object to that bidder at his bid. Otherwise,

no safe deviation can sell to a bidder who declined, and every safe deviation involves

charging some bidder his bid, so it is optimal to sell the object by the rules. Thus,

(G,SN) is credible.

Suppose (G,SN) is credible and sealed-bid. Recall that (G,SN) is pruned. If after

some action by bidder i, there are two prices that i might pay, the auctioneer can safely

deviate to charge the higher price. Thus, for each action, if i might win after playing that

action then there is a unique price that i might pay (his bid). If i never wins after playing

some action, that action is to decline. Let bi(θi) denote the bid placed by bidder i with

type θi, if it exists.

Suppose that i has the highest priority, but does not play the action taken by θKi .

Since (G,SN) is orderly, for every agent j ∈ N , if j placed a bid, there is an innocent

explanation if j wins and an innocent explanation if j loses. Thus, if j wins then j has

13There can be multiple actions that decline, all having the same consequence.

15

placed the highest bid, or the auctioneer can safely deviate to sell the object to the highest

bidder for strictly more revenue.

Suppose i has the highest priority, and plays the action assigned to θKi . Since (G,SN)

is orderly, i must win for sure. If type θKi −ε declines, then clause 3(b) holds vacuously and

we are done. Otherwise, bi(θKi ) ≥ bi(θ

Ki − ε), since (G,SN) is BIC.14 (G,SN) is orderly,

so when i’s type is θKi − ε and the highest opponent type is θKj − ε, i wins the object.

(G,SN) is credible, so bi(θKi − ε) ≥ bj(θ

Kj − ε), if θKj − ε places a bid. Thus, (G,SN) is a

quasi-first-price auction.

Finally, to show that there exists an ε-optimal quasi-first-price auction, choose some

optimal reserve ρ∗, and for each i and θi, let bi(θi) be θi’s expected payment conditional

on winning under a second-price auction that is orderly and has reserve ρ∗.15 Such a

mechanism respects all incentive constraints, and has the property that if θiB θj B ρ∗,

then bi(θi) ≥ bj(θj) ≥ ρ∗. By Proposition 5, this is ε-optimal.

3.2 Credible and strategy-proof optimal auctions

We now characterize credible and strategy-proof optimal auctions.

Definition 12. (G,SN) is strategy-proof if, for all i ∈ N , for all S ′−i

Si ∈ argmaxS′i

EθN [ui(S′i, S′−i, θN)] (8)

Definition 13. (G,SN) is an ascending auction (with reserve price ρ) if:

1. All bidders start as active, with initial bids (bi)i∈N := (θ0i )i∈N .

2. The high bidder is the active bidder with the highest bid that is weakly above ρ

(breaking ties according to B).

3. At each non-terminal history, some active bidder i (other than the high bidder) is

called to play, and he chooses between actions that place a bid in Θi and actions

that quit.

(a) Each bid is no less than the last bid that i placed.

(b) Each bid is no more than is necessary for i to become the high bidder.

(c) If i quits, then he is no longer active.

14Suppose bi(θKi ) < bi(θ

Ki − ε). By interim IR, θKi − ε− bi(θKi − ε) ≥ 0. θKi − ε could profitably imitate

θKi , to increase his probability of winning and decrease his payment when he wins, so (G,SN ) is not BIC.15Formally, for some optimal reserve ρ∗ ≥ θ0i ,

bi(θi) =

E[maxρ∗,maxj 6=i θj | ∀j 6= i : θi B θj ] if θi B ρ∗

decline otherwise. (7)

16

(d) At each information set, there is a unique action that places a bid, with one

exception: If the reserve has not yet been met, and there is exactly one active

bidder left, there may be multiple actions that place bids.

4. i’s strategy specifies:

(a) If i’s type is strictly below a bid, he does not place that bid.

(b) If i’s type is weakly above ρ and there is no high bidder, he places a bid.

(c) If i’s type is above the current high bid (breaking ties with B), he places a bid.16

5. The auction ends if one of three conditions obtains:

(a) If there are no active bidders. In that case, the object is not sold.

(b) If only the high bidder is active. In that case, the object is sold to the high

bidder at his last bid.

(c) If the high bidder has bid θKi , and no active bidder has higher tie-breaking

priority. In that case, the object is sold to the high bidder at his last bid.

We pause to note a mild indeterminacy: When an active bidder is called to play, it

could be that the available bid is not yet enough to become the high bidder. For instance,

bidder i might choose whether to place a bid of 50 or quit, even though the current high

bid is 100. In that case, types of i between 50 and 100 could place the bid or could

quit. However, their actions are constrained by the fact that Si must be measurable with

respect to i’s information sets - it must be that bidder i never quits when he might still

win.

Observation 3. If F is regular, then there exists an optimal ascending auction. In

any ascending auction, IR-0 binds and IC binds locally downward. Given an optimal

reserve ρ∗, ascending auctions maximize the virtual value of the winning bidder. Thus, by

Propositions 3 and 4, such an auction is optimal.

The definition of extensive-form mechanisms permits the auctioneer to communicate

with agents in any order, to convey any information (or no information) to the agent

called to play, and to ask that agent to report any partition of his type space. Thus,

there are many optimal auctions. However, the optimal auctions that are credible and

strategy-proof are exactly the ascending auctions. To be precise:

Theorem 2. Assume F is regular and (G,SN) is orderly and optimal. (G,SN) is credible

and strategy-proof if and only if (G,SN) is an ascending auction.

16Notice that, since i’s strategy must be measurable with respect to i’s information sets, this impliesthat if i’s type is above the least possible high bid associated with that information set, he places a bid.

17

Proof overview. Suppose (G,SN) is credible and strategy-proof. To prove that (G,SN) is

an ascending auction, we must show that for any extensive form that is not an ascending

auction, there exists a profitable safe deviation for the auctioneer. A key feature of

ascending auctions is that whenever the winner is not yet decided, all types of i that

might still win pool on the same action. This is stated precisely in Lemma 3, and is

closely related to unconditional winner privacy as defined by Milgrom and Segal (2017).

If at some history winning types do not pool, then the auctioneer can exploit one type

by deviating to charge him a higher price. In the case of a second-price auction, the

auctioneer simply exaggerates the value of the second-highest bid. In general, however,

the deviation must be more subtle in order to be safe - instead of just choosing a different

outcome, the auctioneer may systematically misrepresent agents’ actions midway through

the extensive form. We construct an algorithm that produces a profitable safe deviation

for any such extensive form.

Suppose (G,SN) is an ascending auction. By inspection, it is strategy-proof. What

remains is to show that it is credible. Suppose that the auctioneer has a profitable safe

deviation. For every agent i, Si remains a best response to any safe deviation by the

auctioneer. Thus, since the auctioneer has a profitable safe deviation, she can openly

commit to that deviation without altering the agents’ incentives - we can define a new

protocol (G′, S ′N) that is BIC and yields strictly more expected revenue than (G,SN). But

(G,SN) is optimal, so this is a contradiction. (The full proof is in the Appendix.)

By Theorem 1, restricting attention to revelation mechanisms forces a sharp choice

between incentives for the auctioneer and strategy-proofness for the agents. Theorem 2

shows that allowing other extensive forms relaxes this trade-off.

While first-price auctions and ascending auctions seem to be disparate formats, they

share a common feature. In both formats, if an agent might win the auction without

being called to play again, then that agent knows exactly how much he will pay for the

object. Thus, we can regard each agent as placing bids in the course of the auction,

with the assurance that if he wins without further intervention, he will pay his bid. This

‘pay-as-bid’ feature is shared by all credible auctions:

Proposition 6 (Pay-as-bid). Assume (G,SN) is credible. Suppose i is called to play at

information set Ii, takes some action a, and might win without being called to play again.

Then there is a unique price ti(Ii, a) that i will pay if he wins without being called to play

again.

Proof. Suppose i might win without being called to play again, and there are two distinct

prices ti < t′i that i might pay in that circumstance. The auctioneer has a profitable

deviation; when i is meant to pay ti, she can deviate to charge t′i. (G,SN) is pruned, so

this has an innocent explanation, and (G,SN) is not credible.

18

Proposition 6 provides a consideration in favor of multi-stage auctions. Suppose we

wish to have bidder i’s payment depend on bidder j’s private information. In order for

the auction to be credible, bidder i must place a bid that incorporates that information,

which requires i to learn that information during the auction.

3.3 An Auction Trilemma

Clearly, the quasi-first-price auction is not strategy-proof, except in the degenerate case

that the optimal reserve is almost equal to the highest type. Thus, Theorems 1 and 2

yield the following corollary.

Corollary 1 (Auction Trilemma). Assume F is regular and (G,SN) is orderly. Assume

that for any optimal reserve ρ∗ < θKi − 2ε. No ε-optimal (G,SN) is sealed-bid, credible,

and strategy-proof. However, there exist ε-optimal (G,SN) that are:

1. sealed-bid and strategy-proof (the second-price auction),

2. sealed-bid and credible (the first-price auction),

3. strategy-proof and credible (the ascending auction).

Credibility, sealed bids, and strategy-proofness are all desirable properties. There is

no optimal auction that has all three; and picking any two of three characterizes a classic

auction format (Figure 1).

4 Asymmetric Distributions

So far we have assumed that bidders’ values are independently and identically distributed.

Suppose instead that type spaces and probability distributions could be asymmetric. That

is, it may be that for agents i, j and some k ∈ Z, θki 6= θkj , and each agent has a probability

mass function pi : Θi → [0, 1]. Define fi and Fi similarly, and

ηi(θi) ≡ θi −1− Fi(θi)fi(θi)

(9)

Under asymmetry, first-price auctions remain credible but may no longer be ε-optimal.

To see why this is so, consider the following simple example.

Example 2. There are two bidders. Bidder 1’s value is uniformly distributed with support

Θ1 = ε, 2ε, . . . , 1 and bidder 2’s value is uniformly distributed with support Θ2 = 1 +

ε, 1+2ε, . . . , 2, where ε = 2−k for positive integer k. Thus, the virtual values are η1(θ1) =

2θ1 − 1 for bidder 1 and η2(θ2) = 2θ2 − 2 for bidder 2.

19

Proposition 7. There exist asymmetric value distributions such that no (G,SN) is cred-

ible, sealed-bid, and ε-optimal.

Proof overview. In Example 2, when ε is small enough, no (G,SN) is credible, sealed-bid,

and ε-optimal. When θ1 is slightly below 1 and θ2 is slightly above 1, η1(θ1) > η2(θ2).

Thus, an ε-optimal mechanism must sell to bidder 1 at some such type profile. Suppose

(G,SN) is credible and sealed-bid, so if an agent wins he pays his bid bi(θi). By interim

individual rationality, b1(θ1) ≤ θ1. By ε-optimality, θ1 < b2(θ2). At type profile (θ1, θ2),

the auctioneer can safely deviate to sell the object to θ2, which yields strictly more revenue,

a contradiction. (The full proof is in the Appendix.)

Example 2 demonstrates that, under asymmetry, the best credible sealed-bid mecha-

nism may deliver materially less revenue than the optimum.17 The next natural question

is: When value distributions are regular but asymmetric, can any credible auction attain

the optimum? It turns out that not only is there a credible optimal auction, there is even

a strategy-proof credible optimal auction.

We modify the ascending auction of Definition 13, instead scoring bids according to

their virtual value.

Definition 14. (G,SN) is a virtual ascending auction if:

1. All bidders start as active, with initial bids (bi)i∈N := (θ0i )i∈N .

2. The high bidder is the active bidder with the highest virtual value ηi(bi) that is

non-negative (breaking ties according to B).

3. At each non-terminal history, some active bidder i (other than the high bidder) is

called to play, and he chooses either to place a bid in Θi or to quit.

(a) At each information set, there is a unique action that places a bid.

(b) Each bid is no less than the last bid that i placed.

(c) Each bid is no more than is necessary for i to become the high bidder.

(d) If i quits, then he is no longer active.

4. i’s strategy specifies that he places a bid if and only if his type is weakly more than

that bid.

5. The auction ends if one of three conditions obtains:

(a) If there are no active bidders. In that case, the object is not sold.

17This example can be modified so that both bidders’ type distributions have the same support, butdisjoint supports simplify the argument.

20

(b) If only the high bidder is active. In that case, the object is sold to the high

bidder at his last bid.

(c) If the high bidder i has bid θKi , and no active bidder can make a bid with a

strictly higher virtual value. In that case, the object is sold to the high bidder

at his last bid.

To illustrate, consider the type distributions of Example 2. The virtual ascending

auction proceeds as follows: At the beginning, the virtual value of bidder 2 is at least

2ε so he is the current high bidder, with bid 1 + ε. We first ask bidder 1 to bid 12

+ ε.

If he quits, bidder 2 wins and pays 1 + ε. If bidder 1 places the bid, then we know his

virtual value is at least as high as bidder 2’s virtual value, so he becomes the new high

bidder. We then alternate between the bidders, asking each to increase his bid by ε. This

implements the optimal allocation.

It is easy to verify that the virtual ascending auction is optimal and strategy-proof.

To verify that it is credible as well, note that our proof strategy for the symmetric case

applies mutatis mutandis to this case as well. The virtual ascending auction is optimal,

and the agents’ strategies are a best response to any safe deviation. Thus, if the auctioneer

has a profitable safe deviation, she could openly commit to that deviation, producing a

new BIC protocol that yields strictly more expected revenue than the optimum, which is

a contradiction.

In summary, asymmetry interacts with credibility in subtle ways. Clearly, when type

distributions are asymmetric, standard first-price auctions and ascending auctions may

not be optimal. First-price auctions remain credible18, but Example 2 shows that there

may be no way to modify them to restore optimality (while retaining credibility and sealed

bids). Ascending auctions may not even be credible - the auctioneer may profitably deviate

by running agents’ price clocks out-of-sync. However, modifying the scoring rule restores

both credibility and optimality, while retaining strategy-proofness.

The foregoing arguments suggest another reason to look outside the class of sealed-bid

mechanisms: General extensive forms allow the auctioneer to credibly commit to treat

bidders asymmetrically.19 Under asymmetric distributions, the best credible auction can

yield strictly more revenue than the best sealed-bid credible auction. However, this gap

depends on the restriction that losing bidders do not make payments. The following

modified all-pay auction is sealed-bid, credible, and optimal: Each type θi makes a bid

equal to the expected payment of θi in the virtual ascending auction. Every agent pays

his bid, and the auctioneer awards the object to the agent with the highest non-negative

virtual value.20

18First-price auctions are ‘robustly’ credible, in the sense that they are credible regardless of the jointdistribution of types.

19However, when one considers worst-case equilibria, standard first-price auctions have good revenueguarantees (Roughgarden, 2009; Feldman et al., 2016; Bergemann et al., 2017).

20Of course, all-pay auctions are rarely used in practice. This may be because losing bidders can find

21

5 A ‘prior-free’ definition

The definition of credibility depends on the joint distribution of agent types (Definition

6). It may be useful to have a definition that is ‘prior-free’, for settings such as matching

or maxmin mechanism design.

Definition 15. Given (G,SN), S0 ∈ S∗0 (SG0 ) is profitable ex post if, for all θN :

u0(S0, SN , θN) ≥ u0(SG0 , SN , θN) (10)

with strict inequality for some θN .

(G,SN) is weakly credible if no safe deviation is profitable ex post.

For comparison, (G,SN) is credible if no safe deviation is profitable in expectation.

Weak credibility allows one to dispense with strong assumptions about the auctioneer’s

beliefs.

What happens if we replace “credible” with “weakly credible” in the statement of The-

orems 1 and 2? Since any credible protocol is weakly credible, this weakens one direction

of implication but strengthens the other. Weak credibility still suffices to characterize

both auctions.

Theorem 1∗. Assume F is regular and (G,SN) is orderly and BIC. (G,SN) is weakly

credible and sealed-bid if and only if (G,SN) is a quasi-first-price auction. There exists a

quasi-first-price auction that is ε-optimal.

Theorem 2∗. Assume F is regular and (G,SN) is orderly and optimal. (G,SN) is weakly

credible and strategy-proof if and only if (G,SN) is an ascending auction.

Proof. Since credible protocols are weakly credible, the “if” direction is implied by The-

orems 1 and 2.

In the proof of Theorem 1, we show that if (G,SN) is sealed-bid but not a quasi-first-

price auction, then there exists a safe deviation that is profitable ex post. This proves the

“only if” direction of Theorem 1∗.

In the proof of Theorem 2, we show that if (G,SN) is strategy-proof but not an

ascending auction, then there exists a safe deviation that is profitable ex post. This

proves the “only if” direction of Theorem 2∗.

ways to renege on their payments, or because bidders dislike the prospect of making large paymentsand getting nothing in return. The robustness of all-pay auctions to auctioneer cheating is studied in anearly draft of Dequiedt and Martimort (2015), circulated under the title “Mechanism Design with PrivateCommunication”.

22

6 Discussion

To raise the old question once more: What accounts for the popularity of common real-

world auction forms? “What determines which form will (or should) be used in any

particular circumstance?” (Milgrom and Weber, 1982)

Our analysis indicates that the first-price auction and the ascending auction are not

just historical accidents, but are game-theoretic solutions to a well-defined commitment

problem. Furthermore, each auction form is the unique solution in its class.

It is worth considering why real-world auctioneers might lack full commitment power.

Vickrey (1961) suggests that the seller could delegate the task of running the auction

to a third-party who has no stake in the outcome. However, auction houses such as

Sotheby’s, Christie’s, and eBay charge commissions that are piecewise-linear functions

of the sale price.21 Running an auction takes effort, and many dimensions of effort are

not contractible. Robust contracts reward the auctioneer linearly with revenue (Carroll,

2015), so it is difficult to employ a third-party who is both neutral and well-motivated.

When an auctioneer makes repeated sales, reputation could help enforce the full-

commitment outcome. However, the force of reputation depends on the discount rate

and the detection rate of deviations. Safe deviations are precisely those that a bidder

could not detect immediately. Online advertising auctions are repeated frequently, so

it is plausible that bidders could examine the statistics to detect foul play.22 However,

some economically important auctions are infrequent or not repeated at all - for instance,

auctions for wireless spectrum or for the privatization of state-owned industries. Even

established auction houses such as Christie’s and Sotheby’s have faced regulatory scrutiny,

based in part on concerns that certain deviations are difficult for individual bidders to

detect.

Not all auctioneers have full commitment power, just as not all firms are Stackelberg

leaders. When the auctioneer lacks full commitment, it can be hazardous for bidders to

reveal all their information at once. In a first-price auction, a bidder ‘reveals’ his value

in return for a guarantee that his report completely determines the price he might pay.23

In an ascending auction, a bidder reports whether his value is above b only when the

auctioneer (correctly) asserts that bids below b are not enough to win. Credibility is

21http://www.sothebys.com/en/news-video/blogs/all-blogs/sotheby-s-at-large/2016/10/

important-update-regarding-sothebys-buyers-premium.html, http://www.christies.com/

buying-services/buying-guide/financial-information/, http://pages.ebay.com/help/sell/

fees.html, accessed 11/5/2017.22However, bidders in online advertising auctions have expressed concerns that supply-side plat-

forms (SSPs) are deviating from the rules of the second-price auction. The industry news web-site Digiday alleged, “Rather than setting price floors as a flat fee upfront, some SSPs are set-ting high price floors after their bids come in as a way to squeeze out more money from ad buy-ers who believe they are bidding into a second-price auction”. https://digiday.com/marketing/

ssps-use-deceptive-price-floors-squeeze-ad-buyers/, accessed 11/30/2017.23This property is generalized in a natural way by the ‘first-price’ menu auction (Bernheim and Whin-

ston, 1986).

23

a shared foundation for these seemingly disparate design features. How this principle

extends to other environments is an open question.

References

Athey, S., Levin, J., and Seira, E. (2011). Comparing open and sealed bid auctions:

Evidence from timber auctions. The Quarterly Journal of Economics, 126(1):207–257.

Bergemann, D., Brooks, B., and Morris, S. (2017). First-price auctions with general

information structures: Implications for bidding and revenue. Econometrica, 85(1):107–

143.

Bergemann, D. and Morris, S. (2005). Robust mechanism design. Econometrica,

73(6):1771–1813.

Bernheim, B. D. and Whinston, M. D. (1986). Menu auctions, resource allocation, and

economic influence. The Quarterly Journal of Economics, 101(1):1–31.

Bester, H. and Strausz, R. (2001). Contracting with imperfect commitment and the

revelation principle: the single agent case. Econometrica, 69(4):1077–1098.

Bogetoft, P., Christensen, D. L., Damgard, I., Geisler, M., Jakobsen, T. P., Krøigaard,

M., Nielsen, J. D., Nielsen, J. B., Nielsen, K., Pagter, J., et al. (2009). Secure multi-

party computation goes live. In Financial Cryptography, volume 5628, pages 325–343.

Springer.

Burguet, R. and Sakovics, J. (1996). Reserve prices without commitment. Games and

Economic Behavior, 15(2):149–164.

Caillaud, B. and Mezzetti, C. (2004). Equilibrium reserve prices in sequential ascending

auctions. Journal of Economic Theory, 117(1):78–95.

Carroll, G. (2015). Robustness and linear contracts. American Economic Review,

105(2):536–563.

Cassady, R. (1967). Auctions and auctioneering. Univ of California Press.

Chung, K.-S. and Ely, J. C. (2007). Foundations of dominant-strategy mechanisms. The

Review of Economic Studies, 74(2):447–476.

Dequiedt, V. and Martimort, D. (2015). Vertical contracting with informational oppor-

tunism. American Economic Review, 105(7):2141–2182.

24

Elkind, E. (2007). Designing and learning optimal finite support auctions. In Proceedings

of the eighteenth annual ACM-SIAM symposium on Discrete algorithms, pages 736–745.

Society for Industrial and Applied Mathematics.

Feldman, M., Lucier, B., and Nisan, N. (2016). Correlated and coarse equilibria of single-

item auctions. In International Conference on Web and Internet Economics, pages

131–144. Springer.

Grant, D. (2014). Why auction rooms seem empty these days. The Wall Street Journal.

Green, J. and Laffont, J.-J. (1977). Characterization of satisfactory mechanisms for the

revelation of preferences for public goods. Econometrica, pages 427–438.

Holmstrom, B. (1979). Groves’ scheme on restricted domains. Econometrica, pages 1137–

1144.

Krishna, V. (2010). Auction Theory. Academic Press, San Diego, USA.

Li, S. (2017). Obviously strategy-proof mechanisms. American Economic Review,

107(11):3257–87.

Liu, Q., Mierendorff, K., Shi, X., et al. (2014). Auctions with limited commitment.

Technical report, Working Paper.

Lobel, I. and Paes Leme, R. (2017). Dynamic mechanism design under positive commit-

ment. working paper.

Loertscher, S. and Marx, L. M. (2017). Optimal clock auctions. working paper.

Lucking-Reiley, D. (2000). Vickrey auctions in practice: From nineteenth-century phi-

lately to twenty-first-century e-commerce. The Journal of Economic Perspectives,

14(3):183–192.

Maskin, E. and Tirole, J. (1990). The principal-agent relationship with an informed

principal: The case of private values. Econometrica, pages 379–409.

Maskin, E. and Tirole, J. (1992). The principal-agent relationship with an informed

principal, ii: Common values. Econometrica, pages 1–42.

McAdams, D. and Schwarz, M. (2007). Credible sales mechanisms and intermediaries.

American Economic Review, 97(1):260–276.

McAfee, R. P. and McMillan, J. (1987). Auctions and bidding. Journal of economic

literature, 25(2):699–738.

25

McAfee, R. P. and Vincent, D. (1997). Sequentially optimal auctions. Games and Eco-

nomic Behavior, 18(2):246–276.

Milgrom, P. (1987). Auction theory. In Bewley, T., editor, Advances in Economic Theory:

Fifth World Congress, pages 1–32. Cambridge University Press, Cambridge.

Milgrom, P. and Segal, I. (2017). Deferred-acceptance auctions and radio spectrum real-

location. Technical report, working paper.

Milgrom, P. R. and Weber, R. J. (1982). A theory of auctions and competitive bidding.

Econometrica: Journal of the Econometric Society, pages 1089–1122.

Myerson, R. B. (1981). Optimal auction design. Mathematics of Operations Research,

6(1):58–73.

Myerson, R. B. (1983). Mechanism design by an informed principal. Econometrica, pages

1767–1797.

Myerson, R. B. and Reny, P. J. (2016). Broad sequential equilibria of multi-stage games

with infinite sets of signals and actions. Working paper.

Porter, R. and Shoham, Y. (2005). On cheating in sealed-bid auctions. Decision Support

Systems, 39(1):41–54.

Rothkopf, M. H. and Harstad, R. M. (1995). Two models of bid-taker cheating in vickrey

auctions. Journal of Business, pages 257–267.

Rothkopf, M. H., Teisberg, T. J., and Kahn, E. P. (1990). Why are Vickrey auctions

rare? Journal of Political Economy, pages 94–109.

Roughgarden, T. (2009). Intrinsic robustness of the price of anarchy. In Proceedings of

the forty-first annual ACM symposium on Theory of computing, pages 513–522. ACM.

Shubik, M. (2004). The Theory of Money and Financial Institutions: Volume 1. MIT

Press, Massachusetts, USA.

Simon, L. K. and Stinchcombe, M. B. (1989). Extensive form games in continuous time:

Pure strategies. Econometrica, pages 1171–1214.

Skreta, V. (2015). Optimal auction design under non-commitment. Journal of Economic

Theory, 159:854–890.

Vartiainen, H. (2013). Auction design without commitment. Journal of the European

Economic Association, 11(2):316–342.

26

Vickrey, W. (1961). Counterspeculation, auctions, and competitive sealed tenders. The

Journal of Finance, 16(1):8–37.

Wilson, R. (1987). Game theoretic analysis of trading processes. In Bewley, T., editor,

Adv. Econ. Theory. Cambridge University Press.

A Definition of Extensive Game Forms with Conse-

quences in X

An extensive game form with consequences in X is a tuple (H,≺, P, A,A, (Ii)i∈N , g),

where:

1. H is a set of histories, along with a binary relation ≺ on H that represents prece-

dence.

(a) ≺ is a partial order, and (H,≺) form an arborescence24.

(b) h∅ denotes h ∈ H : ¬∃h′ : h′ ≺ h

(c) Z ≡ h ∈ H : ¬∃h′ : h ≺ h′

(d) σ(h) denotes the set of immediate successors of h.

2. P is a player function. P : H \ Z → N .

3. A is a set of actions.

4. A : H \h∅ → A labels each non-initial history with the last action taken to reach it.

(a) For all h, A is one-to-one on σ(h).

(b) A(h) denotes the actions available at h.

A(h) ≡⋃

h′∈σ(h)

A(h′) (11)

5. Ii is a partition of h : P (h) = i such that:

(a) A(h) = A(h′) whenever h and h′ are in the same cell of the partition.

(b) For any Ii ∈ Ii, we denote: P (Ii) ≡ P (h) for any h ∈ Ii. A(Ii) ≡ A(h) for any

h ∈ Ii.

(c) Each action is available at only one information set: If a ∈ A(Ii), a′ ∈ A(I ′j),

Ii 6= I ′j then a 6= a′.

6. g is an outcome function. It associates each terminal history with an outcome.

g : Z → X24That is, a directed rooted tree such that every edge points away from the root.

27

B Proofs omitted from the main text

B.1 Proposition 1

For each of the three clauses in Definition 2, we show that if (G,SN) does not satisfy this

clause, we can transform (G,SN) to have strictly fewer histories, such that the transformed

protocol is BIC and results in the same outcomes for each type profile. Since the set of

histories in (G,SN) is finite, it follows that there exists a BIC (G′, S ′N) that cannot be

reduced further, but results in the same outcomes as (G,SN).

Suppose there exists h such that there is no θN such that h zG(SN , θN). Since

the game tree is finite, we can locate an earliest possible h; that is, an h such that no

predecessor satisfies this property. Consider h′ that immediately precedes h, and the

information set I ′i such that h ∈ I ′i. There is some action a′ at I ′i that is not played by

any type of i that reaches I ′i. We can delete all histories that follow i playing a′ at I ′i (and

define (≺′,A′, P ′, (I ′i)i∈N , g′) and S ′N so that they are as in G, but restricted to the new

smaller set of histories H ′). Since these histories were off the path of play, their deletion

does not affect the incentives of agents in N \ i. Since i preferred his original Si to any

strategy that played a′ at I ′i, his new strategy S ′i remains incentive-compatible. Thus, the

transformed (G′, S ′N) is BIC.

Suppose there exists h /∈ Z such that |σ(h)| = 1. We simply rewrite the transformed

game (G′, S ′N) that deletes h (and all the other histories in that same information set)

and ‘automates’ i’s singleton action at h. That is, for all h′ ∈ Ii for Ii such that h ∈ Ii,we remove h′ from the set of histories, and define (≺′,A′, P ′, (I ′i)i∈N , g′) and S ′N so that

they are as in G, but restricted to H \ Ii. (G′, S ′N) is BIC.

Suppose there exists h /∈ Z, such that for i = P (h), there does not exist θi, θ′i, θ−i such

that

1. h ≺ zG(SN , (θi, θ−i))

2. h ≺ zG(SN , (θ′i, θ−i))

3. xG(SN , (θi, θ−i)) 6= xG(SN , (θ′i, θ−i))

If there does not even exist (θi, θ−i) such that h ≺ zG(SN , (θi, θ−i)), then our argument

about the first clause applies. Suppose there exists (θi, θ−i) such that h ≺ zG(SN , (θi, θ−i)).

Upon reaching h, we can henceforth ‘automate’ play as though i had type θi. That is, we

can delete any history h′ such that h h′ and P (h′) = i, or h h′ and there does not

exist θ′′−i such that h′ ≺ zG(SN , (θi, θ′′−i)). Given the new smaller set of histories H ′, we

again define (≺′,A′, P ′, (I ′i)i∈N , g′) and S ′N so that they are as in G, but restricted to H ′.

By construction, for all θ′i, if i is playing as though his type is θ′i and we would have

reached history h under (G,SN), then the outcome is the same under (G′, S ′N) as when i

is playing as though his type is θi under (G,SN) (which by hypothesis is the same as when

28

i is playing as though his type is θ′i under (G,SN)). Plainly, if we would not have reached

history h under (G,SN), then the outcomes under (G,SN) and (G′, S ′N) are identical.

Thus, (G′, S ′N) is BIC.

This completes the proof of Proposition 1.

B.2 Proposition 2

To prove Proposition 2, we show that each of the three transformations we used in the

proof of Proposition 1 also preserve credibility. That is, for each (G′, S ′N) that is produced

from (G,SN) by one of the three transformations, if the auctioneer has a profitable safe

deviation from SG′

0 , then she also has a profitable safe deviation from SG0 .

Consider the first transformation (deleting all histories that follow action a at Ii,

when a is never chosen on the path of play). Suppose the auctioneer had a profitable safe

deviation S ′0 from SG′

0 . The auctioneer could make that same deviation, but additionally

offer the response λ(a) whenever sending the message λ(Ii). By hypothesis, agent i never

selects λ(a) as a reply, so for any θN and any j, j’s resulting observation has an innocent

explanation. Thus, the auctioneer also has a profitable safe deviation from SG0 .

Consider the second transformation (deleting all histories in some information set

with a singleton action set). Suppose the auctioneer had a profitable safe deviation S ′0

from SG′

0 . The auctioneer could make that same deviation from SG0 , except that for the

deleted information set Ii, the auctioneer delays sending λ(Ii, A(Ii)) until the last possible

moment. That is consider S0 that is the same as S ′0, except that, if the auctioneer has

not yet sent λ(Ii, A(Ii)) to agent i, then:

1. If S ′0 specifies that the auctioneer sends λ(I ′i, A(I ′i)) for I ′i Ii, then S0 specifies

that she first sends λ(Ii, A(Ii)) and then (immediately thereafter) sends λ(I ′i, A(I ′i))

2. If S ′0 specifies that the auctioneer chooses an outcome such that the resulting obser-

vation for i does not have an innocent explanation under SG0 , then S0 specifies that

she first sends λ(Ii, A(Ii)) before choosing that outcome.

S0 is a profitable safe deviation from SG0 .

Consider the third transformation (deleting histories where i is called to play, following

some history h such that, for any two types of i that reach h, both types of i result in the

same outcome). Suppose S ′0 was a profitable safe deviation from SG′

0 .

If the observation for i that results from S ′0 does not have an innocent explanation

under SG0 , it must be that (given on all the communication i has seen so far), the outcome

S ′0 is about to select can only occur under G at terminal histories that follow h. But by

hypothesis, for any θi and θ′i that are consistent with reaching h, and any θ−i consistent

with reaching h, the resulting outcome is the same. Thus, let S0 be exactly as in S ′0,

except that if S ′0 specifies that the auctioneer chooses an outcome such that the resulting

29

observation for i does not have an innocent explanation under SG0 , then S0 specifies that

the auctioneer communicates with i as though play started from h and the opponent type

profiles were θ−i, for some θ−i consistent with reaching h.

Formally, if S ′0 would choose an outcome such that i’s observation has no innocent

explanation, then fix some θN such that h ≺ zG(SN , θN). Initialize h := h.

1. If h ∈ Z, then terminate and choose x = g(h).

2. Else if P (h) 6= i, then for IP (h) such that h ∈ IP (h):

(a) h := h′ | h′ ∈ σ(h) and SP (h)(IP (h), θP (h)) = A(h′).

(b) Go to step 1.

3. Else:

(a) Send (m,R) = λ(Ii, A(Ii)) for Ii such that h ∈ Ii.

(b) Upon receiving r ∈ R, choose h := h′ | A(h′) = λ−1(r) and h′ ∈ σ(h).

(c) Go to step 1.

Since, under Si, i’s play in this final stage makes no difference to the outcome, delaying

communication with i until the outcome is about to be selected results in a safe deviation.

This completes the proof of Proposition 2.

B.3 Proposition 4

Let yG,SNi (θi, θ−i) denote the probability i gets the object when his type is θi and his

opponent types are θ−i.

Thus,

uG,SNi (k, k)− uG,SN

i (k − 1, k − 1) = uG,SNi (k, k − 1)− uG,SN

i (k − 1, k − 1)

= εEθ−i[yG,SNi (θk−1, θ−i)] (12)

uG,SNi (k, k) =

k∑l=1

εEθ−i[yG,SNi (θl−1, θ−i)] = Eθ−i

[k∑l=1

εyG,SNi (θl−1, θ−i)] (13)

Eθi(Eθ−i(revenue from i)) = Eθ−i

(Eθi(welfare from i))− Eθi(Eθ−i(utility for i)) (14)

Eθ−i(Eθi(welfare from i)) = Eθ−i

[K∑k=0

εf(θk)θkyG,SNi (θk, θ−i)] (15)

30

Eθi(Eθ−i(utility for i)) = Eθ−i

[K∑k=1

εf(θk)k∑l=1

εyG,SNi (θl−1, θ−i)]

= Eθ−i[K∑k=0

(1− F (θk))εyG,SNi (θk, θ−i)]

= Eθ−i[K∑k=0

εf(θk)1− F (θk)

f(θk)yG,SNi (θk, θ−i)] (16)

Combining Equations 15 and 16 yields:

Eθi(Eθ−i(revenue from i)) = Eθ−i

[K∑k=0

εf(θk)yG,SNi (θk, θ−i) [θk − 1− F (θk)

f(θk)]︸ ︷︷ ︸

virtual value

] (17)

Summing across agents yields Proposition 4.

B.4 Proposition 5

Since (G,SN) is BIC, every type of i prefers playing according to Si, instead of playing

as though his type is ε lower. That is,

∀i : ∀k > 1 : uG,SNi (k, k) ≥ uG,SN

i (k, k − 1) (18)

Thus,

uG,SNi (k, k)− uG,SN

i (0, 0) =k∑l=1

uG,SNi (l, l)− uG,SN

i (l − 1, l − 1)

≥k∑l=1

uG,SNi (l, l − 1)− uG,SN

i (l − 1, l − 1) = Eθ−i[k∑l=1

εyG,SNi (θl−1, θ−i)]

(19)

Using the same steps as in Proposition 4 (but with inequalities) yields:

0 ≤ EθN [∑i∈N

yG,SNi (θN)η(θi)]− π(G,SN)−

∑i∈N

uG,SNi (0, 0) (20)

Since (G,SN) is BIC, every type of i prefers playing according to Si, instead of playing

as though his type is ε higher. That is,

∀i : ∀k > 1 : uG,SNi (k − 1, k − 1) ≥ uG,SN

i (k − 1, k) (21)

31

uG,SNi (k, k)− uG,SN

i (0, 0) =k∑l=1

uG,SNi (l, l)− uG,SN

i (l − 1, l − 1)

≤k∑l=1

uG,SNi (l, l)− uG,SN

i (l − 1, l) =k∑l=1

εEθ−i[yG,SNi (θl, θ−i)]

(22)

Eθi(Eθ−i(utility for i))− uG,SN

i (0, 0) ≤ Eθ−i[K∑k=1

εf(θk)k∑j=1

εyG,SNi (θj, θ−i)]

= Eθ−i[K∑k=0

(1− F (θk))εyG,SNi (θk, θ−i)] + Eθ−i

[K∑k=0

εf(θk)(yG,SNi (θk, θ−i)− yG,SN

i (θ0, θ−i))]

= Eθ−i[K∑k=0

εf(θk)1− F (θk)

f(θk)yG,SNi (θk, θ−i)]+Eθ−i

[K∑k=0

εf(θk)(yG,SNi (θk, θ−i)−yG,SN

i (θ0, θ−i))]

(23)

Again using the same steps as in Proposition 4 yields:

EθN [∑i∈N

yG,SNi (θN)η(θi)]− π(G,SN)−

∑i∈N

uG,SNi (0, 0)

≤ εEθN [∑i∈N

yG,SNi (θN)︸ ︷︷ ︸≤1

−∑i∈N

yG,SNi (θ0i , θ−i)︸ ︷︷ ︸≥0

] ≤ ε (24)

B.5 Theorem 2

Given (G,SN), let Θhi denote the types of i that are consistent with i’s actions up to

history h, that is:

Θhi = θi | ∀h′, h′′ h : [h′ ∈ Ii, h′′ ∈ σ(h′)]→ [Si(Ii, θi) = A(h′′)] (25)

Proposition 8. If h ≺ h′ then Θhi ⊇ Θh′

i . If h ∈ Ii and h′ ∈ Ii, then Θhi = Θh′

i .

The first is clear by inspection. The second follows because the definition of Θhi

invokes only i’s past information sets and actions, and G has perfect recall. Thus, we

define ΘIii = Θh

i | h ∈ Ii.Define also:

θhi = minθi ∈ Θhi (26)

θh

i = maxθi ∈ Θhi (27)

32

B.5.1 credible, strategy-proof → ascending

Definition 16. (G,SN) has threshold pricing if, for some reserve price ρ ∈ Θi and

tie-breaking order B, if i wins the object at type profile θN , then i pays

Bminθ′i ∈ Θi | θ′iB

Bmaxj 6=i

θj and θ′iB ρ (28)

Lemma 1. If (G,SN) is optimal, orderly, and strategy-proof, then (G,SN) has threshold

pricing.

Proof. We proceed by induction. The inductive hypothesis is: For all θi ≤ θki , if i wins