Creating Value with Capital - SNC-Lavalin · Capital is the investment, project financing and asset...

Transcript of Creating Value with Capital - SNC-Lavalin · Capital is the investment, project financing and asset...

Creating Value with Capital

Capital

Our success stems from delivering solutions that generate stable, long-term, reliable returns for both our clients and our partners.

LEADER IN THE DEVELOPMENT & DELIVERY OF LARGE-SCALE, COMPLEX P3 INFRASTRUCTURE

PROJECTS

TURNKEYSOLUTIONS

$12BOF PROJECT FINANCING IN THE PAST10 YEARS

RAISED OVER

$4.5B* INVESTMENT PORTFOLIO

*Average Fair Market Value as per analysts calculations, as at September 11, 2017.

Capital is the investment, project financing and asset management arm of SNC-Lavalin. We develop projects, arrange financing, invest equity, undertake complex financial modelling and manage investments.

Our clients rely on us to provide integrated turnkey solutions. Our experienced development and financing team works closely with our four key market sectors — Infrastructure, Mining & Metallurgy, Oil & Gas and Power – and with strategic partners, institutional investors and investment funds to promote growth opportunities.

We leverage our expertise in engineering, procurement and construction (EPC), operations and maintenance (O&M), and project structuring to develop projects on a build-own-operate (BOO) basis for Power, Oil & Gas and Mining & Metallurgy. We are also a major player in developing infrastructure projects developed as public-private partnerships (P3s) in Canada.

We provide new sources of development funding and equity by creating investment funds and strategic alliances with select financial partners. Together with our partners, we arrange and invest equity, and arrange debt to ensure full project financing.

In the end, our success stems from delivering solutions that generate stable, long-term, reliable returns for both our clients and our partners.

Our strengths: › We structure innovative financing solutions and have the

ability to provide development funding together with equity positions in our projects.

› We meet clients’ needs through various design-build-own-operate models with other SNC-Lavalin sectors.

› We manage our multi-billion-dollar portfolio to increase its value while generating strong returns over time.

› We invest and manage long-term investors’ money alongside ours.

Who we are

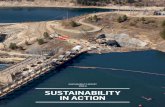

Credit: Infrastructure Canada

SNC-Lavalin is a partner of the Signature on the Saint Lawrence consortium responsible for the design and construction, as well as operation and maintenance, of the New Champlain Bridge Corridor Project under a public-private partnership with the Government of Canada.

New Champlain Bridge Corridor Project

3

William R. Bennett Bridge

Our integrated modelOur clients are increasingly looking at procurement models that better suit how they manage their own risks and balance sheets. We are one of the few end-to-end solution providers with world-class expertise at scale in financing & asset management, engineering, procurement, construction, operations & maintenance. This is a key differentiator in our industry and a powerful vehicle for delivering superior value to our clients and stakeholders.

Capital Engineering Operations & Maintenance

Telecommunications & Security

ConstructionProcurementTraining

Our clients and partners are at the heart of our strategy

We are experienced asset managers with a solid track recordAs a long-term investor, we manage our investment portfolio assets and look for financing solutions and partnering opportunities to propel our growth strategy. We oversee a project’s progress and asset performance and devise strategies to improve returns. Once our non-core assets have reached maturity, we monetize them to maximize their value for our stakeholders.

The Partnership

In 2017, we launched an infrastructure investment vehicle, SNC-Lavalin Infrastructure Partners LP. This Partnership holds SNC-Lavalin’s interests in a selection of mature Canadian infrastructure assets and allows us to monetize 80% of our economic interests to a strategic limited partner while we retain 20%.

We act as the General Partner and as the Manager of the Partnership, and as such, SNC-Lavalin remains the counterpart to the various stakeholders and partners in the transferred assets. This Partnership further sets the foundations to create new project financing vehicles that will support the development of our robust pipeline of projects.

We are a partner of choice for P3sIn Canada, we are a leader in the development and delivery of large, complex P3 infrastructure projects.

Since 1999, through our longstanding equity participation in infrastructure assets, we have played an active role in shaping Canada’s P3 landscape into one of the best managed and attractive markets of its kind.

Canada Line

Recent awards

Year Publication or Organization Category Project

2016 Infrastructure Investor magazine North America P3 Deal of the Year Award New Champlain Bridge Corridor Project

2016 P3 Bulletin Silver award for Best Transit and Aviation Project

Eglinton Crosstown LRT

2016 P3 Bulletin Gold award for Best Road/Bridge/Tunnel Project New Champlain Bridge Corridor Project

2015 P3 BulletinBest Waste/Energy/Water Project John Hart Generating Station

Replacement ProjectJudges Award for Projects Grand Prix

2015Canadian Council for Public-Private Partnerships (CCPPP)

Gold Award for Effective Procurement New Champlain Bridge Corridor Project

2015 CCPPP Gold Award for Project Financing Eglinton Crosstown LRT

2014 CCPPP Gold Award for Project FinancingJohn Hart Generating Station Replacement Project

2014 CCPPP Gold Award for Infrastructure (O&M only) Elgin County Courthouse

2014 P3 Bulletin Silver award for Best Rail/Transit Project The Confederation Line

2013 IJGlobal Project Finance magazineNorth America’s Public-Private-Partnership Deal of the Year

The Confederation Line

2013 CCPPP Gold Award for Transportation Innovation The Confederation Line

More than ever, delivering major capital projects in today’s world requires solid partners as well as sound structuring and financing. We listen closely to understand your needs and concerns to develop an investment strategy and a project financing structure geared for success. Our goal is to create the best value for money through innovative infrastructure financing solutions.

54

John Hart Generating Station Replacement Project

Our divested assets

Asset [Location] Market Sector Divestment Date

Murraylink Transmission [Australia]

Power 2000

AltaLink [Canada]

Power 2014

Astoria I [USA]

Power 2005

Gazmont [Canada]

Power 2005

Trencap [USA]

Power 2005

West End Dam [South Africa]

Power 2005

Malta International Airport [Malta]

Airports & Aviation 2010

Ovation [Canada]

Buildings & Facilities 2010

Ambatovy Nickel Project [Madagascar]

Mining & Metallurgy 2015

Restigouche Hospital Centre

Our Canadian P3 assets

Asset [Location] Market Sector Investment Date Equity Holding Current Status

Eglinton Crosstown LRT [Toronto, Ontario]

Rail & Transit 2015 25% Under construction

Champlain Bridge Replacement [Montreal, Quebec]

Highways & Bridges 2015 50% Under construction

John Hart Generating Station [Campbell River, BC]

Power 2014 100% Under construction

Confederation Line [Ottawa, Ontario]

Rail & Transit 2013 40% Under construction

Highway 407 East Extension Phase I [Toronto, Ontario]

Highways & Bridges 2012 50% Substantial completion

Restigouche Hospital Centre [Campbellton, New Brunswick]

Healthcare 2011 100% In operation

McGill University Health Centre [Montreal, Quebec]

Healthcare 2010 60% In operation

Southeast Stoney Trail [Calgary, Alberta]

Highways & Bridges 2010 50% In operation

William R. Bennett Bridge [Kelowna, BC]

Highways & Bridges 2005 100% In operation

Canada Line Rapid Transit [Vancouver, BC]

Rail & Transit 2005 33.33% In operation

Highway 407 Express Toll Route [Toronto, Ontario]

Highways & Bridges 1999 16.77% In operation

Our portfolio*

*Managed either directly or through the Partnership.

Our global assets

Asset [Location] Market Sector Investment Date Equity Holding Current Status

Highway Concessions One [India]

Highways & Bridges 2012 16.9% Ongoing activities

Puy-de-Dôme Cog Railway [France]

Rail & Transit 2008 51% In operation

Astoria Project Partners II [United States]

Power 2008 6.2% In operation

Myah Tipaza [Algeria]

Water & Wastewater 2008 25.5% In operation

Hadjret en Nouss [Algeria]

Power 2006 26% In operation

76

[email protected] www.snclavalin.com/en/capital

HEAD OFFICE455 René-Lévesque Blvd. West Montreal, QC, H2Z 1Z3, Canada Telephone: +1 514 393-1000