CPMS 2016 Q3 USA Market Revie › bt › HyL9256RT6T09072Pl7J7U9q › 2016 Q3 US Re… · 6 GICS...

Transcript of CPMS 2016 Q3 USA Market Revie › bt › HyL9256RT6T09072Pl7J7U9q › 2016 Q3 US Re… · 6 GICS...

2

Areas of Focus

1. Market performance: best sectors and stocks

2. How has Q4 performed historically?

3. Single factor analysis & model performance

4. Market fundamentals & outlook

3

S&P 500 Performance 2016 Q3 (Price Change)

2000

2050

2100

2150

2200

July August September

The quarter started off with a strong rebound from Brexit but

declined slightly afterwards.

3.6% -0.1% -0.1%

3.3%

4

U.S. Market Performance (Total Return)

July August September Q3

S&P 500 3.7% 0.1% 0.0% 3.9%

S&P 400 4.3% 0.5% -0.6% 4.1%

S&P 600 5.1% 1.4% 0.6% 7.2%

DJIA 2.9% 0.3% -0.4% 2.8%

NASDAQ 6.6% 1.2% 2.0% 10.0%

-2%

0%

2%

4%

6%

8%

10%

12%

While all indexes had performed strongly at the beginning of the quarter, many had muted results

afterwards. Small caps and the NASDAQ outperformed other indexes for Q3.

5

July August September Q3

S&P 500 73% 50% 50% 62%

S&P 400 76% 58% 48% 66%

S&P 600 76% 61% 49% 63%

DJIA 73% 50% 43% 53%

0%

20%

40%

60%

80%

100%

Market Breadth (% of stocks with a positive total return)

Breadth was high across many indexes in the third

quarter, mainly due to solid returns in July.

6

GICS Sectors: 2016 Q3 Total Returns

Sector Sector

Weight

Q3

Return

Q3

Breadth Best Performer % Worst Performer %

10 Energy 7.3% 2.3% 81% (30/37) Apache Corporation +29 Diamond Offshore Drill -5

15 Materials 2.9% 3.7% 48% (13/27) Albemarle Corporation +7 Mosaic Company -18

20 Industrials 9.7% 4.1% 57% (38/67) Quanta Services Inc +9 Fortune Brands Home -9

25 Consumer Discretionary 12.5% 2.9% 42% (35/83) Goodyear Tire +10 Tractor Supply Co -20

30 Consumer Staples 9.9% -2.6% 19% (7/36) Molson Coors Brewing. +7 Campbell Soup Company -10

35 Health Care 14.7% 0.9% 54% (32/59) Illumina Inc +8 Mylan N.V. -10

40 Financials 12.8% 4.6% 33% (21/64) E*TRADE Financial Corp +10 Wells Fargo & Co -13

45 Information Technology 21.2% 12.9% 71% (47/66) Western Digital Corp +26 Cognizant Tech Soltn -17

50 Telecommunications 2.6% -5.6% 0% (0/5) AT&T Inc. -1 Frontier Communications -7

55 Utilities 3.3% -5.9% 77% (21/28) AES Corporation +6 NRG Energy, Inc. -7

60 Real Estate 3.1% -2.1% 32% (9/28) Equity Residential +5 Host Hotels & Resorts -8

S&P 500 3.9% 50% (251/500) Apache Corporation +29 Tractor Supply Co -20

Technology was the outperforming sector for Q3. Telecom and Utilities

experienced the greatest loses for the quarter.

9

Q3’s 50 Best Performing Stocks

Poor Growth metrics

Attractive valuations

At the beginning of Q3,

The 50 Best shared some of

the following attributes:

Initial poor earnings revisions

and surprise which turned

Higher earnings and price

variability

11

Q3’s 50 Worst Performing Stocks At the start of Q3,

The 50 Worst shared some of

the following attributes:

Market-like ROE

Smaller-cap stocks with lower

price beta

Higher earnings and sales

momentum

Higher earnings surprise and

revision metrics

Slightly poor valuation metrics

12

Historic Performance – Q4

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

71 73 75 77 79 81 83 85 87 89 91 93 95 97 99 01 03 05 07 09 11 13 15

% T

otal R

eturn

80% % positive

9 # negative quarters

36 # positive quarters

Q4 Q1 Q2 Q3 Q4

Average 3.3% 2.9% 0.9% 4.4%

Median 3.4% 2.7% 2.7% 5.6%

Std Dev 8.1% 7.4% 9.0% 8.5%

S&P 500 Total Return – 4th

Quarter Performance: 1970 to 2015

13

Q4 Historic Performance

GICS Sector Q4 Performance: 1989 to 2015

Return (%) Energy Materials Industrials

Consumer

Disc.

Consumer

Staples

Health

Care Financials I.T. Telecom Utilities

*Real

Estate

Median 4.4% 8.5% 6.3% 7.4% 6.1% 5.2% 7.5% 8.7% 7.5% 4.9% 4.8%

Std Dev 9.2% 11.1% 8.6% 10.6% 7.2% 6.3% 11.8% 16.7% 11.9% 6.6% 16.1%

% Positive 68% 80% 84% 80% 92% 92% 76% 76% 68% 76% 83%

Historically, Technology and Materials have been the best performing sectors in Q4.

All sectors have historically posted more profitable quarters than not, with

Consumer Staples and Health Care doing so over 90% of the time.

The chart below illustrates the historic median return, standard deviation and probability of a

profitable quarter for all sectors in the US:

*Real Estate Sector Performance starts at 2002

14

Which fundamentals did the market reward during Q3?

At the start of the period, we equally weighted the best and

worst 50 stocks using each of the most commonly used

CPMS factors separately and measured their performance.

15

Single Factor Analysis – Best Values

The CPMS universe was limited to stocks in the S&P 500.

Dividend growth and P/E metrics top the list of single factors. Low 5-year

beta was the heavy underperformer.

16

Single Factor Analysis – Worst Values

The CPMS universe was limited to stocks in the S&P 500.

This quarter selecting stocks using the worst values unusually

returned strong results.

17

Single Factor Analysis – Best Net of Worst

The CPMS universe was limited to stocks in the S&P 500.

A long/short approach highlights how investors may have been rewarded by

selecting top-ranking stocks and avoiding those that rank poorly

19

CPMS Model Strategy Returns: Q3 2016

Slightly under half of CPMS models performed better than the S&P 500 in Q3. The Dangerous

strategy, which is intended to underperform, actually was the biggest outperformer.

Style Portfolios July August September Q3

Dangerous 10.3% 5.5% 3.8% 20.8%

D10 Earnings Value/Earnings Momentum 7.8% 1.4% 1.6% 11.0%

Asset Value 5.7% 3.7% 0.1% 9.7%

Earnings Value 5.2% 1.0% 2.1% 8.5%

Price Momentum 9.9% -4.4% 1.2% 6.4%

Earnings Momentum 7.1% -2.5% 0.9% 5.4%

Industry Relative 4.3% -0.2% 0.5% 4.6%

D10 Valuation/Momentum Breakout 4.9% -2.7% 2.3% 4.4%

S&P 500 Total Return 3.7% 0.1% 0.0% 3.9%

Asset Growth 4.4% -1.2% -0.5% 2.7%

Momentum Breakout 5.3% -5.4% 2.5% 2.2%

Large Cap D10 Income/Asset Growth 4.3% -1.4% -0.7% 2.1%

Dividend Growth 4.0% -1.6% -0.4% 2.0%

Earnings Growth 5.6% -3.1% -0.6% 1.8%

Valuation 1.0% -2.5% 2.7% 1.1%

Income 2.4% -1.7% -0.4% 0.3%

Dividend Income 2.3% -1.3% -0.9% 0.0%

D10 Dividend/Earnings Growth 3.2% -2.2% -2.3% -1.4%

21

What are you paying? vs. What are you getting?

P/B vs. ROE (net of T-bills): CPMS Median

The ROEs of the CPMS universe have remained relatively flat vs. the end of Q2; P/Bs have rose

slightly from last quarter, indicating spread between ROE and valuation is contracting.

22

Valuations & Profitability

P/B vs. ROE – Tier 1 (Large Cap) vs. Tier 2 (Mid/Small Cap)

Relative ROEs have down slightly in favor of smaller caps, however outlook looks to go in

the direction of larger caps. Tier 1 stocks have moved to be slightly less expensive on

book value over the quarter relative to Tier 2 stocks.

23

Earnings

Year-over-year earnings growth (Median & Average - CPMS Universe)

Earnings growth has increased over the quarter.

24

Earnings

Year-over-year earnings growth of the S&P 500

Year over year Index earnings saw a slight decrease over the quarter.

25

Estimate Revisions & Earnings Surprise

Earnings surprise and average estimate revision have improved by a slight margin

from the previous quarter. Estimate revisions are still in negative territory.

26

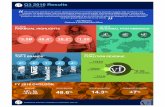

GICS Sectors: 2016 Q3 Overview

Sector Current

P/B

Expected

ROE

Expected

EPS Growth

Earnings

Surprise

Estimate

Revisions

10 Energy 1.6x 0.7% -42.7% 3.8% 1.4%

15 Materials 2.6x 16.4% 7.5% 2.6% -0.3%

20 Industrials 2.9x 16.1% 2.3% 1.4% -2.8%

25 Consumer Discretionary 2.9x 18.5% 4.1% 1.8% -2.8%

30 Consumer Staples 4.6x 20.4% 2.4% 0.9% -0.2%

35 Health Care 4.1x 14.7% 6.6% 1.0% -2.8%

40 Financials 1.3x 9.9% 5.0% 0.8% -1.1%

45 Information Technology 3.2x 13.8% 8.1% 2.3% -1.6%

50 Telecommunications 1.6x 7.1% -19.0% 2.5% -2.8%

55 Utilities 2.0x 10.6% 6.5%% -1.5% 0.0%

Most sectors show positive expected EPS growth with the exceptions being Energy and

Telecom. Sector revisions at the end of Q3 are all negative.

28

The Asset Mix Decision

Equity dividend yields continue to offer a suitable alternative to bonds.

The S&P 500 yield remains slightly above 2%.

29

Economic Snapshot

Unemployment and capacity utilization have moved higher. The inflation rate is relatively

flat from last quarter.

30

Technical Analysis

Short-term indicators have moved downward while long-term indicators have moved up from the

prior quarter. The S&P 500 looks to be overbought.

32

Fundamental Summary

FUNDAMENTALS:

Valuations:

Slightly more expensive relative to the prior quarter. Larger caps seem to be favored

over smaller caps.

Profitability:

Expected ROE numbers strongest for Staples, weakest for Energy.

Earnings Growth:

Earnings growth expectations are positive quarter over quarter in most sectors with

the exception being Energy and Telecomm. Estimates being revised downwards for

all sectors.

ASSET MIX DECISION: Low bond yields remain in support of equities.

TECHNICAL ANALYSIS: Technicals indicate the market is overbought.

ECONOMICS ANALYSIS: Unemployment has increased. Inflation is muted. Capacity Utilization

moved slightly higher.