Cost function

-

Upload

preetianeja -

Category

Business

-

view

495 -

download

0

description

Transcript of Cost function

`̀

Cost Analysis and Cost Analysis and EstimationEstimation

What Makes Cost Analysis Difficult?

Link Between Accounting and Economic Valuations Accounting and economic costs often

differ. Historical Versus Current Costs

Historical cost is the actual cash outlay. Current cost is the present cost of

previously acquired items. Replacement Cost

Cost of replacing productive capacity using current technology.

Opportunity Cost

Opportunity Cost Concept Opportunity cost is foregone value. Reflects second-best use.

Explicit and Implicit Costs Explicit costs are cash expenses. Implicit costs are noncash

expenses.

Incremental and Sunk Costs in Decision Analysis

Incremental Cost Incremental cost is the change in cost tied

to a managerial decision. Incremental cost can involve multiple units

of output. Marginal cost involves a single unit of output.

Sunk Cost Irreversible expenses incurred previously. Sunk costs are irrelevant to present

decisions.

Short-run and Long-run Costs

How Is the Operating Period Defined? At least one input is fixed in the short

run. All inputs are variable in the long run.

Fixed and Variable Costs Fixed cost is a short-run concept. All costs are variable in the long run.

Short-run Cost Curves

Short-run Cost Categories Total Cost = Fixed Cost + Variable

Cost For averages, ATC = AFC + AVC Marginal Cost, MC = ∂TC/∂Q

Short-run Cost Relations Short-run cost curves show minimum

cost in a given production environment.

Short Run Cost GraphsShort Run Cost Graphs

AFC

Q

Q

1.

2. AVC

3.

Q

AFC

AVC

ATC

MC

MC intersects lowest point of AVC and lowest point of ATC.

When MC < AVC, AVC declinesWhen MC > AVC, AVC rises

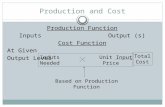

Relationships Among Cost & Relationships Among Cost & Production FunctionsProduction Functions

AP & AVC are inversely AP & AVC are inversely related.related. (ex: one input) (ex: one input)

AVC = WL /Q = W/ (Q/L) = AVC = WL /Q = W/ (Q/L) = W/ APW/ APLL

As APAs APL L rises, AVC fallsrises, AVC falls

MP and MC are inversely MP and MC are inversely relatedrelated

MC = dTC/dQ = W dL/dQ = MC = dTC/dQ = W dL/dQ = W / (dQ/dL) = W / MPW / (dQ/dL) = W / MPLL

As MPAs MPLL declines, MC rises declines, MC rises

prod. functions

cost functions

MPL

L

MC

AP

AVC

Q

Q

cost

Long-run Cost Curves

Economies of Scale Long-run cost curves show

minimum cost in an ideal environment.

Long Run Cost FunctionsLong Run Cost Functions All inputs are variable All inputs are variable

(can adjust) in the long (can adjust) in the long run.run.

LAC is long run average LAC is long run average costcost ENVELOPE of SAC curvesENVELOPE of SAC curves

LMC is flatter than LMC is flatter than SMC curves.SMC curves.

The optimal plant size for The optimal plant size for a given output Qa given output Q2 2 is plant is plant size 2. (A SR concept.)size 2. (A SR concept.)

However, the optimal However, the optimal plant size occurs at Qplant size occurs at Q33, , which is the lowest cost which is the lowest cost point overall. (A LR point overall. (A LR concept.)concept.) Q

LAC

LMCSAC2

SMC2

Q2 Q3

Long Run Cost Function (LAC) Long Run Cost Function (LAC) Envelope of SAC curvesEnvelope of SAC curves

Cost Elasticity and Economies of Scale

Cost elasticity is εC = ∂C/C ÷ ∂Q/Q. εC < 1 means falling AC,

increasing returns. εC = 1 means constant AC

constant returns. εC > 1 means rising AC,

decreasing returns.

Long-run Average Costs

Economists think that the LAC is U-Economists think that the LAC is U-shapedshaped

Downward section due to:Downward section due to: Product-level economiesProduct-level economies which include which include

specialization and learning curve effects.specialization and learning curve effects. Plant-level economiesPlant-level economies, such as economies in , such as economies in

overhead, required reserves, investment, or overhead, required reserves, investment, or interactions among products (economies of interactions among products (economies of scope).scope).

Firm-level economiesFirm-level economies which are economies in which are economies in distribution and transportation of a distribution and transportation of a geographically dispersed firm, or economies in geographically dispersed firm, or economies in marketing, sales promotion, or R&D of multi-marketing, sales promotion, or R&D of multi-product firms.product firms.

CRS region

MES Max ES

DRS

LAC

Flat section of the LACFlat section of the LAC Displays constant returns to scaleDisplays constant returns to scale The minimum efficient scale (MES) is the smallest The minimum efficient scale (MES) is the smallest

scale at which minimum per unit costs are attained.scale at which minimum per unit costs are attained. Upward rising section of LAC is due to:Upward rising section of LAC is due to:

Diseconomies of scale. These include Diseconomies of scale. These include transportation costs, imperfections in the labor transportation costs, imperfections in the labor market, and problems of coordination and control market, and problems of coordination and control by management.by management.

The maximum efficient scale (Max ES) is the largest The maximum efficient scale (Max ES) is the largest scale before which unit costs begin to rise.scale before which unit costs begin to rise.

Modern business management offers techniques to Modern business management offers techniques to avoid diseconomies of scale through profit centers, avoid diseconomies of scale through profit centers, transfer pricing, and tying incentives to transfer pricing, and tying incentives to performance.performance.

Economies of Scope Economies of Scope Concept

Scope economies are cost advantages that stem from producing multiple outputs.

Big scope economies explain the popularity of multi-product firms.

Without scope economies, firms specialize. Exploiting Scope Economies

Scope economics often shape competitive strategy for new products.

Cost-volume-profit Analysis

Cost-volume-profit Charts Cost-volume-profit analysis shows

effects of varying scale. Breakeven analysis shows zero profit

points of cost coverage.

![Cost Function[1]](https://static.fdocuments.in/doc/165x107/577cc6bc1a28aba7119f0266/cost-function1.jpg)