COMPANY IN BOTH NAME AND SUBSTANCE, THE · PDF file · 2014-12-01• Hydraulic...

Transcript of COMPANY IN BOTH NAME AND SUBSTANCE, THE · PDF file · 2014-12-01• Hydraulic...

PAGE INDEX

Profile

Sales by Business Segment and Major Products

Financial Highlights

Message to Our Shareholders

An Outline of the MTP 2007

Special Feature

The Pinnacle of Safe, Eco-Friendly Technology

Ensuring Safety at the Critical Moments of a Flight

Expanding into the Tire Solutions Business

A Critical Component of Clean Energy

Review of Operations

Motorsports Activities

Corporate Governance, Compliance and

Risk Management

Corporate Social Responsibility (CSR)

Research and Development (R&D)

Operational Risks

Financial Section

Major Subsidiaries and Affiliates

Board of Directors, Corporate Auditors and

Corporate Officers

Shareholder Information

01

02

03

04

08

10

12

14

16

18

30

32

35

40

42

45

76

78

79

FORWARD-LOOKING STATEMENTS

The descriptions of projections and plans that appear in this annual report are “forward-looking statements.” They involve known and unknown risks and uncertainties in regard to such factors as product liability, currency exchangerates, raw material costs, labor-management relations and political stability. These and other variables could cause the Companies’ actual performance and results to differ from management’s projections and plans.

01Bridgestone annual report 2007

The Bridgestone Group (the parent company Bridgestone Corporation

and its consolidated subsidiaries) constitutes the world’s largest

manufacturer of tires and rubber products. The parent company was

established in 1931 in the small town of Kurume on the island of

Kyushu. Today, the Bridgestone Group has about 180 manufacturing

plants in 26 countries and sells products in over 150 markets

worldwide. Tires made up about 80% of consolidated sales in 2007,

with the remainder derived from a broad range of industrial and

consumer products and services, together with bicycles and other

sporting goods.

Amid major ongoing change in the external business climate, the

Bridgestone Group has embarked on reforms intended to realize a

robust earnings base with stable, long-term growth potential.

Organizational reforms and a new Mid-term Management Plan (MTP)

have been the central elements in this drive to optimize worldwide

operations with the aim of cementing the Bridgestone Group’s leading

global position. Always seeking to attain a higher level, the Group

remains focused on its mission of “Serving society with superior

quality” through a lineup of products and services that satisfy the

needs of the customer, society and the environment as a whole.

TO BE THE WORLD’S UNDISPUTED

NO. 1 TIRE AND RUBBER

COMPANY IN BOTH NAME AND

SUBSTANCE, THE BRIDGESTONE

GROUP IS COMMITTED TO

ATTAINING THE PINNACLE OF

PERFORMANCE THROUGH ITS

PRODUCTS, SERVICES, PEOPLE

AND OPERATING RESULTS.

02

Industrial productsBelts• Steel cord conveyor belts• Fabric conveyor belts• Belt-related commodities• Pipe conveyor systems

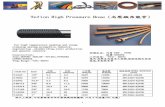

Hoses• Braided hoses• Hydraulic hoses• Automobile hoses

Antivibration and noise-insulating materials• Air springs• Dampers• Noise-insulating systems

Waterproofing materials• Water stoppers• Waterproof sheets for civil

engineering

Rubber tracks

Multi-rubber bearings

Marine products• Dredging hoses• Oil booms• Silt barriers

Antivibration componentsFor vehicles, railway cars,industrial machinery

Chemical productsBuilding materials andequipment• FRP panel water tanks• Unit flooring systems• Steel fiber for concrete

reinforcement• Roofing materials• Unit bath systems• Polybutylene pipes and fitting for

plumbing systems• Sealing materials for buildings

and housing

Thermal insulating polyurethanefoam productsFor general building, housing

Flexible polyurethane foamproductsFor bedding, furniture, vehicles,industry

Ceramic foam

Electro-materials• Semiconductive rollers• Other semiconductive

components

Performance film products• Performance films for plasma

display panels• Photovoltaic module

encapsulants• Interlayer adhesive films for

laminated glass

Sporting goods• Golf balls• Golf clubs• Tennis shoes• Tennis rackets• Tennis balls• Golf swing diagnostic system

Bicycles

Other productsPurebeta ceramic dummywafers, holders, rings, heaters,electrodes and other items forsemiconductor manufacturing

Tires and tubesFor passenger cars, trucks, buses, construction andmining vehicles, industrial machinery, agriculturalmachinery, aircraft, motorcycles and scooters, racingcars, karts, utility carts, subways, monorails

Automotive partsWheels for passenger cars, trucks, buses

Retreading materials and services

Automotive maintenance and repair services

Raw materials for tires

DIVERSIFIED PRODUCTS

TIRES

81%19%

SALES BY BUSINESS SEGMENT

AND MAJOR PRODUCTS

Bridgestone Corporation and SubsidiariesYear ended December 31, 2007

03Bridgestone annual report 2007

FINANCIAL HIGHLIGHTS

Bridgestone Corporation and SubsidiariesYears ended December 31, 2007 and 2006

Net sales

Overseas sales

Operating income

Net income

Total equity

Total assets

Per share in yen and U.S. dollars

Net income

Basic

Diluted

Shareholders’ equity (Note 2)

Cash dividends

Capital expenditure

Depreciation and amortization

Research and development costs

Net return on shareholders’ equity

Net return on total assets

2007

$29,699,685

22,680,736

2,189,768

1,153,132

12,354,139

29,428,428

1.48

1.48

15.39

0.23

2,386,167

1,520,675

759,947

—

—

2006

¥2,991,275

2,213,880

190,876

85,121

1,221,846

3,053,440

109.10

109.07

1,511.43

24.00

261,335

145,349

86,687

7.4

3.0

2007 / 2006

+13.3

+16.9

+31.0

+54.6

+15.4

+10.0

+54.6

+54.6

+16.3

+8.3

+4.2

+19.4

+0.1

—

—

2007

¥3,390,219

2,589,006

249,962

131,630

1,410,225

3,359,255

168.69

168.65

1,757.23

26.00

272,381

173,585

86,748

10.3

4.1

Millions of yen Percent changeThousands of

U.S. dollars (Note 1)

Note 1: Solely for the convenience of readers, the Japanese yen amounts in this annual report are translated into U.S. dollars at the rate of ¥114.15 to $1, theapproximate year-end rate.

Note 2: Shareholders’ equity is equity excluding stock acquisition rights and minority interests.

04

POISED FOR SUSTAINED GROWTH

2007 business reviewDespite an increasingly difficult business environmentcaused by changes in the global structure of demand andcompetition, consolidated net sales increased by 13% to¥3,390.2 billion. Gains were recorded across allgeographical segments. The primary reasons for thisgrowth were company-wide efforts to reinforce strategicproduct lines from development to production and sales,the introduction of appealing new products worldwide andthe enhancement of our portfolio of highly competitiveproducts and businesses. Operating income was up 31%to ¥250.0 billion, due in particular to initiatives aimed atmitigating the impact of increasing raw material costs,while net income surged 55% to ¥131.6 billion. The resultsfor both net sales and operating income represent historichighs for the Bridgestone Group.

Based on these results, we are well on track to achievethe targets set out in the Mid-term Management Plan,which will be described later.

For a more detailed review of our performance in 2007,please refer to the Management’s Discussion & Analysissection (pp. 46-51).

Reflections on progress to dateWhen I became president two years ago, I set a goal forthe Bridgestone Group to be recognized as the world’sundisputed No. 1 tire and rubber company in both nameand substance. The progress that we have made sincethen has afforded me greater insight into the challengesthat we face in attaining this goal.

One thing is clear: size is critical for achieving sustainedgrowth in a business such as tires where products areinternationally standardized. In the 20 years since weacquired Firestone — a move that catapulted theBridgestone Group into the top three of the tire industry —our efforts to blend the best of each firm into an integratedwhole have helped to forge a new company culture. Interms of scale of operations we have become one of theworld leaders today.

Yet the rapidly changing global market in which weoperate differs vastly from the conditions back in 1988.Tire demand has shifted to either side of the spectrum,

away from the middle. Today, the market segments thatare growing are state-of-the-art high-performance tiresand low-priced general-purpose tires. The gains in marketshare being made by low-priced tires from low-costmanufacturers point to fundamental shifts in the structureof competition. The earnings structure of the tire industryhas undergone wrenching change as well, due to thepressures applied by inexorably rising raw material costs.

To succeed in the face of such change, I see my role asone of creating a strong Bridgestone Group with a robustearnings structure capable of generating sustained growthinto the future. I believe that this goal translates into threeaims. First, we must develop a trim global structure thatcan react swiftly to change. Second, our performancetargets for the short, medium and long term — as well asall other aspects of business performance — must beowned by the whole Bridgestone Group. Third, we mustfind the correct balance. Developing advanced technologyto lead market change is, of course, vital. At the sametime, however, we must also strive to overcome thecompetition by providing customers with value-addedsolutions, rather than merely making and selling tires andother consumable goods.

Finally, we cannot regard the quest to be the world leaderin both name and substance as merely a question ofachieving the highest sales and profits. To be the bestcompany, the Bridgestone Group must also displayleadership in areas such as the environment, quality,product safety, compliance, risk management (inclusive offire prevention and occupational safety), internal controls,human resource development and corporate citizenshipactivities. That is why we have positioned corporate socialresponsibility (“CSR”) activities at the heart of what we do.In short, we must aim to be a world leader in all aspectsof our activities as a company. By achieving a productivebalance among these various elements, I believe that theBridgestone Group has the strength to build on thesehealthy foundations to create a truly global andsustainably successful enterprise.

Toward optimized global operationsAmong the risks that large-scale international operationsface is lowered earnings due to individual parts of thegroup merely pursuing sales expansion. It is therefore

Message to Our Shareholders

05Bridgestone annual report 2007

Shoshi Arakawa

Chairman of the Board, CEO and President

critical that we optimize the use of global managementresources and strive to eliminate waste. We refer to this asthe “total optimization” of Bridgestone Group operations.The ultimate goal is that organizations, systems andprocesses are all engineered to create maximum value, toavoid waste and to react to change quickly.

There are two things involved in realizing this goal. First,we need to create optimal global coordination. Second,we must ensure that the Mid-term Management Plan iscompletely integrated across the Bridgestone Group.Structure and planning are essential to the formulation ofclear targets and policies to achieve these objectives.These two tasks have been my priority since myappointment. With the announcement of our latest plan inOctober 2007, I believe that our organization andplanning are now working well together and in tandem.

A reformed and optimized global structureOur organizational reforms have involved theestablishment of eight strategic business units (SBUs)supported by a Global Management Platform (GMP). SixSBUs focus mainly on the tire business in differentgeographic regions and the other two SBUs consist ofour specialty tire and diversified product operations. Inaddition, the Global Head Office (GHO) sets policy for theBridgestone Group and plays an organizational andvisionary role in optimizing global operations.

Within the GMP framework, we have also created anentity called the GLC (Global Logistics Center) to sethigh-level policy for core functions such as productplanning, business development, materials purchasing,facility procurement, and global tire supply chainplanning. The GLC enables the Bridgestone Group toimprove its response to market trends by analyzing andapproaching projects beginning at the product planningstage, helping the Group make optimal decisions from aglobal perspective about what raw materials to buy,where to produce and which markets to supply withwhich products. Beginning in 2008, I am confident thatthe practical benefits of our reconfigured organization willstart to emerge in terms of accelerated productintroductions.

Globally integrated business planningThe details of the five-year Mid-term Management Planthat we released in October 2007 are discussedelsewhere in this Annual Report. Just as important as thenumbers in the plan is the process by which weformulated it.

06

Message to Our Shareholders

to ensure our competitiveness over the long term. This isthe case in many specialty tire areas, including radial tiresfor construction and mining vehicles, aircraft andmotorcycles. Third, we are continuing to developenvironment-friendly products, both in our tire anddiversified product operations. Examples of thesestrategic products include runflat tires, ECOPIA brand tiresfor better fuel economy, electronic paper displays andEVA (ethylene vinyl acetate) film for solar modules. We arealso focusing attention on strengthening the DiversifiedProducts business and increasing our fundamentalcompetitiveness in raw materials development andproduction technology.

By focusing development resources on these strategicareas, we aim to expand our global business while alsopromoting greater vertical integration within theBridgestone Group, which is one of our competitivestrengths. Although our development is primarily product-focused, we are also seeking to build our reputation as a“solutions provider”. In May 2007, the Bridgestone Groupacquired US-based Bandag, Incorporated, a leadingcompany within the retreading industry. We will nowprovide even better service to our customers by offeringa comprehensive tire maintenance solution, backed by acomplete line of new and retread truck tire offerings.

Antimonopoly investigation and improperpayments to foreign agentsIn news releases on May 4, 2007 and February 12, 2008,Bridgestone Corporation disclosed that Japanese, US,European and other authorities have been investigatingthe Company and certain of its employees in connectionwith international cartel activities and/or improper moneypayments to foreign agents respectively. We haveappointed an Investigation Committee consisting of ourexternal attorneys who have been involved in the ongoinginvestigation of these matters. This investigation iscontinuing and may expand. The Company willinvestigate the whole picture of these improper activitiesand will take this opportunity to speedily resolve thefundamental problems and issues presented by anymisconduct that we may uncover. In addition, theCompany will employ our best efforts to establishpreventive measures to stop future misconduct.

Enhancing shareholder valueThe Bridgestone Group is committed to generating valuefor its shareholders through improved financial returnsbased on sustained business expansion. Our policy is tomaintain a stable and steady dividend, taking into account

The plan summarizes where the Bridgestone Groupwants to be throughout the period up to 2012, along withthe measures that we will implement to get there. Thisplan was not a top-down, target-setting exercise.Instead, it involved extensive discussions with managersthroughout the Group to ensure that targets are feasibleand that, more importantly, the measures developed willoptimize the global operations of the Bridgestone Group.We also developed a series of Key PerformanceIndicators (KPIs) to track progress within each business.

Each SBU and GMP function has full managementresponsibility and functional ownership. Each also retainsorganizational autonomy to enable an effective yet flexibleresponse to business conditions and performance. Thestructure is thus one of independently operating SBUsand GMP functions working within a GHO-defined policyframework, based on a coherent and optimized businessplan and close communication between these three partsof the overall organization. I believe that this arrangementallows an optimal mix of motivation, accountability andflexibility across all Group operations.

One final aspect of our business planning is the fact thatwe will update the plan each year to take account ofchanges in the business environment. The purpose ofthis rolling plan mechanism is not to keep moving thegoalposts but rather to allow us to revise our measureswhere necessary to respond to changes as they arise.The integrated revision of measures is a critical part ofmaking sure that our global operations are fully optimizedand remain that way going forward.

Targeting the pinnacle of development toensure enhanced products and servicesThe Bridgestone Group is currently developing variousmeasures in line with this structure and plan. A particularfocus concerns the continuing enhancement ofBridgestone products as a means to drive sustainedgrowth. To this end, we continue to focus our efforts oncertain strategic areas based on our concept of “aimingfor the higher level.”

Our goals in strategic product development are basicallythreefold. First, we aim to reinforce our competitiveadvantage in those areas where the Bridgestone Grouphas preceded its competitors, such as runflat tires, wintertires, ultra-high-performance tires and ultra-low-profileGREATEC tires for commercial vehicles. Our second aimis to gain an overwhelming competitive edge throughadvanced technology and sophisticated business models

07Bridgestone annual report 2007

growth in earnings and any changes in financialcondition. We also seek to balance the level ofshareholder return against the accumulation of capitalreserves required to invest in the reinforcement of thebusiness base for the long term. This requiresinvestments in domestic and overseas productionfacilities, sales and marketing systems and R&Dprograms, among other things. For the fiscal yearended December 2007 we will pay a final dividend of¥13 per share, bringing total dividends for the year to¥26 per share.

The Bridgestone Group has always had immensepotential by virtue of the talent within its individualfunctions. In the future, we will look to maximize returnsby optimizing our global operations. I hope to harnessall of the Group’s resources more efficiently so that wecan boost returns by quickening our response andincreasing our competitiveness. Our goal is to createan organization with a truly global structure, supportedby genuinely global planning capabilities. Thismanagement formula is rare within corporate Japan —so rare that we hope others will strive to emulate the“Bridgestone model” of global development.

I ask for your continued support and understanding as we work to raise the value of the Bridgestone brandworldwide.

April 2008

Shoshi ArakawaChairman of the Board, CEO and President

TRAVERSING A PATH TO THE

PINNACLE OF PERFORMANCE:

Objectives and Measures of the

Mid-term Management Plan 2007 and a

Focus on Strategically Important Products

08

Management goalTo be the world’s undisputed No. 1 tire and rubbercompany in both name and substance

MTP development frameworkThe Bridgestone Group has formulated a coherent Mid-term Management Plan (MTP) to achieve the totaloptimization of Group business resources, based onpolicies established by the Global Head Office (GHO).Each Strategic Business Unit (SBU) seeks to realize theseplans using specialized support provided by the functionalunits of the Global Management Platform (GMP).

Key strategies1. Always aim for the higher level

(1) Strategic tire products

Enhance tire business domain with high growth potentialwhere the Bridgestone Group has a unique competency.

A. Areas where the Bridgestone Group can precede itscompetitors through reinforcement of products• Runflat tires for passenger cars; UHP (ultra-high-

performance) tires; winter tires• High-value-added tires for commercial vehicles

(GREATEC, low-profile)

B. Areas where the Bridgestone Group can achieve long-term competitive advantage through technology andbusiness modelSpecialty tires• Large off-the-road radial tires for construction and

mining vehicles• Aircraft radial tires• Motorcycle radial tires

(2) Eco-friendly products and services

Position eco-friendly products and services as strategicbusinesses in support of the Group’s CSR initiatives.

A. Eco-friendly productsa. Tires b. Diversified products• Runflat tires • Electronic paper displays• ECOPIA brand products • EVA film for solar modules

B. Eco-friendly servicesA business model that supplies products and servicesto promote greater resource conservation• Retread business (Bandag)

The Bridgestone Group plans to supply tiremanagement solutions to commercial fleetcustomers through its Bandag brand (acquired inMay 2007) while at the same time aiming to make asubstantial contribution to environmental protectionand resource conservation.

(3) Diversified products

The Bridgestone Group plans to generate about 20% ofconsolidated sales and operating profit from diversifiedproducts. The aim is to boost profitability byconcentrating resources on high-margin products suchas high-performance films.

AN OUTLINE OF THE FIVE-YEAR MID-TERM

MANAGEMENT PLAN (2008-2012)

Contribution of specialty tire operations[Ratio of net sales/operating profit](FY07 est. at time of MTP2007 release)

Outer ring: Net sales

Specialty tires Other tires

An Outline of the MTP 2007

5%

18%

Inner ring:Operating profit

09Bridgestone annual report 2007

(4) Reinforce fundamental competitiveness

The Bridgestone Group aims to develop highly competitivematerial and production technologies to continuesupplying the quality demanded by the market whilecreating improved material cost profiles.

(5) Enhancement of corporate governance structure

Plans call for the further development of governance andcompliance systems to ensure that both management andoperational execution are efficient and goal-oriented.

(6) Basic systems to reinforce the Group’s CSR initiatives

• Establishment of the Integrated CSR EnhancementCommittee (January 2007)

• Aim of CSR activities: To realize its corporatephilosophy to serve society with superior quality andsupport ongoing development of a healthyBridgestone Group

• Focus on 22 specific themes on a global basisacross the Bridgestone Group in order to reinforceCSR activities

(7) Environmental management

Targeting environmental issues at the global, regional andworkplace levels, the Bridgestone Group maintains itsleadership position in this area and will create specific plansfor a diverse program of environmental managementactivities to cover a broader range of business domains.

2. Integrate and expand business domains based on

clear long-term strategy

The Bridgestone Group is working to strengthen verticalintegration placing an emphasis on the integrated andeffective use of resources. This will allow the Group tobuild an optimized supply chain and supply society withhigh-quality products and services.

The Global Logistics Center (GLC) was established inOctober 2006 with the aim of raising supply-chaincompetitiveness for the global tire business.

3. Achieve truly global development through SBUs

Over the plan period, the Bridgestone Group aims toincrease consolidated net sales by about 20% byaggressively targeting growth in overseas and specialtytire markets, while at the same time boosting operatingprofit by 80% through increased sales of strategicproducts and rationalization efforts. Another key goal is todevelop supply systems to support this growth.

Major production expansion plans:

• India (passenger car tires: capacity increase)• Indonesia (passenger car tires: capacity increase)• Mexico (passenger car tires: new plant (operations

started))• Hungary (passenger car tires: new plant (operations

started))• Poland (truck and bus tires: new plant)

Net sales growth by tire SBUs (2007 E 2012)

(Black bar: exch. rate adjusted )

4. Target optimum group management based on MTP

To realize the MTP goals, the Bridgestone Group continuesto develop planning and management structures tooptimize the integrated use of Group resources in amanner consistent with its basic strategy. This involves ashift away from the current resource model to a policystance defined as “Lean and Strategic.”

Performance targets

2007 2011 2012Net sales ¥3.4 trillion ¥3.8 trillion ¥4.0 trillion

Operating profit increase (2007 E 2012)

Expansion of strategic products +¥100 billionRationalization +¥50 billionDiversified products business +¥25 billionVolume, others +¥10 billion

+¥185 billion

2007 2011 2012ROA 4.1% Over 5.0% 6.0%

Exchange rates 100JPY/US$ (2007 forecast: 118JPY/US$)

130JPY/EURO (2007 forecast: 155JPY/EURO)

0

40

80

120

160

200

(135)

ChinaEuropeTheAmericas

Japan SpecialtyTire

(105)

(150) (150)

(185)(%)

10

Bridgestone runflat tiresrepresent an advanced and eco-friendly solution for enhancedvehicle safety.

Special Feature

11Bridgestone annual report 2007

THE PINNACLE OF

SAFE, ECO-FRIENDLY

TECHNOLOGY

The Bridgestone Group has been developingrunflat tires for more than 20 years as a saferdriving solution. They represent the pinnacle ofefforts to develop technology that embraces thethree core elements of safety, comfort and theenvironment. In recent years, increasingnumbers of passenger car models have beenfitted with runflat tires, notably in Europe, theUnited States and Japan.

Runflat tires function safely at a specified speedfor a specified mileage even after a loss of airpressure. By eliminating the need to carry aspare, runflat tires help to reduce vehicle weight,promoting better fuel economy while helping toconserve resources. They also afford cardesigners greater freedom to utilize theincreased space.

In 2007, Bridgestone Corporation unveiled a newtechnology called “COOLING FIN” that enhancesthe post-puncture durability of sidewall-reinforced runflat tires*1. The new fins are radialprotrusions located on the external tire surface.These work by promoting increased airturbulence, which in turn helps to cool the tiresidewall. This new technology paves the way fordeveloping runflats for vehicles such as minivans,large passenger sedans and some SUVs. Suchvehicles have larger tire cross-sections*2 thatgenerate greater sidewall heat at lower tirepressures. COOLING FIN technology also opensup the possibility of reducing the thickness ofrubber used to reinforcethe tire sidewall, leadingto a reduction in weightas well as morecomfortable ridecharacteristics.

Height of cross-sections *2

Sidewall-reinforced runflat tire *1

Shape of tire after puncture

Sidewall-reinforcingrubber

ENSURING SAFETY

AT THE CRITICAL

MOMENTS OF A FLIGHT

During take-off and landing the tires fitted to theAirbus A380 (pictured) support a gross weight ofup to 560,000kg traveling at speeds of up to370km/h. As in Formula One racing, suchextreme conditions demand tires that feature a fullrange of advanced tire technologies. The next-generation Boeing 787 will also be delivered withBridgestone tires as fully standard fitments.

Bridgestone aircraft tires are based on the triple-R concept, which stands for RevolutionarilyReinforced Radial. Based on cutting-edge beltconstruction, this unique structural designprovides four key benefits: increased resistanceto external damage; a reduced chance of tiredestruction through bursting or tread separationeven if damage occurs; reduced tire weight forbetter fuel economy; and improved abrasionresistance, which allows for more takeoff andlanding cycles between tire replacement.

Bridgestone Corporation is one of the very fewcompanies with the design and productioncapabilities to supply these kinds of tires.Bridgestone Corporation is investing in newaircraft radial production capacity at its TokyoPlant, with production slated to start in thesecond half of 2008 while the Kurume Plantcontinues to produce aircraft radial tires. Totalproduction capacity of radial tires for aircraft willbe 2.5 times the current level. BridgestoneCorporation also has retread aircraft tire plants inNorth America, Europe, Asia and Japan to offera comprehensive range of products and servicesfor the commercial aircraft market.

12

Special Feature

Bridgestone radial tires are fitted to the AirbusA380, which carries 555 passengers in itsstandard cabin configuration.

13Bridgestone annual report 2007

14

The retread tire business extendsthe presence of the BridgestoneGroup into eco-conscious tiremanagement solutions forcommercial customers worldwide.

Special Feature

15Bridgestone annual report 2007

EXPANDING INTO

THE TIRE SOLUTIONS

BUSINESS

At the end of May 2007, Bridgestone AmericasHolding, Inc., the U.S. subsidiary of BridgestoneCorporation, completed its acquisition of Bandag,Incorporated, one of the world’s top companies inthe retread tire sector. US-based Bandagmanufactures retreading materials and equipmentfor a global network of more than 900 franchiseddealers across 90 countries that produce andmarket retread tires and supply tire managementservices. Bandag’s traditional business servesend-users via a wide variety of products offeredby dealers, ranging from tire retreading and repairto the outsourcing of tire management systemsfor commercial truck fleets. Bandag owns tenproduction bases located in the United States,Belgium, Brazil and Mexico.

Retreading involves removing used tire treads andapplying freshly vulcanized new treads so that thebody of the tire can be reused safely. It is a widelyused solution in Europe and North America for thetires that are fitted to trucks, buses and aircraft.Retreading not only helps to reduce the total costof tires, but also makes a major environmentalcontribution in terms of the more effectiveutilization of natural resources.

The integration of Bandag enables theBridgestone Group to enhance the level ofservice and technology for customers, whileproviding the same great level of quality. Theglobal Bridgestone Group will now provide evenbetter service to customers by offeringcomprehensive tire maintenance solutions,backed by a complete line of new and retreadtruck tire offerings.

A CRITICAL

COMPONENT OF

CLEAN ENERGY

In the Diversified Products business, BridgestoneCorporation is pursuing a policy of selection andconcentration in order to drive optimumcorporate growth. One promising area for thefuture is EVA (ethylene vinyl acetate) film for use in the production of solar power modules.

EVA film is used to attach the silicon cell whichconverts solar rays into electricity to the backingsheet and glass surface of the solar module viaheat-induced molecular binding. This process relieson the property of EVA film to become transparentupon heating. EVA film is also waterproof and UV-resistant, which makes it an ideal adhesive film forsolar modules installed outdoors.

To cater to growing global demand for solarpower modules, Bridgestone Corporation isinvesting to increase production capacity for EVAfilm at its Iwata Plant located in ShizuokaPrefecture, Japan. The monthly productioncapacity of EVA film is scheduled to double to2,000 tons by late 2010.

Global demand continues to rise for photovoltaiccells, which offer a clean alternative powersource to help in cutting CO2 emissions. TheBridgestone Group places a high priority onenvironmental activities as an important meansof achieving higher sustainable long-termperformance growth. EVA film is therefore adoubly important product in this regard.

16

Special Feature

EVA film is a critical component ofsolar modules, which are inincreasing demand as a cleanenergy source.

17Bridgestone annual report 2007

18

BETTER FINANCIAL PERFORMANCE VIA

GREATER EMPHASIS ON COMPETITIVE

PRODUCTS IN GROWTH AREAS

Consolidated sales in the tire business segment totaled ¥2,750.4 billion (net of inter-segmenttransactions) in fiscal 2007, an increase of 15% compared with the previous year. Operatingincome rose 40% to ¥195.0 billion, mainly due to successful efforts across the BridgestoneGroup to mitigate the effects of high raw material costs. The focus remained on maximizingsales momentum via the introduction of appealing products worldwide and on engineeringfurther improvements in the product mix through higher sales of high-value-added productlines. Segment capital expenditures totaled ¥240.8 billion, reflecting investment in variousBridgestone Group production sites worldwide that are the supply bases for strategic products.

Review of Operations l Tires

Sales (net of inter-segment transactions)

¥ billion

Operating income¥ billion

2007

2006

2005

2004

2003

2007

2006

2005

2004

2003

2,750.4 195.0

2,393.2

2,153.0

1,928.0

1,836.4

139.1

167.9

160.3

148.3

JAPAN TIRE SBU

Although unit tire sales were on a par with the previousyear, most of the growth was generated by sales ofstrategic products and high-value-added lines. Sales oftires for the original equipment market were up over2006. However, high fuel prices remained a significantdampening factor on demand in the replacement tiremarket. Additionally, in the passenger car segment of thereplacement tire market, demand for summer tires wasflat, while demand for winter tires dropped sharply amidan exceptionally mild winter across Japan.

In the original equipment market, BridgestoneCorporation (“Bridgestone”) focused on improvingproduct mix by expanding sales of high-performance tireswhile at the same time seeking to boost the image of theBridgestone brand by promoting the use of such tires inluxury and up-market vehicles. Bridgestone also soughtto enhance its presence in all automobile sectors inJapan, including mid-market passenger car models.

In the replacement tire market, Bridgestone pursueda strategy of “quality-led growth” by seeking to expandsales of high-value-added products while obtainingacceptance for a higher selling price in the marketplace.Bridgestone implemented price increases in Japan during2007 across most tire categories in an attempt to offsetthe effects of sustained high raw material prices. Price

increases were between 5% and 10%.Bridgestone continued to position itself in the

Japanese tire market as a premium brand offering arange of benefits in terms of quality, safety andenvironmental performance. The major strategic productswere runflat tires, UHP (ultra-high-performance) tires andwinter tires in the passenger car segment, as well as low-profile truck and bus radial tires and the eco-friendlyECOPIA brand tires in the commercial vehicle segment.

Creating a solid domestic business platformThe shift to a single strategic business unit (SBU) tomanage the Japanese tire business promises to generatesignificant benefits over the medium to long term. Thekey goal is to create a solid domestic business platformthrough the integrated optimization of tire production andsales operations within Japan.

The development of the Japan Tire SBU involvesintegration on a number of levels: production and sales;the original equipment and replacement tire operations;decision-making processes; and operational planning.The Bridgestone Group’s basic stance is to proceed withgroup and global business development on top of thestrong Japanese business. Throughout its history,Bridgestone has developed advanced capabilities in bothproduction and sales operations, which has helped tosupport and enhance its business performance.

19Bridgestone annual report 2007

Bridgestone is focusing onboosting sales of strategicproducts such as UHP (ultra-high-performance) tires.

Efforts are being made to expandsales of high-value-added productlines in the truck and bus tiresector.

Cockpit is a chain of highlyspecialized stores designed to meet individual customerneeds.

However, in order to further enhance thesecapabilities to develop a more secure footing,Bridgestone continues to seek improvements acrossall functions. Bridgestone will promote the integratedoptimization of tire production and sales operations toensure that these improvements provide the bestpossible result for the organization as a whole. Thebenefits promise to materialize over time throughenhanced competitiveness in terms of costs,technology and sales presence.

The major challenges in the Japanese tirebusiness can be summarized in terms of changes inthe structures of demand, earnings and competition.These in turn are translating into downward pressureon prices combined with upward pressure on rawmaterial costs. Bridgestone remains focused onfollowing the “quality-led growth” strategy to boost itscompetitive edge by leveraging technical superiorityto develop high-quality differentiated tire products.This strategy also plays a central role in thedevelopment of a solid domestic business platform.

Growing demand for eco-friendly, fuel-efficient tiresCommercial vehicle fleet operators the world over aremainly concerned with procurement and operatingcost. Eco-friendly tires with reduced rolling resistancethat deliver better fuel economy are thus anincreasingly popular solution for truck and busoperators in Japan. Bridgestone provides ECOPIAbrand products to cater to this growing demand.Feedback from commercial customers that haveadopted this product has been especially positive,with user surveys confirming the economic benefits interms of lower fleet operating costs.

Outlook for fiscal 2008Automobile production levels in Japan are projectedto remain high in fiscal 2008, with export productionincreasing to compensate for the flat domesticmarket. Bridgestone will respond more swiftly tochanges in the original equipment sector, whileenhancing the quality of its products. In thereplacement tire sector, demand is expected toincrease slightly overall.

Bridgestone will continue focusing on improvingprofitability by promoting sales of strategic products,such as runflat tires, UHP tires and winter tires, togenerate a higher-value sales mix. As SBU integrationcontinues, increased cooperation between the salesand marketing teams in the original equipment andreplacement tire sectors is expected to contribute tohigher sales and increased returns. The plannedreinforcement of the retreading business in theJapanese market offers further potential for newgrowth within the tire management services sector.

20

Review of Operations l Tires

The Bridgestone Group primarily operates in the Americasthrough a wholly owned subsidiary and holding company,Bridgestone Americas Holding, Inc. (“BSAH”). BSAH is theparent company to several subsidiaries, includingBridgestone Firestone North American Tire, LLC (“BFNT”),BFS Retail & Commercial Operations, LLC (“BFRC”), BFSDiversified Products, LLC (“BFDP”) and a new member —Bridgestone Bandag, LLC (“BSBD”). BSAH also has anumber of other subsidiaries based in North, South andCentral America.

*Note: Refer to page 28 for details on the diversified products

business in the Americas.

North AmericaWithin the tire business, the best-performing sectors werereplacement tires for passenger cars and off-the-road tiresfor mining and construction equipment. Sales of radial tiresfor commercial vehicles (trucks and buses) were negativelyaffected by soft demand, especially in the original equipmentsector. Reduced production of light trucks and SUVs withinthe US and Canada resulted in lower tire shipments tosupply OEM contracts. However, the consumerreplacement sector benefited from better brand and productmix resulting from an emphasis on strategic categories suchas high-performance tires. Higher selling prices were anotherfactor contributing to growth in sales revenue.

Overall sales of tires in the North American marketwere ahead of fiscal 2006. Sales of tires by BFNT, which isBSAH’s tire manufacturing and wholesaling operation inNorth America, were less than originally expected due tosofter demand in the commercial vehicle and passengercar original equipment sectors. BFNT recorded positivegrowth in operating profit compared with the previous yeardue to a solid performance across most business units.Sales of replacement tires by BFRC, which remained thelargest automotive retailer in the world, exceeded both theprior year and internal projections.

During fiscal 2007, BFNT completed the sale of itsclosed Oklahoma City plant. A plot of vacant land of morethan 240,000m2 on the edge of the plant site was donatedto the local school system to serve as a wildlife habitat areaas well as a site for a new elementary school building.

In other developments, BFNT began construction of anew distribution facility in Jacksonville, Florida, which isexpected to be complete by mid-2008. BFNT alsoannounced a multi-year integrated marketing partnershipwith the National Football League (NFL). Under theagreement, the Bridgestone brand is designated as theNFL’s first “Official Tire.” The partnership promises toincrease exposure for the brand through programs such asthe Super Bowl, which attracts some of the highest ratingsfor any television program in the US and is also watchedby a worldwide audience in excess of 100 million. In

March, 2008, BFNT and Bridgestone Firestone CanadaInc. (“BFCA”) also announced a new global multi-yearpartnership with The National Hockey League (NHL) andthe National Hockey League Players’ Association (NHLPA)in which the Bridgestone brand will serve as the “OfficialTire of the NHL, NHLPA and the Hockey Hall of Fame.”

Strategy and outlookOverall, BSAH continues to strengthen its operations inthe Americas and is focusing efforts on the manufactureand sale of premium value-added products such as high-performance, ultra-high-performance and runflatpassenger car tires. In addition, the company continuesto position itself for the future in the retail automotive tireand service sector by committing to growth indemographically desirable locations.

Continually seeking to provide customers with evenbetter quality and value, BSAH continues to pursueincreased cost competitiveness through targeted capitalinvestments towards those goals, while closing thosefacilities that have proven to be obsolete or non-competitive.

Unprecedented ongoing escalation in raw materialcosts — especially those related to petroleum — presentedthe major challenge in 2007. BSAH continues to look forways to enhance productivity as well as quality while strivingto mitigate the impact of these rising costs. Based on closemonitoring of the marketplace, BSAH evaluates its coststructure on an ongoing basis to determine appropriatecountermeasures as necessary. This issue is expected toremain a key operational factor in fiscal 2008.

The prospects of an economic slowdown in the UnitedStates during 2008 imply a possible negative impact onconsumer spending. BSAH will make appropriateadjustments to operating expenses in line with changingeconomic conditions. BSAH expects growth in sales andprofit during 2008 versus 2007 despite challenging economicconditions that may affect some portions of its business.

A major force in the tire retreading marketBandag represented a significant addition to theBridgestone Group during 2007, particularly in NorthAmerica. The company was a strong contributor to salesduring the seven-month period following the completion ofthe acquisition in May 2007. Bandag also celebrated themajor milestone of 50 years in business during the year.

Boasting an outstanding corporate culture, a talentedworkforce and superior quality products, the Bandagbusiness makes the Bridgestone Group a major force withinthe markets for tire retreading and tire managementservices. Significant synergies and market opportunities withthe Bridgestone Firestone Truck & Bus group have alreadybeen identified. Subsequently, on March 31, 2008, BSAHannounced a reconfiguration of the Bandag operationswithin the global Bridgestone Group to take betteradvantage of the combined strengths of our globaloperations that a unified new truck and retread tire business

AMERICAS SBU

21Bridgestone annual report 2007

BSAH celebrates the grandopening of the state-of-the-arttire facility in Monterrey,Mexico.

BFRC continues to be thelargest automotive retailer inthe world.

The Bridgestone Group hascompleted the Bandagacquisition and will nowprovide even better service tocustomers by providingcomprehensive tiremaintenance solutions backedby a complete line of new andretread truck tire offerings.

The new Hungary plant is vitalto achieve the objective ofsteady, profitable growth inEuropean business.

can deliver. In North America, BFNT’s truck and bus tiresales and marketing groups will be combined withBandag’s North American retreading operations and willbe aligned as a division of BFNT. The newly combinedoperations will be known as Bridgestone Bandag TireSolutions. In Europe, Bandag’s operations will beintegrated with Bridgestone Europe to similarly facilitatefurther development of existing synergies. In Asia, theBandag retread operations have already been alignedwith Bridgestone Corporation operations.

Central & South AmericaBridgestone Firestone Latin American Tire Operations(“BFLA”), an operating unit through which the LatinAmerican subsidiaries report to BSAH, experiencedrobust sales growth over the prior year, mainly due tostrong performances in the Brazilian and Mexicanmarkets. Although operating income did not achieveprojected levels due to strong offshore competition,higher expenses and the impact of currencyexchange, the results still significantly exceeded theprevious year’s performance.

New tire plants in Bahia, Brazil, and Monterrey,Mexico, began production in 2007. BridgestoneFirestone de Mexico, S.A. de C.V. (“BFMX”)announced plans to close a tire plant in Mexico City inthe second half of 2008 while separately undertaking acapacity expansion at its plant in Cuernavaca.

Market trends and performanceThe European tire market recorded a decline indemand in the passenger car segment during fiscal2007. Demand was firm, however, in the commercialvehicle segment, supported by brisk economicgrowth in East European markets.

Bridgestone Europe NV/SA (“BSEU”) notched upgains in share across both market segments,particularly in truck and bus radial tires (originalequipment) and targeted high-value-added productareas such as winter and UHP (ultra-high-performance)tires. Unit sales of passenger car and light truck tireswere strong, exceeding levels recorded in fiscal 2006.Unit sales of runflat tires, winter tires and UHP tires rosesignificantly and contributed to product miximprovement. Sales of truck and bus tires were alsohigher than in the previous year.

BSEU posted a double-digit increase in salesrevenue in 2007. Profits increased despite high rawmaterial costs.

Strategy and outlookThe core strategy in Europe focuses on raising profitsthrough product mix improvements by boosting

EUROPE SBU

22

Review of Operations l Tires

Bridgestone’s presence in strategic products such asUHP tires, runflat tires, winter tires for passenger cars,and GREATEC and low-profile truck and bus tires. Other aspects of the strategy are the development ofhigher-value customer sales and service channels andregional production capacity upgrades to increaseregional self-sufficiency.

Raw material prices are expected to reach historichighs in 2008. While EU market GDP growth is projectedto be around 2%, BSEU expects competition in Europe to intensify as emerging Asian tire manufacturerscontinue to make inroads into the market. The strategyfor generating higher profits revolves around continuing toimprove the sales mix while working to mitigate theimpact of increasing raw material prices.

Regional infrastructure developmentBSEU is investing in production and logistics infrastructure inEurope to boost regional self-sufficiency of supply and addgreater manufacturing value at the local level.

During 2007, BSEU’s new plant for passenger cartires near Tatabánya in Hungary completed allcertification procedures. Production began in January2008. This plant employs Bridgestone’s revolutionaryBIRD (Bridgestone Innovative and Rational Development)production system. BIRD is the first tire productionsystem that automates the entire manufacturingsequence from processing raw materials to theinspection of finished tires.

Construction of another new plant for truck and bustires in Stargard, Poland is underway. Together with theexisting facility in Poznan, once operational these twoplants in central Europe are expected to bring significantbenefits to BSEU in terms of increased supply self-sufficiency and through a supply system that enablesenhanced sales of strategic products.

In other developments during 2007, the final phase of the European proving ground was completedand the European Technical Center was expanded.BSEU also began operating a new logistics facility inMadrid, Spain.

Channel strategyBSEU continues to follow a medium-term channeldevelopment strategy. The centerpiece of this strategy forthe passenger car tire market is the First Stop retail chain.The number of First Stop outlets in the region increasedfrom around 1,560 to 1,740 during 2007.

BSEU is also developing its presence in Europe as asolutions provider to commercial truck fleets. During 2007,several large pan-European transport fleets signed up toBridgestone’s Total Fleet Management program, to benefitfrom services delivered by the pan-European network ofTruckpoint outlets. BSEU will further strengthen its retreadbusiness by facilitating further development of existingsynergies of new and retread truck tire offerings.

Market trends and performanceTire demand in both the passenger car and commercialvehicle segments continues to expand at around 10%per year, in line with the underlying growth of the Chineseeconomy. The market also has outstanding long-termgrowth potential owing to the fact that the process ofmotorization is still at a relatively early stage.

The market is highly competitive, with many localsuppliers competing against overseas manufacturers.Locally produced bias tires still account for a large part ofthe market by volume.

Overcoming the challenging market conditionsthrough efforts to expand sales and to mitigate theimpact of higher raw materials costs, Bridgestone (China)Investment Co., Ltd. (“BSCN”) posted a substantial year-on-year improvement in performance during fiscal 2007.Sales volume, revenue and profits were all significantlyhigher than in 2006.

Strategy and outlookBSCN is following a “quality-led growth” strategy in Chinafrom a long-term perspective. By placing the emphasison quality in terms of not only the performance andtechnical aspects of the product but also the distributionchannel and customer service, the aim is to differentiatethe Bridgestone brand as the driver’s first choice for high-performance radial tires both in the passenger car tireand truck and bus tire sectors.

In recent years, China has witnessed an explosion in thenumber of motorists purchasing and driving passengercars. BSCN is deliberately targeting the high-performancesegments of the original equipment and replacement tiremarkets. Coverage of the F1TM Shanghai Grand Prixcontinues to heighten the visibility and awareness of theBridgestone brand within China, while also helping toenhance our technological advantage and product reliability.

In the truck and bus tire sector, BSCN aims to offer abroad range of high-quality products to target the needs offleet operators facing highly demanding conditions onChina’s expanding road network.

Regional infrastructure developmentReflecting the market’s high growth potential, theBridgestone Group continues to invest in a verticallyintegrated production and distribution chain in China.Major production facilities include tire plants in Tianjin,Shenyang and Wuxi and a steel cord plant in Shenyang.Production of truck and bus radial tires and steel cordbegan in 2007 at new facilities in Huizhou. A syntheticrubber plant in the same part of the country is due tocome on stream in 2008.

In 2007, underlining the commitment to establish along-term presence as a quality brand in China, BSCNcompleted the construction of a proving ground to test

CHINA TIRE SBU

23Bridgestone annual report 2007

Continuous efforts are being madeto expand the retail network inEurope, while enhancing quality.

The first truck and bus tireproduced at the new plant inHuizhou, China.

A more extensive retail networkwill ensure a higher level ofsales and service quality in theAsia and Oceania region.

products for the local original equipment andreplacement tire markets. The facility opened in March2008. Covering about an 84-hectare site, the provingground is specifically designed to test high-performance tires. It includes a 900-meter high-speedstraight as well as stretches designed to test tire safety,handling and performance under various high-speedconditions. Besides development testing, BSCN plansto use the facility for various promotional and trainingpurposes. The Bridgestone Group views China as a keymarket, and is therefore implementing comprehensivemeasures spanning production, sales and technology.

Market trends and performanceSustained high raw material costs were a commonfeature of markets across the region due to highprices for oil and natural rubber. Automobile salesdipped in volume terms in some markets, especiallyThailand, Malaysia and Taiwan. Market conditionswere particularly challenging in Thailand, where acombination of political instability, high oil prices, asluggish economy and a rising local currency servedto depress domestic demand as well as exports.Low-priced tires from low-cost manufacturers,especially Chinese producers, made inroads into anumber of markets across the region.

The regional SBU posted higher sales and profitsthan in fiscal 2006 despite the various financialpressures on the top and bottom line. Performanceswere good in Thailand, Indonesia and India, whereassales declined compared with the previous year inTaiwan and New Zealand. In Thailand, ThaiBridgestone Co., Ltd. was able to overcomeincreasingly harsh market conditions by enhancingproductivity while boosting sales. This involvedincreasing prices, improving the mix and reinforcing thein-market retail presence of the Bridgestone Group.

Strategy and outlookThe strategy for the Asia & Oceania region remains inline with the global approach of “quality-led growth.”Bridgestone Group companies are working to move up-market to differentiate the brand by focusing on productand service quality, while raising prices. The successfulresults achieved in Thailand during 2007 in the face of adifficult market epitomize this strategy in action.

At the product level, Bridgestone Groupcompanies focused on upgrading the sales mix byincreasing the proportion of strategic products sold,especially UHP (ultra-high-performance) and runflattires. In the commercial vehicle sector, BridgestoneGroup companies aim to promote a shift to radialtires while also selling more tubeless products.

ASIA & OCEANIA TIRE SBU

24

Review of Operations l Tires

Regional infrastructure developmentBridgestone Group companies continue to invest in higherproduction capacity in the region to support a strategy ofupgrading the sales mix to include a greater proportion ofhigh-performance tires. Increasing production capacity isalso important for optimizing the region’s role as a globalexport base for strategic products.

During 2007, Bridgestone Corporation announcedplans to increase daily capacity for passenger car and lighttruck radial tires at the Indore plant in India (by 4,500 unitsto 15,000 units) and at the Karawang plant in Indonesia (by8,400 units to 27,000 units). In January 2008, ThaiBridgestone Co., Ltd finalized plans to increase productioncapacity for passenger car radial tires at the Nong Khaeplant in Thailand. Daily capacity is scheduled to rise by6,000 units to 36,500 units by late 2010.

Elsewhere, Thai Bridgestone Co., Ltd beganconstruction on a new proving ground located near theNong Khae plant. The new facility, which will be roughlyten times the size of the existing course, will be used totest tires for the original equipment and replacementsectors specifically for the Thai market, and to enhance thespeed and efficiency of development assessment andperformance verification. The facility will also be used forlocal sales promotion activities and training exercises forpeople inside and outside the company. Additionally, theestablishment of a development structure focused on othercountries in Asia other than Thailand will contribute to theadvancement of motorization in the entire Asian region.

Channel developmentIn February 2008, an agreement was announced underwhich Bridgestone Group companies in the Asian regionwill acquire Shell Autoserv retail stores — 64 stores inThailand and eight in Malaysia. This move promises tofurther strengthen the Bridgestone Group’s retail presenceand enhance its ability to respond to continuing growth intire demand in those markets. The existing retail networkcomprises 178 stores in Thailand and 201 stores inMalaysia, consisting of both company-owned stores andfranchise shops. These provide car maintenance services,with a primary focus on tire sales.

Supported by the high price of oil, strong economicexpansion and high levels of construction activitycontinued to drive growth in regional demand for tires in2007. Some of the best-performing markets for theBridgestone Group within this region were oil-producingnations in the Middle East. Sales volume and revenuewere ahead of the prior year. Product launches such asthe POTENZA Adrenaline and Dueler Sports helpedboost sales of strategic tire products.

Bridgestone’s strategy in the Middle East and Africa is to

increase sales prices and improve the product mix to offsetthe effects of high raw material prices and the strength of theyen. Such factors are expected to persist in 2008.

Bridgestone South Africa (Pty) Ltd., a wholly-ownedsubsidiary of Bridgestone South Africa Holdings (Pty)Ltd., started mass production and shipping of runflat tiresat its tire plant in Brits in October 2007. With this, theBridgestone Group now boasts a quadripartiteproduction system of runflat tires spanning Japan, theUnited States, Poland and South Africa. The runflat tiresbeing produced are 205/55R16 TURANZA ER300, andapproval has been gained to use them on new BMW 3Series automobiles produced in South Africa.

RussiaBrisk economic expansion continues to support robustgrowth in unit sales within the Russian passenger carmarket, and demand for foreign tire brands has risensteadily. The market for imported winter passenger cartires is a particular target for Bridgestone Corporation.For example, the new BLIZZAK WS60 studless winter tirewas introduced to critical acclaim during 2007.

Bridgestone is investing in sales and distributioninfrastructure in the Russian market to build sales torespond to growing demand.

Specialty tires are key strategic products for theBridgestone Group. These sectors are ones where theBridgestone Group aims to translate cutting-edgetechnical superiority and an outstanding business modelinto high-value-added brand differentiation, therebyproviding a competitive edge over the long term.

Off-the-road tiresRapid growth in China, India and other emergingeconomies is driving demand for mineral resources,supporting a boom in mining worldwide. Underpinned bythese factors, demand for off-the-road tires used inconstruction and mining equipment, especially large andultra-large off-the-road radial tires, continued to outstripsupply during 2007.

Sales grew by more than 25% in fiscal 2007compared with the previous year. This reflected theexpansions in capacity at the Hofu and Shimonosekiplants in Japan along with successful efforts to improvemanufacturing efficiency and thus maximize productivity.Operating profits were significantly higher, due in part tothe effects of yen depreciation and higher selling prices.

With the expansions in capacity at the Hofu andShimonoseki plants, sales are forecast to grow further in2008 due to continuing strong demand. While aneconomic slowdown in the United States could depressdemand for small and medium-sized radial tires used on

MIDDLE EAST & AFRICA TIRE SBU

SPECIALTY TIRE SBU

25Bridgestone annual report 2007

Bridgestone tires for constructionand mining equipment areemployed at resourcedevelopment sites worldwide.

High-quality services promoteincreased sales of POTENZAAdrenaline, Dueler Sports andother strategic products.

construction equipment, Bridgestone Corporation(“Bridgestone”) expects robust demand fromconstruction machinery makers. Yen appreciationand high raw material costs are expected to putpressure on profitability.

Responding to growing global demandThe Bridgestone Group is one of the few companieswith the technical and production capabilities to makelarge and ultralarge off-the-road radial tires, which areidentified as competitive and strategic products.Based on projections of sustained growth in globaldemand in this market, Bridgestone is constructingan entirely new production facility in the Japanese cityof Kitakyushu to ensure a stable future supply ofultralarge radial tires for construction and miningequipment applications. The new plant is due tocommence operations in the second half of 2009. Inline with the extended mining boom, Bridgestoneannounced plans in 2007 to expand the capacity ofthe Kitakyushu plant beyond the original plan.

Aircraft tiresSales grew by more than 30% compared with theprevious year. This demonstrated the success of theBridgestone Group strategy over the past few yearsto secure a major share of the growing market forradial tires based on the incorporation of advancedtechnology into the product lineup.

Although the US economic slowdown impliessome uncertainty, prevailing growth trends areexpected to continue in 2008. Bridgestone expects afurther double-digit advance in sales, in part reflectingthe start-up of production of aircraft radial tires at itsTokyo Plant in addition to its Kurume Plant in Japan.

A long-term shift to radialsProjections by Boeing and Airbus show the growth incommercial airline passenger traffic over the next 20years will average about 5% per year. Demand foraircraft tires continues to expand in line with thistrend. Within this market, demand for aircraft radialtires is growing at double-digit rates as airlinesincreasingly opt for the benefits of radial tires overbias tires when new aircraft models join a fleet.

Compared with bias tires, aircraft radial tires havelower weight and require less frequent retreading.Such factors promote reduced operating coststhrough savings in fuel and maintenance. For thesereasons, demand for aircraft radials — and for relatedretreading services — is expected to generate solidgrowth over the long term.

Strengths of the Bridgestone GroupHarsh usage conditions demand the incorporation of a full range of advanced technologies into aircraft

The Karawang Plant of ourIndonesian subsidiary aims toincrease production capacity ofhigh-performance tires tostrengthen its position as a keysupplier of strategic productswithin the Bridgestone Group.

26

Review of Operations l Tires

Bridgestone’s outstandingtechnological expertise is alsoreflected in radial tires formotorcycles.

tires — an area where Bridgestone excels. Bridgestonehas also developed a sophisticated business modeland global supply chain featuring production basesaround the world to satisfy retreading demand. In ahighly competitive market, Bridgestone has won praisefrom customers for its overall business packagesolutions developed for this sector.

Augmenting the regional coverage ofBridgestone’s supply infrastructure, a new retreadingfacility began operations in Qingdao, China, withmass-production starting in July 2007. Bridgestonealso relocated its retreading plant in January 2007, toMayodan, North Carolina (USA). This furtherexpanded the presence of Bridgestone in the keyChinese and US markets.

Equipping a new generation of aircraftBridgestone radial tires are standard equipment on anew generation of airliners that promise to carrypassengers around the world for many years tocome. The Airbus A380 made its maiden commercialflight in October 2007. Bridgestone’s RRR(Revolutionarily Reinforced Radial) tire is also beingfitted to the Boeing 787, for which Bridgestoneserves as a sole supplier.

Motorcycle tiresDemand for motorcycle radials was strong in Europeand North America in 2007, although sales droppedoff somewhat later in the year in the United States.Demand was flat in Japan. Boosted by buoyant levelsof exports and currency factors, sales were morethan 15% higher than in fiscal 2006. Sales areexpected to remain on a par with this level in 2008,reflecting a projected slowdown in OEM demand.

The long-term trend remains positive formotorcycle radial tires, especially in the road sportsmarket, where most new high-performancemotorcycle models are now fitted with radial tires.Bridgestone is investing in sales and marketinginfrastructure for motorcycle radial tires to build salesover the medium to long term.

Since 2002 Bridgestone has sponsored teams inthe MotoGP class of the FIM Road RaceChampionship, which represents the pinnacle of two-wheel road racing. Casey Stoner of Australia won theMotoGP series championship in 2007 on aBridgestone-shod Ducati. This astonishingachievement helped to demonstrate the technicalexcellence of Bridgestone high-performance radialtires. In 2008, Bridgestone will begin worldwide salesof the BATTLAX BT-016 HYPERSPORT motorcycleradial tire, which incorporates technology amassedthrough the development of tires for MotoGP. Thisnew tire displays excellent performance, includingbraking, cornering and acceleration.

The first production model ofthe latest next generationjetliner by Airbus known asthe A380 has been equippedwith Bridgestone’s aircraftradial tires.

© AIRBUS S.A.S. 2007 _ photo by exm company / H. GOUSSÉ

Sales of anti-seismic rubberhave been brisk in Japan.

27Bridgestone annual report 2007

CONCENTRATING RESOURCES ON HIGH-

VALUE-ADDED PRODUCTS IN AREAS WITH

GROWTH POTENTIAL

The diversified products segment comprises a broad range of chemical and industrial products,the diversified products business of Bridgestone Americas, bicycles and sporting goods.

Consolidated segment sales amounted to ¥639.8 billion (net of inter-segment transactions) infiscal 2007, an increase of 7% relative to the previous year. Operating income rose 6% to ¥54.7billion. Business was particularly strong in automotive components and the commercial buildingmaterials operations in the United States. Segment capital expenditures totaled ¥31.5 billion.

Review of Operations l Diversified Products

Sales (net of inter-segment transactions)

¥ billion

Operating income¥ billion

2007

2006

2005

2004

2003

2007

2006

2005

2004

2003

639.8 54.7

598.1

538.4

488.7

467.5

51.8

45.9

36.5

34.6

DIVERSIFIED PRODUCTS SBU

Besides tires, Bridgestone Corporation manufactures awide variety of rubber and chemical products. In theautomotive sector, these products include polyurethanefoam seat pads, antivibration rubber and othercomponents. Bridgestone also supplies industrialproducts and construction materials, including buildingmaterials, conveyor belts and related ore-transportingsystems for mining applications.

Multi-rubber bearings, which are fitted to buildings tohelp absorb seismic shock during an earthquake, areanother example of cutting-edge Bridgestone technologywith practical safety applications. Other applied industrialrubber products include rubber tracks for specializedvehicles and office equipment products such assemiconductive rollers.

Bridgestone is also a leading company in a number ofapplied materials fields, including interlayer adhesive filmsfor laminated glass (used in solar cells) and performancefilms used in plasma display panels.

Fiscal 2007 business performanceBridgestone’s diversified products segment reportedhigher sales on a consolidated basis. This marked the fifthconsecutive year of growth and once again demonstratedthe effectiveness of Bridgestone’s strategy of selectionand concentration of resources. Higher sales prices, salesgrowth and efforts to mitigate higher raw material costs

enabled Bridgestone to overcome continued high prices forkey raw materials such as natural rubber and steel products.Profits exceeded the prior year’s results (when 2006results are adjusted to account for organizational changes).

High-performance films were a major contributor togrowth. PDP filters and adhesive films for solar moduleswere two globally marketed products that achievedsubstantial growth in sales. Targeting the constructionindustry in Japan, Bridgestone posted significantly highersales growth of multi-rubber bearings for absorbingseismic vibrations and components for residential waterand air piping systems. However, sales of materials formarine civil engineering applications were downcompared with the previous year due to a decrease inpublic works investment.

Business strategy and outlookBridgestone possesses a varied portfolio of diversifiedproducts based on its expertise in rubber and relatedmaterials. Bridgestone is in the process of undertaking astrategic review to identify those products andbusinesses with the greatest future growth potential.Going forward, the strategy is to concentrate resourceson these areas of growth. By developing new productsbased on original, advanced technology and by creatingnew business models that generate added value throughexceptional quality delivered using market-orientedsolutions, the ultimate objective is to contribute to higherearnings growth at the consolidated level.

28

Review of Operations l Diversified Products

In the applied materials sector, Bridgestone has anumber of emerging businesses with great promise thatare in late-stage technical development, including ultra-high-purity silicon carbide (PureBeta) and liquid powderfor creating electronic paper displays.

Market conditions are expected to be more difficult infiscal 2008 due to the strength of commodity prices andthe sub-prime crisis on the US house-building sector.Bridgestone plans to focus on enhancing productivitywhile mitigating the effects of high raw material costs.

EVA adhesive film for solar modulesWith global demand for solar power continuing to growsteadily, demand for materials used in the production ofsolar modules is on the rise. Bridgestone supplies EVA(ethylene vinyl acetate) film as an adhesive material forbinding the silicon-based photovoltaic cell to a glasssubstrate in solar modules. Bridgestone plans to doublemonthly production capacity of EVA film by late 2010.Please refer to the Special Feature section (p. 16) forfurther details on this strategic growth product.

The diversified products business in the Americas mainlyconsists of roofing and building materials, vehicle andindustrial air springs, fibers and textiles, natural rubber andpolymers. In North America, BFS Diversified Products,LLC (“BFDP”) (a subsidiary of Bridgestone AmericasHolding, Inc.) is the market leader in thermoplastic andrubber roofing materials, as well as air springs.

Performance in 2007BFDP’s sales continued to grow in 2007 and exceededthe prior year’s results, although growth was not at thelevel originally projected due mainly to lower demandwithin the construction products segment. Operatingincome declined due to the impact of higher raw materialcosts and a softening in the construction productsbusinesses. This was somewhat offset by a goodperformance in the polymers and air spring business units.

Outlook for 2008Sales in the construction products businesses are expectedto grow in 2008 although not as significantly as 2007 as theNorth American commercial construction markets continueto soften. The continuing economic slowdown and higherraw material costs are expected to also impact the air springand polymers businesses, although the expected salesgrowth in the construction products and fibers and textilesbusinesses is projected to offset this impact.

Although slower than in prior years, BFDP expectspositive sales growth in 2008. In addition to the overall

anticipated increase in sales in the construction productssector, sales are expected to grow as the result ofincreased market penetration for items such as theGenFlex line of commercial roofing products.

Bridgestone Cycle Co., Ltd. (“Bridgestone Cycle”), themain Bridgestone Group firm in this sector, has been theleading domestic manufacturer of bicycles in Japan formore than 40 years.

Market trends and business performanceLow-priced imports, mainly from China, continued tomake inroads into the Japanese market in 2007 whiledomestic output in Japan declined by about 20%.

Although unit sales of bicycles were slightly lowerthan in the previous year, Bridgestone Cycle recordedsales growth of 5% over fiscal 2006 due to significantlyhigher sales of high-value-added electric power-assistedmodels, along with an increase in average sales pricesacross the range.

Business strategy and outlookBridgestone Cycle’s aim is to increase sales and profitsby upgrading the sales mix while maintaining a steadyshare of the Japanese market. This involves promotinghigher-value-added models such as the Assista andencouraging consumers to trade up by stimulatingdemand for fashionable and eco-conscious models.Bridgestone Cycle is promoting bicycles as a healthy andeco-friendly transport alternative for environmentallyconcerned consumers living in Japan’s major cities.

Bridgestone Cycle expects market conditions toremain harsh in fiscal 2008. The company aims toimprove the sales mix by selling more high-value-addedproducts such as electric power-assisted models.

Smart eco-friendly technologyIn 2007, Bridgestone Cycle introduced models featuringan original intelligent belt-drive system that can even befitted to 8-gear sports bicycles. The new “Smart Belt”mechanism allows smooth, noiseless gear changes.Bridgestone Cycle has incorporated the new technologyinto some luxury models.

Quality firstResponding to concerns about the number of accidents,in 2004 the Japan Bicycle Association (JBA) introducedthe BAA (Bicycle Association Approved) mark as avoluntary quality standard to address perceived safetyproblems. Bridgestone Cycle is leading the way indesigning and manufacturing models that conform to theBAA quality standard. The approach is also beingextended to sports bikes.

BRIDGESTONE AMERICAS’

DIVERSIFIED PRODUCTS BUSINESS

BICYCLES

29Bridgestone annual report 2007

Ave Maria is a new 5,000 acreCatholic community located justeast of Naples, Florida. The designof the Oratory (featured in thephoto) includes both BFDP’sroofing and panel systems.

A large number of fans comeout to enjoy Bridgestone Openin Japan.

Not only tires but otherproducts such as antivibrationrubber are also supplied foruse in automobiles.

The Anchor RHM9 Pro is a top-end sports bike featuring a ruggedfull-carbon frame.

Bridgestone Sports Co., Ltd. (“Bridgestone Sports”)is the market leader in Japan in sales of sportinggoods such as golf balls. The main BridgestoneGroup firm in this sector, Bridgestone Sports alsosupplies sporting goods aimed at tennis enthusiasts.

Market trends and business performanceThe Japanese market for golfing products postedpositive growth in 2007. This reflected higheradmissions at golf courses and the increasedpopularity of the sport among women. The apparelsegment of the market saw the best growth. Incontrast, the market for tennis-related goods shrankrelative to the previous year.

Bridgestone Sports posted lower profits on flatsales during 2007. This was mainly due to aslowdown in sales of Bridgestone’s premium golfballs and clubs, which was exacerbated by asustained increase in the cost of raw materials.

Business strategy The golfing population in Japan is growing modestlyat present and is expected to decrease over the longterm due to the impact of a dwindling birthrate andan aging population. Competition is also intensifyingwith the entry of foreign brands into the market, whilethe market pull of large retail chains is increasing. Asa result, the environment surrounding the sportsindustry is expected to remain tough.