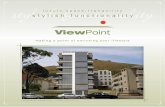

Apartments in Padmavati Offer Best of City life in Green Environs

Cleveland Green Apartments

-

Upload

ryan-sloan -

Category

Documents

-

view

218 -

download

0

Transcript of Cleveland Green Apartments

-

8/6/2019 Cleveland Green Apartments

1/26

Is project in Qualified Census Tract or Difficult to Develop Area?

New Construction/Adaptive Reuse:

Is this project a follow-on (Phase II, etc) to a previously-awarded tax credit development project?

If yes, list names of previous phase(s):If yes, list names of previous phase(s):

Will the project meet Energy Star standards as defined in Appendix B?

Does a community revitalization plan exist?

Target Population: Family

Will the project be receiving project based federal rental assistance?

If yes, provide the subsidy source:If yes, provide the subsidy source: and number of units:and number of units:

Indicate below any additional targeting for special populations proposed for this project:

Print Preview - Full Application

Tax Credits, RPP Loans, and/or Tax Exempt Bond Loans

Project Description

Project Name: Cleveland Green Apartments

Address: Off Bratton Drive Extension

City: Garner County: Johnston Zip: 27529

Census Tract: 411 Block Group: 3

No

Political Jurisdiction: Johnston County

Jurisdiction CEO Name: First: Last:Rick Hester Title: County ManagerJurisdiction Address: 207 E. Johnston Street

Jurisdiction City: Smithfield Zip: 27577

Jurisdiction Phone: (919)989-5100

Site Latitude: 35.66

Site Longitude: -78.59

Project Type: New Construction

No

Rehab:

Is this project a previously awarded tax credit development?

If yes, what year were credits awarded?:

Number of residents holding Section 8 vouchers:

Yes

No

Will the project use steel and concrete construction and have at least 4 stories? No

Will the project include a Community Service Facility under IRS Revenue Ruling 2003-77? No

If yes, please describe:

No

Mobility impaired handicapped: 5% of units comply with QAP Section IV(F)(3) (in addition to the units required by other federal andstate codes.)

-

8/6/2019 Cleveland Green Apartments

2/26

-

8/6/2019 Cleveland Green Apartments

3/26

Indicate below an individual or a validly existing entity (a corporation, nonprofit, limited partnership or LLC) as the official applicant. UnderQAP Section III(C)(5) only this individual or entity will be able to make decisions with regard to this application. If awarded the applicantmust become part of the ownership entity. The applicant will execute the signature page for this application.

Applicant Information

Applicant Name: United Developers, Inc.

Address: 3800 Raeford Road

City: State: NC Zip:Fayetteville 28304

Contact: First: Last: Title:Murray Duggins

Telephone: (910)485-6600

Alt Phone: (910)485-6600

Fax: (910)483-4274

Email Address: [email protected]

NOTE: Email Address above will be used for communication between NCHFA and Applicant.

-

8/6/2019 Cleveland Green Apartments

4/26

Total Site Acreage: Total Buildable Acreage:

If buildable acreage is less than total acreage, please explain:

Identify utilities and services currently available (and with adequate capacity) for this site:

Storm Sewer Water Sanitary Sewer Electric

Is the demolition of any buildings required or planned?

If yes, please describe:

Are existing buildings on the site currently occupied?

If yes:(a) Briefly describe the situation:

(b) Will tenant displacement be temporary?

(c) Will tenant displacement be permanent?

Is the site directly accessed by an existing, paved, publicly maintained road?

If no, please explain:

Is any portion of the site located inside the 100 year floodplain?If yes:(a) Describe placement of project buildings in relation to this area:

(b) Describe flood mitigation if the project will have improvements within the 100 year floodplain:

Site Description

7.38 7.38

No

No

Yes

No

-

8/6/2019 Cleveland Green Apartments

5/26

-

8/6/2019 Cleveland Green Apartments

6/26

Does the owner have fee simple ownership of the property (site/buildings)?

If yes provide:

Purchase Date: Purchase Price:

If no:

Site Control

No

(a) Does the owner/principal or ownership entity have valid option/contract to purchase the property? Yes

(b) Does an identity of interest (direct or indirect) exist between the owner/principal or ownership entity with the option/contract for

purchase of the property and the seller of the property?If yes, specify the relationship:

No

(c) Enter the current expiration date of the option/contract to purchase: 10/15/2007

(D) Enter Purchase Price: 811,800

-

8/6/2019 Cleveland Green Apartments

7/26

Present zoning classification of the site:

Is multifamily use permitted?

Are variances, special or conditional use permits or any other item requiring a public hearing needed to develop this proposal?

If yes, have the hearings been completed and permits been obtained?If yes, specify permit or variance required and date obtained. If no, describe permits/variances required and schedule for obtainingthem:

Are there any existing conditions of historical significance located on the project site that will require State Historic Preservation office

review?

If yes, describe below:

Are there any existing conditions of environmental significance located on the project site?

If yes, describe below:

Zoning

1H1

Yes

No

No

No

-

8/6/2019 Cleveland Green Apartments

8/26

-

8/6/2019 Cleveland Green Apartments

9/26

EMail: [email protected] Nonprofit: No

-

8/6/2019 Cleveland Green Apartments

10/26

-

8/6/2019 Cleveland Green Apartments

11/26

Notes

** Please refer to the Income Limits and Maximum Housing Expense Table to ensure that Total Monthly Tenant Expenses for lowincome units are within established thresholds.

-

8/6/2019 Cleveland Green Apartments

12/26

Specify Low Income Unit Targeting in table below. List each applicable targeting combination in a separate row below. Click [Add] tocreate another row. Click "X" (at the left of each row) to delete a row. Add as many rows as needed.

Total Low Income Units:

Note: This number should match the total number of low income units in the Unit Mix section.

Targeting

# BRs Units %

2 16 targeted at 30 percent of median income affordable to/occupied by

2 24 targeted at 50 percent of median income affordable to/occupied by

2 24 targeted at 60 percent of median income affordable to/occupied by

3 6 targeted at 30 percent of median income affordable to/occupied by

3 10 targeted at 50 percent of median income affordable to/occupied by

3 8 targeted at 60 percent of median income affordable to/occupied by

88

-

8/6/2019 Cleveland Green Apartments

13/26

Estimated pricing on sale of Federal Tax Credits: $0.

Remarks concerning project funding sources:(Please be sure to include the name of the funding source(s))

Funding Sources

Source AmountNon-

Amortizing*Rate(%)

Term(Years)

Amort.Period(Years)

AnnualDebt

Service

Bank Loan 2,410,820 7.25 20 30 197,352

RPP Loan

Local Gov. Loan - Specify:

RD 515 Loan

RD 538 Loan - Specify:

AHP Loan

Other Loan 1 - Specify:

Other Loan 2 - Specify:

Other Loan 3 - Specify:

Tax Exempt Bonds

State Tax Credit(Loan) 746,220 0 30 30 0

State Tax Credit(Direct Refund)

Equity: Federal LIHTC 5,422,760

Non-Repayable Grant

Equity: Historic Tax Credits

Deferred Developer Fees

Owner Investment

Other - Specify:

Total Sources** 8,579,800

* "Non-amortizing" indicates that the loan does not have a fixed annual debt service. For these items, you must fill in 20-year debtservice below.

** Total Sources must equal total replacement cost in Project Development Cost (PDC) section.

93

-

8/6/2019 Cleveland Green Apartments

14/26

Development Costs

Item Cost Element TOTAL COSTEligible Basis

30% PV 70% PV

1 Purchase of Building(s) (Rehab / Adaptive Reuse only)

2 Demolition (Rehab / Adaptive Reuse only)

3 On-site Improvements 560,000 560,0004 Rehabilitation

5 Construction of New Building(s) 4,600,000 4,600,000

6 Accessory Building(s)

7 General Requirements 305,000 305,000

8 Contractor Overhead 105,000 105,000

9 Contractor Profit 325,000 325,000

10 Construction Contingency 175,000 175,000

11 Architect's Fee - Design (11 + 12 = max 3% lines 2-10) 75,000 75,000

12 Architect's Fee - Inspection

13 Engineering Costs

SUBTOTAL (lines 1 through 13) 6,145,000

14 Construction Insurance (prorate)15 Construction Loan Orig. Fee (prorate)

16 Construction Loan Interest (prorate) 75,000 75,000

17 Construction Loan Credit Enhancement (prorate)

18 Construction Period Taxes (prorate) 7,000 7,000

19 Water, Sewer and Impact Fees 200,000 200,000

20 Survey

21 Property Appraisal 4,500 4,500

22 Environmental Report 2,500 2,500

23 Market Study 4,200 4,200

24 Bond Costs

25 Bond Issuance Costs

26 Placement Fee27 Permanent Loan Origination Fee 24,100

28 Permanent Loan Credit Enhancement

29 Title and Recording 1,000

SUBTOTAL (lines 14 through 29) 318,300

30 Real Estate Attorney 45,000 45,000

31 Other Attorney's Fees

32 Tax Credit Application Fees (Preliminary and Full) 2,200

33 Tax Credit Allocation Fee (0.58% of line 59, minimum $7,500) 42,400

34 Cost Certification / Accounting Fees 8,700 8,700

35 Tax Opinion

36 Organizational (Partnership)

37 Tax Credit Monitoring Fee 48,400SUBTOTAL (lines 30 through 37) 146,700

38 Furnishings and Equipment 15,000 15,000

39 Relocation Expense

40 Developer's Fee 800,000 800,000

41 Other Basis Expense (specify)

42 Other Basis Expense (specify)

43 Rent-up Expense

44 Other Non-basis Expense (specify)

45 Other Non-basis Expense (specify)

-

8/6/2019 Cleveland Green Apartments

15/26

-

8/6/2019 Cleveland Green Apartments

16/26

Please provide a detailed description of the proposed project:

Construction (check all that apply):

Brick Vinyl Wood HardiPlank Balconies/Patios Sunrooms Front Porches

Front Gables or Dormers Wide Banding or Vertical/Horizontal Siding

Other:

Have you built other tax credit developments that use the same building design as this project?

If yes, please provide name and address:

Market Study Information

Cleveland Green Apartments will be located on just over 7 acres of land in Johnston County. It willbe an 88 unit family project located in 9 buildings with a seperate office building/community room.The rent structure has been made very affordable 25% of the units targeting those at 30% of themedian income. The remaining units will target those at 50% and 60% of the median income.However, all of the units are affordable to those at 50% of the median income.Shopping, medical services, and restaurants are only a quarter mile from the site.

Yes

Golfview Apartments4131 Fescue CourtHope Mills, NC

Crosswinds Green I & II3415 Town StreetHope Mills, NC

Longview Apartments117 Longview Drive

Fayetteville, NC

Blanton Green I & II1024 Lauren McNeill LoopFayetteville, NC

Rosehill West Apartments1945 James Hamner WayFayetteville, NC

Raeford Green Apartments300 Southern AvenueRaeford, NC

Woodgreen I & II Apartments200 Bradford DriveAberdeen, NC

Southview Green Apartments3143 Round Grove PlaceHope Mills, NC

Palmer Green Apartments I380 West Palmer AvenueRaeford, NC

Bunce Green ApartmentsDistinct CircleFayetteville, NC

Riverview Green Apartments

-

8/6/2019 Cleveland Green Apartments

17/26

Site Amenities:

Onsite Activities:

Landscaping Plans:

Interior Apartment Amenities:

Do you plan to submit additional market data (market study, etc.) that you want considered?

If yes, please make sure to include the additional information in your pre-application packet.

Riverview CourtRoanoke Rapids, NC

Eastside Green Apartments715 Duggins WayFayetteville, NC

Legion Crossing ApartmentsIreland DriveHope Mills, NC

Tokay Green ApartmentsUnited DriveFayetteville, NC

Palmer Green II ApartmentsWest Palmer AvenueRaeford, NC

Blanton Green III Apartments1024 Lauren McNeill LoopFayetteville, NC(under construction)

The site will include a resident computer center, playground area, covered picnic area, sitting areas,tot lot, gazebo, and covered patio with seating.

Support Service Coordinator on-site.

Above average landscaping with irrigation system.

Apartments will be furnished with a range hood, disposal, refrigerator (frost free), dishwasher,storage, W/D hookups, mini-blinds, pantry, with ceiling fans, carpet, vinyl, VCT, and central heat andair. The living rooms will be equipped with data connection ports.

No

-

8/6/2019 Cleveland Green Apartments

18/26

-

8/6/2019 Cleveland Green Apartments

19/26

Other facilities or services:

Schools1.8 Medical Offices.25

Public Transportation Stop0 Bank/Credit Union.25

Convenience Store.25 Restaurants.25

Basketball/Tennis Courts1.8 Professional Services.25

Public Parks10 Movie Theater10

Gas Station.25 Video Rental1

Library6.8 Public Safety (Fire/Police)4.4

Fitness/Nature Trails.25 Post Office.2

Public Swimming Pools

*The new Johnston Memorial Hospital will soon be built within 5 miles of the site.

-

8/6/2019 Cleveland Green Apartments

20/26

-

8/6/2019 Cleveland Green Apartments

21/26

-

8/6/2019 Cleveland Green Apartments

22/26

Project Operations (Year One)

Projected Operating Costs

Administrative Expenses

Advertising 2,000

Office Salaries 9,500

Office Supplies 4,000

Office or Model Apartment Rent

Management Fee 60,000

Manager or Superintendent Salaries 14,000

Manager or Superintendent Rent Free Unit

Legal Expenses (Project) 3,500

Auditing Expenses (Project) 4,000

Bookkeeping Fees/Accounting Services

Telephone and Answering Service 3,000

Bad Debts

Other Administrative Expenses (specify):

Vehicle expense and mileage1,000

SUBTOTAL 101,000

Utilities Expense

Fuel Oil

Electricity (Light and Misc. Power) 9,000

Water 4,000

Gas

Sewer 4,000

SUBTOTAL 17,000

Operating and Maintenance Expenses

Janitor and Cleaning Payroll 5,000

Janitor and Cleaning Supplies 5,000

Janitor and Cleaning Contract

Exterminating Payroll/Contract 8,000

Exterminating SuppliesGarbage and Trash Removal 8,000

Security Payroll/Contract 4,000

Grounds Payroll 14,000

Grounds Supplies 4,000

Grounds Contract

Repairs Payroll 8,000

Repairs Material 8,000

Repairs Contract

Elevator Maintenance/Contract

Heating/Cooling Repairs and Maintenance 7,000

Swimming Pool Maintenance/Contract

Snow RemovalDecorating Payroll/Contract

Decorating Supplies 1,200

Other (specify):

Miscellaneous Operating & Maintenance Expenses

SUBTOTAL 72,200

Taxes and Insurance

Real Estate Taxes 69,000

Payroll Taxes (FICA) 8,000

-

8/6/2019 Cleveland Green Apartments

23/26

Miscellaneous Taxes, Licenses and Permits 200

Property and Liability Insurance (Hazard) 27,000

Fidelity Bond Insurance

Workmen's Compensation 1,500

Health Insurance and Other Employee Benefits 1,900

Other Insurance:

SUBTOTAL 107,600Supportive Service Expenses

Service Coordinator 8,000

Service Supplies

Tenant Association Funds

Other Expenses (specify):

SUBTOTAL 8,000

Reserves

Replacement Reserves 22,000

SUBTOTAL 22,000

TOTAL OPERATING EXPENSES 327,800

ADJUSTED TOTAL OPERATING EXPENSES(Does not include taxes, reserves and resident support services) * 228,800

TOTAL UNITS(from total units in the Unit Mix section)

88

PER UNIT PER YEAR 2,600

-

8/6/2019 Cleveland Green Apartments

24/26

-

8/6/2019 Cleveland Green Apartments

25/26

MINIMUM REQUIRED SET ASIDES (No Points Awarded):

Minimum Set-Asides

Select one of the following two options:

20% of the units are rent restricted and occupied by households with incomes at or below 50% of the median income (Note: NoTax Credit Eligible Units in the the project can exceed 50% of median income)

40% of the units are rent restricted and occupied by households with incomes at or below 60% of the median income (Note: NoTax Credit Eligible Units in the the project can exceed 60% of median income)

If requesting RPP funds:

40% of the units are occupied by households with incomes at or below 50% of median income.

State Tax Credit and QAP Targeting Points:

High Income county:

At least twenty-five percent (25%) of qualified units will be affordable to households with incomes at or below thirty percent (30%)of county median income.

At least twenty-five percent (25%) of qualified units will be affordable to and occupied by households with incomes at or belowthirty percent (30%) of county median income.

At least fifty percent (50%) of qualified units will be affordable to households with incomes at or below forty percent (40%) ofcounty median income.

At least fifty percent (50%) of qualified units will be affordable to and occupied by households with incomes at or below fortypercent (40%) of county median income.

Tax Exempt Bonds

Threshold requirement (select one):

At least ten percent (10%) of qualified units will be affordable to and occupied by households with incomes at or below fifty percent(50%) of county median income.

At least five percent (5%) of qualified units will be affordable to and occupied by households with incomes at or below forty percent(40%) of county median income.

Eligible for targeting points (select one):

At least twenty percent (20%) of qualified units will be affordable to and occupied by households with incomes at or below fiftypercent (50%) of county median income.

At least ten percent(10%) of qualified units will be affordable to and occupied by households with incomes at or below forty percent(40%) of county median income.

-

8/6/2019 Cleveland Green Apartments

26/26

PLEASE indicate which of the following exhibits are attached to your application. Others may be required as noted.

Full Application Checklist

A Nonprofit Organization Documentation or For-profit Corporation Documentation

B Current Financial Statements/Principals and Owners (signed copies)

C Ownership Entity Agreement, Development Agreement or any other agreements governing development services

D Management Agent Agreement

E Owner and Management Experience & Management Questionnaire (Appendix C)

F Letters from State Housing Agencies or designated monitoring agent verifying out of state experience

G Completed IRS Form 8821 (Appendix I)

H Local Government Letter or Letter from Certified Engineer or Land Surveyor Confirming Floodplain Designation with Mapshowing all flood zones (original on letterhead, no fax or photocopies)

I Local Government Letter Confirming Zoning including any pending notices or hearings (original on letterhead, no fax orphotocopies)

J Letters from Local Utility Providers regarding availability and capacity (original on letterhead, no fax or photocopies)

K Documentation from utility company or local PHA to support estimated utility costs

L Appraisal (required for land costs greater than $15,000 and for all Adaptive Re-use and Rehab projects)

M Site plan, floor plans and elevations for all projects. Scope of work for Adaptive Re-use and Rehab projects. (Full Size, 24 x36 inches)

N Hazard and structural inspection and termite reports (Adaptive Re-use and Rehab projects only)

O Copy of certificate of occupancy or proof of placed-in-service date (Rehabs Only)

P Proposed Relocation Plan including relocation budget and copies of notices. Required for all Rehabs and any projectsinvolving existing occupants of any dwellings to be rehabbed or demolished.

Q Evidence of Permanent Loan Commitment and other sources of funds ( i.e. Equity letter, AHP, RD and local governmentfunds). For Rehabs with existing loans provide 1) copies of loan documents, 2) current loan balances from existing lenderswith reserve balances, 3) letter from lender that outlines assumption requirements.

R Local Housing Authority Agreement and Project Based Rental Assistance Letter, if applicable (Sample letters provided inAppendix I). For projects with existing PBRA contracts, provide a copy of the current contract and bank statement or otherdocumentation verifying reserve balances and annual reserve contribution requirements.

S Statement regarding terms of Deferred Developer Fee. If a nonprofit is involved, a resolution from their board approvingdeferral of fee is required.

T Inducement Resolution (Tax-Exempt Bond Financed Projects only)

![T20 Concepts Green Apartments July 2013 [Compatibility Mode]](https://static.fdocuments.in/doc/165x107/58e65d7c1a28ab8d758b4c33/t20-concepts-green-apartments-july-2013-compatibility-mode.jpg)