Chapter 9 Banking and Accounting Procedures. Office Procedures for the 21 st Century, 8e Burton and...

-

Upload

wesley-edwards -

Category

Documents

-

view

221 -

download

3

Transcript of Chapter 9 Banking and Accounting Procedures. Office Procedures for the 21 st Century, 8e Burton and...

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.2

Banking and Accounting Procedures

Banking Procedures Accounting Procedures Ethics in Accounting Procedures International Currency Exchange

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.3

Banking Procedures

Traditional Banking Procedures Cashier’s check Bank draft Bank money order Traveler’s check Electronic funds transfer (EFT) Automated teller machines (ATMs) Direct payroll deposit

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.4

Banking Procedures (continued)

Automatic deposits Automatic debits Web banking Telephone transfers Check endorsements

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.5

Banking Procedures (continued)

Checks Establish checking account at bank Transfer of funds–ordinary checks

Check–written by depositor Drawer–also called maker; person who writes a

check Drawee–bank from which check is drawn Payee–person to whom the check is written

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.6

Banking Procedures (continued)

Cashier’s Check Also known as treasurer’s check or official check Written by an authorized officer of bank on its own

funds Guarantees payment to payee by drawer’s

bank Depositor obtains official check by writing bank

a check on his/her funds for amount plus fee

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.7

Banking Procedures (continued)

Bank Draft Check drawn by bank on its own funds in

another bank located either in same city or another city

Made payable to third party, and upon endorsement, may be cashed at bank on which it is drawn

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.8

Banking Procedures (continued)

Bank Money Order Requires endorsement of payee May be cashed at any bank Purchaser charged small fee Amount of money may be limited

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.9

Banking Procedures (continued)

Traveler’s Check Used in place of cash Must obtain in person and sign in presence

of selling agent Purchased from banks and credit unions If lost or stolen, will usually be refunded

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.10

Banking Procedures (continued)

Electronic funds transfer (EFT) Delivery system for electronic transactions No lost or stolen checks Payment made quickly and on time Major services—EFT, ATMs, centers for

electronic funds transfers, payment by telephone

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.11

Banking Procedures (continued)

Automated teller machines (ATMs) Many convenient locations Customers can obtain cash or make

deposits Requires EFT card and personal

identification number (PIN) or password

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.12

Banking Procedures (continued)

Debit card Used in place of checks Money is taken directly from the individual or

company’s checking account May be used as debit card or credit card When used as a debit card, requires a pin

number or password; when used as a credit card must sign sales slip

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.13

Banking Procedures (continued)

Direct Payroll Deposit Organization pays employees without checks Organization provides bank with magnetic tape

description of payroll disbursements made to the employees

Employee receives statement from company or third party

Statement shows gross payment, type and amount of deductions, and net payment

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.14

Banking Procedures (continued)

Automatic deposits Funds automatically deposited Electronic routing number and account

number are needed for deposit Routing number and bank account number

is usually printed on bottom of checks

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.15

Banking Procedures (continued)

Automatic debits Preauthorized automated transfer of funds

from one account to another account within same financial institution

For an individual or company From checking or savings Example: Payment of utilities Copy of canceled check, account number and

signature authorizing transfer is required

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.16

Banking Procedures (continued)

Web banking Must have access to Internet Primary functions

Easy online management of banking transactions

Ability to make electronic transfers Provides real-time information Software/password to access may be needed Requires ID

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.17

Banking Procedures (continued)

Telephone transfers Call the company, provide nine-digit routing

number of bank, bank account number, check number, and amount

May be charged a fee Company will draft the amount from your

checking account and bank honors check Payment can be made on exact due date,

avoiding late charges

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.18

Banking Procedures (continued)

Bank checks Stop-payment notification

Used when check is lost or stolen Used when check is written for incorrect amount Conditions of agreement are not met

Check endorsement

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.19

Banking Procedures (continued)

Endorsing Checks Check presented for cash or deposit must

be signed (endorsed) By the payee On reverse side of check Bank will accept for deposit checks that have

been endorsed by representative of payee Endorsement can be rubber stamped or

handwritten in ink

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.20

Banking Procedures (continued)

Three types of endorsements Blank endorsement Restrictive endorsement Full endorsement

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.21

Banking Procedures (continued)

Blank endorsement Consists only of signature of payee Payable to bearer Use with caution when depositing or

cashing checks

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.22

Banking Procedures (continued)

Restrictive endorsement Limits use of check Words such as “For deposit only” or “Pay to”

are written before organization’s name or depositor’s signature

Use when deposits are sent to bank by mail

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.23

Banking Procedures (continued)

Full endorsement Also called a two-party check Transfer check to specified person or

organization “Pay to the order of” followed by name of

person/organization receiving funds is written on check preceding signature of endorser

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.24

Banking Procedures (continued)

Bank deposits Preparing the cash/coin

Coin values per roll Currency preparation

Separate by denomination Arrange all president’s faces going in same direction Strap all currency that meets required amounts Each strap must contain same denomination

Preparing the deposit slip

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.25

Bank Statement Reconciliation

Statement issued by bank to depositor Shows previous month’s balance, deposits,

checks paid, bank charges, and ending balance

Comparison of bank balance on the statement with the checkbook balance To make comparison, checks listed on

statement are checked off in check register

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.26

Bank Statement Reconciliation (continued)

Steps to reconcile bank statement Record in the company’s checkbook all

automatic transactions not previously entered

+ any interest earned + automatic deposits - service charges - automatic payments - telephone transfers and charges

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.27

Bank Statement Reconciliation (continued)

Enter in company’s checkbook register a check mark for each canceled check and all deposits received by the bank listed on the bank statement

Total all outstanding checks (not paid by bank) Total all deposits shown in checkbook register

that are not on bank statement

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.28

Bank Statement Reconciliation (continued)

Adjust the bank statement balance Enter the checking account balance shown on front of

bank statement Add any deposits not yet shown on statement Subtract the total of outstanding checks

The adjusted bank statement balance from the reconciliation should agree with the adjusted checkbook balance

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.29

Bank Statement Reconciliation (continued)

If the adjusted bank statement balance and checkbook balance do not agree, follow these steps: Find the difference between the two Check the bank statement balance for errors Look for omission of checks and deposits Check for a math error in the check stubs

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.30

Accounting Procedures Petty cash fund

Established for small office expenditures Used for things such as

Messenger service, postage due on a package, or emergency purchase of office supplies

All expenses must be accounted for Balance petty cash fund regularly Keep the cash and completed vouchers in a box or

envelope and put them in a safe place Prepare a petty cash voucher for each expenditure

made Keep an accurate petty cash record, book, or

distribution sheet for each period; record each transaction in this record

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.31

Accounting Procedures (continued)

Replenish the petty cash fund periodically or soon enough to keep an adequate supply of cash on hand

To replenish the petty cash fund, balance the petty cash record, formally request a check for the amount needed to bring the fund amount back to its beginning balance

Submit records called for by the accounting department

Cash the check and enter the beginning amount on the first line of the “Explanation” column of the petty cash record

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.32

Accounting Procedures (continued)

Payroll Payroll register used to summarize each

employee’s pay for a particular period Summarizes each employee status

Wages earned Payroll deductions Final take-home pay

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.33

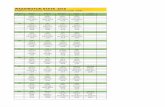

Accounting Procedures (continued)

Completing a payroll register In the payroll register, enter the employee’s

information—name, marital status, number of withholding allowances, hourly rate, regular hours worked and overtime hours worked

Calculate regular earnings Calculate overtime earnings Add regular and overtime earnings to determine gross

earnings

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.34

Accounting Procedures (continued)

Calculate social security (OASDI) by multiplying gross earnings by 6.2%

Calculate Medicare by multiplying gross earnings by 1.45%

Look up federal income tax in tax tables obtained from Circular E Employer’s Tax Guide if not provided for you

Enter any other deductions in the payroll register Total all deductions Subtract deductions from gross pay to determine net

pay Checks are written for the net pay amount to each

employee

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.35

Accounting Procedures (continued)

Financial statements Income Statement

Operating statement also called profit and loss statement showing money earned and expenses incurred

Balance Sheet Summarizes the balances of the assets Reports what a company is worth on any one given

day Assets, liabilities, and owner’s equity

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.36

Accounting Procedures (continued)

Budgeting Process of planning future business operations

and defining those plans, expressed in financial terms in a formal report

Estimate of income and expenses of all areas of organization for a certain period of time (month or year)

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.37

Accounting Procedures (continued)

Budget reports Provides the basis for analyzing and revising

spending activities Compares actual sales or costs with figures

budgeted Follow the budget by not overspending the

budgeted amount

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.38

Accounting Procedures (continued)

Office supplies inventory Record of supplies on hand Perpetual (permanent) inventory record

Inventory each item Keep balance accurate

Add to item when ordering more Subtract from item when removing

Decide if balance on hand is sufficient or if time to replenish

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.39

Accounting Procedures (continued)

Accounting department Handles cost control for company

Budgets have account titles and numbers Typically, managers are responsible for their area

Which accounts are used most often? How accounts may be used? Correct procedures for ordering and spending

Allowable expenses Department code to use

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.40

Ethics in Accounting Procedures

Auditors and accountants create the financial statements and must be the watch-dogs for accurately reporting information

Ethics is stressed in the accounting field by requiring CPAs to take an ethics course once every three years

High ethical standards are required in every phase of the office professional’s job

Office Procedures for the 21st Century, 8eBurton and Shelton

© 2011 Pearson Higher Education,Upper Saddle River, NJ 07458. • All Rights

Reserved.41

International Currency Exchange

Necessary when manager travels abroad

Locate current exchange rate Available via Internet Call local banks At airports with international flights

Exchange rates are quoted per $1 U.S