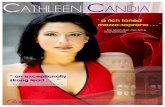

Cathleen Wright Director of Financial Aid Texas Lutheran University.

-

Upload

brandon-copeland -

Category

Documents

-

view

218 -

download

0

Transcript of Cathleen Wright Director of Financial Aid Texas Lutheran University.

Cathleen WrightDirector of Financial Aid

Texas Lutheran University

Must have written policies and procedures on the following:Deadlines for document submission and

consequences of failure to meet those deadlines

Method of notifying students of award changes due to verification

Required correction procedures for studentsStandard procedures for referring

overpayment cases to the Department.

Must give each applicant selected for verification a written statement explaining the following:Documents required for verificationStudent responsibilities

Correction procedures Submission deadlines Consequences of missing deadlines

Notification methods How you will notify of award changes Time frame of notification

Those selected by CPS Those selected by School

30% Verification Option – verify all CPS selected applicants up to 30% of the schools total federal aid applicants.Applications the school selects or that have

conflicting data do not count toward 30% Incarceration Recent Immigrant Spouse unavailable Parents unavailable

Death of the student Applicant verified by another school Pacific Island resident Not an aid recipient

Not eligible because of SAPWithdrew before receiving aid

Household Size Number Enrolled in College Adjusted Gross Income U.S. Income Tax Paid Certain Untaxed Income and Benefits

Note: Schools may choose additional items.

Verification worksheet Don’t have to verify if:

Same as reported and verified in previous year

ISIR/SAR received within 90 days after application signed

For dependent student, household size for married parent is 3 or is 2 if parent is single, divorced, separated or widowed.

Household size for married independent student is two or is one if student is single, divorced, separated or widowed.

Verification worksheet Don’t have to verify if:

Only one in college ISIR/SAR received within 90 days after

application signedThe family members the student lists are

enrolled at your school and you have confirmed their enrollment.

Acceptable documentation:Signed federal tax returnTax transcriptForm W-2Form 4868Signed statement

Can accept copies, fax or digital images Must be signed by at least one tax filer

or have tax preparer information

Must check tax returns for anyone reported on the FAFSA.

Type of form reported on FAFSA should match form filed.

AGI on FAFSA should match AGI on tax return unless:You adjust for divorce, separation or

professional judgment.

Untaxed income – any income excluded from federal income tax

Must verify:Child support IRA/Keoug deductions Interest on tax-free bondsAny other untaxed income reported on the

federal tax return. Not required to verify any untaxed

income or benefit received from a federal, state or local government agency that is based on need.

Students selected for verification must complete it.

Have authority to withhold disbursements until verification completed. (recommended)

Interim disbursementsPell Grant, Perkins and SEOG – can make

one disbursement for the student’s first payment period.

FWS – can employ for up to 60 daysStafford – can originate but not disburse

$400 tolerance for dollar itemsAGI + untaxed income – tax paid

No tolerance for non-dollar items

Correction increases eligibility If selected for verification - can disburse aid

on original EFC until corrected ISIR received If not selected for verification – do not

disburse aid until corrected ISIR received Correction decreases eligibility

If EFC decreases – must wait for corrected ISIR to be received to disburse aid.

Cannot update income or asset information if accurate at time FAFSA was filed.

Must update household size, number in college and dependency status in certain circumstancesDependency status – must update any time

during award year unless changed because of a marital status change. Must be updated regardless of whether student

selected for verification

Household size and number in collegeCannot be updated unless student selected

for verification If selected for verification – must be

updated to be correct at time of verification unless they changed due to change in marital status, in which case updating is not permitted.

Obligated to know: If student or parent was required to file a

tax returnThe correct filing status for the student or

parentThat an individual cannot be claimed by

more than one person. i.e. student cannot claim himself and also be claimed on parent tax return

Must resolve conflicting informationKeep in mind that if have W-2s, must verify

income from work on FAFSA or risk having unresolved conflicting information in the file

If income from work on tax return doesn’t match income from work on ISIR – must resolve

If have interest income on tax return but no assets – possible conflict – must resolve

If both parents filed Head of Household – must question whether that is correct filing status

NPRM published in June 18, 2010 Federal Register

Selection for verification:Removes 30% cap - must verify all selected

appsEliminates certain exclusions:

Pacific Island residents Incarcerated students Recent immigrants

Modifies exclusions for: Parent’s or spouse’s contact information

unknown Parent or spouse is mentally incapacitated

Verification items Variable selection that corresponds to the

most error-prone data elements for a particular student

Determined by ED and published in Federal Register each year

Eliminates the minimum five required data elements

Can accept tax data electronically loaded by IRS to FAFSA in lieu of tax returns

Require schools to verify ISIR before processing Special Condition/Professional Judgment changes

No tolerance – must make all corrections Must update student’s dependency

status Whether selected for verification or not Includes changes in marital status

Allows schools to make interim aid disbursements as long as: Verification is completed Corrections have been submitted Changes are not expected to affect eligibility

Questions?

![TRINITY LUTHERAN CHURCH TRINITY WEEKLY NEWS 12115 … · John Tobben (Hodgkin's Lymphoma) Janice Shull (wisdom & understanding) Kathryn Wright Karen Wilhelm [Sister] (cancer) Bill](https://static.fdocuments.in/doc/165x107/5feb787611589846a84974b7/trinity-lutheran-church-trinity-weekly-news-12115-john-tobben-hodgkins-lymphoma.jpg)