Capital Area Expressway Authority - LLA Default Homepage

Transcript of Capital Area Expressway Authority - LLA Default Homepage

/ o / ^

CAPITAL AREA EXPRESSWAY AUTHORITY

FINANCIAL REPORT

DECEMBER 31.2010

Under provisions of state law, this report is a public document. A copy of the report has been submitted to the entity and other appropriate public officials. The report is available for public inspection at the Baton Rouge office of the Legislative Auditor and, where appropriate, at the office of the parish clerk of court.

Release Date,

Postlethwaite &Netterville

A Prcrfeuional Accounting Corporation

wvwKpnq)a.com

CAPTTAL AREA EXPRESSWAY AUTHORITY

Basic Financial Statements As of and for tiie Year Ended December 31,2010

CONTENTS

Page No.

Independent Auditors* Report 1

Management's Discussion and Analysis 2 -4

Basic Fmancial Statements:

General Fund/Governmental Activities Balance Sheet and Statement of Net Assets 5

General Fund/Governmental Activities of Statement Revenues, Expendihires, and Changes m Fund Balance and Statement of Activities 6

Notes to Financial Statements 7-11

Required Supplementary Tnfnrmatinn-Budgetary Con^arison Schedule 12

Report on Intemal Control over Financial Reporting and on . Compliance and Other Matters Based on an Audit of Financial Statements Performed m Accordance with Govemment Auditing Standards 13 -14

Schedule of Findings and Questioned Costs 15

Summaiy Schedule of Prior Year Findings 16

f l j 9 | H | Postlethwaite UsiKI&Netterville

A Profeuional Accounting Corporation Auocicftd Offices in Principal Citim oF ttw Unitsd StolM

www.pncpa.com

Independent Auditors* Report

Capital Area Expressway Authority Metropolitan Baton Rouge, Louisiana

We have audited the accompanying fmancial statements ofthe Capital Area Expressway (the Authority) as of and for the year ended December 31, 2010. These financial statements are the responsibility ofthe Authority's management. Our responsibility is to express an opinion on these financial statements based on our audit

We conducted our audit in accordance with auditing standards generally accepted in the United States of America and the standards applicable to fmancial audits contained in Govemment Auditing Standards issued by the Comptroller General ofthe United States. Those standards reqmre that we plan and perform the audit to obtain reasonable assurance about whetiier die financial statements are free of material misstatement. An audit mcludes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position ofthe Capital Area Expressway Authority as of December 31,2010 and the changes in financial position for the year then ended in conformity with accounting principles generally accepted in the United States of America.

Accounting principles generally accepted in the United States of America require that the management's discussion and analysis and budgetary comparison mformation on pages 2 through 4 and page 12, respectively, be presented to supplement the basic financial statements. Such information, although not a part ofthe basic financial statements, is required by the Govemmentai Accounting Standards Board, who considers it to be an essential part ofthe financial reportmg for placing the basic financial statements in an appropriate operational, economic, or historical context. We have applied certam luiuted procedures to tiie required supplementary uiformation in accordance with auditing standards generally accepted in the United States of America, which consisted of inquires of management about the methods of preparing tiie infonnation and comparing tiie information for consistent with management's responses to our inquiries, the basic financial statements, and other knowledge we obtained during our audit of the basic financial statements. We do not express an opmion or provide any assurance on the information because the limited procedures do not provide us with sufficient evidence to express an opinion or provide any assurance.

In accordance with Govemment Auditing Standards^ we have also issued our report dated July 18,2011, on our consideration of the Authority's intemal control over financial reporting and on our tests of its compliance with certain provisions of laws, regulations, contracts, and grants. TTie purpose of that report is to describe the scope of our testing of intemal control over financial reporting and compliance and the results of that testing, and not to provide an opmion on the mtemal control over financial reporting and compliance. That report is an integral part of an audit performed in accordance with Govemment Auditing Standards and should be read in conjunction with this report in considering the results of our audit.

/o^,J^^t^^^4. t^mJ^ -*- TU^t^^^i^iM-Baton Rouge, Louisiana July 18,2011

- 1 -

8550UnitedPlazaBlvd, Suite 1001 • Baton Rouge, LA 70809 • Tel: 225.922.4600 • Fax: 225.922.4611

CAPITAL AREA EXPRESSWAY AUTHOIOTY MANAGEMENT'S DISCUSSION AND ANALYSIS FOR THE YEAR ENDED

DECEMBER 31,2010

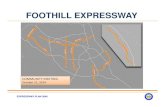

The Capital Area E3q)ressway Authority (the Authority) was created in 2004 in order to advance the interests of the Metropolitan Baton Rouge, Louisiana area with respect to major infi-astructure projects. To date, the Authority's primary focus has been the preliminary planning and feasibility study ofa "Baton Rouge Loop".

This section of the Amhority's annual fmancial report represents management's analysis of the Autiiority's financial performance during the fiscal year ended December 31, 2010. Please read it in conjunction with the financial statements, which follow this section.

FINANCIAL HIGHLIGHTS

The Autiiority's net assets and fund balance were $937,872 as of December 31,2010 and consisted almost entirety of cash. These fimds are available to spend in 2011.

• No mtergovemmental revenues were received or recognized in 2010. Such revenues from the State of Louisiana have historicalty been the primary fimding source for activities of the Authority. The Autiiority operated in 2010 primarily torn prior year's fimd balance.

• The expenses of the Authority consisted of professional services of $12,837 and costs incurred toward an environmental mipact s tu^ of $1,247,326.

OVERVIEW OF THE FINANCIAL STATEMENTS

These financial statements consist of two sections - Management's Discussion and Analysis (this section) and the basic financial statements (including the notes to the financial statements).

GOVERNMENT-WIDE FINANCUL STATEMENTS

Hie Statement of Net Assets and the Statement of Activities are two basic financial statements required by Govemmentai Accounting Standards that report information about the Authority using a long-temi economic resources focus. Hie financial data is reported using tiie accrual basis of accounting, and provides insight as to the Authority's long-term financial position and changes to that financial position over a one-year poiod. T^e net assets of a governmental entity and the changes thereto provide an mdication of its financial health over time.

FUND FINANCIAL STATEMENTS

Fund financial statements provide detailed mformation about a govemment on a modified accrual basis. A fimd is a fiscal and accounting entity with a self-balancing set of accounts that the governments use to track specific sources of funding and expenditures tiiereof

Due to the snnplistic nature of its operations to date and tiie fact that the Amhority uses only a general fimd (as opposed to multiple fimds); no differences exist between the fund financial statements and the govemment-wide financial statements. The govemment wide financial statements and the fimd financial statements are therefore pres^ted together in one column on pages 5 and 6.

-2 -

CAPITAL AREA EXPRESSWAY AUTHORTIY MANAGEMENT'S DISCUSSION AND ANALYSIS FOR THE YEAR ENDED

DECEMBER 31,2010

GOVERNMENT-WIDE FINANCIAL STATEMENTS (continued)

The Statements of Net Assets and Activities for 2010 and 2009 are as follows:

Statement of Net Assets December 31

2010

Current assets $ 1,108,743 Noncunent assets

Total assets 1,108,743

Current liabiUties 170,871 Noncurrent liabilities

Total liabilities 170,871

Net assets (unrestiicted) $ 937,872

Statement of Activities December 31

$

2009

2,344,536

2344,536

149,744

149,744

$ 2,194,792

2010 2009

$ 475,000 31,626

506,626

2391,432

$ (1,884,806)

Intergovemmental revenues $ Interest income 3,243

Total revenues 3,243

Expenses 1,260,163

Changes in net assets $(1,256,920)

Net Assets ofthe Autiiority decreased during the year. The primary source of fimdmg for the Authority's activities has historically been a Cooperative Endeavor Agreement with the State of Louisiana. Most of the fimding made available to date under the Agreement was received in 2008 as a result ofthe Louisiana Legislature appropriating $4,000,000 in the 2007 legislative session. An additional appropriation provided for m the 2009 Legislature of $475,000 was received by tiie autiiority m 2009. No fimding was received in 2010. The environmental impact study began m 2009 and continued during 2010 thereby mcreasing expenses and decreasing the unexpended surplus from 2009.

- 3 -

CAPIFAL AREA EXPRESSWAY AUTHORTTY MANAGEMENT'S DISCUSSION AND ANM.YSIS FOR THE YEAR ENDED

DECEMBER 31,2010

ORIGINAL BUDGET VS FINAL BUDGET

No budget amendments were made by the Authority during 2010.

LONG-TERM DEBT ACnVTTY AND CAPITAL ASSETS

The Authority has not issued any long term debt nor has it purchased any capital assets.

FACTORS CONSIDERED IN SETTING NEXT YEAR'S BUDGET

The Autiiority has not adopted a budget for 2011. When the 2011 budget is developed and adopted, the Authority will utilize available fimd balance and any additional fimds made available through the Cooperative Endeavor Agreement and the 2011 Legislature.

CONTACTING THE AUTHORTTY

This financial report is designed to provide a general overview of the Autiiority's finances and to demonstrate the Authority's accountability for the money it receives. If you have any questions about tiiis report or need additional mfomoation, contact the Authority, 222 St Louis Street, Baton Rouge LA 70821,(225)389-3061.

- 4 -

CAPITAL AREA EXPRESSWAY AUTHORITY

BALANCE SHEET and STATEMENT OF NET ASSETS

GENERAL FUNDXGOVERNMENTAL ACTTVinES DECEMBER 31.2010

ASSETS Pooled cash residmg with the City-Parish Govemment of East Baton Rouge Bank deposits

68 1,108,675

TOTAL ASSETS 1,108,743

LIABILrriES Accraed expenses 170,871

FUND BALANCE/NET ASSETS Fund balance/unrestricted net assets 937,872

TOTAL UABILrriES AND FUND BALANCES\NBT ASSETS $ 1,108,743

TTie accompanying notes are an integral part of tiiese financial statements

- 5 -

CAPTTAL AREA EXPRESSWAY AUTHORITY

STATEMENT OF REVENUES. EXPENDTrUItES, AND CHANGES IN FUND BALANCE and STATEMENT OF A C n v m E S

GENERAL FUND\GOVERNMENTAL ACTIVITTES FOR THE YEAR ENDED DECEMBER 3L 2010

REVENUES Intergovemmental revenues Interest income

Total Revenues

EXPENDTTURESVEXPENSES Legal and professional fees Design and engineering fees

Total Expenditures\£xpenses

3,243 3,243

12,837 1,247,326 1,260,163

DEFICIENCY OF REVENUES OVER EXPENDrrURES\ CHANGE IN NET ASSETS

FUND BALANCESVNET ASSETS Beginmng of year

End of year

(1,256,920)

2,194,792

937,872

The accompanying notes are an mtegral part of these financial statements

- 6 -

CAPITAL AREA EXPRESSWAY AUTHORTTY

NOTES TO FINANCIAL STATEMENTS DECEMBER 31,2010

1. INTRODUCTION

The Capital Area Expressway Authority (referred to as the Authority) was created m 2004 as a public non-profit corporation in accordance with the provisions ofthe Louisiana Nonprofit Corporation Law, as a body politic possessing fiill corporate powers, whose formation and incoiporation is autiiorized under tiie Louisiana Transportation Development Act, Chapter 26 of Title 48 of Louisiana Revised Statutes. The Authority is a special piupose government, independent of tiie state and local govemments, created for the purpose of advancing the mterests of the Baton Rouge, Louisiana metropolitan area with respect to major mfi'astmchue projects, specifically the '*Baton Rouge Loop".

The Authority is currentfy govemed by a board consisting of three members as follows: the Secretary of the Louisiana Department of Transportation and Development, the Mayor-President of East Baton Rouge Parish and tiie President of West Baton Rouge Parish. The Authority's articles of incorporation call for a goveming board of five members, however, two previous members resigned and have not been replaced.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A. REPORTING ENTITY

The Authority complies with U.S. Generally Accepted Accounting Principles (GAAP) and as such, applies all relevant Govemmentai Accountmg Standards Board (GASB) pronouncements. GASB Statement 14 establishes criteria for determining the govemmentai repotting entity and component units tiiat should be included within the reportmg entity. Under provisions of this Statement, the Authority is considered a primary government, since it is a specid purpose government that has a separately functioning goveming body that is not subrogated to the will of any one local or state government, is legally separate, and is fiscalty independent of the state or participating local governments. As used in GASB Statement 14, fiscally independent means that the Autiiority may, without the approval or consent of another govenunental entity, determine or modity its own budget, levy its own taxes or ^>ply for mtergovemmental fimding agreements, and issue bonded debt The Authority also has no component units, defined by GASB Statement 14 as other legally separate organizations for which the appointed Authority members are financially accountable.

B. MEASUREMENT FOCUS, BASIS OF ACCOUNTING AND PRESENTATION

The accompanying financial statements liave been [»epared in accordance with accounting principles generally accepted in tiie United States of America as prescribed by the GASB. These principles are found m tiie Codification of Govemmentai Accounting and Financial Reporting Standards, published by the GASB. GASB is the accepted standard setting body for estabtishing governmental accounting principles and reportmg standards.

The Authority applies all GASB pronouncements and those Fmancial Accounting Standards Board (FASB) statements and interpretations which were issued on or before November 30, 1989, unless those pronouncements conflict witii or contradict GASB pronouncements.

- 7 -

CAPTTAL AREA EXPRESSWAY AUTHORITY

NOTES TO FINANCIAL STATEMENTS DECEMBER 31,2010

2. SUMMARY OF SIGNIFICANT ACCOUNTING POUCIES f continaed)

B. MEASUREMENT FOCUS, BASIS OF ACCOUNTING AND PRESENTATION (continued)

The Authority employs fimd accounting as is common among govenunental entities and as prescribed by the Govemmentai Accoimting Standards Board. Fimds are accounting entities that are created to account for various sources of fimding in order to demonstrate compliance with restrictions that may be imposed on those sources by taxpayers, grantors, o^itors or others. Funds consist of three basic types: govemmentai, proprietary and fiduciary. Govemmentai fimd types are used to account for those programs that are primarily fimded with taxes and mtergovemmental revenues. The Authority uses one fimd, its general fimd,;n1uch is considered to be a governmental fund.

Under Govemmentai Accoimting Standards, two separate financial statements are presented: tiie fimd level financial statements and tiie govemment-wide fhiancial statements. Separate financial statements are presented for each fimd type as described above. The govemmentai fimd financial statements are presented using the current financial resources measurement focus and the modified acorual basis of accounting. Under the modified accrual basis of accounting, revenues are recognized \siien they become measurable and available to fimd current operations. Additionally, intergovemmental revenues must meet all eligibility requirements pertaining to the fimding in order to be recognized. Expenditures are recognized when the related fimd liability is incurred, except for principal and interest on long-term debt which is recognized when due.

The govemment-wide financial statements (Statement of Net Assets and Statement of Activities) are presented using the economic resources measurement focus and the accrual basis of accounting. Under the accrual basis of accounting, revenues are recognized when they are eamed without consideration of when those revenues are available. Expenses are recognized when the related liability is incurred, or resources are used, regardless ofthe timing of related cash flows. Expenditures providing benefits beyond one year are capitalized as assets on tiie statement of net assets and depreciated or amortized over the estimated usefiil lives of those assets. Additionally, long term debt is carried on the statement of net assets.

Because no differences exist between the modified accrual and the accrual bases of accountmg for the Authority's 2010 financial statements, both tiie fimd fmancial statements and the govemment-wide financial statements are presented in tiie same columns. Events and conditions occurring or existing dming fiiture periods may cause differences between the modified and fiill accrual bases of accounting and therefore separate presentations may be necessary.

C. BUDGET POLICIES

The proposed budget for each fiscal year is conqileted and made available for pubhc inspection and a pubUc hearing is held for suggestions and comments. The proposed fiscal year budget is Ihen formally adopted by the Authority after the public hearing. The budgets, which included proposed expenditures and the means of financing them, are prepared on the modified accrual basis of accounting. Formal budgetary integration is used during the year as a management control device. When actual revenues withm a fimd are failing to meet esthnated annual budgeted revenues by five percent or more, and/or

- 8 -

CAPTTAL AREA EXPRESSWAY AUTHORITY

NOTES TO FINANCIAL STATEMENTS DECEMBER 31.2010

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued^

C. BUDGET POLICIES (continued)

actual expenditures vnthin a fimd are exceeding estimated budgeted esq^enditures by five percent or more, a budget amendment to reflect such changes is adopted by the Authority in a pubhc meeting. Budgeted amounts included in tiie financial statements include the originally adopted budget and all subsequent amendments.

D. NET ASSETS

. Net assets represent the difference between assets and liabilities and can be classified m the followmg components:

• Restricted net assets consist of extemal constraints placed on net asset use by creditors, grantors, contributors, or laws or regulations of other govemments or constramts imposed by law through constitutional provisions or enablmg legislation.

• Uiuestricted net assets arc fiee of restrictions such as those listed above. If the restriction imposed is consistent witii the overall purpose of the fimd or reporting entity, then the net assets arc reported as unrestricted.

When both restricted and unrestricted resources are available for use, it is tiie Authority's policy to use restricted resources as they arc needed.

E. ESTIMATES

The preparation of financial statements in conformity with accounting principles generally accepted in the United States reqmres management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contmgent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenditures during the reporting period. Actual results could differ fiom those estimates.

3. CASH AND INVESTMENTS

Under state law, the Authority may deposit fimds witiiin a fiscal agent bank organized under the laws ofthe State of Louisiana, or a nationally chartered bank with principal offices in Louisiana. Statutorily allowed investments mclude direct US Govemment debt securities, securities issued by US sponsored Agencies, mutual fimds whose underlying investments consist of US govemment obligations, repurchase agreements collateralized by US debt securities, and certain others.

The Autiiority's cash consists of $68 of pooled cash within tiie City-Parish Govemment's consolidated cash account and $1,108,675 of cash deposits in a local bank. The pooled cash account's underlying assets consist of deposit accounts in qualifying local banks, US Trcasury and Agency securities, and overnight repurchase agreements. The consolidation ofthe cash pool allows for reduced admmistrative

- 9 -

CAPTTAL AREA EXPRESSWAY AUTHORTTY

NOTES TO FINANCIAL STATEMENTS DECEMBER 31,2010

3. POOLED CASH AND INVESTMENTS (continued^

costs and maximization of investment eammgs. Each participating fimd or entity shares m the investment earnings according to its average cash and investment balance. The cash {XK)! is highly liquid to the Authority and poses no custodial credit risk to the Authority. Details of the City-Parish's consolidated cash account are disclosed m the City-Parish of East Baton Rouge's financial statements, a copy of which can be obtained fiom Kathleen Kreko of the City-Parish's accounting department, 222 St. Louis Street, Baton Rouge, LA 70821, (225) 389-3069.

The cash deposited in a local bank is protected firom custodial credit risk through a pledge of the bank's etigible investment securities and FDIC insurance.

Custodial credit risk is the risk that a depositor may not receive a retum of its deposited fimds upon failure of the financial institution. The C<nporation does not have a formal policy for ciistodial credit risk for cash.

4. COMMTIMENTS

A contract has been executed in the amount of $4,750,000 (as amended) with an engmeering and design firm to conduct an envux>nmental impact study and to serve as a general consultant to the Authority. Approximately $3,825,000 had been expended under this contract as of December 31, 2010.

5. COOPERATIVE ENDEAVOR AGREEMENTS

The Authority is currently operating under two separate cooperative endeavor agreements:

a. Dated December 21,2007 and amended October 29,2008, witii tiie Louisiana Department of Transportation and Development - provides $4,000,000 (amended with an additional $475,000 fiom the 2009 legislation session) as appropriated by Act 203 of the Louisiana Legislature's 2007 regular session for the purpose of conducting environmental raipact studies for a proposed '"Baton Rouge Loop". The initial fimdmg of $4,000,000 was received m 2008 while the additional appropriation was received in 2009. The agreement remains in effect until the project has been completed or until withdrawal ofthe Agreement due to lack of fimding.

b. Dated April 3, 2008 with die City of Baton Rouge and Parish of East Baton Rouge (City-Parish) - provides that the City-Parish govemment will provide administrative services to the authority including fmancial and accounting, procurement, certain legal services, and other services at no expense to the Authority. The agreement remains in effect indefinitely.

-10 -

CAPITAL AREA EXPRESSWAY AUTHORTTY

NOTES TO FINANCIAL STATEMENTS DECEMBER 31,2010

6. BOARD COMPENSATION

The Autiiority's members receive no compensation for their service. During 2010, the members consisted of:

Kip Holden Mayor - President ofthe City of East Baton Rouge Parish Shawn Wilson/Sheri Lebas Louisiana Department of Transportation Riley Berthelot President of West Baton Rou^e Parish

7. CONCENTRATIONS

The Autiiority's revenues to date haye.been derived solely from the Cooperative l^deavor Agreement with the State of Louisiana. Future fimding under the Agreement is contingent upon appropriations made through the State's budget setting process.

8. SUBSEQUENT EVENT

Management has evaluated subsequent events through the date tiiat the financial statements were available to be issued, Juty 18,2011, and determined that no events, other than tiie matter referred to above, occurred that required disclosure. No subsequent events occurring after this date have been evaluated for inclusion in the financial statements.

- 1 1 -

CAPITAL AREA EXPRESSWAY AUTHORITY

BUDGETARY COMPARISON SCHEDULE GENERAL FUND

FOR THE YEAR ENDED DECEMBER 31.2010

Original Budget

Final Budget Actual

Variance wifhFhial

Budget

REVENUES Intergovernmental revenues Interest income

Total revenues

EXPENDIT UR£S\EXP£NS£S D e s ^ and exi^tetmg fees Legal fees Audit fees

Total e7q>endibire$\expenses

$

EXCESS OF REVENUES OVER EXPENDI'i'URESV CHANGES IN NET ASSETS

FUND BALANCESVNET ASSETS Beginning of year

End of year $

-5,000 5,000

2,110,000 20,000

5,000 2,135,000

(2.130,000)

2,194,792

64,792

$ 5,000 5,000

2,110,000 20.000

5.000 2.135.000

(2.130.000)

2,194,792

$ 64,792

$ - $ 3,243 3,243

1.247326 7.837 5.000

1,260,163

(1,256,920)

2,194,792

$ 937,872 $

-(1,757) (1,757)

862,674 12.163

-874.837

873,080

-

873.080

-12-

f U a S I Postlethwaite liKiKI&Netterville

A ProFessionol Accounring Corporation Associated Offices in Principal CiHes of the United States

vNWw.pncpa.com

REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING AND ON COMPLIANCE AND OTHER MATTERS BASED ON AN AUDIT OF FINANCIAL

STATEMENTS PERFORMED IN ACCORDANCE WITH GOVERNMENT AUDITING STANDARDS

Capital Area Expressway Authority Metropolitan Baton Rouge, Louisiana

We have audited the financial statements ofthe Coital Area Expressway Autiiority (tiie Authority) as of and for the year ended December 31, 2010, and have issued our report tiiereon dated July 18,2011. We conducted our audit in accordance with auditing standards generally accepted in the United States of America and the standards applicable to financial audits contamed in Govemment Auditing Standards issued by the Comptroller General of die United States.

Intemal Control Over Financial Reporting

In plannmg and performing our audit, we considered the Authority's intemal control over financial reporting as a basis for designing our auditing procedures for the purpose of expressmg our opmion on the financial statements, but not for the purpose of eiqiressing an opinion on the effectiveness of the Authority's intemal control over financial reporting. Accordingfy, we do not express an opinion on the effectiveness ofthe Authority's mtemal control over financial reporting,

A deficiency in intemal control exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent, or detect and correct misstatements on a timely basis. A material weakness is a deficiency, or a combination of deficiencies, m intemal control such that there is a reasonable possibility that a material misstatement of die entity's financial statements will not be prevented, or detected and corrected on a timely basis.

Our consideration of intemal control over financial reporting was for the limited purpose described in the first paragr^h of this section and was not designed to identify all deficiencies in intemal control over financial reporting that might be deficiencies, si^iificant deficiencies, or material weaknesses. We did not identify any deficiencies in intemal control over financial reporting that we consider to be material weaknesses, as defined above.

Compliance and other matters

As part of obtainmg reasonable assurance about whetiier tiie Autiiority's fmancial statements arc fiw of material misstatement, we performed tests of its compliance witfi certain provisions of laws, regulations, contracts, and grant agreements, noncompliance with which could have a direct and material effect on the determination of financial statement amounts. However, providing an opinion on compliance with those provisions was not an objective of our audit and, accordingly, we do not express such an opiiuon. The results of our tests disclosed an instance of noncompliance or other matters that are requhed to be reported under Govemment Auditing Standards which is described in the accompanying schedule of findings and questioned costs as item 2010-1.

- 1 3 -

8550UnitedPlazaB!vd, Suite 1001 • Baton Rouge, LA 70809 • Tel: 225.922.4600 • Fox: 225.922.4611

This report is intended for use by die Autiiority, federal and state awarding agencies, and the Louisiana Legislative Auditor and is not mtended to be and should not be used by anyone other than these specified parties. However, under Louisiana Revised Statute 24:513, tius report is distributed by the Legislative Auditor as a pubUc document.

/l*.2Ju^Sw»i;^ ^ Tlt/Cu n y ^ St

Baton Rouge, Louisiana

July 18,2011

-14-

P&N

CAPTTAL AREA EXPRESSWAY AUTHORITY SCHEDULE OF FDWINGS AND QUESTIONED COSTS

DECEMBER 31,2010

A. Summary of Auditors' Results

Type of auditor's report issued: Internal Control over Financial Rq>orting: • Material weakness (es) identified? • Significant deficiency(ies) identified that are

not considered to be material weaknesses?

Noncompliance material to financial statements noted?

UnquaUfied

no

none reported

yes

B. Findings - Financial Statement Audit

2010 - 1 Louisiana Local Government Budget Act (the Act)

Criteria:

Condition:

Cause:

Effect

Recommendation:

Mmagement 's Response:

According to LA RS 39:1309, all action necessaiy to adopt and otherwise finalize and implement the budget for a fiscal year shall be taken in open meeting and completed before the end ofthe prior fiscal year.

The 2010 was not adopted until September 8,2010, over 8 months into the fiscal year.

This condition apparentiy was caused by the Board's infiiequency of meetii^. Only one meeting was conducted during 2010.

Although actions required by the Local Government Budget Act were taken, they were not completed prior to the begmning of the Authority's fiscal year. Therefore, tiie Autiiority was only partially compliant with the Act. Furthermore, tiie Authority operated without an ^proved budget for much ofthe year.

We recommend filU compliance with the Act in fiiture years. The Board may want to consider meeting more often in order to foster fiirther compliance with the Act

The Authority experienced tumover on its board which has contributed to tiie condhions that resulted m the finding. The Authority will seek appropriate replacements or amend its Inlaws in order to ensure compliance with the Act

- 1 5 -

2009 -1

Criteria:

Condition:

Effects:

Recommendation:

CAPITAL AREA EXPRESSWAY AUTHOIOTY SUMMARY SCHEDULE OF PRIOR YEAR FINDINGS

Louisiana Local Govemment Budget Act (the Act)

LA Revised Statute 39:1305 requires that a budget message accompany tiie proposed and adopted budget.

LA Revised Statute 39:1305 also reqmres that budgets be amended when actual revenues fall short of budgeted revenues by more than 5% or when expenditures exceed bud^ted amounts by more than 5%.

The 2009 budget did not include a budget message. Furtiiermore, actual revenues fall short of budgeted revenues by 6%.

The Autiiority was non-compliant witii tiie statute.

We recommend full compliance with the statute for fiiture years.

Management's Response: The Authority experienced tumover on its board which has contributed to the conditions that resulted in the finding. The Authority will seek appropriate replacements or amend its bylaws in order to operate with its remaining members

Current Status: The above actions required by the Act were compliant for 2010. However, as noted in finding 2010-1, issues still remain regarding compliance with the Act.

-16 -