Benefits of a CariCRIS Rating to a Corporate...

Transcript of Benefits of a CariCRIS Rating to a Corporate...

SME eSmart- Powering Your Potential Find out more today by calling: (868)-627-8879 ext. 228 or email: [email protected]

Home Mortgage Bank’s rating reaffirmed at CariA

NCB Financial Group Limited’s initial corporate credit rating assigned at CariA

National Commercial Bank Jamaica Limited’s rating upgraded to CariBBB+

NCB (Cayman) Limited’s initial corporate credit rating assigned at CariA

The Government of the Commonwealth of Dominica placed on Rating Watch – Developing

Dominica AID Bank’s rating downgraded by 1-notch and placed on Rating Watch – Negative

The Government of the British Virgin Islands placed on Rating Watch – Developing

The Government of Anguilla placed on Rating Watch – Developing

NCB Capital Markets Limited’s rating upgraded to CariBBB

Trinidad and Tobago Mortgage Finance Limited’s rating reaffirmed at CariAA-

The National Gas Company of Trinidad and Tobago Limited’s rating reaffirmed at CariAA+

The Government of the Republic of Trinidad and Tobago’s rating reaffirmed at CariAA+

The Government of Saint Lucia’s ratings for its proposed bond issues assigned at CariBBB

OUR UPCOMING WORKSHOPS!

Operational Risk Management in 16 & 17 November 2017 Trinidad

Financial Institutions

Please contact Prudence Charles ([email protected]) or Sita Sonnyram ([email protected]) to register

Benefits of a CariCRIS Rating to a Corporate Entity:

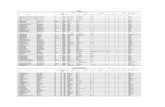

Latest Rating Actions by CariCRIS

Improve relationships with creditors with an independent, objective

assessment of business

Strengthen your governance and hedge against business risk

Attract investors to raise money in capital markets

Detect credit deterioration early and focus your management on

hedging risks

DATE WORKSHOP COUNTRY

Please visit our website at www.caricris.com for the detailed Rationales on these and other ratings

CariCRIS’ credit ratings and daily Newswire can also be found on the Bloomberg Professional Service.

REGIONAL

Trinidad and Tobago

CBTT Governor: Banks must make customers lives easier

Governor of the Central Bank Alvin Hilaire advised commercial banks that

they needed to simplify their processes and procedures to make the lives

of customers engaging their services easier.

Scotiabank to use own mortgage reference rate

Scotiabank T&T has announced that it would no longer be using the

Central Bank of T&T’s Mortgage Market Reference Rate and instead,

would be aligning its residential mortgages to the Scotiabank Mortgage

Reference Rate (SMRR) effective December 1, 2017.

NFM profits down 23 per cent

National Flour Mills (NFM) has recorded a 23 per cent decrease in profit

after tax for the nine-month period ending September 30, 2017.

WITCO gives up $1.99

Overall Market activity resulted from trading in 15 securities of which 3

advanced, 6 declined and 6 traded firm.

Jamaica

IMF gives Jamaica top marks

While the IMF has praised Jamaica for its exemplary implentation of

difficult economic reforms, the fund is still at a loss why Jamaica's

economic growth should be so low.

Wisynco To Go Public With $1b IPO, Plans To Expand

Wisynco Group, a top beverage maker, will tap the stock market for funds

to expand its reach across Jamaica and pay down on debt, through an

initial public offering (IPO) of shares targeted to raise more than a $1

billion.

JACRA Start-Up Delayed By Lagging Regulations

Jamaica Agricultural Commodities Regulatory Authority, JACRA, under

whose umbrella the commodity boards have been merged, should start

functioning by year end, according to permanent secretary in the Ministry

of Industry, Commerce, Agriculture & Fisheries, Donovan Stanberry.

Barbados

Despite Tax Measures, Barbados Economy in A Slump

The Barbados economy is still in a slump and remains on a downward

track, with the island’s foreign reserves in a worse position despite onerous

tax measures introduced in the last budget.

Double Taxation Agreement Between Barbados and Italy In Effect

The Double Taxation Agreement (DTA) between the Government of

Barbados and the Italian Republic has entered into force.

The Bahamas

Baha Mar Unveils Its $25m Marketing Push

BAHA Mar yesterday unveiled its $25 million marketing campaign to drive

new year demand, telling Tribune Business it was eyeing a "very strong

2018".

Hurricanes’ Toll on Tourism Jobs

Temporary layoffs at Resorts World Bimini will affect some 150 workers, with

more than a dozen expected to be made redundant, The Tribune has

learned.

St. Kitts and Nevis

St. Kitts Welcomes Caribbean's First Park Hyatt

St. Kitts is pleased to welcome the Park Hyatt St. Kitts Christophe Harbour,

the Caribbean's first Park Hyatt featuring the first Miraval Life in Balance

Spa in the Caribbean, which officially opens today on the island's

southeast peninsula and brings a new level of luxury to the expanding

tourism product.

Panama

Latin America tops climate change investment boom

While some sectors of the US administration still claim that climate change

is a hoax, the Latin America and the Caribbean region is benefiting from

what others see as a new industrial revolution and business opportunity.

Other Regional

IDB provides training to strengthen development effectiveness in the

region

About 60 participants from Jamaica, Guyana, Suriname, Barbados and

The Bahamas attended an Impact Evaluation workshop organized by the

Inter-American Development Bank from October 23 to 27. The workshop

provided a combination of theoretical and applied sessions on impact

evaluation methods, as well as a practicum on impact evaluation design.

CDB, Mexico announce fund to boost regional infrastructure

The Caribbean Development Bank (CDB) has entered into a

memorandum of understanding with the government of Mexico’s

development bank, Banco Nacional de Comercio Exterior (Bancomext),

acting as the Trustee of the Infrastructure Fund for the Countries of

Mesoamerica and the Caribbean (FIMCA, also known as Fondo Yucatán)

to support regional infrastructure development. As part of the agreement,

CDB will act as a financial intermediary for the fund.

INTERNATIONAL

United States

U.S. job growth seen surging after storm-related disruptions

U.S. job growth likely rebounded sharply in October after hurricane-

related disruptions depressed employment in September, in a move that

could seal the case for an interest rate increase from the Federal Reserve

in December even as wage growth probably slowed.

Futures rise with Apple ahead of jobs data

Apple’s upbeat results and strong initial demand for the new iPhone X put

Wall Street on track for a strong opening on Friday, while investors

watched out for October jobs data for clues on the strength of the labor

market.

Dollar lackluster before U.S. jobs data

The dollar steadied on Friday, capping a week of mild losses, as investors

waited for fresh data for evidence of more strength in the U.S. economy

and the progress of tax plans to bet on the greenback’s outlook.

United Kingdom

UK economy peps up, bolstering BoE rate hike call: PMI

Britain’s economy appears to be picking up speed, according to a survey

on Friday that will reassure the Bank of England a day after it raised

interest rates for the first time a decade.

Europe

Euro zone inflation may be higher than expected in 2018: ECB's Nowotny

Euro zone inflation could be higher next year than now projected as

energy prices are moving higher, European Central Bank Policymaker

Ewald Nowotny told Bloomberg television on Friday.

China

China's second-largest bank unveils easy loan in push for rental housing

market

China’s second biggest bank, China Construction Bank, has unveiled a

credit loan product for home renters, the first of its kind, as the

government looks to develop the rental housing market, the People’s

Daily said.

China tightens controls on down payment financing for home buyers:

Xinhua

Chinese authorities have intensified efforts to curb illegal financing for

mortgage down payments and asked banks to step up checks on home

buyers’ income authenticity, the official Xinhua news agency said, amid a

drive to rein in financial risks.

China gives mutual funds bigger role in retirement planning

China’s securities regulator is hoping the mutual funds industry can play a

bigger role in retirement planning, publishing on Friday guidelines for a

new type of product that seeks to adopt western-style, lifelong investment

strategies.

Japan

Japanese stocks attract biggest inflows in seven week, BAML says

Investors shovelled $3.4 billion into Japanese stocks, the biggest inflows in

seven weeks, data from Bank of America Merrill Lynch (BAML) showed on

Friday, as they looked for a pick-up in domestic demand and prospects

for an expansionist budget.

Global

Oil near two-year highs as tightening market woos buyers

Oil prices rose on Friday, nearing their highest levels in more than two

years, with buyers attracted by expectations of an extension to a global

pact to cut output that has reduced oversupply.

Baha Mar Unveils Its $25m Marketing Push Thursday 2nd November, 2017 – Tribune 242

BAHA Mar yesterday unveiled its $25 million marketing campaign to drive

new year demand, telling Tribune Business it was eyeing a "very strong

2018".

Graeme Davis, Chow Tai Fook Enterprises (CTFE) Bahamas president, told

Tribune Business: "This specific campaign is a $25 million investment.

"That's just Baha Mar as a destination; that does not include marketing by

the Grand Hyatt, SLS or Rosewood.

"We have an agreement with the Ministry of Tourism for a co-operative

effort. They are making an initial investment of $4 million, as well as $10

million for next year."

Mr Davis said Baha Mar was targeting the North American, Latin American

and Asian markets for visitors long-term. "Having global brands, we have

the opportunity to reach out to a much broader audience and work with

tourism stakeholders to ensure we are attracting new customers to the

Bahamas," he added. Concerns have been raised over Baha Mar's low

occupancy numbers, with Dionisio D'Aguilar, minister of tourism, this week

expressing his frustration over the pace of the $4.2 billion project's ramp-up

to full opening.

However, Mr Davis told Tribune Business: "Our numbers are looking very

strong for 2018. "We are pleased with the progress we are making for

2018." He said Baha Mar currently has just over 3,000 employees, with that

number growing steadily. "We plan to be up to 4,000 by the end of this

year, and going into the winter season of 2018," Mr Davis added.

"As we open up the Rosewood and start to grow occupancy even more,

we will get up to over 5,000 employees."

He said Baha Mar's SLS resort is set to open November 14. Mr Davis said he

did not expect any issues with obtaining the resort's full occupancy

certificate. "Right now we have a temporary certificate of occupancy,

which you can operate under indefinitely," he added.

"Obviously there are minor items to finish in order to apply for the

certificate of occupancy. The final item, which was delaying the

certificate of occupancy, has been accomplished and so we don't see

any issues with getting our certificate of occupancy but, again, that does

not prevent us from operating today."

CTFE, the Hong Kong-based conglomerate owned by the Cheng family,

has until December 1, 2017, to complete its acquisition of Baha Mar from

the project's financier, the China Export-Import Bank.

The closing hinges on China Construction America (CCA), the project's

contractor, completing the remaining $700 million construction work.

CCA, in legal filings relating to its dispute with a Florida-based lounge

chair supplier, revealed that its 'substantial completion' date for Baha Mar

was October 15. There has been no indication as to whether this target

was hit, but CTFE's phased opening strategy continues to proceed with no

sign of any problems.

<< Back to news headlines >>

Hurricanes’ Toll on Tourism Jobs Thursday 2nd November, 2017 – Tribune 242

Temporary layoffs at Resorts World Bimini will affect some 150 workers, with

more than a dozen expected to be made redundant, The Tribune has

learned.

RWB President Missy Lawrence yesterday pointed to a dramatic drop in

tourism across the entire Caribbean due to a destructive hurricane season

as she confirmed the “anchor property” has started to “curtail staffing.”

The resort did not confirm the number of affected staff; however, sources

close to the matter stressed that lay-offs were temporary, adding the

process was not complete.

Labour Minister Dion Foulkes also declined to confirm the number

of affected staff, noting that he wanted to give the resort the opportunity

to speak to its employees first.

However, he confirmed that both the Ministry of Labour and the

Department of Labour had been in talks with the resort last week.

“While Resorts World Bimini is now open and operational, we are still in the

process of recovering from the damage caused by Hurricane Irma,” Mrs

Lawrence said in a statement. “Commercial air lift continues to only serve

a small portion of our guests, and the current ferry service is limited during

the winter months due to inclement weather. As a result, we have made

the hard decision to curtail staffing until a time when increased resort

visitation warrants a re-evaluation.

“Throughout this process, Resorts World has worked with the minister of

labour’s office to fully comply with the Employment Act. In addition, the

names of affected individuals were shared with the Department of Labour

to expedite applications for benefits at each employee’s respective

places of residence.

“We do not make these decisions lightly,” Mrs Lawrence added, “but must

respond to the dramatic drop in tourism across the entire Caribbean

following a destructive hurricane season. We appreciate the hard work

and contributions of all our employees, and we wish those affected the

very best as they transition to new opportunities.”

Yesterday, Mr Foulkes said the resort has asked for a few months to

increase airlift.

He stressed that all affected employees will be eligible to NIB

unemployment benefits, adding the Labour Department will process

applications in a timely manner.

“We have been in discussions with them since the latter part of last week,

as a result of the hurricane they had to close the property and all of the

staff went home. Some of them in Grand Bahama, some in Nassau and

some in Bimini,” Mr Foulkes said. “They have been in the process of

reopening and increasing airlift, and they have indicated that they should

be up to complete staff level within a few months. There are a number (of

workers) affected with temporary layoffs and a very small number will be

made redundant. Both the Ministry and the Department of Labour, we

have agreed to wait until all employees are notified before disclosing

actual numbers for both categories.’

Mr Foulkes added: “As for the temporary layoffs, some people have

resigned but that’s a very small number made redundant. I impressed

upon them they have to comply with provisions of Employment Act and

with the other laws that govern employment in the Bahamas, to date they

have been doing so.”

Tensions between Resorts World Bimini and residents have worsened in

recent weeks due to what some have described as the resort’s

“irresponsible environmental practices.”

More than six weeks since the passage of Hurricane Irma, which tore

through the resort’s floating docks, residents told The Tribune they are still

fishing large chunks of Styrofoam from bays around the island.

The resort has maintained that it has done its best to resolve the matter,

adding the vendor who originally provided its marina docks has agreed to

place skimmers in the marinas for long-term remediation.

<< Back to news headlines >>

St. Kitts Welcomes Caribbean's First Park Hyatt Thursday 2nd November, 2017 – SKN Vibes

St. Kitts is pleased to welcome the Park Hyatt St. Kitts Christophe Harbour,

the Caribbean's first Park Hyatt featuring the first Miraval Life in Balance

Spa in the Caribbean, which officially opens today on the island's

southeast peninsula and brings a new level of luxury to the expanding

tourism product.

"The debut today of Park Hyatt St. Kitts Christophe Harbour is a historical

occasion for the island," said Minister of Tourism, International Trade,

Industry and Commerce the Hon. Mr. Lindsay F.P. Grant. "This elegant and

sophisticated property brings the unparalleled Park Hyatt experience to St.

Kitts as the brand's first hotel in the Caribbean, which is a welcome

addition to our existing accommodations product and to our overall

island community."

Racquel Brown, CEO of the St. Kitts Tourism Authority, added, "We are very

pleased that the Park Hyatt St. Kitts Christophe Harbour opens today, as it

increases the island's appeal among those discerning destination travelers

seeking experiential getaways who represent a key segment of our visitor

market."

Spanning the secluded beach of Banana Bay at the foot of the island's

lush rolling hills, the 126-room resort will enable guests to discover St. Kitts

through sophisticated design, art, culinary experiences and immersive

excursions. Home to three signature restaurants, two pools, a destination

resort spa and wellness sanctuary, and indoor and outdoor event spaces,

the resort introduces the Park Hyatt experience to the Caribbean. From

the living walls of the distinctive entryway and throughout, all features of

the resort have been thoughtfully and sustainably designed by Range

Developments with local materials and unique water features to create

an oasis in harmony with the surrounding environment.

All 78 rooms and 48 suites overlook the golden sandy beach and

exceptional vistas greet guests at every turn. Each room showcases views

of the Caribbean Sea and islands beyond with luxurious touches such as

private balconies and terraces, local artwork, rain-showers and deep

soaking tubs. Premium suites feature private rooftop swimming pools and

sundecks. For the ultimate indulgence for discerning guests, the three-

bedroom Presidential Villa is equipped with a private infinity pool, wellness

area, personal butler and private chef.

The Park Hyatt St. Kitts Christophe Harbour has been developed as an

integral part of the Christophe Harbour resort community.

For more information about Park Hyatt St. Kitts Christophe Harbour or to

make reservations, visit https://stkitts.park.hyatt.com/en/hotel/home.html,

or visit www.ChristopheHarbour.com for more information about

Christophe Harbour.

<< Back to news headlines >>

Latin America tops climate change investment boom Thursday 2nd November, 2017 – Newsroom Panama

While some sectors of the US administration still claim that climate change

is a hoax, the Latin America and the Caribbean region is benefiting from

what others see as a new industrial revolution and business opportunity.

A World Bank report says the region leads the way in attracting

investments to fight climate change and has become an attractive

market for investment in sustainable urban transport and infrastructure

and is expected to reach more than $1trillion in investments by 2030.

The report identifies seven sectors with enormous potential to attract

private investment for renewable energy, storage of energy and solar

energy outside the grid, agribusiness, green construction, urban transport,

water supply and urban waste management.

According to the report, “Creating Markets for Climate Businesses” the

transport and climate-smart infrastructure sectors are expected to

generate more than $1 trillion in investments for 2030 in the region.

It indicates that in order to develop the potential and catalyze private

investments, a combination of political reforms and innovative business

models must be promoted. This would help Latin America and the

developing countries to achieve the climate goals set in the historic Paris

Agreement, signed by 33 countries in the region.

Five of the largest countries in the region -Brazil, Chile, Colombia, Mexico

and Peru- lead sustainable development in sectors such as renewable

energy, urban ecological infrastructure and energy efficiency, as well as

smart cities. Costa Rica aims to be the first carbon-neutral nation by 2021

and to have 100% renewable energy production by 2030.

The investment potential is enormous: In Mexico, for example, it is

indicated that investment potential from now to 2030 is $791 million,

mainly in renewable energy and sustainable urban infrastructure. In

Argentina the potential is $338 million and in Colombia s $195 million. In

Brazil, the investment potential is even greater at $ 1.3 billion.

“The private sector is the key to fighting climate change,” said IFC

Executive Director Philippe Le Houérou. “The private sector has the

innovation, financing and necessary tools. It is in our hands to help unlock

more private sector investments, but this also requires government reforms

and innovative business models, which together will create new markets

and attract the necessary investment. In this way, the commitment to

smart cities and renewable energy set in Paris can be fulfilled.”

With 80% of its population living in cities, Latin America and the Caribbean

is the most urbanized region in the world. The way in which your cities

grow will be fundamental to reach the climate change mitigation

objectives.

In the construction sector, green buildings are forecast to contribute $80

billion in investment opportunities until 2025. Countries such as Colombia,

Costa Rica, Mexico and Peru recently adopted green building codes. As

a result, it is expected that new buildings in these countries will consume

between 10 and 45% less water and energy.

Rapid Transit

Latin America became a leader in the development of rapid transit bus

systems (BRT). including the BRT system in Curitiba, Brazil Buenos Aires,

Argentina.

Buenos Aires, which accounts for almost half of Argentina’s GDP has

begun an ambitious $400 million transportation plan of dollars to boost

urban connectivity, to reduce congestion and pollution by slashing usage

of automobiles.

Panama is testing an electric bus system and building a third subway

system.

<< Back to news headlines >>

CBTT Governor: Banks must make customers lives easier Friday 3rd November, 2017 – Trinidad and Tobago Guardian

Governor of the Central Bank Alvin Hilaire advised commercial banks that

they needed to simplify their processes and procedures to make the lives

of customers engaging their services easier.

"As we develop as a society, financial transactions can tend to become

more complex and opaque—sometimes you get the impression that you

need to enlist a Senior Counsel to get you through the fine print of the

contract for setting up the most basic savings account!" Hilaire said as he

delivered remarks at the 20th Anniversay celebration of the Banker's

Association of T&T (BATT) held at the Hyatt hotel in Port-Of-Spain on

Wednesday.

The event, which brought together executives from the local banking

community, paid special tribute to members of the inaugural board of

BATT and its first president, former RBC Bank CEO Peter July.

Hilaire added that simplifying processes was an integral part in shaping

the level of customer awareness .

"It is therefore imperative that banks and other financial institutions

commit to meaningfully simplifying their agreements and making every

effort to ensure that their customers understand the terms and conditions"

he said.

The CBTT governor also encouraged banks to be an example worthy of

emulation in the area of corporate governance.

He said: "In the corporate governance field, due to their high visibility,

banks are well placed to implement best practices in how their boards

operate and in demonstrating integrity in the conduct of their affairs"

Also speaking at the event, outgoing BATT president Anya Schnoor

commended the work of the organization for evolving and keeping pace

with the changing needs of customers.

"BATT has grown and flourished tremendously over the last two decades,

both in terms of its remit, and the impact of its interventions. In an effort to

keep abreast with new trends, the banking sector has introduced various

products through electronic platforms that have now granted our

customers access to areas previously underserved."

In delivering his remarks at the gala, new BATT president and Republic

Bnak managing director Nigel Baptiste stated he was confident in the role

that banks continue to play in society, in spite of the negative perception

some may have of them.

"I remain convinced that there are a lot more individuals in Trinidad and

Tobago who respect the contribution that banks have made to our

country and to their own wellbeing, whether it is through the access to

financing to satisfy their goals and aspirations or through our many

charitable activities." Baptiste said.

<< Back to news headlines >>

Scotiabank to use own mortgage reference rate Friday 3rd November, 2017 – Trinidad and Tobago Guardian

Scotiabank T&T has announced that it would no longer be using the

Central Bank of T&T’s Mortgage Market Reference Rate and instead,

would be aligning its residential mortgages to the Scotiabank Mortgage

Reference Rate (SMRR) effective December 1, 2017.

In a notice published on Thursday, the bank advised its residential

mortgage customers that its variable mortgage interest rates will be

aligned to a new base rate.

It stated, “this rate will replace the previously applied Central Bank

Mortgage Market Reference Rate and will be published on the bank’s

website.”

The bank also assured customers affected by this change that they are

expected to receive details and a full explanation in their disclosure

statement.

<< Back to news headlines >>

NFM profits down 23 per cent Friday 3rd November, 2017 – Trinidad and Tobago Guardian

National Flour Mills (NFM) has recorded a 23 per cent decrease in profit

after tax for the nine-month period ending September 30, 2017.

NFM's profit fell from $29.26 million in 2016, to $22.55 million for the

comparable period in 2017.

The company's revenues also fell from $335.9 million in 2016, to $320 million

for the equivalent 3rd quarter period in 2017.

Commenting on the company's performance, company chairman Nigel

Romano said the decline was "driven largely by a 10 per cent fall in

revenue mainly due to declining animal feed sales, and the impact of a

29 per cent increase in NFM's effective corporation tax rate."

Romano added that in spite of the depressed local and regional

economic environment, the company was seeing "progress" in its export

endeavours.

"Our export sales initiatives have started to show some progress and along

with our traditional stronger last quarter performance will help to boost

revenue going into the fourth quarter"

The NFM chairman noted that the company had been successful in its

initiatives to contain costs and increase efficiencies.

"We have just concluded the Wave Three projects as part of our

continuous improvement programme, which has helped us to improve

our efficiencies and achieve some success in containing rising costs of

major raw material inputs, over which we have no control." Romano said.

He said the company's focus for the rest of the year would be on "revenue

growth and management of the risks associated with price volatility of key

raw material inputs"

<< Back to news headlines >>

WITCO gives up $1.99 Friday 3rd November, 2017 – Trinidad and Tobago Guardian

Overall Market activity resulted from trading in 15 securities of which 3

advanced, 6 declined and 6 traded firm.

Trading activity on the First Tier Market registered a volume of 310,813

shares crossing the floor of the Exchange valued at $1,805,166.46.

NCB Financial Group was the volume leader with 125,205 shares changing

hands for a value of $776,301.33, followed by Trinidad Cement Limited

with a volume of 100,000 shares being traded for $400,000.00.

JMMB Group contributed 67,087 shares with a value of $142,737.63, while

Sagicor Financial Corporation added 4,290 shares valued at $34,106.50.

Angostura Holdings registered the day's largest gain, increasing $0.05 to

end the day at $15.05.

Conversely, The West Indian Tobacco Company registered the day's

largest decline, falling $1.99 to close at $121.00.

On the Mutual Fund Market 17,680 shares changed hands for a value of

$358,360.00.

Clico Investment Fund was the most active security, with a volume of

16,680 shares valued at $350,280.00.

Clico Investment Fund declined by $0.46 to end at $21.00.

<< Back to news headlines >>

IMF gives Jamaica top marks Friday 3rd November, 2017 – Jamaica Observer

While the IMF has praised Jamaica for its exemplary implentation of

difficult economic reforms, the fund is still at a loss why Jamaica's

economic growth should be so low.

“After more than four years of difficult economic reforms, Jamaica's

programme implementation remains exemplary,” states the staff

appraisal for the second review under the IMF Stand-By-arrangement,

released yesterday.

“All quantitative condiditons and structural benchmarks were met and

the Government's reform plan is broadly on schedule. Strong domestic

ownership of the reform agenda across two different governments and

the broader society has helped to entrench macroeconmic stability and

fiscal discipline. The authorities sustained commitment coupled with the

ongoing programme monitoring by civil society has paved the way for

reforms to be increasingly domestically owned, designed and executed,”

the IMF said in the staff apraisal.

Other positives included a reduction in unemployment to 12.2 per cent,

the lowest rate in almost a decade, and the successful introduction of the

FX auction system. But growth in the economy remains low — though

higher than in pevious years — at just 1.3 per cent, below IMF projections

of 1.7 per cent growth.

Dr Uma Ramakrishnan, IMF mission chief to Jamaica, said that despite

growth in areas such a construction, manufacturing and tourism, much of

the blame for the low growth could be laid on agriculture, which has

been variously affected by flood and drought.

“Agriculture is highly sensitive to fluctuations in weather,” Ramakrishnan

told the Jamaica Obsever from her Washington office in a video press

conference at the IMF office at the Bank of Jamaica in downtown

Kingston yesterday.“That is creating a drag on growth.”

Other negatives included stagnation in the mining industry, which should

now end with the reopening of Alpart, but she added that the country

needs to build “resilience in agriculture”.

Another negative may be the Government's slow approach to tackling

the large size of the public sector.

Transformation of the public sector “will initially lead to some

redundancies”, Ramakrishnan said, but she would not be drawn on how

much that might mean in terms of the number of people losing their

livelihoods.

“We are not saying its 10,000 or 3,000 — there is no number. We need to

wait and see.”

“The right size is a choice the Government must take,” she informed the

Caribbean Business Report.

Now could be the right time for making redundancies, as with

unemployment falling, “the private sector is creating jobs and the

economy is getting ready” to take on employees from the public sector.

“The public sector is not the engine of growth, it should be the private

sector,” she reasoned.

Currently the public sector wage bill and debt financing take up about

two thirds of the Government's spending envelope, leaving only one third

for all other areas, including education, health and infrastructure.

“That is not an efficient or fair allocation of resources,” Ramakrishnan

remarked.

Meanwhile, Jamaica needs to stop fixating on the exchange rate,

especially with the US dollar, and start instead to concentrate on inflation.

“Moving to inflation targeting requires making price stability the anchor for

monetary policy alongside a flexible, market-determined eschange rate,”

the IMF said in the staff appraisal.

The Jamaican dollar “is broadly correctly valued”, Ramakrishnan said,

noting also that inflation was currently less than five per cent — extremely

low for Jamica.

“That is what people should be focusing on,” Ramakrishnan stated.

<< Back to news headlines >>

Wisynco To Go Public With $1b IPO, Plans To Expand Friday 3rd November, 2017 – Jamaica Gleaner

Wisynco Group, a top beverage maker, will tap the stock market for funds

to expand its reach across Jamaica and pay down on debt, through an

initial public offering (IPO) of shares targeted to raise more than a $1

billion.

The listing will allow more Jamaicans to partake in the ownership of one of

Jamaica's largest businesses held by the Mahfood family.

The support the company received from Jamaicans following last year's

fire aided in the decision by the owners to go public.

"We got an outpouring of support from employees, customers, and

Jamaicans. We got a real warm response to the company. Based on the

life cycle of the company, and the efforts of rebuilding the warehouse,

we felt it important for employees and the broader Jamaica to

participate in the ownership of the company," said Chairman William

Mahfood.

Wisynco sales hit $21 billion in 2017, representing a compound annual

growth rate of 11 per cent since 2013. Its profit margin has averaged 36

per cent since 2012, with a return on equity above 30 per cent, the

Financial Gleaner understands.

While avoiding specifics, Mahfood expects the company to list at or

below the main market multiples. The market is currently trading at 12.5

times earnings.

Wisynco plans to list the operating divisions of the group, which includes

distribution and manufacturing, but not the restaurant arm, which holds

franchises for Domino's Pizza and Wendys.

Mahfood said listing the manufacturing and distribution operations as a

whole would provide greater value, even while noting that splitting both

arms would have posed a challenge.

"It is very difficult to do that and it was not practical," he said, adding that

neither the manufacturing nor distribution arm was small enough in size to

list on the junior market.

"We are going to raise more than $1 billion in sale of shares. Some of the

funds raised will go towards a major expansion in St Catherine and

expansion of the business in Western Jamaica. Some of the funds will look

at more efficiency and some used to pay down on debt," Mahfood said.

The group, which is headquartered in St Catherine, operates than 350,000

square feet of warehouse space, 110,000 square feet of factory space,

and more than 700 sales-related full-time employees.

NCB Capital Markets is the lead arranger for the IPO and broker for the

transaction, with PricewaterhouseCoopers acting as financial adviser.

At the end of process, Wisynco will remain majority owned by the

Mahfood family as it has been for the last 50 years.

"The draft prospectus has been submitted to the Companies Office and

Financial Services Commission for review and comment. Once the

prospectus is finalised, we will have it registered for listing as soon as

possible. Based on the typical timeline, and assuming that the review

process goes smoothly, one could reasonably expect a listing by end of

year," said NCB Capital Markets CEO Steven Gooden.

Gooden said he could not discuss the valuation of the company until the

release of the prospectus.

"The valuation will reflect the growth expectation for the company and

what the market is willing to accept," he said. "Given Wisynco's size, it's

likely to be one of the largest such IPOs on the JSE."

Founded in 1965 by the Mahfood family, West Indies Synthetic Company

began manufacturing 'Iron Man' water boots from a 6,000 square foot

factory in Twickenham Park, St Catherine. The company soon evolved to

offer a full-range of footwear for men and children, the production of

cups and containers, and the distribution of imported beverages from

Trinidad.

Today, Wisynco Group owns and manufactures its own portfolio of

beverages - WATA water, WATA flavoured waters, BOOM Energy Drink

and BIGGA Soft Drink. It is also the exclusive bottler for the Coca-Cola

Company.

On the distribution side, the company markets the products of its fruit juice

joint venture partner, Trade Winds, as well as a range of items on behalf of

local and overseas producers.

<< Back to news headlines >>

JACRA Start-Up Delayed By Lagging Regulations Friday 3rd November, 2017 – Jamaica Gleaner

Jamaica Agricultural Commodities Regulatory Authority, JACRA, under

whose umbrella the commodity boards have been merged, should start

functioning by year end, according to permanent secretary in the Ministry

of Industry, Commerce, Agriculture & Fisheries, Donovan Stanberry.

"That is the expectation and the hope," he said. "As you know, the JACRA

Act has been passed. However, the regulations have been lagging for

some time now."

The only roadblock to finalising the regulations, he said, would be

bottlenecks at the Office of the Chief Parliamentary Counsel, the body

that drafts legislation.

Under the new regime for commodities boards - JACRA combines the

coconut, cocoa and coffee boards as well as the ministry's export division,

which oversees trade in spices - the Government is divesting its ownership

of assets and largely, but not entirely, exiting the commercial side of the

markets.

Stanberry said the disposal of assets is ongoing, while noting it had no

impact on the regulations.

"When you divest things, you cannot always predict what will happen.

You need a willing seller and a willing buyer. We have gone one round

with the cocoa assets and we did not get a taker, so we have to go back

[to the drawing board]," he said.

The Government's divestment agent, Development Bank of Jamaica, DBJ,

had been in talks with Portland Holdings, owned by Michael Lee-Chin, for

the cocoa holdings, but the deal fizzled.

The Cocoa Board assets include fermentories in Richmond, St Mary, and

Morgan's Valley, Clarendon; the Montrose cocoa farm, also located in

Richmond; processing equipment at Marcus Garvey Drive, Kingston; and

13.7 acres of land with buildings at Haughton Court in Lucea, Hanover.

"The Lee-Chin people declined; they were no longer interested. I don't

know why," said Stanberry.

"We have since got one or two unsolicited enquiries; we are in

consultation with DBJ in terms of the next move," he said.

The export division itself owns a warehouse in Kingston, but Stanberry said

that will not be sold, as it might be needed for JACRA's oversight function

of certifying commodities.

The Coconut Board will be undergoing reforms to its structure, and will

continue to own its assets, he added.

"The position is that this board will transition from a statuary body to a

member-owned organisation, registered under the Companies Act. They

now will be responsible to continue the commercial activities of the

board," Stanberry said.

"What JACRA is doing is, on the one hand, separating commercial from

regulatory functions and, having done that separation, moving to

consolidate all the regulatory functions of those bodies into one. The

regulatory functions will be subsumed to JACRA," the permanent

secretary explained.

Stanberry said that only the regulations were needed for JACRA to open

office.

"How the thing is set up, it is the regulations which will give effect to the

act itself. For example, it is the regulations which will indicate when it will

come into being. We are working feverishly with the chief parliamentary

counsel for those regulations," he said.

"It's not as if we are not doing anything. We are preparing offices, working

with employees - some of whom will be separated - working with unions,

working with an organisational chart. So, it's not as if we are sitting down,

twiddling our thumbs," he added.

JACRA will have its offices at Marcus Garvey Drive, in the same area

occupied by the Coffee Board.

<< Back to news headlines >>

IDB provides training to strengthen development effectiveness in the

region Thursday 2nd November, 2017 – Caribbean News Now

About 60 participants from Jamaica, Guyana, Suriname, Barbados and

The Bahamas attended an Impact Evaluation workshop organized by the

Inter-American Development Bank from October 23 to 27. The workshop

provided a combination of theoretical and applied sessions on impact

evaluation methods, as well as a practicum on impact evaluation design.

In addition to lectures on the subject, several case studies from Jamaica

were used to give participants some exposure to key lessons learned by

IDB colleagues in recent years. These included IDB projects on citizen

security and justice, climate change, energy, social protection and

health.

Therese Turner-Jones, the general manager for the Inter-American

Development Bank’s (IDB) Caribbean Country Department, has

emphasized the importance of systematically and scientifically measuring

the impact of development projects to ensure that the desired impact is

being successfully achieved. This is in keeping with the bank’s focus to

strengthen development effectiveness across the region.

Impact evaluation has been characterized as the most rigorous and

powerful tool to estimate the causal effects of a project or an investment

and it is within this context that the IDB has staged another in a series of

training programmes designed to build capacity among government

ministries and project executing units and other partners in the Caribbean.

Addressing the workshop, Turner Jones shared that the IDB’s vision for the

Caribbean is to improve lives by creating vibrant sustainable economies

where people are safe, productive and happy. Within this context, Turner-

Jones urged the approximately 60 participants from Jamaica, Guyana,

Suriname, Barbados and The Bahamas to embrace the importance of

conducting effective project evaluations in realizing this vision.

Turner-Jones stated, “If it can’t be measured, it doesn’t exist, if it can’t be

measured it cannot be managed and most importantly if it can’t be

measured it cannot be improved.”

The October 23 IDB workshop provided a combination of theoretical and

applied sessions on impact evaluation methods, as well as a practicum on

impact evaluation design. In addition to lectures on the subject, several

case studies from Jamaica were used to give participants some exposure

to key lessons learned by IDB colleagues in recent years. These included

IDB projects on citizen security and justice, climate change, energy, social

protection and health.

Commenting on the impact of the weeklong workshop, Daynea Facey,

the senior education officer (acting) Programme Monitoring and

Evaluation Unit at Jamaica’s ministry of education, indicated that “the IDB

training was grueling but exceptional.” She noted that “the unfettered

access to the knowledgeable IDB staff and trainers who advised us on

how to apply impact measurement strategies and approaches to our

real-life projects and programmes was quite beneficial. I am eternally

grateful for this fantastic opportunity!”

In addition to the strategies and approaches gained from the workshop,

Facey and other participants will have access to impact evaluation online

resources from the IDB.

The successful workshop builds on previous IDB training programmes that

focused on strengthening participants’ project management knowledge

and equipping staff in the social sectors to conduct rigorous impact

evaluations.

Donna Harris, senior social protection specialist at the IDB noted that

“these training programmes are integral to IDB’s efforts to foster a culture

of generating quality information from projects and using evidence to

inform public policy as part of the bank’s mandate to improve

development effectiveness.”

In this regard, all the knowledge that the IDB Group has acquired on

program evaluations since 2008 has been centralized on a web platform

providing public access to resources on project evaluation and

complementing the development effectiveness series to foster knowledge

sharing with partners and across the region.

<< Back to news headlines >>

CDB, Mexico announce fund to boost regional infrastructure Thursday 2nd November, 2017 – Caribbean News Now

The Caribbean Development Bank (CDB) has entered into a

memorandum of understanding with the government of Mexico’s

development bank, Banco Nacional de Comercio Exterior (Bancomext),

acting as the Trustee of the Infrastructure Fund for the Countries of

Mesoamerica and the Caribbean (FIMCA, also known as Fondo Yucatán)

to support regional infrastructure development. As part of the agreement,

CDB will act as a financial intermediary for the fund.

FIMCA will assist governments of CDB’s borrowing member countries

(BMCs) with reducing infrastructure deficits that remain a major

impediment to economic growth. Resources of approximately US$70

million are available from the fund, and accessible through various

financial intermediaries, to Caribbean as well as to Central American

countries.

“Substantial investment in upgrading and expanding the infrastructure is

vital for job creation, and provides a solid pillar for sustained economic

growth and poverty reduction in our region. The Mexican infrastructure

fund will make a much-needed contribution to closing the huge

infrastructure deficit that exists in CDB’s BMCs. It marks yet another

milestone in Mexico’s ongoing commitment to assisting our region to meet

its development objectives,” said CDB president, Dr Warren Smith.

“Mexico and the Caribbean are friends and allies in working towards the

development and prosperity of our societies. FIMCA provides financial

support for the development of infrastructure projects in Central America

and the Caribbean, through financial intermediaries. CDB’s role in the

Caribbean region is critical, therefore we are very pleased to have the

collaboration of CDB as financial intermediary to the Fund, to continue

working to support the development of relevant infrastructure projects

that have economic and social benefits for the Caribbean countries and

people,” said Vanessa Rubio, Mexico’s deputy secretary of finance and

public credit.

Deficiencies resulting from aging, non-climate resilient, inefficient,

inadequate or missing infrastructure continue to adversely affect

economic and social conditions in this region. These deficiencies have

been exacerbated by the 2008 global recession, as well as the increasing

incidence and severity of natural hazards, brought about by climate

change. Catastrophic losses suffered by Anguilla, Antigua and Barbuda,

the British Virgin Islands, Dominica, Haiti and the Turks and Caicos Islands

during the passage of Hurricanes Irma, Jose and Maria in September 2017

have further highlighted this issue and the need for urgent action to close

the region’s infrastructure gaps.

Bancomext is the trustee of the fund, which provides financial assistance

through intermediaries. These institutions support the beneficiary countries

throughout the preparation, design and execution of projects, overseeing

the adequate use of the fund’s resources. Projects will be appraised by

CDB, using its own rules and guidelines, and then submitted by the bank

to the technical committee of the fund for consideration and final

approval. As per the agreement signed by CDB and Bancomext, the fund

will provide grant resources of up to US$5 million for eligible infrastructure

projects in any of the bank’s BMCs. Resources from FIMCA may be

blended with CDB’s.

Mexico joined CDB in May 1982, and is a regional, non-borrowing member

of the bank. FIMCA was established in 2012.

<< Back to news headlines >>

Despite Tax Measures, Barbados Economy in A Slump Thursday 2nd November, 2017 – Caribbean360

The Barbados economy is still in a slump and remains on a downward

track, with the island’s foreign reserves in a worse position despite onerous

tax measures introduced in the last budget.

Acting Central Bank Governor Cleviston Haynes reported that while the

economy posted a modest 1.4 per cent growth during the first nine

months of the year and raked in an additional BDS$98.6 million (US$49.3

million) in tax revenues, the foreign reserves was way below the

international benchmark of 12 weeks of imports and the fiscal deficit was

still too high.

In his report, which outlined the country’s performance for the first nine

months of the year, international reserves plummeted to just 8.6 weeks of

imports or BDS$549.7 million (US$274.85 million), putting more pressure on

the stability of the Barbados dollar.

At the same time, he reported Government’s overall debt had climbed to

144 per cent of gross domestic product, with current expenditure

increasing by BDS$13.9 million (US$6.95 million), largely due to an increase

in grants to public institutions.

The deficit, which is estimated at BDS$279 million (US$139.5 million)for the

last six months, showed a BDS$115 million (US$57.5 million) improvement

over the same period in 2016.

Haynes said tough decisions were facing the Freundel Stuart

administration.

He stayed clear of repeated calls from other economists and key social

partners for the government to seek help from the International Monetary

Fund or any other financial institution, but stressed strong action had to be

taken.

“It goes without saying that we are concerned about the direction in

which the reserves have been going,” he said.

“Despite moderate economic growth and policy-induced reduction in

the fiscal imbalance, the Barbadian economy continues to face

significant economic challenges. In particular, strengthening of the

international reserves is needed to ensure that the reserve buffer remain

adequate in order to protect the fixed exchange rate peg.”

He further urged the government to address expenditure, underscoring

the need for more cuts.

“Political decisions will have to be taken as to where they want to effect

such cuts and what the nature of those cuts will be. When I say cuts in

expenditure it could come in different forms . . . but the bottom line is that

we have to reduce the size of the fiscal deficit,” Haynes stressed.

“The fiscal outlook underscores the need for expenditure restraint in the

short term to supplement the recently introduced revenue measures, as

Government seeks to place the public finances on a sustainable path

and reduce the debt overhaul,” he added.

The Central Bank is forecasting growth of 1 to 1.5 per cent this year, but it

noted that this was largely dependent on whether large scale tourism-

related project got off the ground.

<< Back to news headlines >>

Double Taxation Agreement Between Barbados and Italy In Effect Thursday 2nd November, 2017 – Caribbean360

The Double Taxation Agreement (DTA) between the Government of

Barbados and the Italian Republic has entered into force.

The instruments of ratification for the Convention for the Avoidance of

Double Taxation with Respect to Taxes on Income and the Prevention of

Fiscal Evasion were exchanged by Barbados’ Minister of Industry,

International Business, Commerce and Small Business Development

Donville Inniss and Ambassador and Special Envoy to the Caribbean of

the Italian Republic, Paulo Serpi.

A statement from the ministry said the entry into force of the

Barbados/Italian Republic DTA represents not only Barbados’ firm strides to

expand its treaty network, but it also signals the country’s willingness to

foster closer ties with Italy and the European Union in particular.

“DTAs have been recognized as one of the most effective mechanisms for

developing new and strengthening existing economic ties between

nations.

The negotiation of these agreements is, therefore, a critical element of a

framework for developing substantial trading and investment

opportunities,” it said, adding that the DTAs facilitate joint ventures,

reduction in taxes and business related costs, exchange of tax

information, and reduction of fiscal impediments to cross-border trade

and investment.

“Barbados continues to aggressively promote itself as a legitimate

international business and financial services centre. Its distinction as a

service economy and a strategic base for onward investment into other

markets has made it an attractive jurisdiction for conducting business.

It is on this basis that opportunity should be capitalized upon to cultivate a

strategic business alliance which would benefit both Barbados and the

Italian Republic.”

The ministry says the government intends to vigorously pursue the

expansion of its treaty network in 2017 and beyond.

To date, Barbados has 37 DTAs with the Caribbean Community

(CARICOM), the United States, Canada, United Kingdom, Finland,

Norway, Malta, Sweden, Italy, Switzerland, Cuba, Venezuela, China,

Mauritius, Kingdom of the Netherlands, Republic of Seychelles, Republic of

Mexico, Panama, Iceland, Czech Republic, Bahrain, Singapore, Czech

Republic, United Arab Emirates, Qatar and San Marino.

The Barbados/Italy DTA now brings the number of agreements to 38.

It is expected that more of these agreements will be concluded in the

near future.

<< Back to news headlines >>

UK economy peps up, bolstering BoE rate hike call: PMI Friday 3rd November, 2017 – Reuters

Britain’s economy appears to be picking up speed, according to a survey

on Friday that will reassure the Bank of England a day after it raised

interest rates for the first time a decade.

Sterling hit a day’s high against the dollar after the IHS Markit/CIPS services

Purchasing Managers’ Index (PMI) jumped to 55.6 in October from 53.6 in

September, its biggest one-month rise since August 2016.

Despite nervousness among businesses about Brexit, the reading was its

highest since April and exceeded all forecasts in a Reuters poll of

economists.

The survey of services businesses, which account for around 80 percent of

British economic output, follows relatively upbeat PMI readings this week

for the smaller manufacturing and construction sectors.

Taken together they suggest the economy is growing at a quarterly rate

of 0.5 percent, IHS Markit said, picking up from growth of 0.4 percent in

the three months to September.

Britain’s economy has lagged behind others in Europe and beyond this

year as sterling’s plunge following last year’s vote to leave the European

Union pushes up inflation and uncertainty over the shape of Brexit causes

businesses invest more slowly.

“The UK PMI may be starting to show some convergence with its firm

global counterpart,” JPMorgan economist Allan Monks said.

Growth in the services sector outpaced that in the euro zone, as

measured by a flash estimate, for the first time since January, the PMI

showed. IHS Markit will publish a final estimate for the euro zone on

Monday.

“The Bank of England will likely see October’s (PMIs) as supportive to the

decision to raise interest rates,” said Howard Archer, chief economic

adviser to the EY ITEM Club consultancy.

Many private economists had warned before Thursday’s decision by the

BoE that a rate hike would be premature.

“However, serious uncertainties over the outlook evident among services

companies fuels suspicion that it is likely to be some considerable time

before the Bank of England hikes interest rates again,” Archer said.

The BoE raised rates for the first time in more than 10 years on Thursday

and said its next increases would be “very gradual”.

Deputy Governor Ben Broadbent said on Friday that the BoE’s signal that it

may need to raise interest rates two more times to bring down inflation

was not a promise.

Businesses are unsure about the outlook, and optimism among services

companies remained well below its long-run average, fueled mainly by

uncertainty over Brexit, the PMI data showed.

“A deeper dive into the numbers highlights the fragility of the economy,”

said Chris Williamson, chief business economist at IHS Markit, which

compiles the PMIs.

BoE Governor Mark Carney said on Thursday that the central bank’s next

move would be heavily influenced by the progress of talks on Britain’s

departure from the EU.

Growth could get a boost if a transitional deal gave businesses

confidence to invest. But a failure to reach a deal would further weaken

the pound and intensify inflation pressure.

The services PMI, which covers non-retail businesses, said firms were

putting up prices at the fastest rate since April.

Costs increased rapidly, though at the slowest rate in just over a year,

possibly tallying with the BoE’s view that the inflationary effect of last

year’s more than 10 percent fall in the value of the pound is starting to

fade.

Across the economy as a whole, the PMI showed that job creation was at

its weakest since March. “Squeezed margins and concerns about the

economic outlook had led to more cautious hiring strategies,” IHS Markit

said.

(Editing by William Schomberg and Catherine Evans)

<< Back to news headlines >>

U.S. job growth seen surging after storm-related disruptions Friday 3rd November, 2017 – Reuters

U.S. job growth likely rebounded sharply in October after hurricane-

related disruptions depressed employment in September, in a move that

could seal the case for an interest rate increase from the Federal Reserve

in December even as wage growth probably slowed.

According to a Reuters survey of economists, the Labor Department’s

closely watched employment report on Friday will likely show that

nonfarm payrolls increased by 310,000 jobs last month. That would be the

largest gain since October 2015.

Payrolls declined by 33,000 jobs in September, the first drop in seven years,

as employment in the leisure and hospitality sector tumbled by a record

111,000.

The drop was blamed on hurricanes Harvey and Irma, which devastated

parts of Texas and Florida in late August and early September, leaving

workers mostly in lower-paying industries temporarily unemployed.

A rebound in employment growth in October would reinforce the Fed’s

assessment on Wednesday that “the labor market has continued to

strengthen and that economic activity has been rising at a solid rate

despite hurricane-related disruptions.”

The U.S. central bank kept interest rates unchanged on Wednesday and

financial markets have almost priced in an increase in borrowing costs in

December. The Fed has hiked rates twice this year.

“It will confirm the Fed’s view of solid growth, meaning they are on track

to raise interest rates in December,” said Bricklin Dwyer, a senior

economist at BNP Paribas in New York. “While distorted by storms, the

overall picture is of an economy that is reaccelerating in the second half

of the year.”

But the return of lower-paid industry workers is expected to slow wage

growth in October. Average hourly earnings shot up 0.5 percent in

September, lifting the annual increase to 2.9 percent. They are seen

gaining 0.2 percent in October, which would lower the year-on-year

increase to 2.7 percent.

“Some of September’s upside represented a compositional bias as more

lower-paying industries were impacted by the storms, shifting the mix of

workers toward higher-paying industries and biasing average hourly

earnings higher,” said Ellen Zentner, Chief U.S. Economist at Morgan

Stanley in New York.

NEAR FULL EMPLOYMENT

Economists, however, remain optimistic that wage growth will accelerate

with the labor market near full employment. The unemployment rate is

forecast to hold steady at a more than 16-1/2-year low of 4.2 percent. The

jobless rate is slightly below the Fed’s median forecast for 2017.

For now, tepid wage growth would bolster views that inflation will

continue to undershoot its 2 percent target and raise concerns about

consumer spending, which appears to have been largely supported by

savings.

The economy grew at a 3.0 percent annualized rate in the third quarter.

Economic strength has persisted even as President Donald Trump and the

Republican-led U.S. Congress have struggled to enact their economic

program.

Republicans in the U.S. House of Representatives on Thursday unveiled a

bill that proposed slashing the corporate tax rate to 20 percent from 35

percent, cutting tax rates on individuals and families and ending certain

tax breaks for companies and individuals. The tax plan has already been

met with resistance from small businesses, realtors and homebuilders.

October’s anticipated employment gains would bring the average for the

past two months to 139,000, below the 172,000 monthly average in the last

12 months to August. The economy needs to create 75,000 to 100,000 jobs

per month to keep up with growth in the working-age population.

The slowdown in the job growth trend largely reflects difficulties employers

have finding qualified workers.

“Companies are having a tough time filling job openings,” said Joel

Naroff, Chief Economist at Economic Advisors in Holland, Pennsylvania.

Private payrolls are expected to have surged by 303,000 jobs in October

after falling 40,000 in September. Manufacturing employment likely

rebounded by 15,000 jobs after slipping 1,000 in September. Gains are also

expected in the retail sector, which shed 2,900 jobs in September.

Construction payrolls, which rose by 8,000 jobs in September, probably got

a boost from the clean-up and rebuilding efforts in the wake of the

hurricanes.

(Reporting by Lucia Mutikani; Editing by Chizu Nomiyama)

<< Back to news headlines >>

Oil near two-year highs as tightening market woos buyers Friday 3rd November, 2017 – Reuters

Oil prices rose on Friday, nearing their highest levels in more than two

years, with buyers attracted by expectations of an extension to a global

pact to cut output that has reduced oversupply.

Global benchmark Brent futures LCOc1 traded up 45 cents at $61.07 a

barrel at 0914 GMT, approaching levels around $61.70 a barrel last seen in

July 2015. Brent has risen around 38 percent since its low in 2017 reached

in June. U.S. West Texas Intermediate (WTI) crude CLc1 traded at $54.92 a

barrel, up 38 cents. WTI is around 31 percent above its 2017 low hit June.

This week’s U.S. Energy Information Agency (EIA) report on crude

inventories and exports showed a large draw in U.S. stocks, showing that

market is rebalancing.

“Wednesday’s EIA report was bullish so the longs took profit then but now

the uptrend is reasserting itself. Roll-over of the OPEC/non-OPEC deal looks

certain and is also supportive,” said Tamas Varga, senior analyst at

London brokerage PVM Oil Associates.

The Organization of the Petroleum Exporting Countries meets at the end

of November to discuss further action after it agreed nearly a year ago

with Russia and other producers to hold back 1.8 million barrels per day

(bpd) of oil supply. Russia said on Thursday the deal, which is due to expire

in March, could be extended if necessary but that a decision was not

imminent.

While supplies are being withheld, demand is also rising, especially in

China, whose roughly 9 million bpd of imports have surpassed those of the

United States to top the world’s crude importer list. “China’s oil demand

growth appears to be accelerating,” investment bank Jefferies said.

Physical oil prices are also rising. Saudi Aramco, the UAE’s ADNOC and

Qatar Petroleum have all raised their crude prices for Asian buyers, with

Aramco’s December premium over the average of the Oman and Dubai

benchmarks now at the highest in three years.

(Additional reporting by Henning Gloystein in Singapore; Editing by

Edmund Blair)

<< Back to news headlines >>

Futures rise with Apple ahead of jobs data Friday 3rd November, 2017 – Reuters

Apple’s upbeat results and strong initial demand for the new iPhone X put

Wall Street on track for a strong opening on Friday, while investors

watched out for October jobs data for clues on the strength of the labor

market.

Apple (AAPL.O) shares surged 3 percent in premarket trading after the

world’s largest company by market capitalization gave a robust sales

forecast for the year-end holiday shopping season.

U.S. job growth likely rebounded sharply in October after hurricane-

related disruptions depressed employment in September, in a move that

could seal the case for an interest rate increase from the Federal Reserve

in December even as wage growth probably slowed.

Traders now see a 98.2 percent chance of an interest rate hike in

December, according to CME Group’s FedWatch tool.

The Labor Department releases nonfarm payrolls numbers at 8:30 a.m. ET.

It is likely to rebound by 310,000 jobs in October after a 33,000-jobs fall in

September. The unemployment rate is forecast unchanged at 4.2 percent

and average hourly earnings rising 0.2 percent after jumping 0.5 percent

in September.

President Donald Trump on Thursday tapped Fed Governor Jerome Powell

to become head of the U.S. central bank, signaling a continuation of

current Chair Janet Yellen’s cautious monetary policies.

In Washington, House Republicans also finally disclosed their long-delayed

plans for tax cuts that Trump has promised, setting off a frantic race in

Congress to give him his first major legislative victory. Starbucks (SBUX.O)

slipped 3.4 percent after the company trimmed its profit forecast and

posted disappointing sales, squeezed by competition.

AIG (AIG.N) fell 4.3 percent after the insurer posted a bigger loss on huge

catastrophe losses and said it set aside more money in reserves to meet

losses related to prior-year accident claims.

(Reporting by Sruthi Shankar in Bengaluru; Editing by Sriraj Kalluvila)

<< Back to news headlines >>

Dollar lackluster before U.S. jobs data Friday 3rd November, 2017 – Reuters

The dollar steadied on Friday, capping a week of mild losses, as investors

waited for fresh data for evidence of more strength in the U.S. economy

and the progress of tax plans to bet on the greenback’s outlook.

The market showed little reaction to U.S. President Donald Trump’s

appointment on Thursday of Fed Governor Jerome Powell to lead the U.S.

central bank as markets expected his leadership will signal a continuation

of Janet Yellen’s cautious policies.

“Powell’s appointment doesn’t change anything in terms of what we

expect from the Fed over the next year and the bigger story here is that

three biggest economic blocs including China, U.S. and Europe are

growing at a strong pace together for the first time since the crisis,” said

Richard Falkenhall, Senior FX Strategist at SEB in Stockholm.

The next big data release comes later today. The U.S. non-farm payrolls

report is expected to show job numbers bounced back in October after

September’s drop.

Against a broad basket of currencies, the dollar edged 0.1 percent up to

94.77 .DXY, up from a one-week low of 94.411 set on Thursday.

The dollar has bounced more than 4 percent since hitting a September

low after falling more than 12 percent in the first nine months of the year.

Even longer-term skeptics of the dollar such as BNP Paribas warn against

shorting the greenback as market positioning has become more

balanced and because of the “gradual progress” of the U.S. tax reform

bill.

In Washington, House Republicans also finally disclosed their long-delayed

plans for tax cuts that President Trump has promised, setting off a frantic

race in Congress to give him his first major legislative victory.

The Australian dollar AUD=D3 was the big loser of the day, falling half a

percent after disappointing retail sales data. The British pound GBP=D3

dropped to a one-month low after plunging on Thursday.

The Australian dollar slipped half a percent to $0.7666 AUD=D3, coming

under pressure after data showed that retail sales were flat in September.

That was below market expectations for a rise of 0.4 percent on the

month.

Sterling continued to fall after suffering its biggest one-day fall against the

dollar since June on Thursday, when the Bank of England raised interest

rates for the first time in more than a decade but said it sees only gradual

rises ahead.

Sterling fell 0.2 percent to $1.3040 GBP=D3, its lowest since Oct. 6, after

losing 1.4 percent on Thursday.

Morgan Stanley strategists said the prospect of more U.S. rate increases

next year would put pressure on currencies such as the Australian dollar

and sterling, since households in those countries have racked up large

debts in recent years.

“As the Fed continues to raise interest rates, these funding costs will rise, if

not compensated by lower borrowing costs in their home currency,”

Morgan Stanley strategists said in a note.

(Reporting by Saikat Chatterjee; Editing by Larry King and Emelia Sithole-

Matarise)

<< Back to news headlines >>

China's second-largest bank unveils easy loan in push for rental housing

market Friday 3rd November, 2017 – Reuters

China’s second biggest bank, China Construction Bank, has unveiled a

credit loan product for home renters, the first of its kind, as the

government looks to develop the rental housing market, the People’s

Daily said.

Renters can apply for the loan to pay rent and related costs in the

southern boomtown of Shenzhen with a credit line of up to 1 million yuan

($150,879), the official newspaper said on Friday.

The bank says the loan is easy to obtain, with a swift one-day approval

process and can be repaid within 10 years, it added.

As property prices have shot up, driven by speculation and demand from

a growing middle class, rental yields have eased to multi-year lows, with

the rental market having long been underdeveloped and largely

unregulated.

The bank’s Shenzhen branch on Friday also announced strategic pacts

with 11 major developers and rental firms, including China Vanke and

China Evergrande Group, to launch 5,481 long-term rental homes on the

Shenzhen market, the paper said.

The bank’s involvement has “eased developers’ financing concerns over

return on investment and thus their reluctance to enter the rental market”,

it quoted Wang Feng, the director of the Shenzhen Real Estate Research

Center as saying.

China announced plans in August to launch pilot programmes in 13 major

cities, including Beijing and Shanghai, to build rental housing projects in an

effort to ease a housing shortage.

($1=6.6278 Chinese yuan renminbi)

(Reporting by Yawen Chen and Beijing Monitoring Desk)

<< Back to news headlines >>

China tightens controls on down payment financing for home buyers:

Xinhua Friday 3rd November, 2017 – Reuters

Chinese authorities have intensified efforts to curb illegal financing for

mortgage down payments and asked banks to step up checks on home

buyers’ income authenticity, the official Xinhua news agency said, amid a

drive to rein in financial risks.

China’s housing market has been on a near two-year tear, giving the

economy a major boost but stirring fears of a property bubble even as the

authorities try to contain risks from a rapid build-up in debt.

While Beijing has introduced a flurry of measures to dampen housing

speculation, including raising the down payment ratio in some cities,

cases of savvy buyers skirting the rules have been reported by Chinese

media.

The People’s Bank of China (PBOC), the China Banking Regulatory

Commission (CBRC), and the Ministry of Housing and Urban-Rural

Development (MHURD) jointly issued the directive against illegal down

payment financing, Xinhua reported on Friday.

They will also strictly prevent individual consumer loans from being misused

in housing purchases, Xinhua said.

The head of the central bank warned in October that China’s household

debt is rising too quickly, and some analysts suspect a recent burst of

consumer loans points to the illicit use of loans for property investment.

Outstanding household consumer loans in both yuan and foreign

currencies totaled 30.2 trillion yuan ($4.56 trillion) at the end of September,

jumping 29.1 percent from a year earlier.

Intensified scrutiny should also be applied to internet financing companies

and micro loan providers, Xinhua said.

While some analysts say the crackdown over illegal funds flowing into the

property market is a continuation of the existing policy, a renewed,

concerted effort by the three government entities suggest overheating

has become an increasingly serious concern.

The report also said a joint working mechanism will be established to

improve coordination among the three entities to ensure the most up-to-

date housing sales and price data are available to banks, in order to

effectively stem mortgage fraud.

Developers and real estate agents must regulate their payment process

and report suspicious transactions, it added.

(Reporting by Yawen Chen and Kevin Yao; Editing by Jacqueline Wong)

<< Back to news headlines >>

China gives mutual funds bigger role in retirement planning Friday 3rd November, 2017 – Reuters

China’s securities regulator is hoping the mutual funds industry can play a

bigger role in retirement planning, publishing on Friday guidelines for a