Benefits of a CariCRIS Rating to a Corporate...

-

Upload

phamkhuong -

Category

Documents

-

view

213 -

download

0

Transcript of Benefits of a CariCRIS Rating to a Corporate...

SME eSmart- Powering Your Potential Find out more today by calling: (868)-627-8879 ext. 228 or email: [email protected]

Home Mortgage Bank’s rating reaffirmed at CariA

NCB Financial Group Limited’s initial corporate credit rating assigned at CariA

National Commercial Bank Jamaica Limited’s rating upgraded to CariBBB+

NCB (Cayman) Limited’s initial corporate credit rating assigned at CariA

The Government of the Commonwealth of Dominica placed on Rating Watch – Developing

Dominica AID Bank’s rating downgraded by 1-notch and placed on Rating Watch – Negative

The Government of the British Virgin Islands placed on Rating Watch – Developing

The Government of Anguilla placed on Rating Watch – Developing

NCB Capital Markets Limited’s rating upgraded to CariBBB

Trinidad and Tobago Mortgage Finance Limited’s rating reaffirmed at CariAA-

The National Gas Company of Trinidad and Tobago Limited’s rating reaffirmed at CariAA+

The Government of the Republic of Trinidad and Tobago’s rating reaffirmed at CariAA+

The Government of Saint Lucia’s ratings for its proposed bond issues assigned at CariBBB

OUR UPCOMING WORKSHOPS!

Operational Risk Management in 16 & 17 November 2017 Trinidad

Financial Institutions

Please contact Prudence Charles ([email protected]) or Sita Sonnyram ([email protected]) to register

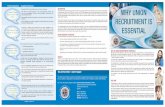

Benefits of a CariCRIS Rating to a Corporate Entity:

Latest Rating Actions by CariCRIS

Improve relationships with creditors with an independent, objective

assessment of business

Strengthen your governance and hedge against business risk

Attract investors to raise money in capital markets

Detect credit deterioration early and focus your management on

hedging risks

DATE WORKSHOP COUNTRY

Please visit our website at www.caricris.com for the detailed Rationales on these and other ratings

CariCRIS’ credit ratings and daily Newswire can also be found on the Bloomberg Professional Service.

REGIONAL

Trinidad and Tobago

TSTT workers stage protests

Although TSTT has already stated that they will not retrench any employee

when closing their bmobile retail outlets, the Communication Workers

Union (CWU) said they have no faith in the company and is preparing for

war.

T&T, Caribbean companies to benefit from EPA

Minister of Trade and Industry Paula Gopee-Scoon said in spite of some

challenges, the Economic Partnership Agreement (EPA) has the potential

to help local and regional companies penetrate European markets.

T&T Chamber optimistic about tax efficiency under TTRA

The T&T Chamber of Industry and Commerce (TTCIC) is hopeful that when

the T&T Revenue Authority (TTRA) is implemented it will result in a more

efficient processing of VAT returns.

FSO: More financial inclusion needed in T&T

Financial Services Ombudsman (FSO) Dominic Stoddard said the

perception in T&T is that more can be done to increase financial inclusion

in the country.

Jamaica

Jamaican Hotels Bullish On Winter Season, Downplay Business From Storm-

Hit Markets

The damage to property and infrastructure in some sections of the

Caribbean has seen a fall in habitable room inventory, with the result that

vacationers are looking elsewhere for winter travel options.

NCB Bond Hits Target

Shares in NCB Financial Group (NCBFG) have been climbing since the

banking group announced the placement of a new corporate bond to

raise US$105 million ($13.36 billion).

Jamaica Cont’d

Jamaica Producers To Sell Pineapples To Cayman, Other Markets

Jamaica Producers Group Limited (JP), which is currently searching for a

specialist farm manager for pineapple production, said it is now making

headway on plans to expand markets for the fruit.

Jamaica slips three spaces in crucial Doing Business Report

One month after showing improvement on the Global Competitiveness

Report, Jamaica has conversely slipped three places in the prestigious

Doing Business Report 2018 ranking to 70 of 190 countries.

Barbados

Commercial banks forced to hold more Govt paper

With commercial banks currently displaying a low appetite for such

instruments, the Central Bank of Barbados today announced an increase

in the amount of Government paper the banks are required to hold by

law.

Economy grows but foreign reserves fall further

The Barbados economy grew by an estimated 1.4 per cent over the first

nine months of this year but the foreign reserves have taken another hit.

Plunging reserves

With election fever already in the air, Acting Central Bank Governor

Cleviston Haynes is not about to tell the Freundel Stuart administration to

bite the proverbial bullet and agree any International Monetary Fund

(IMF) financing arrangement.

No hike

With this island’s two trade major unions currently persisting with demands

for double digit pay increases for their members, the Central Bank has

issued a fresh word of caution that the economy can ill-afford any such

fiscal strain at the moment

The Bahamas

Port Operator Targets Cruise Ship Expansion

The Nassau Container Port (NCP) yesterday said it plans to allocate $7.5

million to capital projects and debt repayment, as it eyes diversification

into cruise ship services.

The Bahamas Cont’d

Gov't Faces $900m Climate Change Bill

The Government has estimated it faces a $900 million bill to mitigate

climate change under the United Nations (UN) framework, with the

Bahamas facing "accelerated vulnerability" to natural disasters.

Cable Unveils Dividend Restart Within One Year

CABLE Bahamas expects its growth strategy to start paying off for

shareholders in less than a year's time, although it is "not fully satisfied yet"

with the returns generated.

Gov't Pays '3x' Value Of Bob's Toxic Loans

Bank of the Bahamas' (BOB) latest bail-out has cost Bahamian taxpayers

more than three times' the net value of toxic loans purchased from the

stricken BISX-listed bank.

Guyana

Guyana Goldfields generates US$50M in third quarter

Guyana’s biggest gold mine, Guyana Goldfields Inc., announced that it

generated over US$50M for the third quarter alone. The period, July 1st to

September 30, 2017, saw the production of 41,000 ounces of gold.

Haiti

IDB to invest $65 million to improve water and sanitation services in Haiti

Haiti will improve drinking water and sanitation services in the Port-au-

Prince metropolitan area, as well as in rural areas, in particular those

affected by Hurricane Matthew, with a $65 million grant from the Inter-

American Development Bank (IDB).

British Virgin Islands

BVI premier updates Overseas Territories leaders on recovery plans at

Miami meeting

Premier and minister of finance, Dr Orlando Smith, presented an update

on the current status of the British Virgin Islands hurricane recovery and

restoration efforts at a meeting of Caribbean British Overseas Territories

leaders held in Miami over the weekend.

Dominica

Looting deals major blow to private sector says DAIC

Executive Director of the Dominica Association of Industry and Commerce

(DAIC) Lizra Fabien has said the private sector in Dominica has suffered a

major blow because of looting after Hurricane Maria.

INTERNATIONAL

United States

Fed set to hold rates steady ahead of Trump's leadership decision

The Federal Reserve is expected to keep interest rates unchanged on

Wednesday as speculation swirls on who will be its next leader, but the U.S.

central bank will likely point to a firming economy as it edges closer to a

possible rate rise next month.

Futures jump on strong earnings; Fed takes center stage

U.S. stock index futures pointed to a strong opening for Wall Street on

Wednesday, as an upbeat third-quarter earnings season lifted sentiment

while investors waited for clues on future rate hikes from the latest Fed

meeting.

Dollar climbs against yen before Fed decision, Kiwi catapults

The dollar climbed on Wednesday, nearing a 3 1/2-month high against

the yen, as investors focused on a policy decision from the U.S. Federal

Reserve later in the day as well as any progress on President Donald

Trump’s tax reform plans.

U.S. gasoline demand hits record high in August: EIA

U.S. gasoline demand hit a record in August, delivering a strong end to

the summer driving season, according to data released on Tuesday by

the U.S. Energy Information Administration.

United Kingdom

Sterling hits four-and-a-half-month high vs euro on strong factory data

Sterling jumped to a 4-1/2 month high against the euro on Wednesday

after British manufacturers reported robust growth for October, cementing

expectations that the Bank of England will raise interest rates on Thursday.

Europe

European shares start November on a two-year high

European stocks surged to two-year peaks on Wednesday, lifted by

resilient company earnings and record highs set in Asia and New York,

though a 6 percent slump in Standard Chartered shares kept the banking

sector under a cloud.

End of ECB's asset buys will be a "minor issue": Hansson

Winding down bond purchases to zero will be “a minor issue” for the

European Central Bank because of a bulked up balance sheet and a

commitment to keep interest rates low, ECB Policymaker Ardo Hansson

said on Wednesday.

China

China c.bank injects $2.6 bln via MLF, SLF in Oct, down 70 pct from Sept

China’s central bank injected a net 17.1 billion yuan ($2.6 billion) into the

financial system via short- and medium-term liquidity tools in October, 70

percent less than in the previous month.

Japan

BOJ can't exit stimulus when inflation below 1 percent - BOJ Governor

Candidate Ito

The Bank of Japan likely won’t be able to exit its massive stimulus program

while inflation is hovering below 1 percent, Takatoshi Ito, an academic

who is a potential candidate to become the next BOJ governor, said on

Wednesday.

BOJ's new 'cost-push' index suggests price pressures building

A new Bank of Japan indicator that measures the costs of goods and

services not yet passed through to the wider economy showed on

Wednesday price pressures are growing, even as consumer inflation

remains subdued.

India

India jumps to 100th spot on World Bank's Ease of Doing Business list

India jumped into 100th place on the World Bank’s ranking of countries by

Ease of Doing Business for the first time in its report for 2018, up about 30

places, driven by reforms in access to credit, power supplies and

protection of minority investors.

Global

Oil hits highest since mid-2015 as OPEC sticks to supply deal

Oil rose to its highest since mid-2015 on Wednesday as data showed

OPEC has significantly improved compliance with its pledged supply cuts

and Russia is also widely expected to keep to the deal.

Cryptocurrencies' total value hits record high as bitcoin blasts above

$6,500

The aggregate value of all cryptocurrencies hit a record high of around

$184 billion on Wednesday, according to industry website

Coinmarketcap, making their reported market value worth around the

same as that of Goldman Sachs and Morgan Stanley combined.

TSTT workers stage protests Wednesday 1st November, 2017 – Trinidad and Tobago Guardian

Although TSTT has already stated that they will not retrench any employee

when closing their bmobile retail outlets, the Communication Workers

Union (CWU) said they have no faith in the company and is preparing for

war.

Workers at Park Street, Port-of-Spain and St James Street, San Fernando

brushed aside lunch to march outside the company’s compounds, as the

first step in industrial action geared toward saving over 250 jobs, which

includes staff from employment agencies.

“This is a lunchtime demonstration but it is going to be the first step in a

series of actions that are going to take place. This union stands firm that

not one worker must leave within the walls of TSTT,” CWU chairman

Desmond Campbell said yesterday.

Campbell said the CWU foretold this action by TSTT when they protested

at the Cipero Road Work Centre last April.

At that time, the CWU spoke of a dismantling of TSTT as a State-owned

company to be gifted to the private sector.

He said that in May, TSTT announced the acquisition of Massy

Communications for $255 million, yet the country was still unaware of the

details of that purchase.

With TSTT set to close nine of its 10 centres, Campbell said citizens are not

being given a choice and would have to visit dealers to do all

transactions.

“I want the people of Trinidad and Tobago to be mindful that this is not

about money, it is about job security. It is also about the national

patronage. TSTT is 51 per cent owned by the people of Trinidad and

Tobago and has shares divested in NEL. To date, TSTT and the government

of Trinidad and Tobago owe it to the citizenry to come clean on the deal

with Massy and TSTT,” Campbell said.

While the CWU has not received official correspondence of the shutdown

of the branches, a media release last week from TSTT stated that as part of

their analysis, it was found that more than 70 per cent of the transaction

activities at its bmobile retail stores were bill related.

Yesterday, employment agencies, including Regency Recruitment

Resources and Jo-Anne Mouttet & Associates issued a public advisory,

stating that they were alerted by TSTT of their digital transformation.

This transformation includes the use of TSTT’s enhanced online portal,

interconnected kiosks and an expanded bill payment network including

the banks, Sure Pay and dealers.

It was on this ground TSTT, took the decision to close the 10 retail stores.

Though agents’ contracts were expected to expire yesterday, after

discussion between TSTT and the employment agencies, those notices

were rescinded and extensions to employment contracts were issued.

<< Back to news headlines >>

T&T, Caribbean companies to benefit from EPA Wednesday 1st November, 2017 – Trinidad and Tobago Guardian

Minister of Trade and Industry Paula Gopee-Scoon said in spite of some

challenges, the Economic Partnership Agreement (EPA) has the potential

to help local and regional companies penetrate European markets.

“It (the EPA) has the potential to expand market opportunities for the

regional private sector within the European Union (EU) ” she said.

Gopee-Scoon spoke yesterday at the Third Meeting of the CARIFORUM-EU

Parliamentary Committee Meeting at the Hyatt Regency Hotel, Port-of-

Spain.

She said nine years ago this month, the EPA Agreement between the

CARIFORUM states and the EU was signed, ushering a new legal basis for

preferential trade between the two regions.

The purpose of the agreement is to make it easier for people and

businesses from the two regions to invest in and trade with each other and

thus to help Caribbean countries grow their economies and create jobs.

The Caribbean Forum (CARIFORUM) is a subgroup of the African,

Caribbean and Pacific Group of States and serves as a base for

economic dialogue with the EU.

She called on visiting EU parliamentary members who were at the

meeting yesterday to influence the EU Commission in adopting a more

flexible approach in the challenges which CARIFORUM countries face.

“Especially in this time of difficult economic conditions and our

vulnerability to natural disasters.”

She called the EPA a “comprehensive trade and development

agreement.”

“The agreement addresses a number of areas like trade in goods, services

and investment, competition policy, innovation and intellectual property,

transparency in public procurement, environmental and social aspects

and personal data protection. It also pertains an over-arching

developmental co-operation chapter.”

She said while the EPA has not yet come into force it has been

provisionally applied since 2008 by all parties with the exception of Haiti.

She pointed out that there are challenges and referred to the first review

of the EPA and said that market penetration for regional companies has

been very difficult.

Boleslaw Piecha, Member of the European Parliament and Chair of

European Parliament’s Delegation to the CARIFORUM-EU Parliamentary

Committee who also spoke yesterday said that the EU delegation would

visit several local companies who have already entered the EU market

including Angostura and T&T Fine Cocoa.

“The EPA is a very good agreement which provides trade and investment

opportunities,” he said.

<< Back to news headlines >>

T&T Chamber optimistic about tax efficiency under TTRA Tuesday 31st October, 2017 – Trinidad and Tobago Guardian

The T&T Chamber of Industry and Commerce (TTCIC) is hopeful that when

the T&T Revenue Authority (TTRA) is implemented it will result in a more

efficient processing of VAT returns.

The Chamber’s reaction comes after last Monday’s announcement by

the Ministry of Finance that it was proceeding with phase one of the

implementation of the TTRA.

In emailed responses, the Chamber said, it “believes effective

implementation of the TTRA will widen the tax net and result in improved

tax collection.

“We hope this will also facilitate better processing of VAT refunds; the

current lag which in some instances is in excess of a year, is

unacceptable.”

Stating that the implementation of the TTRA was long overdue, the TTCIC

said including the non-compliant businesses with the businesses which are

compliant with paying their taxes will ease the burden of having to

increase taxes further on the businesses which are already compliant.

On the issue of any anticipated changes in the salary/wage bill when the

workers are transferred to the TTRA, the Chamber said it was putting

efficiency on the front burner.

“We recognize there may be some limitations on how the Govt can shift

the required manpower into the TTRA so while we are concerned about

the increased cost, what is more important is an efficient and effective

organisation which can fulfil its mandate.”

Though recongising the role of revenue authorities in strenghtening and

improving tax collection, President of the Public Services Association

Watson Duke said the establishment of the TTRA was “ no panacea” for

many of the tax issues plaguing the country.

<< Back to news headlines >>

FSO: More financial inclusion needed in T&T Tuesday 31st October, 2017 – Trinidad and Tobago Guardian

Financial Services Ombudsman (FSO) Dominic Stoddard said the

perception in T&T is that more can be done to increase financial inclusion

in the country.

Financial inclusion, as defined by the World Bank Group, means

individuals and businesses have access to useful and affordable financial

products and services that meet their needs.

Stoddard was yesterday delivering remarks at the ceremony to relaunch

the Bankers Association of T&T (BATT) Code of Banking practices which

was held at the Scotiabank Hospitality Suite at the Queen's Park Oval in

Port-Of-Spain.

"The evolving financial technologies remains a challenge for many

customers, especially those not as technologically savvy as some of our

up and coming citizens, or maybe those who may not yet trust the safety

and security of online banking." Stoddard said.

Quoting from the Financial Literacy Survey of 2007, he said the unbanked

population was 21 per cent and an updated survey in 2013 found that the

situation did not change since the figure remained the same.

This statistic he said, "speaks to tremenduous untapped economic

potential."

In spite of this, Stoddard said the Office of the Ombudsman reaffirmed its

commitment to the ideals of the Code of Banking practice.

President of BATT, Anya Schnoor said the purpose of relaunching the code

was to enhance the banking community's commitment to customers.

She added that the code resembles the 2003 version and the changes

which were made were not "cosmetic."

"Careful attention has been put into the review and strengthening of

each provision taking into consideration the changing dynamics in our

industry, customer expectations and current global best practice."

Addressing the issue of complaints, she said for many years the public has

criticised member-banks on various issues and as such, "we want our

customers to know that the code makes explicit provision for dispute

resolution and we want them (the public) to avail themselves of this

facility, should the need arise."

Stating specifically what is in place, Schnoor said banks serve as the first

point of call for queries and complaints and the Office of the Financial

Services Ombudsman as the second point of call, if the customer is

dissatisfied with the outcomes of the bank's internal process for resolution.

<< Back to news headlines >>

BVI premier updates Overseas Territories leaders on recovery plans at

Miami meeting Tuesday 31st October, 2017 – Caribbean News Now

Premier and minister of finance, Dr Orlando Smith, presented an update

on the current status of the British Virgin Islands hurricane recovery and

restoration efforts at a meeting of Caribbean British Overseas Territories

leaders held in Miami over the weekend.

Smith joined colleague premiers and chief ministers to discuss progress

being made and to agree collective actions in support of the affected

territories. He also highlighted some of the lessons learned from the series

of unprecedented weather events during the 2017 hurricane season.

The premier explained that in the BVI, Hurricanes Irma and Maria were

preceded by an intense flood event in August, which had already

severely impacted the territory.

Smith expressed thanks and appreciation for the deep level of support

received from his colleagues in the immediate after math of Hurricane

Irma.

He thanked the premiers of the Cayman Islands and Bermuda for their

continued assistance with law enforcement officers and linesmen to assist

in the restoration of electricity supply. The premier further appealed for

additional assistance with linesmen as the restoration of the power supply

is a key component to the BVI’s recovery effort.

Meanwhile, the leaders agreed that hurricane recovery and

reconstruction should be the focus of the annual Joint Ministerial Council

Meeting, due to the significant number of territories affected and the high

level of devastation wrought by the unprecedented 2017 hurricane

season.

The leaders discussed the likelihood for the continuing increase in the

intensity of hurricanes and other severe weather events in the region as a

result of climate change, and identified the need for strong economic

support to sustain their economies to face this challenge. They

recommitted themselves to working together and to ensuring that this

concern would be the focus of the upcoming Joint Ministerial Council

meeting with the British government late next month.

The meeting also highlighted the efforts of Bermuda, the Cayman Islands,

Gibraltar, Montserrat and the Falkland Islands as a reflection of the strong

bond which exists between the people of the territories, which is also

shared with the United Kingdom.

Territory leaders committed to continued support of each other in disaster

management and mitigation strategies; sharing information, expertise and

best practices in communications and physical planning.

The British Overseas Territories in the Caribbean region include Anguilla,

Bermuda, the British Virgin Islands, the Cayman Islands, Montserrat and the

Turks and Caicos Islands. The Joint Ministerial Council is held in London

annually and provides an opportunity for United Kingdom’s Overseas

Territory leaders to discuss matters of concern directly with the British

government.

<< Back to news headlines >>

Looting deals major blow to private sector says DAIC Tuesday 31st October, 2017 – Dominica News Online

Executive Director of the Dominica Association of Industry and Commerce

(DAIC) Lizra Fabien has said the private sector in Dominica has suffered a

major blow because of looting after Hurricane Maria.

She described the matter as ‘the human hurricane,’ saying it will take

some time before businesses rebound.

“The private sector has been affected by the human hurricane which is

the amount of looting, the looting that took place,” she said on state-

owned DBS Radio.

Fabien pointed out that the level of looting has disappointed the private

sector.

“The private sector is quite disappointed with what happened,” she

stated. “This creates a ripple effect for our economy, even greater than

what we could see with our own eyes, things as lack of essential services,

destruction of the food chain, lack of funds for circulation in Dominica.”

She noted that it is important that the private sector sees how it should

move forward as soon as possible and improve the business condition in

Dominica.

Meanwhile, Vice President of the DAIC, Stephen Lander, has expressed

concerns over the ‘ripple effects’ the large amount of layoffs might have

on the economy after Hurricane Maria.

“The more people that get laid off, the less buying power you have in the

economy and that trickles down to those businesses that can open and

serve the public, their businesses may go down because less people are

buying,” he said.

<< Back to news headlines >>

Jamaican Hotels Bullish On Winter Season, Downplay Business From Storm-

Hit Markets Wednesday 1st November, 2017 – Jamaica Gleaner

The damage to property and infrastructure in some sections of the

Caribbean has seen a fall in habitable room inventory, with the result that

vacationers are looking elsewhere for winter travel options.

However, resort managers in Jamaica have mixed views on the possibility

of the fallout impacting occupancy rates in Jamaica in any extraordinary

way.

"I realise everyone is suggesting that the Eastern Caribbean's demise will

lead to higher numbers and visitors for our island. I don't necessarily

agree," said Dimitris Kosvogiannis, general manager of the 225-room Melia

Jamaica Braco Village.

"While I do believe some traffic may be diverted our way, we must

carefully examine the segments and destinations affected ... For example,

guests choosing St Barts as vacation spot, primarily based on its luxury

component and unparalleled culinary choices on that island, will most

likely not chose Jamaica, the land of all-inclusives, with a few notable

exceptions," he said.

Jamaica's tourism market has been growing by around six per cent,

according to the latest numbers to August. In the first eight months

stopover visitors to 1.625 million compared to 1.532 million in the same

period in 2016.

The Ministry of Tourism is itself cautioning against widespread expectation

of new business diverted from storm-hit markets.

"It is important to note that several of the islands worst affected by the

storm don't have comparable resorts to Jamaica, so there is no shift of

business by brand," said Delano Seiveright, senior adviser /strategist to the

Minister of Tourism.

"As for the cruise side of the business we are seeing additional calls given

the disruption of some Eastern Caribbean itineraries," he said.

Seiveright attributes the market gains so far this year to "aggressive growth

initiatives", including the alliance with Airbnb, market outreach to places

like Canada Western Europe, and closer collaboration with cruise

operators.

The outlook for the winter season, which traditionally kicks off on

December 15 annually, is positive, based on advance bookings. Some

properties say some of that business would normally have gone to other

Caribbean destinations.

"Hilton Rose Hall Resort & Spa and the four Jewel Resorts have a positive

outlook for the upcoming season and believe that Jamaica is absolutely

seeing some supplemental short term demand this fall and into the first

quarter of 2018," said Charmaine Deane, area director of marketing and

communications for the Jewels resort group.

Deane said the new business "is from both the group and leisure market

segment along with some business that needed to be relocated from

other Caribbean islands" and that the increase ranged between 5 per

cent and 50 per cent, depending on the property.

"This has been evident from higher call volumes, as well as mostly higher

occupancies year over year within the Jewel Resorts and Hilton Rose Hall

portfolio here on island," she said.

Hurricanes Irma and Maria cut a destructive path through various

Caribbean territories in September. The impacted islands included

Barbuda, Anguilla, St Martin, St Barts, British Virgin Islands, US Virgin Islands,

and Puerto Rico.

St Barts' hotels are expected to be out of commission until the end of 2018.

Kosvogiannis says Melia Braco is itself projecting good business for the

peak season, but insists that any impact on bookings from storm-hit

markets would be minimal.

"We have confirmed buyouts for January, March and April and anticipate

a very full month for February," said the hotel manager. "Our property has

received international recognition and we are confident we will continue

to grow and expand into new markets as we establish the brand in the

North American market."

But he did not expect, he said, that those who had booked vacations for

the islands in the north east will switch en suite to islands such as Jamaica.

"If I am to travel to Cuba, for example, as I wish to visit the history, tradition

and Latin flair offered there, I would be very hard-pressed to choose the

birth place of reggae as an alternative. This would be tantamount to

planning for a steak dinner and going to a seafood restaurant," he

reasoned.

Sandals Resorts International, which operates 15 Sandals and three

Beaches resorts in Jamaica and around the Caribbean, indicates that the

hurricanes have had minimal impact on its properties.

"Sandals resorts across the Caribbean continue to experience robust

occupancy," said Director of Corporate Services Jeremy Jones.

"In the Eastern Caribbean, we had one resort closed on the heels of

Hurricane Irma for previously planned renovations and those guests were

relocated to our other resorts in that region," he said.

<< Back to news headlines >>

NCB Bond Hits Target Wednesday 1st November, 2017 – Jamaica Gleaner

Shares in NCB Financial Group (NCBFG) have been climbing since the

banking group announced the placement of a new corporate bond to

raise US$105 million ($13.36 billion).

NCB Financial hit the fundraising target on Tuesday, but the market

reaction was muted.

For the month of October, up to Monday, the NCBFG stock climbed 23

per cent to $107.02, but on Tuesday the price fell to $105 around midday,

but eventually recovered to $107.03 per share.

The bond, arranged by subsidiary NCB Capital Markets Limited, comes

within the context of a fairly liquid US dollar money market, with investors

seeking lucrative investment options for their money. The bond will pay

interest semi-annually at seven per cent per annum, and matures in five

years in October 2022.

"We can say that we successfully raised the bond today," NCB Capital

Markets CEO Steven Gooden told Gleaner Business.

The banking conglomerate is expected to use the bond proceeds to

finance new deals.

"NCBFG is building its financial arsenal to pursue various investment

opportunities both in the local and regional markets," said President and

Group CEO Patrick Hylton in a full-page press advertisement announcing

the bond offer on October 8.

"With this expansion comes the opportunity to diversify our revenue

streams; it is our intention to continue maximising on our regional interests

through a combination of strategic investments, joint ventures, mergers

and acquisitions that will stimulate further business," Hylton said in the

statement.

Some market analysts have interpreted that to mean that NCB Financial

could seek to increase its stake in Guardian Holdings.

Asked about the possibility of acquiring additional shares in Guardian,

Gooden said the company does not comment on such matters as a

matter of policy.

NCB Financial now owns 29.99 per cent of Guardian Holdings, a regional

conglomerate with operations in 21 markets. It paid $28 billion for

65,547,241 ordinary shares in Guardian last year May.

"If they go after Guardian and fully acquire it, then what you have is a true

regional powerhouse. It would be even larger than Sagicor," said the

head of a local investment house, who commented on condition of

anonymity.

"That would be massive," he said.

The new bond is NCB Financial's second large fundraising this year. The

banking conglomerate previously raised $18.4 billion and that bond was

subsequently listed on the Jamaica Stock Exchange (JSE). It became the

largest debt security to list on the JSE bond trading platform, alongside a

tiny pool of corporate bonds.

<< Back to news headlines >>

Jamaica Producers To Sell Pineapples To Cayman, Other Markets Wednesday 1st November, 2017 – Jamaica Gleaner

Jamaica Producers Group Limited (JP), which is currently searching for a

specialist farm manager for pineapple production, said it is now making

headway on plans to expand markets for the fruit.

Production yields are expected to climb next year by 17 per cent, and

Producers is eyeing other markets as volumes grow.

"The export plans for this year primarily involve regional markets such as

The Cayman Islands, where we are already present with bananas," said

Group CEO Jeffrey Hall.

Hall said the market for pineapples is about 25 per cent of that of

bananas - the company's main produce - but is growing more rapidly. The

main distribution channel for both fruit remains the retail sector, but

tourism continues to grow, he said.

The specialist manager being recruited for JP's pineapple operation is

meant to "support growth in line with international best practices", the

CEO said. The company simultaneously has been working on a cold

storage facility, which is due for commissioning this month.

"It's a $130-million invest-ment," Hall said.

In 2016, JP almost doubled its farm acreages in St Mary for the pineapple

orchard. The fruit takes 14 months from planting to harvest.

"We will have 100 acres of pineapple and 400 acres of banana in

cultivation next year, with 200 full time employees directly engaged in

farming and another 200 engaged in food processing and marketing and

distribution. We expect overall production yields to increase 17 per cent

year over year for 2018," Hall said.

He adds that the company is otherwise doing "a number of bold things" to

modernise its fresh produce operations. The aim, he said, is to keep

abreast of market trends for towards healthy eating and demand for

more convenient access to high-quality fresh produce, and to tap into

expanding channels in the tourism sector and major supermarket chains.

JP's fruit processing divisions secured Global GAP certification - an

internationally recognised set of standards for farm cultivation - in

October. The company will be rolling out a new marketing campaign

highlighting the "natural farm fresh" attributes of JP fresh produce and

positioning them as "the best value" for Jamaican consumers, Hall said.

<< Back to news headlines >>

Port Operator Targets Cruise Ship Expansion Tuesday 31st October, 2017 – Tribune 242

The Nassau Container Port (NCP) yesterday said it plans to allocate $7.5

million to capital projects and debt repayment, as it eyes diversification

into cruise ship services.

Michael Maura, chief executive of port operator, Arawak Port

Development Company (APD), told Tribune Business that had already

"expressed interest" in the Government's plans to redevelop and upgrade

the Prince George Wharf terminal.

He explained that expanding APD's services into cruise ship operations

would also help to mitigate volatility associated with the Arawak Cay-

based port's cargo volumes, the BISX-listed port operator having

projected a 2.5 per cent year-over-year decline for its 2018 financial year

following a record 2017.

APD's twenty-foot equivalent (TEU) container volumes were 13.35 per cent

ahead of budget for the year to end-June, and Mr Maura said the port

was also seeking to partner with Bahamas Customs and the Government

to boost the latter's revenues, crackdown on criminals and improve the

import process.

Subject to government approval, the APD chief said it planned to

develop a Vehicle Terminal as a 'one-stop shop' where imported

automobiles could be licensed and inspected. And the proposed Cargo

Inspection Facility would permit in-depth examinations to take place at

the port, clamping down on smuggling and tax evasion.

Outlining APD's plans to Tribune Business, Mr Maura said: "We plan to

allocate approximately $7.5 million towards the retirement of debt and

planned capital expenditures, with the remainder supporting cash

reserves, potential new business development and shareholder

dividends."

While the APD board has yet to determine the size and timing of a

dividend, Mr Maura said the port operator continued to target new

business opportunities to increase earnings and shareholder value.

"The Ministry of Tourism and the Ministry of Transport have expressed a

desire to make improvements to Prince George Wharf," he told this

newspaper. "APD has expressed its interest in this project and await

project details.

"By diversifying APD's business, and expanding APD operations and

services to the cruise industry, this would serve to reduce the impact on

financial performance resulting from the occasional decline in cargo

imports.

"The addition of a new revenue stream to APD also serves to distribute

APD's cost of operations across both cargo and cruise, which potentially

reduces the tariff on groceries and other core imports. This serves to lower

the landed cost of goods in New Providence."

Mr Maura disclosed that APD's TEU import volumes for the 12 months to

end-June 2017 exceeded projections by more than 8,000, coming in at

70,277 compared to 62,000. They were well ahead of 2016's 61,779.

"The increase in cargo volumes were driven primarily by Hurricane Joaquin

and Matthew-related construction materials; vehicle imports of 16,864

compared to budget of 12,192 and prior year of 11,975," Mr Maura said.

"The remobilisation of the Baha Mar project also contributed to the

increase over prior year. APD budgeted conservatively for 2017 due to

little GDP growth and the stalled Baha Mar project. As a practice we do

not budget for post-hurricane cargo volumes."

Adopting a conservative approach to APD's current financial year, Mr

Maura added: "As we look at 2018, we have budgeted import TEUs of

68,500, which represents a 2.5 per cent reduction in volumes. We will also

not benefit from the Baha Mar bad debt and extraordinary port storage

enjoyed in 2017."

Besides Prince George Wharf, Mr Maura said the port operator was also

examining projects closer to home. "Subject to Government approval and

finalising the details, the company will develop a Vehicle Terminal to

include Bahamas Customs and Department of Road Traffic offices to

provide the import business community - and public - with the ability to

both clear and license vehicles at the port as a 'one-stop-shop'," he

explained.

"Subject to government approval and finalising the details, as part

Bahamas Customs' on-going efforts to combat criminal activities, APD will

construct a Cargo Inspection Facility. This facility will serve as a substantive

component of Bahamas Customs' enhanced risk management

programme.

"Freight containers, vehicles and general cargo designated for a

comprehensive examination will be processed by this facility while

remaining at the Nassau Container Port," Mr Maura continued.

"It is contemplated that this facility will contain modern contraband

detection equipment. The introduction of this facility to the trade process

is intended to eliminate existing delays and procedure for recognised firms

which have a history of compliance and transparency.

"The investments in Customs and Road Traffic facilities directly influence

legitimate trade and enhance Customs' contraband detection efforts.

Combating illegal trade directly supports legitimate business and

economic growth."

Turning to APD's financial performance, Mr Maura said the company beat

2017 budget expectations by 15.2 per cent and 8.1 per cent, respectively.

"Total revenues were $32.5 million compared to budget of $28.2 million

and prior year of $27.1 million, driven by the increase in import volumes

and unbudgeted Baha Mar storage-related revenues of $700,000," Mr

Maura said.

"Total expenses for fiscal year-ended 2017 were $15.9 million compared to

budget of $17.3 million, and prior year of $17.2 million. The reduction in

expense compared to prior year was in large part due to bad debt

recovery of $700,000, directly related to warehouse rent collected from

Baha Mar, and expense reductions compared to prior year of

approximately $370,000 in repairs and maintenance."

Mr Maura said the latter primarily related to the Arawak Cay port's cranes,

plus a fall in legal and professional fees of about $320,000. "In 2016 we

would have incurred consultancy expenses relative to our company ICT

systems, legal work relating to Baha Mar, and tax advisory services," he

explained.

The APD chief also confirmed that the port operator "does not charge for

hurricane relief items shipped to Nassau [that are] consigned to NEMA

and other qualifying relief organisations. The revenues derived from

hurricane-related imports would have been driven primarily by insurance

settlements".

<< Back to news headlines >>

Gov't Faces $900m Climate Change Bill Tuesday 31st October, 2017 – Tribune242

The Government has estimated it faces a $900 million bill to mitigate

climate change under the United Nations (UN) framework, with the

Bahamas facing "accelerated vulnerability" to natural disasters.

The scale of the economic and environmental danger facing the

Bahamas has been laid bare in an Inter-American Development Bank

(IDB) report on a $35 million project designed to develop a system for

managing, and building resilience to, threats to this nation's coastline.

Emphasising that the Bahamas is "highly vulnerable" to hurricanes and

other natural disasters, the IDB paper on the Climate-Resilient Coastal

Management and Infrastructure project warned that such storms were

increasing in severity and frequency. With much of the Bahamas' key

resort assets and public infrastructure located on or near the coast, it

added that climate-related events posed a serious threat to this nation's

economic future and well-being.

The IDB paper added that an emphasis on "engineering solutions", rather

than ones informed by science-related analysis, meant that the Ministry of

Works' efforts to protect the Bahamian coastline were failing in several

Family Island locations.

And natural tourist attractions, together with coastline defences, were

being steadily eroded with the Bahamas thought to have lost more than

50 per cent of "the live coral cover of its reefs".

"The Government of the Bahamas has recognised that future growth and

diversification of its tourism-dependent economy depends on ecosystem

services, maintaining biodiversity and enhancing the resilience of

economic activities to coastal risks, including climate change," the IDB

paper seen by Tribune Business says.

The IDB said that "given the strategic importance of the country's coastal

zone to economic development", the Government had "made several

advances towards climate-resilient coastal management" including its

embrace of the Sustainable Nassau Initiative and National Policy for the

Adaptation to Climate Change.

However, the IDB said most action to-date had been "small scale", and

added: "Recently, the Government of the Bahamas estimated the cost of

implementing mitigation actions related to the Nationally Determined

Contribution (NDC) to the United Nations Framework Convention on

Climate Change (UNFCCC) to be over US$900 million through 2030.

"A recent IDB study indicates that the probable coastal flooding exposed

area in a one-in-a-50-year flood event in New Providence is projected to

expand to 15 per cent by 2050 due to increasing precipitation caused by

climate change.

"Nationally, one metre sea level rise (SLR) would place 36 per cent of

major tourism properties, 38 per cent of airports, 14 per cent of road

networks and 90 per cent of sea ports at risk."

The Bahamian economy remains highly dependent on tourism, whose

$2.4 billion in direct visitor spend was equivalent to 27 per cent of total

GDP in 2015, rendering this nation particularly susceptible to climate

change.

"The tourism sector's potential future growth rests predominantly on

continued investments in tourism infrastructure, and the uniqueness and

health of the archipelago's coastal resources," the IDB added.

"The Bahamas is highly vulnerable to natural hazards, including hurricanes,

which put at risk both economic activities and associated public

infrastructure concentrated along the coast of New Providence and

several of the Family Islands.

"From 1970 to 2016, the country experienced 18 major disasters including

hurricanes, affecting 38,000 citizens. Seven, or 40 per cent, of these 18

major disasters occurred in the last 10 years, signifying that impacts from

disasters have increased at an accelerating rate."

The IDB report said Hurricane Joaquin inflicted an estimated $104.8 million

worth of damage when it struck the sparsely-populated southern

Bahamian islands in 2015, and this was followed by $438.6 million in losses

and damage when Hurricane Matthew hit New Providence and Grand

Bahama one year later.

"These events underscore the socio-economic vulnerability of the

Bahamas, with its small population spread in a large discontinuous area

where informal or isolated settlements, housing and basic services located

along the shore are not designed in accordance to adequate building

codes," the paper added.

Warning that climate change threatens to exacerbate these problems,

the IDB said: "A review of Bahamian coastal engineering structures

constructed previously revealed additional issues such as lack of

understanding of the impact of adjacent coastal construction and

natural habitats on receding stretches of shoreline, and lack of design

guidance for coastal structures under various climate change scenarios.

"Engineering solutions, such as seawalls and causeways, are failing in

several locations in the Family Islands owing to lack of empirical data to

inform science-based designs..... Although the Ministry of Public Works is

currently building coastal engineering structures to protect roads and

other public infrastructure from these risks, empirical data and modelling

on the multiple causes of flooding (tides, wave overtopping, storm surges,

inland flooding) and shoreline instability are needed to design lasting

solutions."

The paper added that the degradation of coastal ecosystems was also

exaggerating the Bahamas' vulnerability, finding: "Based on available

data, the country has lost over half of live coral cover of its reefs.

"Mangrove wetlands of the Bahamas are threatened by land conversion

for development, and estimates in New Providence indicate a 32 per

cent decline in wetlands over the last 30 years. Throughout the Bahamas,

invasive species such as casuarina (Australian Pine) cause sand dune

erosion and inhibit the growth of native vegetation.

"These threats amount to losses in natural coastal protection that,

increasingly, are being recognised as 'natural infrastructure' that, in

suitable locations, has greater adaptive capacity and is often less costly

than conventional solutions."

<< Back to news headlines >>

Cable Unveils Dividend Restart Within One Year Tuesday 31st Octtober, 2017 – Tribune242

CABLE Bahamas expects its growth strategy to start paying off for

shareholders in less than a year's time, although it is "not fully satisfied yet"

with the returns generated.

The BISX-listed communications provider told investors in its newly-released

2017 annual report that dividend payments, currently suspended, will

resume during its 2019 financial year - which begins on July 1 next year.

Anthony Butler, Cable Bahamas' chairman and chief executive, yesterday

told Tribune Business that some shareholders - especially retail investors -

needed to be patient and understand that the company was investing

for future gain, with key initiatives still in start-up mode.

Cable Bahamas' accounts for the 18 months to end-June 2017 revealed a

$51.727 million net loss, driven by the 'red ink' associated with start-up and

infrastructure build-out costs incurred by the Aliv mobile operator and its

Florida investments.

The Florida operations lost $27.281 million, and Aliv $55.538 million,

although Cable Bahamas' 48.25 per cent equity stake in the latter meant

that itself - and its shareholders - incurred less than half that sum. Despite

the $22.986 million loss suffered by Cable Bahamas' shareholders, Mr Butler

reassured investors that the BISX-listed operator was on track with the

execution of its 2014 growth strategy.

"We're doing fine," he told Tribune Business. "We are where we are. A lot of

people don't understand the start-up [stage], and are looking for the

returns. We stopped the dividend to conserve the cash, and are using

and investing it wisely."

Cable Bahamas' losses over the past two financial years have seemingly

unnerved some shareholders, with the dividend suspension exacerbating

their concerns.

This was alluded to by Gary Kain, Cable Bahamas' chairman, in the

annual report where he said that the company's share price had

"experience some unusual fluctuation" over the past 18 months.

"This was in large part due to individual shareholders who suffered

hurricane damages liquidating their position, and concerns over the entry

of competition in the video sector [BTC]," Mr Kain suggested.

However, dividend suspensions are relatively routine for companies

seeking to conserve capital for investment opportunities assessed as

generating even greater future returns. With Aliv and the Florida

operations now starting to emerge from start-up mode, the key now is for

Cable Bahamas to execute and ensure increased revenue drops to the

bottom line.

"We're executing the strategy we put in place in 2014, when the plan was

to move into the mobile business," Mr Butler told Tribune Business. "We're

happy with the execution of the plan. Florida is doing well, Cable

Bahamas is continuing to generate earnings, and Aliv is growing market

share."

Mr Kain said the BISX-listed communications provider has yet to achieve its

investment return targets, but indicated it was making progress by

announcing a timeline for the resumption of dividend payments.

"We are confident in our strategic direction, and our EBITDA growth

continues to improve," he wrote in the annual report. "However, we are

not yet fully satisfied by the returns that we are achieving on the

substantial investments that the group has made in recent years.

"However, overall, the Board remains confident of the group's cash

generation ability, and its forecast return on capital. This confidence will

be reflected in our imminent review of the dividend policy, which was put

on hold in July 2016 to preserve cash during initial stages of the mobile

build-out and the fixed-line expansion programme in Florida. The

company recently announced that these dividend payments will resume

in financial year 2019."

Cable Bahamas, which has management and Board control at Aliv, said

it was targeting a 30-35 per cent market share for the Bahamas' second

mobile operator by year-end 2017.

Suggesting that it had obtained a 20 per cent share by end-June 2017,

with 78,000 subscribers, Cable Bahamas said Aliv had produced almost

$13 million in revenues during the seven months following its November

2016 launch.

"In less than eight months of operations, ALIV has completed an extremely

successful finance capital fundraise, which resulted in $60 million of note

payable debt financing for the company," Cable Bahamas said. "The

offer was 100 per cent oversubscribed and fully financed.

"Therefore, coupled with the shareholders' investment of $135 million, and

$35 million from vendor partner funding, Aliv has a total of $230 million in

capital funding. This greatly contributes to our financial stability within the

market.

"Our network and investments of $144 million is comprised of infrastructure

and equipment for our Family Island roll-out, which offers the platform for

the most advanced network and supporting systems in the country."

Emphasising Florida's earnings and diversification potential, Cable

Bahamas said its wholly-owned Summit Broadband affiliate had added

5,483 residential customers over the 18 months to end-June 2017.

"Summit continued to see growth as revenue increased by 71 per cent to

reach $84 million," Cable Bahamas said. "Over the last four years, total

revenue grew by approximately $77 million or over 1,043 per cent. The

largest contributing factors to this growth were revenues from residential

subscribers (an increase of 33,656 subscribers in the four-year period).

"Residential revenue contributed approximately $53 million or 63 per cent

of total revenue, and acquired 5,483 net new subscribers in 2017,

representing a 17 per cent growth over the past 18 months. We expect to

significantly grow over the next five years in residential and commercial

revenue."

Cable Bahamas said its Hurricane Matthew recovery costs totalled $8

million, as a result of having to restore communications services to 60,000

homes and businesses, with more than 200,000 phone calls fielded.

"A significant part of the Grand Bahama outside plant network, which

sustained the most damage, was rebuilt to the tune of nearly $6 million.

An additional $2 million in cost was expensed during the financial year as

a result of the storm not relating to the rebuild," the annual report

disclosed.

<< Back to news headlines >>

Gov't Pays '3x' Value Of Bob's Toxic Loans Tuesday 31st October, 2017 – Tribune242

Bank of the Bahamas' (BOB) latest bail-out has cost Bahamian taxpayers

more than three times' the net value of toxic loans purchased from the

stricken BISX-listed bank.

The full-year 2017 accounts, released yesterday, reveal that the

Government paid $162 million to acquire non-performing credit worth just

a net $49 million as part of the bank's August 'rescue'.

The accounts, audited by the KPMG accounting firm, reveal that the $113

million "difference" will be written back into Bank of the Bahamas' balance

sheet as 'special retained earnings', boosting its net equity and helping to

largely erase a $140.498 million accumulated deficit.

Explaining the implications of BOB's most recent bail-out, the financials

said: "A portfolio of non-performing loans with principal amount of $131

million, and accrued (unpaid) interest receivable of $31 million, with a

total net book value of approximately $49 million was derecognised.

"$162 million in unsecured promissory notes [government bond or IOUs]

was received for these loans and was recognised as an asset.... The net

difference of approximately $113 million between the Notes received and

the net book value of the derecognised assets was recognised directly in

equity as 'Special Retained Earnings', and is considered to be a part of the

bank's regulatory capital."

The gulf between the sum paid by the Government/Bahamian taxpayers

to rescue an essentially insolvent Bank of the Bahamas, and the net value

of the 'toxic' loans acquired by the Bahamas Resolve bail-out vehicle, has

never previously been disclosed.

The August 2017 transaction copied the model established by the first

Bahamas Resolve 'rescue', which injected $100 million worth of

government paper into BOB in exchange for 'bad' loans worth a net $45

million.

However, the latest bail-out represents a far greater transfer of liabilities

from BOB to the Bahamian taxpayer. For the sum paid by the Government

is 230.6 per cent, or more than three times' higher, than the $49 million net

worth assigned to Bahamas Resolve's latest toxic loan portfolio. The ratio

for the first 'rescue' was just 122 per cent.

That $49 million valuation is also open to question, given that James Smith,

Bahamas Resolve's inaugural chairman, previously revealed to Tribune

Business that the first $45 million portfolio was worth half that amount once

all the loan security/collateral was properly assessed.

The two bail-outs are a massive transfer of liability from BOB, and its

shareholders, to the Bahamian taxpayer, given that it is the Government -

through Bahamas Resolve - that now has responsibility for collecting on

these 'toxic' loans - a process that could last decades.

The Government is also redeeming the $100 million worth of bonds

injected into BOB through the first Bahamas Resolve transaction, a process

that will be completed via four payouts this fiscal year.

This raises the possibility that the Government will, at some stage, also

have to redeem the $162 million involved in the latest transaction and

replace them with hard cash - something that represents the most

significant potential drain for taxpayers.

But BOB's financial statements for the year to end-June 2017 reveal that

the Minnis administration had little choice but to effect a second 'bail-out',

given that an astonishing 55 per cent - more than half - of the bank's loan

portfolio was rated non-performing.

The bank's continued deterioration was highlighted by the fact that non-

performing loans, as a percentage of BOB's total credit portfolio, had

increased from 46.07 per cent at year-end 2016 to 55.11 per cent just one

year later.

This meant that $246.973 million, out of a net $448.125 million portfolio, was

90 days or more past due at end-June 2017. In particular, 79.4 per cent or

$44.038 million of BOB's $55.487 million commercial mortgage portfolio was

deemed 'impaired' at the year-end date.

Some 57.8 per cent, or $103.494 million of BOB's $179.101 million

commercial loan and overdraft segment, was also branded as 'non-

performing' at year-end 2017.

The scale of the latest Bahamas Resolve transaction was meant to cure

this, and BOB's continued non-compliance with four out of five key

regulatory capital ratios set by the Central Bank of the Bahamas.

"It is expected that this transaction will restore all of the bank's regulatory

capital ratios to compliance," BOB's 2017 financial statements said of the

latest 'bail-out'.

"As of June 30, 2017, and 2016, the bank was not in compliance with

regulatory minimum requirements for the following [four] ratios primarily

due to the significant net losses recorded by the bank and the

consequential accumulated deficit position.

"The Central Bank is aware of these regulatory deficiencies, and has

imposed certain supervisory interventions on the bank. The bank continues

to report to the Central Bank on its progress. Effective September 30, 2016,

the Central Bank increased the minimum capital requirement for the ratio

on total capital to total risk weighted assets to 18 per cent for the bank."

The extent to which the Government continues to prop up BOB is further

highlighted by the fact that, at end-June 2017, the Public Treasury and

other government agencies accounted for 37.4 per cent - more than

one-third - of the bank's total deposits.

The impact from the Bahamas Resolve transaction was not included in

BOB's 2017 financials, given that the 'rescue' occurred two months after its

year-end. The BISX-listed bank's net loss almost doubled, from $23.296

million in 2016 to $46.3 million, almost entirely due to a more than-100 per

cent increase in loan loss provisions.

These grew from $24.499 million to $51.957 million for the year to end-June

2017, highlighting the extraordinary weakness of BOB's credit portfolio.

KPMG, pre-bail-out, warned shareholders that there was a "material

uncertainty" over BOB's ability to continue as a 'going concern' given the

heavy, consistent losses incurred by the bank since its 2014 financial year.

"The bank has experienced continuing operating losses for the last several

years, and was also non-compliant with certain of its externally imposed

regulatory capital requirements as at June 30, 2017, and 2016," KPMG

said.

"These events and conditions, along with other matters as set forth,

indicate that a material uncertainty exists that may cast significant doubt

on the bank's ability to continue as a going concern.

"Management does not expect that the continued operating losses or

regulatory capital deficiencies will impact the bank's continuing ability to

operate as a going concern. Our opinion is not modified in respect of this

matter."

In a separate development, Tribune Business understands that Anthony

Allen, formerly Scotiabank's top Bahamian executive, has resigned from

his post as BOB's deputy chairman for unspecified "personal reasons".

<< Back to news headlines >>

IDB to invest $65 million to improve water and sanitation services in Haiti Tuesday 31st October, 2017 – Caribbean News Now

Haiti will improve drinking water and sanitation services in the Port-au-

Prince metropolitan area, as well as in rural areas, in particular those

affected by Hurricane Matthew, with a $65 million grant from the Inter-

American Development Bank (IDB).

The funds will help improve the sanitary situation in Port-au-Prince and rural

communities by supplying them with drinking water and sanitation

services and enhancing hygiene practices, including menstrual hygiene,

and focusing on the needs of the population living in the areas affected

by the latest hurricane.

The project will also strengthen the ability of the Port-au-Prince

metropolitan region’s Technical Service Center (CTE-RMPP, after its French

initials) to improve the company’s financial sustainability, as well as the

capabilities of the Regional Drinking Water and Sanitation Office of the

West (OPERA West) and of the National Drinking Water and Sanitation

Agency (DINEPA).

Hurricane Matthew has caused major damage to drinking water systems

in the departments of Nippes, Sud and Grand ‘Anse. Total losses caused

to the sector by climate events have been estimated at $20.6 million,

including $14.2 in damages caused in rural areas, where some 700,000

people have been left without access to drinking water. Some 60 drinking

water facilities have been severely damaged or totally destroyed.

This third operation will help take the number of household water

connections from 45,000 to 100,500 and the number of kiosks from 185 to

280, while 12,000 new condominium connections will be added. All in all,

this will raise the share of the population with access to drinking water

services from 44 percent now to 60 percent.

<< Back to news headlines >>

Commercial banks forced to hold more Govt paper Tuesday 31st October, 2017 – Barbados Today

With commercial banks currently displaying a low appetite for such

instruments, the Central Bank of Barbados today announced an increase

in the amount of Government paper the banks are required to hold by

law.

Saying the move was “appropriate”, Acting Governor Cleviston Haynes

announced that “effective December 1, 2017, commercial banks will be

required to hold 18 per cent of their domestic deposits in stipulated

securities, and from January 1, 2018 the banks will be required to hold 20

per cent of their deposits in stipulated securities.

“This is the second increase for the year and complements the fiscal

initiatives introduced by the Minister of Finance in his Financial Statement

and Budgetary Proposals earlier in the year,” Haynes said, while pointing

out that “the cash reserve requirement for commercial banks remains

unchanged at five per cent and the reserve requirement for deposit-

taking trust and finance companies and merchant banks also remains

unchanged”.

In his May review the acting governor had announced that commercial

banks would be required to hold 15 per cent of their domestic deposits in

stipulated securities, up from ten per cent. That took effect from June 15,

2017.

Over the past year in particular a number of commercial banks have

backed away from taking on Government debt out of fear that when it

becomes due, Government may not be able to repay, given its dwindling

reserves, which now stand at 8.6 weeks of imports or $549.7 million, and its

soaring national debt of 144 per cent of gross domestic product.

However, in defence of the further tightening of the domestic monetary

policy, Haynes pointed out that the securities reserve requirement had

been as high as 20 per cent in the past, while suggesting that as the

economic situation improves it would likely fall back down to the ten per

cent level, which existed for the last seven years.

“We believe that as we work through our economic challenges that it is

important for all of the players in the system to contribute towards helping

to restore confidence and growth in the system. And therefore we believe

that it is appropriate at this time to increase the securities reserve

[requirement],” Haynes said.

“It is our belief that once we are able to address the economic

challenges which we face at present, that we will be able in the future to

bring those ratios back down to levels that we consider to be appropriate.

But this is a measure that is necessary at this point to contribute towards

the overall economic stabilization for which we aspire,” he said.

However, the acting governor said what was now critical was for

Government to put the necessary fiscal policies in place to restore overall

confidence in the economy.

For the first half of the 2017-2018 financial year, the deficit was again

financed domestically, with commercial banks providing 76 per cent of

the funding “principally because of the requirement for banks to increase

their holdings of Government securities”, according to the latest Central

Bank report.

“The banking sector continued to exhibit a trend of high excess liquidity,

improved asset quality and high levels of capitalization. The excess cash

reserve ratio declined to 15.1 per cent, well above the historical norm

even after the impact of the monetary policy decision to raise the

commercial bank’s requirement ratio in June 2017,” Haynes added.

<< Back to news headlines >>

Plunging reserves Tuesday 31st October, 2017 – Barbados Today

With election fever already in the air, Acting Central Bank Governor

Cleviston Haynes is not about to tell the Freundel Stuart administration to

bite the proverbial bullet and agree any International Monetary Fund

(IMF) financing arrangement.

However, during a press conference today called to review the country’s

performance for the first nine months of this year, Haynes made no bones

about saying that the island’s foreign reserves position was currently out of

whack.

And while staying clear of taking a definite position on whether

Government should go the IMF route, he warned that assistance from

international development partners, including the Development Bank of

Latin America, would not “address the overall issues we have in terms of

the demands and supply of foreign exchange”.

However, he said some hard political decisions would have to be made in

terms of state spending, while suggesting that divestment of some

Government assets should be a key consideration.

“It goes without saying that we are concerned about the direction in

which the reserves have been going,” Haynes said, while reporting that

the economy grew by a modest 1.4 per cent during the first nine months

of this year, led by tourism, which expanded by four per cent.

But this was simply not enough to erase the country’s worrying deficit,

which was estimated at $279 million for the last six months, a $115 million

improvement over the same period in 2016.

Equally worrying was the state of the country’s international reserves

which plummeted further below the 12 weeks benchmark to reach just 8.6

weeks of import or $549.7 million at the end of September, putting more

pressure on the stability of the Barbados dollar.

“Despite moderate economic growth and policy-induced reduction in

the fiscal imbalance, the Barbadian economy continues to face

significant economic challenges. In particular, strengthening of the

international reserves is needed to ensure that the reserve buffer remain

adequate in order to protect the fixed exchange rate peg,” the acting

governor stressed.

At the same time, he reported Government’s overall debt has climbed to

144 per cent of gross domestic product, with current expenditure

increasing by $13.9 million, largely due to an increase in grants to public

institutions.

During the first half of the year, the deficit was largely financed by local

sources, with commercial banks providing 76 per cent of the funding and

Central Bank assistance “contained to $46.1 million”.

Following the presentation by Minister of Finance Chris Sinckler back in

May of a $542 million austerity package that included a 400 per cent

increase in the National Social Responsibility Levy (NSRL), there has been a

slight improvement in the fiscal position over the last nine months, with

Haynes reporting that tax revenues increased by $98.6 million, due in part

to a $48.8 million boost in receipts from the controversial NSRL.

In addition, excise taxes rose by $46.4 million, resulting from higher excise

duties on fuel and improved chargeable values on imported goods.

Corporate taxes also rose by $35.5 million, but the Central Bank said there

were smaller gains in the collection of Value Added Tax and personal

income taxes as the overall revenue outturn was dampened by weaker

import duties and a fall in withholding tax.

In this context, Haynes said while it was “understandable” that a lot of the

focus this year has been on tax measures, there was a need for stronger

focus by the Freundel Stuart administration on addressing the expenditure

side, even though he acknowledged that the situation could not be fixed

overnight.

“Political decisions will have to be taken as to where they want to effect

such cuts and what the nature of those cuts will be. When I say cuts in

expenditure it could come in different forms . . . but the bottom line is that

we have to reduce the size of the fiscal deficit,” Haynes stressed.

“The fiscal outlook underscores the need for expenditure restraint in the

short term to supplement the recently introduced revenue measures, as

Government seeks to place the public finances on a sustainable path

and reduce the debt overhaul,” he added.

With elections constitutionally due here by the middle of next year and

political parties already in full campaign mode, the acting governor

further warned that “the scale of fiscal and debt imbalances now require

significant structural reforms, related to the public sector financial

management and improved tax administration”.

He said while the economy was expected to record between one per

cent and 1.5 per cent growth for the current financial year, this was highly

dependent on the execution of some large tourism-related projects.

The growth, which is higher than the revised 0.9 per cent projected by the

IMF, is also dependent on the amount of revenue earned from the

recently announced tax measures, as well as the level of financial

investment to help “offset some of the reduction in domestic demand

arising from the fiscal measures”.

<< Back to news headlines >>

No hike Tuesday 31st October, 2017 – Barbados Today

With this island’s two trade major unions currently persisting with demands

for double digit pay increases for their members, the Central Bank has

issued a fresh word of caution that the economy can ill-afford any such

fiscal strain at the moment.

Just last week the National Union of Public Workers (NUPW) issued a

warning to the Freundel Stuart administration that it was fast running out of

time to get the stalled public sector wage negotiations back on track.

NUPW President Akanni McDowall revealed to Barbados TODAY at the

time that the union had written to the Ministry of Civil Service demanding

a return to the bargaining table by today for talks on a proposed 23 per

cent wage hike for its members who have not had a pay increase for

nearly a decade.

However, in a brief statement this afternoon, the NUPW said to date no

acknowledgement has been received from the ministry; therefore the

union was prepared to take whatever action was necessary to bring the

parties to the table.

Amid rising domestic cost of living, the Barbados Workers’ Union has also

been pressing for a 15 per cent salary hike for its members.

However, based on the outcome of a performance review of the

controversial National Social Responsibility Levy (NSRL) at the end of

September, the Freundel Stuart administration is yet to say whether it can

afford to meet the unions’ demands.

Asked by Barbados TODAY to comment on the situation during his nine-

month review of the country’s economic performance, Acting Governor

Cleviston Haynes maintained the position he had taken back in May that