Balan Irina 1

description

Transcript of Balan Irina 1

-

Dissertation paperDeterminants of inflation in RomaniaStudent: Balan IrinaSupervisor: Professor Moisa AltarACADEMY OF ECONOMIC STUDIESDOCTORAL SCHOOL OF FINANCE AND BANKING

-

Contents Literature review The data Estimating the inflation rate CPI model PPI model Concluding remarks

-

LITERATURE REVIEW using cointegration and error-correction models Domac I. and Elbirt C. (1998) argue that the roots of Albanian inflation are rahter conventional: inflation is positively associated with money growth and exchange rates but negatively with real income Brada and Kutan (1999) - the Czech Republic, Hungary and Poland - import price changes play the most important role in explaining inflation dynamics, while nominal wage growth and money supply are quantitatively unimportant Nikolic M. (2000) estimated the determinants of Russian inflation in a single equation framework - money growth is a core determinant of Russian inflation Golinelli R. and Orsi R. (2002) - analysed the determinants of the inflation rate in the Czech Republic, Hungary and Poland and they found that the exchange rate is the main long term factor influencing domestic prices, and can be seen to be the common inflation-adjusting mechanism utilised in all three countries

-

Chart1

5.1

174.5

210.4

256.1

136.7

32.3

38.8

154.8

59.1

45.8

45.7

34.9

17.8

14

Romania

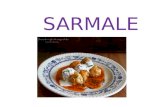

Figure 1: Anual inflation rate in Romania (%)

Sheet1

199019911992199319941995199619971998199920002001

Czech Republic10.856.711.220.8109.18.88.510.72.13.94.7

Hungary28.9352322.518.828.223.618.314.3109.89.2

Poland585.870.34335.332.227.819.914.911.87.310.15.5

Romania5.1174.5210.4256.1136.732.338.8154.859.145.845.734.9

19911992199319941995199619971998199920002001

Czech Republic56.711.220.8109.18.88.510.72.13.94.7

Hungary352322.518.828.223.618.314.3109.89.2

Poland70.34335.332.227.819.914.911.87.310.15.5

Romania174.5210.4256.1136.732.338.8154.859.145.845.734.9

19901991199219931994199519961997199819992000200120022003

Romania5.1174.5210.4256.1136.732.338.8154.859.145.845.734.917.814

Sheet1

0000

0000

0000

0000

0000

0000

0000

0000

0000

0000

0000

Czech Republic

Hungary

Poland

Romania

Sheet2

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Romania

Anual inflation rate in Romania (%)

Sheet3

-

THE DATA (all variables in logarithms)

quarterly data sample: 1991:1 - 2003:4 source: National Bank of Romania, Romanian Institute of Statistics p - Consumer Price Index (fixed base 1996=100) p_ppi - Producer Price Index (fixed base 1996=100) m - broad money (M2) w - nominal wages y - industrial production index (fixed base 1996=100) e - nominal exchange rate (ROL/USD)

-

THE GOAL

to estimate the determinants of inflation

methods: Cointegration technique, VAR and VEC models

-

Estimating the inflation rate

unit root tests

Variable

ADF

PP

p

p_ppi

m

w

y

e

I(1)

I(1)

I(1)

I(1)

I(1)

I(1)

I(1)

I(1)

I(1)

I(1)

I(1)

I(1)

I(1)

I(1)

-

Estimating the inflation rate

VAR analysis Johansen cointegration testUnrestricted Cointegration Rank TestHypothesizedTrace5 Percent1 PercentNo. of CE(s)EigenvalueStatisticCritical ValueCritical ValueNone ** 0.671155 144.7644 87.31 96.58At most 1 ** 0.516027 90.26820 62.99 70.05At most 2 ** 0.429085 54.70761 42.44 48.45At most 3 * 0.296258 27.24240 25.32 30.45At most 4 0.185047 10.02659 12.25 16.26 *(**) denotes rejection of the hypothesis at the 5%(1%) level Trace test indicates 4 cointegrating equation(s) at the 5% level Trace test indicates 3 cointegrating equation(s) at the 1% levelHypothesizedMax-Eigen5 Percent1 PercentNo. of CE(s)EigenvalueStatisticCritical ValueCritical ValueNone ** 0.671155 54.49624 37.52 42.36At most 1 * 0.516027 35.56059 31.46 36.65At most 2 * 0.429085 27.46521 25.54 30.34At most 3 0.296258 17.21581 18.96 23.65At most 4 0.185047 10.02659 12.25 16.26 *(**) denotes rejection of the hypothesis at the 5%(1%) level Max-eigenvalue test indicates 3 cointegrating equation(s) at the 5% level Max-eigenvalue test indicates 1 cointegrating equation(s) at the 1% levelA. CPI model

-

impulse response functions variance decomposition Variance Decomposition of P: PeriodS.E.PEMWY 1 0.056720 100.0000 0.000000 0.000000 0.000000 0.000000 2 0.114275 93.85281 2.451476 2.716686 0.892874 0.086158 3 0.158674 87.38295 3.384578 3.737108 4.504839 0.990522 4 0.192170 80.12246 4.351817 3.949469 9.803749 1.772504 5 0.214628 74.43547 5.603106 3.842002 13.63369 2.485737 6 0.230038 70.31289 6.864842 3.870439 15.82085 3.130981 7 0.241042 67.40471 7.922160 4.046781 16.91413 3.712217 8 0.249382 65.35814 8.715221 4.348139 17.40862 4.169876 9 0.256012 63.91147 9.275760 4.725601 17.60252 4.484657 10 0.261499 62.87060 9.657330 5.134743 17.67093 4.666394

-

SHORT-RUN DYNAMICS VEC representationD(P) = C(1)*( P(-1) - 1.170937515*W(-1) + 0.2982640716*Y(-1) + 0.002647872491*(@TREND(91:1)) + 8.729001573 ) + C(2)*( E(-1) - 1.222579591*W(-1) + 0.03272644293*Y(-1) - 0.008874279592 *(@TREND(91:1)) + 7.60235849 ) + C(3)*( M(-1) - 1.069243511 *W(-1) - 0.7280624046*Y(-1) - 0.006766951579*(@TREND(91:1)) + 0.0527490756 ) + C(4)*D(P(-1)) + C(5)*D(P(-2)) + C(6)*D(P(-3)) + C(7)*D(E(-1)) + C(8)*D(E(-2)) + C(9)*D(E(-3)) + C(10)*D(M(-1)) + C(11)*D(M(-2)) + C(12)*D(M(-3)) + C(13)*D(W(-1)) + C(14)*D(W( -2)) + C(15)*D(W(-3)) + C(16)*D(Y(-1)) + C(17)*D(Y(-2)) + C(18) *D(Y(-3)) + C(19)

-

R2 0.906Adj. R2 0.848

Coefficient

Std. Error

t-Statistic

Prob.

C(1)

-0.814528

0.218811

-3.722515

0.0008

C(2)

0.270003

0.071490

3.776815

0.0007

C(3)

0.121931

0.106420

1.145753

0.2613

D(p(-1))

0.668933

0.207208

3.228324

0.0031

D(p(-2))

0.507886

0.209492

2.424367

0.0218

D(p(-3))

0.054800

0.170047

0.322264

0.7496

D(e(-1))

0.029440

0.103609

0.284145

0.7783

D(e(-2))

-0.371292

0.094693

-3.921026

0.0005

D(e(-3))

-0.126947

0.109797

-1.156195

0.2570

D(m(-1))

0.171201

0.167383

1.022807

0.3149

D(m(-2))

0.280404

0.130784

2.144025

0.0405

D(m(-3))

0.036422

0.174237

0.209038

0.8359

D(w(-1))

-0.064621

0.201443

-0.320789

0.7507

D(w(-2))

-0.058450

0.170338

-0.343144

0.7340

D(w(-3))

-0.090983

0.128050

-0.710530

0.4831

D(y(-1))

0.401300

0.164282

2.442748

0.0209

D(y(-2))

0.143692

0.182006

0.789487

0.4362

D(y(-3))

-0.128014

0.158577

-0.807269

0.4261

constant

-0.012510

0.044949

-0.278315

0.7827

-

residual tests

Breusch-Godfrey Serial Correlation LM Test:

F-statistic

1.293750

Probability

0.299182

Obs*R-squared

12.11215

Probability

0.059513

ARCH Test:

F-statistic

0.191267

Probability

0.663956

Obs*R-squared

0.198922

Probability

0.655592

-

stability test

-

In-sample fit for the model

-

B. PPI model VAR analysis Johansen cointegration test

Unrestricted Cointegration Rank Test

Hypothesized

Trace

5 Percent

1 Percent

No. of CE(s)

Eigenvalue

Statistic

Critical Value

Critical Value

None **

0.565996

114.6477

87.31

96.58

At most 1 **

0.524582

72.91269

62.99

70.05

At most 2

0.289215

35.73466

42.44

48.45

At most 3

0.210171

18.66540

25.32

30.45

At most 4

0.128351

6.868447

12.25

16.26

*(**) denotes rejection of the hypothesis at the 5%(1%) level

Trace test indicates 2 cointegrating equation(s) at both 5% and 1% levels

Hypothesized

Max-Eigen

5 Percent

1 Percent

No. of CE(s)

Eigenvalue

Statistic

Critical Value

Critical Value

None *

0.565996

41.73502

37.52

42.36

At most 1 **

0.524582

37.17803

31.46

36.65

At most 2

0.289215

17.06926

25.54

30.34

At most 3

0.210171

11.79696

18.96

23.65

At most 4

0.128351

6.868447

12.25

16.26

*(**) denotes rejection of the hypothesis at the 5%(1%) level

Max-eigenvalue test indicates 2 cointegrating equation(s) at the 5% level

Max-eigenvalue test indicates no cointegration at the 1% level

-

impulse response functions variance decomposition

Period

S.E.

P_PPI

E

M

W

Y

1

0.069582

100.0000

0.000000

0.000000

0.000000

0.000000

2

0.132047

88.09193

9.452873

1.196678

1.136262

0.122255

3

0.160008

80.59072

11.80334

2.924426

4.138142

0.543368

4

0.173924

73.40588

13.48070

4.025327

8.628089

0.460004

5

0.181116

68.70436

14.89957

4.407568

11.42647

0.562037

6

0.186366

65.53107

16.35004

4.608071

12.80272

0.708098

7

0.191102

63.22293

17.86279

4.758302

13.43549

0.720491

8

0.196033

61.31825

19.29533

4.911243

13.79045

0.684724

9

0.200990

59.66170

20.56622

5.058059

14.04124

0.672784

10

0.205728

58.21028

21.66202

5.196492

14.23669

0.694517

-

SHORT-RUN DYNAMICS VEC representationD(P_PPI) = C(1)*( P_PPI(-1) - 2.48984122*M(-1) + 1.410028341*W(-1) + 1.007226247*Y(-1) + 0.006980471507*(@TREND(91:1)) + 14.88603259 ) + C(2)*( E(-1) - 2.47182148*M(-1) + 1.338029779 *W(-1) + 1.185997149*Y(-1) + 0.01758795447*(@TREND(91:1)) + 11.13242619 ) + C(3)*D(P_PPI(-1)) + C(4)*D(P_PPI(-2)) + C(5) *D(P_PPI(-3)) + C(6)*D(E(-1)) + C(7)*D(E(-2)) + C(8)*D(E(-3)) + C(9)*D(M(-1)) + C(10)*D(M(-2)) + C(11)*D(M(-3)) + C(12)*D(W(-1)) + C(13)*D(W(-2)) + C(14)*D(W(-3)) + C(15)*D(Y(-1)) + C(16)*D(Y( -2)) + C(17)*D(Y(-3)) + C(18)

-

R2 0.933Adj. R2 0.895

Coefficient

Std. Error

t-Statistic

Prob.

C(1)

-0.606827

0.109469

-5.543350

0.0000

C(2)

0.551595

0.097025

5.685050

0.0000

D(p_ppi(-1))

0.390650

0.148409

2.632246

0.0133

D(p_ppi(-2))

0.608079

0.173151

3.511839

0.0014

D(p_ppi(-3))

-0.030612

0.079954

-0.382868

0.7045

D(e(-1))

0.132318

0.111346

1.188350

0.2440

D(e(-2))

-0.513438

0.115565

-4.442835

0.0001

D(e(-3))

-0.493779

0.130951

-3.770710

0.0007

D(m(-1))

0.102157

0.136725

0.747170

0.4608

D(m(-2))

-0.188631

0.107790

-1.749980

0.0903

D(m(-3))

0.155841

0.112735

1.382366

0.1771

D(w(-1))

0.285759

0.111475

2.563428

0.0156

D(w(-2))

-0.029445

0.126186

-0.233344

0.8171

D(w(-3))

0.013717

0.101413

0.135256

0.8933

D(y(-1))

-0.239335

0.166358

-1.438673

0.1606

D(y(-2))

-0.067026

0.135804

-0.493547

0.6252

D(y(-3))

-0.370331

0.158653

-2.334221

0.0265

constant

0.066437

0.029255

2.270930

0.0305

-

residual test

Breusch-Godfrey Serial Correlation LM Test:

F-statistic

1.290639

Probability

0.290960

Obs*R-squared

4.051542

Probability

0.131892

ARCH Test:

F-statistic

0.712090

Probability

0.403214

Obs*R-squared

0.732153

Probability

0.392186

-

stability test

-

In-sample fit for the model

-

Conclusions the empirical results indicate that there is a long-run equilibrium relantionship between prices and e, m, w and y; the findings show that in the long run inflation in Romania is positively related to the nominal exchange rate, money growth and nominal wage growth, while it is negatively related to the output (proxied by the industrial production index); in terms of the magnitude of effects shocks to wages and nominal exchange rate have relatively larger impacts on prices; the empirical findings from the error-correction model showed that inflation adjusts to its equilibrium fairly rapidly; in the short run inflation is determined by its past values, the exchange rate and by the output;

-

the significant and negative coefficient on the variable of the nominal exchange rate implies that the appreciation of the Romanian leu in the transition period has contributed to reducing inflation; in the CPI model, in the short run, inflation is also determined by the money supply while in the PPI model moeny doesnt affect inflation; in the CPI model, in the short run, wages doesnt influence inflation, while in the PPI model it does.

-

REFERENCES:

Arratibel Olga, Rodriguez-Palenzuela Diego, Thimann Christian (2002)- Inflation dynamics and dual inflation in accession countries: A new keynesian perspective , ECB WP. Brada Josef, King Arthur E.,. Kutan Ali M. (2000) - Inflation bias and productivity shocks in transitions economies: The case of the Czech Republic, ZEI WP. Bertocco Giancarlo, Fanelli Luca, Paruolo Paolo (2002)- On the determinants of inflation in Italy: evidence of cost-push effects before the European Monetary Union. Enders Walter Applied Econometric Time Series, JohnWiley $ Sons, Inc. Engle R. F.,. Granger C. W. J (1987)- Cointegration and error correction: representation, estimation and testing , Econometrica. Gali J., Gertler M., Lopez-Salido J. D. (2001) - European inflation dynamics, European Economic Review. Gerlach Stefan, Svensson Lars E. O. (2000)- Money and inflation in the euro area: A case for monetary indicators?, NBER WP. Golinelli Roberto, Orsi Renzo (2002) - Modelling inflation in EU accession countries: The case of the Czech Republic, Ezoneplus WP.

-

Golinelli R., Orsi R. (1998)- Exchange rate, inflation and unemployment in East European economies: the case of Poland and Hungary. Golinelli R., Rovelli R.( 2001) - Painless disinflation? Monetary policy rules in Hungary (1991 - 1999). Hamilton James, D. (1994) Time Series Analysis, Princeton University Press. Hubrich Kirstin (Aug. 2003)- Forecasting euro area inflation: does aggregating forecast accuracy? , ECB WP. Johansen Soren (1991) Estimation and Hypothesis Testing of Contegration Vectors in Gaussian Vector Autoregressive Models, Econometrica, vol. 59, No. 6. Kim Byung-Yeong (2001)- Determinants of inflation in Poland: A structural cointegration approach, Bofit Discussion Papers. Lyziak Tomasz (2003) - Consumer inflation expectations in Poland, ECB WP. Mohanty M. S., Klan Marc - What determines inflation in emerging market economies?, BIS WP;

-

CPI model

Pairwise Granger Causality Tests

Null Hypothesis:

Obs

F-Statistic

Probability

E does not Granger Cause P

50

5.30421

0.00854

P does not Granger Cause E

0.57743

0.56544

M does not Granger Cause P

50

7.63532

0.00140

P does not Granger Cause M

2.36732

0.10531

W does not Granger Cause P

50

3.24510

0.04825

P does not Granger Cause W

7.33230

0.00175

Y does not Granger Cause P

50

0.06496

0.93720

P does not Granger Cause Y

2.15490

0.12773

M does not Granger Cause E

50

1.44232

0.24710

E does not Granger Cause M

4.00100

0.02516

W does not Granger Cause E

50

1.82747

0.17255

E does not Granger Cause W

6.31042

0.00384

Y does not Granger Cause E

50

1.73196

0.18852

E does not Granger Cause Y

0.42012

0.65952

W does not Granger Cause M

50

4.28134

0.01986

M does not Granger Cause W

0.03292

0.96764

Y does not Granger Cause M

50

0.27489

0.76092

M does not Granger Cause Y

0.41005

0.66607

Y does not Granger Cause W

50

0.99528

0.37761

W does not Granger Cause Y

3.67962

0.03311

-

PPI model

Null Hypothesis:

Obs

F-Statistic

Probability

E does not Granger Cause P_PPI

50

11.1745

0.00011

P_PPI does not Granger Cause E

0.21038

0.81107

M does not Granger Cause P_PPI

50

8.90000

0.00055

P_PPI does not Granger Cause M

1.69156

0.19574

W does not Granger Cause P_PPI

50

5.61756

0.00664

P_PPI does not Granger Cause W

3.12871

0.05343

Y does not Granger Cause P_PPI

50

0.68804

0.50777

P_PPI does not Granger Cause Y

0.36211

0.69821

M does not Granger Cause E

50

1.44232

0.24710

E does not Granger Cause M

4.00100

0.02516

W does not Granger Cause E

50

1.82747

0.17255

E does not Granger Cause W

6.31042

0.00384

Y does not Granger Cause E

50

1.73196

0.18852

E does not Granger Cause Y

0.42012

0.65952

W does not Granger Cause M

50

4.28134

0.01986

M does not Granger Cause W

0.03292

0.96764

Y does not Granger Cause M

50

0.27489

0.76092

M does not Granger Cause Y

0.41005

0.66607

Y does not Granger Cause W

50

0.99528

0.37761

W does not Granger Cause Y

3.67962

0.03311