BALAJI INSTITUTE OF I.T AND MANAGEMENT KADAPA 2.5 UNITS-(FROM LAST HAL… · Financial Management,...

Transcript of BALAJI INSTITUTE OF I.T AND MANAGEMENT KADAPA 2.5 UNITS-(FROM LAST HAL… · Financial Management,...

BALAJI INSTITUTE OF

I.T AND MANAGEMENT

KADAPA

FINANCIAL MANAGEMENT (17E00204)

ICET CODE: BIMK SECOND INTERNAL

ALSO DOWLOAD AT http://www.bimkadapa.in/materials.html

Name of the Faculty: S.RIYAZ BASHA

Units covered: Last half of 3rd Unit, 4th & 5th Units

E-Mail:[email protected]

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 1

(17E00204)FINANCIAL MANAGEMENT

SYLLABUS * Standard Discounting Table and Annuity tables shall be allowed in the examination

1. The Finance function: Nature and Scope. Importance of Finance function – The role in

the contemporary scenario – Goals of Finance function; Profit Vs Wealth maximization .

2. The Investment Decision: Investment decision process – Project generation, Project

evaluation, Project selection and Project implementation. Capital Budgeting methods–

Traditional and DCF methods. The NPV Vs IRR Debate.

3. The Financing Decision: Sources of Finance – A brief survey of financial instruments.

The Capital Structure Decision in practice: EBIT-EPS analysis. Cost of Capital: The

concept, Measurement of cost of capital – Component Costs and Weighted Average Cost.

The Dividend Decision: Major forms of Dividends

4. Introduction to Working Capital: Concepts and Characteristics of Working Capital,

Factors determining the Working Capital, Working Capital cycle-Management of Current

Assets – Cash, Receivables and Inventory, Financing Current Assets

5. Corporate Restructures: Corporate Mergers and Acquisitions and Take-overs-Types of

Mergers, Motives for mergers, Principles of Corporate Governance.

Textbooks:

Financial management –V.K.Bhalla ,S.Chand

Financial Management, I.M. Pandey, Vikas Publishers.

Financial Management--Text and Problems, MY Khan and PK Jain, Tata McGraw- Hill

References

Financial Management , Dr.V.R.Palanivelu ,S.Chand

Principles of Corporate Finance, Richard A Brealeyetal., Tata McGraw Hill.

Fundamentals of Financial Management, Chandra Bose D, PHI

Financial Managemen , William R.Lasheir ,Cengage.

Financial Management – Text and cases, Bringham&Ehrhardt, Cengage.

Case Studies in Finance, Bruner.R.F, Tata McGraw Hill, New Delhi.

Financial management , Dr.M.K.Rastogi ,Laxmi Publications

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 2

UNIT-3

THE FINANCING DECISION

1.5 COST OF CAPITAL

The cost of capital is the rate of return the company has to pay to various suppliers of funds.

There is a variation in the cost of capital due to the fact that different levels of investment

carry different levels of risk, which is compensated for, by different levels of return on

investment.

There are two main sources of capital for a company viz. shareholders and lenders. The cost

of equity and cost of debt are the rates of return that need to be offered to the shareholders

and lenders for supplying capital.

“The cost of capital is the minimum required rate of earnings of the cut-off rate for

capitalexpenditures”.

“The cost of capital is the minimum required of return the hurdle or target rate the cut-off

rateor the financial standard of performance of a project.”

“The project cost of capital is the minimum required rate of return on funds committed to

theproject which depends on the friskiness of its cash flows.”

“The firms cost of capital means overall or average required rate of return on the aggregate

ofinvestment projects”.

1.5.1 SIGNIFICANCE OF THE COST OF CAPITAL:

The determination of the firm’s cost of capital is important from the point of view of both

capital budgeting as well as capital structure planning decisions.Cost of capital is a concept of

vital importance in the financial decision making. It is useful as astandard for

1. Evaluating investment decisions: The primary purpose of measuring the cost of capital is

its use as a financialstandard for evaluating the investment projects.

a. In NPV method the investment project is accepted it has positive NPV. The projects

NPV are calculated by discounting its cash flows by the cost of capital. Positive NPV

makes a net contributing to the wealth of shareholders.

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 3

b. If the project has zero NPV it means that its cash flows have yielded a return just equal

to the cost of capital and acceptance or rejecting of the project does not affect the

wealth of shareholders.

c. In the I.R.R. method the investment project is accepted if it has an internal rate of return

greater than the cost of capital.

d. The cost of capital is the minimum required rate of return on the investment project that

keeps the present wealth of shareholders unchanged cost of capital represent a financial

standard for allocation the firm funds supplied by owners and creditors in the most

efficient manner.

2. Designing Debt Policy: The debt policy of a firm is significantly influenced by the cost

considerationdebt helps to save taxes as interest on debt is a tax deductible expense. The

interest tax should reducethe overall cost of capital though it also increase the financial risk

of the firm.

In designing the financing policy the proportioned debt and equity in the capital structure

thefirms aims at maximizing the firm value by minimizing the overall cost of capital.

The cost of capital can also useful in deciding about the methods of financing at a point of

time.

Ex. Cost may be compared in choosing between leasing and borrowing.

3. Appraising the financial performance of top management: The cost of capital

framework can be used to evaluate the financialperformance of top management. It involves a

comparison of actual profitability of the investmentprojects undertaken by the firm with the

project overall cost of capital and the appraisal of the actualcost incurred by management in

rising the required funds.The cost of capital also plays a useful role in a dividend decision

and investment in current assets.

1.6 ELEMENTS OF COST OF CAPITAL (OR) MEASUREMENT OF COST OF

CAPITAL:

The cost of capital consists of the following elements:

1. cost of equity

2. cost of retained earnings

3. cost of preference shares

4. cost of debt

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 4

5. weighted average cost of capital

I.)Cost of equity: the funds required for the project are raised from equity shareholders. These

funds need not be repayable during the lifetime of the company. Hence it is a permanent

source of fund. If the business is doing well the ultimate beneficiaries are the equity

shareholders (ESH). On other hand, if the company comes for liquidation due to losses, the

ultimate sufferers are also equity shareholders. Sometimes they may not get their investment

back during the liquidation process. That’s why equity share capital is also known as ‘risk

capital’.

Profits after tax less dividends paid to preference shareholders are the funds available

to ESH. These funds have been re-invested in the company and therefore, these retained

funds should be included in the cost of equity.

Cost of equity may be defined as the minimum rate of return that a company that must

earn on its equity financed portion so that the market value of share remain unchanged.

Methods of valuation:

The following methods are used in calculation of cost of equity.

a) Dividend yield method: This method is based on the assumption that the market value of

share is directly related to the future dividends on the shares. Another assumption is that

the future dividend per share is expected to be constant. It does not allow for any growth

in future dividends. But in reality the shareholders expects the return from his equity

investment to grow over time.

D1

Thus Ke = -------

PE

Where Ke= Cost of equity

D1 = annual dividend per share

PE = Market price per share

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 5

b) Dividends Growth Model: In this method an allowance for future growth in dividend is

added to the current year dividend. It is recognized that the current market price of a

share reflects expected future dividends. This model is also known as Gordon dividend

growth model.

D1 + g

Ke = ------------

PE

(OR)

Do (1+g)+g

Ke= -----------------

NP

Where Ke= cost of equity

D1 = current dividends per ES

G=growth in expected dividend

PE = Market price per ES

c) Price earning model: It takes into consideration the earnings per share (EPS) and

market price of share (MPS). It is based on the assumption that it the earnings are not

disbursed as dividends and kept as retained earnings are not disbursed earnings will causes

future growth in the earnings of the company as well as an increase in the market price of

the share. In calculation of equity share capital the EPS is divided by the current market

price.

E

Thus Ke= ------

M

Where Ke = cost of equity

E = current EPS

M=MPS

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 6

d) Capital Asset Pricing Model (CAPM): William F.Sharpe developed the CAPM. He

emphasized the risk factor in portfolio theory.

Risk refers to possibility of variation in the expected returns of the investor’s portfolio risk

consists of both systematic risk and unsystematic risk. Systematic risk affects the entire stock

market. For example wars, political situation influence the downward of upward movement

of stock exchange. On the other hand, the unsystematic risk happens to a company or any

industry due to shortage of raw-materials, technological changes, change in the preference of

customers etc.,

The CAPM divides the cost of equity into two components, the near risk-free return available

on investing in govt. bonds and an additional risk premium for investing in a particular share

or investment. This a additional risk premium comprises the average return on the overall

market portfolio and the beta (or risk) factor of particular investment. Putting this all together

the CAPM assess the cost of equity for an investment as follows:

Ke=Rf + Bi(Rm-Rf)

Where Ke = cost of equity

Rf = risk – free rate of return

Rm = average market return

Bi= risk of the investment.

II) Cost of retained earnings: These are the funds accumulated over the years. These

retained profits are now distributed to the shareholders, become the company can use these

funds for further profitable investment opportunities. The cost of retained earnings is an equal

to the income that they would otherwise obtain by placing these funds in alternative

investment. It the retained earnings are distributed to the equity shareholders will attract

personal taxation and therefore, the cost of retained earnings is calculated as follows:

Kr = Ke (1-T)

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 7

Where Kr = cost of retained earnings

Ke = cost of equity

T= tax rate of individuals

III. Cost of preference shares: the cost of preference share is the cost of return that must be

earned on preference capital financed investments, to keep unchanged the earnings available

to equity share holders.

A. Cost of irredeemable preference shares: the cost of irredeemable preference

share capital is the rate of preference dividend, also called the coupon rate

dividend by net issue proceeds.

I (1-T)

Kd = -----------

Np

Where Kd= cost of debt

I = annual interest payment

T = tax rate

Np = net proceeds from the issue of debentures, bonds, term loans etc.

1.7 THE CONCEPT OF AVERAGE VS MARGINAL COST OF CAPITAL

1. Marginal cost of capital:-Current rate of interest on long term debt or normal rate of

return is treated as firms marginalcost of capital. It is also termed as explicit cost.

Marginal cost of capital The weighted average cost of capital is computed for the sources of

finance already employedby the firm. If the company undertakes new projects or expansion

schemes. It may be required tocompute the cost of raising new funds and not the historical

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 8

costs incurred in the past. The weightedaverage cost of capital of the expansion programmes

or new projects is called the marginal cost ofcapital. Thus, the weighted average cost of new

or incremental capital is known as marginal cost ofcapital.

To finance its new projectors, a company should raise funds proportionally in accordance

withthe optimum capital structure. When a company raises funds to finance its new projects

in the sameproportion as it has for the company as a whole, and the component costs remain

unchanged, there willbe no difference between the average cost of capital (of the total funds)

and the marginal cost a capital(new funds). But the marginal cost of capital would rise

whenever any component cost increases. Therationale for using the marginal cost of capital

as an investment criterion is to maximize the value ofequity shares of the company.

2. Average Cost of Capital:-Average cost of capital is the weighted average of the costs of

each component of funds used bythe firm. The composite cost of capital is the weights being

the proportion of each source of funds in thecapital Structure. In financial decision making

the term cost of capital is used in this sense. Thisapproach enables the corporate management

to maximize the profits and wealth of the equityshareholders by investing funds in projects

earning in excess of the cost of its capital mix.

The following steps are involved in the computation of weighted average cost of capital:

Calculate the specific costs of various sources of finance, viz debt, preference equity etc.

Multiply the cost of each source by its proportion in the capital structure.

Add the weighted costs of all sources of funds to arrive at the weighted or composite cost of

capital.

1.7.1 WEIGHTED AVERAGE COST OF CAPITAL:

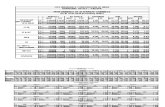

What is weighted average cost of capital? Illustrate your answer with imaginary figures.

a) Meaning of Weighted Average Cost of Capital: A company has to employ owner’s funds

as well as creditors funds to finance its projects so as to make the capital structure of the

company balanced and to increase the return to the shareholders. The total cost of capital is

the aggregate of costs of specific sources. In financial decision making, the concept of

composite cost is relevant. The composite cost of capital is the weighted average of the costs

of various sources of funds, weights being the proportion of each source of funds in the

capital structure. It should be remembered, that it is weighted average, and not the simple

average, which is relevant in calculating the overall cost of capital. The composite cost of all

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 9

capital lies between the least and the most expansive funds. This approach enables the

maximization of corporate profits and the wealth of the equity shareholders by investing the

funds in a projects earning in excess of the cost of its capital- mix.

Weighted average, as the name implies, is an average of the costs of specific source of capital

employed in a business, properly weighted by the proportion, they hold in the firm’s capital

structure.

Weighted Average, How to calculate? Though the concept of weighted average cost of

capital is very simple, yet there are so many problems in the way of its calculations. Its

computation requires:

i) computation of weights to be assigned to each type funds; and

ii) assignment of costs to various sources of capital

once these values are known, the calculation of weighted average cost becomes very simple.

It may be obtained by adding up the products of specific cost of all types of capital multiplied

by their appropriate weights.

In financial decision making, the cost of capital should be calculated on after tax basis.

Therefore, the component costs to be used to measure the weighted cost of capital should be

after tax costs.

Computation of weights: the assignment of weights to specific sources of funds is a difficult

task. Several approaches are followed in this regard but two of them are commonly used i.e.,

book-value approach and market value approach. As the cost of capital is used as a cut- off

rate of investment projects, the market value approach is considered better because of the

following reasons:

i) it evaluates the profitability as well as the long term financial position of the firm.

ii) The investors always consider the committing of his funds to an enterprise and an

adequate return on his investment. In such cases, book values are of little

significance.

iii) It does not indicate the true economic value of concern.

iv) It considers price level changes. But as the market value fluctuates widely and

frequently, the use of book value weights is preferred in practice because,

v) The firm sets its targets in terms of book value.

vi) It can easily be derived from published accounts and

vii) The investors generally use the debt-equity ratio on the basis of published figures

to analyze the riskiness of the firms.

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 10

Determining the type of capital structure: the next problem in calculating the weighted

average cost is the selection of capital structure from which the weights are obtained. There

may be several possibilities i.e,.,

a) current capital structure either before or after the projected new financing

b) marginal capital structure i.e, proportion of various types of capital in total of

additional funds to be raised at certain time and

c) optimal capital structure. All may agree that firms do seek optimum capital structure

i.e., the capital structure that minimizes the average cost of capital .

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 11

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 12

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 13

1.8 DIVIDEND DECISION

The term dividend refers to that part of profits of a company which is distributed by the

company among its shareholders after execution of retained earnings. It is the reward of the

shareholders for investments made by them in the shares for the company. And In other

words, it is the return that a shareholder gets from the company out of profit on his

shareholding.

According to the Institute of Chartered Accountant of India, “A dividend is distribution to

shareholders out of profit or reserves available for this purpose”.

1.9 MAJOR FORMS OF DIVIDEND/TYPES OF DIVIDEND

Dividends can be classified in various forms. Dividends paid in the ordinary course of

business are known as profit dividends. While dividends paid out of capital are known

Liquidation dividends.

Dividends may also be classified on the basis of medium in which they are paid:

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 14

1. ON THE BASIS OF TYPES OF SHARES:-

i. Equity Dividend: Dividend paid on equity shares called as equity dividend. Generally

dividend on equity shares is recommended by the Board of Directors depending upon profit

of the company. Rate of dividend is not fixed. It depends upon the recommendation of

directors which in turn depends upon the profit and future requirement of funds of the

company. Because the Directors has freedom regarding quantum and time of payment of

dividend.

ii. Preference Dividend: Preference dividend is the dividend paid to preference shareholders.

The preference dividend is paid at pre-determined rate and like equity shares, dividend on

preference shares is also recommended by the Board of Directors. As the name suggest

preference dividend gets priority over equity dividend. Equity dividend is paid only after

payment of shares on preference dividend. The board does not have power to reduce the rate

of dividend, however they can recommend higher dividend on preference shares.

2.ON THE BASIS OF MODES OF PAYMENT:-

i. Cash Dividend: A cash dividend is a usual method of paying dividends. Payment of

dividend in cash results in outflow of funds and reduces the company’s net worth, though the

shareholders get an opportunity to invest the cash in any manner they desire. This is why the

ordinary shareholders prefer to receive dividends in cash. But the firm must have adequate

liquid resources at its disposal or provide for such resources so that its liquidity position is not

adversely affected on account of cash dividends.

ii. Bonus Share/Stock Dividend: Stock dividend means the issue of bonus shares to the

existing shareholders. If a company does not have liquid resources it is better to declare stock

dividend. Stock dividend amounts to capitalization of earnings and distribution of profits

among the existing. Shareholders without affecting the cash position of the firm.

iii. Bond Dividend: A Bond dividend promise to pay the shareholders at a future specific

date. In case a company does not have sufficient funds to pay dividends in cash, it may issue

notes or bonds for amounts due to the shareholders. The objective Bond dividend bears

interest and is accepted as collateral security.

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 15

iv. Property Dividend: Property dividends are paid in the form of some assets other than

cash. They are distributed under exceptional circumstances and are not popular in India.

v. Composite Dividend: When dividend is paid partly in the form of cash and partly in other

form, it is called as composite dividend. This is not a new technique for payment of dividend

it is a combination of earlier discussed techniques.

3. ON THE BASIS OF TIME OF PAYMENT:-

i. Interim Dividend: Generally dividend is declared at the end of financial year, but

sometime company pays dividend before it declares dividend in its annual general meeting.

In other words, we can say that it is dividend paid between two annual general meetings.

Generally it is paid when company’s Board thinks that company has earned sufficient/huge

profit. In such a case Directors should be very careful because at the end of year profit may

fall short than what was expected by them.

ii. Regular Dividend: Dividend declared in Annual General Meeting is called as Regular

dividend. Every year company declares dividend in its Annual General Meeting.

iii. Special Dividend: A sound dividend policy should be formed in such a way that rate of

dividend should not be changed frequently year to year. Rate of dividend should be static.

However, wherever there is any huge/abnormal/extra profit, company should declare it as

special dividend. So that the shareholders do not expect for the same in each year, the basic

purpose of this special dividend is to convey the shareholders that this is a special dividend

and will not be paid every year.

1.9.1 TYPES OF DIVIDEND POLICY

1. Regular Dividend Policy:Payment of dividend at the usual rate is termed as regular

dividend. The investors such as retired persons, widows and other economically weaker

person prefer to get regular dividends.

Advantages of Regular Dividend Policy:-

A regular dividend policy offers the following advantages:

i) It establishes a profitable record of the company.

ii) It creates confidence among the shareholders.

iii) It aids in long-term financing and renders financing easier.

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 16

iv) It stabilizes the market value of shares.

v) The ordinary shareholders view dividends as a source of funds to meet their day-to-day

living expenses.

vi) If profits are not distributed regularly and are retained, the shareholders may have to

pay a higher rate of tax in the year when accumulated profits are distributed.

However, it must be remembered that regular dividends can be maintained only be

companies of long standing and stable earnings. A company should establish the regular

dividend at a lower rate as compared to the average earnings of the company.

2. Stable Dividend Policy:The term ‘stability of dividends’ means consistency or lack of

variability in the stream of dividend payments. In more precise terms, it means payment of

certain minimum amount of dividend regularly. A stable dividend policy may be established

in any of the following three forms:

i) Constant Dividend per Share: Some companies follow a policy of paying fixed

dividend per share irrespective of the level of earnings year after year. Such firms, usually,

create a ‘Reserve for Dividend Equalization’ to enable them pay the fixed dividend even in

the year when the earnings are not sufficient or when there are losses. A policy of constant

dividend per share is most suitable to concerns whose earnings are expected to remain

stable over a number of years.

ii) Constant Pay-out Ratio: Constant pay-out ratio means payment of a fixed percentage

of net earnings as dividend every year. The amount of dividend in such a policy fluctuates

in direct proportion to the earnings of the company. The policy of constant pay-out is

preferred by the firms because it is related to their ability to pay dividends.

iii) Stable Rupee Dividend plus Extra Dividend: Some companies follow a policy of

paying constant low dividend per share plus an extra dividend in the years of high profits.

Such a policy is most suitable to the firm having fluctuating Earnings from year to year.

Advantages of Stable Dividend Policy:-

A stable dividend policy is advantageous to both the investors and the company on

account of

the following:

i. It is sign of continued normal operations of the company.

ii. It stabilizes the market value of shares.

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 17

iii. It creates confidence among the investors

Iv. It meets the requirements of institutional investors who prefer companies with stable

dividends.

3. Irregular Dividend Policy:Some companies follow regular dividend payments on account

of the following:

i. Uncertainty of earnings

ii. Unsuccessful business operations

iii. Lack of liquid resources

iv. Fear of adverse effects of regular dividends on the financial standing of the company

4. No Dividend Policy:A company may follow a policy of paying no dividends presently

because of its unfavorable working capital position of on account of requirements of funds of

future expansion and growth.

UNIT-3-AFTER 2.5 UNITS-IMPORTANT QUESTIONS

Briefly explain about Measurement of cost of capital of cost of capital?

What is Dividend? Elucidate major forms of dividend?

Cost of capital, weighted average cost of capital related Problems?

FINANCIAL MANAGEMENT M.B.A -II –SEMESTER- R17

UNIT-3 The Financing Decision |BALAJI INST OF I.T AND MANAGEMENT 18

CASE STUDY

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 1

(17E00204)FINANCIAL MANAGEMENT

Syllabus

* Standard Discounting Table and Annuity tables shall be allowed in the examination

1. The Finance function: Nature and Scope. Importance of Finance function – The role in the

contemporary scenario – Goals of Finance function; Profit Vs Wealth maximization .

2. The Investment Decision: Investment decision process – Project generation, Project

evaluation, Project selection and Project implementation. Capital Budgeting methods–

Traditional and DCF methods. The NPV Vs IRR Debate.

3. The Financing Decision: Sources of Finance – A brief survey of financial instruments. The

Capital Structure Decision in practice: EBIT-EPS analysis. Cost of Capital: The concept,

Measurement of cost of capital – Component Costs and Weighted Average Cost. The Dividend

Decision: Major forms of Dividends

4. Introduction to Working Capital: Concepts and Characteristics of Working Capital, Factors

determining the Working Capital, Working Capital cycle-Management of Current Assets –

Cash, Receivables and Inventory, Financing Current Assets

5. Corporate Restructures: Corporate Mergers and Acquisitions and Take-overs-Types of

Mergers, Motives for mergers, Principles of Corporate Governance.

Textbooks:

Financial management –V.K.Bhalla ,S.Chand

Financial Management, I.M. Pandey, Vikas Publishers.

Financial Management--Text and Problems, MY Khan and PK Jain, Tata McGraw- Hill

References

Financial Management , Dr.V.R.Palanivelu , S.Chand

Principles of Corporate Finance, Richard A Brealey etal., Tata McGraw Hill.

Fundamentals of Financial Management, Chandra Bose D, PHI

Financial Managemen , William R.Lasheir ,Cengage.

Financial Management – Text and cases, Bringham & Ehrhardt, Cengage.

Case Studies in Finance, Bruner.R.F, Tata McGraw Hill, New Delhi.

Financial management , Dr.M.K.Rastogi ,Laxmi Publications

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 2

UNIT-4

INTRODUCTION TO WORKING CAPITAL

1.INTRODUCTION TO WORKING CAPITAL MANAGEMENT:

Working capital is the life blood and nerve centre of a business. Just as circulation of blood is

essential in the human body for maintaining life, working capital is very essential to maintain

the smooth running of a business. No business can run successfully without an adequate amount

of working capital.

Working capital refers to that part of firm’s capital which is required for financing short term or

current assets such as cash, marketable securities, debtors, and inventories. In other words

working capital is the amount of funds necessary to cover the cost of operating the enterprise.

Meaning: Working capital means the funds (i.e.; capital) available and used for day to day

operations (i.e.; working) of an enterprise. It consists broadly of that portion of assets of a

business which are used in or related to its current operations. It refers to funds which are used

during an accounting period to generate a current income of a type which is consistent with

major purpose of a firm existence.

Definition:

The following are the some of the definitions given for working capital by experts in the areas of

finance.

“ the sum of current assets is the working capital of a business”.-J.S.Mill.

“working capital has ordinarily been defined as the excess of current assets over current

liabilities”. – C.W.Gerstenberg.

Definition of Working Capital:“Working Capital sometimes called as Net Working Capital is

represented by the excess of current assets over the current liabilities and identified the relatively

liquid portion to total enterprise capital which constitutes a margin of buffer for maturing

obligations within the ordinary operating cycle of the business”.

‘Working Capital is a excess of current assets over current liabilities’.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 3

1.1 OBJECTIVES & NEED OF WORKING CAPITAL:

To ensure optimum investment in current assets.

To strike balance between the twin objectives of liquidity and profitability in the use of

funds.

To ensure adequate flow of funds of current operations.

To speed up flow of funds or to minimize the stagnation of funds.

Businesses with a lot of cash sales and few credit sales should have minimal trade

debtors. Supermarkets are good examples of such businesses;

Businesses that exist to trade in completed products will only have finished goods in

stock. Compare this with manufacturers who will also have to maintain stocks of raw

materials and work-in-progress.

Some finished goods, notably foodstuffs, have to be sold within a limited period because

of their perishable nature.

Larger companies may be able to use their bargaining strength as customers to obtain

more favorable, extended credit terms from suppliers. By contrast, smaller companies,

particularly those that have recently started trading (and do not have a track record of

credit worthiness) may be required to pay their suppliers immediately.

Some businesses will receive their monies at certain times of the year, although they may

incur expenses throughout the year at a fairly consistent level. This is often known as

“seasonality” of cash flow. For example, travel agents have peak sales in the weeks

immediately following Christmas.

Working capital needs also fluctuate during the year. The amount of funds tied up in

working capital would not typically be a constant figure throughout the year.

Only in the most unusual of businesses would there be a constant need for working

capital funding. For most businesses there would be weekly fluctuations.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 4

1.2 CONCEPTS/TYPES OF WORKING CAPITAL

A)On The Basis of Concept:-On the basis of concept, working capital is classified as

gross working capital and net working capital. This classification is important form the point of

view of the financial manager.

i) Gross Working Capital:- The term working capital refers to the gross working capital and

represents the amount of funds invested in current assets.

GROSS WORKING CAPITAL = TOTAL OF CURRENT ASSETS

ii) Net working Capital:- The term working capital refers to the net working capital. Net

working capital is the excess of current assets over current liabilities.

NET WORKING CAPITAL = CURRENT ASSETS - CURRENT LIABILITEIS

Kinds of Working Capital

On The Basis of Concept On The Basis of time

Gross Working

Capital

Net

Working Capital

Permanent or

Fixed working

Capital

Temporary or

Variable Working

Capital

Regular Working

Capital

Reserve

Working Capital

Seasonal Working

Capital

Special Working

Capital

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 5

B)On The Basis of Time:-On the basis of time, working capital may be classified as

permanent of fixed working capital and temporary or variable working capital.

i) Permanent or Fixed Working Capital:-Permanent of fixed working capital is the

minimum amount which is required to ensure effective utilization of fixed facilities and

for maintaining the circulation of current assets. There is always a minimum level of

current assets, which is continuously required by the enterprise to carry out its normal

business operations. For example, every firm has to maintain a minimum level of raw

materials, work-in-process, finished goods and cash balance. This minimum level of

current assets is called permanent or fixed working capital as this part of capital is

permanently blocked in current assets. As the business grows the requirements of

permanent working capital also increase due to the increase in current assets. The

permanent working capital can further be classified as regular working capital and

reserve working capital required ensuring circulation of current assets from cash to

inventories, from inventories to receivables and form receivables to cash and so on

a) Regular Working Capital:- this is the amount of working capital required for

the continuous operations of an enterprise. It refers to the excess of current assets

over current liabilities. Any organization has to maintain a minimum stock of

materials. Finished goods and cash to ensure its smooth working and to meet its

immediate obligations.

b) Reserve Worki8ng Capital:- Reserve working capital is the excess amount over

the requirement for regular working capital which may be provided for

contingencies that may arise at unstated period such as strikes, rise in prices,

depression, etc.,

ii) Temporary or variable Working Capital:-Temporary or variable working capital is the

amount of working capital which is required to meet the seasonal demands and some special

exigencies. Variable working capital can be further classified as seasonal working capital and

special working capital.

a) Seasonal Working Capital:- Seasonal working capital is required to meet the

seasonal needs of the enterprise such as, a textile dealer would require large

amount of funds a few months before Diwall.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 6

b) Special Working Capital:- Special working capital is that part of working

capital which is required to meet special emergency such as launching or

extensive marketing campaigns for conducting research, etc

c)

Differences between Temporary and Permanent Working Capital:- In the following figure

we can see the differences between the Temporary and Permanent Working capital in case of

two firms like Constant Firm and growing firm.

1.3 COMPONENTS OF WORKING CAPITAL:-

Working Capital will be defined as that Excess of current assets over current liabilities of a firm.

The following are components of working capital which comprise of current assets and current

liabilities. Examples of current assets are:

CONSTITUENT OF CURRENT

LIABILITIES

CONSTITUENT OF CURRENT

ASSETS

1. Bills Payable.

2. Sundry Creditor or Accounts Payable.

3. Accrued or Outstanding Expenses.

4. Short term loans and advances.

5. Dividends Payable.

6. Bank over Draft.

1. Cash in hand and bank balances.

2. Bills Receivables.

3. Sundry Debtors.

4. Short term loans and advances.

5. Inventories of Stock:

Raw Materials.

Temporary

Permanent

Time

Constant Permanent Capital

Time

Increasing Permanent Capital

Wo

rkin

g C

ap

ita

l (R

s.)

Wo

rkin

g C

ap

ita

l (R

s.)

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 7

7. Provision for Taxation. Work – in – Process.

Stores and Spares

Finished Goods.

6. Temporary Investment of Surplus funds.

7. Prepaid Expenses, Accrued Income.

1.4 GROSS CAPITAL VS. NET WORKING CAPITAL:

The distinction between gross working capital and net working capital does not in any

way undermine the relevance of the concepts of either gross or net working capital. A financial

manager must consider both of them because they provide different interpretations. The gross

working capital denotes the total working capital or the total investment in current assets. A

firm should maintain an optimum level of gross working capital. On the other hand Net working

capital means the excess of current assets over current liabilities.

Gross Working Capital = Total of Current Assets

Net Working Capital = Current Assets – Current Liabilities

2. CHARACTERISTICS OF WORKING CAPITAL

The features of working capital distinguishing it from the fixed capital are as follows:

(1)Short term Needs: Working capital is used to acquire current assets which get converted into

cash in a short period. In this respect it differs from fixed capital which represents funds locked

in long term assets. The duration of the working capital depends on the length of production

process, the time that elapses in the sale and the waiting period of the cash receipt.

(2) Circular Movement: Working capital is constantly converted into cash which again turns

into working capital. This process of conversion goes on continuously. The cash is used to

purchase current assets and when the goods are produced and sold out; those current assets are

transformed into cash. Thus it moves in a circular away. That is why working capital is also

described as circulating capital.

(3) An Element of Permanency:Though working capital is a short term capital, it is required

always and forever. As stated before, working capital is necessary to continue the productive

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 8

activity of the enterprise. Hence so long as production continues, the enterprise will constantly

remain in need of working capital. The working capital that is required permanently is called

permanent or regular working capital.

(4) An Element of Fluctuation: Though the requirement of working capital is felt permanently,

its requirement fluctuates more widely than that of fixed capital. The requirement of working

capital varies directly with the level of production. It varies with the variation of the purchase

and sale policy; price level and the level of demand also. The portion of working capital that

changes with production, sale, price etc. is called variable working capital.

(5) Liquidity: Working capital is more liquid than fixed capital. If need arises, working capital

can be converted into cash within a short period and without much loss. A company in need of

cash can get it through the conversion of its working capital by insisting on quick recovery of its

bills receivable and by expediting sales of its product. It is due to this trait of working capital

that the companies with a larger amount of working capital feel more secure.'

(6) Less Risky: Funds invested in fixed assets get locked up for a long period of time and

cannot be recovered easily. There is also a danger of fixed assets like machinery getting obsolete

due to technological innovations. Hence investment in fixed capital is comparatively more risky.

As against this, investment in current assets is less risky as it is a short term investment.

Working capital involves more of physical risk only, and that too is limited. Working capital

involves financial or economic risk to a much less extent because the variations of product

prices are less severe generally. Moreover, working capital gets converted into cash again and

again; therefore, it is free from the risk arising out of technological changes.

(7) Special Accounting System not needed: Since fixed capital is invested in long term assets,

it becomes necessary to adopt various systems of estimating depreciation. On the other hand

working capital is invested in short term assets which last for one year only. Hence it is not

necessary to adopt special accounting system for them.

3. FACTORS DETERMINING WORKING CAPITAL REQUIREMENTS:

1)Nature of Business:- the working capital requirements of a firm basically depend upon the

nature of its business. Public utility undertakings like Electricity, Water Supply and Railways

need very limited working capital because they offer cash sales only and supply services, not

products and as such no funds are tied up in inventories and receivables. On the other hand

trading and financial firms require less investment in fixed assets but have to invest large

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 9

amount sin current assets like inventories, receivables and cash; as such they need large amount

of working capital.

2)Size of Business / Scale of Operations:- the working capital requirements of a concern are

directly influenced by the size of its business which may be measured in terms of scale of

operations Greater the size of a business unit, generally larger will be the requirements of

working capital.

3)Production Policy:- In certain industries the demand is subject to wide fluctuations due to

seasonal variations. The requirements of working capital, in such cases, depend upon the

production policy.

4)Manufacturing Process / Length of Production Cycle:- In manufacturing business, the

requirements of working capital increase in direct proportion to length of manufacturing process.

Longer the process period of manufacturing, larger is the amount of working capital required.

5)Seasonal Variations:- In certain industries raw material is not available throughout the year.

They have to buy raw materials in bulk during the season to ensure an uninterrupted flow and

process then during the entire year.

6)Working Capital Cycle:- In a manufacturing concern, the working capital cycle starts with

the purchase of raw material and ends with the realization of cash from the sale of finished

products. This cycle involves purchase of raw materials and stores, its conversion into stocks of

finished goods through work-in-progress with progressive increment of labour and service costs,

conversion of finished stock to sales, debtors and receivables and ultimately realization or cash

and this cycle continues again from cash to purchase of raw material and so on. The speed with

which the working capital completes once cycle determines the requirement of working capital

longer the period of the cycle larger is the requirement of working capital.

7)Rate of Stock Turnover:- There is a high degree of inverse co-relationship between the

quantum of working capital and the velocity or speed with which the sales are affected. A firm

having a high rate of stock turnover will need lower amount of working capital as compared to a

firm having a low rate of turnover.

8)Credit Policy:- The Credit Policy of a concern in its dealings with debtors and creditors

influence considerably the requirement6s of working capital a Concern that purchases its

requirements on credit and sells its products /services on cash requires lesser amount of working

capital. On the other hand a concern buying its requirements for cash and allowing credit to its

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 10

customers, shall need larger amount of working capital as very huge amount of funds are bound

to be blocked up in debtors or bills receivables.

9)Business Cycles:- Business cycle refers to alternate expansion and contraction in general

business activity. In a period of boom i.e., when the business is prosperous, there is a need for

larger amount of working capital due to increase in sales, rise in prices, optimistic expansion of

business, etc. on the contrary in the times of depression i.e., when there is a down swing of the

cycle, the business contracts sales decline, difficulties are faced in collections from debtors and

firms may have a large amount of working capital lying idle.

10)Rate of Growth of Business :- the working capital requirements of a concern increase with

the growth and expansion of its business activities. Although, it is difficult to determine the

relationship between the growth in the volume of business and the growth in the working capital

of a business. Yet it may be concluded that for normal rate of expansion in the volume of

business, we may have retained profits to provide for more working capital but in fast growing

concerns, we shall require larger amount of working capital.

11)Earning Capacity and Dividend Policy:- Some firms have more earning capacity than

others due to quality of their products, monopoly conditions, etc. such firms with high earning

capacity may generate cash profits form operations and contribute to their working capital. The

dividend policy of a concern also influences the requirements of its working capital.

12)Price Level Changes:- Changes in the price level also affect the working capital

requirements. Some firms may be affected much while some others may not be affected at all

by the rise in prices.

13)Tax Level:- The first appropriation out of profits is payment or provision for tax. Taxes

have to be paid in advance on the basis of the profit of the preceding year. Tax liability is, in a

sense, short term liability payable in cash. An adequate provision for tax payments is, therefore,

an important aspect of working capital planning. If tax liability increases, it leads to an increase

in the requirement of working capital and vice versa.

14)Other Factors;-Certain other factors such as operating efficiency, management ability,

irregularities to supply, import policy, asset structure, importance of labour, banking facilities,

etc., influence the requirements of working capital.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 11

4. WORKING CAPITAL CYCLE / OPERATING CYCLE

The working capital requirement of a firm depends, to a great extent upon the operating cycle of

the firm. The duration of time required to complete the sequence of events right from purchase

of raw material goods for cash to the realization of sales in cash is called the operating cycle or

working capital cycle. It can be determined by adding the number of days required for each

stage in the cycle. In case of manufacturing concerns, working capital is required to cater to the

following needs of business in order:

a)Operating Cycle Manufacturing Firm:-

1. Raw materials are to be purchased for cash.

2. Production process converts raw materials into work-in-process.

3. Work-in-process in converted into finished goods, during course of time through

production process.

4. Finished goods are converted into accounts receivable (debtors and bills receivable)

through sale.

5. Accounting receivable are realized into cash in due course of time.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 12

Operating Cycle of a Manufacturing concern

The above operating cycle is repeated –again and again over the period depending upon

the nature of the business and type of product etc. the duration of the operating cycle for the

purpose of estimating working capital is equal to the sum of the duration allowed by the

suppliers.

b) Operating Cycle of Non-Manufacturing Firm:- Non-Manufacturing firms are wholesalers,

retailers, service firms which do not have manufacturing process. They will have direct

conversion of cash into finished goods and then into cash. In other words, they purchase

finished goods from manufacturing firm and sell them either cash or credit if they sell goods on

credit the process will like in the following figure.

Operating Cycle of a Trading Concern

Finished Goods (1)

Sa

les (2

)

Debtors (3)

Cas

h

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 13

c) Operating Cycle of Service and Finance Firm

Working capital cycle can be expressed as: =R+W+F+D-C where

R = Raw material storage period = Average Stock of raw materials

Average cost of production per day

W = Work in progress holding period = Average work in progress inventory

Average cost of production per day.

F = Finished goods storage period =Average stock of finished goods

Average cost of goods sold per day

D = Debtor collection period = Average Book Debts

Average credit sales per day

C = Credit period availed = Average trade creditors

Average credit purchase per day

Debtors Cash

Operating Cycle of Service and Finance Firm

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 14

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 15

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 16

5. MANAGEMENT OF CURRENT ASSETS

Working capital management involves the management and control of the gross current assets.

And the current assets mainly comprise cash, sundry debtors (also known as accounts receivable

(ARs) and bills receivable (BRs)) and inventories. Thus the working capital management

comprises the management of all those components individuals and collectively too.

Working capital refers to the excess of current assets over current liabilities.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 17

A. CASH MANAGEMENT: identify the cash balance which allows for the business to

meet day to day expenses but reduces cash holding costs.

B. RECEIVABLES MANAGEMENT: identify the appropriate credit policy i.e., credit

terms which all attract customers such that any impact on cash flows and the cash

conversion cycle will be offset by increased revenue and hence return on capital.

C. INVENTORY MANAGEMENT: identify the level of inventory which allows for

uninterrupted production but reduces the investment in raw materials and minimizes re-

ordering costs and hence increases cash flow.

A.CASH MANAGEMENT: Cash is one of the current assets of a business. It is needed at all

times to keep the business going. A business concern should always keep sufficient cash for

meeting its obligations. Any shortage of cash will hamper the operation of a concern and any

excess of it will be unproductive. Cash is the most unproductive of all the assets. While fixed

assets like capacity cash in hand will not add anything to the coercer. Cash in a broader sense

includes coins currency notes cheques bank drafts and also marketable securities and time

deposits with banks.

5.1 FACTORS DETERMINING CASH NEEDS

The amount of cash for transaction requirements is predictable and depends upon a variety of

factors which are as follows.

1. Credit Position Of The Firms: the credit position influences the amount of cash required in

two distinct ways.

If a firms credit position is sound it is not necessary to carry a large cash reserve for

emergencies.

Components of working capital management

Management of cash Management of receivables

Management of inventory

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 18

If a firm finance its inventory requirements with trade credit its cash requirements are

considerably smaller since the firm can synchronize the credit terms it gives to its

customers with eh terms it receives.

2. Status Of Firm’s Receivable: the amount of time required for a firm to convert its

receivable into cash also affects the amount of cash needed and of course, reduces total

working capital employed. In other words the longer the credit terms the slower the turn

over. When flow out is not synchronized with turn over a firm must carry amounts of cash

relatively larger than would otherwise be required.

3. Status of Firms Inventory Account: the status of a firms inventory account also affects the

amount of cash tied up at any one time. For example, if one business firm carries two

months inventory on hand and another firm carries only one month’s supply the former has

twice as much investment in inventory and will normally be called up on to maintain a

larger investment in cash in order to finance its acquisition.

4. Nature of Business Enterprise: the nature of firms demand definitely affects the volume of

cash required. For example, a firm whose demand is volatile needs a relatively larger cash

reserve than one whose demand is stable.

5. Management’s Attitude towards Risk: a more conservative management will hold a larger

cash reserve than one that is less conservative. The former usually demands more liquidity

than the latter and consequently does not experience the same degree of efficiency.

6. Amount of Sales In Relation To Assets: another characteristic affecting the level of cash is

the amount of sales in relation to assets. Firms with large sales relative to fixed assets are

required to carry larger cash reserves. This is the result of having larger sums invested in

inventories and receivable.

7. Cash Inflows and Cash Outflows: every firm has to maintain cash balance because its

expected inflows and outflows are not always synchronized. The timings of the cash inflows

may not always match with the timing of the outflows. Therefore a cash balance is required

to fill up the gap arising out of difference in timings and quantum of inflows and outflows.

8. Cost of Cash Balance: another factor to be considered while determining the minimum

cash balance is the cost of maintaining excess cash or of meeting shortage of cash. There is

always an opportunity cost of maintaining excessive cash balance. If a firm is maintaining

excess cash then it is missing the opportunities of investing these funds in a profitable way.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 19

5.2 OBJECTIVES OF CASH MANAGEMENT

Cash management refers to management of cash balance and the bank balance including the

short terms deposits. For cash management purposes the term cash is used in this broader sense,

i.e., it covers cash equivalents and those assets which are immediately convertible into cash.

Even if a firm is highly profitable its cash inflows may not exactly match the cash outflows. He

has to manipulate and synchronize the two for the advantage of the firm by investing excess

cash if any as well as arrangement funds to cover the deficiency.

1. Meeting the Payment Schedule: in the normal course of business firms to make

payments of cash on a continuous and regular basis to suppliers of goods, employees and

so on. At the same time there is a constant inflow of cash through collections from

debtors. The importance of sufficient cash to meet the payment schedule can hardly be

over emphasized.

2. Minimizing Funds Committed To Cash Balance: the second objectives of cash

management are to minimize cash balances. In minimizing the cash balances two

conflicting aspects have to be reconciled. A high level of cash balances ensures prompt

payment together with all the advantages. But it also implies that large funds will remain

idle as cash is a non earning asset and the firm will have to forego profits. A low level of

cash balances on the other hand may mean failure to meet the payment schedule. The

aim of cash management should be to have an optimal amount of cash balances.

5.3 CASH BUDGET

It is an estimate of cash receipts from all sources and cash payments for all purposes and the net

cash balances during the budget period. It ensures that the business has adequate cash to meet its

requirements as and when these arise. It indicates cash excesses and shortfalls so that action may

be taken in advance to invest any surplus cash or to borrow funds to meet any shortfalls.

According to GUTHMEN AND DOUGAL cash budget is an estimate of cash receipts and

disbursements for a future period of time.

5.3.1 PURPOSE OF CASH BUDGET

1. Helps in Determining Future Cash Requirements: cash budget helps in estimating the

future cash requirements. It is estimated how much cash will be needed for different activities in

a period.

2. Help In Making Plans: cash budget helps in making plans. It gives reality and possibility on

plans.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 20

3. Planning Suitable Investment Of Surplus Cash: in cash budget declared as surplus as per

the cash budget the financial manager will study the amount of surplus future requirements of

cash and also take into consideration the chance factor.

4. Helps In Cash Control And Liquidity Of The Enterprises: by preparing cash budget one

can controlled over cash misuse of cash be stopped by preparing cash budget. It also helps the

liquidity of cash.

PARTICULARS JAN FEB MAR

1. opening cash balance

2. estimated cash receipts

Cash sales

Cash collection from debtors

Interest received from investments

Cash inflow on issue of new securities

Raising of loans

Sales of assets

divided

XXX XXX XXX

3. total receipts available during the month (1+2)

4. estimated cash payments

payment for cash purchases

payment to Sunday creditors for credit purchases

payment for wages and salaries

payments for other administrative expenses

payment in the nature of capital expenditure

loan repayment

dividend payment

payment of interest on loan

5. total cash payments

6. closing cash balance (3-4)

XXX XXX XXX

XXX XXX XXX

XXX XXX XXX

XXX XXX XXX

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 21

EXAMPLES: Prepare a cash budget for the months of June, July, and august 2014 from the

following information:

opening cash balance in June 7,000

cash sales for June 20,000 July 30,000 and august 40,000

wages payable 6,000 every month

interest receivable 500 n the month of august

Purchase of furniture for 16,000 in July.

Cash purchases for June 10,000 July 9,000 and august 14,000.

Cash budget

(For the period June to August 2014)

Particulars June July August

opening cash balance

add: cash receipts (estimated)

cash sales

interest

7,000

20,000

11,000

30,000

10,000

40,000

500

Total receipts 27,000 41,000 50,500

Less: cash payments (estimated)

Cash purchases

Payment of wages

Purchases of furniture

10,000

6,000

9,000

6,000

16,000

14,000

6,000

Total payment 16,000 31,000 20,000

Closing balance (surplus/deficit)

(total receipts – total payments)

11,000

10,000

30,500

Note: the closing cash balance in June will be the opening cash balance in July

6. RECEIVABLES MANAGEMENT

Accounts receivables are simply extensions of credit to the firm’s customers allowing

them a reasonable period of time in which to pay for the goods. Most firm treat account

receivables as a marketing tool to promote sales and profits. The receivables constitute a

significant portion of the working capital and are important elements of it.

The receivables emerge whenever goods are sold on credit and payments are deferred by

customers. Receivables are a type of loan extended by a seller to the buyer to facilitate

the purchase process. As against the ordinary type of loan the trade credit in the form of

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 22

receivable is not a profit making service but an inducement or facility to the buyer

customer of the firm.

According to HAMPTON receivables are asset accounts representing amount owned to

firm as a result of sale of goods or service in ordinary course of business.

According to Bobert N. Anthony accounts receivables are amounts owed to the business

enterprise, usually by its customers. Sometimes it is broken down into trade accounts

receivables; the former refers to amounts owed by customers and the latter refers to

amounts owed by employees and others.

Thus receivables are forms of investment in any enterprise manufacturing and selling

goods on credit basis large sums of funds are tied up in trade debtors. Hence a great deal

of careful analysis and proper management is exercised for effective and efficient

management of receivables to ensure a positive contribution towards increase in turnover

and profits.

Receivables management is the process of making decisions relating to investment in

trade debtors. Certain investment in receivables is necessary to increase the sales and the

profits of a firm. But at the same time investment in this asset involves cost

considerations also. Further there is always a risk of bad debts too.

6.1 OBJECTIVES OF RECEIVABLES MANAGEMENT

The objectives of receivables management are to improve sales eliminate bad debts and reduce

transaction costs incidental to maintenance of accounts and collection of sale proceeds and

finally enhance profits of the firm. Credit sales help the organization to make extra profit. It is a

known fact firms charge a higher price when sold on credit compared to normal price.

1. Book Debts Are Used As A Marketing Tool For Improvement Of Business: if the firm

wants to expand business it has to necessarily sell on credit. After a certain level additional sales

do not create additional production costs duet o the presence of fixed costs. So the additional

contribution totally goes towards profit improving the profitability of the firm.

2. Optimum Level of Investment In Receivables: to support sales it is necessary for the firm to

make investment in receivables. Investment in receivables involves costs as funds are tied up in

debtors. Further there is also risk in respect of bad debts too. On the other hand receivables bring

returns. If so till what level investment is to be made in receivables? Investment in receivables is

to be made till the incremental costs are less than the incremental return.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 23

In the other words the objectives of receivables management is to promote sales and profits until

that point is reached where the return on investment in further funding receivables is less than

the cost of funds raised to finance that additional credit.

6.2 FACTORS AFFECTING THE SIZE OF RECEIVABLES

The following factors directly and indirectly affect the size of receivables.

1. Stability of Sales: in the business of seasonal character total sales and the credit sales will go

up in the season and therefore volume of receivable will also be large. On the other hand if a

firm supplies goods on installment basis its balance in receivables will be high.

2. Size and Policy of Cash Discount: it is also important variable in deciding the level of

investment in receivables. Cash discount affects the cost of capital and the investment in

receivables. If cost of capital of the firm is lower in comparison to the discount to be allowed

investment in receivables will be less. If both are equal it will not affect the investment at all. If

cost capital is higher than cash discount the investment in receivables will be larger.

3. Bill Discounting and Endorsement: if firm has any arrangement with the banks to get the

bills discounted or if they re-endorsed to third parties, the level of investment in assets will be

automatically low. If bills are honored on due dates the investment will be larger.

4. Terms Of Sale: a firm may affect its sales either on cash basis or on credit basis. As a matter

of fact credit is the soul of a business. It also leads to higher profit level through expansion of

sales. The higher the volume of sales made on credit the higher will be the volume of receivables

and vice-versa.

5. Volume of Credit Sales: it plays the most important role in determination of the level of

receivables. As the terms of trade remains more or less similar to most of the industries. So a

firm dealing with a high level of sales will have large volume of receivable.

6. Collection Policy: the policy practice and procedure adopted by a business enterprise in

granting credit deciding as to the amount of credit and the procedure selected for the collection

of the same also greatly influence the level of receivables of a concern. The more lenient or

liberal to credit and collection policies the more receivables are required for the purpose of

investment.

7. Collection Collected: if an enterprise is efficient enough in encasing the payment attached to

the receivables within the stipulated period granted to the customer. Then it will opt for keeping

the level of receivable low. Whereas enterprise experiencing undue delay in collection of

payments will always have to maintain large receivables.

8. Quality of Customer: if a company deals specifically with financially sound and credit

worthy customers then it would definitely receive all the payments in due time. As a result the

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 24

firm can comfortably do with a lesser amount of receivables than in case where a company deals

with customers having financially weaker position.

7. INVENTORY MANAGEMENT

The dictionary meaning of inventory is stock of goods. The word inventory is understood

differently by various authors. In accounting language it may mean stock of finished goods only.

In a manufacturing concern it may include raw materials work in process and stores etc.

INTERNATIONAL ACCOUNTING STANDARD COMMITTEE (I.A.S.C): defines

inventories as tangible property,

Held for sale in the ordinary course of business

In the process of production for such sale or

To be consumed in the process of production of goods or services for sale.

According to Bolten S.E., inventory refers to stock pile of product a firm is offering for sale and

components that make up the product.

7.1 NATURE/ELEMENTS OF INVENTORY

1. Raw Material: It includes direct material used in manufacture of a product. The purpose of

holding raw material is to ensure uninterrupted production in the event of delaying delivery. The

amount of raw materials to be kept by a firm depends on various factors such as speed with

which raw materials are to be ordered and procured and uncertainty in the supply of these raw

materials.

a. Direct Material: direct material is the primary classification for raw materials in

manufacturing operations. It is directly related to the final product. It is only the material

that after manufacturing processes are applied ships out to a distributor or the final

customer. If e.g., company manufacture hammers then steel would be its primary direct

material.

b. Indirect Material: indirect material is the class of material in the manufacturing process

that does not actually ship to the customer as part of the final product.

For Example, The gas used to heat the furnaces that melt the steel in the manufacture of

hammers is an indirect material. Similarly the water that cools the metal is also an indirect

material

2. Work In Progress: in includes partly finished goods and materials held between

manufacturing stages. It can also be stated that those raw materials which are used in production

process but are not finally converted into final product are work in progress.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 25

3. Consumable: consumables are products that consumers buy recurrently i.e., items which get

used up or discarded. For example, consumable office supplies are such products as paper pens,

file folders post it notes computer disks and toner or ink cartridges.

4. Finished Goods: the goods ready for sale or distribution comes under this class. It helps to

reduce the risk associated with stoppage in output on account of strikes breakdowns shortage of

material etc.

5. Stores And Spares: this category includes those products which are accessories to the main

products produced for the purpose of sale. For example, stores and spares items are bolt nuts

clamps, screws, etc.

7.2 FACTORS AFFECTING INVETNORY MANAGEMENT

1. Characteristics of the Manufacturing System: the natures of the production process the

product design and production planning and plant layout have significant affect on inventory

policy.

a. Degree Of Specialization And Differentiation Of The Products At Various Stages: the

degree of changes in the nature of the product from raw material to final product at various

stages of transformation viz. final assembly and packaging determines the nature of

inventory control operation, for example, if nature of product remains more or less same at

various stages of production then economics can be achieved by keeping the right balance

of stock of semi finished product.

b. Process Capability and Flexibility: process capability is characterized by processing

time of various operations example; the replenishment lead time directly influences the

size of inventory. Inventory policy should aim towards balancing the production flexibility

capability inventory levels and customer service needs.

c. Production Capacity and Storage Facility: the capacity of production system as well as

the nature of storage facilities considerably affects the inventory policy of an organization

e.g., capacity for heating oil production in an oil refinery is governed in part by its

distribution system. Similarly production the cost of facility is high then it sets a limit on

the storage capacity.

d. Quality Requirements: quality is the performance of the product as per the commitment

made by producer to the customer. The qualities required for various factors are quality of

material manpower machine and management. The quality requirements of material

directly affect the inventory decision.

Financial Management M.B.A -II –SEMESTER-R17

UNIT-4 Introduction to Working Capital |BALAJI INST OF I.T AND MANAGEMENT 26

e. Nature of the Production System: it is characterized by the number of manufacturing

stages and the inter relationship between various production operations e.g, in product line

system inventory control is simpler than in job type system.

2. Amount of Protection against Storages: there is always variation in demand and supply of

product. The protection against such unpredictable variations can be done by means of buffer

stocks.

a. Changes In Size And Frequency Of Orders: The amount of product sold in large number

of orders of small size can be operated with fewer inventories.

b. Unpredictability Of Sales: if there are too many fluctuations in demand of product then