ASIAN DEVELOPMENT BANK RRP: PAK 33271 REPORT · PDF fileFINANCIAL (NONBANK) ... KSE –...

-

Upload

phungkhanh -

Category

Documents

-

view

216 -

download

2

Transcript of ASIAN DEVELOPMENT BANK RRP: PAK 33271 REPORT · PDF fileFINANCIAL (NONBANK) ... KSE –...

ASIAN DEVELOPMENT BANK RRP: PAK 33271

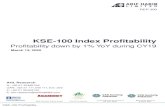

REPORT AND RECOMMENDATION

OF THE

PRESIDENT

TO THE

BOARD OF DIRECTORS

ON

PROPOSED LOANS

AND GUARANTEES

FOR THE

FINANCIAL (NONBANK) MARKETS AND GOVERNANCE PROGRAM

IN THE

ISLAMIC REPUBLIC OF PAKISTAN

November 2002

CURRENCY EQUIVALENTS

(as of 4 November 2002)

Currency Unit – Pakistan rupee/s (PRe/PRs) PRe1.00 = $0.0170

$1.00 = PRs58.84

ABBREVIATIONS

ADB – Asian Development Bank CDNS – Central Directorate of National Savings CGP – coguarantee program CMDP – Capital Market Development Program CP – commercial paper CSP – Country Strategy and Program DFI – development finance institution EOBI – Employee's Old-Age Benefits Institution FMG – Financial (Nonbank) Markets and Governance GDP – gross domestic product IA – implementing agency IAS – International Accounting Standards ICP – Investment Corporation of Pakistan IDBP – Industrial Development Bank of Pakistan IMF – International Monetary Fund KSE – Karachi Stock Exchange LIBOR – London interbank offer rate MOF – Ministry of Finance MRPA – master risk participation agreement NBFI – nonbank financial institution NIT – National Investment Trust NPL – Nonperforming loan NSS – National Savings Scheme PFI – participatory financial intermediary PIB – Pakistan investment bond PRCL – Pakistan Reinsurance Company Limited PRG – political risk guarantee PRGF – Poverty Reduction Growth Facility PRI – political risk insurance SBP – State Bank of Pakistan SECP – Securities and Exchange Commission of Pakistan SLIC – State Life Insurance Corporation TA – technical assistance TB – treasury bill TFC – term finance certificate US – United States WTO – World Trade Organization

NOTES (i) The fiscal year (FY) of the Government ends on 30 June. FY before a calendar year

denotes the year in which the fiscal year ends, e.g., FY2002 began on 1 July 2001 and ended on 30 June 2002.

(ii) In this report, “$” refers to US dollars.

This Report was prepared by a team consisting of W. Liepach (Team Leader), V.V. Subramanian, M. Good and M. Endelman.

CONTENTS CONTENTS i PROGRAM, LOAN, GUARANTEE, AND INVESTMENT SUMMARY ii I. THE PROPOSAL 1 II. THE MACROECONOMIC CONTEXT 1 III. THE SECTOR 3

A. Sector Description and Performance 3 B. Opportunities and Issues 6

IV. THE PROPOSED PROGRAM 10 A. Objectives and Scope 10 B. Policy Framework and Actions 11 C. Important Features 15 D. Financing Plan 15 E. Implementation Arrangements 16

V. TECHNICAL ASSISTANCE LOANS 17 VI. NONLENDING ASSISTANCE 18

A. Political Risk Guarantee Facility for Enhancing Pakistan's Integration with International Capital Markets 18

B. Political Risk Guarantee Facility for Enhancing Access to Cover for Selected Violence-Related Risks 19

VII. PROGRAM BENEFITS, IMPACTS, AND RISKS 19 VIII. ASSURANCES 22

A. Specific Assurances 22 B. Conditions for Loan Effectiveness 22 C. Conditions for PRG Effectiveness 22

IX. RECOMMENDATION 23 APPENDIXES 1. Sector Analysis 25 2. Processing Approach, Background Studies and Chronology 33 3. External Assistance 34 4. Program Framework 36 5. Development Policy Letter and Policy Matrix 39 6. Estimate of Program Adjustment Cost 48 7. Ineligible Items 50 8. Technical Assistance for Strengthening Pension, Insurance, and Savings Systems 51 9. Technical Assistance for Strengthening Regulation, Enforcement, and Governance of Nonbank Financial Markets 56 10. Political Risk Guarantee Facility for Enhancing Pakistan's Integration with International Capital Markets 61 11. Political Risk Guarantee Facility for Enhancing Access to Cover for Selected Violence-Related Risks 66 12. Summary Poverty Reduction and Social Strategy and Poverty Impact Assessment 71 SUPPLEMENTARY APPENDIX (available upon request) A. Poverty Impact Assessment

PROGRAM, LOAN, GUARANTEE, AND INVESTMENT SUMMARY

Borrower

Islamic Republic of Pakistan

The Proposal

Support for the Government’s Financial (Nonbank) Markets and Governance (FMG) Program, comprising (i) a program loan for FMG policy reforms; (ii) two technical assistance (TA) loans: one for strengthening pension, insurance, and savings systems; and one for strengthening regulation, enforcement, and governance of nonbank financial markets; and (iii) two political risk guarantees (PRGs) with counterindemnity by the Islamic Republic of Pakistan: one for enhancing Pakistan’s integration with international capital markets; and one for enhancing access to cover for selected violence-related risks following the terrorist attacks on 11 September 2001 in the United States (US).

The Program Rationale

To finance the expansion of its economic base and generate employment, Pakistan requires a wide range of financial services and instruments beyond what can be provided by the banking sector. Broadening and deepening of the financial system through development of nonbank financial products and services is also required to reduce financial sector vulnerabilities and systemic risks associated with a banking crisis, the impacts of which are often most severe for the poor. Nonbank financial markets, in particular capital markets, are needed for sustainable mobilization of long-term savings and investment. This is closely linked to the development of life insurance and pension systems, which fulfill an important social role in old-age protection, as well as general insurance to protect against a variety of risks that can undermine economic development. Institutional investors also play an important role in improving corporate governance and information disclosure. The Asian Crisis, in particular, has highlighted the importance of good corporate governance and sound financial risk management for sustainable economic growth. Pakistan has since the mid–1990s embarked on comprehensive financial sector reforms. The Capital Markets Development Program, implemented successfully over 1997–2001 with Asian Development Bank (ADB) support, established a necessary foundation for the sustainable development of nonbank financial markets. Yet, despite good progress in particular on the regulatory and infrastructure side, Pakistan’s nonbank financial markets remain narrow and lack depth, as investors have so far not realized their full market potential. Further initiatives and reforms are required in particular to strengthen investor confidence in the integrity and robustness of markets, and bring about a lasting economic impact.

iii

Objectives and Scope

The overall goal of the Program is to facilitate private sector-led productivity growth as well as social protection. It thus aims to contribute to poverty reduction indirectly. The purpose of the Program is to support the Government’s financial sector reform agenda, and development of capital markets and other nonbank financial services. The immediate objectives of the Program are to (i) strengthen investor confidence through improved governance, transparency, and investor protection; (ii) increase the depth and diversity of financial intermediation through new capital market issues for saving and investment; (iii) improve operational efficiency and risk management of intermediaries; and (iv) reduce financial sector vulnerabilities. The reform agenda is structured around five components: (i) improvement in the fiscal, interest rate, and investment policy environment; (ii) improvement in governance of market participants and transparency in information disclosure; (iii) increase in supply of financial instruments and improvements in market infrastructure; (iv) increase in demand for financial instruments through development of contractual savings and institutional investment; and (v) development of related financial services and institutions. The Program's reform agenda is supported by two TA loans: one for strengthening of pension, insurance, and savings systems; and one for strengthening regulation, enforcement, and governance of nonbank financial markets. The Program is complemented further through non-lending initiatives including ADB’s guarantee products to enhance integration of Pakistan’s financial markets with international capital flows; and to ensure continued access to cover for selected noncommercial risks, which was withdrawn by the international insurance industry following the terrorist events in the US on 11 September 2001.

Poverty Classification Thematic Classification Environmental Classification

Other Good Governance; Private Sector Development Category C

The Program Loan

Amount and Terms

A loan of $260 million from ADB’s ordinary capital resources will be provided under ADB’s London interbank offered rate (LIBOR)-based lending facility. The loan will have a 15-year term, including a grace period of 3 years; an interest rate determined in accordance with ADB’s LIBOR-based lending facility; a front-end fee of 1.0%, a commitment charge of 0.75% per annum; conversion options that may

iv

be exercised in accordance with the terms and conditions set forth in the Loan Agreement, the Loan Regulations, and ADB’s Conversion Guidelines; and other terms and conditions set forth in the Loan Agreement.

Program Period and Tranching

The FMG Program period extends to December 2005. The Government will be able to withdraw funds from the loan account for a period of about 3 years starting from loan effectiveness up to 31 December 2005. The loan will be disbursed in tranches based on performance in meeting specified tranche release conditions. The first tranche, equivalent to $100 million, will be made available upon loan effectiveness following up-front compliance with specified conditions. The second tranche will be released upon satisfactory compliance with 18 specified conditions, as well as continued compliance with all previous tranche conditions. To provide an incentive for early compliance, an incentive release of $80 million under the second tranche can be made as soon as any nine of the second tranche release conditions have been met, expected by November 2003. The final release of the second tranche of $80 million will take place upon satisfactory compliance with the remaining conditions, expected by November 2004.

Executing Agency

The Ministry of Finance (MOF) will be the Executing Agency. It will monitor and facilitate overall implementation of the FMG Program and administer the utilization of loan proceeds. MOF will also ensure compliance with all policy-related conditions. The Securities and Exchange Commission of Pakistan (SECP) will be the implementing agency, with full responsibility for implementation of all conditions within its regulatory and development mandate. MOF and SECP will ensure effective coordination through existing mechanisms with other concerned agencies, including the Ministry of Commerce, Ministry of Labor, Privatization Commission, State Bank of Pakistan, and the private sector as appropriate.

Procurement The loan will finance the full foreign exchange costs (excluding local duties and taxes) of imports procured in and from the ADB’s member countries, other than those specified in the list of ineligible items and those items financed by other multilateral and bilateral official sources. The Borrower will certify that the value of eligible imports exceeds the amount of ADB’s projected disbursements under the program loan in a given period. ADB will have the right to audit the use of loan proceeds and to verify the accuracy of the Borrower’s certification.

Counterpart Funds

The counterpart funds, to be generated out of the loan proceeds, will be used to finance the cost of structural adjustment, including the establishment of funds and facilities under the FMG Program, and to finance high priority social and human development projects, including social protection for the poor.

v

Technical Assistance Loans

Strengthening Pension, Insurance, and Saving Systems

Strengthening Regulation, Enforcement, and Governance of Nonbank Financial Markets

Two TA loans, for a total of $6 million equivalent, will be provided for capacity building associated with the FMG Program from ADB’s Special Funds resources. The loans will have a term of 32 years, including a grace period of 8 years; an interest rate of 1.0% per annum during the grace period and 1.5% per annum thereafter; and such other terms and conditions as are substantially in accordance with those set forth in the TA Loan Agreements. This TA will develop solutions to improve Pakistan’s pension system and strengthen the capacity of key government institutions in the mobilization and management of contractual savings. The TA will comprise five components, including (i) establishment of an overall framework for pension provision; (ii) financial assessment of civil and military pension schemes; (iii) institutional reform and strengthening of the Employee’s Old-age Benefits Institution; (iv) capacity building for investment management in the State Life Insurance Corporation; and (v) institutional reform and strengthening of the Central Directorate of National Savings. The total cost of the TA is estimated to be $4.5 million equivalent, comprising $2.4 million in foreign exchange costs and $2.1 million equivalent in local currency costs. ADB will finance $3 million equivalent comprising the full foreign exchange costs and $0.6 million equivalent in local currency costs. This TA will ensure sustainable development of nonbank financial markets and protection of investors and policy holders. It will comprise four components: (i) further improvement of legal and regulatory frameworks; (ii) capacity building of SECP with particular attention to its enlarged mandate for regulation and supervision of nonbank financial institutions, insurance, and pensions; (iii) support for restructuring of stock exchanges; and (iv) establishment of sustainable mechanisms for skills development and training. The total cost of the TA is estimated to be $4.4 million equivalent, comprising foreign exchange costs of $2.4 million and local currency costs of $2.0 million equivalent. ADB will finance $3 million equivalent comprising the entire foreign exchange costs and $0.6 million equivalent in local currency costs.

Political Risk Guarantee Facilities

Two revolving facilities will be established that provide PRGs to enhance Pakistan’s access to international capital flows and promote soundness of investment and financial markets, for a total guarantee volume of up to $200 million equivalent. The PRG facilities will be promoted in conjunction with the other FMG Program initiatives. All PRGs issued under the facilities will be counterguaranteed and indemnified by the Islamic Republic of Pakistan. The PRGs may be administered on behalf of ADB through facility agents selected according to normal commercial procedures. The facilities will be available for a period of 4 years from their effective date, during which new PRGs may be issued to replace those that are canceled or have expired. Each PRG issued under the facility may have a maximum term of up to 10 years.

vi

Enhancing Pakistan’s Integration with International Capital Markets

Enhancing Access to Cover for Selected Violence-related Risks

ADB will charge a one-time front-end fee of up to 1% percent for each PRG issued, in line with ADB’s guarantee policies and payable on the nominal amount of each guarantee issued. ADB will also charge a PRG fee of 0.4% per annum on the aggregate value of all liabilities outstanding under each PRG, calculated on a daily basis and collected periodically. Each beneficiary of a PRG will pay a market-based fee, as a percentage per annum of the guaranteed amount, which will be determined prior to the PRGs becoming available and which may be changed from time to time. Any surplus generated by the facilities, after deduction of all expenses for establishment and operation, will be capitalized to build up a claims reserve or otherwise utilized as agreed upon between ADB and the Government. To enhance integration of Pakistan’s financial markets with international capital flows, ADB will guarantee to international investors payment of proceeds from eligible investments if that payment is not made as a result of a guaranteed risk, including restriction on foreign exchange convertibility and transferability blockage. The PRG facility will, however, not cover any risks that affect the value of the investment itself. The maximum aggregate liability under the PRG facility covered by ADB at any time will not exceed $25 million equivalent. The PRG facility may be enhanced through private sector political risk insurance providers under ADB’s coguarantee program. To ensure availability of insurance cover for selected violence-related risks that is not readily available in the commercial market following the terrorist attacks in the US on 11 September 2001, and thus to protect economic and financial sector soundness, ADB will guarantee payment of a certain amount to a guaranteed party in case terrorism or other political violence risk as specified under the PRG policy occurs. The maximum aggregate liability under the PRG facility covered by ADB at any time will not exceed $175 million equivalent, but the PRG facility may be enhanced through coguarantee and commercial reinsurance arrangements.

Program Benefits and Beneficiaries

The overall outcome of the Program will be a vibrant, diversified, efficient, and sustainable financial market offering a wide range of nonbank products and instruments for saving and investment in a well-regulated sector environment. This will contribute to productivity growth, employment generation, and strengthening of social safety nets, as well as fiscal and financial sector stability. Specifically, the following benefits will accrue: (i) improved resource mobilization and access to financing of economic expansion from domestic and foreign sources; (ii) wider choice of funding and saving instruments accessible to the corporate sector and general public, at more competitive pricing that does not penalize for inefficiencies in the banking sector; (iii) greater flexibility and improved risk management for institutional investors; (iv) increased investment skills and better advisory service to benefit the general public; (v) increased

vii

transparency, information disclosure, and investor protection; (vi) diversification and deepening of the financial sector with less reliance on the banking sector, reducing vulnerability to financial sector crisis, which often has its most severe impact on the poor; (vii) enhanced social protection through a wider range of insurance and old-age protection products, with greater client orientation and outreach including to the poor on a sustainable basis; and (viii) improved public finances through increased tax revenue in the medium to long term as a result of increased saving and investment, as well as a defined mechanism to deal with selected violence-related risks that can no longer be covered commercially.

Risks and Safeguards

Implementation of the FMG Program is facing a number of key risks, for which mitigating measures have been put in place as appropriate. � High short-term adjustment costs, causing fiscal disruption. Adjustment cost has been reflected in the revenue targets agreed upon with the International Monetary Fund under the Poverty Reduction and Growth Facility, conservative collection targets for tax revenue from financial instruments have been applied, and incentives for tax benefits have been capped. � Change of government policies and reversal of reform process. Implementation of the reform agenda will to a large extent rely on the private sector, which strongly supports and has been involved in formulation of the Program. Wide stakeholder consultation during processing sought to ensure awareness and broad-based ownership for the reforms. In September 2002, the State Bank of Pakistan was made a constitutional body with independence for monetary policies shielded from government interference. � Political interference into regulatory matters. The regulator has been given a transparent governance framework with strong legal protection from direct government interference. � Insufficient capacity and integrity of the regulator. TA support will be provided under the Program to further upgrade skills; financial autonomy will allow the regulator to attract and retain competent staff. � Slow progress in reforming key institutions, including Employees Old-Age Benefits Institution and State Life Insurance Corporation. TA support for institutional development will be provided under the Program; continued dialogue with ADB will support proreform forces. � Inadequate implementation of governance and risk management standards due to vested interests. The private sector and a wide range of stakeholders will be involved in program implementation to lessen dependence on a single lobbying group; the establishment of a private sector-driven corporate governance center will raise governance standards and awareness. � Macroeconomic outlook worsening due to external global or regional developments. As elsewhere, this will affect the performance of Pakistan's financial markets, but reform measures under the Program will increase financial sector resilience and lessen the impact of external shocks.

I. THE PROPOSAL 1. I submit for your approval the following Report and Recommendation to support the Financial (Nonbank) Markets and Governance (FMG) Program in the Islamic Republic of Pakistan. Asian Development Bank (ADB) support will comprise (i) a program loan for FMG policy reforms; (ii) two technical assistance (TA) loans: one for strengthening of pension, insurance, and savings systems; and one for strengthening regulation, enforcement, and governance of nonbank financial markets; and (iii) two political risk guarantee (PRG) facilities with counterindemnity by the Islamic Republic of Pakistan: one to enhance Pakistan’s integration with international capital markets, and one to enhance access to cover for selected violence-related risks following the terrorist attacks on 11 September 2001 in the United States (US).

II. THE MACROECONOMIC CONTEXT 2. Challenging Internal and External Environment. After a difficult period for Pakistan’s economy and frequent change in Government during much of the 1990s, the comprehensive structural reforms initiated and accelerated in particular over the past 2 years at various levels have now started to pay-off, and the macroeconomic situation has gradually stabilized.1 The events following the terrorist attacks in the US on 11 September 2001 have created a further challenge for Pakistan with far-reaching economic, social, and political implications. On the economic front, this has included a fall in industrial production, cancellation of export orders, declining international demand and prices, and reduced availability and rising cost of insurance. 3. Macroeconomic Stability Maintained. The Government has responded skillfully to the considerable challenges it has been facing, and macro indicators reflect this: growth for fiscal year (FY) 2002 was 3.6%, only slightly below the 3.7% originally targeted, and inflation continued to be under control at below 3%. The budget deficit was 7.1% of gross domestic product (GDP), higher than originally projected.2 Exports reached $9.1 billion, which is well short of the goal of $10.1 billion, but a larger fall in imports helped contain the trade deficit for FY2002 at about $1.2 billion and within target. Fuelled by increased remittances from abroad, an unexpectedly large current account surplus of about $2.7 billion could be achieved. Following the successful rescheduling of its bilateral debt obligations and increased inflow of remittances and external aid, gross foreign exchange reserves increased to more than $8 billion by October 2002, the highest amount ever, and the Pakistan rupee has stabilized and even strengthened. Within the current framework, the growth target of 5.2% for FY2003 looks achievable. Recognizing these positive developments, international credit agencies have upgraded their financial risk ratings for Pakistan.3 However, amid continued regional tensions and uncertainties the macroeconomic stabilization has so far failed to attract much investment. Foreign direct investment has remained low, at less than $500 million, and has been directed primarily towards the energy sector. Likewise, international portfolio investment, which has been negative since mid-1998 and declined to less than 3% of market capitalization, has yet to return in an economically significant way. 1 ADB. 2001. Country Economic Review: Pakistan. Manila. State Bank of Pakistan (SBP). 2002. Annual Report. Available: http:// www.sbp.org.pk. 2 The original target was set at 4.9%, but was subsequently revised to 5.3% and then to 5.7%. The larger deficit was

primarily due to a shortfall in customs revenue, one time write-offs, and generally lower economic activity following the events of 11 September 2001. This was only partly offset through spending cuts, including development expenditure. Adjusting for one-time expenditures, the deficit is 5.7%, in line with revised targets.

3 Moody’s Investor Service has raised the rating for Pakistan’s external debt and bank deposits to B3 and CAA1, respectively. Standard & Poor’s has affirmed its rating for foreign currency debt at “B-“ and local debt at “B+”, with “stable” outlook. For further details see http://www.moodys.com and www.ratings.com.

2

4. Weak Credit Expansion Despite Easing of Monetary Policy. Strong capital inflows, appreciation of the rupee and low inflation have provided room for easing of monetary policy. The State Bank of Pakistan (SBP) gradually reduced its discount rate from 14% in July 2001 to 9% in early 2002, while treasury bill rates declined sharply and are now hovering around 6-7%, compared with about 13% at the beginning of FY2002. Yet, the banking sector has not been willing or able to fully translate this steep cut in interest rates into lower lending rates, which reflects both inefficiency and lack of competition in the financial sector.4 At the same time, demand for credit has fallen due to lower cotton prices; a fall in working capital requirements, in particular of textile manufacturers; and low investment levels following the uncertainties after 11 September 2001. There has been some sign of a rebound in 2002. Further reduction of interest rates may be problematic, though, as this could trigger downward pressure on the Pakistan rupee. This would also cut into the commercial banks' interest earnings and thus inhibit their ability to build up capital for dealing with their bad loan portfolio, as well as reduce tax revenue for the Government.5 5. Firm Commitment to Reforms. The Government has demonstrated strong commitment for reform to its development partners, including the international finance institutions. For the first time after several attempts, Pakistan was in 2001 able to successfully complete implementation of an agreement with the International Monetary Fund (IMF). IMF subsequently approved, in December 2001, a 3-year Poverty Reduction and Growth Facility (PRGF), for SDR1.03 billion. This provides a framework for further reforms and macroeconomic stabilization, and implementation of the PRGF to date is generally on track.6 6. Poverty Reduction Remains the Key Challenge. Poverty levels in Pakistan have increased since the early 1990s and are strongly correlated with the slowdown in economic growth. At the same time, inequality in income distribution worsened significantly, in particular in urban areas. A large share of employment is in the informal sector, without adequate social protection, and the continued high population growth has put pressure on the labor market that it has been unable to absorb.7 This has given rise to social tensions with far-reaching implications, and is believed to have also fuelled extremist groups. To counter these trends, the Government’s economic policies seek to uplift livelihood and create opportunities for the poor through support for employment-generating activities, more effective social sector spending, and greater participation in decision making at the local level. Pro-poor outlays during FY2002, much of which took place at the provincial and local level, fell short of expectations, however, amid a shortfall in revenues and as local governments became operative only in late 2001. Appropriate measures are required to ensure that macroeconomic stabilization and adjustment programs yield visible benefits for the poor, and to mitigate disproportionate negative impacts that were often associated with reform programs in the past decade. 7. Continued Support Warranted. Despite the considerable external and internal challenges. Pakistan has been able to credibly keep its reform program on track. However, tangible benefits have yet to emerge for a large share of the population. For private sector investors, Pakistan remains a place with both high risks and great opportunities. Therefore, it is

4 Average combined lending rates for all banks fell from 14.4% in July 2001 to only about 12% in February 2002,

albeit with considerable variation among the banks. Foreign banks tend to be more competitive in their rates than the nationalized commercial banks. Average deposit rates declined only marginally, from about 5% to 4.6%.

5 For a more detailed overview of Pakistan's monetary and fiscal policy, see http://www.sbp.org.pk/monetary.htm. 6 Details of the PRGF as well as progress in implementation can be accessed through the IMF website:

http://www.imf.org. 7 For further details on Pakistan labor market and challenges, see International Labor Organization. 2000. Pakistan

Country Employment Policy Review. ILO.

3

timely for ADB to further support the reform agenda and address investor concerns to stimulate investment and savings, while ensuring that benefits trickle down to the poor.

III. THE SECTOR 8. ADB’s country strategy program (CSP) for 2002-20048 as well as the Government’s development agenda, articulated in a number of documents,9 give high priority to poverty reduction through private sector-led pro-poor economic growth, social sector development, and improved governance. Within this overall framework, the financial sector has an important role to play to increase resource mobilization, improve efficiency of allocation, enhance access to financial products and services, contribute to the sustainability of social safety nets, and safeguard economic stability. A. Sector Description and Performance 9. Shallow and Narrow. Pakistan’s financial sector is not very large and diversified. Deposits amount to only about 56% of GDP.10 The money (M2) to GDP ratio – which is an indicator for financial sector deepening – at only about 44% suggests that a major portion of the economy is still not monetized.11 10. Heavy Government Involvement. Despite a number of reforms initiated by the Government in the past which have sought to reduce its operational involvement in the financial sector, the Government still plays a predominant role, and much financial intermediation is driven by its financing needs. In 2000, about 65% of deposits were mobilized through government-owned or -controlled institutions, and 51% of credit was allocated to the Government, with an additional 4% to state-owned enterprises, leaving barely 45% for the private sector.12 The government-run National Savings Scheme (NSS), in particular, continues to plays a significant role in mobilizing savings from the general public and channeling those directly to the Ministry of Finance (MOF) to meet Government expenditures rather than financing productive assets. Savings mobilization and credit delivery, in particular in rural areas, are still dominated by government-owned institutions. In addition, the country's largest institutional investors, including the State Life Insurance Corporation (SLIC) and the Employees Old-Age Benefits Institution (EOBI), remain government controlled, which raises governance concerns, as most of the funds they are entrusted with belong to private individuals. 11. Prevalent but Inefficient Banking System. Financial intermediation is dominated by the banking system, which accounts for 61% of deposits. About 34% of deposits are with the NSS, and only 5% are mobilized through nonbank financial institutions (NBFIs).13 Nonperforming 8 ADB. 2002. Country Strategy and Program 2002-2004: Pakistan. Manila. 9 Economic Revival Plan (December 1999); Three Year Development Plan 2000-2003; Ten Year Perspective

Development Plan 2001/11; Interim Poverty Reduction Strategy Paper (2000); Poverty Partnership Agreement with ADB (2002); Budget Documents for FY2001, FY2002 and FY2003.

10 This compares to 150% in India, 125% in Malaysia, 53% in the Philippines, and around 50% the US. It should be noted that non-bank financial markets, in particular capital markets, account for a much larger share of savings in all of those countries compared to Pakistan.

11 In Pakistan, M2 comprises currency in circulation and deposits with scheduled banks and SBP. The M2/GDP ratio compares to 58% in India, 64% in the Philippines, and 106% in Malaysia.

12 Allocation to the private sector hovered between 45% and 55% for most of the past decade, and the fall at the end of the 1990s reflects above all a fall in demand due to the generally subdued investment climate.

13 NBFIs are defined in the context of this program as all financial institutions and intermediaries that do not fall under the SBP banking regulations, including insurance, pension funds, development finance institutions, leasing companies, investment banks, and other related services, but excluding microfinance.

4

loans (NPLs) average around 24% for all banks, and more than 50% for specialized financial institutions, including development finance institutions (DFIs). Coupled with administrative inefficiencies, this has driven up intermediation costs and the spread between average deposit and lending rates is as high as 8%. The situation is generally better for foreign banks, which tend to be more selective in credit extension. The generally poor access, limited choice, and low quality of financial services and products contribute to explaining the low savings rate that has stagnated at around 13% of GDP. 12. High Fragmentation and Limited Role of NBFIs. Within the financial sector, nonbank products, markets, and services remain relatively little developed and poorly capitalized. This is despite the fact that there is a large number of NBFIs, including 16 investment banks, 16 DFIs and specialized finance institution, 33 leasing companies, 45 modarabas,14 41 investment companies and mutual funds, 420 brokers, 3 discount houses, and 58 insurance companies. Many of the NBFIs posses a very weak institutional base both in terms of assets as well as human resources to respond in an effective manner to the challenges of the economy. In many cases, their establishment was predicated on short-term returns and regulatory arbitrage rather than long-term economic interest. The proliferation has created more problems than it has resolved, in particular by creating supervisory problems and undermining confidence in the sector. To build up genuine competition, confidence, and transparency in the sector, the Government seeks to promote consolidation through mergers or closures by raising the capital requirements for various financial intermediaries. 13. Mixed Performance of Equity Markets. Pakistan’s equity market, which is dominated by the Karachi Stock Exchange (KSE) but also includes exchanges in Lahore and Islamabad, has seen some impressive growth over the past decade: The number of listed companies at the KSE increased to 741 at the end of FY2002 from 628 in 1992, market capitalization increased to more than PRs400 billion from PRs218 billion, and annual trading rose to 68 billion shares, from 1 billion in 1992. Much of this development – except for the increase in trading volume – took place during the first half of the 1990s, and not all of this is good news. Most importantly, the economic impact of the equity market, despite the developments, has been negligible. Market capitalization is still only around 11% of GDP.15 Many companies sought listing primarily for tax advantages without subsequent trading taking place and little interest in investor relations or dividend payouts. Both the issuer and investor base is very narrow, with trading being heavily concentrated on a few scrips only. Trading volume relative to market capitalization is among the highest in the world, reflecting a very strong speculative and short-term interest in a narrow market that makes it highly volatile. The KSE share index has hovered between 1000 and 2000 points for most of the past decade without exhibiting a marked trend. Factoring in the devaluation of the Pakistan rupee and economic uncertainties, as well as the high guaranteed returns offered by the NSS, investing in the stock market has not been a very attractive proposition. All this has deterred long-term and foreign investors, and valuations of some economically sound companies are often very low. This environment is not very attractive for companies with serious economic ambitions to raise capital from the equities market, and there have been only 13 new listings on all three exchanges over the past 5 years. To counter the trend, the Securities and Exchange Commission of Pakistan (SECP) has, since its inception in 1999, and within the framework of the Government’s first Capital Market Development Program (CMDP), taken credible steps to restore investor confidence. In particular, SECP has been improving risk management and is vigorously enforcing compliance with rules and regulations,

14 Modarabas are finance companies that operate according to Islamic principles of finance, not involving interest. 15 This compares with 41% in India, 35% in the Philippines, 154% in Malaysia, and 270% in the US.

5

including delisting of defaulting companies. These measures will need to be enhanced further but constitute an important basis for more sustainable market development. 14. Growing Debt Market but Narrow Range of Instruments. Pakistan’s emerging debt market has gained considerable momentum over the past few years. The corporate bond market consists primarily of Term Finance Certificates (TFCs) with 3-5 years maturity. The number of new issues has risen constantly from the first listed issue in 1995. By the end of FY2002, 39 TFCs had been issued for a total volume of more than PRs22 billion, of which the largest share was issued by the leasing industry. The steep rise in particular over the past 2 years was helped through the reforms promoted under the CMDP, including improved tax treatment; streamlined issuance process; ban on institutional investments in NSS; and introduction by the Government of long-term Pakistan Investment Bonds (PIBs) in December 2000 with maturities of 3, 5, and 10 years, which established a much-needed benchmark for pricing. In FY2002, the Government carried out six PIB auctions and raised PRs46 billion. Most of the investors in PIBs are banks, which raises some regulatory and market concerns. The increase in primary issues has yet to translate into an active secondary market for both PIBs and TFCs, for which trading activity is limited. In addition, the range of instruments is still narrow, in particular for companies. Tenors for TFCs are generally not available beyond 5 years, and there is also no short-term corporate paper in the absence of proper guidelines and tax treatment for such. 15. Weak Institutional Investor Base. Institutional investment is key to the development of money and capital markets. In Pakistan it is poorly developed and has not been growing recently. Life insurance premium income amounts to less than 0.3% of GDP, much lower than in the Philippines (0.8%), India (1.8%), Malaysia (2.1%), or the US (4.5%), and has shown little growth over the few past years, unlike in most other emerging Asian economies. Private pension and provident funds lack a proper regulatory framework and are offered by only a few large companies. The largest institutional investors, SLIC and EOBI, with assets in excess of $1.2 billion and $700 million, respectively, are government controlled; and the largest share of their investments is in government debt. The investment process of these institutions is not very transparent. Coupled with high administrative costs, this has resulted in very poor returns. The mutual funds industry was unable to offer attractive alternatives and to reach out to the retail market in a significant way. There are fewer than 100,000 investors in mutual funds in Pakistan, with total assets of about PRs26 billion under management, mostly with the National Investment Trust (NIT). This represents less than 3% of bank deposits, and compares with about 23 million investors in India with assets amounting to 12% of deposits. Under the CMDP, some progress has been made with privatization of the management of the country's two largest mutual funds, NIT and Investment Corporation of Pakistan. Yet, lacking a wider range of instruments and market depth for portfolio diversification and management, the industry has generally focused on equity funds and has consequently been hampered by the inherent problems of the market. International investors showed some interest in Pakistan’s capital markets during the first half of the 1990s, and foreign portfolio investment peaked at about $1.3 billion in 1997. However, it has since virtually all but disappeared, despite generally favorable market valuations, amid continued economic uncertainties, concerns about market governance, and lack of risk management and hedging tools. The temporary imposition of foreign exchange controls after the nuclear testing in May 1998 has also badly shaken investor confidence. 16. Comprehensive Reforms Initiated. Pakistan has since the mid-1990s embarked on comprehensive financial sector reforms. Key reforms include liberalization of the foreign exchange market and interest rates; increased autonomy of the central bank and its focus on monetary policy and banking supervision; establishment of an independent regulator for capital markets and NBFIs; upgrading of legal and regulatory frameworks; reduction of NPLs in the

6

banking sector; and restructuring of government-owned financial institutions including privatization, merger, closure, and enhanced management autonomy. Yet, the reform agenda is far from complete, and reforms are ongoing at various levels to further reduce the Government’s involvement in financial sector operations and enhance private sector participation on market-based principles. 17. CMDP Implemented Generally Successfully. A first phase of reforms for capital market development was implemented generally successfully over 1997-2001 under the CMDP, supported by ADB.16 The reforms were carried out under a difficult macroeconomic environment and subdued investor and issuer interest. The main achievement under the CMDP has been the establishment of an effective regulator as well as improvements in the technological market infrastructure. Progress was also made in improving investor protection, governance of the stock exchanges, and development of the primary corporate debt market, as well improving prudential norms for NBFIs. The ambitious reforms have addressed some of the most fundamental problems and established a good basis for further market development. Yet, important areas within Pakistan’s financial sector must be addressed further to bring about the full impact of these reforms. In many ways, the achievements under the CMDP have been necessary but not sufficient. A project completion report detailing the accomplishments under the first CMDP was released in November 2002.17 B. Opportunities and Issues 18. Potential for Growth and Development. Given the underdeveloped state of Pakistan’s nonbank financial markets relative to the size of its economy as well as other emerging markets, and the inefficiencies and structural problems within the banking system to finance the much-needed capacity expansion of the economy, there is good reason and scope for growth. Capital markets, in particular, can play an important role for sustainable investment and mobilization of long-term savings. This is closely linked to the development of contractual savings through life insurance and pension funds, which fulfill an important social role in old-age protection. Direct financial intermediation through markets can improve funding and investment management of companies, and thus their productivity, while offering better return for savers. Broadening of the financial system can further reduce financial sector vulnerabilities and systemic risks associated with a banking crisis, the impacts of which are often most severe for the poor. Further reduction in government involvement in the sector would also stimulate allocation of resources according to market-based principles. 19. Improving Investor Confidence is Key. While a good foundation has been built through the CMDP, functioning of financial markets cannot be mandated by the Government or any other party. Their efficiency and effectiveness depends on building credibility with private sector investors and issuers, which needs to be sustained over time in a dynamic environment. Within this context, strengthening investor confidence through policy consistency, a strong and credible regulator, and effective dialogue among various stakeholders is of paramount importance. This needs to be underpinned by a set of consistent actions to strengthen governance, institutions, risk management, and operations.

16 ADB. 1997. Report and Recommendation of the President to the Board of Directors on a Proposed Loan to

Pakistan for the Capital Market Development Program (CMDP). Manila. ADB. 1997. Report and Recommendation of the President to the Board of Directors on a Proposed Loan to

Pakistan for the Capacity Enhancement of the Securities Market. Manila. 17 ADB. 2002. Project Completion Report on the Capital Market Development Program Loan and Capacity Building of

the Securities Market. Manila.

7

20. Increase Corporate Governance and Transparency. The development and sustainability of financial markets will depend highly on the framework of corporate governance adopted and the degree of adherence to the framework in practice. As the market develops, it will in turn play an integral role in promoting principles of good governance by enforcing financial discipline on companies that practice poor corporate governance. Poor governance, wide information asymmetry, and lack of confidence in the integrity of transactions and internal control mechanisms are the biggest investor concerns in Pakistan. Thus, governance frameworks need to be improved and vigorously adhered to at various levels. This concerns corporate issuers who raise funds from the market; intermediaries and related service providers including stock exchanges, brokers, and institutional investors; information providers and advisors, including accounting and auditing firms as well as rating agencies; and the regulator. Key ingredients are adequate information disclosure and the right of key stakeholders to influence behavior or change management according to a set of rules. 21. Building a Level Playing Field by Removing Policy Distortions. Key distortions on the policy level remain, primarily with regard to tax and interest rates. There has been differential tax treatment among financial instruments, which has worked to the advantage of some instruments and investors while discriminating against others.18 Moreover, tax rates and assessment modalities have been changed frequently in the past. This has created confusion among investors and unintended distortions, in addition to an administrative burden in tax assessment and collection. Streamlining tax treatment can stimulate financial market activity. This would also generate higher tax returns over the medium to long term to offset any short-term adjustment cost. In addition, interest rates remain administered in an ad-hoc manner for the NSS, and their high level in real terms holds back the development of alternative instruments. Good progress in reforming the NSS was made under the CMDP by excluding institutional investments, and lowering their rates of return. However, to tap into the important retail market for capital market development, NSS rates should be adjusted following a systematic market-based mechanism to levels that are below a comparable benchmark for wholesale securities. 22. Streamline Policy Making, Regulation and Supervision. The integration of financial markets witnessed globally has only been partly matched with institutional responses in Pakistan. Policy making remains fragmented, involving diverse ministries, in particular with regards to contractual savings and institutional investments,19 which are poorly developed and government dominated. In such an environment, policy consistency is less likely to be achieved, and coordination administratively more cumbersome. Similarly, there has been some degree of overlap between SBP and SECP on the regulation of nonbank financial products and services, such as leasing or investment banking. Further clarification and a strong mandate to key institutions in line with international best practices are needed to provide a clear perspective to investors. 18 For example, until FY2003 tax rates on dividend income by insurance companies were depending on ownership

structure and were different than for other corporate institutions; tax rates for some instruments differed for households or institutions, such as withholding tax for bank deposits, which was treated as a final liability for households, but was adjustable against final settlement for institutions; dividends were subject to double taxation if the investment was made through a mutual fund or other contractual savings instruments rather than directly; and tax rates differed for instruments with similar characteristics, e.g. withholding tax was higher on T-bills than for NSS or TFCs and PIBs. Many of the inconsistencies have been removed through the Finance Ordinance, 2002.

19 Life insurance and pension systems are under the Ministry of Commerce and Ministry of Labor, respectively.

8

23. Tap into Retail Markets through Contractual Savings. Strong intermediaries are required to make capital markets accessible to the general public on a retail level. While the range of investment instruments has been limited, the dominance of a few government-controlled institutions, in particular SLIC and NIT, and preferential treatment given to them, has further inhibited competition and innovation. The development of pension funds has been largely neglected, or has received bad press through inefficient operation in a poorly regulated environment. In addition, tax treatment has not been supportive; and mutual funds have, in the absence of liquid debt markets, focused on volatile equity funds. Most retail markets elsewhere have developed through introduction first of low-risk money market funds that can favorably compete with bank deposits, and later expansion through debt funds into equity. There is a huge potential in Pakistan to tap into this segment, which would allow fund managers to develop a critical mass needed to invest in staff and research. Equally important for the development of retail products is a strong and credible regulator to protect the public, as well as adequate skills of fund managers. The availability of the latter could particularly benefit from the introduction of foreign partners in the market. The mobilization of funds from the retail level, in turn, will provide much needed liquidity for the development of new instruments. Development of the retail market through institutional investment is thus crucial for the development of Pakistan's financial markets. Further consideration should also be given to converting the NSS into a funded scheme and to lower its administrative costs while increasing its operational efficiency. Reduction of administrative overheads, and professionalism of investment management are also required for the other large government-controlled intermediaries; and private sector participation, subject to strict accountability, may increase efficiencies. 24. Develop Wider Range of Instruments and Deepen Markets. Institutional investors need a wide range of instruments with sufficient depth and secondary market activity to effectively manage their investment portfolios. The introduction of short-term commercial paper in particular could yield significant benefits, as corporates could fund their working capital requirements and improve treasury management without being penalized for the inefficiencies of the banking sector. It would also allow them to free up collateral to finance longer term capacity expansion, while offering better short-term returns than currently available. Furthermore, there is a need to deepen markets through increase in debt and equity issues as well as secondary trading in more securities, to allow institutional investors to effectively manage and diversify their investment portfolios. The equities market, in particular, could both benefit from and provide a credible avenue for privatization of blue-chip state-owned companies, as well as a source for capital expansion by medium-sized enterprises that have not been utilized in the past. This needs to be complemented through a wider range of hedging and credit enhancement tools. The successful introduction of new issues and deepening of the market is closely linked to further reform of NSS rates as well as tax treatment. 25. Upgrade Market Structure and Infrastructure. Few areas are more affected by the rapid advancements in information technology than financial markets. While a good technological base has been established under the CMDP with automation of trading and creation of central securities deposit, clearing, and settlement systems, the development of Internet-based technology in particular has created new opportunities and challenges to increase the access to capital markets by retail investors. Further systems are needed to accommodate new instruments and market segments. This requires institutional responses by the stock exchanges, in particular. There is increasing competition and integration among international exchanges, and Pakistan must respond to those trends to offer an attractive and competitive market-place. Integration of the domestic exchanges into a national market, demutualization of exchanges, as well as introduction of new over-the-counter market segments will be required.

9

26. Improve Risk Management and Enforcement. The increasing sophistication of financial markets carries high inherent risks that must be adequately addressed. There is an increasing awareness internationally that concept of self-regulation need to be complemented through strong regulatory regimes and credible enforcement as well as adequate risk management systems and tools. This must also include mechanisms of investor compensation and market stabilization during times of stress on markets. 27. Improve Efficiency of Related Financial Products and Services. An effective and resilient financial sector requires a range of services for risk management and outreach to diverse client needs. A strong insurance sector in particular complements financial markets by mitigating risks that could undermine the economic system. The development and efficiency of the insurance industry are closely linked to the functioning of financial markets, in turn playing a major role in developing financial markets and governance through institutional investment. These aspects have not yet been sufficiently developed in Pakistan, and a large portion of the insurance market remains under direct government control. Likewise, most of the specialized DFIs remain under government control. They have in the past generally failed to efficiently channel long-term funds into productive investments. The Government has embarked on an ambitious program for further consolidation and restructuring of DFIs. This is a costly exercise with significant fiscal implications that requires the assistance of international financing institutions, but further privatization or consolidation will shift incentive structures that are likely to result in greater product innovation and support for market-determined financing mechanisms. There is also considerable scope to increase the efficiency of other NBFIs, in particular to provide longer term finance, including the leasing industry, through mergers and better capitalization. 28. Upgrade Skills. Modern financial systems require adequate skills and capacity to deal with increasingly complex issues at various levels. Pakistan has a good but very small skills base that must be enhanced and broadened considerably, covering both the private and public sector. Externally funded capacity-building measures will be required to address the most urgent needs, but must be complemented by internally generated mechanisms to raise professional standards in a sustainable manner. This should entail the development of standards and curricula at the international level applicable to the Pakistan context, and professional training institutes set up with the private sector to offer options for sustainable skills development. 29. Dealing with External Challenges. Pakistan’s financial sector is facing international as well as religious trends, in particular with respect to its membership in the World Trade Organization (WTO) and the decision of the Supreme Court on Islamization of the economy and financial system. In addition, the events following the terrorist attacks on 11 September 2001 in the US have long-lasting implications for Pakistan’s financial sector. The Government is responding to these challenges in a flexible and pragmatic manner. As a WTO member, Pakistan welcomes participation of qualified international investors and service providers to strengthen its financial sector. There remain only a few restrictions, primarily in the insurance sector. In response to the Supreme Court decision to put in place a financial system based on Islamic principles, the Government is working on a credible proposal that would allow a dual system as practiced, e.g., in Malaysia, with encouragement to financial institutions to develop Islamic financial products. The development of equity and other asset-based markets in particular would be in line with this. The events of 11 September impact primarily the general insurance industry, as terrorism-related cover is no longer available in the market. This, if unaddressed, will put pressure on the financial viability of projects, financing costs of companies, and ultimately financiers. It will also risk the sustainability of public finances, as the

10

Government will be exposed to large losses from public sector properties and companies that remain uninsured, including potential liabilities by Pakistan International Airlines. In addition, tighter control and scrutiny of international capital flows can be expected. 30. A more detailed analysis of the key sector issues and opportunities is in Appendix 1.

IV. THE PROPOSED PROGRAM 31. Following successful implementation of the CMDP, the Government sought ADB’s continued support for its financial markets development agenda. Support for financial (nonbank) markets also forms part of the ADB’s financial sector strategy for Pakistan and was included in the CSP for 2002.20 Program formulation was closely coordinated with various stakeholders, including the private sector and other developments partners. An overview of processing steps, approaches, and background studies undertaken is provided in Appendix 2. Summary information on external assistance to the sector is presented in Appendix 3. The program framework is in Appendix 4. The agreements on the FMG Program loan are reflected in the Government’s development policy letter and the attached policy matrix in Appendix 5. A. Objectives and Scope 32. The overall goal of the Program is to facilitate private sector-led productivity growth as well as social protection. It thus aims to contribute to poverty reduction indirectly. This is to be achieved by improving the framework for mobilization of long-term resources for saving and investment through market-based financial instruments and institutions. The Program also aims to increase resilience against financial sector crisis and mitigate its negative implications for the poor. 33. The purpose of the Program is to support the Government’s financial sector reform agenda, and development of capital markets and other nonbank financial services in particular. The immediate objectives of the Program are to (i) strengthen investor confidence through improved governance, transparency, and investor protection; (ii) increase the depth and diversity of financial intermediation through new capital market issues for saving and investment; (iii) improve the operational efficiency and risk management of intermediaries; and (iv) reduce financial sector vulnerabilities. 34. These objectives will be achieved through a mix of reforms on various levels, including policy, governance, institutions, and operations. From a market perspective, the Program will cover equity markets, debt and money markets, contractual savings, and other NBFIs and services, including insurance, leasing, and DFI reform. 35. The policy reform agenda, to be financed through a program loan, is supported by two TA loans: one for strengthening of pension, insurance, and savings systems; and one for strengthening regulation, enforcement, and governance of nonbank financial markets. The Program is complemented further through nonlending initiatives including ADB’s guarantee products to enhance integration of Pakistan’s financial markets with international capital flows; and to ensure continued access to cover for selected noncommercial risks that was withdrawn by the international insurance industry following the terrorist events in the US on 11 September 2001. 20 The Program was originally listed as Capital Markets Development Program II, but the title was subsequently

changed to better reflect the contents of the Program.

11

B. Policy Framework and Actions 36. Much of the basic regulatory and technological infrastructure has been put in place for capital market development, and the key challenge now is to get investment going. This requires above all promoting new capital market issues and developing institutional investment, which is closely linked to improvements in corporate governance of both financial intermediaries and corporate issuers. Improvements in corporate governance, in turn, are often brought about by institutional investors. The approach suggested under the Program is to break this nexus through simultaneous reforms that introduce instruments with lower risk to provide a wider choice of liquid investment alternatives to investors, vigorously improve and enforce corporate governance and risk management standards to increase investor confidence, introduce measures that encourage private sector participation in institutional investment, and upgrade skills at various levels. In addition, complementary financial products and services will be promoted for broadening and sustaining the financial sector base. 37. The reform agenda is structured around five components: (i) improvement of the fiscal, interest rate and investment policy environment; (ii) increase in investor confidence through improvement of governance, transparency, and investor protection; (iii) increase in supply of financial instruments and improvements in market infrastructure; (iv) increase in demand for financial instruments through development of contractual savings and institutional investment; and (v) development of related financial services and institutions. 38. In line with ADB’s evaluation findings on policy reform design of past program loans and revised policies on program lending,21 conditions have been formulated with increased focus on outcomes to allow for greater flexibility in actions to achieve compliance. Details on specific actions under the Program are in the policy matrix in Appendix 5.

1. Improvement of Fiscal, Interest Rate, and Investment Policy Environment 39. Reforms under this component will improve the fiscal policy environment to promote and encourage long-term saving and investment in financial markets, as well as further reform the NSS. Specific actions will rationalize tax treatment for financial instruments and investors, and provide selective incentives to stimulate long-term savings and nonspeculative equity investment. Distortions in foreign exchange transfer for reinsurance and of investment criteria for securities to qualify as statutory liquidity requirements are also being removed. In addition, a more systematic mechanism for linking interest rates for the NSS to market-based benchmarks is being introduced. NSS reforms are in particular required to further adjust the yield for short-term holding periods to comparable market rates for retail securities. For the medium term, consideration will be given to further lowering stamp duties and converting the NSS gradually from an unfunded into a funded scheme with investments in government securities and rated corporate debt, and to promote long-term capital formation through selected fiscal incentives. Policy measures under component 1 of the Program are summarized in Table 1.

Table 1: Policy measures to improve fiscal, interest rate, and investment policy environment

1st Tranche Release Action 2nd Tranche Release Action

(1) Rationalize tax treatment for financial instruments and investors.

(1) Further rationalization of tax treatment for financial instruments.

21 ADB. 1999. Review of ADB’s Program Lending Policies. Manila.

12

(2) Adjust fiscal measures to promote long-term capital formation

(2) Further adjustment of fiscal measures to promote long-term capital formation.

(3) Adjust NSS rates to a more market-based benchmark mechanism.

(3) Improve the administrative efficiency of NSS.

(4) Rationalize investment eligibility criteria for securities.

(5) Remove distortions in foreign exchange transfer for reinsurance.

2 Increase in Investor Confidence through Improvement in Governance,

Transparency, and Investor Protection 40. Reforms to improve investor confidence seek to raise governance standards, and to improve transparency in information disclosure and enforcement for investor protection. Those reforms will be spearheaded by SECP. Important measures that have already been taken over the past year include the streamlining and clarification of responsibilities for policy formulation and regulation within the government as well as further improvements in the mandate and governance structure of SECP for broad-based regulation of financial markets and services. This should allow SECP to develop into a full-fledged financial services regulator following best practices recently applied elsewhere and taking account of the increasing integration of financial markets and products. A corporate governance code based on wider stakeholder consultation has been introduced and will be vigorously enforced, to cover the corporate sector, financial intermediaries, and related professions. The Companies Ordinance is being updated to provide legal cover for some of the provisions. In addition, laws and regulations for enhanced transparency in financial transactions and corporate affairs will be introduced, including legislation to combat money laundering and regulate corporate insolvencies. Brokers will be required to strictly separate proprietary trading from investor accounts. Standards for information providers and accounting and auditing firms as well as information disclosure will be improved. The stock exchanges will improve their governance structure and risk management systems, and the board of KSE has already been reorganized to allow enhanced representation by nonmember directors. A national exchange for financial instruments is envisaged with a corporate structure, possibly through integration of the existing exchanges or otherwise. Policy measures under component 2 of the Program are summarized in Table 2.

Table 2: Policy measures to increase investor confidence through improvement in governance, transparency, and investor protection

1st Tranche Release Action 2nd Tranche Release Action

(6) Clarify and strengthen coordination for financial sector policy formulation and regulation.

(4) Improve the legal framework for transparency in financial transactions and corporate affairs.

(7) Enhance mandate and governance structures of SECP.

(5) Enhance SECP capacity for market surveillance, and for regulation and supervision of NBFIs.

(8) Improve corporate governance standards. (6) Enforce the corporate governance code. (9) Improve information disclosure standards and transparency in market transactions.

(7) Improve the quality of information disclosure.

(10) Improve governance of stock exchanges and other capital market intermediaries.

(8) Further reform the structure of stock exchanges.

13

(11) Strengthen prudential and risk management standards for nonblank financial intermediaries.

(9) Further improve efficiency in trading and operational risk management practices.

(12) Improve dispute resolution mechanism between brokers and investors.

(10) Develop professional standards, qualifications, and continued education.

3. Increase in Supply of Financial Instruments and Improvements in Market

Infrastructure 41. This component seeks to facilitate new capital market issues and introduce new financial instruments. Reforms will be initiated primarily by SECP together with the stock exchanges, and supported by SBP as far as government bonds and money markets are concerned. A second board and/or new over-the-counter (i.e., quote-driven) market for equities is being created to facilitate equity issues by new or smaller companies with good growth potential. To increase the supply of equities, the government will make use of the stock market to implement its privatization program, in particular for blue chip companies. The use of electronic trading will be facilitated through adequate technology platforms. New risk management instruments are being introduced to facilitate forward cover and hedging. Equity futures have already been introduced, and concept papers for the development of interest rate swaps and new money market instruments are being initiated. Regulations and procedures will be developed to facilitate issuance and trading of commercial paper by rated companies and corporate bodies. Clearing and settlement systems will be upgraded further in particular to facilitate further secondary trading in debt instruments, and a system of market making for corporate debt will be introduced. Policy measures under component 3 of the Program are summarized in Table 3.

Table 3: Policy measures to increase supply of financial instruments and improve market infrastructure

1st Tranche Release Action 2nd Tranche Release Action

(13) Introduce new markets for smaller and less frequently traded companies.

(11) Improve the supply of equity issues through privatization.

(14) Introduce financial hedging instruments and markets.

(12) Improve secondary debt market activity.

(15) Initiate development of a money market for commercial paper.

(13) Further develop money markets.

(16) Promote the bond market (PIBs and TFCs).

4. Increase in Demand for Financial Instruments through Development of

Contractual Savings and Institutional Investment 42. Improvements in the policy, governance, and supply side (under components 1–3) will provide the basic foundation for further growth of institutional investment. To build on this, institutional changes including increased private sector participation will be introduced in the largest government-owned institutional investors to ensure better alignment between the interests of management and investors and savers. This will include measures to improve asset management and better outreach and provision of services, in particular for pensions and life insurance. A regulatory framework will be introduced to improve minimum standards for pension funds. Mutual funds for the money and debt markets will be encouraged to tap into retail investment. At the same time, institutional investors that raise funds from the general public will be subjected to stricter governance standards and information disclosure. Professional

14

standards will be introduced for fund managers and investment analysts. As the build-up of domestic institutional investment will require some time, foreign portfolio investment will be actively encouraged and may be supported through guarantee arrangements to address country risk issues. Foreign portfolio inflow through proper institutional channels will also transfer expertise into the domestic market. Policy measures under component 4 of the Program are summarized in Table 4.

Table 4: Policy measures to increase demand for financial instruments through development of contractual savings and institutional investment

1st Tranche Release Action 2nd Tranche Release Action

(17) Upgrade regulation for mutual funds. (18) Clarify and streamline regulatory responsibilities for pensions.

(14) Promote private pensions.

(19) Liberalize investment restrictions for institutional investors.

(15) Improve the operational efficiency of large government-controlled institutional investors (SLIC, EOBI).

5. Development of Related Financial Services and Institutions

43. Improvements in the regulatory framework will raise the standards of financial soundness for NBFIs, and encourage consolidation of the highly fragmented sector. Improvements in the regulatory framework will also further encourage the development of mortgage-backed markets for housing finance and asset securitization, in particular by the leasing industry. Recently, the Government has allowed tax deductibility of mergers and carry forward of losses for merged entities to encourage merger and restructuring of financial institutions. The Government has also reduced the number of government-owned DFIs through liquidation or merger. The restructuring of the Industrial Development Bank of Pakistan (IDBP) is currently at an advanced stage. The Program will support the cost of restructuring IDBP for sale to the private sector or for liquidation in case no buyer can be found. Reforms have also been initiated in the insurance sector, including improved governance of state-owned insurance companies, reduction of the monopoly of state-owned companies, for public sector properties and activities, greater private sector participation for reinsurance, and improved retention capacity for selected noncommercial risks that are no longer covered by the market. Policy measures under component 5 of the Program are summarized in Table 5.

Table 5: Policy measures to develop related financial services and institutions

1st Tranche Release Action 2nd Tranche Release Action

(20) Promote corporate and financial sector restructuring and consolidation.

(16) Strengthen the regulatory framework and supervision for NBFIs.

(21) Reduce government dominance and consolidate DFIs through sale or mergers

(17) Sell IDBP to the private sector or liquidate it if no buyer can be found.

(22) Improve governance of government-controlled insurance companies.

(18) Reduce public sector involvement in commercial insurance operations.

(23) Open the general insurance market (for public sector property and activities).

(24) Enhance risk retention capacity for noncommercial risks and strengthen reinsurance.

15

C. Important Features 44. An important and innovative feature of the Program is that it builds on ADB’s unique capacity among multilateral financing institutions to combine public and private sector instruments and integrate nonlending assistance to leverage the policy reform agenda. In particular, the Program seeks to leverage private sector investment directly into the development process and establish a genuine public-private partnership, in addition to the traditional public sector lending, which seeks to finance the cost of adjustment. Through the innovative application of its PRG instrument, ADB will augment and sustain private sector resource flows into the economy. Two PRG Facilities (see paras. 63-68) will support risk mitigation to enhance Pakistan’s access to international capital flows and integration with international financial markets, and to ensure access to comprehensive insurance for soundness of investment and financial markets. Within this context, the Program will also respond to the Government’s initiatives in dealing with the consequences on the insurance industry of the terrorist attacks in the US on 11 September 2001, after which cover for selected violence-related risk was withdrawn. 45. The implementation of those nonlending components requires special arrangements with the private sector that are separate from the arrangements for implementation of the Program and TA loans. D. Financing Plan 46. The Government has requested a loan of $260 million from ADB’s ordinary capital resources to help finance the Program. The loan will be provided to support the FMG Program, as described in the development policy letter and the attached policy matrix (Appendix 5). The loan amount was determined on the basis of the cost and strength of the structural reforms as well as the strategic significance of the sector. The costs of structural adjustment are estimated to be about $939 million equivalent, consisting of the following main components:

(i) revenue shortfall due to harmonization of tax structure, selected tax incentives, and adjustment in interest rate structures ($592 million);

(ii) restructuring and development of government-owned institutions, including IDBP, SLIC, NIC, EOBI, and Central Directorate of National Savings ($316 million);

(iii) support to a guarantee mechanism to cover terrorism-related risks ($18 million); and

(iv) development and operation of regulatory and enforcement infrastructure ($13 million).