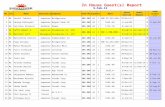

April/May 2012 InHouse

-

Upload

certified-builders-association -

Category

Documents

-

view

218 -

download

2

description

Transcript of April/May 2012 InHouse

Insurance cover for LBPs – Pgs 16, 17

INHOUSE

Activity approved by the Registrar

April / May 2012

– Pg 15

Calling all ITaB and CBANZ employed Apprentices ...

... Are you up to a challenge?

Consumerism gone mad in building – Pg 12, 13

The official magazine of Certified Builders Association of New Zealand Inc

CBANZ welcomes new Chief Executive Officer – Pg 5

CBANZ Annual Conference18-19 May 2012 Wellington

Pgs 6,7

Contents

Unique Antarctic opportunity pg 4

Conference discount for ITaB apprentices pg 4

Notice of Special Business pg 5

CBANZ Annual Conference pg 6,7

Licensing - Supervision: LBP pg 8

Licensing - Earning your points pg 9

Consumerism gone mad in building sector – Geoff Hardy pg 12,13

ITaB news pg 14

3rd Annual Apprentice Challenge pg 15

Guarantees and Insurances pg 16,17

RBW Seminars pg 18,19

Around the regions – Wanaka Pg 20

Hunting & Fishing giveaway pg 24

Health and Safety update pg 25

Tax and property sales – IRD pg 26,27

Q&A: The law at work – E2Law pg 29

Installing insulation and getting it right pg 30,31

ToolTube pg 32

Licensed – Show it! pg 32

CBANZ websites pg 34

CBANZ Helplines pg 35

Message

3

Te Papa in Wellington is the stunning venue for this year’s Annual CBANZ National Conference – 18-19 May

Pgs 6,7

ON THE COVER

Contact CBANZ®

Farming House 102 - 104 Spring Street

PO Box 13405, Tauranga Central, Tauranga 3141 Telephone 07 927 7720 Freephone 0800 CERTIFIED

Facsimile 07 927 7721Email [email protected] Web www.certified.co.nz

This is my final inhouse report as my term as

Chairman comes to an end at the 14th CBANZ

Conference to be held in Wellington on 18th

and 19th May 2012. I would like to thank

everyone for their support and help during this

term. The three years have gone very quickly

but enjoyably and it has been a bonus to have

had this role.

The Certified Builders Association, Department

of Building and Housing and Winstone

Wallboard’s Roadshow on Restricted Building

Work has been in your area. The support this

Roadshow has been given by CBANZ members

is very pleasing to see. Thank you to Dion and

Melanie for presenting a great Roadshow. To

our partners thank you for your support.

I often wonder about those builders who don’t

belong to this Association, as to how they are

going to understand or work in this industry

when they don’t have any of the contractual

documents or Guarantees this Association has

available for its members. I can only say that

you need to belong to this Association so you

are kept up to date in what is happening in

your industry.

The economy is starting to show signs of

improvement which will bring a heavy

workload to all of us. I refer you to the article

in the inhouse February/March 2012 page 12

(Make sure all your contract documents say the

same thing) – well worth the read.

For those still making up their minds on going

to the 14th CBANZ Conference to be held in

Wellington this is a great time to learn from

the workshops available and network with

the other members, so come and join us in

Wellington.

See you there.

Allan Shaw

Chairman

from the Chairman

newsassociation

4

The CBANZ Conference in Wellington offers

the opportunity to make a unique purchase

on Saturday 19th May. A core sample of

granite from Antarctica will be auctioned

with funds going to the Apprenticeship

Scholarship Trust. The auction will be held at

1.30pm during the conference lunch break.

The granite sample was donated to the

Cook Strait region of CBANZ by Webster

Drilling and the region has kindly passed on

the donation for the auction to benefit the

Apprenticeship Scholarship Trust.

The core sample was taken from the Italian

Base at Terra Nova Bay in Antarctica in 1999.

It is 300mm in diameter with a 100mm hole,

approx 75mm thick though the thickness

varies.

The pilot hole was drilled to provide a large

diameter hole through a granite bluff to

A unique opportunity

Certified Builders Association of New Zealand Incorporated

NOTICE OF ANNUAL GENERAL MEETING

2011 FINANCIAL REPORT

A copy of the 2011 Financial Report is now available on

CBANZ website. It will also be included in the Conference

Programme in delegate’s satchels at Conference.

Any items that you would like discussed at the AGM, please

email or fax to CBANZ CEO Grant Florence by 5.00pm

Monday 30th April 2012.

Facsimile: 09 927 7721

Email: [email protected]

Notice is hereby given that the Annual General Meeting of Certified Builders Association of New Zealand Incorporated will

be held on Saturday 19 May 2012 commencing at 2.15pm at Soundings Theatre, Te Papa, Wellington

AGENDA

1 Welcome and Apologies

2 Minutes from last Annual General Meeting 11th June 2011

3 Chairman’s Report

4 Chief Executive’s Report

5 Presentation of the Annual Financial Report for the year 2011

6 Announcement of Directors of Board

7 Special Business (as required)

8 General Business

ITaB Apprentices have the

opportunity to further

their learning by attending

CBANZ Conference in

Wellington and are

sponsored by the AST Trust

(Apprenticeship Scholarship

Trust) 50% discount off the

Registration fee. (Function

costs are at full rate.) Go

online www.certified.

co.nz and download the

Registration form, complete

and send to CBANZ.

Conference discount for ITaB Apprentices

come out into the sea well below sea

level. The hole then provided a conduit

for pipework to the seawater intake.

Pipes draped over the bluff were being

constantly crushed by the sea-ice.

5

6

7

The scope of the carpentry licence covers many aspects of Restricted Building Work on site from footing excavations to installation of bracing plaster board. Many of these specialist trades will require supervision for a record of work [memoranda] to be signed off.

The description under the licensing

system is as follows. Provide control or

direction and oversight of the building

work to an extent that is sufficient to

ensure that the building work

• is performed competently

• complies with the building consent

under which it is carried out

On page 11 of your CBANZ Site

Handbook the Association offers advice

for wage earners and labour-only

engagement associated to supervision.

Do not assume the role of supervision

– this must be acknowledged in writing

and preferably within your terms of

engagement i.e. contract/employment

agreements.

As an LBP you will be required to declare

within your Record of Work [memoranda]

that supervision took place. Don’t forget

to note who was the contractor engaged

in the restricted building work.

Prior to licensing as a practitioner you

had a “duty of care” to the homeowner

and subsequent homeowners. Under

licensing this does not change, duty of

care also encompasses the LBP engaging

in the role of supervision.

On page 3 of your CBANZ Site Handbook

the Association has listed some guidance

points to assist you with meeting the

requirements of supervision. In addition

to these you might like to obtain a

producer statement from the unlicensed

contractor, which in itself is a record of

work for the job file outlining ...

• who the contractor is and

company legal identity

• company details

• site address

• contractors qualifications – are

they an approved applicator of

a system? [this is a competency

indicator]

• scope of work undertaken

• product/install guarantees on

offer

• have them sign as a declaration

that their work complies with the

approved plans and specifications.

Along with the suggestions listed on

page 3 of your Site Handbook this is

compiling evidence of your competency

involving supervision. It also creates a

paper trail of trades involved with your

particular job.

The free record of work [memoranda]

that you receive with the Site Book

will now include producer statement

templates and record of works that

you can use for your specialist trades,

no excuses for them not to have these

signed before they leave the site.

Supervision – LBP

By Jason McClintock

Operations Manager

Licensed Building Practitioner

From the desk at Operations LICeNSINg

8

To order your Site Handbooks

email Millie Turkington on

These will be charged out at $10

for a pack of 5 Site Handbooks

plus additional free record of

works [memoranda] and producer

statement templates.

9

Licensed Building Practitioner skills maintenance pointsOne hour learning = one skills maintenance point

Any learning of building related information of a

technical nature is valid for points

• inhouse

• Local members meeting

• Reading a merchant’s magazine

• Onsite training

• Any off site training or seminar

• Business training that will affect your

building business

• Formal training such as a level 5 course

Don’t forget to keep your own register of points

accrued and evidence of attendance e.g. meeting

flyer.

eArNINg your PoINTS

The leaky home crisis was the catalyst for most of the new building laws that have been introduced over the past decade. Those reforms have largely stemmed from the Hunn Report of August 2002, which was a very good analysis of the state of the building industry at the time, and the factors that gave rise to leaky homes.

However the one weakness of the Hunn

Report was that it made a number of

assumptions about the inadequacies

of our justice system, without a proper

understanding of the relevant law. The

overall thrust of their conclusions was

that homeowners were at a significant

disadvantage when attempting to

Geoff Hardy is a specialist

commercial lawyer in Auckland

and also a member of the

CBANZ Board.

Contact Geoff on 09 379 0700

Consumerism gone mad in the building

sectorhold builders to account for shoddy

workmanship, and that the power

balance was very much in favour of the

builder.

The reality, in fact, is the opposite.

Our law of contract and our tort of

negligence, which applies to builders as

much as to anyone else, has been around

for centuries. Since 1993 consumers have

also had the benefit of the guaranties

and remedies that apply to building

services under the Consumer Guarantees

Act. Homeowners can enforce those laws

against builders in the Disputes Tribunals

and in the Courts, just like any other

citizen can.

But unlike any other citizen, homeowners

have two additional methods of resolving

their grievances that are unique to the

building industry – the Weathertight

Homes Resolution Service, and the

Construction Contracts Act 2002. On

top of that, under most of the building

contracts in common use they have the

options of negotiation, mediation, and

arbitration as well.

They can also enforce their rights. Owner-

operators of building companies that

have gone into liquidation are just as

much liable as their insolvent companies

would have been. And in New Zealand,

Councils are liable to homeowners to a

much greater extent than in overseas

countries. Plus, under our joint and

several liability rules the homeowner can

often recover 100% from the Council and

leave the Council to recover from the

other liable parties.

Despite this, it remains the official view

that homeowners are starved of legal

rights and remedies. And so a raft of

consumer-friendly provisions were duly

approved by the Cabinet in August

2010, and have found their way into the

Building Amendment Bill (No. 4) that will

shortly be referred to a parliamentary

select committee for a round of public

submissions.

If the No. 4 Bill is passed without

modification, then homeowners who

believe they have been the victims of

shoddy workmanship will have a choice

between five different laws covering

essentially the same thing, but all

slightly inconsistent with each other.

They will be able to sue for negligence,

or for breach of contract, as they have

always been able to do. They will also

be able to enforce the builder’s implied

service guarantees under the Consumer

Guarantees Act. They can also enforce

the implied warranties under the

Building Act, which are very similar to the

Consumer Guarantees Act guarantees,

but run in parallel with them. Finally,

they can enforce the new one year

warranty for defective building work.

The implied warranties under the

Building Act require the builder to be

conscientious and diligent, to comply

with the plans & specifications, building

consent and Building Code, to achieve

12

13

the agreed completion date, and to meet

the client’s reasonable expectations.

Those obligations seem fair enough, but

if the homeowner believes they have

been breached, he can simply cancel the

building contract. It doesn’t matter how

minor the breach is or how far advanced

the project is, and he doesn’t have to

give the builder an opportunity to fix it

first.

These warranties (and the corresponding

right to cancel) apply not only to

builders, but also to designers (architects,

engineers, and draftsmen) who design

the structural components or the

external envelope of a household unit.

The warranties are also automatically

implied into every agreement for the sale

and purchase of a household unit where

the vendor is an “on-seller”. On-sellers

are people who build a household unit,

or arrange for it to be built, or acquire a

household unit from the first owner, in

each case for the purpose (or with the

intention) of selling it. However the same

right to cancel does not apply, so the

purchaser’s remedies will be found in the

sale and purchase agreement itself, or

the Contractual Remedies Act 1979.

In addition, if the homeowner believes

there has been “defective” building

work, and the defect is capable of being

remedied, he has the option of notifying

the builder or designer within one year

of completion. In that case the builder

or designer must remedy the defect (in

his own work) within a reasonable time.

However, all the homeowner needs to

do is “assert” that there is a defect. If

the builder or designer does not then

prove (on the balance of probabilities)

that it is not in fact a defect, then the

homeowner’s assertion is automatically

deemed to be correct.

Of course all these rules assume that

shoddy workmanship is self-evident,

whereas in reality it is often just a

genuine difference of opinion. Builders

may argue that the alleged defects are

too trivial or nit-picky, or the client wants

a better standard than the one agreed

and paid for, or the work won’t be

shoddy once it is finished, or the defect

has been caused by the designer or a

tradesman who has contracted directly

with the owner, rather than the builder.

The smorgasbord of rights and remedies

that homeowners are going to be given,

will only make these issues much more

complex to resolve, not less.

DISCLAIMER: This article is not intended

to be relied upon as legal advice.

.From your co-ordinator

Apprentice news

Completion Certificates

What an incredible two months since the

last inhouse. On 1 February l started a

national roadshow with the Department

of Building and Housing (DBH) presenting

the latest information on Restricted

Building Works (RBW).

The roadshow has exceeded

my expectations and the DBH staff were so impressed with our

professionalism they decided not to use independent contractors to do the

majority of the events and only sent their own staff (kudos for CBANZ).

We have been using venues throughout NZ – from our loyal resellers

to Unitec and polytechnics – which have paved the way to get all the

information to our members and unaligned builders.

The feedback from each region and the numbers attending shows how

aware we are of the importance of Licensing. We have given away over

500 membership packs in the past 6 weeks, so hopefully we will start

seeing a real spike in our membership.

A special thank you to Winstone Wallboards, loyal supporters of Certified

Builders, who have been sponsoring every event throughout the country

and are once again supplying first prize for our Apprentice Challenge.

On that note, we have sent out all the competition forms for our National

Apprentice of the Year, which once again is being supported by ITM in all

the regions. If you have a young apprentice please make sure you let them

know it’s happening, we need as many participants as possible to make it

as successful as last year.

Ben from Builtin NZ and myself joined Deane Fluit and the Central Otago

CBANZ team to help raise the profile of CBANZ in the southern region at

the 75th Annual A&P show in Wanaka. Over 20,000 people attended the

event over two days, so it was well worthwhile, with great feedback from

the public, so keep up the good work guys.

See You On The Road

Dion

ITaB would like to congratulate the following

Apprentices on Completion of Apprenticeship

Carpentry

Andrew Sloan BOPP

James Gilbert CPIT

Joseph Henry CPIT

George Cowper NMIT

Joel Davies Northtec

Cameron Barratt-Boyes UNITEC

Matthew Bell UNITEC

Stefan Biggelaar UNITEC

Ian Burt UNITEC

Michael Christianson UNITEC

Joe Dowden UNITEC

Tyson Edwards UNITEC

Jonathan Hicks UNITEC

Daniel Sutton UNITEC

Adam Bungard Wintec

Martin Goile Wintec

Bryce Hickey Wintec

Nathan Loveridge Wintec

Joel Macreadie Wintec

David Mulingani Wintec

David Samson Wintec

Dylan Tuckey Wintec

David Young Wintec

CPIT – Christchurch Polytechnic Institute of

Technology – Canterbury Region

NMIT – Nelson Marlborough Institute of

Technology – Nelson Region

BOPP – Bay of Plenty Polytechnic

Wintec – Waikato Institute of Technology

Congratulation on the completion of

Apprenticeship in Carpentry, proudly supported by

the Apprentice employers, Polytechnic’s and Tutors

and ITaB.

ITaB Stickers are being sent directly to

all new ITaB employers, please contact

ITaB directly if you would like free

promotional stickers to show your

support of the ITaB programme.

ITaB Green Cards are now being sent

directly to the paid apprentice.

The benefits include;

• Discounted Publications including the

NZS3604:2011, E2 Moisture Manual

and SNZ 3604 onsite Handbook.

Contact Millie T ph 0800 482 284

• inhouse Magazine delivered bi-monthly

with articles and information to keep

you up to date with the industry.

• Vodafone, Swazi Clothing, Caltex

and AA and Fisher & Paykel, Harvey

Norman, Noel Leeming discounts and

plans upon application. 0800 482 284

• General Liability/Car/Contents

discounted insurance call Gwenda

CBA Insurance ph 0800 237 843

Contact ITaB on 0800 482 284 if you have

any problem relating to your Green Card.

green Cards offer numerous benefits:

1515

3rd Annual Apprentice Challenge

Are you employed by a Certified Builder or are you an ITaB apprentice?

Sign up to the challenge and elevate yourself to the next level.

Step one: Fill in a registration form and questionnaire return to [email protected] or if you are an ITaB apprentice return to your Tutor at your enrolled Training provider before 15th April. To download your application, please visit www.certified.co.nz, click on the About Certified Builders tab, click on conference information on the left hand navigation bar.

Step two: Finalists will be chosen from the regions to master a practical challenge, held at your local ITaB provider or ITM store, you will be advised of venue and dates. Full details will be supplied of practical challenge requirements.

Calling all Apprentices…

Step three: The regional finalists from this challenge will receive an all expenses paid trip to Wellington* to attend the Certified Builders National Conference 18th-19th May.

Step four: The winner will take home an Outward Bound Course to the value of $3,750. The runner up will win $2,000 worth of DeWalt power tools and the third placegetter will win a $1,000 voucher from ITM.

For more details contact: Dion Tapper on 0800 482 284 * Conditions Apply

16

• Include it in your quote as “Homefirst 10 Year Builders Guarantee – underwritten by CBL Insurance Limited”

• Complete the guarantee application at the same

time as your building contract

• For an application form contact Millie T on 0800 237 843 email: [email protected]

17

A man noticed that his credit card had been stolen but didn't report it.

The thief was spending less than his wife.

The Department of Building and Housing (DBH) roadshows on Restricted Building Work – in conjunction with CBANZ – have been rolling through the country.

By Thursday 1st March the roadshow had

reached Hawke’s Bay. The event was a

great success with 153 builders turning

up to learn about the changes in the

industry with the introduction of the

new Licensed Building Practitioners (LBP)

licences.

The EIT-organised event was the biggest

turnout the roadshow has had to date

from when it started in Invercargill

and began working its way north from

the beginning of February. The great

attendance was a reflection of EIT’s

dedication to the local building industry.

EIT made sure that as many builders as

possible were aware of the event and

able to attend.

The speakers were very impressed

with the EIT trades complex and how

well organised and professional the

EIT Carpentry team is. We even had

inquiries from the DBH speaker if it

would be possible to host other future

seminars at EIT.

The food for the evening was provided

by EIT’s hospitality students and was

very well received. It was definitely the

best spread we have had at any venue

restricted Building Work seminars

and brought another positive comment,

from a roadshow speaker.

We also took the opportunity to present

a power point presentation on all of

our carpentry programmes from level

2 to level 5. Builders really enjoyed

the evening and we received a lot of

positive comments and encouraging

feedback on the direction we are taking

Above and top: Builders pack the Restricted Building Work seminar at EIT in Hawke’s Bay.

18

Around the regions

with our carpentry programmes.

The EIT carpentry team was very

busy with questions about signing

up apprentices and securing work

experience for our students. Overall a

great evening and a fabulous way to

showcase the top quality facilities and

get greater industry involvement and

support for EIT’s carpentry programmes.

– Shane Sigglekow,

Carpentry Apprenticeship Programme

Co-Ordinator, EIT

Builders are all ears at the Restricted Building Work seminar in Papakura last month.

19

Wanaka had its 75th Annual A&P Show this year and being the

second largest show of its type in the country the Central Otago

CBANZ branch decided to put a stand in. The main aim was to get

the CBANZ brand out there and noticed by the public. CBANZ

Business Relationship Manager Dion Tapper and Ben Rickard from

Builtin were asked to attend – two reasons for this:

1. If the public asked specific questions about insurance or CBANZ

membership the people were there to give the answers

2. To give local members the opportunity to have a personal client.

So with the framers sponsored by PlaceMakers Wanaka and the

Around the regions

Central otago builds CBANZ brand at Wanaka showroof trusses sponsored by Mitre 10 Wanaka (our two main

local suppliers) CBANZ Central Otago built a little house

for Ben and Dion. The bonus for them was the coffee cart

parked right next door which provided a constant queue so

you could see people looking and reading.

Central Otago CBANZ President Deane Fluit says his gut

feeling was that the public needed to be made more aware of

the CBANZ brand: “So hopefully we helped this a little bit.”

Deane says a big thank you is due to National Support Office

for sending signage and support information and also to

Dion and Ben for their support during the weekend.

22

The Best Practice Guidelines for Working at Height in New Zealand are being published by the Department of Labour.

These guidelines provide practical

guidance for employers, contractors, sub-

contractors, and employees and all others

engaged in work associated with working

at height.

They have been prepared in association

with 21 representatives from businesses

and organisations in the construction

industry in New Zealand.

Preventing falls from height is a priority

for the Department of Labour and the

guidelines are designed to help everyone

meet their obligations under the Health

and Safety in Employment Act (1992).

The Department is producing a Working

Safely at Height Toolkit of 6 factsheets to

be used together with these guidelines.

The factsheets cover topics including

planning a safe approach to working at

height, how to select equipment for the

job, short duration work at height, edge

protection, temporary work platforms

and restraint technique.

Investigations by the Department of

Labour show that more than 50% of

falls are from less than three metres and

approximately 70% are from ladders and

roofs.

Construction workers are getting

seriously injured and killed from falls

from height for a number of reasons

• the wrong safety gear has been

selected

• the gear isn’t up to standard

• the gear hasn’t been set up

properly

• there’s nothing in place at all to

ensure the safety of workers.

Builders, roofers, electrical workers,

painters and decorators are the most

likely to fall from height and seriously

hurt while they are working.

The Best Practice Guidelines for Working

at Height in New Zealand provide

everyone who is involved with working

at height clear direction on how to

manage the work in a way that will bring

down the death and injury toll.

These guidelines are generic and not

specific to one particular industry so they

can work together with other guidelines

that cover specific issues unique to

particular working environments.

The Department is reminding everyone

to think about the hazard of working

at height – before the job starts, when

it’s kicking off, and when the work is

underway.

It’s about spelling out the need to select

the most effective controls for managing

the hazard of working at height, starting

with elimination (do you need to go

up there at all?), then isolation (edge

protection, scaffolding), and only then

minimisation (fall restraints, ladders).

It’s also about making sure people have

the skills and supervision to work safely

at height.

Falls from height in construction are

preventable. Doing nothing is not an

option.

For more information about working

safely at height visit www.dol.govt.nz/

prevent-falls/ or call the Department’s

Contact Centre 0800 20 90 20 if you have

specific questions or concerns about your

workplace.

Best Practice guidelines for Working at Height

From 1 August 2011 the NZBC B1

Compliance Document required

that concrete slab-on-ground

constructed in accordance with NZS

3604:2011 Timber Framed Buildings

on good ground be reinforced with

a minimum of 2.27kg/m2 of Grade

500E reinforcing mesh fabric which

conforms with AS/NZS 4671 Steel

Reinforcing Materials.

To assist builders to produce a robust

and resilient concrete slab-on-

ground CCANZ has made available

‘Residential Concrete Slab-On-Ground

Floors’, an easy to read 12-page

leaflet that gives guidance on good

practice in relation to such aspects

as slab levels, concrete strength,

the new reinforcing requirements,

control joints, bay sizes, crack

minimisation, as well as placing,

finishing and curing techniques.

The leaflet is part of the Coming Home

to Concrete campaign, which has been

designed to raise awareness of the

advantages of residential concrete

construction, from floor slabs through to

fully concrete houses.

CCANZ chief executive Rob Gaimster

believes that New Zealand currently

has a unique chance to fully explore

the possibilities that can be achieved

through the use of concrete and concrete

products in our homes.

“As we move forward to tackle the

challenges posed by the Canterbury

rebuild as well as the predicted housing

shortage in Auckland, the significant

role concrete can play in providing

comfortable, stylish and strong homes

at affordable prices must be part of

everyone’s thinking.

“The Coming Home to Concrete

campaign illustrates how we have the

opportunity to enhance our residential

building stock by utilising the many

reinforcing concrete best practicebenefits of concrete, and in turn

help ensure resilient and healthy

homes for all New Zealanders.”

Along with the slab-on-ground

leaflet, the Coming Home to

Concrete campaign provides a

range of print and web-based

resources to help all those involved

with residential construction make

informed choices and optimise the

potential of concrete and concrete

products.

Key amongst these resources is a

short film fronted by television

personality Kevin Milne that

highlights the candid views of

homeowners, architects and

builders, during interviews

structured around the attributes of

concrete.

A copy of the Residential Concrete

Slab-On-Ground Floors leaflet is

enclosed with this issue of inhouse

magazine. For additional copies contact

CCANZ – [email protected]. Or

to find out more about the benefits

of Coming Home to Concrete visit

www.cominghometoconcrete.co.nz

Recent amendments to the New Zealand Building Code (NZBC) in relation to reinforced concrete slab-on-ground are detailed as part of the ‘Coming Home to Concrete’ campaign, recently launched by the Cement & Concrete Association of New Zealand (CCANZ).

Builders Brag Page

24

Ph: 0800 486 834 (0800 HUNT FISH)

Shop online or register for catalogues www.

huntingandfishing.co.nz

Send us in your hunting & fishing pics

and we’ll reward those that get

published on this page with a

Hunting & Fishing New Zealand

Fleece Gutbusta Bush Shirt

valued at $39.99.

Send photos to:

Builders Brag Page

PO Box 4472

Palmerston North

Or email in hi-res to [email protected]

(be sure and identify clearly that you are sending an entry for

the Certified Builders Brag Page as well as full contact details!)

Please note photos submitted must be from a CBANZ or ITaB

member or a company affliated with Certified Builders.

32 stores nationwide

Above: ITaB apprentice Callum Rogers, of MVZ Builders Ltd in Nelson with a 197 pound boar taken in Nelson area.

Left: Apprentice Mark Gill from CBANZ member Dunnet Builders in Napier with a goat.

25

There are a number of compelling reasons to have an effective Health and Safety System. The most obvious of these include the desire to keep everyone safe and the need to meet the legal requirements of the Health & Safety in Employment Act.

Until recently the Residential Building

Industry appeared not to be a prime

target of the Department of Labour

(DoL). In certain parts of the country

the only time you would ever see an

inspector was if you reported a serious

harm injury. As part of DoL’s new

initiative to reduce the number of falls

from height, this is about to change.

Department of Labour inspectors will

focus on getting out and visiting sites

to check if they are up to the required

standard. Special attention will be given

to working at height and fall protection.

If they find a problem they will issue an

improvement notice that requires you

to fix the issue. If they return, and the

required improvements have not been

made, they will issue instant fines. For

more information on the new Fall From

Height Prevention Campaign go to www.

dol.govt.nz/prevent-falls/

update on Christchurch

As those of you already in Christchurch

will know you cannot do any EQR related

work without having a Health and

Safety System that meets the agreed

standard. This standard is much higher

than previously expected in Residential

Construction as the Key Industry

Associations and Project Managers are

taking the opportunity to raise the bar.

All contractors need to complete a pre-

qualification document that shows their

Health and Safety System meets the

required standard.

A Health and Safety update:Department of Labour to Get Tough

All builders intending to do EQR work

will need to have or seek a system

that meets this pre-qualification

standard. HazardCo can help you

meet the requirements of the Project

Managers running insurance projects in

Christchurch. We are available to provide

assistance for all builders working or

intending to work in the Christchurch

area.

The year ahead

No doubt 2012 is going to get busier for

all of us and Health and Safety is always

the first thing to get stuck on your “to

do list“ when this happens. We urge you

to ensure that you have an approved

system in place. They are very simple and

inexpensive.

I am sure you do not want to become

another builder who thought “it would

never happen to me“.

Mark Potter0800 555 339

You’ve just sold a property. Have you

checked to see if there are any tax

implications? Even the sale of your

private home could be taxable in some

cases. It pays to get it right! In this article,

Inland Revenue tells you what you need

to know.

Please get advice!The tax laws applying to property transactions can be complex. In this article, we only give you an overview of some of the most common situations.

If you’re planning to buy or sell a

property, we recommend you talk to

your tax advisor before you take action.

Properties are ‘big ticket’ items and if

you’re not aware of all the ins and outs,

you could run a significant financial risk.

Please refer to our guides!

There’s a lot of general information about

properties and tax at www.ird.govt.nz.

Please refer to the following guides:

• Tax and your property transactions

(IR361)

• Buying and selling residential

property (IR313)

• I have bought and resold a property

at a profit. Do I have to pay tax?

(IR314)

All of our guides are found under ‘Forms

and guides’ in the right-hand margin of

the homepage.

Our property decision tree can indicate

whether you have a tax liability when

you sell a property. You can access the

decision tree by clicking through the

path “Businesses & employers/Residential

property/Buying property/Why your

reasons for buying a property are

important”.

Tax and property sales

As an overview, to determine if a

property sale is taxable you need to ask

yourself three questions:

1. What was my intention when I

bought the property?

2. What is my history of buying and

selling properties?

3. Am I a builder, developer, or

property dealer, or associated with

any of these people?

The intention testIn general, if you buy a property solely as

an investment to earn rental income, and

you have no plans to resell the property,

any profit on sale will be a capital gain,

which is not taxable. You won’t be able

to claim a deduction if you make a loss.

On the other hand, if you buy the

property with the firm intention of

selling it when prices rise, you’ll have

to pay income tax on your profit. A loss

on sale is likely to be deductible. This

rule applies even if you’ve owned the

property for a period of time, or you’ve

rented it out while you wait for the right

time to sell.

It’s important to note that you may

have to pay tax even if you only sell one

property – the deciding factor is your

intention at the time of purchase.

your historyPeople who have established a regular

pattern of buying and selling properties

may fall into the category of ‘property

dealer’. If you’re a property dealer, you’ll

need to pay income tax on your profits.

Any losses on sale will be deductible.

Builders, developers, and property dealersIf you’re a property owner, and you or

an associate are involved in dealing in

land, building and construction work,

or in subdividing or developing land,

you may be subject to special tax rules.

For example, the amount of time you’ve

owned your property becomes an

important consideration for tax purposes.

If you or an associated person are

undertaking any of the above activities

and:

your income tax return

Any rental income you earn is

taxable, and expenses related to

earning that income are deductible.

If you sell a rental property for more

than its book value, the depreciation

recovered becomes taxable income.

Do you need to pay income tax on

your profit from a property sale? The

sale price is returned as income in

your tax return, and you deduct the

purchase price in the same return.

Any losses are calculated in the same

way.

your gST return

If you receive rent from a commercial

property, you need to include the

rental income in your GST return.

You can claim GST credits for some of

the expenses related to earning that

income.

When a property is part of your

taxable activity, you may be able to

claim a GST credit at the time you

purchase the property. When you sell,

you’ll probably have to include GST

in the sale price and pay the GST to

Inland Revenue.

Rent received from a residential

property is exempt from GST. As such,

you are unable to claim GST credits

for any expenses related to this

source of income.

26

27

• sell any property that is part of the

assets of the activity, or

• sell any other property (which is not

part of the activity) within 10 years of

buying it or (for builders) completing

improvements to it,

any profit may be taxable.

There are some exceptions: the sale of

your private home or business premises

will not normally be taxable under these

rules.

Example

Trent started buying and selling

residential houses in 2004. By the end

of 2004, he had established a regular

pattern of buying and selling and was a

dealer for tax purposes.

Trent co-owns Trent Rentals Ltd, a

company that buys residential rental

investment properties. In January 2006,

the company buys a rental property to

hold and rent. In December 2010, rentals

in the area are falling and the company

sells the property. Income tax would not

normally be due on the profits from the

sale, because the company bought the

property as an investment. But, because

Trent Rentals Ltd is associated with Trent,

who established himself as a dealer

before this property was bought, and it

was sold within 10 years, Trent Rentals

Ltd must pay tax on the sale regardless of

the company’s original intention to hold

the property as a rental investment.

Private homesBuying and selling your private (family)

home usually has no tax consequences.

However, some people buy a family home

intending to resell it, and they may do

this regularly as a way of earning income.

If you have a regular pattern of buying

and selling your family home, you may

have to pay income tax on your profits.

Phil Penney & his team at Superior

Construction Limited are looking

smart with their work shirts branded

up with their Company name and the

Certified Builders logo!

Thanks to Dina (Phil’s wife) and her

careful fashion decisions, the team are

looking great!

Keep up the great looks guys!

Looking Superior

29

Danny Jacobson & Trudy Marshall e2Law — Employment &

Environment Law

The following questions have arisen in

cases in which e2Law has recently been

involved:

eMPLoyee oBLIgATIoNS AFTer eMPLoyMeNT eNDS

Q: We are a small building company

operating in a very tough

environment with a lot of

competitors. Our senior foreman

has resigned from employment and

is currently working through his

notice period. He has told us he is

going to work for one of our main

competitors. We have checked his

employment agreement and there

are no restraint of trade or similar

clauses. Can we stop him contacting

our customers or competing with us

after employment ends? He is very

popular with our key customers and

they could well choose to transfer

their building business to his new

employer.

A: While your employee will continue

to have a number of obligations

to you during employment,

once employment ends there

is no legal duty or obligation

towards a previous employer. If

there are no restraint of trade

or non-solicitation clauses in his

employment agreement, then after

her employment ends he will be

able to contact your customers,

encourage them to move their

business to his new employer,

encourage other employees to

change employment, and actively

compete with you. For the future,

you may consider updating your

agreements to include restraint of

trade, non-solicitation of customers

and non-solicitation of employee

clauses. These can provide your

business with vital protection in the

event that a key employee leaves,

at least for a period of time while

you try to preserve your existing

customer relationships.

LeAVe WITHouT PAy

Q: One of our builder employees has

recently told us that he is planning an

extended 3 month holiday overseas

to visit his children in the UK and

Europe. He seems to be proceeding

on the basis that he can use up the

15 days annual leave he has owing

and he can take the balance of the

holiday as leave without pay. We are

agreeable to him taking the 15 days

annual leave but in our small business

it is simply not practical to be one

employee down for that lengthy

period and we are concerned that

this would also set a precedent for

other staff to take extended breaks.

What are our rights here?

A: An employee does not have the right

to take leave without pay whenever

he or she pleases. It is entirely up

to you whether you agree to this

extended break or not. If you advise

your employee that you do not agree

to him taking the leave without

pay, it will then be up to him to

either shorten his holiday to the 15

days annual leave, or to resign from

employment in order to take his

extended break.

PAyINg ouT HoLIDAy PAy

Q: For some years, we have followed

a practice of paying out any annual

leave owing to each employee at

the end of every financial year

regardless of whether the employee

actually takes the leave or not. This

works for us as it keeps annual

leave balances under control. One

of our admin staff has told us that

she thinks this is unlawful – is it?

A: Yes, this is

unlawful. You

cannot pay out annual

leave other than when

an employee leaves his or her

employment, or in accordance

with the 2011 amendments to the

Holidays Act, which allow for up to

one week’s annual leave to be paid

out in every entitlement year if an

employee requests and an employer

agrees. It is unlawful to include

a requirement in an employment

agreement (or otherwise) that an

employee must make a request for

leave to be paid out. A requirement

to pay out a portion of leave

cannot be a term or condition of

employment or raised in negotiations

about terms and conditions relating

to salary or wages. An employer

may have a policy that allows the

employer not to consider a request

for pay out – if so, the employee

cannot make the request.

Q&A – the law at work

29

Trudy Marshall and Danny Jacobson are Partners at Employment & Environment Law, Barristers and Solicitors, Tauranga. They operate the Employment Helpline for CBANZ members: ph 07 928 0529. They have also produced a Guide for Employers in the Construction Industry which CBANZ can send out to members on request.

(The above is by its nature general, and is not intended to be a substitute for legal advice).

30

Installing insulation and getting it right!

30

By Verney Ryan, Beacon Pathway

While the focus of Building Code changes and Government subsidy schemes has been on encouraging more insulation in both new homes and retrofitted into existing homes, there’s growing concern that poor installation is undermining the campaign.

Installing insulation incorrectly reduces its

effectiveness at stopping heat loss. BRANZ

fitted insulation to a wall panel and tested

different sized gaps in their Guarded Hot

Box1. They found that R2.8 insulation with

16mm gaps would only perform as well as

R1.4 insulation. Even 4mm gaps reduced

the R value by 12-15%.

The danger is that if installation

problems occur throughout the house,

the cumulative effect on the thermal

performance of the house may mean that

it does not meet the energy efficiency

requirements of the Building Code, even

if the correct R value materials are used.

Typical problems

An audit undertaken for EECA (the

Energy Efficiency and Conservation

Authority) of insulation installed in new

build homes provides worrying reading2.

None of the installations, in their audit

of 58 houses, met the requirements of

New Zealand Standard NZS 4246:2006

Energy Efficiency – Installing Insulation

in Residential Buildings. This Standard

provides a best practice guideline to

installing insulation in order to achieve

good thermal performance.

The audits found typical problems

affecting the home’s thermal

Tips for good insulation

• Only insulate when moisture

content of timber is less than 16%.

• Fit insulation closely to framing –

there should be no gaps around

the outer edges of the segments

and framing, or between butted

joins.

• Make sure there are no folds in the

segments themselves.

• Make sure there is no tucking.

• Insulation material should not be

compressed – it will not perform to

its best.

• Insulation materials should be dry

and undamaged.

• Leave a clear space of at least

25mm between the insulation and

roof or roof underlay.

• Leave clearances around recessed

downlights, unless they have a

CA (close abutted) rating. Better

still, don’t use downlights in your

build at all – read about Consumer

NZ tests on downlights and

heat loss to find out why (www.

consumer.org.nz/reports/recessed-

downlights).

• Leave clearances around auxiliary

control equipment, metal chimneys

and flues.

1. Cox Smith, I. (2010) SR232 Using infrared thermal imaging to audit retrofitted wall insulation in houses.

2. Symon, S. (2010) Investigating quality of installation in new build residential houses.

performance were: folds, tucks, gaps,

compressions, missing insulation, and a

lack of insulation to the middle of the

top plate.

Other issues with installation included

the lack of a 25mm gap to the underside

of the roof underlay, which has the

potential to transfer condensation

and moisture to the insulation; as well

as significant safety faults through

insulating over or around recessed

downlights and electrical equipment.

ensuring good installation

The Insulation Association of New

Zealand has been formed to encourage

better performance in the supply and

installation of residential insulation

throughout New Zealand. The

Association has developed a training

programme offering industry-specific

training in site safety and on the key

requirements of NZS 4246:2006.

To get the best quality installation for

your clients, consider using a graduate of

their training programme. You can find

the names of graduates on the IAONZ

website (www.iaonz.co.nz)

Alternatively, if you prefer to install

insulation yourself, consider undertaking

the IAONZ training programme – you

may be surprised how much you can

learn about this important aspect of the

builder’s craft.

The better the installation, the better the

return for your clients in lower power

bills, and the warmer and cosier they will

be in their new home. All part of the

quality build process.

About Beacon Pathway

Beacon Pathway is committed to the

transformation of New Zealand’s

homes and neighbourhoods, working

to make them higher performing, more

adaptable, resilient and affordable

through demonstration projects, robust

research and a collaborative approach

to creating change.

www.beaconpathway.co.nz

3131

These photographs show typical installation problems from a range of houses. Using a high quality insulation product with a high R value is important – but no matter which product you use, installation of that product is the key to good performance.

Avoid compression and slumping of the insulation – it needs to be a good even fit to work effectively.

Tucks and folds in the insulation reduce its effectiveness and mean that the money spent on insulation is wasted.

Loose fill has covered this downlight – this is a significant fire risk.

Leaving gaps between

insulation and framing

allows heat to escape – and this

can halve the effectiveness of the insulation.

The whole area should be insulated for the best possible thermal performance – gaps like this ‘bleed’ heat from the building.

Gaps between blanket insulation laid in the ceiling

will reduce the effectiveness considerably.

32

Now available to gold card members, enter this link into your address bar/URL

http://www.certified.co.nz/index.php/pi_pageid/199

and watch the first of several educational videos that we will be bringing you to make your lives easier.

The video will be no more than 10 minutes long and not full of jargon.

• The first will step you through filling out your licensing application through the qualified

streamlined process.

• The second video demonstrates the non qualified process for the site licence.

• In the third video Jason McClintock gives an overview of life with licensing, preparing

yourself for when the assessor calls and why you may wish to consider a site licence.

CBANZ will keep you informed when more ToolTube become available.

ToolTube - the CBANZ Video Channel bringing business education into your home

Licensed? Show it!Certified Builders can now supply you with a suite of LBP stickers for:

Stickers are available in black/white or green/white of the LBP logo.

LBP Stickers green/white version Black/white versionWindow stickers (150mm round) $3.50 each $3.50 each

Stamp size stickers for use on

business cards, invoices, letterheads,

envelopes etc (25mm round)

$7.50 per sheet (40 per sheet) $7.50 per sheet (40 per sheet)

Please note: LBP stickers will be supplied only to those of you who are current Licensed

Building Practitioners and this will be strictly regulated.

Special thanks to Tauranga member Blair Arrowsmith for the inspiration and ideas for the

LBP stickers.

invoices, vehicles, letterheads, envelopes, windows and business cards

What they wanted:The Reliabuilt team specified a clean and user friendly website

with major emphasis on their past projects.

Job Build: The home page was designed to draw the browser’s attention

directly to Reliabuilt’s past projects, with easy viewing without

leaving the home page.

Job Outcome:A vibrant 4-page website with a Team page to build confidence

in the browser and lots of great quality images of past projects to

sell their services and prove their experience.

In easy steps you can have youR very own 4-page website

Take a look at one of the websites we have created www.reliabuilt.co.nz

Get a Website ... and your business can be on display 24 hours a day, 7 days a week, 365 days a year!

To find out how ... Contact eve ph 0800 CerTIFIeD or email [email protected]

just $695 (+ GST)

3

easier for the public to understand and locate a

Certified builder

Improved search functions

The upgraded and revamped website reflects the new professional era. The new look and content make it clear what it means to be a Certified Builder and why the public can have confidence in our brand.

updated, modern look

reorganised to reflect the changing environment for the building industry in

New Zealand.

Have you checked out our revamped website?

35

helplines5 FREE

employmentAdvice on any employment-related issue

is available from specialist Tauranga law

firm, Employment & Environment Law.

Danny Jacobson and Trudy Marshall will

assess the employment issue and give

general guidance on the best options in

phone sessions of approx 5-10 minutes. It

is not intended as a substitute for formal

employment/legal advice. You must

identify yourself as a CBANZ member

and any information you disclose will be

treated with confidence.

Ph 07 928 0529 or 021 857 529

email [email protected]

Danny Jacobson

Trudy Marshall

For help with contracts issues contact

Peter Degerholm at Calderglen

Associates. Phone sessions are limited

to 20 minutes and written questions

must be kept brief though they

may include relevant extracts from

documents.

Peter Degerholm Ph 04 587 0061

or 021 307 232 Fax 04 587 0062

email [email protected]

Peter Degerholm

Contracts

general business, accounting or tax

Steve Brocklebank

For general business, accounting or tax

issues you can contact Steve Brocklebank

of PricewaterhouseCoopers. Phone

sessions are limited to 10 minutes at

first, and emails should be kept to the

point. You must identify yourself as a CBANZ member

and any information you disclose will be treated with

confidence.

Steve Brocklebank Ph 03 470 3615 or 027 433 6025

email [email protected]

Business-related legal issuesFor advice on business-related legal issues,

Auckland commercial law firm Madison

Hardy is offering a free service to CBANZ

members. It will only cost you the price

of the phone call. Free advice sessions are

limited to 20 minutes.

Experienced lawyer, and CBANZ director

Geoff Hardy and junior lawyer Gagan

Tangri will answer your queries, during

business hours.

Geoff Hardy Ph 09 379 0700

Gagan Tangri Ph 09 970 9567

Geoff Hardy

Gagan Tangri

web www.e2law.co.nz

Insurance

Jim Rickard

For advice on any insurance-related issue

contact Jim Rickard at CBA Insurances. If

you have your own broker they should be

your first point of contact. However, Jim

is happy to help with any claims problems

and with any general question about what

cover you should have as a builder.

Ph. 07 579 6259 or 0274 505 528

Email [email protected]

35

It’s your call!