Appendices (Parts AII to D)

-

Upload

linda-peng -

Category

Documents

-

view

227 -

download

2

description

Transcript of Appendices (Parts AII to D)

Appendix A (Part II)

Comments Received from Survey to Microfinance Clubs

What resource would you find MOST useful to your club? – Follow up to Question 13a - Guidance from both professionals from the microfinance field and perhaps a start-up kit of sorts for new organizations to get off the ground.Discussing the world of microfinance with professionals would be most helpful.I would love to have more connection with other students working in a similar way. A network to share what we are doing and learn from others would be awesome. The existing platforms aren't too great to do this on.It took our club about 2.5 years before we were working with grassroots microfinance clients in Zambia. This would not have been possible if it hadn't been for the support we got from Microfinance professionals and could have happened much quicker if we hadn't been re-inventing the wheel the whole time. Resources and collaboration are very important when starting a club and the more streamlined this can be the more scalable microfinance clubs in the U.S. can be. I feel like the biggest setback our organization has faced is our lack of direct communication with fellow collegiate microfinance programs and professionals in the field (with the exception of our advisors). It would be a tremendous asset to become a part of a consortium of like-minded clubs and professionals, effectively enabling the collegiate microfinance world to advance more rapidly and with greater unity. Rather than operating as a set of individual units we should work together to develop a model that can be used across the country.Collaboration with other student groups and microfinance institutions to determine the biggest needs and niches for student involvement would be fantastic. When trying to formulate a mission for the group it would have been very helpful to have had input from leaders in the field to determine in what areas students can have the most impact.Many of the club members at my university are interested more in learning rather than in going into the field and becoming a practitioner. Therefore, I find some academic resources to satisfy their academic curiosity very useful. Any tool that would help build the network of microfinance clubs across the US. Any tool that would help build the network between microfinance organizations/ practitioners and microfinance clubs.Currently we are focusing on microfinance projects abroad, however once we are established and have more funds we may work on more local projects.A start-up kit for new microfinance clubs-- or just a start-up kit for any club. Our club focuses heavily on fundraising by obtaining grants and donations from businesses, and a guide to help get us started on this would be very useful.As a lending and savings institution, we would greatly benefit from assistance in keeping our books consistently up to date.Our focus was a bit different, at least when I was heading the group. We focused on investment in microfinance, not exactly working directly with microentrepreneurs or fundraising.

Having a start-up kit for new clubs would be FANTASTIC. Right now, we know what we want, its just hard to find all of the information all in one place.

Also, when we asked about lending guidelines and how exactly ACCION USA works w/ the club we received an answer that was a little unclear. We would like to see the lending guidelines in hard copy and perhaps hear from another club what their experiences have been like so far lending w/ ACCION USA. Receiving clear examples of

1 How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

how they set up their guarantee fund and how they work w/ ACCION to lend to small businesses. That way we have a strong foundation to start from and can start our own path. (Right now we are a little unstable and unsure how we should continue forward w/ the guarantee fund etc.)

Speaking w/ other clubs would be great too. That way we can ask each other how we organized certain club aspects and bounce ideas off of each other.Guidance on measuring club impact and e-learning course about the credit system in the U.S.Networking opportunities. the ability to easily communicate with other professionals from the micro-finance field to help assess where the greatest need for assistance isGuidance on measuring club impactGreater publicity on our campus would be helpful.In our first two years, we loved being able to reach out to other like-minded student groups and school departments. Definitely was the most helpful resource.

How did you become interested in microfinance? - Other Comments -Heard about it from a friendHeard Muhammad Yunus speakStudy abroad I found out about it while in NicaraguaRead about it in economic development books and on the internet high school debate topicHeard Muhammad Yunus speakResearching MF on the web for a scholars program applicationWhile trying to answer the question of "what can a student in the U.S. do about the south-north clandestine migration in to the U.S. on account of severe economic disparities?" In a Church newsletterThrough taking MFTOTStudied it in UndergradWorked in shelters and saw a local needNicholas Kristoff

What motivated you to join your student microfinance organization? - Other Comments -

Interest in applying class learning to real life

What are the main focuses of your student microfinance club? - Other Comments - Investment in microfinanceTraining to operate ROSCA groups and ASCA groups in rural ZambiaConsulting microentrepreneurs with marketing and researchTraveling abroad to volunteer in the microfinance industryProviding students with "socially responsible" international business experience

2 How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Free consulting services to NGOsOffering savings accounts to local low-income communities

What have been your primary duties as a club member? - Other Comments - Planning service trips for Africa, planning training sessions for students, project management for 3 project teamsCoordinating volunteersOrganizing speakers (who work in the field of mi8crofinance and other kinds of economic development) to come to Princeton and talk about their workHosting events, such as speakers on campusDrafting legal corporate documents Planning trip abroadMF Club was just founded in Spring 2010 - have not conducted any business through the organization. Currently working with advisor, professors & students to get club runningLeading group preparing for presentations on investment in microfinanceWent to Uganda to work w/ an MFI. Developed entrepreneurship curriculum for us in Uganda. Translating documents into SpanishDeveloping Educational ProgramsCommunication with microfinance organizationsCreating implementation plans and researchMicrofinance education session planning

What experiences or opportunities have you hoped to gain from being involved with a microfinance club on campus? – Optional Elaboration and Comments on “What continues to attract you to microfinance?” My focus was predominately on sustainable economic development through international microfinance.Empowerment of some of the most capable workers who did not have equal opportunities beforeThe impact that microfinance has on the developing world.Microfinance is such a young, and rapidly growing industry that I feel, and others I know feel, like I can actually take part in its development.In both 2009 and 2010 teams of 6 students trained Zambian Villagers in the use and operation of VSLA Organizations. There are currently 4 ASCA Groups and 2 ROSCA Groups operating in Zambia as a result of these visits. We are in the planning stages of 2011 trips to Zambia and Burkina Faso for the same purpose. Our group's main focus is on working internationally to facilitate the beginning of savings and credit associations with developing countries. Currently, we have started 4 SCAs in Zambia and are actively looking at working in other countries as well to expand this project. We do not bring any outside capital into the associations, but rather teach and facilitate decision-making for the local people as they use their own capital to start the associations. It is a very holistic and self-sustainable program. Through this experience, the group has been able to meet with many MFIs and work with other practitioners to learn and grow in our best practices.I love to see people be empowered.The potential of the concept because it is a new concept and there has been many academic studies on it. My main attraction to microfinance is that is has the prospect to be sustainable poverty alleviation. Probably of the highest importance to me personally is an international context of microfinance. I am interested in the economies of developing countries and the way that microfinance can serve as a tool to stimulate growth in the poorest communities.

3 How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

I want to eventually work in the field of economic development, and I believe that microfinance, along with other forms of social entrepreneurship, is creating real results in the lives of the poor.We really focused on the investment side of things.Wanted to see microfinance in action. The first semester I was in the club we did a lot of research with ACCION International. The next semester, our group wanted to see if we could bring that idea of small lending and business development to our local community.

Develop an awareness of the issues and challenges in the field of microfinance.What drives me to continue exploring this field is to understand whether this model works in other areas with lower population density - ex. Ghana. I went to Ghana to implement a microfinance model and still skeptical about the sustainability of microfinance there due to high operational costs. The wealth of opportunities as well as curiosity in how this economic downturn has impacted it's effectiveness. As a campus kiva chapter, we focus on international MF development, directly through our school club's loans through kiva and with campus education and awareness.

Appendix B: See Attachment (Excel)

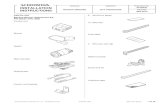

Appendix C: Student Microfinance Organization Master ListKeyGreen background: new organizationBlue background: highly dedicated facultyRed background: founders have stayed within the organization and/or hired full-time staffOrange background: primarily graduate school students

A. Interviewed Student Microfinance Organizations

Organization & University Affiliation

Geographic Focus Lending One-on-one Consulting

Business Training Workshops

Full-Time Staff

Events On Campus

Earned Income (not fundraising)

BR Microcapital (Cornell Business School)

Johnston County, NY

Yes Yes No No Yes No

Cambridge Microfinance Initiative (Harvard)

Boston, MA No Yes Yes No Yes No

4 How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Organization & University Affiliation

Geographic Focus Lending One-on-one Consulting

Business Training Workshops

Full-Time Staff

Events On Campus

Earned Income (not fundraising)

Capital Good Fund (Brown)

Providence, RI

Yes Yes Yes Founders and Americorps staff

Yes Yes – $25 business training class entrance fee

Community Empowerment Fund (UNC)

Chapel Hill and Durham, NC

Yes Yes Yes Founders Yes (fundraising)

No

CHOMI (Centerfor HolisticMicrocreditInitiatives),StetsonUniversity

Spring Hill, FL

Yes No Yes Yes – faculty

Yes – two faculty advisors

No

Elmseed Fund (Yale)

New Haven, CT

Yes Yes Yes No Yes Yes - $30 initial membership fee

Elon Microfinance Initiative (Elon)

Everywhere No No No No Potentially

No

GLOBE (St. John’s University)

International Yes – Daughters of Charity (MFO)

No No Yes – faculty

Yes No

La Ceiba (College of William and Mary and University of Mary Washington)

Honduras Yes Yes Yes Faculty Yes No

MicrOlin (Washington University in St. Louis)

Everywhere Yes – Kiva

No No No Yes No

Notre Dame Microfinance Club

South Bend, IN

Eventually

No Yes Faculty Yes No

SEED (University of Virginia)

Everywhere No Yes NGO Consulting

No Yes No

5 How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Organization & University Affiliation

Geographic Focus Lending One-on-one Consulting

Business Training Workshops

Full-Time Staff

Events On Campus

Earned Income (not fundraising)

The Intersect Fund (Rutgers)

New Jersey Yes Yes Yes Yes – founders and hired staff

Yes Yes – different post-graduation services

B. Other Interviewed SourcesOrganization Individual(s) Description

MBA Program Professor Skeptical of undergraduate savvy with business and capacity for completing quality consulting projects

Small business (Grocery Store)

Manager Gave input on how students could help small businesses and non-profits the most. “Volunteering to create the flyers and use Google maps to sketch out a flyering route” => often more useful than writing a business plan or creating marketing plans that talk about the need to flyer

UC San Diego School of Business

Alumnus 1 Input on business plan writing and value of business degree

UC San Diego School of Business

Alumnus 2 MBA grad with interest in microfinance

Campus Kiva* Campus Kiva Interns Campus Kiva has over 50 university groups lending on KIVA. We are in talks to put a blurb about ACCION USA’s student partnership program on the Campus Kiva website (under “Partners”).

Gumball Capital* Current President The Gumball Challenge teaches students entrepreneurship by challenging them to invent creative ways to fundraise for microfinance organizations. Students entering the one-week challenge are given small microloans.

Two-Dollar Challenge* Founder Dr. Sean Humphrey is also the faculty advisor of La Ceiba at the University of Mary Washington.

Catchafire.org* CEO/Founder Volunteer-non-profit connection site for professionals founded by a former Goldman Sachs investment banker. Piloted in 2010; currently open to only non-profits in the NY region. ACCION USA can benefit from volunteer professionals with real expertise in logo design, publicity campaigns, and creating marketing plans.

6 How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

MoreMarbles.com* CEO/Founder Founded by recent MBA grad and former staff member at Opportunity Fund. MoreMarbles connects university consulting teams (with a faculty advisor) to small businesses or non-profits. Projects typically last a semester, and small businesses or non-profits pay $500 minimum to connect to the students.

ACCION Chicago Interviewed staff member about meeting with University of Chicago undergraduates who wanted to volunteer to do some field work with ACCION Chicago

* Potential partner organizations for ACCION USA’s Student Program

C. Other Student Organizations Organization & University Affiliation

Geographic Focus

Lending One-on-one Consulting

Business Training Workshops

Full-Time Staff

Events On Campus

Earned Income (not fundraising)

Bentley College Waltham, MA

Yes Yes Not Sure Faculty Advisor

Not Sure No

Boston College Bolivia, Nicaragua

No No No Faculty Advisor

Not Sure Not Sure

Bucknell University

Everywhere Yes - Kiva

No No No Yes No

Carleton College Everywhere Yes – Kiva

No No No Yes No

Carolina Microfinance Initiative (UNC)

Not Sure Not Sure Not Sure Not Sure Not Sure Yes Not Sure

Chapman University

Honduras, Panama

Global Microfinance Brigades

Not Sure No No Yes No

Chapman University

Everywhere Yes – Kiva

No No No Yes No

Columbia University

Honduras, Panama

Global Microfinance Brigades

No No No Yes No

Microfinance Working Group (Columbia University)

N/A No No No No Yes No

Davidson College

Everywhere Yes – Kiva

No No No Yes No

Duke University India, Yes – Yes No No Yes No

7 How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Organization & University Affiliation

Geographic Focus

Lending One-on-one Consulting

Business Training Workshops

Full-Time Staff

Events On Campus

Earned Income (not fundraising)

Uganda Partnership with Ugandan and Indian MFOs

Eastern University (Note: inactive)

N/A No No No No Yes – Conference

No

Goizeta Microfinance Club and Fund (Emory Business School)

Bolivia Yes – IMPRO (MFO)

No No No Yes No

Students 4 Sustainability (George Washington University)

Guatemala No No No No Yes Social Business – selling international microentrepreneur goods

Hamilton College

Utica, NY Yes – ACCESS Federal Credit Union acts as an advisor

Not Sure Not Sure Yes – faculty

Not Sure Not Sure

Haverford Microfinance Consulting Club (Haverford College)

Mexico, Local Community

Not Sure Yes Not Sure No Yes Not Sure

Trockman Microfinance Initiative (Indiana University)

Everywhere; interest in local MFIs

Yes – Kiva

No No No Yes Social Business – distributing international microentrepreneur goods

Lehigh Microfinance Club

Everywhere Yes – Kiva

Yes No No Yes – Expo for local businesses and Conference

Social Business – selling handmade gifts from Ten Thousand Villages

8 How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Organization & University Affiliation

Geographic Focus

Lending One-on-one Consulting

Business Training Workshops

Full-Time Staff

Events On Campus

Earned Income (not fundraising)

Macalester Development Group (Macalester College)

Everywhere Not Sure No No No Yes – speakers

No

Messiah College Zambia Yes Yes No No Yes NoMicrochange (Cornell)

Peru Yes – Kiva

No No No Yes No

NYU Microfinance Initiative (NYU Stern Business School)

Everywhere No No No No Yes – Microfinance simulcast and events

No

OWU Student Initiative for International Development (Ohio Wesleyan University)

Everywhere (also has good relationship with nearby town)

Yes – Kiva

No No No Yes No

Owl Microfinance (Rice University)

Everywhere Yes – Kiva, Wokai, Hashoo Foundation

No No No Yes – Mr. Asia competition fundraiser

No

Point Loma Nazarene University

Everywhere Yes – Kiva

No No No Yes No

Princeton University Microfinance Club

Everywhere Not Sure No No No Yes No

Seattle Pacific University

Everywhere Not Sure No No No Yes – Conference

No

Soka University of America

Everywhere No No No No Yes - club members interested in academics

No

Southern New Hampshire

Everywhere N/A N/A N/A N/A N/A N/A

9 How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Organization & University Affiliation

Geographic Focus

Lending One-on-one Consulting

Business Training Workshops

Full-Time Staff

Events On Campus

Earned Income (not fundraising)

Microenterprise Development InstituteSpartan Global Development Fund (Michigan State University)

Everywhere Yes – Kiva

No No No Yes No

Streetbank (Georgetown)

D.C. or elsewhere (unsure)

Yes Yes No No Yes No

Tufts International Yes No No No Not Sure Not SureUC Berkeley Microfinance Simulcast

Everywhere N/A N/A N/A Dr. Sean Foote

Yes N/A

USD Microfinance Club (UC San Diego)

Everywhere Yes Not Sure Not Sure Not Sure Not Sure Not Sure

UC Santa Cruz Honduras and Panama

Microfinance Brigades

No No No Yes No

University of Chicago

Everywhere Yes – Kiva

Not Sure Not Sure No Yes Not Sure

Microfinance Initiative at the University of Houston

Everywhere Not Sure Not Sure Not Sure No Yes No

University of Illinois at Urbana-Champaign

Honduras and Panama

Microfinance Brigades

No No No Yes No

University of Minnesota

Everywhere Not Sure No No No Yes – host speakers

No

Maple Microdevelopment (University of Oregon)

Uganda, Guatemala

No Yes Yes No No No

University of Pennsylvania

Everywhere Yes – lending

Potentially

Potentially No Yes – 4th Annual Conference just completed

No

University of Wisconsin-

Not Sure Not Sure Not Sure Not Sure Not Sure Yes - speakers

Not Sure

10How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Organization & University Affiliation

Geographic Focus

Lending One-on-one Consulting

Business Training Workshops

Full-Time Staff

Events On Campus

Earned Income (not fundraising)

MadisonVanderbilt University

Kyrgyzstan Yes Yes – writing business plans

No No Yes - speakers

No

General Development Initiative (Washington and Lee University)

Everywhere Yes – Develo.org

No No Yes – faculty

Yes No

Wesleyan Not Sure Not Sure Not Sure Not Sure Not Sure Not Sure Not SureGlobal Youth Connection (Wooster College)

Yes

A Drop in the Ocean (Harvard University)

International No Yes No No Not Sure No

11How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Appendix D: Microfinance USA 2010 Conference Noteswww.microfinanceusa2010.orgMay 2010Attendee: Linda Peng, Duke UniversitySummary report from the field

Main Revelations

(1) Student microfinance clubs in the U.S. are currently at very different starting points, have different mission statements, and are involved in a wide spectrum of activities. 1

The guide/wiki I work on this summer must take into account the fact that student microfinance clubs do not have homogenous mission statements. A good guide would incorporate the many different options for students to make an impact, the many challenges they might encounter pursing that impact, and the starting steps for introducing that specific programmatic component to their clubs. In short, this wiki/guide must serve as a good resource for both emerging clubs and clubs that want to “do more.”

(2) Outside the sphere of microfinance clubs, there are an increasing number of undergraduate and graduate students engaged in free consulting services for non-profits and small businesses (which are often social enterprises that feed revenue back into the non-profit). Therefore, in addition to surveying student groups that call themselves “microfinance clubs,” I must also survey students involved in community outreach projects in general – since the services they are providing to local clients (e.g. training workshops, offering technical assistance, writing up business plans, etc.) are very similar to what many emerging microfinance clubs hope to do.

Therefore, in summary, I propose two surveys: One survey targeted at student MICROFINANCE CLUB LEADERS

(presidents, treasurers). The results of this survey will help us better understand how

ACCION USA can form a partnership with established, “true” student microfinance organizations

One survey targeted at ANY STUDENT who has been involved in non-profit or business-oriented outreach work in their local communities

The results of the second survey will help us better understand how students can or have produced substantive volunteer work with residents in their local communities. We can stand to learn a lot from the processes and organizational formats of

1 For example: The most traditional idea of a club – a student-run organization that trains and lends to microentrepreneurs – is embodied in the Yale Elmseed Fund, and also happens to be the oldest student microfinance organization in the field. Meanwhile, the Intersect Fund at Rutgers utilizes student volunteers as part of its staff, but is run by two full-time founders. The group at Notre Dame is being managed by a full-time professor who runs a program that does not let students lend to microentrepreneurs, but nevertheless gets them heavily engaged with microentrepreneurs in South Bend, Indiana. The Capital Good Fund at Brown University has started a “citizen loans” program to help immigrants pay for the cost of citizenship tests and fees. The founders of the microfinance club at Claremont McKenna decided (in the aftermath of the conference) against using their $5k seed funding as loans, and to invest it instead in a good microentrepreneur training program organized by Claremont McKenna students. 12How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

undergraduate consulting clubs and MBA clubs that do training work similar to what student microfinance organizations hope to achieve2.

(3) Microfinance is not just about loans. It is about incentivizing low-income families to save more; it is about providing micro-insurance, matching savings grants, raising awareness about it in the field, financial literacy, and providing training or technical services to entrepreneurs. This means that student microfinance clubs do not necessarily have to lend to be an effective microfinance club. There are lots of ways clubs can get involved.

(4) In the professional field, there is no standardized training regimen used by microfinance organizations to aid microentrepreneurs. I wonder if in my wiki/guide, I can at least try to hit upon descriptions of all the components that are necessary in a good client training program.

(5) There is no point for me to visit a campus unless there’s a program or other activity (e.g. training class, entrepreneur showcase, etc.) that I will only have the opportunity to observe on location.

(6) A number of people have already caught on to the idea of utilizing university students for community projects. www.moremarbles.com connects businesses and non-profits with business students, charges the businesses/non-profits a fee, and pays the students and/or professor. Revenues vary from $500 to $4000. www.americanopportunities.org, a new non-profit, is seeking to “leverage the skills and education of undergraduates and graduates at America’s best universities” by recruiting students as business consultants or associates in AO’s plan to serve emerging microentrepreneurs.

The Metreon terrace – outside a panel room Buena Yerba Gardens in SF

2 Upon reflection, I realize that various student microfinance clubs are already utilizing MBA students or very quickly crossing the line into consulting. The Duke Microfinance Leadership Initiative’s FLIP IT program hosts rapid-fire consulting sessions with non-profits in the Triangle area, not just small business owners. Duke and The Intersect Fund at Rutgers both have MBA student volunteers amongst their staff. 13How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Attendee Snapshots

Met a finance major from the National University in Singapore who was doing a semester-long internship with an investment company near San Francisco. She is a rising junior and is working with some of her friends to launch a youth-to-youth microloan program. Her experiences growing up in Malaysia convinced her that there are a lot of children in Southeast Asia who would be able to benefit from microloans that would give them the opportunity to afford a primary or secondary education. Her current challenge is in finding a trusted partner organization that would be able to work with the children in the field and make sure that the loans are being used for their intended purposes.

Also met a recent ’08 graduate from a UC school, who had worked to raise some money after graduation so that she that she could work with a microfinance organization in Tanzania for six months. She plans to attend the Peace Corps in the fall and work in French-speaking Senegal.

Ran into the Executive Director of the Foundation for Women (focus: providing microcredit for women in developing countries) many times throughout the conference. She is a highly engaging speaker and is promoting a new coffee brand that would serve as a revenue generator for the Foundation for Women. MBA students from UC San Diego are working with her non-profit to work on the launch of this social enterprise. I followed up with her via e-mail and hopefully will be able to talk to the MBA students (or at least ask them to fill out my survey) in July.

Talked to a fundraising officer from an opportunity fund for women in the Bay area. 11-week classes are taught for $100; classes are held in both Spanish and English; approximately 80 classes are taught per year; classes are taught by professionals with experience owning a business.

Talked to a Stanford student who had heard about the conference from a professor who was teaching a course on microfinance. Her entire class was there on Thursday!

Met a UC Berkeley international student from China. We discussed the need for microcredit to poor people in China, and how difficult it was for microfinance organizations to get a head start in China because of the strict regulatory environment on any type of financial institution there. He was not an active member of his microfinance club at Berkeley, but he had volunteered with the Opportunity Fund since freshman year. He also mentioned how he had a lot of friends (presumably undergraduate) who were actively involved in offering consulting services to non-profits. He also mentioned a program at Berkeley called Decal, where students can teach their own courses on any topic (think: House Courses at Duke). A microfinance course was taught this spring. I plan to follow up with this student via e-mail.

Was introduced to the Wooster College students who had won the twitter competition from ACCION USA. Two were recent graduates and one was in my year. They had started their own microfinance organization called Global Youth Connection, a youth-to-youth peer lending network. They won a business competition at Wooster with this idea and have ambitious plans to launch it forward as a student-led non-profit.

Talked to two club founders from Claremont McKenna College. They had just started a microfinance club at their school this year, and were broadcasting the simulcast class on microfinance started by a UC Berkeley professor in the fall. They had received a $5k grant to launch their organization. Initially they were thinking of providing microloans to their local community, but after the panel decided that their efforts would be better served offering some type of consulting or financial training classes to small business

14How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

owners. They are still in the phase of looking for a faculty mentor for the club and developing a game plan for launching the club successfully in the fall.

Ended up sitting next to the VP of Programs at the Opportunity Fund during dinner. Ran over the student-collaboration idea to him and he said that he had some reservations about how exactly a good partnership with students would work. We need to make sure that there is value added to the students, to the clients, and to the microfinance organization (which might initially incur a lot of costs vetting and training the students).

Met the founder of a non-profit in Florida who is helping migrant field workers lift themselves out of poverty through business-starting microloans. He is originally from Brooklyn, and shared parts of his life story with me about working in the non-profit world. Joked about how he did the Fidel Castro method in life – that is, before commanding anyone to do anything, he made sure that he taught himself exactly how to do it first.

Talked to two young women who volunteer for the Microfinance Council and work at the New York Federal Reserve. Both work in public policy and hold graduate degrees.

Met the founder of a microfinance organization that exclusively served disabled persons in Washington State.

Talked to a senior business strategy & operations manager at the Cisco Entrepreneur Institute. Her team is working on an open source customizable learning management system to help MFOs train microentrepeneurs. I have her e-mail and may follow up with her to figure out if this system (~$100 per head; discount if bought in bulk?) can be utilized by student groups that want to provide professional value to their clients.

15How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Day 1 - Thursday, March 20th – Notes from Each Panel

Opening Session: Conversation with Maria Shriver- Recent trend: people leaving corporate America to start their own small businesses to

free up time to raise a child or care for an elder- Challenges that microentrepreneurs have faced: navigating local government permits

and fees; language barriers- More people might now be aware of microfinance, but not many are aware that

microfinance is prevalent in the United States- Right now, a lot of attention is being focused on “green” initiatives- Martin Eakes talked about Self Help’s beginnings and his inspirations. He demonstrated

the importance of a good economy by telling a sad story about a woman whose baby died because she had just lost her job, didn’t have adequate savings, and decided not to take her child to the hospital when he fell ill.

A Living History: Past, Present and Future- Marco Lucioni: “I see the credit crisis as a hurricane.”- What Peer-to-Peer lending (see Kiva’s model) does is replace the traditional need for

collateral. - In the wake of the recent economic crisis, the community banks that didn’t go down

knew their clients. They stayed in touch with them and knew how their businesses were going and knew when to step in to help their customers.

- ACCION USA does not have the capacity to help everyone in all 50 states. Partnering with other organizations is the key to reaching out. – Gina Harman, ACCION USA

Personal Note: To extend the analogy: microfinance organizations are not present in every neighborhood, but lots of neighborhoods have universities or colleges. A student microfinance organization, even without the resources to capably train microentrepreneurs, can at least spread awareness about the resources available for aspiring small business owners to people in their communities.

- “Trust everybody, but monitor like crazy” – Julia Vindasius’ advice on how to ensure high loan repayment rates

- Microfinance is not about the loan. The loan is only a hook. MFOs, more importantly, provide a human network for microentrepreneurs to plug into and to gain invaluable access to information they otherwise never would have had. So MFOs, in a way, are community organizers.

- As a result of the early pioneers of microfinance, national policy is becoming increasingly favorable to microfinance in the U.S.

- Eric Weaver: “Be jealous of the brand.” There was a lot of skepticism about KIVA when it was first launched, and controversy when it decided to open up its operations to clients in the U.S. (people thought microfinance was only for developing countries). KIVA proved to be successful, but Eric Weaver warned that MFOs should take a close look against newcomer payday lender type institutions that claim to be MFIs.

- Confianza (led by Marco Lucioni) is a for-profit MFI!

Microentrepreneurship Bus Tour in San Francisco- Diju Jewlry – Diana Medina

16How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Diana Medina designs and sells her own jewelry. Her workshop is in the back of the store.

She received a $2000 microloan from Women’s Initiative. The loan helped her improve her credit and better position her to apply for new loans. Women’s Imitative also provided a lease grant that covered the first two months of rental of her new store space.

- The Curiosity Shoppe – Lauren Smith and Derek Fagerstrom Lauren Smith and Derek Fagerstrom used to run the Curiosity Shoppe online

(which sells and vintage and quirky items) before they decided they wanted to open up a physical store. After 8 years working in the design and publishing industry in NYC, the couple moved to the Bay area. The street they settled on was profiled for its charm by the New York Times.

Smith and Fagerstrom faced many rejections from conventional local and national banks because they didn’t have three years of financials for the business they wanted to open. They finally found Working Solutions, which gave them the loan and is continuing to offer them account management/financial advising. They enjoy being part of the Working Solutions’ client community network.

Growing Microlending in a Challenging Economy- ACCION New Mexico expanded to two other states because they needed to achieve

scale to solve their inefficiency problems. Because they weren’t finding enough clients in 17How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

New Mexico, the cost of servicing a $500 loan for a rural client was far greater than what the actual loan amounted to, sometimes. They expanded to reach a larger market.

- Other approaches to ride out the economy: finding home-based team members who could help lend to clients that were geographically out of reach from the office; using donated office space provided by partner organizations; created an endowment for investments; issued more loans per team member

- JustinePetersen (based in St. Louis), founded in 1997, decided that their goal was to graduate clients to mainstream financing. Their sole mission was to elevate the credit scores of their clients through loans, and offered an interesting plan (which involved taking out 3 lines of credit) to accomplish this goal. They’ve had clients jump from a 0 to a 620 credit score after one year. JPetersen is a member of the Credit Builders’ Alliance.

Rise of P2P Lending- You can earn 2-6% interest from loans you invest at microplace.com! AND you can take

your money out whenever you want to. No other investment gives you so much freedom. Microplace is heavily regulated in the U.S. and you can ONLY invest in it if you are in the U.S.

- The Lending Club, similarly, has a 9.64% return on investment. - According to the CFO of Microplace, even advisors who specialize in socially

responsible investments don’t completely understand how the regulations work for microfinance.

- KIVA does not offer returns to lenders for a reason. (It wants to maintain its non-profit status.)

- A Global Youth Connection founder asked about competition in the marketplace from other peer-to-peer lending websites. KIVA, Microplace, and Lending Club all said “bring it on,” since there is a huge untapped market of investors for their programs.

- The CFO of Microplace believes that impact measurement is virtually impossible and a huge waste of time. What CAN be evaluated is whether the MFI is doing enough outreach to its toughest commitments; whether it is generating a profit; whether it is offering education/savings/other services that are beneficial to its clients.

- Lending Club measures impact by checking the credit history of its clients throughout the lifetime of the loan and by relying on anecdotal client stories about how the loans have impacted their lives.

18How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Day 2 – Friday, May 21st – Notes from Each Panel

Opening Remarks: Gavin Newsom, Mayor of San Francisco

- “Politicians must not just be against [ ], but provide for a positive alternative.”

- Bank on San Francisco’s stretch goal of 10,000 families was reached within one year, with over 20,000 families signed on to the program.

- San Francisco is developing a policy that will give every child that enters into a San Franciscan public school an education savings fund for college. Research has shown that children who have education accounts opened for them are more likely to go to college.

- One speaker pointed out biases against the poor: “Why is it that financial incentives for the upper income population are called policy whereas financial incentives for the lower income population are called subsidies?”

- Microfinance is not the only solution to poverty, but it is one solution- The Schedule C on the IRS is one of the most important financial documents because it

qualifies self-employed individuals for federal earned income tax credit. - There are currently 4.4 million self-employed households in the United States. - 78 million people in the U.S. do not have 401K savings accounts. - For low-income populations, actively saving is an inherently entrepreneurial endeavor

because it is risky for them to allocate savings to a restricted account. - Savings may be more important than credit.

19How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Student-led Microfinance Clubs

Melissa Paulsen – professor of social entrepreneurship at Notre Dame

Designed a two-semester long class that connects students with entrepreneurs in the community. The first class is a very theoretical introduction to microfinance; the second class gets the students out in the field.

Partnered with the Student International Business Council at Notre Dame Has served over 40 microentrepreneurs over the past few years Hosts workshops for the community Prepackages loans for ACCION USA?? Encourages students to engage in “zip code marketing” – or wander around in

the community Melissa: It does not cost much for students to provide technical assistance to

microentrepreneurs. Students have the ability to tap into market research, databases, and – under the label of “student researcher” – obtain information that professors may not be in a position to get.

To track meetings with clients, students fill out a: Pre-questionnaire Midterm Post-evaluation

Students sign a confidentiality agreement before they start providing technical assistance to small business owners

At the end of the class, students may apply for an award to grant their partner money for their business. For example, students may petition to give their client a sign for their shop, which typically costs $2k - $3k – money which the small business owner might not have.

Challenges Has started to realize that many of the microentrepreneurs need access

to legal expertise, which her undergrads cannot provide. Is working on getting law students at Notre Dame to sign up as volunteers.

Paloma Pineda – officer at Elmseed Enterprise, Yale ‘12 501©3 organization, completely student run 9.5% default in the past 9 years – 21 total loans Students at Yale apply to be Elmseed staff. The process is competitive: Typically

only 20% of applicants are accepted. New staff go through a training course taught by older members. 3 components of Elmseed’s program:

Consulting - 2 student consultants work with every client Business training for clients – student-taught course takes 6 weeks Lending

20How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Elmseed receives funding from corporate sponsors, wealthy individuals, and foundations

Clients are discovered through small business development organizations that either do not offer loans, or offer loans at minimum levels that exceed the need of the entrepreneur. New clients are also discovered through word-of-mouth recommendations from previous clients.

Elmseed also hosts an annual SEED Conference that showcases their clients; this event is advertised heavily.

Challenges The age difference. Because it is often hard for experienced

entrepreneurs to take suggestions from students who start off with almost no knowledge about their clients’ industries, students must be sure to maintain their professionalism and explain each of the assumptions that form the basis of their recommendations.

Institutional memory is another challenge. With students constantly graduating, it’s tough to manage records and partnerships that only last at best for two years.

Time. Paloma cited the Intersect Fund as its biggest critic because whereas Elmseed is completely student-run, the Intersect Fund with its two full-time staff members has been able to take it to the next level.

Rohan Mathew – co-founder of The Intersect Fund in New Jersey, Rutgers ‘09 501c3 with 2.5 full-time staff Member of the Credit Builders Alliance Loan applicants typically hear back about their status within 7 days The Intersect Fund typically gets 2-3 calls per day from people looking for loans 1/8 students who apply to volunteer end up on staff Corporate donations are easiest to get The Intersect Fund was launched with seed funding of $5k 40% of clients come from word-of-mouth recommendations from previous clients;

30% come from community organization recommendations such as churches; the Intersect Fund also markets itself by sending postcards to new small businesses within 20 miles of Rutgers

Rohan: The default rate has been 0%. However, the loans are very risky. The underwriting process consists of three questions: 1) Does the client need the

loan? 2) Can the client afford the loan? 3) Can the client realistically be able to repay the loan?

Challenges How do you assess the credit worthiness of your clients? Legal issues with lending

21How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?

Alex Dang – Director of Global Brigades, founder of Global Microfinance Brigades, UCLA ‘08

Global Brigades is comprised of student chapters at hundreds of universities that raise their own money to send students to do service-related work in Panama or Honduras for 7-10 days during the summer

A quick search on their website revealed http://globalbrigades.wikidot.com, a wiki guide/resource for global brigade clubs. The site includes samples of constitutions, excel sheets of sample fundraising organizers, etc.

One consideration: Would ACCION USA want to partner with groups that are already established, or its own “brigade” of new student groups? Global Brigades has a comprehensive step-by-step guide of what students should do to start up their own club on campus, fundraise, buy tickets, etc. Can ACCION USA afford to convince students to start up ACCION USA chapters, or should it simply introduce a program to partner with already established student clubs (Personally, I’m tempted to lean towards the latter.)

Global Brigades International has its own chapters: Global Law Brigades, Global Business Brigades, Global Medical Brigades (which has a chapter at Duke!), Global Microfinance Brigades, etc.

Alex: not too many students know about domestic MF. There could be a lot of awareness raising in this arena.

22How can Students Help Scale U.S. Microfinance through Partnerships with MDOs like ACCION USA?