APITAL Financing and Investment Models in Industrial C ... · biotechnology in the past...

Transcript of APITAL Financing and Investment Models in Industrial C ... · biotechnology in the past...

FESTELCreating a Better

Future

APITALC

0 © 2010 FESTEL CAPITAL www.festel.com

Financing and Investment Models in Industrial

Biotechnology

Research Methodology and Results for Discussion

© 2010 FESTEL CAPITAL www.festel.com

FESTELCreating a Better

Future

APITALCOECD Workshop on the Outlook on

Industrial Biotechnology Vienna, January 14, 2010

FESTELCreating a Better

Future

APITALC

1 © 2010 FESTEL CAPITAL www.festel.com

Copyright and Disclaimer

Copyright

• All rights for the use of all or parts of the information in this document, including reprinting

the whole document or parts thereof, the storage in databanks and translations remain with

FESTEL CAPITAL

• Individual charts can be reproduced stating FESTEL CAPITAL as source; please contact

FESTEL CAPITAL, should you wish to reproduce larger parts of this document

Disclaimer

• FESTEL CAPITAL has prepared this document to the best of FESTEL CAPITAL„s know-

ledge and belief based on all available information

• FESTEL CAPITAL takes no warranty for the accuracy and completeness of this information

• Before deducting individual conclusions, it is necessary to obtain additional data and

conduct further analyses

• Therefore, all liability for costs or damage resulting from information and conclusions in this

document is excluded

FESTELCreating a Better

Future

APITALC

2 © 2010 FESTEL CAPITAL www.festel.com

Contents

Research Methodology 2

Conclusion and Outlook 4

Goals and Objectives 1

Research Results 3

Drivers/Barriers 3.1

Financing Trends 3.2

Capital Needs 3.3

Market Failures 3.5

Capital Sources 3.4

FESTELCreating a Better

Future

APITALC

3 © 2010 FESTEL CAPITAL www.festel.com

The paper gives an overview of current financing and investment models in industrial biotechnology

• Which characteristics of the industrial biotechnology sector make it an attractive sector for

investors and which discourage investment?

• What are the main drivers and barriers for investments in industrial biotechnology?

• What is the impact of the current financial crisis on the availability of capital and the

investments made?

• What are emerging trends in industrial biotechnology financing and investment area?

• What are the capital requirements for R&D and infrastructure as well as non-classical

financial sources?

• What are industrial biotechnology specific market failures and the consequences?

• Which indicators can be used for measuring trends in financing and investment?

• What is the availability and accuracy, and level of comparability of data related to industrial

biotechnology financing across OECD countries?

Goals and Objectives - Aspects

FESTELCreating a Better

Future

APITALC

4 © 2010 FESTEL CAPITAL www.festel.com

Contents

Research Methodology 2

Conclusion and Outlook 4

Goals and Objectives 1

Research Results 3

Drivers/Barriers 3.1

Financing Trends 3.2

Capital Needs 3.3

Market Failures 3.5

Capital Sources 3.4

FESTELCreating a Better

Future

APITALC

5 © 2010 FESTEL CAPITAL www.festel.com

FESTEL CAPITAL data base Data sources

Additional desk research in October and November 2009 was performed using

typical key words to find relevant information

• Interviews with industrial

companies, research institutions

and investors

• Desk research (company

information, external market

studies, press clippings)

• Open discussions with key

market players

• Excel calculation model with data

between 2003 and 2009

- Sales per segment/sub-

segment

- Capital requirements for R&D

and infrastructure

A structured research approach using the existing FESTEL CAPITAL data base was used to prepare the paper for further discussion

Research Methodology - Approach

Innovations in industrial biotechnology as focus topic of the

Working Group Start-ups within the Chair of Technology and

Innovation Management (Prof. Dr. Roman Boutellier)

Pap

er(s

)

Five market studies with with focus

on special industrial biotech areas

FESTELCreating a Better

Future

APITALC

6 © 2010 FESTEL CAPITAL www.festel.com

Starting point was the existing FESTEL CAPITAL database with relevant data which has been built up from 2003 to 2009

• About 50 interviews with managers and experts from industrial biotech companies as well

as additional interviews with experts from research institutions and the investment area

- Various rounds during the past 6 years

- Semi-structured nature to the interviews

• Periodical desk research using public sources (e.g. business databases) and company

disclosures (e.g. websites and press releases)

• Open discussions with persons from the industry to clarify open questions, which could not

be answered using other sources

More than 150 industrial biotechnology companies were analysed by desk research,

interviewed or FESTEL CAPITAL had an open discussion

Additional desk research in October and November 2009 was performed using typical key

words to find relevant information

Research Methodology - Data Sources

FESTELCreating a Better

Future

APITALC

7 © 2010 FESTEL CAPITAL www.festel.com

Five main regions are analysed to present and discuss the key insights and indicators in the paper

• Europe: EU-27 countries, whereby all of the larger countries are OECD members, and

Switzerland which is also an OECD member

• North America: NAFTA members Canada, Mexico and United States of America which are

all OECD members

• Asia Pacific: Without China and India, but including Australia and Japan

• BRIC countries: Brazil, Russia, India and China

• Rest of the world: All other countries not covered by the other categories

Research Methodology - Regions

FESTELCreating a Better

Future

APITALC

8 © 2010 FESTEL CAPITAL www.festel.com

Contents

Research Methodology 2

Conclusion and Outlook 4

Goals and Objectives 1

Research Results 3

Drivers/Barriers 3.1

Financing Trends 3.2

Capital Needs 3.3

Market Failures 3.5

Capital Sources 3.4

FESTELCreating a Better

Future

APITALC

9 © 2010 FESTEL CAPITAL www.festel.com

Governmental programmes and cleantech as investment category are financial oriented drivers for industrial biotechnology

Governmental programmes

• Financial incentives given by numerous governmental programmes

• Encourage investments in industrial biotechnology where production methods and costs

are currently less competitive to traditional production methods

Cleantech as investment category

• Currently one of the most important investment categories for private equity and venture

capital investors

• Changing consumer behaviour and need for sustainability as attractive trends for investors

Drivers and Barriers - Drivers

FESTELCreating a Better

Future

APITALC

10 © 2010 FESTEL CAPITAL www.festel.com

Investor awareness and acceptance as well as the impact of the financial crisis are financial oriented barriers for industrial biotechnology (1/2)

Awareness and acceptance by investors

• Specific characteristics of industrial biotechnology have advantages, but not yet identified

by investors as an attractive investment field

• Investors still prefer red biotechnology due mainly to the lack of attention given to industrial

biotechnology in the past

• Investors require more knowledge of the industry

- Industrial biotech processes or products usually serve a broader range of applications

- Difficulties in reasonably estimating the scope of market potential and market share

Drivers and Barriers - Barriers

FESTELCreating a Better

Future

APITALC

11 © 2010 FESTEL CAPITAL www.festel.com

Investor awareness and acceptance as well as the impact of the financial crisis are financial oriented barriers for industrial biotechnology (2/2)

Impact of the financial crisis

• Biotech companies highly dependent on well functioning capital markets to finance their

development projects

• Venture capital faced with a capital sourcing problem for their funds resulting in a capital

shortfall and a prioritisation of their investments

• Funding has become increasingly difficult to secure and expensive for biotechnology

companies

• Especially small biotech companies have restricted financial resources at the early stage

and look to secure funding rounds by venture capital

Drivers and Barriers - Barriers

FESTELCreating a Better

Future

APITALC

12 © 2010 FESTEL CAPITAL www.festel.com

Contents

Research Methodology 2

Conclusion and Outlook 4

Goals and Objectives 1

Research Results 3

Drivers/Barriers 3.1

Financing Trends 3.2

Capital Needs 3.3

Market Failures 3.5

Capital Sources 3.4

FESTELCreating a Better

Future

APITALC

13 © 2010 FESTEL CAPITAL www.festel.com

The engagement of financial investors and project oriented financing are emerging financing trends

Engagement of financial investors

• Financial investors increasingly realising “buy-and-build” strategies to achieve appreciation

• Engagements in industrial biotechnology will become more and more important to realise

"buy-and-build" strategies in the chemical industry

Project oriented financing

• Financing structure involves a number of equity investors and a syndicate of banks that

provide loans to the operation

• Enables the involvement of investors in industrial biotech projects who would normally not

invest in these areas

• Becoming more important, especially in the area of renewables, like bioenergy projects

• Scope of these projects very narrow so only special kinds of projects can be financed by

this means and not suitable for industrial biotechnology in general

Financing Trends - Overview

FESTELCreating a Better

Future

APITALC

14 © 2010 FESTEL CAPITAL www.festel.com

Public private partnerships and founding angel activities are emerging financing trends

Public private partnerships

• Government service or private business venture funded and operated through a

partnership of government and one or more private companies

• These partnerships are more and more established in the area of venture capital,

especially for seed and start-up financing of start-up companies

Founding angel activities

• Gap exists between academic research and the commercialisation of the results which

can be best overcome by founding start-up companies to further develop and

commercialise the research results

• Support given to interesting business concepts before the engagements of business

angels and venture capital

• Already being successfully implemented in the UK and the US mainly in the field of

nanotechnology

Financing Trends - Overview

FESTELCreating a Better

Future

APITALC

15 © 2010 FESTEL CAPITAL www.festel.com

Contents

Research Methodology 2

Conclusion and Outlook 4

Goals and Objectives 1

Research Results 3

Drivers/Barriers 3.1

Financing Trends 3.2

Capital Needs 3.3

Market Failures 3.5

Capital Sources 3.4

FESTELCreating a Better

Future

APITALC

16 © 2010 FESTEL CAPITAL www.festel.com

Yearly capital requirements for

R&D per segment

100% = 3,3 billion Euro

Yearly capital requirements for

infrastructure per segment

100% = 6,9 billion Euro

The yearly capital requirements for R&D are about 3,3 billion Euro and for infrastructure 6,9 billion Euro

Capital Needs - Per Segment

Source: FESTEL CAPITAL data base

17%

30%

16%

37%

Base chemicals Specialty chemicals

Consumer chemicals Active pharma ingredients

33%

19%16%

32%

Base chemicals Specialty chemicals

Consumer chemicals Active pharma ingredients

FESTELCreating a Better

Future

APITALC

17 © 2010 FESTEL CAPITAL www.festel.com

0

50100

150200

250300

350400

450

Ano

rgan

ics

Fertiliser

s & g

ases

Org

anic che

micals

Polym

ers & fibr

es

Agr

oche

mical

s

Adh

esives

& sea

lant

s

Paint

s & coa

tings

Food

additiv

es

Oth

er spe

cialty

che

micals

Det

erge

nts

Cos

met

ics

Active

phar

ma

ingr

edient

s

Ca

pit

al re

qu

ire

me

nt

[millio

n E

uro

]

Europe North America Asia Pacific (without China) BRIC countries Rest of the World

Yearly capital requirements for R&D per sub-segment 2007

100% = 3,3 billion Euro

Source: FESTEL CAPITAL data base

The largest capital requirements for R&D are in the area of active pharma ingredients

Capital Needs - Per Sub-segment

FESTELCreating a Better

Future

APITALC

18 © 2010 FESTEL CAPITAL www.festel.com

0

100

200

300

400

500

600

700

Ano

rgan

ics

Fertiliser

s & g

ases

Org

anic che

micals

Polym

ers & fibr

es

Agr

oche

mical

s

Adh

esives

& sea

lant

s

Paint

s & coa

tings

Food

additiv

es

Oth

er spe

cialty

che

micals

Det

erge

nts

Cos

met

ics

Active

phar

ma

ingr

edient

s

Ca

pit

al re

qu

ire

me

nt

[millio

n E

uro

]

Europe North America Asia Pacific (without China) BRIC countries Rest of the World

Yearly capital requirements for infrastructure per sub-segment 2007

100% = 6,9 billion Euro

Source: FESTEL CAPITAL data base

The largest capital requirements for infrastructure are in the area of active pharma ingredients

Capital Needs - Per Sub-segment

FESTELCreating a Better

Future

APITALC

19 © 2010 FESTEL CAPITAL www.festel.com

33%

21%

14%

7%

25%

Europe North America

Asia Pacific (without China) BRIC countries

Rest of the World

32%

21%

14%

7%

26%

Europe North America

Asia Pacific (without China) BRIC countries

Rest of the World

Yearly capital requirements for

R&D per region

100% = 3,3 billion Euro

Yearly capital requirements for

infrastructure per region

100% = 6,9 billion Euro

Europe requires the most capital in both R&D and infrastructure with more than 30%, followed by North America, Asia Pacific and the BRIC countries

Capital Needs - Per Region

FESTELCreating a Better

Future

APITALC

20 © 2010 FESTEL CAPITAL www.festel.com

The capital requirements of existing and new industrial biotech start-ups in Europe will amount to 1.4 billion Euro during the next years

Seed-/Start-up financing of potential start-ups

• Approx. 60 new start-ups in Europe

• Approx. 2 million Euro per start-up

Growth financing of existing start-ups

• Approx. 80 established start-ups in Europe

• Approx. 50% of start-ups need financing

• Approx. 5 million Euro per start-up

Growth financing of existing SMEs

• Approx. 70 established SMEs Europe

• Approx. 50% of start-ups need financing

• Approx. 60 million Euro per SME

120 million

Euro

200 million

Euro

1.050 million

Euro

1.370 million

Euro

Capital need of existing and potential start-ups and SMEs in Europe

Source: Market Study on Financing Strategies in White Biotechnology of FESTEL CAPITAL from April 2005 / Market Study on Financing and Investment Trends in Industrial Biotechnology of FESTEL CAPITAL from February 2009

Capital Needs - Start-ups/SMEs

FESTELCreating a Better

Future

APITALC

21 © 2010 FESTEL CAPITAL www.festel.com

Contents

Research Methodology 2

Conclusion and Outlook 4

Goals and Objectives 1

Research Results 3

Drivers/Barriers 3.1

Financing Trends 3.2

Capital Needs 3.3

Market Failures 3.5

Capital Sources 3.4

FESTELCreating a Better

Future

APITALC

22 © 2010 FESTEL CAPITAL www.festel.com

unclear negativ positiv

Attractiveness of the different financial sources

SME Industry Private

investors

Institutional

investors

Private equity financing

Project financing

Mezzanine financing

Source: Market Study on Financing and Investment Trends in Industrial Biotechnology of FESTEL CAPITAL from February 2009

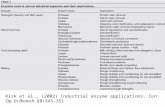

There are some relevant non-classical financial sources like mezzanine financing, project financing and private equity financing

Capital Sources - Attractiveness

FESTELCreating a Better

Future

APITALC

23 © 2010 FESTEL CAPITAL www.festel.com

medium low high

SME Industry Private

investors

Institutional

investors

Experiences with different financial sources

Private equity financing

Project financing

Mezzanine financing

Source: Market Study on Financing and Investment Trends in Industrial Biotechnology of FESTEL CAPITAL from February 2009

There are only restricted experiences of companies with the non-classical financial sources

Capital Sources - Experiences

FESTELCreating a Better

Future

APITALC

24 © 2010 FESTEL CAPITAL www.festel.com

78%

56%54%

33%

24%

8%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

Operational

income

Private

investors

Governmental

funds

Debt funding Equity

investors (VC)

Mezzanine

Sh

are

of

inte

rvie

we

d c

om

pa

nie

s

Financial sources

The operational income is the most important financing source for industrial biotech start-ups

Capital Sources - Financial Sources

FESTELCreating a Better

Future

APITALC

25 © 2010 FESTEL CAPITAL www.festel.com

Contents

Research Methodology 2

Conclusion and Outlook 4

Goals and Objectives 1

Research Results 3

Drivers/Barriers 3.1

Financing Trends 3.2

Capital Needs 3.3

Market Failures 3.5

Capital Sources 3.4

FESTELCreating a Better

Future

APITALC

26 © 2010 FESTEL CAPITAL www.festel.com

Lack of investors for start-ups and pilot plants are the most important market failures

Lack of investors for start-ups

• Further development depends on the ability to establish a prospering start-up scene

• Initial funding and financial support during the first growth phase are and will be an

important issue in the future

• Venture capital appears to be a major source of funding, but attracting venture capital will

remain a challenge in the short and medium term

• Still rather unattractive for investors, due to lack of experience and positive key examples

Lack of investors for pilot plants

• More pilot plants needed to show the technical proof-of-concept

• Credit crisis is limiting the availability of debt capital so investors are struggling despite a

suite of government subsidies and financing

• Unavailability of private debt explains the lack of money available

Market Failures - Overview

FESTELCreating a Better

Future

APITALC

27 © 2010 FESTEL CAPITAL www.festel.com

Contents

Research Methodology 2

Conclusion and Outlook 4

Goals and Objectives 1

Research Results 3

Drivers/Barriers 3.1

Financing Trends 3.2

Capital Needs 3.3

Market Failures 3.5

Capital Sources 3.4

FESTELCreating a Better

Future

APITALC

28 © 2010 FESTEL CAPITAL www.festel.com

Base Chemicals

and intermediates

• Chemical companies only very selectively willing to make investments

due to existing petro-based value chains

• Area not attractive for financial investors due to low profitability

Specialty

Chemicals

• Chemical companies able and willing to make investments in selected

specialty chemical segments

• Area could be attractive for financial investors within their existing

engagements (buy-and-build strategy)

Polymers

• Agro and polymer companies able and willing to make investments due

to strong mid-term market demand

• Area not attractive for financial investors due to low profitability

Fine Chemicals

• Agrochemical and pharmaceutical companies able and willing to make

investments due to strong short-term market demand

• Area more attractive for financial investors than the other areas

Biofuels

• Mineral oil companies able and willing to make investments due to strong

mid-term market demand

• Area could be attractive for financial investors due to large growth rates

Sector Outlook Drivers

The largest potential for investments lies in the production of fine chemicals for the pharma and agro industry

Conclusion and Outlook - Markets

FESTELCreating a Better

Future

APITALC

29 © 2010 FESTEL CAPITAL www.festel.com

Capital requirements

Clear and consistent structure necessary

Structure of FC data base (modified CEFIC structure) as starting point

• Capital requirements to develop

industrial biotechnology

- Per segment/sub-segment

- Per region/country

• Rough data are available from FC

Availability of relevant data

Capital spending

• Capital spending by different market

players

- Industry

- Investors

- Governments

• Currently no consistent data available

Suitable key indicators could be capital spending / capital requirements (per segment/sub-segment and region/country as well as capital source)

Conclusion and Outlook - Research

FESTELCreating a Better

Future

APITALC

30 © 2010 FESTEL CAPITAL www.festel.com

The issue list regarding the need for further research and the definition of next steps can help to improve the paper

Conclusion and Outlook - Issue List

Need for further research

• Better understanding of capital requirements and capital spending in the different sectors,

segments and sub-segments

• Better understanding of the specific impact of investors and investment models

Definition of next steps

• Agree on data structure (capital requirements and capital spending) to enable an OECD

wide comparison

• Agree on data collection and processing process

• Agree on suitable key indicators to get relevant information for policy makers

FESTELCreating a Better

Future

APITALC

31 © 2010 FESTEL CAPITAL www.festel.com

Backups

Backups B

FESTELCreating a Better

Future

APITALC

32 © 2010 FESTEL CAPITAL www.festel.com

More than 150 industrial biotechnology companies were analysed by desk research, interviewed or FESTEL CAPITAL had an open discussion (1/2)

Research Methodology - Interviews

Abbreviations: Dr = Desk research, Si = Standardised interview, Od = Open discussion

Company Dr Si Od Company Dr Si Od Company Dr Si Od

AB Enzymes x x Ciba SC x x x Lonza x x x

Abitep x Clariant x x LS9 x

AC Biotec x x c-LEcta x x Lybradyn x

Aglycon Mycoton x CMC Biopharmaceuticals x Lyven x

AlgMax x x Codexis x x m2p-labs x

Alligator Bioscience x Cognis x x x Maxygen x

Alvito Biotechnologie x CSM Biochemicals x Meiji x

Amino x Direvo Industrial Biotech x x Merck x x x

Amyris Biotechnologies x Diversa x Metabolix x

AnalytiCon Discovery x Döhler x Molekulare Biotechnologie x

AnBio x Dow Chemical x xMunich Innovative

Biomaterials x

Angel Biotechnology x Dr. Petry Genmedics x MykoMax x

Animox x x Dr. Rieks x Nadicom x

Anoxymer x DSM x x x Nexia Biotechnologies x

Arrayon Biotechnology x DSM Biotech x x Nexyte x

Artechno x DuPont x x Nordzucker x x x

Artes Biotechnology x x x E.gene Biotech x Novacta x x

ASA Spezialenzmye x x EKB Technologies x Novamont x x

ATG Biosynthetics x x Enzis x x Novozymes x x

Autodisplay Biotech x x EnzyScreen x N-Zyme Biotec x

BASF x x ESBATech x OrganoBalance x

Bayer x x x Essum x Pacovis x x

BayGenetics x x Eucodis x x Panolin x x

BBT Biotech x EuroFerm x Petroplast Vinora x x

Beiersdorf x x Evocatal x x Pfeifer & Langen x x

Beldem x Evonik Degussa x x x Phenion x

FESTELCreating a Better

Future

APITALC

33 © 2010 FESTEL CAPITAL www.festel.com

Company Dr Si Od Company Dr Si Od Company Dr Si Od

Biocatalysts x FermenSys x Plantic x x

Bioconsens x Galactic x x PomBioTech x

Biolac x Ganomycin x Procter & Gamble x x

Biomay x Gevo x x Prokaria x x

Biomer x x Green Biologics x Protéus x

Biométhodes x Greenovation Biotech x x Rheinchemie x x x

Biomeva x Gyre x Roche Diagnostics x x

Bionova x HöFer Bioreact x Roquette x x

Bioreact x HPC Biotec x Schill & Seilacher x x

Bioressources Worlwide x Hycail x xScientific Research and

Developmentx x

Biospring x x x IEP x x Senomyx x

Biosynergy x IFB Halle x Sourcon-Padena x

Biotec x x Industrial Biotechnology x Stern Enzym x x

BIOTex x Ingenza x Subitec x x

Biovet x Innovia Films x x Süd-Chemie x x x

Biovian x Inosim x Südzucker x x x

Bioworx x Insilico x x Total x x

Biozym x Invigate x Trenzyme x

Bitop x Iogen x x Treofan x x

BlueBioTech x Jülich Chiral Solutions xW42 Industrial

Biotechnologyx

Brain x x x Jülich Enzyme Products x x Wacker Chemie x x

BTR Laboratories x Jülich Fine Chemicals x x Wentus x x

Butalco x x Kerry Bio Science x Weyl Chem x

Celanese x x x Lehmann & Voss x x X2 Biotechnologies x

Cerestar x x Lesaffre x x X-Zyme x x

ChiPro x Libragen x Zymeworks x

More than 150 industrial biotechnology companies were analysed by desk research, interviewed or FESTEL CAPITAL had an open discussion (2/2)

Research Methodology - Interviews

Abbreviations: Dr = Desk research, Si = Standardised interview, Od = Open discussion

FESTELCreating a Better

Future

APITALC

34 © 2010 FESTEL CAPITAL www.festel.com

Already existing data of FC Additional desk research

• Search key words

(selection)

- Angel investors

- Capital need

- Capital sources

- Capital spending

- Financing

- Funding

- Infrastructure

- Investment

- Private equity

- Venture capital

FC market studies FC data base

Market data updated regularly

based on ongoing discussions

with key market players

• Desk research (company

information, external market

studies, press clippings)

• Interviews with industrial

companies, research

institutions and investors

• Calculation model based on

available information with

specific adjustments

• Biotech production

technologies

(November 2003)

• Financing strategies

(April 2005)

• Renewable raw

materials (July 2005)

• Biofuel production

technologies

(October 2006)

• Financing and

investment trends

(February 2009)

Already existing data of FC and additional desk research were used for data gathering

Research Methodology - Overview

FESTELCreating a Better

Future

APITALC

35 © 2010 FESTEL CAPITAL www.festel.com

Development funds are well established in the pharmaceutical industry as new business model to foster innovativeness (1/2)

Drug

IP, Licenses

Companies

AC = Actelion

CC = Care Capital

CH = Cowen Healthcare Royalty Partner

CP = Celtic Pharma

CR = Capital Royalty

DP = Debiopharm

DC = DRI Capital

NO = Novartis

PC = Paul Capital Healthcare

PB = Paramount BioSciences

RO = Roche

RP = Royalty Pharma

SC = Symphony Capital

SP = Speedel

Extern Intern

Inte

rn

Ex

tern

Drug development

Fin

an

cin

g

CP PB

CC

DP

SC

SP

Emerging

pharma

Big Pharma

Mid-sized

pharma

Development

funds

Private

Equity

funds

CR CH

Royalty

funds

PC DC RP

NO

RO

AC

Financing Trends - Development Funds

FESTELCreating a Better

Future

APITALC

36 © 2010 FESTEL CAPITAL www.festel.com

Development funds are well established in the pharmaceutical industry as new business model to foster innovativeness (2/2)

Financing Trends - Development Funds

Preclinical

development

Capital Royalty/Houston (www.capitalroyalty.com)

1) Paramount BioCapital; 2) former Drug Royalty Corporation; 3) former Paul Royalty Fund

Paul Capital Healthcare/New York3) (www.paulcapitalhealthcare.com)

DRI Capital/Toronto2) (www.drugroyalty.com)

Care Capital/Princeton (www.carecapital.com)

Celtic Pharma/Bermuda (www.celticpharma.com)

Royalty Pharma/New York (www.royaltypharma.com)

Symphony Capital/New York (www.symphonycapital.com)

Paramount Biosciences/New York1) (www.paramountbio.com)

Clinical

development Commercialisation

325 mn USD

1,4 bn USD

1 bn USD

500 mn USD

400 mn USD

1,5 bn USD

300 mn USD

n/a

Royalty funds

Development funds

Cowen Healthcare Royalty Partner/

Stamford (www.cowenroyalty.com) 500 mn USD

Private equity funds

FESTELCreating a Better

Future

APITALC

37 © 2010 FESTEL CAPITAL www.festel.com

Founding Angels are filling the gap between established business models within the start-up area

With partners

Business

concept

Business

idea

Business

plan

Start-up

founding

Start-up

financing

Offices and

labs

Business

development

Technology centres

Venture capital

Business angels

Technology transfer

Consultants

Business plan competitions

Founding Angels

? • Advance Nanotech

• Angle Technology

• Arch Venture Partners

• Arrowhead Research Corporation

• Molecular Manufacturing Enterprises

• Precede Technologies

• Proseed Capital

• Sanderling Ventures

• XL TechGroup

US

UK

Israel

Financing Trends - Founding Angels

FESTELCreating a Better

Future

APITALC

38 © 2010 FESTEL CAPITAL www.festel.com

The considered financing strategies each have specific advantages and disadvantages

Capital Sources - Financial Sources

Strategy Advantages Disadvantages

• Invest in early stage, often after first year

• Lower expectation on rate of return / long term

investment horizon

• Improves equity ratio

• No intervention in operations

• Investments are smaller than with VC

• Increased dependence from external Stakeholders

• Increases liquidity

• No participation in the profit

• No intervention in operations

• Permanent costs with interest payments

• Banks require securities to back up the loans – start ups

predominantly cannot offer them

• Excessive bureaucracy causes add on costs and is time

consuming

• Inflexible programs and long admission processes

• Limited number of programs for service-oriented start-

ups

• Do not need to be paid back

• Employees and overhead are paid

• Enables to strengthen the portfolio (technology and

products)

• Enables to collect large sums

• Enables a fast development of the start-up

• Strategic investment over the total period of develop-

ment and growth with no intervention in operations

• Improves equity ratio and enables financing of further

expansion

• Efforts/expenditures to get VC are very high

• Increased probability of loss of control

• Increased dependence on external stakeholders

• Sale of stake of the company

Equity investors

(VC)

Private investors

Debt funding

Governmental

funds

IPO • Enables acquisition of large financial volumes

• Enables to pursue a fast development of the start-up

• Regulations with regard to the IPO cause significant

add-on costs

• New stakeholders in the firm that cause a loss of

independence and control