Airport Concessions Lima / Peru an Example for Brazil? PPP Americas, 12 May 2010 Felix von Berg,...

-

Upload

karli-parkerson -

Category

Documents

-

view

225 -

download

0

Transcript of Airport Concessions Lima / Peru an Example for Brazil? PPP Americas, 12 May 2010 Felix von Berg,...

Airport Concessions Lima / Peruan Example for Brazil?

PPP Americas, 12 May 2010Felix von Berg, Fraport AG

Content

Page 2

Lima airport concession and the Peruvian

model for airport concessions

Implications for Brazil

PPP Americas 11-13 May 2010, Fraport Presentation

Content

Page 3

Lima airport concession and the Peru-

vian model for airport concessions

Implications for Brazil

PPP Americas 11-13 May 2010, Fraport Presentation

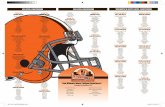

Fraport – managing 13 Airports worldwide under various legal forms

Lima

FRANKFURT

Hong Kong

Shanghai

Amsterdam

Antalya

Hahn

DelhiOrlando

Senegal*

Xi‘an

Kairo*

Athen

Wien

Hannover

Varna Burgas

Lima

FRANKFURT

Antalya

Delhi

Dakar

Xi‘an

Hanover

Varna & Burgas

CairoRiyadhJeddah

Ownership of airportConcessionsManagement Contract

Fraport

St Peters-burg

Majority MinorityFraport

PAX 2009 (m)

Frankfurt 50.9

Delhi 25.3

Antalya 18.7

Jeddah 15.3

Cairo 14.4

Riyadh 10.8

Xi‘an 15.3

Lima 8.8

St. Petersburg 6.8

Hannover 5.0

Burgas 1.7

Dakar 1.8

Varna 1.2

Total 176.0

Lima

PPP Americas 11-13 May 2010, Fraport Presentation

PPP Americas 11-13 May 2010, Fraport Presentation

page 5

Jorge Chavez International Airport (JCIA) Key Facts

Jorge Chavez Int, Airport

• Runway: 3,507,5 m• 84,570 m² passenger

terminals• 304,881 m² of apron • 63 commercial shops run by

34 different companies• 19 passenger loading bridges

Traffic 2009

• 8,786m passengers• 232,374 tons of cargo• 104,965 air traffic

movements• Non-stop destinations

• National: 16• International: 29

page 6

• Typlical “build, operate and transfer”

concession with full air & landside opera-tion of airport (w/o air traffic control) by concessionaire (Lima Airport Partners)

• Concession start 2001, duration 30 years + 10 year extention option

• Take-over of existing staff, but not of bureaucratic structures – quasi start-up

• Investments• during concession > US$ 1bn• Up-to-date > US$ 266m

• Mainly rigid requirements for expansion - not demand based investment criteria

• Service Level IATA B as main quality parameter

Concession outline

PPP Americas 11-13 May 2010, Fraport Presentation

page 7

• Concession fee: %-age of revenues

• CPI – X tariff regulation

• Tax stability agreement for investors

• Solid bankability with usual assignments possible, step-in rights for banks and certain guarantees for debt providers by Peruvian state- Initial financing by OPIC and German

KfW- 2007: Refinancing of LAP with bond

issue• achieved IG-rating before Peru did• Won Euromoney’s and

International Financial Law Review’s “Deal of the year“ Latin America / Americas

Risk Mitigation / Sharing

PPP Americas 11-13 May 2010, Fraport Presentation

page 8

Successful concession (I/III)

1994 1995 1996 1997 1998 1999***2000*** 2001 2002 2003 2004 2005 2006 2007 2008

25 m

50 m

75 mCAPEX (US$)Investments• Before concession

minimal investments • After concession

focussed investments toincrease capacity, qualityand retail revenues average yearly invest: ~ US$ 6 Mio

average yearly invest: ~ US$ 30m

2009

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

PAX

CAGR: 3%CAGR: 10%

5 m

10 mPAX development• Before concession

PAX CAGR (3%) = Ø-GDP growth (2,5%)

• After concession: PAXCAGR 10% versus 5% Ø-GDP growth

Concession

2009 tariffs* in real terms below 2001

2009

1994** 1995 1996 1997 1998 1999*** 2000***2001 2002 2003 2004 2005 2006 2007 2008

Contribution to the public sector**(US$)

* Weighted average ** Calculated before privatization as pro forma EBITDA ,/, Capex, after privatization as total concession fees to public sector + taxes, ***No pro forma data availabe,

25 m

50 m

75 m

100 mNet effect for publicsector• contribution in year 1

already ~ 1,5 x EBITDA and ~ 2 x EBITDA ,/, Capexof best year prior to privatization

average contribution p,a,: ~ US$ 11 Mio

average contribution p,a,: ~ US$ 65 Mio

2009

PPP Americas 11-13 May 2010, Fraport Presentation

LAP concession May 2009

From taking over the airport in 2001.........Successful concession (II/III)

page 9

substation

substation

retail area

apron

page 10

....to one of the best airports in the regionSuccessful concession (III/III)

Skytrax World Airport AwardsTM

1. Place – „Airport of the year“ South America

2. Place – „Airport of the year“ South America

2. Place – „Airport of the year“ South America

1. Place – „Airport of the year“ South America

1. Place – „Airport of the year“ South America

World Travel Awards

Winner Leading Airport South America 2009

2005

2006

2008

2009

2010

2009

PPP Americas 11-13 May 2010, Fraport Presentation

page 11

Funding of Peruvian Airport Sector

Lima airport concession fee

paymentsDedicated Fund

Nothern PeruRegionals

Southern Peru Regionals

(tender ongoing)

• Not profitable airports• Awarded on basis of

least subsidy for operations

• Capex funded by state

PPP Americas 11-13 May 2010, Fraport Presentation

$

$

$

Content

Page 12

Lima airport concession and the Peruvian

model for airport concessions

Implications for Brazil

PPP Americas 11-13 May 2010, Fraport Presentation

page 13

Draft Concession Program for Brazilian Airport Sector

self-sustaining airports (17)*

Remaining 50 airports

Concession program with [25] years terms, tendered individually or in groups. Concessionaire’s responsibilities• Operation and maintenance with international

efficiency and quality standards • Investment obligation to meet growing demand• Concession fee to be paid to the government

Stay with the Infraero / public administration. Funding from• Own operating cash-flow• Concession fee payments from 17 airports

Infraero operating 67 airports with 97% Brazilian commercial traffic

* Of the 67 Infraero airport all 18 with PAX > 1m (exlcuding Natal airport) were studied. All but Cuibá airport were identified as economically viable under above mentioned concession regime

PPP Americas 11-13 May 2010, Fraport Presentation

Ball-park calculation for 17 airports under concession regime (conservative case, in real terns)

page 14

Revenue

R$ mill. R$ mill.

growth 1st phase 2nd phase 3rd phase 4th phase totalannual

averageannual

average

base 1 15 25 25 2009 2013 2021 2029 2009 25 25

2008 2009 2023 2033 years 2012 2020 2028 2032 2032 years years

1 GRU Guarulhos 20,4 21,6 37,2 40,0 3% 1.217 1.021 776 385 3.400 1.134 454 40% 52,5%

2 CGH Congonhas 13,7 14,5 19,7 19,7 1% 250 145 78 78 551 296 130 44% 15,0%

3 GIG Galeão 10,8 11,5 29,2 43,6 6% 692 783 1.585 994 4.054 778 117 15% 13,5%

4 BSB Brasília 10,4 11,2 27,7 36,6 5% 305 633 907 385 2.231 261 3 1% 0,3%

5 SSA Salvador 6,0 6,5 15,3 18,9 5% 168 597 423 198 1.385 192 6 3% 0,7%

6 CNF Confins 5,2 5,5 11,4 15,3 4% 152 264 302 185 903 170 36 21% 4,1%

7 POA Porto Alegre 4,9 5,3 12,5 17,7 5% 267 271 332 199 1.068 196 6 3% 0,7%

8 REC Recife 4,7 5,0 10,4 14,0 4% 70 313 271 168 821 145 10 7% 1,2%

9 CWB Curitiba 4,3 4,6 10,9 15,5 5% 144 486 329 206 1.165 161 21 13% 2,4%

10 SDU Santos-Dumont 3,6 3,8 7,7 7,7 3% 71 92 62 51 277 99 6 6% 0,7%

11 FOR Fortaleza 3,5 3,7 7,7 10,3 4% 113 232 233 139 717 99 2 2% 0,2%

12 BEL Belém 2,2 2,3 4,1 5,2 4% 42 46 89 68 245 56 1 1% 0,1%

13 FLN Florianópolis 2,1 2,2 5,0 7,1 5% 123 106 131 84 444 67 1 1% 0,1%

14 MAO Manaus 2,0 2,1 4,5 6,0 4% 103 299 254 165 822 150 14 9% 1,6%

15 VIX Vitória 2,0 2,1 5,1 7,2 5% 211 106 128 83 528 83 1 1% 0,1%

16 GYN Goiânia 1,6 1,6 3,7 5,3 5% 110 90 112 70 382 62 1 2% 0,1%

18 VCP Campinas 1,1 1,2 2,8 3,9 5% 769 317 410 256 1.752 344 59 17% 6,8%

98 105 215 274 4,2% 4.807 5.801 6.421 3.714 20.744 4.293 865 20,1% 100%

of revenue

Traff ic17 Airports

R$ MM - cte - base dez 2008

25 year term - 2009 - 2033

P ax total in million

ano

TOTAL

Concession Fee

of program

%R$ million

Investments

PPP Americas 11-13 May 2010, Fraport Presentation

Year

total average total average

Concession fee (minimum) 572 607 644 684 2.508 627 21.615 865

Investments 972 1.410 1.425 999 4.807 1.202 20.744 830

Taxes and Contributions 164 198 212 230 805 201 4.470 179

17 Airports 1.708 2.216 2.282 1.914 8.119 2.030 46.829 1.873

total average total average

Revenue 50+Ataero 50+headquarters 438 457 477 498 1.871 468 17.709 708

Cost 50+headquarters+payroll w/o 17 -748 -810 -852 -886 -3.296 -824 -28.827 -1.153

Investment estimate 50 -156 -180 -211 -235 -782 -195 -4.773 -191

A) 50 remaining airports -466 -532 -586 -622 -2.207 -552 -15.891 -636

B) Concession Fee 17 Airports 572 607 644 684 2.508 627 21.615 865

Excess Cash-flow (A + B) 106 75 58 62 301 75 5.724 229

total average

INFRAERO ressources 253 271 301 133 958 240

Ataero portion of INFRAERO 198 225 127 98 648 162

INFRAERO 67 Aeroportos 451 496 429 231 1.607 402 Direct transfers from the Union 254 96 96 145 591 148

Other transfers (via agreements) 40 297 49 23 409 102

Transfers 294 394 145 168 1.000 250

TOTAL 745 890 573 399 2.607 652

total average

Concession (17 airports) 972 1.410 1.425 999 4.807 1.202

INFRAERO (50 airports) 156 180 211 235 782 195

TOTAL 67 Airports 1.129 1.590 1.636 1.234 5.589 1.397

Concessions 17 Airport 2009 2010 2011

2009 2010

2009 2010

2011

2005Investments (actual) 2008

4 years 25 years

4 years 25 years2012

2012

2007

2011

Proposed Investments

INFRAERO 50 remaining airports

20124 years

20064 years

page 15 Funding of 67 airports: ball-park comparison - public sector view (conservative case, in real terns)

Infr

aero

/ p

ublic

sec

tor

fund

ing

with

con

cess

ion

sF

undi

ng o

f in

vest

men

ts20

05-

2008

(ac

tual

)

Year one total concession

fees > Infraero2008 operating

cash-flowwithout investments

2004-2008Infraero able togenerate Ø cash-flow for invest-ments~ R$ 0,4bn

2009-2012Estimated requir.Ø investment~ 1,4bn

Concessionprogram can coverthe gap

Note: 1) ATC and treasury will remain with existing shares of tariffs (67 airports)PPP Americas 11-13 May 2010, Fraport Presentation

Thank you for your attention!

page 16

Fraport, The Airport Manager

Frankfurt Airport Burgas Airport Varna Airport

Cairo International Airport

Aéroport International Blaise Diagne, Dakar

Xi´an Xianyang International AirportKing Abdulaziz Internation Airport, Jiddah

Flughafen Hannover-Langenhagen

Antalya AirportIndira Gandhi International Airport, Delhi

Jorge Chávez International Airport, Lima

King Khalid International Airport, Riyadh

Pulkovo International Airport, St, Peterburg

176 Million Passengers, 13 Airports, 1 Airport Manager

PPP Americas 11-13 May 2010, Fraport Presentation

Page 17

Annex

PPP Americas 11-13 May 2010, Fraport Presentation

page 18

Main assumptions and model considerations of outlined concession model

description

Award criteria• Award on basis of highest proposed concession fee payment

(percentage)• [Consideration of technical proposal &quality of business plan (pass/fail

criterion or as additional award criterion) suggested]

Demand• Based on 2004-2008 traffic growth and IAC data as well as AGC

(/Fraport) analysis based on current air traffic distribution, trends and capacity constraints

Tariffs • Current tariff-regime kept in concession model. Concessionaire get’s

current Infraero tariff share (“Parcela Infraero” and “Ataero Infraero”). ATC (“Ataero Aeronáutica”) and treasury (“Parcela Tesouro”) retain their share

Opex • Infraero’s productivity and efficiency parameters were analyzed and

adjusted in accordance with international benchmarks [not very aggressively]

Investments • Based on current capacity and demand forecast, investments were

modeled to meet IATA service level C [much higher quality standard than currently in place]

Concession term

• 25 years• [could be adjusted on a case-by-case basis in order to make some

concessions more attractive and stimulate stronger tender competition ]

PPP Americas 11-13 May 2010, Fraport Presentation