Agriculture & Other Exempted Incomes1

-

Upload

dhruv-agarwal -

Category

Documents

-

view

220 -

download

0

Transcript of Agriculture & Other Exempted Incomes1

-

8/6/2019 Agriculture & Other Exempted Incomes1

1/18

AGRICULTURE

& OTHER

EXEMPTED INCOMES

Agricultural Income

Share in HUF & Partnership

Exemption to Non-residents

Other exemptions

-

8/6/2019 Agriculture & Other Exempted Incomes1

2/18

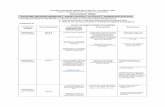

Agricultural income in India

Share in profit of a Partnership

Share in profit of a HUF

Payment received from PPF

Payment received from RPF

Payment received from Statutory PF

Maturity Payment on Life Insurance

Dividend from Domestic/Indiancompany

Leave Travel Concession

Other exemptions

EXEMPTED INCOMES IN INDIA

-

8/6/2019 Agriculture & Other Exempted Incomes1

3/18

Agricultural income 10(1)

Such income must satisfy the three conditions:

y Rent or Revenue should be derived from Land.

y The Land must be used for Agricultural purposes.

y The Land must be used for Agricultural purposes.

Then, it is Exempt from the Tax but it is included in thetotal income to determine the rate of Tax at which thetotal without Agriculture Income would be liable to tax.

-

8/6/2019 Agriculture & Other Exempted Incomes1

4/18

PARTLY AGRICULTURE INCOME

(RULE NO.7)

If Agriculture produce,produced by the

assessee is used in the non-agriculture

finished product which is also produced by

the assessee,then market value of theagricultural produce must be debited in P&L

a/c.

And agriculture income= Market value of

agricultural product-cost of agricultural

product.

-

8/6/2019 Agriculture & Other Exempted Incomes1

5/18

RECEIPT FR M HUF U/S 10(2)

Any sum received by

an Individual as a

member of HUF out of

estate of income of thefamily is e empt from

ta and not included in

the total income of the

Individual.

The logic behind this is

that HUF is already

ta ed on this income

and hence no tashould be levied on

distribution of the

income of HUF.

-

8/6/2019 Agriculture & Other Exempted Incomes1

6/18

PARTNERS SHARE IN PR FIT F FIRM

U/S 10(2A)

In case of a person who is a partner of

a firm which is separately assessed in

that case the amount of share in theprofits of firm ascertain as per the

partnership deed is e empted from

ta .

-

8/6/2019 Agriculture & Other Exempted Incomes1

7/18

LEAVE TRAVEL C NCESSI N U/S 10(5)

The Value of leave travel concession received ordue to an individual is e empted to the e tent it isactually spent.

Thus, the e emption is available to any individual inrespect of the value of any travel concession orassistance received by or due to him,

From his employer for himself and his family, inconnection with his proceeding on leave to anyplace in India.

From his employer or former employer for him selfand his family, in connection with his proceeding toany place in India after retirement service or Afterthe termination of service.

-

8/6/2019 Agriculture & Other Exempted Incomes1

8/18

INTEREST T N N-RESIDENTS U/S 10(4)

Interest on bonds issued by Government.

Interest on FCNR deposits.

Interest on NRE deposits.

Interest on specified savings certificates

received by non-resident Indian citizens u/s

10(4B).

-

8/6/2019 Agriculture & Other Exempted Incomes1

9/18

-

8/6/2019 Agriculture & Other Exempted Incomes1

10/18

SALARY O FNO N-RESIDENT

EMPLOYEE OF A FOREIGN SHIP[U/S

10(6)

The Sub-clause (viii) off section 10((6)) gives the

e emption from ta in case off an individual who iis

not a citizen of India and non- resident,in respect of

income chargeable under the head Salaries

received by him for service rendered in connection

with his employment on a foreign ship. However,his

total stay in India should not e ceed in aggregate a

period of ninety days in the previous years.

-

8/6/2019 Agriculture & Other Exempted Incomes1

11/18

FOREIGNALLOWANCES AND PERQUISITES

TOG

OVERNMENTE

MPLOYEES OUT SIDE

INDIA [U/ S 10(7)]

Sub-section (7) of section 10 states

that any allowance or perquisites paid

or allowed as such out side India by

the Government to a citizen of India for

rendering services outside India will be

totally e empted from ta .

-

8/6/2019 Agriculture & Other Exempted Incomes1

12/18

LIC/PF EXEMPTIONSAmount received in life insurance policy [U/ S

10(10)]

Any sum received under a life insurance policy,

including the sum allocated by way of bonus onsuch policy shall be totally e empt from ta .

Payment from provident fund[U/S 10(11)]

Any payment from a provident fund to which the

provident funds Act, 1925, applies or from any otherprovident fund set up by the central Government

and notified in the official gazette (i.e. public

provident fund)is totally e empted from ta .

-

8/6/2019 Agriculture & Other Exempted Incomes1

13/18

RPF/ HRAAccum ulated balance from a recognized provident

fund [u/s 10(12)]

The accumulated balance due and becoming

payable to an employee participating a recognizedprovident fund, to the e tent provided in rule of part

A of schedule, is e empted from ta .

Payment from an approved superannuating fund

[U/S 10(13)]]

House rent allowance [U/S 10(1 3A)]

-

8/6/2019 Agriculture & Other Exempted Incomes1

14/18

OTHEREXEMPTIONS Income of a consultant under a technical assistant

grant Agreement between the international

organization and the Government of foreign state

[U/S 10(8A)]

Income of an Individual who is assigned to duties in

India in connection with any technical assistance

agreement entered and project in accordance with

an agreement entered into by the central

Government and the Agency[U/ S10(8B)].

Payment under the Bhopal Gas Leak Disaster

(processing of claims) Act, 1985 [U/S 10(10BB)].

-

8/6/2019 Agriculture & Other Exempted Incomes1

15/18

COMPENSATION ON RETIREMENT OF AN

EMPLOYEE[U/S 10(10C)]

At the time of his voluntary retirement or termination

of his service in accordance with any scheme of

voluntary retirement or in case of public sector

company referred to in point (a) above, a scheme of

voluntary separation, shall be e empted to the

e tent such amount does not e ceeds five rupees,

shall be e empted to the e tent such amount does

not e ceeds five lakh rupees.

-

8/6/2019 Agriculture & Other Exempted Incomes1

16/18

SCHOLARSHIP/ MP ALLOWANCE

Scholarship [U/S 10(16)]

Scholarship granted to meet the cost of

education is totally e empt from ta and will

not be included in the computation ofincome.

Allowances received by the member of

parliament or state legislature [U/S 10(17)]

-

8/6/2019 Agriculture & Other Exempted Incomes1

17/18

PENSION RECEIVED BY A PERSONHONORED

BY A GALLANTRYAWARD [U/S 10(18)]

This clause provides e emption for any income by

way of :-

Pension received by an individual who has been in

service of central or state Gov. and has beenawarded,Parama Vir Chakra),MahaVir Chakra or

Vir Chakra.

Family pension received by any member of the

family in case of death of the awardee.

-

8/6/2019 Agriculture & Other Exempted Incomes1

18/18

SUBMITTED TO:-

MORADABAD BRANCH OF

CIRC

BY:-

DHRUV AGARWAL