Adu Value Study - Executive Summary - 20111216x

-

Upload

kol-peterson -

Category

Documents

-

view

218 -

download

0

Transcript of Adu Value Study - Executive Summary - 20111216x

-

8/3/2019 Adu Value Study - Executive Summary - 20111216x

1/1

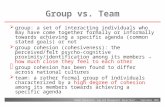

Appraised values based on income vs. sale prices, for

14 Portland properties featuring ADUs. Each

property is represented by a bar with three metrics of

value.

Understanding and appraising properties with accessory dwelling units

Martin John Brown and Taylor Watkins, September 2011.Contact the authors athttp://martinjohnbrown.net& http://watkinsandassociates.net.

EXECUTIVE SUMMARYFew forms of housing have caused as much excitement

among planners and social advocates, and as much

consternation among appraisers and real estate

professionals, as accessory dwelling units (ADUs)

also known as granny flats, backyard cottages, carriagehouses, and numerous other labels.

ADUs are small, independent dwellings on the grounds

of a single family home. They have promise for

meeting social and environmental needs, flexiblyhousing families and providing legitimate rental units.

However, appraisals and lending on properties with

ADUs are complicated by misunderstanding of these

dwellings, and varying policies among institutions.

A house with an ADU offers a seeming contradiction to

many parties in the lending process: a two-unit,

income-producing property with single family zoning.

Though permitted by local government, the guidelines

of national loan repurchasers suggest such properties

are illegal, and that the ADU may (and perhaps should)

represent only incidental contributory value. Though

the ability to produce rent is a crucial characteristic of a

legitimate ADU, it rarely plays a part in appraisals.

Valuations are usually based on the sales comparison

approach to value, with irregular results due to lack ofcomparables and other factors.

An income-based approach to value is possible, and given its fundamental basis in market rents, might be more

stable and rational than the sales comparison approach, which echoes and may reinforce boom and bust cycles.

We created an income approach to valuing properties with ADUs, and applied it to 14 properties with permitted

ADUs in Portland, Oregon, comparing the appraised values to actual sales prices for those properties. The

income-based approach yielded valuations which were significantly higher than actual sales prices, by 7.2% or

9.8% on average, depending on the exact formula used. Viewed by income, ADUs contributed a substantial

proportion of each propertys appraised value, a mean of 25% or 34%, depending on the formula. Appraisedvalues were only slightly less variable than sales prices; the difference in variability was not significant.

These results have several implications. Currently, owners in Portland might generate more value by holding and

renting properties featuring ADUs than selling them. ADU advocates might lobby for loan programs recognizing

the reality of legal ADUs, and oppose owner occupancy requirements in new ADU developments, to interestincome investors in developing them. Appraisers requiring an alternative or counterpoint to the sales comparison

approach for properties featuring ADUs could gain insight with the income approach. Developing credible and

consistent valuations should help this promising form of microdevelopment reach its full potential. # # #

This work was supported by The Appraisers Research Foundation. The full details are available in a technical

paper currently submitted for publication. For more details or reprint permissions, please contact the authors.