Adjusting Accounts Accounts are adjusted at the end of each accounting period to bring an asset or...

-

Upload

hillary-murphy -

Category

Documents

-

view

232 -

download

0

Transcript of Adjusting Accounts Accounts are adjusted at the end of each accounting period to bring an asset or...

Adjusting AccountsAdjusting Accounts

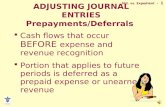

• Accounts are adjusted at the end of each accounting period to bring an asset or liability account to its proper amount.

• Adjusting entries also update the related expense or revenue accounts.

• These adjustments are necessary for the preparation of financial statements.

LO 41 © 2013 McGraw-Hill Ryerson Limited.

Types:• Prepaid expenses• Depreciation• Unearned revenues• Accrued expenses• Accrued revenues

AdjustmentsAdjustments

2 LO 4© 2013 McGraw-Hill Ryerson Limited.

• Costs paid in advance of receiving their benefits.

• They are recorded as assets.• As these assets are used, their costs

become expenses.• These costs expire with the passage of

time or through use and consumption, e.g., insurance, supplies.

Prepaid ExpensesPrepaid Expenses

3 LO 4© 2013 McGraw-Hill Ryerson Limited.

Prepaid Expenses–Example

On January 1, a company purchases an insurance policy that covers three months and costs $1,800.

• The policy will benefit the company for three months and will be expired at the end of three months.

• The cost of the policy should be spread over the time period it benefits the organization. (matching principle).

$600 $600 $600

$1,800January February March

4 LO 4© 2013 McGraw-Hill Ryerson Limited.

Prepaid InsuranceJan. 1 1,800 1,800

Cash

$600 $600 $600

$1,800January February March$

1,800

$1,800

The entry to record the purchase of the insurance policy would be: Prepaid Insurance 1,800

Cash 1,800

5 LO 4

Prepaid Expenses–Example

© 2013 McGraw-Hill Ryerson Limited.

Prepaid Insurance Insurance ExpenseJan. 1 1,800Jan.31 600 600balance 1,200

$600 $600 $600

$1,800January February March

$1,800

$1,800

The entry to record the expiry of the insurance for January would be: Insurance Expense 600

Prepaid Insurance 600

6 LO 4

Prepaid Expenses–Example

© 2013 McGraw-Hill Ryerson Limited.

Prepaid Insurance Insurance ExpenseJan. 1 1,800Jan.31 600 600Feb.28 600 600balance 600

$600 $600 $600

$1,800January February March

$1,800

$1,800

The entry to record the expiry of the insurance for February would be: Insurance Expense 600

Prepaid Insurance 600

7 LO 4

Prepaid Expenses–Example

© 2013 McGraw-Hill Ryerson Limited.

Prepaid Insurance Insurance ExpenseJan. 1 1,800Jan.31 600 600Feb.28 600 600Mar.31 600 600balance 0

$600 $600 $600

$1,800January February March$

1,800

$1,800

The entry to record the expiry of the insurance for March would be: Insurance Expense 600

Prepaid Insurance 600

8 LO 4

Prepaid Expenses–Example

© 2013 McGraw-Hill Ryerson Limited.

• Companies acquire assets such as equipment, buildings, vehicles, and patents to generate revenues.

• These assets are expected to provide benefits for more than one accounting period.

• Depreciation is the process of allocating the costs of assets over their expected useful lives.

DepreciationDepreciation

9 LO 4© 2013 McGraw-Hill Ryerson Limited.

• Depreciation is based on the matching principle where the cost of an asset is matched over the time the asset helped earn the revenue.

Straight-LineDepreciationExpense

= Asset cost – Estimated residual value

Estimated useful life

DepreciationDepreciation

10 LO 4© 2013 McGraw-Hill Ryerson Limited.

Depreciation - Example

On January 1, 2014, a company purchased a piece of equipment for $72,000. The equipment is expected to have a useful life of four years and have a residual value of $8,000.

= $72,000 - $8,000

4 years

= $16,000/year

Straight-LineDepreciationExpense

= Asset cost – Estimated residual value

Estimated useful life

11 LO 4© 2013 McGraw-Hill Ryerson Limited.

Depreciation - Example

Cash72,000 1/1/14 72,000

Equipment

The entry to record the purchase of the equipment would be:

Equipment 72,000 Cash 72,000

12 LO 4© 2013 McGraw-Hill Ryerson Limited.

Depreciation - Example

Depreciation Expense,Depreciation, Equipment

16,000 12/31/14 16,000Equipment

Accumulated

The entry to record Depreciation at the end of the first year would be:

Depreciation Expense, Equipment 16,000 Accumulated Depreciation, Equip. 16,000

13 LO 4© 2013 McGraw-Hill Ryerson Limited.

Depreciation - Example

Depreciation Expense,Depreciation, Equipment

12/31/14 16,00016,000 12/31/15 16,000

balance 32,000

EquipmentAccumulated

The entry to record Depreciation at the end of the second year would be:

Depreciation Expense, Equipment 16,000 Accumulated Depreciation, Equip. 16,000

14 LO 4© 2013 McGraw-Hill Ryerson Limited.

Depreciation - Example

Depreciation Expense,Depreciation, Equipment

12/31/14 16,00012/31/15 16,000

16,000 12/31/16 16,000balance 48,000

EquipmentAccumulated

The entry to record Depreciation at the end of the third year would be:

Depreciation Expense, Equipment 16,000 Accumulated Depreciation, Equip. 16,000

15 LO 4© 2013 McGraw-Hill Ryerson Limited.

Depreciation - Example

Depreciation Expense,Depreciation, Equipment

12/31/14 16,00012/31/15 16,00012/31/16 16,000

16,000 12/31/17 16,000balance 64,000

EquipmentAccumulated

The entry to record Depreciation at the end of the fourth year would be:

Depreciation Expense, Equipment 16,000 Accumulated Depreciation, Equip. 16,000

16 LO 4© 2013 McGraw-Hill Ryerson Limited.

Depreciation - Example

2014 2015 2016 2017Equipment $72,000 $72,000 $72,000 $72,000 Less: Accumulated Depreciation 16,000 32,000 48,000 64,000Equipment-net $56,000 $40,000 $24,000 $8,000

Partial Balance SheetDecember 31

Depreciation, Equipment72,000 01/01/14

12/31/14 16,00012/31/15 16,00012/31/16 16,00012/31/17 16,000

EquipmentAccumulated

17 LO 4© 2013 McGraw-Hill Ryerson Limited.

Cash received in advance of providing products and services.• The company has an obligation to provide

goods or services.• Unearned revenues are liabilities.• As products and services are provided, the

amount of unearned revenues becomes earned revenues.

Unearned RevenuesUnearned Revenues

18 LO 4© 2013 McGraw-Hill Ryerson Limited.

Unearned Revenues — Example

On March 1, a company received a $12,000 payment from a customer for maintenance services to be provided over the next two months.

Unearned Revenue12,000 Mar.1 12,000

Cash

The entry to record the receipt of cash would be: Cash 12,000

Unearned Revenue 12,000

19 LO 4© 2013 McGraw-Hill Ryerson Limited.

Unearned Revenues - Example

On March 31, $6,000 of this revenue had been earned.

Maintenance Revenue12,000 Mar.1

6,000 Mar.31 6,0006,000 balance

Unearned Revenue

The entry to record the earned revenue would be: Unearned Revenue 6,000 Maintenance Revenue 6,000

$12,000/2months= $6,000/month

20 LO 4© 2013 McGraw-Hill Ryerson Limited.

Unearned Revenues - Example

By April 30, another $6,000 of this unearned revenue had been earned.

Maintenance Revenue12,000 Mar.1

6,000 Mar.31 6,0006,000 Apr.30 6,000

0 balance

Unearned Revenue

The entry to record the earned revenue would be: Unearned Revenue 6,000 Maintenance Revenue 6,000

$12,000/2months= $6,000/month

21 LO 4© 2013 McGraw-Hill Ryerson Limited.

Costs incurred in a period that are both unpaid and unrecorded. • Adjusting entries must be made to record the

expense for the period and the related liability at the balance sheet date.

• Examples: interest, wages, rent, taxes

Accrued ExpensesAccrued Expenses

22 LO 4© 2013 McGraw-Hill Ryerson Limited.

Accrued Expenses - Example

On December 31, $1,200 of interest has accrued on a company’s bank loan. The payment of the interest is not due until January 1.

The December 31 entry to record the accrued interest would be:

Interest Expense 1,200 Interest Payable 1,200

23 LO 4© 2013 McGraw-Hill Ryerson Limited.

Accrued Expenses - Example

In December, a company incurred $3,700 of utilities expense. The company had not received the utility bill at December 31.

The December 31 entry to record the accrued utilities expense would be:

Utilities Expense 3,700 Accounts Payable 3,700

24 LO 4© 2013 McGraw-Hill Ryerson Limited.

Revenues earned in a period that are both unrecorded and not yet received in cash.• Adjusting entries must be made to record the

revenue for the period and the related asset at the balance sheet date.

• Examples: fees earned, interest earned, rent earned

Accrued RevenuesAccrued Revenues

25 LO 4© 2013 McGraw-Hill Ryerson Limited.

Accrued Revenues - Example

On December 31, $16,500 of consulting fees have been earned but have not been recorded or billed to the client.

The entry to record the accrued consulting fees earned would be:

Accounts Receivable 16,500 Consulting Fees Earned 16,500

26 LO 4© 2013 McGraw-Hill Ryerson Limited.