Accounting 3 - Adjusting Entries for Deferrals

-

Upload

oanh-nguyen -

Category

Documents

-

view

230 -

download

0

Transcript of Accounting 3 - Adjusting Entries for Deferrals

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

1/17

-1-

Hult International Business School - London

International Accounting

Handout 3 Adjusting Entries for Deferrals

Module A - 2015 / 2016

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

2/17

-2-

Adjusting Entries OverviewAt the end of the accounting period, adjustments need tobe made to several trial balance accounts. Adjustments are needed because events would have taken place

during the accounting period (which DID have an impact on accountbalances) but were never recorded; either because it was impossible to do or inconvenient to do.

Examples:

Office supplies account balance was not adjusted every time a printer cartridgewas changed;

Prepaid insurance account balance was not adjusted every day the policy wasin force;

Unearned revenue account balance was not adjusted every day work was

done for a client who prepaid for services;

At the end of the accounting period therefore, these entries must bemade, otherwise these account balances (and therefore financialstatements) will not reflect the economic reality.

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

3/17

-3-

Transactions (V) in T Accounts15.Halfway through the year WW takes out a business insurance coverage and(pre)pays $1,000 cash for it. Its will cover WW for the next twelve months.

Deferred Expense under rules of accrual accounting:

Property, Equipment, Supplies are all recorded as assets (as they areresources that will benefit the business going forward).

These assets will get used up at some point, the benefit will cease to exist.

Consequently, these assets will become a business expense.

This leads to a deferred expense adjusting entry.

=

Debit Credit Debit Credit

+ +

1,000 1,000

PrepaidInsurance Cash

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

4/17

-4-

Transactions (V) in T Accounts16.On October 1st, WW receives $1,200 advance payment from a customer forconsulting work to be performed (equally) over the next 12 months.

Deferred Revenue under rules of accrual accounting:

Revenue can only be recorded when it has been earned, i.e. service has beenperformed.

Cash received as a prepayment gives rise to a liability (Unearned Revenue).

As work is later completed Revenue is (progressively) recognized and theliability account is (progressively) eliminated.

This leads to a deferred revenue adjusting entry.

=

Debit Credit Debit Credit

+ +

1,200 1,200

Cash UnearnedRevenue

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

5/17

-5-

Trial Balance RevisitedA trial balance fortransactions 1

through 16 is shown

below.

There were no errors madein recording the transactionsduring the accountingperiod, however someaccounts (highlighted) arenot correct.

Adjustments need to be

made.

WinstonWolfeServicesInc.

Debit Credit

Cash 19,450

A/R 200

OfficeSupplies 2,000

ComputerWorkstation 4,000

PrepaidInsurance 1,000

A/P 2,000

Debt 3,000

UnearnedRevenue 1,200

CommonStock 23,000

Dividends 3,000

Revenue(s) 1,200

Expense(s) 750

Total 30,400 30,400

TrialBalanceSheet($s)

December31,20X5

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

6/17

-6-

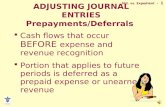

Deferred Expenses & Revenues (I)Deferred means ... delayed until later. Recording (expensible) items as assets means ... delaying

(deferring) the recording of an expense until later; Since the economic benefit (from these assets) will eventually expire; these asset accounts will have to be reduced causing an expense to be

recorded.

Recording (revenueble) items as liabilities means ... delaying(deferring) the recording of a revenue until later; Since the economic benefit (from these liabilities) will eventually arise; these liability accounts will have to be reduced causing a revenue to be

recorded.

First Later

DeferredExpense CashPaid ExpenseRecognized

DeferredRevenue CashReceived RevenueRecognized

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

7/17

-7-

Deferred ExpensesRecording (expensible) items as assets means ... delaying(deferring) the recording of an expense until later; Since the economic benefit (from these assets) will eventually

expire; these asset accounts will have to be reduced causing an expense

to be recorded.

Debit AssetAccout $XYZ Debit ExpenseAccount $XYZ

Credit Cash,A/P,etc. $XYZ Credit AssetAccout $XYZ

First Later

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

8/17

-8-

Deferred Expenses (I)

15.(A) Halfway through the year WW takes out a business insurance coverageand (pre)pays $1,000 cash for it. Its will cover WW for the next twelve months.

15. (B) By the end of the year, half the insurance policy would have expired. Anadjusting entry for $500 must be made in order to adjust the asset account.

Insurance Expense (not originallyon the trial balance), will now appearthere.

=

Debit Credit Debit Credit

+ +

1,000 1,000

Prepaid

Insurance Cash

=

Debit Credit Debit Credit

+ +

500 500

InsuranceExpense PrepaidInsurance

Debit AssetAccout $XYZ Debit Expense Account $ABC

Credit Cash,A/P,etc. $XYZ Credit AssetAccout $ABC

First Later

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

9/17

-9-

Deferred Expenses (II)

(A) The Office Supplies account on the trial balance indicates a balance of $2,000.

(B) Inventory taken at the end of the year indicates that the cost of the OfficeSupplies account still in possession is $1,500.

$500 worth of Office Supplies have therefore been used up and have become a

period expense. Adjusting entry is required.

Supplies Expense (not originally on the trial balance), will now appear there.

=

Debit Credit Debit Credit

+ +

500 500

SuppliesExpense OfficeSupplies

Debit AssetAccout $XYZ Debit Expense Account $ABC

Credit Cash,A/P,etc. $XYZ Credit AssetAccout $ABC

First Later

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

10/17

-10-

Deferred Expenses DepreciationEquipment, PE&E Fixed Assets accounts also need to be

adjusted. Deterioration of fixed assets causes them to be progressively

depreciated (periodic wear and tear reduction in benefit from theequipment);

At some point it will be worn out and no benefit will be left in it.

As opposed to supplies, Equipment, PP&E conforms tothe Cost Concept. Original cost of PP&E must be kept in the account. As opposed to reducing the PP&E account directly, it must be reduced

indirectly. Credit will be recorded not directly to the PP&E account, but to the separate(though related) account calledAccumulated Depreciation.

I.e. there will be two accounts for PP&E in the ledger. Net of which will give us the ending balance of the PP&E account.

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

11/17

-11-

Accumulated Depr. & Depr. ExpenseDepreciation Expense associated with the PP&E account

can only be estimated. Unlike Office Supplies (where inventory count will tell exactly what is

left in the account); Unlike Prepaid Insurance (where contract will tell exactly what period of

coverage is left); For PP&E estimates must be made for:

Useful life of the equipment; Salvage (re-sale) value at the end of the useful life;

There are several methods to calculate the Depreciation Expense,simplest of which is the straight line, i.e. in proportion.

Adjusting entry to record the estimated Depreciation is shown below on

the right:

Debit PP&EAccout $XYZ Debit Depr.Expense $ABC

Credit Cash,A/P,etc. $XYZ Credit Acc.Depreciation $ABC

First Later

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

12/17

-12-

Accumulated Depr. Account (I)A contra account ... whose balance is netted off the PP&E

account on the B/S.

(A) The Equipment (Computer Workstation) account on the trial balance indicatesa balance of $4,000.

(B) Assuming the purchase was made at the beginning of the year, useful life of 5years, no salvage value and straight line depreciation, Depreciation Expense of$4,000 / 5 = $800 must be recorded.

=

Debit Credit Debit Credit

+ +

800 800

Accumulated

Depreciation

Depreciation

Expense

Debit PP&EAccout $XYZ Debit Depr.Expense $ABC

Credit Cash,A/P,etc. $XYZ Credit Acc.Depreciation $ABC

First Later

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

13/17

-13-

Accumulated Depr. Account (II)The un-depreciated portion of PP&E cost (i.e. the

remaining amount) is the Book Value and is listed as an

Asset on the B/S.

Winston

Wolfe

Services

Inc.

Assets

Cash 19,450

A/R 200

OfficeSupplies 1,500

ComputerWorkstation 4,000

AccumulatedDepreciation 800 3,200

PrepaidInsurance 500

TotalAssets 24,850

BalanceSheet($s)

December31,20X5

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

14/17

-14-

Deferred Revenues (I)Recording (revenueble) items as liabilities means ...delaying (deferring) the recording of a revenue until later;

Since the economic benefit (from these liabilities) will eventually

arise; these liability accounts will have to be reduced causing a revenue

to be recorded.

Debit Cash $XYZ Debit UnearnedRev. $ABC

Credit UnearnedRev. $XYZ Credit RevenueAccount $ABC

First Later

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

15/17

-15-

Deferred Revenues (II)

16.(A) On October 1st, WW receives $1,200 advance payment from a customer forconsulting work to be performed (equally) over the next 12 months.

16.(B) By the end of the year, one quarter of the Unearned Revenue wouldbecome earned. An adjusting entry for $300 must be made in order to adjustthe liability account.

Revenues account will now increase.

Debit Cash $XYZ Debit UnearnedRev. $ABC

Credit UnearnedRev. $XYZ Credit RevenueAccount $ABC

First Later

=

Debit Credit Debit Credit

+ +

1,200 1,200

Cash UnearnedRevenue

=

Debit Credit Debit Credit

+ +

300 300

UnearnedRevenue Revenue(s)

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

16/17

-16-

Adjusted Trial BalanceMajority of accounts have changed.WinstonWolfeServicesInc.

Debit Credit

Cash 19,450

A/R 200

OfficeSupplies 2,000

ComputerWorkstation 4,000

PrepaidInsurance 1,000

A/P 2,000

Debt 3,000

UnearnedRevenue 1,200

CommonStock 23,000

Dividends 3,000

Revenue(s) 1,200

Expense(s) 750

Total 30,400 30,400

TrialBalance($s)

December31,

20X5

WinstonWolfeServicesInc.

Debit Credit

Cash 19,450

A/R 200

OfficeSupplies 1,500

ComputerWorkstation 4,000

AccumulatedDepreciation 800

Prepaid

Insurance 500A/P 2,000

Debt 3,000

UnearnedRevenue 900

CommonStock 23,000

Dividends 3,000

Revenue(s) 1,500Expense(s) 750

DepreciationExpense 800

InsuranceExpense 500

SuppliesExpense 500

Total 31,200 31,200

AdjustedTrialBalance($s)

December31,20X5

-

7/23/2019 Accounting 3 - Adjusting Entries for Deferrals

17/17

-17-

Summary Deferred Items Items first recorded as Assets are transferred into an Expense

account.

Items first recorded as Liabilities are transferred into a Revenue

account.

Image source: http://www.expertsmind.com/questions/example-of-adjusting-entries-

30185459.aspx