A Comparative Study on Services Provided by Different Broking Firms

-

Upload

balvendra03 -

Category

Documents

-

view

223 -

download

1

Transcript of A Comparative Study on Services Provided by Different Broking Firms

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

1/53

A comparative study on servicesprovided by the different broking

firms

PROJECT SURVEY REPORTSubmitted

To

ICFAI NATIONAL COLLEGE, BIKANER

For the Degree

Of

MASTER OF BUSINESS ADMINISTRATION

By

Rajesh PrajapatINC, Bikaner

(6nd11912)

Under Guidance of

Mrs. Ritu S Sisodia

Faculty of INC, Bikaner

ICFAINATIONAL COLLEGE, BIKANER2006-2008

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

2/53

ACKNOWLEDGEMENT

It is great pleasure for me to express my hearty and sincere gratitude to my Faculty

Guide, Mrs. Ritu S Sisodia. Faculty of Marketing of INC, Bikaner. Under whose genuine

and inspiring guidance the present piece of investigation could get its present shape

within such a limited range of time.

The investigator feels his duty to express his sincere thanks to Ms. Krati Taldar and Ms.

Chanchal Sharma Faculty of INC, Bikaner for their suggestions, encouragement and help.

Special thanks are also due to all the employees, customers for their precious co-

operation provided to the investigator during the period of data collection.

I am thankful to my brother & my friends. Their inspirations, affection, care and whose

blessings have given me necessary enthusiasm and encouragement to complete this work.

At last but not the least I express my thanks to Mr. Aswani Diwakar , IT Faculty of INC,

Bikaner. for providing support in formatting and writing this report and giving me

assistance as and when required..

Place: Bikaner Rajesh Prajapat

Date: INC Bikaner

(6ND11912)

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

3/53

TABLE OF CONTENTS

Particulars

Acknowledgment-----------------------------------------------------------------------------------

List of Tables& Figures ..

Chapter -I..

Introduction

1.1 Introduction to the Stock Broking Houses

1.2 Introduction of the Broking Firms

1.3 Introduction to the Subject

CHAPTER II...

PROJECT PROFILE

2.1 Title of the Study

2.2 Objective of the Study

2.3 Significance of the study

2.4 Use of Research Method and Design

2.5 Population and Selection of Sample

2.6 Instrumentation

2.7 Data Collection

2.8 Introduction to Psychometric Test

2.9 Scope of the Study, and

2.10 Limitations of the Project Study

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

4/53

CHAPTER-III..

Figures and findings

3.1 Introduction

3.2 Findings from Questionnaires

CHAPTER IV.

REPORT OF THE PROJECT

4.1 Conclusions

4.2 Recommandations & Suggestions

BIBILIOGRAPHY

ANNEXTURES...

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

5/53

LIST OF TABLES & FIGURES

------------------------------------------------------------------------------------------------------------Table No. Particulars

3.1 Various accounts of customers in all broking firms

3.2 Market share of all broking firms

3.3 Comparison of broking charges of all broking firms

3.4 Comparison of A/C opening charges of all broking firms

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

6/53

CHAPTER I

Introduction

1.4 Introduction to the Stock Broking Houses

1.5 Introduction of the Broking Firms

1.6 Introduction to the Subject

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

7/53

Objective of Stock Broking Firms

Broking Firms

A transaction on a stock exchange must be made between two members of the

exchange a typical person may not walk into the New York Stock Exchange

(for example), and ask to trade stock. Such an exchange must be done through a

broker.

There are three types of stock broking service.

Execution-only, which means that the broker will only carry out the client's

instructions to buy or sell.

Advisory dealing, where the broker advises the client on which shares to

buy and sell, but leaves the final decision to the investor.

Discretionary dealing, where the stockbroker ascertains the client's

investment objectives and then makes all dealing decisions on the client's

behalf.

In addition to actually trading stocks for their clients, stock brokers may also offer

advice to their clients on which stocks, mutual funds, etc. to buy.

Definition of Stock Broker

All stock investors have one thing in common, whether they trade in penny

shares or are long-term share investors; they all have to work through stock

brokers.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

8/53

When entering the world of the stock market, choosing a stock broker is your first

priority and may be the most important choice you will make. There are many

choices in stock brokers and you need to understand the key differences in each

in order to better make your decision.

Traditionally, full-service stock brokers were the only type that was available.

They charged very high commission fees but also gave a lot of help and

guidance in choosing the right investments. In 1975, all of that changed and the

discount stock brokers became the reigning champs of the investing world. In the

last decade, the internet has permitted individual investors to research their own

potential stocks for themselves, and even buy and sell stocks. There have been

advantages to the arrival of the discount stock broker and online brokerage firm,

but for some investors it has led to more mistakes in a smaller time. The key is

doing your research and investing wisely.

On one end of the spectrum are the discount and online stock brokers. These

brokerage firms act as order takers for their investors. The investor places an

order on the telephone or online. The only help given is with the technical

aspects of the website or the ordering process. There is no guidance given as to

which stocks to buy, when to buy or when to sell. Many online brokerage firms

offer their members access to stock market research, but this is provided by a

third party. The account management tools help you understand how greatly you

have invested and where it is going. These tools are generally online or

downloadable. The discount and online stock brokers are for people either

already familiar with the stock market, or those who do not have much money to

invest. They do require that the investor spend some time researching and

planning their investments. If you are interested in doing your own research or

want to dodge hefty brokerage fees than discount and online brokers may be for

you.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

9/53

The next level in service is a discount or online brokerage with an assistance

stock broker. The assistance stock broker will give a small amount of help. In

online brokerage firms, the assistant stock broker takes the form of offering more

research available and newsletters with investing tips. There is still a quantity of

research that wants to be done by the individual investor, but these brokerages at

least point their clients in the correct direction.

The traditional full service stock broker provides recommendations for specific

shares that would be good for your portfolio. The stock broker analyzes your

financial situation to figure out your needs. They put together an investing plan

that is reviewed periodically and adjusted as needed. Full-service stock brokers

are an admirable choice for those who dont have the time or the interest in

staying on top of the newest economic news. The full service stockbroker does

all the research for you and presents you with the best investments for your

situation. Their clients are handled with awareness to special details and goals.

This awareness does come with hefty commission fees, but considering the

quantity of work and dedication that full service stock brokers give, these fees are

understandable. Traditional full-service brokers make money based on the

quantity of transactions they facilitate.

A money manager is one level up from a full-service stock broker in their level of

economic services. Money managers (also called economic advisors) will work

with clients to develop their total financial picture, which may or may not include

investing in stocks. Money managers support stocks and bonds for clients. Each

one has his or her own exclusive style and so it is important that you decide

wisely to make sure your money manager has the same economic philosophy

that you do. A professional money manager does not collect commissions on

transactions. They are salaried from a percentage of the assets under their

management. In that way, they are working for you and themselves at the same

time. If your portfolio grows, their commission will grow as well.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

10/53

Introduction of Sharekhan

Sharekhan, one of India's leading brokerage houses, is the retail arm ofSSKI.

With over 510 share shops in 170 cities, and India's premier online trading portal

www.sharekhan.com, our customers enjoy multi-channel access to the stockmarkets.

http://www.sski.co.in/http://www.sski.co.in/ -

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

11/53

Online Services to Suit Customers Needs!

With a Share khan online trading account, you can buy and sell shares in an

instant! Anytime you like and from anywhere you like!

You can choose the online trading account that suits your trading habits and

preferences - the Classic Account for most investors and Speed trade for active

day traders. Your Classic Account also comes with Dial-n-Trade completely free,

which is an exclusive service for trading shares by using your telephone.

Get everything you need at a Sharekhan outlet!

All you have to do is walk into any of our 640 share shops across 280 cities in

India to get a host of trading related services - our friendly customer service staff

will also help you with any accouts related queries you may have.

A Sharekhan outlet offers the following services:

Online BSE and NSE executions (through BOLT & NEAT terminals)

Free access to investment advice from Sharekhan's Research team

Sharekhan ValueLine (a monthly publication with reviews of

recommendations, stocks to watch out for etc)

Daily research reports and market review (High Noon & Eagle Eye)

Pre-market Report (Morning Cuppa) Daily trading calls based on Technical Analysis

Cool trading products (Daring Derivatives and Market Strategy)

Personalised Advice

Live Market Information

Depository Services: Demat & Remat Transactions

http://www.sharekhan.com/ClassicAccount/http://www.sharekhan.com/SpeedTrade/http://www.sharekhan.com/DialnTrade/http://www.sharekhan.com/DialnTrade/http://www.sharekhan.com/DialnTrade/http://www.sharekhan.com/ClassicAccount/http://www.sharekhan.com/SpeedTrade/http://www.sharekhan.com/DialnTrade/ -

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

12/53

Derivatives Trading (Futures and Options)

Commodities Trading

IPOs & Mutual Funds Distribution

Internet-based Online Trading: SpeedTrade

Investing in Mutual Funds through Sharekhan

We're glad to announce that you will now be able to invest in Mutual Funds

through us! We've started this service for a few mutual funds, and in the near

future will be expanding our scope to include a whole lot more. Applying for a

mutual fund through us is open to everybody, regardless of whether you are a

Sharekhan customer.

To invest in a fund, all you have to do is download the application form, print it

out, fill it in and send it over to us. We'll do the rest for you.

Product Offerings

The Balanced Scheme:

Ideal for investors looking at steady and superior returns with low to medium risk

appetite. This portfolio consists of a blend of quality blue-chip and growth stocks

ensuring a balanced portfolio with relate vely medium risk profile. The portfolio

will mostly have large capitalization stocks based on sectors & themes who have

medium to long term growth potential.

Product Approach

Investment are based on 3 tenets:

i]

ii]

iii]

Consistent, steady and sustainable returns

Margin of Safety

Low Volatility

Product Characteristics

> Bottom up stock selection

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

13/53

> In-depth, independent fundamental research> High quality companies with relatively large capitalization.> Disciplined valuation approach applying multiple valuation measures> Medium to long term vision, resulting in low portfolio turnover

Convenient, Secure and Automated Demat services

Dematerialisation and trading in the demat mode is the safer and faster

alternative to the physical existence of securities. Demat as a parallel solution

offers freedom from delays, thefts, forgeries, settlement risks and paper work.

This system works through depository participants (DPs) who offer demat

services and the securities are held in the electronic form for the investor directly

by the Depository.

Sharekhan Depository Services offers dematerialisation services to individual

and corporate investors. We have a team of professionals and the latest

technological expertise dedicated exclusively to our demat department, apart

from a national network of franchisee, making our services quick, convenient

and efficient.

At Sharekhan, our commitment is to provide a complete demat solution which is

simple, safe and secure.

Indiabulls

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

14/53

Regardless of how the market is performing or which way the economic winds are

blowing, you, as a trader, are researching, charting, crafting a strategy, buying and

selling. You are getting in, getting out and moving on to the next trade.

Choose from a comprehensive offering of accounts, platforms and products. Customize

our technology and services to support the way you work.

Trade smarter on Power IndiabullsTM - Choose from a broad spectrum of sophisticated

trading tools using a fast desktop Trading Software - Trading just got faster.

Features of Power IndiabullsTM :

Live Streaming Quotes

Fast Order Entry

Tic by Tic Live Charts

Technical Analysis

Live News and Alerts

Extensive Reports for Real-time Accounting

Indiabulls Equity AnalysisTM

Get full access to Indiabulls Equity AnalysisTM, our objective, fact-based approach to

rating stocks.

Managing money with an open hand is hard. You need a guide on how to invest in the

fast fluctuating stock market. Building and maintaining your ideal portfolio needs

dependable and fact-based information. Indiabulls Equity AnalysisTM satisfies that need

by providing in depth analysis of companies that are frequently traded.

Indiabulls Equity AnalysisTM is generally updated daily. So, you should review and

consider any recent market or company news before investing. Indiabulls Equity

AnalysisTM are general information; they do not take into account your individual

circumstances, financial solutions or needs, nor do they represent a personalized

recommendation of stock or stocks to you. Stocks can be volatile and entail risks.

http://www.indiabulls.com/equities/equity_analysis.htmhttp://www.indiabulls.com/equities/equity_analysis.htmhttp://www.indiabulls.com/equities/equity_analysis.htm -

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

15/53

Investment in stocks is subject to market risk. Please read the SEBI prescribed Risk

Disclosure Document before investing.

Competitive Commissions

Enjoy competetive commissions and get the service and support you need at a fair price.

Benefits

Comprehensive Financial Services - As an Active trader, you'll have the tools,

resources and support you need to execute your trading strategy, plus your choice of a

wide range of investment products and services.

Dedicated Support and Services - Enjoy priority access to Relationship Managers who

are dedicated to support your trading and investing needs.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

16/53

CHAPTER IIPROJECT PROFILE

2.1 Title of the Study

2.2 Objective of the Study

2.3 Significance of the study

2.4 Use of Research Method and Design

2.5 Population and Selection of Sample

2.6 Instrumentation

2.7 Data Collection

2.8 Introduction to Psychometric Test

2.9 Scope of the Study, and

2.10 Limitations of the Project Study

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

17/53

PROJECT PROFILE

Project profile is a part of the methodology of research which is used for a survey

research work. It is a way to solve the research problem. In the Project Profile various

steps are generally used by a researcher to study his/her research problem related to the

project selected by him or her. These steps are:

2.1 Title of the Study,

2.2 Objective of the Study,

2.3 Need & Significance of the Study,

2.4 Use of the Research Method and Research design,

2.5 Population and Selection of Sample,

2.7 Instrumentation,

2.8 Data Collection,

2.9Introduction of the Psychometric test,

2.10 Scope of the Study

2.11 Limitations of the Project research.

2.1 Title of the Study

The investigator selected the following title of the study related to his study related

to his project: Services provided by the different broking firms.

2.2 Objective of the Study

The main objective of the present study was to compare Services provided by the

different broking firms. There were some of the secondary objectives of the present

study. There were as under:

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

18/53

2.2.1 To develop the related questionnaires for measuring the comparative

Services provided by the different broking firms.

2.2.2 To study the customers preference for the different broking firms.

2.2.3 To explore the preferential attitude of customers towards the services of

broking firms.

2.2.4 To investigate the problems of customers with regard to services of

broking firms.

2.2.5 To analyze the facilities/services which are being provided to the

employees and customers by broking firms.

2.2.6 To study the effects of faster delivery, attractive advertisement and

quality satisfaction etc. on customers demand of services of broking firms.

2.2.7 To familiarize the concerning companies, the employees and the

customers with the features of the results obtained in the present research and

to encourage them to modify their activities/behaviors according to the

obtained results.

2.3 Need & Significance of the Study

A review of related literature of security market reveals that in India & Abroad, a

few surveys have been conducted on the development and problems faced by the

broking firms.

But, no specific study has been conducted on the Services provided by the

different broking firms. Therefore, the investigator felt the untouched area of

research for the present study.

The need & Significance of the present study was felt on the following grounds:

2.3.1 General Point of View

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

19/53

At present, like other countries of the world, in India, the broking firms are

facing the various problems in the field of their products. Broking firms have

contribution in the market-share with regard to their services.

Service-level depends upon so many variables. Quality Satisfaction, CustomersDemand, charges, a/c opening fees, Provision of Facilities, market-share, timing

& tips, & Advertising Strategy etc, Organizational structure of an enterprise,

human resources, Govt. Policies and business ethics etc. are some of the

variables which have relationship with the contribution towards service-level of

different broking firms. Hence, the investigator felt the need to study the

comparative market-share of Coca-Cola & Pepsi.

2.3.2 Individual & Social Point of View

The broking firms require some media for development. If the society provides

suitable environment for the development of broking firms, the firms can

contribute towards the market-share for the benefits of the customers. If, the

environment is adverse, the firms cannot perform their role effectively for the

benefits of society.

Similarity, it is necessary for broking firms to identify the trading behavior of

customers. If the brokers behavior is not good towards the customers, and theold techniques of trading in the benefits of broking firms, the firms can

emphasize the provisions of facilities to customers for increasing their market-

share. Therefore, the present study has a great significance from both the

individual as well as the social point of view.

2.3.2 Academic Point of View

The literature available on the broking firms reveals that there are some thirst

areas upon which no studies have been conducted. These areas are: Marketing

management, Human Resource Management, Job-Satisfaction of the broking

firms employees and executives. Policies of Govt. impact of infra-structural

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

20/53

development. Business Ethics and Responsibilities etc. all of these thirst areas

are related with service-level of the broking firms.

2.3.3 Practical Point of View

The investigator felt the lack of proper tool for the measurement of broking

firms contribution towards the service-level at the Location level. Therefore,

the investigator himself developed the Questionnaire related to the service-level

(Customer Form).

Lastly, the significance of the present study was felt for the firms to motivate the

personnels of Lower, Middle & Top Management to work effectively on the

basis of the results obtained. Various facilities can be provided to retailers as

well as to the personnels of various levels of management.

2.4 Use of Research Methods and Design

In the research work, a method and research design is used according to the nature

& objective of the research problem. According to J.W. Best (1981), four types of

methods can be used for a research problem. These methods are: Historical

Research Method, Descriptive Survey Research Method, Experimental Research

Method and Action Research Method.

In the present study, Descriptive Survey Research Method has been used. The term

survey suggests gathering of related evidence to current conditions. Therefore,

Survey Research is a Method of collecting and analyzing of data obtained from the

large number of respondents representing a specific population.

There are four independent variables in the present study. Each variable has two

levels, so the research design for the present study is the Factorial Research Design.

The independent variables with their level are as follows:

(A) Age: above Thirty years 7 below Thirty years.

(B) Experience: More than Five years & Less than Five years.

(C) Category: General Category & Other Category.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

21/53

The independent variable the present study is service-level and its dimensions. An

overall, Rigid descriptive research design has been used focusing attention on

Formulation of objectives of the study,

Designing method for data collection,

Selection of sample Size,

Collecting the data,

Processing and Analysis of the data,

Findings & Conclusions,

Reporting of the study,

Bibliography & Annexure.

2.5 Population and Selection of Sample

All the customers who were dealing in the products of broking firms in the main

areas of Bikaner city constituted the population for the present study. All of the

customers of this area were also constituted the population for the present study.

It was not possible to include the whole population in the study. Therefore, it was

felt necessary to select a sample of the population which could represent the whole

population. A sample of 200 customers (200 related all broking firms) were

randomly selected from the concerned area.

2.6 Instrumentation

The following tools have been used in the present study:

2.6.1 Questionnaire Related to service-level of broking firms (Customers

Form)

All the above noted tools were constructed and developed by the investigator himself.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

22/53

2.7 Data Collection

A psychometric test means a standardized test which is used to analyze and

interpret the collected data related to a research problem. Its purpose is to test the

hypotheses formulated.

In the area of research, two types of psychometric tests are used :

(A) Parametric or Standardized test, and

(B) Non- Parametric or Distribution free test.

(A) Parametric or Standardized Test

The parametric tests are as Z test, t-test, x 2 (chi- Square) test, F-test, Karl Pearson

Product Moment Coefficient etc.

(B) Non- Parametric or Distribution free test

Some of the important non-Parametric tests are : Sign test: One sample runs test;

Rank Sum test; Fisher-Irwin test; Kendalles Coefficient; Kruskal-Wallis test and

Spearmans Rank Correlation test etc.

2.10 Scope of the Study

In the scope of the present study, the following contents have been included-

2.10.1 In the present study, all the broking firms have been included.

2.10.2 Only the various categories of customers of all companies, who are

dealing in and consuming respectively the companys products, have

been included.

2.10.3 Only the main area of Bikaner city has been brought into the scope

of the present study.

2.10.4 In the present study, only 40% sample of total customers was

included.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

23/53

2.10.5 This study has a sample of 200 customers of all the broking firms.

2.10.6 Though, the service level depends upon a series of dimensions, but in

the present study only eight dimensions have been included. These

dimensions are: Quality Satisfaction, Customers Demand, charges,a/c opening fees, Provision of Facilities, market-share, timing & tips,

& Advertising Strategy etc.

2.11 Limitations of the Project Study

The present investigation has the following limitations-

2.11.1 Time and money were the greatest limitations in carrying out the present

investigation.

2.11.2 The number of retailers being illiterate or less, they took a lot of time in providing

the data.

2.11.3 A few respondents were influenced by some specific factors, so they did not car to

provide the satisfactory response.

2.11.4 Another limitation was the non-availability of suitable tools to measure the

service level of the companies. Tools were developed and standardized by the

researcher himself.

2.11.5 The customer not has given much information about taking his risk in share

trading.

2.11.6 The customer are interested to open demat a/c or share trading.

2.11.7 Some customer dont know about the demat a/c or share trading.

2.11.8 Now the people invest in the securities very frequently but mostly are the small

investor.

2.11.9 Income of investor not so much & not having proper knowledge

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

24/53

CHAPTER III

Figures and findings

3.1 Introduction

3.2 Findings from Questionnaires

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

25/53

Figures and findings

3.1 Introduction

Analysis and interpretation is an essential part of a research work. For this purpose, the

necessary data are collected with the help of Questionnaires & standardized Psychometric

tests. After collecting the data, the data are tabulated. After tabulation, the analysis and

interpretation work is completed. In the process of analysis and interpretation, the

findings are obtained with the help of statistical treatment according to the proposed

objectives.

In the present research, the following Questionnaires and standardized tool were used for

achieving the findings-

(i) Questionnaires of shopping style of customers

3.2 Finding from the Questionnaires

In the present research work the following types of Questionnaires and scale have been

used:

3.2.1 Questionnaire Related to SERVICE-LEVEL (Customers Form)

3.2.2 Findings from the Customers Questionnaire related to service-level

For the purpose of the present study, 200 customers were randomly selected from

of the Bikaner city. These customers were using the demat a/c of all broking firms.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

26/53

No. of a/cs of various companies

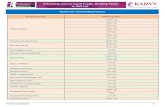

Table No. 3.1

Various accounts of customers in all broking firms

Name of company No of A/CIndia info line 405

Hem securities 200ICICI direct.com 250

Kotak mahindra 128Anagram 27Karvy 52Reliance Money 34

Others 200

FIGURE 1

Showing the accounts of all broking firms

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

27/53

A C C O U N

05 0

1 0 01 5 02 0 02 5 03 0 03 5 04 0 04 5 0

India

infoline

Hem

securiti

es

ICICId

irect.

com

Kotak

Mahind

ra

Anagram Ka

rvy

Relia

nceM

oney Ot

hers

c o m p a n i

Accounts

A C C O U N

Market share of various broking firms

Table No. 3.2

Market share of all broking firms

Name of company Market ShareIndia info line 31.25

Hem securities 15.43ICICI direct.com 19.29

Kotak mahindra 9.87

Anagram 2.08Karvy 4.01

Reliance Money 2.63Others 15.43

FIGURE 2

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

28/53

Showing the market-share of all broking firms

M A R K E T S H A

0

5

10

15

20

25

30

35

Market Share

COMPANIE

MARKETSHARE

IN

PERCENTAGE

India info line

Hem securi t ie

ICICI direct.co

Kotak Mahind

Anagram

Karvy

Rel iance M on

Others

Brokerage charges of all broking houses

All firms are having different broking charges as their rules-

Table No. 3.3

Comparison of broking charges of all broking firms

Name of company Brokerage charges(Rs)India info line .03 & .30

Hem securities .05 & .50

ICICI direct.com .07 & .50Kotak mahindra .05 & .50

Anagram .05 & .50

Karvy .05 & .70

Reliance Money .03 & .50

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

29/53

FIGURE 3

Showing the broking charges of all broking firms

BROKERAGE CHARGES

00.10.20.30.40.50.60.70.8

India

info

line

Hem

secu

rities

ICICId

irect.

com

KotakM

ahind

ra

Anag

ram

Karvy

Relia

nceM

oney

COMPANIES

BROKERAGE

IN

RUPEES

Intera Day

Delivery day

A/C opening charges of various companies

Each firm are charging some money as a/c opening fees.if we are comparing

all these then

Table No. 3.4

Comparison of A/C opening charges of all broking firms

Name of company Charges

India info line 555Hem securities 350ICICI direct.com 750

Kotak Mahindra 750Anagram 750Karvy 750

Reliance Money 750

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

30/53

FIGURE 4

Showing the account opening charges of all broking firms

account opening charges

0100200300400500600700800

India

info

line

Hem

secu

rities

ICICId

irect.

com

KotakM

ahind

ra

Anag

ram

Karvy

Relia

nceM

oney

various organizations

charges

Series1

Share khan has one of the best state of art web portal providing fundamental and

statistical information across equity, mutual funds and IPOs. You can surf across

5,500 companies for in-depth information, details about more than 1,500 mutual

fund schemes and IPO data. You can also access other market related details

such as board meetings, result announcements, FII transactions, buying/selling

by mutual funds and much more.

Type of Account

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

31/53

Classic Account Trading Terminal

ShareKhan Classic account

Allow investor to buy and sell stocks online along with the following features like

multiple watch lists, Integrated Banking, demat and digital contracts, Real-time

portfolio tracking with price alerts and Instant credit & transfer.

a) Online trading account for investing in Equities and Derivatives

b) Free trading through Phone (Dial-n-Trade)

c) Two dedicated numbers for placing your orders with your cellphone or

landline.

Automatic funds transfer with phone banking (for Citibank and HDFC

bank customers)

Simple and Secure Interactive Voice Response based system for

authentication

get the trusted, professional advice of our telebrokers

After hours order placement facility between 8.00 am and 9.30 am.

Integration of: Online trading + Bank + Demat account

Instant cash transfer facility against purchase & sale of shares

IPO investments

Instant order and trade confirmations by e-mail

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

32/53

Single screen interface for cash and derivatives

ShareKhan Speed Trade account

This accounts for active traders who trade frequently during the day's trading

session. Following are few popular features of Speed Trade account.

Single screen interface for cash and derivatives

Real-time streaming quotes with Instant order Execution & Confirmation

Hot keys similar to a traditional broker terminal

Alerts and reminders

Back-up facility to place trades on Direct Phone lines

Brokerage:Some stock trading companies charge direct percentage while others charge a

fixed amount per Rs 100. Sharekhan charges 0.5% for inter day shares and 0.1%

for intra day or you could say Sharekhan charges 50 paise per Rs 100.

How to open account with Sharekhan?

For online trading with Sharekhan, investor has to open an account. Following

are the ways to open an account with Sharekhan:

Call them at phone number provided below and ask that you want to open

an account with them.

1. Call on Toll free number: 1-800-22-7500 to speak to a Customer

Service executive

2. If you are in Mumbai call on 022-66621111

3. Visit one of their branches. Sharekhan has a huge network all over

India. Click on http://sharekhan.com/Locateus.aspx this link to find

out your nearest branch. Just select the place near you and you'll

find a manager to assist you there.

4. You can send them an Email on [email protected] to know

about their products and services.

5. If you wish to chat with customer service representative, you can

join the chat session.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

33/53

Advantages of Sharekhan:

1. Online trading is very user friendly and one doesn't need any software to

access.

2. They provide good quality of services like daily SMS alerts, mail alerts,

stock recommendations etc.

3. Sharekhan has ability to transfer funds from most banks. Unlike ICICI

Direct, HDFC Sec, etc., so investor not really needs to open an account

with a particular bank as it can establish link with most modern banks.

Disadvantages of Sharekhan:

1. They charge minimum brokerage of 10 paisa per stock would not let youtrade stocks below 20 Rs. (If you trade, you will loose majority of your

money in brokerage).

2. Lots of hidden rules and charges.

3. They do not provide facility to book limit order trades during after-hours.

4. Classic account holders cannot trade commodities.

5. Cannot purchase mutual funds online.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

34/53

Indiabulls is India's leading Financial Services and Real Estate Company having

presence over 414 locations in more than 124 cities. Indiabulls Financial Services

Ltd is listed on the National Stock Exchange, Bombay Stock Exchange,

Luxembourg Stock Exchange and London Stock Exchange.

Type of Account

Indiabulls Equity Trading Account

Indiabulls Equity Trading Account is standard Online trading account from India

bulls and along with online trading it also provides priority telephone access that

gives you direct access to your Relationship Manager and full access to

'Indiabulls Equity Analysis'.

Application Trading Terminal (Need Installation)

Power Indiabulls

Power Indiabulls trading terminal is the most advanced new generation trading

platform with great speed. This trading terminal is built in JAVA.

Power Indiabulls is extremely reach in features including Live Streaming Quotes,

Fast Order Entry and execution, Tic by Tic Live Charts, Technical Analysis, Live

News and Alerts, Extensive Reports for Real-time Accounting.

Document Required to open Equity Trading Account with Indiabulls

1. One passport size photograph.

2. Proof of bank account

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

35/53

3. Copy of PAN card.

4. Identity proof - copy of passport or PAN card or voter ID or driving license

or ration card.

5. Address proof - copy of driving license or passport or ration card or voter

card or telephone bill or electricity bill or bank statement.

Brokerage and fees:

Account opening fees : Rs 1200/- (One time non-refundable) as below:

250/- Equity Trading Account opening charge

200/- Demat Account opening charge

750/- Software changes

Advantages of Indiabulls Equity Trading Account

1. Brokerage is less compare to other online trading companies.

2. Provide trading terminal 'powerbulls', a java based software. It's very fast

in terms of speed and execution.

Reliance Money (or RelianceMoney.com) is the financial services division of the

Anil Dhirubhai Ambani Group promoted Reliance Capital Limited.

RelianceMoney.com is offering most dynamic web based trading

environment to its customers. The new trading platform has many new features

which basically fill up the gap between old online trading companies in India and

their customers.

The Reliance Money trading websites comes with special security features

'Security Token', which makes you online trading experience more secure

without complexity.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

36/53

Stock Trading is available in BSE and NSE. Offline trading is also available

through Reliance Money partners in your city and through phone by dialing 022-

39886000.

Investment options are available in

1. Equity (Stock) Trading

2. Derivatives Trading

Special feature is available first time to track your positions online, in real time.

3. Forex Trading

4. Commodity Trading

5. IPO's

6. Mutual Funds

7. Insurance

Type of Account

Reliance money is offering 3 types of accounts to its customers. Account forbeginners, for middlers and for experts.

Brokerage and fees:

Reliance Money is offering lowest brokerage rates in today's online stock

trading industry. The brokerages are as low as 0.075% for delivery based

trading and 0.02 for now delivery.

Note: The above figures may not accurate, please contact your nearest Reliance

Money broker to check the brokerages they are offering.

Also check rates of Securities Transaction Tax

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

37/53

How to open account with Reliance Money?

Account opening with Reliance Money is easy. Simply fill a form online at below

address and somebody from Reliance Money will contact you soon.

Advantages of Reliance Money

1. Extra security features with 'Security Token'', which is the most secure and

tested technology in computer world.

2. Simple, easy and fast online stock trading.

3. Almost all investment options are available under one account including

Equity Trading, Derivatives, Forex, Commodity, IPO, Mutual Funds and

Insurance.

4. Branches are now available in all major cities and the number is growing.

Branches are open from 9am to 9pm.

Useful info from Reliance Money Broacher (March 2007)

Reliance Money - Transacting and investing simplified

Get ready to change the way you transact and invest in financial products and

services.

Whether you wish to transact in Equity, Equity & Commodity Derivatives, IPOs,

Offshore Investments, or prefer to invest in Mutual Funds, Life & General

Insurance products or avail Money Transfer and Money Changing services, you

can do it all through Reliance Money.

Simply open a Reliance Money account and enjoy the convenience of handling

all your key financial transactions through this one window.

Benefits of having a Reliance Money account

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

38/53

1) It's Cost-effective

You pay comparatively lower transaction fees. As an introductory offer, we

invite you to pay a flat fee of just Rs. 500/- and transact through Reliance

Money. This fee is valid for two months or a specified transaction value*. See

the table for details.

Validity (whichever is

earlier)Turnover limit

Access Fee

(Rs.)

Time

Validity

Turnover

Validity

Non-delivery

turnover

Delivery

turnover

500 2 months Rs. l Cr. Rs. 90 Lac Rs. 10 Lac1350 6 months Rs. 3 Cr. Rs. 2.7 Cr. Rs. 30 Lac

2500 12 months Rs. 6 Cr. Rs. 5.4 Cr. Rs. 60 Lac

2) It offers Single- Window Access

Through Reliance Money's associates, you can transact in Equity, Equity &

Commodity Derivatives, Offshore Investments **, Mutual Funds, IPOs, Life

Insurance, General Insurance, Money Transfer, Money Changing and Credi t

Cards, amongst others.

3) Its Convenient

You can access Reliance Money's services through

a) The Internet,

b) Transaction Kiosks,

c) The phone (Call & Transact) and through

d) Our all - India network of associates On an assisted trade (through the

Call Centre or our network of associates) a charge of Rs. 12 per executed

trade will be applicable.

4) It's Safe

Your account is safe guarded with a unique security number that changes

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

39/53

every 32 seconds. This number works as a dynamic password to keep your

account extra safe.

5) It provides you a Demat Account

You get your own Demat Account with Reliance Capital at an annual fee of

just Rs. 50/-.

6) It provides you a 3...in...l facility

You can access your Banking, Trading and Demat Account through a single

window and transfer funds across accounts seamlessly!

7) It provides you value-added services

At www.reliancemoney.com you get

a) Reliable research, including views of external experts with an enviable

track record.

b) Live news updates from Reuters and Dow Jones.

c) CEOs/ Expert views on the economy and financial markets.

d) Tools that help you plan your investments, tax, retirement, etc, in the

Personal Finance section.

e) Risk Analyzer for analysis of your risk profile.

f) Asset Allocates to build an appropriate investment portfolio.

Religare Enterprises Limited is Ranbaxy Laboratories Limited promoted financial

product and service Provider Company.

Religare provide its service in three different segments including Retail, Wealth

management and the Institutional spectrum.

Religare Securities Limited is a subsidiary company of Religare Enterprises Ltd

and involve in equity related services include online trading at BSE and NSE,

Derivatives, commodities, IPO, Mutual fund, Investment banking and institutional

broking services.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

40/53

People who wonder where Religare word came from, it's a Latin word meaning

'to bind together'.

Type of Account

R-ACE (Basic)

It's the basic online trading account provided by Religare. Investor can trade and

access their account information online and over the phone as well.This account

comes with a browser based online trading platform and no additional software

installation needed.

This account also provides Lifetime free DP account with no annual maintenance

charges.

R-ACE Lite (Advanced)

It's the advanced account option for the investor with Religare. This trading

account provides the entire feature of R-ACE (Basic) account. In addition it also

provides real-time streaming stock quotes and alerts.

This trading platform is also browser based and no software installation is

needed.

R-ACE Pro (Professional)

As the name indicates this account is for high volume traders. Along with the

features from above 2 accounts, this account also comes with a Trading

Terminal, software which needs to install on your computer. This terminal directly

connects the investor to stock market and having all industry standard Treading

terminal features including technical charting (intra-day and EOD), multiple watch

list, advanced hot-key functions for faster trading, derivative chains, futures &

options calculator.

As in basic and advance account, trading is available online through internet and

offline though phone.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

41/53

Brokerage and Account opening fees:

Religare offers three kinds of accounts as above. Below are detail about fees and

activation charges for each account:

1. R-ACE

Account activation charges Rs.299/-.

Minimum margin of Rs.5000/- required.

2. R-ACE Lite

Account activation charges Rs.499/-.

Minimum margin of Rs.5000/- required.

3. R-ACE Pro

Account activation charges Rs.999/-.Minimum margin of Rs.10,000/- required.

4. All the account comes with free annual maintenance charge.

5. All account comes with free DP account.

6. Brokerage at Religare

On the basis of volume and frequency of trading, Religare provide different

options for brokerages. On the broader way they divided into three

categories:

o Classic Account

Intraday brokerage varies from 0.3% to 0.5%.

Delivery brokerage varies from 0.30% to 0.50%.

Derivatives brokerage varies from 0.3% to 0.5%.

o Freedom Account

In this payment scheme, investor has to pay a fix amount in

advance for Monthly (Rs 500/-), Quarterly (Rs.1400), Half-yearly

(Rs 2500) or Annual Subscription (Rs 4000). This one time

payment enable account holder to trade for Rs. 3,00,000 intraday &

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

42/53

derivative trading and Rs. 40,000 of delivery based trading for zero

brokerage.

o Trump Account

Trump account has two payment options, Trump Plus and Trump

Super plan:

1. Trump Plus has annual subscription fees of Rs 2,500, Brokerage

on Delivery Trades of 0.25% and Brokerage on Intraday Trades &

F&O Trades of 0.025%.

2. Trump Super has annual subscription fees of Rs. 15,000,

Brokerage on Delivery Trades of 0.15% and Brokerage on Intraday

Trades & F&O Trades of 0.015%.

How to open account with Religare

For online trading with Religare, investor has to open an account. Following are

the ways to open an account with Religare:

Call them at phone number provided below and ask that you want to open

an account with them.

Visit http://www.religareonline.com/applyonline.asp and fill a form.

Representative from religare will contact you. Visit one of their branches. Religare has a huge network all over India with

more than 300 branch locations and a chain of franchises. Click on

http://www.religareonline.com/branches.asp this link to find out your

nearest branch. Just select the place near you and you'll find a manager to

assist you there.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

43/53

From the mobile phone type "RELIGARE" and send it to 54646. Customer

representative from Religare will call you with in 24 hours.

Advantages of Religare

1. Religare gives interest on unutilized cash when investor is waiting to make

next trade or online investment.

2. Religare Allow their investor to trade without having to worry about cash

margin. Investor can get exposure (on cash segment) as high as 20 times

for intraday trades.

3. They provide intraday reports and historical charting.

4. Lifetime free DP account.

5. Varity of fee structure to fulfill need of different type of investors.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

44/53

CHAPTER IV

REPORT OF THE PROJECT

4.1 Conclusions

4.2 Recommandations & Suggestions

Report of the project

4.1 introduction

The report, whether it is a thesis, dissertation or a short term-paper, or a project report,

usually follows a fairly standardized pattern. The following outline presents the usual

sequence of topics:

4.1.1 Preliminary Section

In this section the title, certificate of the title, acknowledgement, preface, indexing

of contents, list of tables and list of figures etc are included.

4.1.2 Main Body of the Report

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

45/53

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

46/53

(vii) Through Reliance Money's associates, you can transact in Equity, Equity

& Commodity Derivatives, Offshore Investments **, Mutual Funds,

IPOs, Life Insurance, General Insurance, Money Transfer, Money

Changing and Credit Cards, amongst others.

(viii) Due to its quality satisfaction, Karvy & ICICI direct has controlled more

Market-Share in comparison to others.

(ix) Online trading is very user friendly and one doesn't need any software to

access.

(x) They provide good quality of services like daily SMS alerts, mail alerts,

stock recommendations etc.

(xi) Intraday charges of indiainfoline are less as compare to others and karvys

charges are high.

(xii) In All four Brokers having the 75% of the over all market.

(xiii) In popularity of Security market the customers having the great interest.

(xiv) The online system is Indiabulls ltd stronger than other competitors.

(xv) A large number of executive and good quality of the workers is the plus

point for Broker Firms.

(xvi) All are performing their best.

4.3 Recommendations/Suggestions for Improvements

On the basis of the conclusions of present study, a few suggestions for improvements

are as follows :

(i) Each type of services should be provided by the all the firms in sufficient

quality.

(ii) All firms should charge less as like Hem securities. The firms provide

more and more facilities to customers for the purpose of advertisement.

(iii) All the broking firms should provide proper supply of its products by

improving the Distribution Channels, Advertisement Strategy and

efficiency of its employees.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

47/53

(iv) Better schemes and benefited should be provided to the customers by the

all firms.

(v) Broking charges of karvy are high so the firms have to charges low so that

more customers can attract.

(vi) The customers who are dealing from last 5 years should be provided with

some extra schemes and facilities.

(vii) Quality of the services should be improved by the reliance money.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

48/53

BIBILIOGRAPHY

Useful links about ShareKhan/Contact Sharekhan at:

1. ShareKhan Website: http://www.ShareKhan.com2. Product Demo - SpeedTrade:

http://www.sharekhan.com/Demos/speedtrade/index.html3. Product Demo - Classic:

http://www.sharekhan.com/Demos/classic/index.html4. Email: [email protected]

5. FAQs: http://sharekhan.com/KnowledgeCentre/Sharekhan_FAQ.aspx6. Phone: 022-666211117. Toll Free: 1-800-22-7500

Useful links & info about Indiabulls

1. Indiabulls Website:http://www.indiabulls.com

http://www.sharekhan.com/http://www.sharekhan.com/Demos/speedtrade/index.htmlhttp://www.sharekhan.com/Demos/classic/index.htmlhttp://sharekhan.com/KnowledgeCentre/Sharekhan_FAQ.aspxhttp://www.indiabulls.com/http://www.indiabulls.com/http://www.sharekhan.com/http://www.sharekhan.com/Demos/speedtrade/index.htmlhttp://www.sharekhan.com/Demos/classic/index.htmlhttp://sharekhan.com/KnowledgeCentre/Sharekhan_FAQ.aspxhttp://www.indiabulls.com/ -

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

49/53

2. E-mail: [email protected]. Contact No.: 1800-11-11-30, 0124-4572444

Useful links about Reliance Money

1. Reliance Money Website: : www.RelianceMoney.com2. Branch Locator: Reliance Money Branch Locator1. Website: www.RelianceMoney.com2. Email :[email protected] 3. Phone : 022-39886000

Useful links about Religare / Contact Religare at:

1. Website: www.religareonline.com

2. Email: [email protected], [email protected]. FAQs: https://nat.religaresecurities.com/stsb/presentationlayer/FAQ.pdf4. Phone: 011-443123455. Toll Free: 1800-11-44-88

http://emailto:[email protected]/http://www.reliancemoney.com/http://www.reliancemoney.com/mailto:[email protected]:[email protected]://www.religareonline.com/https://nat.religaresecurities.com/stsb/presentationlayer/FAQ.pdfhttp://emailto:[email protected]/http://www.reliancemoney.com/http://www.reliancemoney.com/mailto:[email protected]://www.religareonline.com/https://nat.religaresecurities.com/stsb/presentationlayer/FAQ.pdf -

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

50/53

ANNEXTURES

Services of broking firms

(Questionnaire for customers)

Supervisor: Investigator :

Mrs. Ritu S Sharma Rajesh Prajapat

Faculty of ICFAI NATIONAL COLLEGE, MBA student

Bikaner (Raj.) ICFAI NATIONAL COLLEGE

Respected Sir,

The questionnaire is being supplied to you for measuring the Services provided by the

broking firms. Please read the questions and give your responses by the tick-mark on one

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

51/53

of the alternative. Your responses would be kept confidential. They will be used only for

the research purpose.

________________________________________________________________________

Name:

Occupation:

Age:

Monthly income:

Address:

(1) In which company you invested?

(a) India infoline (b) India bulls

(c) ICICI direct. (d) Sharekhan

(e) Reliance Money (f) Any other

(2)What are the account opening charges?

(a) 750 (b) 555

(c) Free (d) any other.

(3)What are the brokerage rate of intra and delivery?

(a) .03 & .30 (b) .03 & .75

(c) .02 & .30 (d) any other.

(4) In which type of schemes/products of broking firm, you have invested?(a) Mutual funds (b) saving account

(c) d-mat account (d) fixed deposit

(e) Life insurance (f) commodities

(g) Others (h) trading account

(I) None

(5) Is broking firm fulfills your expectations?

(a) Yes (b) no

(6) In which company you want to invest in future?

(a) India infoline (b) India bulls

(c) ICICI direct.

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

52/53

(7) Is your organization provides Invest anytime facility?

(a) Yes (b) no

(8)From how many schemes/products you are aware?

(a) Fixed deposit (b) bonds

(c) Mutual funds (d) nse/bse/ncdex

(e) Life insurance policy (f) future and option

(g) All of above (h) none

(9)If you have invested threw broking firm what are the services provided by

company?

(a) Online line trading (b) off line trading

(c) Funding scheme (d) providing software for

online trading

(e) Any other services (f) none

(10)Are they providing you daily tips, massages, news?

(A)REARLY (B) FOR SPECIAL TRADE

(C)RAGULARY (D) NO

(11).What options do you prefer for trading?

(A)OVER THE PHONE (B) AT OUR BRANCH

(C)ON LINE TRADING

(12).What is the factor that you are trading with Broker?

(A)SERVICE (B) GOOD BEHAVIOUR

(C)BROCKRAGE

(13).Are you satisfied that they are providing you best credit limit?

(A)YES (B) NO

-

8/6/2019 A Comparative Study on Services Provided by Different Broking Firms

53/53

(14).Are you getting all this as right time? Contact notes/Statements/Tale

calling/Massages tips?

(A)FOR SPECIAL TRADE (B) YES

(C)NO

(15).Which thing of Broker firm do you like most?

(A)CUTTING ADGE TECHONOLOGY (B) ACCLAIMED RESEARCH

(C)DEDECATED RELATIONSHIP MANAGER

(16).Are you satisfied our tt5 and tt5 advance and Odin software?

(A)YES (B)NO

(17).Which factor influences you to work with your Broker?

(A)PREMIUM BROCKRAGE (B) NO FIXED CHARGE

(18).Are you satisfied with services provided by firm or not?

(a) Very satisfied (b) satisfied

(c) Not satisfied (d) cant say.