4.2 Financial Statement Basics Exercises1

-

Upload

prashant-khare -

Category

Documents

-

view

223 -

download

0

Transcript of 4.2 Financial Statement Basics Exercises1

-

8/13/2019 4.2 Financial Statement Basics Exercises1

1/24

The BASICS of FINANCIAL STATEMENTS

For Agricultural Producers

EXERCISES

Authors:

Jaes Mc!ra""

Fra"cisco A#ell$

%oug Richardso"

Christ& 'aggo"er

%e(arte"t of Agricultural Eco"oics

Te)as Coo(erati*e E)te"sio"

Te)as A+M ,"i*ersit&

Ma& -./ 0112

-

8/13/2019 4.2 Financial Statement Basics Exercises1

2/24

The Basics of Fi"a"cial Statee"ts E)ercises

I"structio"s

This section contains a series of questions and exercises used to gain a betterunderstanding of the basic concepts behind financial statements. The questions andexercises addressed in this section focus on the four main financial statements: (1)Balance Sheet; (2) ncome Statement; (!) Statement of "ash #lo$s; (%) Statement of&$ner's quit. ach of these statements combine the tools that can be used to e*aluatethe performance and pro*ide other useful information to better guide decision ma+ing ina farm or ranch business.

The first set of exercises is a list of multiple choice and fill in the blan+ questions

that help identif the main components of the four different financial statements. Thesequestions should also allo$ the user to understand $hat the differences and similaritiesare bet$een each of the statements and ho$ this can ser*e as a basis for communicationabout the performance of a business.

The second set of exercises allo$ the user to piece together an actual set offinancial statements b using the information pro*ided from an example ranch business.The ,est Texas -anch in this case has a list of accounts associated $ith each of thefour main financial statements. t is required that the user places each account into itsproper classification $ithin each financial statement. The last page of this exercisecontains the information necessar to calculate the performance ratios of the business.The basic goal of this exercise is to be able to identif proper placement of each of the

accounts associated $ith their respecti*e financial statements. f done properl thenumbers used in calculating the financial ratios should match up $ith some of the onesgenerated from the financial statements.

-

8/13/2019 4.2 Financial Statement Basics Exercises1

3/24

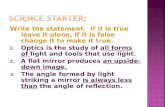

Multi(le Choice a"d Fill i" the Bla"3 4uestio"s

1) "omplete the follo$ing sentences.a) ,hat the business has: .b) /o$ much the business o$es: 00000000.

c) ,hat the business is $orth: 000000000.

2) "ircle each of the follo$ing equations that are correct. ( ssets 3 3iabilities quit)a) 4 3b) 5 3c) 4 3d) 5 3e) 3 4

Ta#le -5

!) n the table abo*e mar+ $hich of the accounts are assets or liabilities and if the arecurrent or non6current.

%) /o$ are assets displaed in the asset section of the balance sheet7a) scending order of liquidit

b) 8escending order of amount

Assets Liabilities Current Non-Current

Accrued Expenses

Long Term Investments.

Accrued Interest - Non Real Estate Loans and Notes

Raised Breeding Stoc

Investments in gro!ing and "inis#ing livestoc

$overnment %a&ment Receivable

Credit Card' (per. Loan' Curr. Note %a&able

%urc#ased Breeding Stoc.

%repaid Expenses

Crops'Raised )eed "or Sale.

Cas# * C#ecing

Breeding +orses

Accounts Receivable.%rincipal ,ue - Non Real Estate Loans and Notes

Savings and Time ,eposits

Income Taxes %a&able

Accounts %a&able

%rincipal Balance- Non Real Estate Loans and Notes

-

8/13/2019 4.2 Financial Statement Basics Exercises1

4/24

c) scending order of amountd) 8escending order of liquidite) B order of practicalit

9) ,hich account identifies mone o$ed to the business but has et to be collected.a) "ash and "hec+ingb) Suppl repaid xpenses and 3easesc) n*estments Bonds and Securitiesd) ccounts -ecei*ablee) Sa*ing and Time 8eposits

) "ircle each of the follo$ing that are included as "urrent n*entor ssets7a) 3i*estoc+ for Sale

b) "rops < -aised #eed for Salec) urchased Breeding Stoc+d) =ehicles >achiner ? quipmente) -aised or urchased #eed intended to be used in li*estoc+ production.

@) ,hich describes prepaid expenses7a) Supplies -ecei*edb) Bills paid but ser*ices not et recei*edc) "urrent ssets that can be turned into cash

A) "omplete the follo$ing sentences that describe the "urrent sset "cle.a) n*entor $hen sold becomes 0000000.b) ccounts recei*able upon collection becomes 000000000.c) "ash bus inputs that produce 00000000.

) ,hich of the follo$ing is the main characteristic that describes a non6current asset7a) -epresent a great amount of mone for the business.b) "on*erted into cash in less than 12 months.c) Cot con*erted into cash during the normal course of the business.d) ssets that are intended for sale.

1D) /o$ is a non6current asset reported on the balance sheet7a) Con "urrent sset at cost 4 Eear depreciationb) Con "urrent sset at mar+et *alue 4 Eear depreciation

-

8/13/2019 4.2 Financial Statement Basics Exercises1

5/24

c) Con "urrent sset at mar+et *alue 4 ccumulated depreciationd) Con "urrent sset at cost 4 ccumulated depreciation

11) "omplete the follo$ing definitions.a) 00000000 depreciation (on the balance sheet) is the 000000000 of all the

depreciation charges ta+en since the asset $as 0000000 .b) 8epreciation charges ta+en in a period 00000000 profits for the period but do not000000000 cash.

12) /o$ are liabilities categoriFed for presentation on the balance sheet7 ("ircle all thatappl)a) To $hom the debt is o$ed.b) scending order of liquidit

c) 8escending order of liquiditd) B order of practicalit

1!) "omplete the follo$ing sentences. (Gse increase or decrease)a) "urrent liabilities decrease and

-

8/13/2019 4.2 Financial Statement Basics Exercises1

6/24

b) The *alue of o$ner's equit 00000000 $hen the business has a 000000000 thereb lo$ering retained earnings; or assets 0000000 more than liabilities.

1@) ,hich of these statements are true about the income statement7a) t includes cash and non6cash *alues.

b) s calculated after taxes.c) Gsed to measure the change of &$ner quit.d) Gsed to measure Cet ncome.e) Ho*ernment paments $ould not be includedf) t enables the farm operator to +no$ the sources of income.

1A) /o$ do $e organiFe the income statement7a) ssets and liabilities.b) "urrents and non current assets and current and non6current liabilities.c) "ash for operations cash for in*estments and expenses.d) -e*enues and expenses

1) "omplete the follo$ing equation. (Gsing 5 6 or ) ,hat is sold in the period

( ) ,hat it cost to ma+e ( )Heneral ? dministrati*e expenses for the period ( ) ncome for the period

2D) ,hich of these items belong to the "ash -eceipt ccount7 ("ircle all that appl)a) n*entor ? ccounts -ecei*able "hangeb) -aised 3i*estoc+ roductsc) Steers transferred out to another business entitd) "ash recei*ed from the sale of productse) =et ser*icesf) Hain (3oss) on Sale

-

8/13/2019 4.2 Financial Statement Basics Exercises1

7/24

b) Hains or 3osses from breeding stoc+.c) -epairs and >aintenance.d) #eed.e) 8epreciationf) ccounts -ecei*able

22) ,hich of these equations is correct7a) Cet income from operations Hross -e*enue 4 &perating xpenses 5 nterestb) Cet income from operations Hross -e*enue 4 &perating xpenses 5 "apital

Hain or 3osses 4 Taxesc) Cet income from operations Hross -e*enue 4 &perating xpenses 4 nterestd) Cet income from operations Hross -e*enue 4 &perating xpenses 5 nterest 5

"apital Hain or 3osses 4 Taxes

2!) ,hich of these equations is correct on the Statement of "ash #lo$s7a) Cet cash from financing Ce$ borro$ings 4 8ebt aments 4 nterest xpense

b) Cet "ash from operations -eceipts 4 xpenses 4 nterest xpenses 4 Taxesc) Cet "ash from in*esting Sales 4 urchases 4 xpensesd) Cet "ash from in*esting Sales 4 urchases 4 8epreciation

2%) "omplete the follo$ing equation $ith (5 < 4) signs that are missing.

"ash on hand at the start of the period ( ) "ash recei*ed in the period ( )"ash spent during the period "ash on hand at the end of the period.

29) n $hich financial statements do non6cash transactions ha*e an effect7 ("ircle all thatappl)a) Balance Sheetb) ncome Statementc) Statement of "ash #lo$sd) Statements of &$ner's quit

2) Based on the Statement of "ash #lo$s label each of the follo$ings as a source of"ash nflo$s (") or "ash &utflo$s ("&).a) -ecei*ing paments from customers. 00000b) Borro$ing mone. 00000c) aing interest and principal on debt. 00000d) aing for Supplies and emploees. 00000e) >a+ing maIor capital in*estment in long6li*ed producti*e assets li+e breeding

stoc+ or farm machiner. 00000f) aing ncome Taxes. 000000

-

8/13/2019 4.2 Financial Statement Basics Exercises1

8/24

g) Sales of breeding stoc+. 000000

2@) "ash receipts cash expenses cash interest expenses and cash tax expenses on theStatement of "ash #lo$ must match data $ith $hich other financial statements7a) Balance Sheet

b) ncome Statementc) Statement of &$ner quit

2A) "omplete the follo$ing sentence.The Statement of &$ner's quit reconciles the 0000000 and 0000000 o$ner'sequit through determining the changes in 0000000 and net change in capitalcontributions and distributions.

2) JBeginning o$ner equitK on the Statement of &$ner's quit must match data $ith$hich other financial statements7a) Balance Sheet

b) ncome Statementc) Statement of "ash #lo$s

!D) The ending o$ner's equit on the Statement of &$ner's quit could be compared tothe o$ner's equit calculated from the L.a) Balance Sheetb) ncome Statementc) Statement of "ash #lo$s

!1) #rom $hich of the main financial statements gi*e the data required to calculate thefollo$ing ratios7a) "urrent -atio 00000.b) -eturn on quit 00000.c) 8ebt6to6sset -atio 00000.d) quit6to6sset -atio 00000.e) -eturn on ssets 00000.

!2) The follo$ing definitions describe either profitabilit liquidit or sol*enc. 3abeleach of the follo$ing definitions $ith the correct performance measure.

-

8/13/2019 4.2 Financial Statement Basics Exercises1

9/24

a) bilit of the business to generate sufficient cash to meet cash demands $ithoutdisturbing the on6going operation of the business. 0000000

b) bilit of the business to generate income in excess of expenses. 0000000c) bilit to repa all financial obligations if all assets $ere sold and abilit to

continue operations as a *iable business after a financial ad*ersit. 0000000

The 'est Te)as Ra"chBASIC BALANCE S6EET

ASSETS

-

8/13/2019 4.2 Financial Statement Basics Exercises1

10/24

B

"

8

Curre"t Assets A 7 B 7 C 7 % 8 E 9

#

H

/

Net No"Curre"t Assets ;F !< 7 6 8 I 9

Total Assets E 7 I 8 J 9

LIABILITIES

M

3

>

C

Curre"t Lia#ilities = 7 L 7 M 7 N 8 > 9

N

No"curre"t Lia#ilities P74

Total Lia#ilities > 7 P 7 4 8 R O 6

EQUITY

>?"er@s Euit& J R 8 S 9

Total Lia#ilities + Euit& R 7 S 8 T 9

'est Te)as Ra"ch

Accounts %a&able /011.11

Accounts Receivable /111.11

Accrued expenses -

Inventor& 2/311.11

Non Current Liabilities 1/111.11

Land ,ebt 04/50.11

Current %ortion o" debt 3/050.11

Non Current Assets at cost 634/571.11

Cas# 00/824.11

Accumulated ,epreciation 0/701.11

%repaid expenses 2/111.11Land /811/111.11

-

8/13/2019 4.2 Financial Statement Basics Exercises1

11/24

Income Taxes %a&able -

GROSS REVENUE TOTAL

1

B

"

!ross Re*e"ue A 7 B 7 C 8 % :9

EXPENSES

(

#

H

/

P

MTotal >(erati"g E)(e"se E 7 F 7 ! 7 6 7 I 7 J 7 = 8 L :9

>

Net I"coe fro >(eratio"s % : ;L 7 M< 8 N :9

&

:

NET INCOME N 7 > : P 8 4 :9

Total

9tilities 1/35.11

,epreciation 52/701.11

Non Cas# Trans"er out 67/111.11

Capital $ains :Losses; :5/546.11;

Labor 67/111.11

ME STATEMENT

'est Te)as Ra"ch

-

8/13/2019 4.2 Financial Statement Basics Exercises1

12/24

CASH FROM OPERATIONS TOTAL

B

"

8

Net Cash Fro >(eratio"s A : B : C : % 8 E :9

CASH FROM INVESTING

#

H

Net Cash Fro I"*esti"g F : ! 8 6 :9

CASH FROM FINANCING

P

Net Cash Fro Fi"a"ci"g I : J 8 = :9

3

>

NET CASH FLOW E 7 6 7 = : L 7 M 8 N :9

Total

%urc#ases 27/111.11

,ebt %a&ments 7/355.11

Interest Expenses 7/646.11

Cas# Contributions -

Taxes 1/811.11Cas# >it#dra!als -

Sales 56/454.11

Expenses 5/80.11

Ne! Borro!ings -

Receipts 08/757.11

BASIC STATEMENT >F CAS6 FL>'S

'est Te)as Ra"ch

-

8/13/2019 4.2 Financial Statement Basics Exercises1

13/24

RETAINED EARNINGS TOTAL

B

Net Cha"ge i" Retai"ed Ear"i"gs A : B 8 C :9

CAPITAL CONTRIBUTIONS

#

H

Total E 7 F 7 ! 8 6 :9

CAPITAL DISTRIBUTIONS

P

M

Total I 7 J 7 = 8 L :9

Net Cha"ge i" Ca(ital 6 : L 8 M :9

OWNER EQUITY RECONCILIATION

C

Total Euit& Cha"ge C 7 M 8 > :9

E"di"g >?"er Euit& N 7 > 8 P :9

Total

>it#dra!als -

Beginning (!ner E?uit& /041/138.11

Capital ,istributions

Cas# * Investment -

Building/ =ac#iner& * E?uipment -

Land -

Capital Contribuitons

Cas# * Investment -

Building/ =ac#iner& * E?uipment 51/111.11

Land -

Net Income 21/155.11

BASIC STATEMENT >F >'NER@S E4,IT

'est Te)as Ra"ch

-

8/13/2019 4.2 Financial Statement Basics Exercises1

14/24

RETURN ON ASSETS (ROA)

1

B

"

Retur" o" Assets ;A 7 B< C 8 % :9

RETURN ON EQUITY

1

(

Retur" o" Euit& A E 8 F :9

CURRENT RATIO

H

/

Curre"t Ratio ! 6 8 I :9

DEBT-TO-ASSET RATIO

P

"

%e#t:to:Asset Ratio J C 8 = :9

EQUITY-TO-ASSET RATIO

(

"

Euit&:to:Asset Ratio E C 8 M :9

Total

Total Current Assets 75/624.11Total Current Liabilities /650.11

Total Liabilities 30/717.11Total Assets 2/110/354.11

Total E?uit& /71/27.11Net Income "rom (perations 71/730.11

Interest Expenses 7/686.11

RATI>S

'est Te)as Ra"ch

-

8/13/2019 4.2 Financial Statement Basics Exercises1

15/24

-

8/13/2019 4.2 Financial Statement Basics Exercises1

16/24

The BS"S of #CC"3 STT>CTS#or gricultural roducers

CS,-S

-

8/13/2019 4.2 Financial Statement Basics Exercises1

17/24

-

8/13/2019 4.2 Financial Statement Basics Exercises1

18/24

A"s?ers

>ultiple choice and fill in the blan+ questions.

1) a) assets

b) liabilitiesc) equit

2) a b e!)

%) d9) d) a b e@) bA) a) ccounts -ecei*able

b) "ashc) n*entor

) c1D)d11) a) ccumulated; sum; first acquired

b) decrease; decrease12)a c1!) a) increase

b) decrease1%)a b19)b1) a) increases; increase

b) decreases; decrease1@) a b d f

Assets Liabilities Current Non-Current

Accrued Expenses x x

Long Term Investments. x x

Accrued Interest - Non Real Estate Loans and Notes x x

Raised Breeding Stoc x x

Investments in gro!ing and "inis#ing livestoc x x

$overnment %a ment Receivable x x

Credit Card' (per. Loan' Curr. Note %a&able x x%urc#ased Breeding Stoc. x x

%repaid Expenses x x

Crops'Raised )eed "or Sale. x x

Cas# * C#ecing x x

Breeding +orses x x

Accounts Receivable. x x

%rincipal ,ue - Non Real Estate Loans and Notes x x

Savings and Time ,eposits x x

Income Taxes %a&able x x

Accounts %a&able x x

%rincipal Balance- Non Real Estate Loans and Notes x x

-

8/13/2019 4.2 Financial Statement Basics Exercises1

19/24

1A)d1) (6) (6) ()2D) b d g h21) a c d e22)c

2!)b2%) (5) (6)29) a b d2)a) "

b) "c) "&d) "&e) "&f) "&g) "

2@)b

2A) Beginning; ending; retained earnings; contributed capital; distributed capital2)a!D)a!1) a) Balance Sheet

b) Balance Sheet and ncome Statementc) Balance Sheetd) Balance Sheete) Balance Sheet ncome Statement

!2) a) 3iquiditb) rofitabilitc) Sol*enc

-

8/13/2019 4.2 Financial Statement Basics Exercises1

20/24

The ,est Texas -anch

BASIC BALANCE S6EET

ASSETS

"ash O @@92.DD

ccounts -ecei*able O 1DDD.DD

n*entor O 2DD.DD

repaid expenses O 2DDD.DD

Curre"t Assets 9 D2/0511

Con "urrent ssets at cost O %!AD.DD

ccumulated 8epreciation O @[email protected]

3and O 19DDDDD.DD

No" Curre"t Assets 9 -/.0/G-1511

Total Assets 9 0/11H/.2511

LIABILITIES

ccounts aable O [email protected]

ccrued expenses O 6

"urrent ortion of debt O @[email protected]

ncome Taxes aable O 6

Curre"t Lia#ilities 9 --/2H511

No"Curre"t Lia#ilities O 1DDDD.DD

3and 8ebt O 1@[email protected]

Total Lia#ilities 9 -.H/D1D511

>?"ers Euit& 9 -/D-1/-0D511

Total Lia#ilities + Euit& 9 0/11H/.2511

-

8/13/2019 4.2 Financial Statement Basics Exercises1

21/24

GROSS REVENUE

"ash -eceipts 1@9A!A.DDOCon "ash Transfer out %ADDD.DDO

n*entor ? ccounts -ecei*able "hange 2DD.DDO

!ross Re*e"ue 00/H2D5119

EXPENSES

n*entor "hange (xpenses) 9%@D.DDO

-epairs and >aintenance !A;2.DDO

3abor %ADDD.DDO

#eed 2!%DD.DDO

8epreciation [email protected]

=eterinar 9A29.DDO

Gtilities 1D1!.DDO

Total >(erati"g E)(e"ses -/2DH5119

nterest xpense 1A%9%.DDO

Net I"coe fro >(eratio"s 2/D.H5119

"apital Hains (3osses) (1!!;%.DD)O

Taxes 1D9DD.DDO

NET INCOME 01/1225119

BASIC INC>ME STATEMEMT

-

8/13/2019 4.2 Financial Statement Basics Exercises1

22/24

CASH FROM OPERATIONS

-eceipts 1@9A!A.DDO

xpenses [email protected]

nterest xpenses 1A%;%.DDO

Taxes 1D9DD.DDO

Net Cash Fro >(eratio"s -G/2GH5119

CASH FROM INVESTING

Sales !%;!;.DDO

:urchases 2ADDD.DDO

Net Cash Fro I"*esti"g /25119

CASH FROM FINANCING

Ce$ Borro$ings 6O8ebt :aments A!!.DDO

Net Cash Fro Fi"a"ci"g ;D/.22511

-

8/13/2019 4.2 Financial Statement Basics Exercises1

23/24

RETAINED EARNINGS

Cet ncome 2DD!!.DDO

,ithdra$als 6O

Net Cha"ge i" Retai"ed Ear"i"gs 01/1225119

CAPITAL CONTRIBUTIONS

"ash ? n*estment 6O

Building >achiner ? quipment !DDDD.DDO

3and 6O

Total 21/1115119

CAPITAL DISTRIBUTIONS"ash ? n*estment 6O

Building >achiner ? quipment 6O

3and 6O

Total :9

Net Cha"ge i" Ca(ital 21/1115119

OWNER EQUITY RECONCILIATION

Beginning &$ner quit 1@;DD9.DDO

Total quit "hanges 9DD!!.DDO

nding &$ner quit 1A1D12A.DDO

BASIC STATEMENT >F >'NER E4,IT

-

8/13/2019 4.2 Financial Statement Basics Exercises1

24/24

RETURN ON ASSETS (ROA)

Cet ncome from &perations %[email protected]

nterest xpenses 1A%9%.DDO

Total ssets 2DD@!;.DDO

Retur" o" Assets 25-

RETURN ON EQUITY

Cet ncome from &perations %[email protected]

Total quit 1A1D12A.DDO

Retur" o" Euit& 05

CURRENT RATIO

Total "urrent ssets A!%2;.DDO

Total "urrent 3iabilities 11%[email protected]

Curre"t Ratio 9H50.

DEBT-TO-ASSET RATIO

Total 3iabilities [email protected]

Total ssets 2DD@!;.DDO

%e#t:to:Asset Ratio -1

EQUITY-TO-ASSET RATIO

Total quit 1A1D12A.DDO

Total ssets 2DD@!;.DDOEuit&:to:Asset Ratio .1

RATI>S