3 - The Importance of Indexes and Beta Trading

-

Upload

collegetradingexchange -

Category

Documents

-

view

216 -

download

0

Transcript of 3 - The Importance of Indexes and Beta Trading

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

1/13

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

2/13

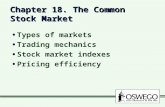

Types of Indices :

Price Weighted Price is the only component to determining the value Capitalization Weighted Market Cap is another component to

overall value Dollar Index

Composition: Index Futures A futures contract that represents a particular equity

index (S&P 500, DJIA, etc.) and can be utilized as both a speculationand hedging tool.

Beta Beta Capital Asset Pricing Model Coefficient that is a pastindication of how volatile a single stocks returns are to an index. A

beta of 1 is similar to an index return while above offers potentiallymore volatility and reward.

TERMS TOKNOW:

The Trading Pitt 2010 2

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

3/13

UNDERSTANDINGTHE BIGGERPICTURE

Key to finding the best setups is understanding overall picture.

Obviously the thing to do was to be bullish in abull market and bearish in a bear market Reminisces of a Stock Operator

3The Trading Pitt 2010

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

4/13

EXPLAININGINDEXBEHAVIOR

Weighting can sometimes skew indexbehavior and lead to temporary correlations(AAPL is 13% + of QQQQ ETF)

4The Trading Pitt 2010

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

5/13

WHEN SHOULD I CATCH

BETA AND WHEN SHOULD

I STOCK PICK?

Correlation, Sentiment, and ImpliedCorrelation via option prices can giveyou clues when to stock pick or chasebeta

5The Trading Pitt 2010

In low correlationenvironments pick stocks.High, go to the index

Implied Correlation is oftenhigher than realized and likevolatility not always goodforecasting tools.

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

6/13

SIMULATION 1Intermediate Market ReversalMay 7th, 2010

6The Trading Pitt 2010

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

7/13

KEY POINTSFROMSIMULATION 1

MAY 7 TH , 2010

In extreme circumstances, you needto go off what market players arewatching. In this case the 200-Day MA

7The Trading Pitt 2010

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

8/13

Working on Two Different Time Frames Watching out for support on longer

charts though nothing in sight on 5 min Instead of hitting the bids, rather place

bids around that level for a low risk high

reward trade

Visualization exercises are good for both pre-market and post-marketsettings

8The Trading Pitt 2010

VISUALIZATIONEXERCISE

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

9/13

SECONDSIMULATION

/GC (GOLD)6/8/20106:00:00

Bear and Bull Trap Reversal

9The Trading Pitt 2010

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

10/13

KEY POINTSSIMULATION 2

Gold did not close above this level, andcaught all the breakout momentum traderswhen they ran into real selling orders.

10The Trading Pitt 2010

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

11/13

RANDOMSIMULATION

MARCH 31 ST ,2010

Rules: Buy or Sell the best/worst stocksrespectively on strength/weakness.No Fading!Ill be demonstrating dollar neutral spreading.

11The Trading Pitt 2010

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

12/13

Looking at futures compared to equities

12The Trading Pitt 2010

ANALYSIS,COMMENTS,QUESTIONS?

-

8/7/2019 3 - The Importance of Indexes and Beta Trading

13/13

13The Trading Pitt 2010

WHAT TOLOOK OUTFOR THISWEEK: