22415 MS Footwear Omsl 4mm

Transcript of 22415 MS Footwear Omsl 4mm

Mailing address: P.O. Box 30009, 3001 DA Rotterdam, The NetherlandsPhone: +31 10 201 34 34 Fax: +31 10 411 40 81E-mail: [email protected] Internet: http://www.cbi.nl

Office and showroom: WTC-Beursbuilding, 5th floor37 Beursplein, Rotterdam, The Netherlands

CENTRE FOR THE PROMOTION OF IMPORTS FROM DEVELOPING COUNTRIES

FOOTWEAR

FOO

TW

EA

R

EU MARKET SURVEY 2002

EU

MA

RK

ET

SU

RV

EY

2002V

OLU

ME

II VOLUME II

EU MARKET SURVEY 2002

FOOTWEAR

Compiled for CBI by:

Drs. Jan P. Servaas

August 2002

DISCLAIMERThe information provided in this market survey is believed to be accurate at the time of writing. It is, however, passedon to the reader without any responsibility on the part of CBI or the authors and it does not release the reader from theobligation to comply with all applicable legislation.

Neither CBI nor the authors of this publication make any warranty, expressed or implied, concerning the accuracy ofthe information presented, and will not be liable for injury or claims pertaining to the use of this publication or theinformation contained therein.

No obligation is assumed for updating or amending this publication for any reason, be it new or contrary informationor changes in legislation, regulations or jurisdiction.

Updated version of CBI’s Market survey “Footwear” published in September 2001.

Photo courtesy:

Jop Rijksbaron

CONTENTS

REPORT SUMMARY 6

1 PRODUCT CHARACTERISTICS 81.1 Product groups 81.2 Products 81.3 Customs/statistical product classification 10

2 INTRODUCTION TO THE EU MARKET 11

3 CONSUMPTION OF FOOTWEAR 133.1 Market size 133.2 Market segmentation 163.3 Consumption patterns and trends 18

4 PRODUCTION 214.1 Footwear production in the EU 214.2 EU Outward Processing Trade 24

5 IMPORTS 265.1 Total imports 265.2 Imports by product group 335.3 The role of developing countries 38

6 EXPORTS 426.1 EU exports of footwear 42

7 TRADE STRUCTURE 457.1 EU trade channels 45

7.1.1 Manufacturers 457.1.2 Agents 467.1.3 Importers/wholesalers 467.1.4 Retailers 46

7.2 Distribution channels for developing countries 53

8 PRICES AND MARGINS 548.1 Margins 548.2 Prices 558.3 Sources of price information 55

9 OPPORTUNITIES FOR DEVELOPING COUNTRY EXPORTERS 56

APPENDICES1 Detailed classification of footwear, by Harmonised System Code 582 Detailed import and export statistics of footwear by product type and area of origin into the EU, 1998-2000 613 Specification of imports of footwear by product type into major EU countries 1998-2000 644 Trade associations 695 Trade fair organisers 716 Trade press 737 Business Support Organisations 758 Other useful addresses 769 List of developing countries 7810 List of major buyers of footwear in The Netherlands 7911 List of major buyers of footwear in the EU 8712 Useful internet sites 89

5

REPORT SUMMARY

IntroductionThis survey profiles the market for footwear in theEuropean Union (EU) and is an updated and extendedversion of the former CBI survey Footwear, publishedin July 1996. The emphasis of the survey lies on thoseproducts, which are of importance to developingcountry suppliers. The major national markets withinthe EU for those products are highlighted. The surveyincludes contact details of importers, trade associations,and other relevant organisations. Furthermore, statisticalmarket information on consumption, production andtrade, and information on trade structure and prices andmargins is provided. As an exporter, you need this information to formulateyour own market and product strategies. In order toassist you with this, CBI has also developed a matchingEU Strategic Marketing Guide for Footwear. It offers apractical handbook for exporters engaged, or wishing toengage, in exporting footwear to the EU. It aims tofacilitate exporters in formulating their own market andproduct strategies through the provision of practicalinformation and a methodology of analysis and ready-to-fill-in frameworks. As mentioned above, statistical market information onconsumption, production and trade, and information ontrade structure and prices and margins, which isrequired for the ready-to-fill-in frameworks, can befound in this EU Market Survey.

Market research This EU Market Survey and the EU StrategicMarketing Guide serve as a basis for further marketresearch: after you have read this survey and filled inthe frameworks in the strategic marketing guide it isimportant to further research your target markets, saleschannels and potential customers. Market research depends on secondary data (data thathave been compiled and published earlier) and primarydata (information that you collect yourself). An example of secondary data is this EU MarketSurvey. Primary data are needed when secondary datafall short of your needs, for example when researchingyour specific type of consumer about the acceptance ofyour specific product. Sources of information areamong others (statistical) databanks, newspapers andmagazines, market reports, (annual) reports frombranch associations, but also shops in target countries,products or catalogues from your competitors, andconversations with suppliers, specialists, colleagues andeven competitors. After you received/collected yourinformation you should analyse it. In order to judge theattractiveness of the market, sales channel or customer,you should use/develop a classification or score system.For more detailed information on market research,reference is made to CBI’s Export Planner (2000).

6

Together with other CBI publications, like “Products”and the “Environmental Quick Scan Leather”, a fairlycomplete overview is given to manufacturers/exporters in developing countries, who wish to sell tothe EU market. Seasonal fashion information onclothing and colours, which may be an indication forfootwear fashion, can be obtained from CBI’s FashionForecasts. Some of these sources of information arealso available on the CBI web site.

SurveyThe survey “Footwear” includes outdoor footwear,sports and leisure footwear and indoor footwear formen, women and children. Consumption of footwear in the EU grew by 3.3 percent in the period 1998-2001 to € 53.2 billion (US$ 47.9 bn). Based on preliminary figures, a furthergrowth is expected for the next five years. The footwearmarket has tended to be characterised by cheap,mass-produced items, but in recent years there has beensome movement away from such products towardshigher quality, more individual footwear.Germany is still the most important country in footwearconsumption in the EU, despite a smaller growth thanthe EU average. Germany is followed by Italy, UK,France, and Spain and at a distance by The Netherlands.The five first mentioned leading countries account for81 percent of EU footwear consumption.In many EU countries, the demand for formal (dress shoes) footwear is declining in favour of casualand leisure/sportswear, which implies higher increasingsales in terms of volume rather than in terms of value. Footwear production in the EU decreased from 1,081 million pairs in 1997 to 910 million in 2000. It sank for the first time below the one billion pair levelin 1999 and continued its fall with 5 percent in 2000 asit relocated to other, and especially former Eastern bloc,countries. Italy remained the EU’s leading footwearproducer with almost 43 percent of total EU production,followed by Spain (22%), Portugal (12%) and France(11%). Around 280,000 employees worked in the EUfootwear industry in 2000, while this number was still325,000 in 1995. The footwear industry is relativelylabour-intensive, added to which increasing costs andcompetition from cheap imports have pressedmanufacturers to specialise in niches (luxury, safety ororthopaedic footwear) or to shift production to abroadvia the outward processing route. The footwearmanufacturing industry in two countries, Italy and The Netherlands showed (limited) positive developments,but at the other end of the scale, significant reductionshad been recorded by many other EU producers. For example, UK footwear production plummetednearly 46 percent, followed by Belgium 25%, France13%, Germany 9% and Spain 4%.

EU imports of footwear amounted to € 19.4 billion(US$ 17.9 bn) in 2000. Germany remained the leadingimporter, with an import share of 22 percent in terms ofvalue, followed by UK (17%), France (15%), Italy(13%) and The Netherlands (8%). Belgium rankedsixth, followed by Austria. EU imports of footwear decreased by 4.4 percent in theperiod 1999-2000. Developments in import of footwearvary strongly per country. EU countries can be divided,by developments in value of imports during this period,into very strongly decreased imports (falling more than10%) in Portugal, Finland, Germany and Belgium andbooming imports (rising more than 10%) in Spain.Between these extremes, imports in Italy, France,The Netherlands, Denmark and Ireland grew, whileimports in the other EU countries fell. EU imports from developing countries increased interms of volume (+ 19%) but against lower prices (-6%). Developing countries gain from the lower intra-EU imports, just like other countries from outsidethe EU like Romania and Taiwan. Italy remained the leading supplier to the EU market inthe category outdoor footwear with uppers of leatherwith 141 million pairs in 2000 above Portugal, Vietnam,Spain and China. China remained the EU’s leadingsupplier in the product groups plastic/or rubberfootwear for sports and outdoor. Sports footwear withuppers of textiles came mainly from China, Belgiumand Vietnam, indoor footwear with uppers of textilesfrom China and Spain; outdoor footwear with uppers oftextiles from Vietnam and China.

China remained the leading exporter of footwear to theEU, however, the difference with number two Vietnambecame very small in terms of value. EU imports fromChina rose from US$ 1,261 million in 1998 to US$ 1,661 million in 2000, while imports fromVietnam rose from US$ 967 million in 1998 to US$ 1,509 million in 2000.The growth in imports from developing countries in2000 can be ascribed to the following categories:• Asian low price suppliers, like China and Vietnam.

Other countries from the Far East with sharplyincreased exports to the EU were Cambodia, Macaoand Malaysia.

• CEECs, like Bosnia & Herzegovina, Moldova andSlovenia.

7

The EU member states exported US$ 16.5 billion (€ 17.9 bn) in 2000, representing a fall in value ofalmost 10 percent in the period 1998-2000. In terms ofvolume, EU exports decreased from 967 million pairsin 1998 to 936 million in 2000. The fall in EU exportswas the result of lower exports to countries outside theEU: in value (- 12%) and in volume (- 7%). The leading EU exporter is Italy with 43 percent oftotal EU exports, at a distance followed by Spain,Belgium, Portugal, Germany, France and The Netherlands. The main destinations outside the EUwere the USA (13 percent of total exports and 35 percent of extra-EU exports in 2000, followed bySwitzerland, Japan and Russia).

Specialised retailers (footwear multiples andindependent footwear retailers) accounted for 65 percent of total retail sales in 2001. The marketshare of non-specialised distributors became limited.Other important developments are increasingconcentration and growing internationalisation or cross-border activities, of which the main (besidesmany others) examples are Garant Schuh AG inGermany and sports formula like Intersport and Sport2000. Generally spoken, domestic manufacturers andwholesalers/importers distribute footwear directly to theretail trade. With regard to imports from outsideEurope, wholesalers/importers, large multiples andbuying cooperatives mainly act as contractors.

The keen competition on the footwear market willsteadily increase and this leads to further possibilitiesfor exporters from low-cost countries.A start for exporters, which involves limited risks, is totry to acquire fixed orders for products specified by theclient, because the latter has the best knowledge of hismarket. Exporters in the footwear sector are confrontedwith many aspects like sizing, packaging,environmental aspects. These result in a lot of legal andtechnical requirements, added to which are aspects ofdesign and fashionability leading to qualityrequirements, market developments etc. The role of wholesalers/importers will stabilise, whilethe role of footwear multiples and, to a lesser degree,buying groups or franchise formula will increase in thecoming years. The buying policies of super- andhypermarkets vary from direct imports by theinternational operating chains to buying fromwholesalers/importers.

1.1 Product groupsFootwear is categorised in several ways in officialstatistics, according to:• end use: waterproof footwear, safety footwear, sports

footwear, indoor footwear and other footwear(outdoor footwear if not classified before);

• raw materials used for the uppers and the soles.Uppers can be of leather, synthetic leather, plastic,rubber or textile (canvas). Outer soles may be ofleather, plastic, rubber, wood, cork and othermaterials;

• end user: for children, for women and/or for men; • footwear height: varying from not covering the

ankle, covering the ankle but under the calf, andother covering the ankle (calf-, mid-calf-, knee- andthigh-length);

• in some cases a distinction is made for aspects likethe height of the heels including soles (more than 3 cm) or the presence of a vamp of straps or piecescut out.

Other definitions can be made by the method ofattaching the upper to the sole or other productiontechniques. Defining types of footwear by their end use or wearingcircumstances gives the following breakdown (besidesthe breakdown into women’s, men’s and children’sfootwear) into four major segments:• Outdoor footwear; this segment which is also

indicated as town or street wear, is made up of awide variety of products such as shoes (pumps,moccasins, loafers, Oxford shoes etc.), boots (ankle-, calf-, knee- or thigh-high), clogs, some typesof sandals etc. Using the link to clothing behaviour, a breakdowncan be made in formal (dress shoes), casual andleisure/sports footwear. However, sandals can beclassified as casual as well as leisure/sport footwear,while some models even can be classified as formalwear.

• Sports and leisure footwear; this segment coverssports wear with on the one side, trainers or runners,made for jogging and other sports activities, butwhich are also worn for every day use, and on theother side more specific technical products forfootball, cycling athletics, skiing etc. This segmentalso includes footwear with a leisure character, liketextile uppers especially for summer wear such assneakers, rope-soled sandals, plimsolls etc.

• Indoor footwear; this segment includes slippers(carpet, bedroom and house slippers) and mules.Carpet slippers are indicated as “Pantoffel” inGermany and in The Netherlands and as“charentaise” in France.

8

• Work, hunting and safety footwear. Safetyfootwear offers protection adapted to the type ofwork involved and often covers shoes and boots witha built-in steel toecap designed to prevent crushingdamage to the toes. Distribution and end-use iscompletely different from the other segments offootwear. For that reason this segment is notconsidered in this survey and we refer to the CBIsurvey and guide “Personal Protective Equipment”.

Besides the distinction based on wearing circumstances,a breakdown can be made by: materials used for uppers(leather, rubber/plastic, canvas/textile etc.) and outersoles (leather, rubber, plastic, synthetic leather, woodetc.). The criterion for footwear for adults or forchildren in statistics is the size of the inner sole: aninner sole of less than 24 cm is considered to bechildren’s wear in this survey.

1.2 ProductsIn this paragraph a (not exhaustive) overview is givenof the enormous varieties in types of footwear. Most ofthese types are not used in statistics and for that reasonnot discussed further in this survey.

Types of footwearFootwear is the generic term for foot coverings.Footwear with the opening below the ankle is a shoe,those with the top of the foot exposed are pumps, andthose with the opening above the ankle are classified asboots. In addition, those items which do not fullyenclose the foot are sandals when used outdoors andslippers when used indoors. A classification can bemade in shoes, sandals and slippers, boots and sportshoes or sneakers.Shoes - outer covering for the foot which does notreach higher than the ankle, basically made up of thesole (under the foot), the vamp (front part), the quarter(back part) and the shank (portion under the instep).Shoes may be of the slip-on variety (pumps ormoccasins) or closed with laces (oxford-type), bucklesor Velcro ®.• Pumps; this kind of slip-ons has a large opening for

the foot (rounded or V-shaped) so the top of the foot

1 PRODUCT CHARACTERISTICS

is exposed. It usually has a medium to high heel,sometimes covered with the same material as theupper, sometimes with open toe and/or open heel insling back style. Names of pumps are for instance:high heel (5 cm or more), mid/low heels, ankle strap,sling backs, one-strap shoe, open toe, cross strap, flatshoes, T-strap shoes, back and side open, one-pointshoes, ballet pumps etc. A British name for a pumpis court shoe.

• Moccasins and loafers; characteristics of themoccasin are that upper and sole are in one pieceand the shoe is closed by stitching in the vamp (not at the back as is usual); in this form mainly usedas indoor wear. For outdoors, the outer sole and heelare attached to the bottom and can be identified bythe absence of an inner sole. The loafer is essentiallya two-piece moccasin but has a hard sole and a strapor saddle, made of leather, over the instep. Names ofloafers are: tassel-top loafers, chain loafers, andpenny loafer. The loafer is an example of a dressytype of shoe, while the moccasin (Indian moccasin,leather deck shoes etc.) can be classified as a sport orleisure type.

• Oxford shoes is the generic name for lace-up shoes,like Brogue shoes a closed front tie shoe, the uppercomprising several parts each punched and serrated(gimped) along the margins, together with a punchedand gimped wing cap. A brogue effect is oftenachieved in other styles of shoe by punching andgimping. Brogues are the formal name for wing tipshoes.

Sandals - open type of shoes (backless, with or withouta heel); held on foot by means of straps, like: chappalor chuplee (originating in India), ankle-strap, T-strap,gladiator and platform sandal or with a band over theinstep that holds the shoe on the foot, like: slides, clogs(made with thick sole of wood or cork), mules withheel open or the so-called Hepburn sandal with toe andheel open.

Slippers - include several types of carpet, bedroom orhouse slippers, mules (UK), evening slippers etc.Slippers are not intended to be worn outdoors.Examples of slippers are the low-heel boudoir slipper,the hostess slipper, Grecian slippers etc.

9

Boots - the generic term for footwear with the openingabove the ankle and indicating several lengths (ankle-high and calf-high or reaching the knee or the thigh).Can be classified as utility (hunting, climbing etc.)boots and fashion boots, the latter is not intended to bewaterproof. Ankle boots are: jodhpur boot, desert boot (or chukkaboot or floats), side gore boot (or Chelsea boot),mukluk, demi-boot, george boot etc. The generic namefor calf-length boots is high-low boots, specific typesare cowboy boot, Courrèges boots etc. Types of knee-length boots are Wellington, (turnover) top bootsetc. Boots that reach the thigh are called stocking or fitboots.

Sports footwear - nearly all sport activities requirespecific footwear. The link with leisure started alreadyin the 1920s when tennis became popular and adultsadopted sneakers and plimsolls, before that time onlyworn by children. In the 1950s the basketball bootovertook the sneaker in particular for men’s footwear,of which the most famous brand was Converse’s All Stars. Training shoes (trainers) and runners aresome of the many other names. The name of sneakers was replaced by gym shoes ortennis shoes of white canvas and is now used for arange of low and high sports shoes.The leading brands (Nike, Reebok, Adidas, Puma andFila) use some of the following types of sports shoes intheir assortment: running (with or without reflectingdetails), cross training, conditioning (aerobics andfitness), workout, outdoor or hiking, leisure, walkingand fitness. Most of these sports items are now worn innon-working circumstances by consumers of every age.

Usage of sports shoes for sports like soccer, athletics(spikes), baseball, skiing, surfing etc. is limited to theirspecific activities.

1.3 Customs/statistical productclassification

Products can be specified by the HarmonisedCommodity Description and Coding System (HS).These numbers are used for both Customs andstatistical purposes in EU member countries. The number clearly identifies a specific product, so it ispossible to see which types of footwear are concernedand which materials are used. Referring to the codenumber can therefore facilitate communication andeliminate misunderstanding about the type of footwear. Chapter 64 –“Footwear, leggings, similar articles andparts thereof”- is the relevant section of the HS code.The key product group headings are:

HS code Product group64.01 Waterproof footwear64.02 Footwear with outer soles and uppers of

rubber or artificial plastic material64.03 Footwear with leather uppers64.04 Footwear with textile uppers, soles of

rubber and plastic64.05 Footwear with synthetic leather uppers,

slippers and other indoor shoes with textileand other uppers

64.06 Parts of footwear

Appendix I of this survey gives full information on theHS codes relevant for all different types of footwear.Please note that the product groups falling under the HScodes presented in section 1.3 are not completely in linewith the product groups mentioned in section 1.1 andsection 1.2. Moreover, different statistical sources usedifferent product groups or specifications. This places limitations on in-depth interpretation oftrade figures and of the possible relationships betweenimport figures and production and consumption data.

10

The European Union (EU) is the current name for theformer European Community. Since 1 January 1995 theEU has consisted of 15 member states. Negotiations arein progress with a number of candidate member states,many of which already have extensive trade and co-operation agreements with the EU. In 2000, the size of the EU population totalled 376.5 million, of which two thirds in the age category15-64 years.

The most important aspect of the process of unification(of the former EC countries), which affects trade, is theharmonisation of rules in the EU countries. As theunification allows free movement of capital, goods,services and people, the internal borders have beenremoved. Goods produced or imported in one memberstate can be moved around between the other memberstates without restrictions. A precondition for this freemovement is uniformity in the rules and regulationsconcerning locally produced or imported products.Although the European Union is already a fact, all theregulations have not yet been harmonised. Work is inprogress on uniform regulations in the fields ofenvironmental pollution, health, safety, quality andeducation.

11

On 1 January 1999, the euro (€) became the legalcurrency within eleven EU member states: Austria,Belgium, Finland, France, Germany, Italy, Ireland,Luxembourg, The Netherlands, Spain, and Portugal.Greece became the 12th member in June 2000. Their national currencies are now subdivisions of theeuro and continued to circulate as legal tender until mid2002. Circulation of euro coins and banknotes startedon 1 January 2002 and these will gradually replacenational currency notes and coins, which must bewithdrawn by 1 July 2002.

The most recent Eurostat trade statistics quoted in thissurvey are from the year 2000. On 1 January 1999,statistical and contractual values in ECU wereconverted into euro (€) on a 1:1 exchange rate. The euro/US$ exchange rate stood ultimo June 2002 at US$ 0.9820 for one euro. The US dollar is the basic currency unit used to indicatevalue in this market survey, while most recent years arealso expressed in euros.

2 INTRODUCTION TO THE EU MARKET

Table 2.1 Overview population and age groups in the EU at 1 January 2000

Total 0-14 15-64 65 years Yearly averagepopulation years years and older growth in %in millions in % in % in % 1995-2000

Austria 8.1 17 68 15 0.5Belgium 10.2 18 66 16 0.3Denmark 5.3 18 67 15 0.4Finland 5.2 19 66 15 0.4France 59.3 19 66 15 0.6Germany 82.2 16 68 16 0.4Greece 10.5 16 68 16 0.3Ireland 3.8 23 66 11 1.1Italy 57.7 15 68 17 0.2Luxembourg 0.4 19 67 14 1.0Netherlands 15.9 18 69 13 0.7Portugal 10.0 17 68 15 0.3Spain 39.4 16 68 16 0.1Sweden 8.9 19 64 17 0.4United Kingdom 59.6 19 65 16 0.5EU (15) 376.5 17 67 16 0.4

Source: Eurostat

Trade figures quoted in this survey must be interpretedand used with extreme caution. The collection of dataregarding trade flows has become more difficult sincethe establishment of the single market on 1 January1993. Until that date, trade was registered by means ofcompulsory Customs procedures at border crossings,but, since the removal of the intra-EU borders, this isno longer the case. Statistical bodies like Eurostatcannot now depend on the automatic generation of tradefigures. In the case of intra-EU trade, statisticalreporting is only compulsory for exporting andimporting firms whose trade exceeds a certain annualvalue. The threshold varies considerably from countryto country, but it is typically about € 100,000. As aconsequence, although figures for trade between the EUand the rest of the world are accurately represented,trade within the EU is generally underestimated.This market survey highlights the following countriesbesides the EU in total: Germany, UK, France, Italy andThe Netherlands. These countries are the majorimporters of footwear in the EU in the ranking asmentioned. The ranking in order of consumption isGermany, UK, Italy, France, Spain and The Netherlands.

12

Table 2.2 Exchange rates of EU currencies in US$, 1995-2001

Country Currency 1996 1997 1998 1999 2000 2001 mid2002

European Union ECU 1.25 1.13 1.12 - - -€ 1.065 0.922 0.900 0.982

Austria Ash 0.094 0.082 0.081 0.077 0.068 0.065 -Belgium Bfr 0.032 0.028 0.028 0.026 0.023 0.022 -Denmark Dkr 0.17 0.15 0.15 0.14 0.12 0.12 0.13France Ffr 0.20 0.17 0.17 0.16 0.14 0.14 -Finland FM 0.22 0.19 0.19 0.18 0.16 0.15 -Germany DM 0.66 0.58 0.57 0.54 0.47 0.46 -Greece GRD 0.41 0.36 0.34 0.32 0.28 0.27 -Ireland I£ 1.60 1.52 1.42 1.38 1.20 1.17 -Italy L 0.65 0.59 0.58 0.55 0.48 0.46 -Netherlands NLG 0.59 0.51 0.51 0.48 0.42 0.41 -Portugal Esc 0.65 0.57 0.56 0.53 0.46 0.45 -Spain Ptas 0.79 0.68 0.67 0.64 0.55 0.54 -Sweden Skr 0.15 0.13 0.13 0.12 0.10 0.10 0.10United Kingdom GB£ 1.56 1.64 1.66 1.62 1.51 1.45 1.53

Source: CBS Statline (January 2002)

Information about consumption of footwear issignificant different between the separate EU memberstates. For that reason an uniform detailed overview ofconsumer expenditure on footwear by product types etc.cannot be given in this survey for the major countriesunder review.

3.1 Market size

EUConsumption of footwear in the EU grew by 3.3percent in the period 1998-2001, 2.2 percent in 1999,stabilised in 2000 and grew by 1.4 percent in 2001 to € 53.2 billion (US$ 47.9 bn). Based on preliminary figures, a further growth isexpected for the next five years. The footwear markethas tended to be characterised by cheap, mass-produceditems, but in recent years there has been somemovement away from such products towards higherquality, more individual footwear.Germany is still the most important country in footwearconsumption in the EU, as can be derived from table3.1, despite a smaller growth than the EU average in theperiod 1998-2001. Germany is followed by Italy, UK,France, and Spain and at a distance by The Netherlands.

13

The five first mentioned leading countries account for81 percent of EU footwear consumption.

The footwear sector accounts for about 1.1 percent oftotal consumer expenditure in the EU. Consumptionpatterns of households vary substantially across the EU,due to differences in culture, traditions and tastes.Looking at the major EU countries, Spanish and Italianconsumers are the biggest spenders on footwear.French, UK and Netherlands consumption were higherthan the EU average consumption of footwear,while German consumption was lower.

Germany

The value of footwear consumption in Germanyincreased in the period 1998-2001 after some years ofdeclining, however, this growth occurred only to a veryslight degree. In volume terms, the German marketreached 379 million pairs in 2001. Average pricesdecreased in the period under review, while thefootwear spending per capita stabilised. Demographicdevelopments and a (weak) price inflation are the mainfactors of a slightly growing footwear market.Developments in the footwear market are the result ofmany factors like economic limitations

3 CONSUMPTION OF FOOTWEAR

Table 3.1 Consumption of footwear (€ million) in EU countries in 1998-2001 and expected developments in 2003-2006

1998 1999 2000 2001*) Per head Expected annual consumption growth

2000 2002-2006(in €) in %

Germany 10,507 10,554 10,560 10,729 133 1.6Italy 8,824 8,998 9,116 9,235 143 1.5United Kingdom 9,023 9,414 8,892 9,026 140 1.9France 8,044 8,121 8,197 8,273 138 1.5Spain 5,810 5,868 5,886 5,911 144 1.8The Netherlands 1,836 1,983 2,107 2,231 139 1.9Belgium 1,421 1,437 1,446 1,454 145 1.7Portugal 1,113 1,160 1,173 1,184 121 1.3Greece 998 1,089 1,120 1,135 113 1.3Austria 1,065 1,078 1,094 1,105 138 1.6Sweden 1,036 1,052 1,062 1,072 125 1.5Denmark 640 666 674 692 131 1.5Finland 592 598 608 617 122 1.2Ireland 437 453 462 470 131 1.4Luxembourg 61 64 64 65 145 1.8EU (15) 51,407 52,535 52,461 53,199 137 1.7

*) partly estimatedSources: FSO, Retail Intelligence and Eurostat

(consumer spending in Germany is weak compared toother major EU countries), intensive price competition(increasing market shares for non-specialist retailers),growing imports from low-cost countries (directimports as well as production abroad under the regimeof German manufacturers) etc.

Women’s footwear captures about 54 percent of thefootwear sector in Germany, while men’s footwearaccounts for 34 percent in terms of volume. Per capitaconsumption decreased from 4.8 pairs per person in1996 to 4.6 pairs in 2001, of which 2.4 pairs leather,1.8 pairs non-leather and 0.4 pairs of slippers.Per capita spending valued € 132 (US$ 122) in 2001,lower than the EU average of € 136 (US$ 125). The German footwear market has been polarising forseveral years. High priced footwear covers high-fashionbranded footwear for women, health and comfortfootwear for children and older adults (of which morewomen than men), while branded sports footwear isvery popular among young people. Lower pricedfootwear mostly covers unbranded imported footwear,especially shoes with textile uppers, mainly from Chinaand other East Asian countries like Vietnam, partly as aresult of an ineffective EU anti-dumping policy.These developments resulted in a fall in sales of mid-priced shoes.The most popular brands remained the shoe names ofthe two top retail chains Deichmann and Salamander.Branded shoes from clothing retailers have been doingwell (C&A). Popular brands in the sector comfortableshoes are Ara, Jenny, Gabor, Rieker, Domdorf, Ganter,Salamander and Sioux and in the sector children’sfootwear Elefanten, Ricosta and Salamander. In thesports sector, the two leading brands Adidas and Niketogether take around half the market, while Puma and

14

Reebok together take a quarter. In the health sectorBirkenstock (sandals), Bama and Ganter are the mostpopular brands.

The Netherlands

In 2001, total consumer expenditure on footwear in The Netherlands amounted to € 2.2 billion (US$ 2.1bn), or 5.9 percent more than in the previous year. In 1999, there was even an increase of 6.1 percent toalmost € 2.1 billion (US$ 1.9 bn). The averageconsumption was € 139 per head, which is higher thanthe EU average. A lower annual growth of around 2 percent is expected for the next 5 years. In terms of volume, consumption grew 3.7 percent in1999, 5.2 percent in 2000 but decreased 0.8 percent toreach almost 68 million pairs in 2001.

Average prices of footwear rose 0.9 percent in 2000 and6.7 percent in 2001. Increased expenditure was theresult of the following aspects:• Consumers bought higher priced footwear.

Higher priced footwear concerns mainly luxury andhigh-quality shoes and for women also leather boots.Luxury and high-qualitity shoes (especially for men)are often made by domestic manufacturers (mainlyabroad);

• Consumers expanded their footwear collection,for instance by buying footwear for special events oroccasions; and,

• Popularity among (female) consumers for funshopping.

Brand loyalty is rather low in the footwear sector.According to an inquiry by Shoemonitor in 1999:75 percent of the Dutch consumers does not have afavorite brand. The most popular brands in the women’s

Table 3.2 Consumer expenditure on footwear in Germany, 1996-2000

1996 1998 2000Volume Value Volume Value Volume Value Value

mln pairs € mln mln pairs € mln mln pairs € mln US$ mln

Footwear with leather uppers:Sports 22 1,167 21 1,085 22 1,088 1,002Sandals 36 847 38 791 37 708 652Town wear for:– Women 73 3,632 75 3,698 77 3,749 3,453– Men 44 2,140 43 2,245 45 2,406 2,216– Children 17 574 16 559 16 569 524Other 5 173 4 136 5 134 123Footwear with other uppers:– Slippers 29 271 28 298 29 304 280– Other 146 1,751 152 1,695 148 1,602 1,475Total 372 10,555 377 10,507 379 10,560 9,725

Sources: HBD and Euromonitor

sector are Ecco, Gabor and Clarks; in the men’s sectorvan Bommel, Ecco and Van Lier; in the children’ssector Piedro, Elefanten and Renata; in the sports sectorNike, Adidas, Reebok, Puma and Fila, and in the indoorfootwear sector Rohde, Blenzo and Romika. It has to be noted that the so-called spontaneous brandknowledge is rather low, with the exception of thesports sector.

Italy

Until 1997, the Italian consumer footwear marketshowed a trend towards more expensive products. In the years, which followed the market grew veryslowly in terms of volume and value. The decrease inItalian production (mainly fashion and sports) as wellas in export, a strong increase of imports (from Asiancountries as well as from other EU countries) caused apressure on prices. In terms of the Italian market for footwear by sector,leather footwear accounted for 70 percent of totalconsumption in 2000. Leather footwear was followedby footwear with synthetic and textile uppers,accounting for 13 and 9 percent of total consumption

15

respectively. Compared to other sectors of the market,consumption of leather shoes decreased slightly overthe past three years, but nevertheless has been affectedsomewhat by the general reduction in consumerexpenditure. Per capita spending valued € 143 (US$ 132) in 2000,which was far above the EU average of € 137.

No detailed figures concerning footwear consumptionin Italy were available, so for that reason the figures intable 3.4 are derived from apparent consumption(calculated as production plus imports less export). The availability of detailed production figurescombined with trade statistics from Eurostat gives thefollowing figures.

The sector sports footwear performed well in the periodunder review, primarily due to an increase in importedbranded goods such as Nike and Reebok. The wearingof sports shoes, for purposes other than for sports, as areplacement for everyday leather shoes has beenchanged by an increased usage of casual varieties ofsports shoes.

Table 3.3 Consumer expenditure on footwear in The Netherlands, 1999-2001

1999 2000 2001Value % of Value % of Value Value % of

€ ’000 total € ’000 total € ’000 US$ ’000 total

– Women 902 45.5 946 44.9 1021 941 45.9– Men 516 26.0 547 26.0 575 530 25.7– Children 251 12.7 270 12.8 284 262 12.7– Sports 213 10.7 228 10.8 233 215 10.5– Other 101 5.1 116 5.5 118 109 5.2Total 1,983 100.0 2,107 100.0 2,231 2,057 100.0

Source: EIM, CBS

Table 3.4 Consumer expenditure (in volume and value) on footwear in Italy, 1998-2000

1998 1999 2000Volume Value Volume Value Volume Value Value

mln pairs € mln mln pairs € mln mln pairs € mln US$ mln

Footwear with uppers of:– leather 157.3 6,291 158.3 6,450 157.2 6,445 5,935– synthetic 55.7 1,134 54.4 1,109 58.2 1,196 1,102– rubber 8.1 132 8.3 126 8.5 131 121– textile 44.6 796 46.3 830 47.6 842 775– other 2.7 41 2.4 39 3.0 53 49Slippers 54.4 430 54.9 444 54.6 449 414Total 322.8 8,824 324.6 8,998 329.1 9,116 8,396

Sources: Eurostat and Euromonitor

Women’s footwear accounted for 54 percent of themarket in value in 2000. The share of this market hasbeen maintained by the relative unit value of moreexpensive types of footwear like women’s boots. Men’s and children’s footwear accounted for 25 and 21 percent respectively.

France

Nearly 320 million pair of shoes were sold in France in2000. According to the French Shoe Federationequivalent amounts will be sold in the next five years.

Women’s footwear captures about 50 percent of thefootwear sector in France, men’s footwear 33 andchildren’s 17 percent in terms of value. Per capitaconsumption stabilised in the period under review atabout 5.5 pairs per person, of which 2.2 pairs leather,2.7 pairs non-leather and 0.6 pairs of slippers.Per capita spending valued € 138 in 2000, which is justabove the EU average of € 137. The casual footwear segment, including leather andtextile uppers, was one of the fastest growing sectors ofthe last decade, particularly for children and youngpeople. The dictates of fashion play a more importantrole for ladies’ and teenagers’ footwear than for men’sshoes. Women buy shoes more often than men, whileteenagers of both sexes are the most prolific purchasers.

UK

Consumer expenditure on footwear in the UK rose by1.4 percent in terms of value in the period 1997-2001 toalmost € 9.0 billion (US$ 8.1 bn) and 5.4 percent involume to 220 million pairs. The British footwearmarket is dominated by imports. The strength of the

16

local currency (pound sterling) coupled withcompetition on the high street has seen the index offootwear retail prices rise only 17 percent since 1987compared to a 67 percent inflation rate for all retailgoods in the same period. Per capita spending valued € 140 (US$ 129) in 2000,which is above the EU average.

In value terms, women’s footwear accounted for 49 percent of consumer expenditure in 2001, men’sfootwear for 34 percent, with children’s shoes takingthe balance of 15 percent. In volume terms, a differentpicture emerges because men buy fewer pair of shoeseach year but tend to spend a higher sum of money perpair. Consequently, women’s footwear accounts for 50 percent of volume sales, children’s footwear for 23 percent and men’s footwear takes 27 percent.In terms of purpose, trainers and sport shoes takearound 22 percent of the market with formal and casualfootwear (both categories excluding children’sfootwear) being the other major sectors with 25 and 28 percent respectively, which indicates a move fromtrainers to casual footwear.

3.2 Market segmentation

Segmentation by price/quality ratioThe footwear market comprises several officiallyrecognized sectors. In trade statistics, the market ismainly categorised by end user and materials used inmanufacturing, in particular for uppers. In terms of demand and fashion, five different marketsegments can be identified:

Table 3.5 Consumer expenditure (in volume and value) on footwear in France, 1998-2000

1998 1999 2000Volume Value Volume Value Volume Value Value

mln pairs € mln mln pairs € mln mln pairs € mln US$ mln

Footwear with leather uppers:Sports 7.8 312 6.8 275 7.1 284 262Sandals 19.7 635 19.9 608 20.3 626 576Town wear for:– Women 40.0 2,362 40.4 2,313 40.7 2,330 2,146– Men 25.5 1,433 26.5 1,492 26.2 1,496 1,378– Children 19.2 612 19.8 638 20.0 664 611– Other 11.1 352 10.6 372 10.6 340 313Footwear with textile uppers 104.6 862 99.4 816 101.2 822 757Footwear with other uppers 54.7 1,316 56.0 1,419 56.4 1,466 1,350Slippers 33.0 160 37.5 188 37.0 169 156Total 315.6 8,044 316.9 8,121 319.5 8,197 7,549

Source: derived from FNICF and Eurostat

Price/Quality Fashion/level1. Low/very low price/quality Trend imitators2. Low to middle price/quality Trend takers3. Middle/high price, classical, Comfort, fit

branded shoes fashion4. High fashion – price/quality, Trend makers

not necessarily high5. High price/quality Trend takers

The size of the segments distinguished varies percountry. Generally spoken can be said that the twoextremes are represented in all (major) EU countries.Concerning the other segments, some different patternsare shown: German consumers, with the exception of young people, are less fashion conscious thanconsumers in the other major EU countries and thesegments 3 and 2 are most important; French andItalian consumers are more oriented on segments 4 and 3 with preferences for the “dressual” shoe (a combination of dress and casual); consumers in theUK and The Netherlands are mainly oriented onsegments 2 and increasingly on 4. In the UK, highfashion can be combined with casual and sports shoes.It has to be noted that price is no longer the firstconsideration in the latter-mentioned countries as it wasfor many years. One of the consequences is that the consumer expectsretailers to have a clear image. In order to meet theseconsumer demands, we see many shoe stores going in

17

for upgrading and, on the other side, discountersmaintain their operating at discount level. This will bediscussed in more detail in chapter 7 “Trade structure”.

Segmentation by user

– based on demographicsThe size and age structure of the population is one ofthe basic determinants of how much will be spent onfootwear. Table 2.1 in the previous chapter showed thecomposition by age groups of the population in the EU.Although this may appear to be a rough method forcategorising the market, it is interesting because:• generally speaking, different age categories have

different clothing behaviour including accessorieslike footwear, and

• developments within the various age categories can be followed, by comparing results with projections.

The EU population has a declining birth rate and anageing population. The category below 20 yearsdecreased considerably in the selected EU countries,.The categories 40 and older increase substantially. In 2000 about 40% of the total population was olderthan 45. As the “baby boom” generation becomes older,we see the population as a whole becoming “greyer”,apparent in the number of senior citizens above 55 years of age. However, the healthy and active seniorcitizens make up an important and growing marketsegment including sports and leisure activities and this

Table 3.6 Consumer expenditure (in volume and value) on footwear in UK, 1998-2000

1998 1999 2000Volume Value Volume Value Volume Value Value

mln pairs € mln mln pairs € mln mln pairs € mln US$ mln

Men’sFormal shoes and boots 10.7 705 11.4 692 11.2 669 602Casual shoes and boots 16.9 798 18.6 1,102 19.4 1,135 1,022Trainers and sport shoes 20.8 1,136 21.9 1,122 21.0 1,032 929Slippers 4.9 86 5.3 108 5.1 99 89Other 2.7 106 3.6 151 3.9 155 140Women’sFormal shoes and boots 29.8 1,735 30.9 1,738 30.8 1,630 1,467Casual shoes 26.7 1,086 27.8 1,165 27.5 1,107 996Sandals 15.4 602 17.1 709 16.9 658 592Canvas and sport shoes 16.7 681 17.7 754 16.5 641 577Slippers 13.4 287 13.2 214 13.5 212 191Other 2.9 105 3.8 152 3.6 148 133Children’sShoes and boots 18.9 854 18.7 698 19.4 721 649Sport shoes 18.2 523 19.7 596 19.6 595 535Sandals 5.4 63 6.0 91 6.2 94 85Other 5.8 132 4.7 122 5.9 130 117Total 209.2 8,899 220.4 9,414 220.5 9,026 8,124

Sources: TNS Fashion Trak and BFA

age group has a growing share of available disposableincome. Consumer requirements and aspirations differ bysegment of the population. Children are an importantsegment and purchasing patterns vary according to age.For children of the age of three years and younger,parents pay particular attention to the structure of theshoe (shape, rigidity, stiffeners which maintain the backof the shoe) and, more often than not, they are ready tobuy expensive good quality articles, to ensure a perfectdevelopment of the child’s foot. In this age group, it isthe adults who choose the footwear. When the childrenare aged between three and ten, parents still seek toacquire a sensible quality shoe, which will not damagethe foot, but choice is also guided by the size of thefamily budget and the child’s tastes.Pre-adolescents (10-14 years of age) have a strongdesire for freedom of choice. Boys have a preferencefor sportswear and often demand a certain model orbrand, which is particularly popular with their friends.Girls meanwhile often have long slim feet which havenot gained full maturity and consequently it is notalways easy for them to find shoes that fit. The juniorsaged 15-18 years are nearly totally independent in theirchoice of footwear, the only curb being the familybudget. Sports and outdoor-wear are very much to thefore, fired by the popularity of brands such as Nike andAdidas (sportswear), Doc Martens and Caterpillar(outdoor wear). Their choice is geared to socialrecognition and group membership. Meanwhile today’sparents have tastes which differ from those of their ownparents. Fashion-wise, the trend is towards easy to wearand easy to care garments; city wear has become morerelaxed and more geared to outdoor and sportswear.Products need to be versatile so that the same footwear,for instance, can be worn during the day at the officeand in the evening at parties of restaurants.

– based on socio-economic factorsThe slowdown in the global economy, the first signs ofwhich appeared in the middle of 2000 continued into2001. Private consumption in the EU has become moresubdued as consumers have become less optimisticregarding their financial prospects. Weaker employmentand wage prospects led to slower private consumptiongrowth. There are significant differences in consumption habitsin the varying EU countries, due to differences inculture, traditions and tastes. Footwear accounted for1.15 percent of household expenditure in the EU in2000, while this percentage was 1.30 percent in 1990.Consumer expenditure was higher on sectors likehealth, housing/energy, transport/communication andleisure/education activities.In 2000, spending on footwear was higher than the EUaverage in Spain and Italy, while it was lower than theEU average in Germany, UK and The Netherlands.Spanish consumers devoted the highest share of

18

expenditure on footwear at 1.96 percent in 2000. The UK showed a modest growth in the last decade inspending on footwear, while in most other countries ithas significantly declined.

– based on life stylesToday, two consumers of the same age, same familystructure and same income may have extremelydifferent life styles, reflected in different buying habitsand product preferences. Clothing and footwear,more than ever, serves as the means of expression ofpersonality. Character, ideas and attitude to life areemphasised by the way a person dresses. Combinationfashion is eminently suited to expressing a personalstyle.Today, consumers set priorities in their pattern ofexpenditure according to their life style. The increasingly individualistic nature of society willbring about a rise in demand for goods with anexpressive value. People do not mind spending theirmoney on such goods, while for products with a lowerpriority, a low price is the main criterion.

– based on seasonal aspectsGenerally spoken, weather has an impact on the timingof expenditure, which tends to be highly seasonal.Unexpected weather changes influence consumers intheir purchasing decisions.

3.3 Consumption patterns and trends

Fashion and fashion trendsFootwear fashion is strongly related to fashiondevelopments in clothing behaviour. Fashion trends infootwear must necessarily be in harmony with those ofclothing and fashion requires substantial investment increativity: highly skilled designing, the right colours,materials etc. Fashion in footwear can be based on abasic model but also on specific features like colour,materials, shape, outer sole and heel-heights, decoration

Table 3.7 Share of spending on footwear in majorEU countries, 1990-2000 (in % of totalconsumer spending)

1990 1995 2000

France 1.33 1.20 1.15Germany 1.32 1.15 1.04Italy 1.57 1.41 1.36The Netherlands 1.05 0.94 0.93Spain 1.99 1.96 1.96United Kingdom 0.92 0.94 1.04EU (15) 1.30 1.19 1.16

Sources: Retail Intelligence and own research

(bows, buckles, ribbons etc.). There are also segmentswhere the idea of more or less permanent articles exist:safety footwear, wellingtons, rope soled sandals,slippers etc. However even in these segments thepressure of fashion is not absent.

In all EU countries we see a switch from formalclothing in favour of more casual wear; this trend hasalso affected the footwear market. Canvas casualfootwear and sports footwear (trainers) have becomeacceptable wear for non-work situations and are nowworn by every age group.Slippers traditionally worn around home are partlyreplaced by slip-on canvas shoes, espadrilles (rope-soled) or sports shoes. Waterproof and water-repellant footwear have becomemore popular in the EU, following the trends in theUSA. New leather techniques and high-tech membranesare used in all kinds of shoes, mainly developed for thesports sector, but also applied to casual and town shoes.Developments are also derived from the applications inmountain-climbing shoes and special work shoes.

Italian producers and designers lead footwear fashionand dominate the market for leather fashion shoes,while leading brands mainly from the USA dictatefashion in sports footwear. The fashion trends whichoriginate there are in turn adopted and modified byforeign importers including multiple buyers, who thenspecify their requirements to contract manufacturers. Although the number of older consumers is increasingand this will raise the demand for better fitting highquality shoes, there is a gradually increasing demandfor fashionable shoes for this age group as well.

The effects of fashion vary according to the type ofproduct. Women’s footwear is obviously the segmentmost influenced by fashion. According to the trade,around half of sales of women’s footwear is geared tofashion. Men meanwhile are far less influenced by thelatest styles and are said to be more interested incomfort and quality. They are even ready to spend alittle more so that their shoes last longer.

The following footwear trend prognoses apply tosummer 2003 and are published by the French trade fairMidec-Paris:

Changing moodsProspective studies of Summer 2003 announce aturning point in trends and consumer behaviour. New values are emerging and current fashion behaviouris taking a gentler tone. People aspire to more softnessand serenity, to temper the tensions in the outsideworld.Peace, patience, simplicity, delicacy, slowness, pleasureand hedonism are up-and-coming values. They expressa desire to preserve inner balance as a way of

19

withstanding environmental stress and strain.A refocus on the essential excludes anything futile andfleeting. Although brands are still attractive, they areused as a refuge rather than for show. Simplicity isenjoyed as a luxury and confirms the need for a laid-back form of personal sophistication.The rejection of standardisation is another strikingfeature. Consumers now surf and zap, take pleasure inmixing genres and slip easily from one stylistic code toanother.In this shifting environment, commercial successdepends on many factors: innovation and creativity andthe imaginative touch that makes all the difference. A detail, an unusual material, an original finish or wayof wearing the item ... and the product rises out of thepurely functional sphere and goes straight to theconsumer’s heart.

Colour highlightsDelicate bleached colours and pale neutrals, which canbe extended to pastels. The sophisticated colours ofcosmetics, powder and faded petals, which go with thefeminine touch. Always a safe bet: traditional leathertones, symbolising refinement and elegance, beige,blond, ochre, honey, hazelnut, caramel and even verydark browns. Midsummer calls for sunny,mouth-watering colours: apricot, cherry, papaya, mint,lemon... A new palette of cool, grey, indeterminatecolours, inspired by the mineral and vegetablekingdoms. A range of clinical, refreshing colourssuggesting well-being and modernity, which harmonisewith neutrals or take a dynamic turn with brightaccents.

Highlights in materialsSensual textures and a trend towards softer leatherswith natural effects. A wave of romanticism andfemininity is expressed in leather or textiles by floralprints, hope-chest lace and embroidery, broderieanglaise, upholstery fabrics, brands and trims, refinedmaterials such as satin and feathers.A craze for cult materials (meaning genuine) – leather,denim, linen, jute as a fabric or cord, wood, straw,raffia. Oil cloth used in fun ways. Sophisticated roughand vintage effects which opt for the subtlety ofimperfection.An interest in leather and weaving which suggesthandcrafts and artistic skill just visually: leather ormixed medium plaiting, backed leather, macramé,decorative effects, painted leather or canvas.The increased use of laser techniques in design, and incutting leather or technical materials, opens up endlesspossibilities for decoration: cut-out motifs, lacy effects,an impression of broderie anglaise, tattooing or wearand tear.

Women and young adultsWomen’s fashion hesitates between practicality andpleasure. Being fashionable is no longer a matter of heelheights, or shapes (pointed, round and square toes getalong very well together), but of proportions, materials,colours and impulses, and mixing and matching genres.City: Old favourites that are easy to walk in are stillgoing strong: derbies, moccasins, brogues, city trainingshoes, stylish or retro sneakers given a sophisticatedclever use of materials, colour and tapered lines.Simpler, flat heels prevail: urban or romantic ballerinasfrom the dance world, low-cut on mini heels, point to acomeback of childhood values. New uses for sandals,babouches, flip flops, barefoot sandals and ethnicelements: beads, plaiting, feathers, embroidery andquirky mixes set the tone for a tribal or sophisticatedhybrid fashion.Midsummer: High-arched wedges are significant,especially in wood, cord and cork. Leg-wrappingsandals are in, and with them all uppers that tie higharound the leg, in rustic, poetic or even sexy versions.Wooden clogs are gaining ground, in a Zen spirit, orgaloshes version for indoor- and outdoor wear.Charming or sophisticated espadrilles are still with us.Outsider: The Western spirit for mules and summerboots and ankle boots. Revamped pumps are back,tapered or rounded and on heels of all heights.

Men and young adultsMen are taking more care of their appearance. It is notlonger socially out of place to be fashionable; on thecontrary it is a sign of modernity. Reassured by themedia, men are more confident in their tastes and opento more daring clothing.City: The boot-maker spirit with fine soles or broadwelts is still strong, along with sophisticated city-sportmodels on thin soles. For everyday comfort, casual slip-ons, sometimes inspired by indoor footwear, andsupple moccasins take the lead. Confidence in the newtechnologies leads to new behaviours and interest,practical footwear such as sporty modes with innovativefastenings and high-performance materials. Retro sportsplay on authenticity in all its forms and renovate biking,boxing, tennis shoes and city sneakers, while thepioneer spirit comes to town with high uppers leather orleather and canvas mixes.Sportswear and Midsummer: The nautical look isstill in but with a freebooter style for moccasins,soft-toed slip-ons, and barefoot sandals with a penchantfor cord, vintage buckles, brushed off leather and fadedcanvas. Comfort, protection and ergonomics are thebuzzwords for walking sandals and foot-huggingmodels with straps and functional ties. The interest inthe primitive arts, crafts and tradition is also found inmenswear, an African or Oriental trend for barefootsandals, Berber babouches, slip-ons and thongs inplaited, plain or backed leather. Espadrilles are backwith a casual, rustic or refined look.

20

ChildrenExcept for the tiny tots, children’s footwear follows thelead of the grown-ups. Children have appropriated thestyles of their elders but added a dash of dream andescapism.For future playground champions, there are still unisexmodels from the sports world, just the thing for runningwild: boat shoes with a new twist, cycling, bowling,boxing, running and tennis shoes in canvas or leather,low-cut or with high uppers in a colourful, graphicspirit. Two or three colours personalised with stripes,topstitching, lettering, designs and, as a novelty, straps.Mary Janet, ballerinas and city sandals, follow suit forgirls with simpler lines and a modern air.The outdoor spirit in a safari mood for girls and boysalike, in warm sand and desert colours. Technicalrangers, Mohican moccasins, adventure sandals,genuine barefoot sandals and tough training shoesadvocate an all-terrain spirit and use tough canvasshockproof materials, rivets and treaded soles.The ethnic trend can be found in girls’ footwear inplaits, perforations, flowers patchwork, beads, fringes,mirrors, sequins and incrustations.The romantic wave also seduces little Lolitas with arange of tender colours: white tinted whites and delicatepastels. The hope chest spirit, broderie anglaise, floralpatterns, fresh stripes, embossed effects, and pleats forMary Janes, sneakers, sandals, tennis shoes with simplyirresistible charm.And for midsummer, a decidedly gay, optimistic mood.Decorated sneakers, ballerinas, sandals and quirkybeach sandals copy grown-up styles and play aroundwith iridescent and coloured translucent materials,plastic inclusions, and kitsch details: frills, ribbons, andscreen prints to seduce the mini pin-ups.

BrandsIn the EU market for footwear, manufacturers’ brandsare important for the high-fashion, classical, health andsports sectors. These shoes come mainly from Europeanmanufacturers with the exception of sports footwear.Retail chains and importers use fantasy labels andbrands to distinguish their collections from those ofcompetitors and also to target particular segments e.g.clothing brands are increasingly used as distinguishingpromotional features (with agreement/royalty paymentto the brand name owner). Brand names are of littleimportance for cheap gym shoes, slippers and othertextile and plastic shoes. One sector, that of specialistsport shoes, is dominated by well promoted brands.These sport shoes are frequently promoted alongsidefashion clothing ranges for individual sports. Examples of these labels are: Adidas, Nike, Reebok,Puma and Lotto. The main source of production forthese sport shoes is the Far East.

4.1 Footwear production in the EU

EU

Footwear production in the EU decreased from 1,081 million pairs in 1997 to 910 million in 2000,sank for the first time below the one billion pair level in1999 and continued its fall with 5 percent in 2000 as itrelocated to other, and especially former Eastern bloc,countries. Preliminary EU production figures for 2001indicate a further decrease of 2.1 percent to 889,000pairs. Italy remained EU’s leading footwear producer withalmost 43 percent of total EU production, followed bySpain (22%). Other major producers are Portugal (12%)and France (11%). Around 280,000 employees workedin the EU footwear industry in 2000, while this numberwas still 325,000 in 1995. The footwear industry isrelatively labour-intensive, added to which increasingcosts and the competition of cheap imports havepressed manufacturers to specialise in niches (luxury,safety or orthopaedic footwear) or to shift production toabroad via the outward processing route (OPT).The footwear manufacturing industry in two countries,Italy and The Netherlands showed (limited) positivedevelopments, but at the other end of the scale,significant reductions had been recorded by many otherEU producers. For example, UK footwear productionplummeted nearly 46 percent, Belgium 25%,France 13%, Germany 9% and Spain 4%.

21

There are large differences between the member statesin production regarding number of output as well astype of product. Many footwear manufacturers in theEU are now importing uppers and to a lesser degreeouter soles and other parts for final assembly in theirproducts. EU imports (from outside the Union) of partsof footwear amounted to US$ 1,426 million, of which85 percent uppers. Romania is the main supplier ofuppers followed by India (for many years leadingsupplier and passed by Romania in 1999), Tunisia andHungary. Almost all sports and sports leisure shoes continue tobe made in the Far East (almost 80% of the globalproduction!) and Eastern Europe, including productionfor the major international manufacturers such as Nike,Reebok, Adidas, Fila, Hi-Tec and Puma.Europe accounts for 20 percent of the world’sproduction of leather uppers, for an important partfashion and quality production coming mainly fromItaly, Portugal and Spain.

Germany

German production of footwear has been on the declinefor many years, as imports from low labour costcountries have increased. HDS, Germany’s footwearindustry association, has released figures for 2001showing a 9.6 percent increase in exports to DM 1.67billion (US$ 785 million). In terms of production, thegood growth in exports counteracted the weakness in

4 PRODUCTION

Table 4.1 Production of footwear by EU member states 1997-2000 (in million pairs)

1997 1998 1999 2000 % change % change1997/2000 1999/2000

Italy 460.0 425.0 380.9 390.8 - 15 + 3Spain 207.5 220.9 212.9 203.6 - 2 - 4Portugal 103.0 105.6 107.6 106.7 + 4 - 1France 135.4 125.5 114.6 99.7 - 26 - 13Germany 40.4 41.5 39.8 35.8 - 11 - 9UK 88.9 82.8 62.9 34.1 - 62 - 46Austria 11.9 10.6 10.7 10.2 - 14 - 5Denmark 10.2 10.5 10.2 9.9 - 3 - 3Greece 11.5 10.0 9.5 9.4 - 18 - 1The Netherlands 5.6 3.6 3.8 4.1 - 27 + 8Finland 3.7 3.9 3.7 3.5 - 5 - 5Ireland 1.0 1.0 1.0 1.0 0 0Sweden 1.0 0.9 1.0 1.0 0 0Belgium/Luxembourg 0.9 0.8 0.7 0.5 - 44 - 25Total EU 1081.0 1042.6 959.3 910.3 - 16 - 5

Source: CEC

the domestic market where sales fell 2.7 percent to DM 4.28 billion (US$ 2.0 billion).

Salamander is the biggest shoe manufacturer in Europe(€ 1.29 billion in 2001) and includes besides the brandSalamander: Lurchi, Yellowmiles, Sioux, Betty Barclayand Apollo. The Salamander Group also has a retaildivision with 115 shops in Germany, as well as abroad(Austria, France and East European countries)Many German manufacturers are doing well in the so-called “health and comfort” sector, of whichBirkenstock and Ganter are well-known with importantexports to respectively the USA and Japan. Imports of footwear parts (uppers and soles) for finalassembly in Germany increased from US$ 316 millionin 1999 to 360 million in 2000, coming mainly fromPortugal, Italy, India and Hungary.

The Netherlands

Footwear production in The Netherlands accounted foralmost 6 percent of the domestic market in 2000. The number of footwear manufacturers in theNetherlands has declined too and numbers only 20 companies (with more than 20 employees) with anannual output of 4 million pairs, including productionabroad. The leading companies like Van Lier,Van Bommel, Greve, Berkelmans, Avang and Durea arespecialised in the more expensive footwear.

22

Table 4.2 Overview of German footwear industry, 1998-2001

1998 1999 2000 2001

Plants (average number) 161 151 138 133Employees (average number) 18,577 17,766 16,964 16,457Volume of output (’000 pairs) 41,500 39,840 35,820 33,884Value of output (DM bn) 6.56 6.30 5.95 5.92Domestic sales (DM bn) 4.92 4.73 4.40 4.28Foreign sales (DM bn) 1.64 1.57 1.52 1.67

Source: HDS

Italy

Italy plays a major role in global footwear production,in spite of high costs of labour and is concentrated onquality, well designed footwear in leather. Italy isEurope’s largest producer of footwear (ahead of Spain,France and Portugal) and fifth largest on a global scale.However, Italian footwear production decreased from460 million pairs in 1997 to 375 million in 2001. Italian footwear manufacturers ended with a turnover of€ 8.3 billion (US$ 7.6 bn) in 2000, 11 percent morethan 1999, with 390 million pairs produced (up 2.4%).In 2001, production fell again just like in the period1997-1999. This period showed falls of respectively 8 and 10 percent, while production figures in 2001reached 375.2 million pairs (3.8 percent less than 2000)at a value of € 8,670 million (+4.8%). This downturnreflects a deterioration in export sales in the face ofintense competition, especially from low-cost countriesand higher imports, which have made it increasinglydifficult for Italian producers to retain their shares ofthe home market. Export figures showed negative signscompared to the previous year with 353.7 million pairs(- 2.4%) at a value of € 7.231 million (equal to anincrease of 9.5 percent). The average price of exportedfootwear (€ 20.44 per pair) has increased by 12.1 percent. The quantity of goods manufactured andexported has dropped considerably whilst this trend hasnot affected the total value and average prices;

Table 4.3 Overview of the footwear industry in The Netherlands, 1997-2000

1997 1998 1999 2000

Plants (average number) 238 206 195 191Employees (average number) 1,814 1,734 1,688 1,650Volume of output (’000 pairs) 5,550 3,650 3,800 3,925Value of output (€ mln) 110 113 114 120Domestic sales (€ mln) 77 77 78 80Foreign sales (€ mln) 33 36 36 40

Source: CBS

the overall Italian offer reached a higher bracket witheach product sector being positioned on a higher level,although to different degrees.

The Italian footwear industry is very fragmented. The number of companies amounted to 7,500 in 2000.Footwear producers employ an average of about 15 persons. In 2001, leather accounted for 86 percent oftotal production value and 70 percent of the totalvolume of 375 million pairs. All the main types offootwear suffered falls in output. In particular,production of sports footwear and textiles uppers fell.

Many companies are now importing uppers and solesfor final assembly in Italy. In 1995 imports of theseamounted to US$ 404 million, while they increased to652 million in 1999 and to 740 million in 2000.Romania is the main supplier of uppers and soles withan import share of 37 percent (in terms of value), at adistance followed by Tunisia, Albania, India, Bulgariaand Hungary.

France

France is the fourth leading shoe manufacturer in theEU. It ranked third for many years but was passed byPortugal in 2000. French production decreased 20 percent in the period 1998-2000 to less than 100 million pairs in 2000 with a value of FF 11.8 bn. The ten leading companies are Eram, Bacou, Bata,Mephisto, Pindière, Lafuma, Aigle, Jalatte, Allemand

23

Industries and Polygone. Eram is not only the leadingmanufacturer but also the leading retailer in France.Bacou and Jalatte are manufacturers of safety footwear,besides other safety products. Bata is active in around70 countries as a manufacturing, wholesaling andretailing organisation. Mephisto is specialised inwalking shoes and an estimated 85 percent of itsturnover is covered by exports. The other companies areall active in fashionable footwear, of which AllemandIndustries is the leading children’s footwearmanufacturer.Just like manufacturers in Italy, French companiesimported an increasing degree of uppers and soles for(final) assembly. In 1995 these imports amounted toUS$ 140 million and even 213 million in 2000, comingmainly from Tunisia (27%) and Morocco (18%),followed by Italy, Spain and India..

Leading categories in French footwear production in2000 were footwear with leather uppers (47 millionpairs or 47 percent of total production) and footwearwith uppers of textiles (36 million pairs or 36 percent).The remaining 17 percent included footwear withrubber or plastic uppers. In terms of value, the leadingproduct group was footwear with leather uppers (67% of total production). The trend to move production to foreign sites is likelyto continue as a cost-saving measure. The sluggishnessof the home market and the intense competition fromthe low-wage countries has led French manufacturers to

Table 4.4 Overview of Italian footwear industry, 1997-2001

1997 1998 1999 2000 2001

Plants (average number) 8,880 8,510 7,660 7,570 7,500Employees (average number) 120,500 119,060 114,015 111,650 113,100Production (in mln pairs) 460.0 425.0 380.9 389.9 375.2Value of output (€ million) 8,052 7,907 7,417 8,269 8,670Domestic sales (€ mln) 2,128 2,064 1,915 1,663 1,439Foreign sales (€ mln) 5,924 5,843 5,502 6,606 7,231

Source: ANCI

Table 4.5 Overview of French footwear industry, 1997-2000

1997 1998 1999 2000

Plants (average number) 238 226 212 191Employees (average number) 26,300 24,800 23,300 20,800Volume of output (million pairs) 135.4 125.5 114.6 99.7Value of output (FFr.mln) 14,000 13,800 13,200 11,800Foreign sales (FFr.mln) 5,220 5,470 5,780 5,140

Source: CNC

react in order to survive. A number of companies hascreated brands along with a selective distribution orspecialised in specific products, such as children’sfootwear. Other strategies consist of moving intospecialised niches like safety wear, hiking and mountainboots.

UK

For a number of years, the UK was the fifth largestproducer of footwear in the EU. Germany passed theUK in terms of volume in 2000, after a fall of 46 percent in UK output. In 2001 around 12,000 peoplewere employed in completed footwear manufacturing,with perhaps a further 5,000 in supplier and alliedtrades.UK production of footwear has been in decline formany years (103 million pairs in 1995 and 34 million in2000) as imports from low labour cost countries haveincreased. The closure of UK’s largest retail chain, BSC(British Shoe Corporation) a subsidiary of the SearsGroup in 1999, resulted in heavily discounted sales oflarge quantities of stock by retailers. The severe pricecompetition has put pressure on manufacturers, whichhave responded by closing some or all UK factories andsourcing overseas to retain market share. However, thisaction has tended to lower footwear prices further.C&J Clark International Ltd is the UK’s top-ranked

24

shoe company in terms of sales. The companycontinues to introduce new ranges, while at the sametime refining classics. R Griggs & Company Ltd, whichmanufactures the Dr Martens shoe range, is the secondmost successful shoe company. Other manufacturers areChurch & Co, Start Rite, Pentland-Group, Peter Black,Lambert Howarth etc. Clarks and Church are significant retailers as well asmanufacturers.

Imports of uppers and soles for final assembly into theUK increased strongly until 1998. In 1999 the importsof uppers more or less stabilised at US$193 million,whereas ten years ago this was only US$ 45 million. In 2000, these imports decreased to US$ 177 million,caused by the considerable fall in domestic production.The main suppliers of uppers and soles were India(31% of total imports), Thailand (24%), China (18%)and Brazil (6%) in 2000.

4.2 EU Outward Processing TradeThe restructuring policy of many manufacturingcompanies in the EU has also involved the outsourcingof more labour intensive operations in area inside theEU (Portugal, Ireland, Spain and Greece) and outsidethe EU, like Central and East European countries(CEECs), Mediterranean countries and Asian countries.

Table 4.6 Overview of UK’s footwear industry, 1997-2001

1997 1998 1999 2000 2001 est

Plants (average number) 741 676 670 535 530Employees (average number) 22,980 21,300 20,700 17,500 17,000Production (in ’000 pairs) 88,900 82,800 62,900 34,100 33,800Value of output (£ bn) 1,233 1,068 1,015 608 584Foreign sales (£ bn) 422 382 380 233 230

Source: British Footwear Association

Table 4.7 EU developments in OPT of footwear in total and by trade partners, 2000

2000 US$ mln Leading trade partners in 2000

EU 556 Romania (41%), Hungary (13%), Albania (12%), Croatia (5%) of which:Italy 386 Romania (54%), Albania (17%), Serbia Montenegro (5%), Croatia (4%) Germany 83 Hungary (58%), Czech Rep. (28%), Croatia (10%), Moldova (6%)Denmark 19 Poland (72%), Hungary (9%), Lithuania (8%)France 18 Tunisia (26%), Morocco (24%), Slovakia (23%), Croatia (9%) UK 12 India (77%), Thailand (17%)Other EU countries 38 Romania (43%), India (18%), Hong Kong (9%), Slovakia (8%)

Source: Eurostat

This policy, outward processing trade (OPT), gives EUmanufacturers the possibility to maintain control overthe management and quality of the outsourcingoperations and to respond quickly to changing marketdemands.EU OPT for footwear increased steadily in the period1990-1998 from US$ 308 to 604 million, followed by asmall decrease of less than 2 percent in 1999 and astrong decrease of 16 percent in 2000.

Almost 90 percent of total OPT value came fromCEECs. The most important OPT country outsideEurope was India (2.4%), followed by theMediterranean countries Morocco (0.9%) and Tunisia(0.9%). OPT with India decreased from US$ 26.7million in 1998 to 12.7 million in 2000. OPT withTunisia almost halved in one year: from US$ 9.5million in 1999 to 4.8 million in 2000, while importsfrom Morocco stabilised at US$ 5.0 million.

25

5.1 Total importsBefore we take a look at the import figures for footwearinto the EU, it should be noted that all data presented inthis chapter are official trade figures provided byEurostat. We therefore refer to the remarks in chapter 1,explaining that official statistics are not always all-embracing and should be interpreted with care. It should also be noted that the statistics do not takeinto account the considerable volume of fraudulentimports of Chinese products via other countries. Anti-fraud investigations, among others by theEuropean Anti Fraud Office (OLAF ), on this issue forinstance in verifying certificates of origin, learned thatlarge volumes of shoes originating in China weredeclared as originating in certain countries of theMiddle and Far East.Control on trade policy measures and other instrumentsagainst fraud are discussed in chapter 1.2 of the EUStrategic Marketing Guide.

EU

Total EU (15) imports of footwear amounted to US$ 17.9 billion (€ 19.43 bn) in 2000. Germanyremained the leading importer, with an import share of22 percent in terms of value, followed by UK (17%),France (15%), Italy (13%) and The Netherlands (8 %).Belgium (6%) ranked sixth, followed by Austria (4%).

26

EU imports of footwear decreased by 4.4 percent in theperiod 1999-2000. EU countries can be divided, as todevelopments in value of imports during this period,into:• Very strongly decreased imports (more than 10%)

in Portugal, Finland, Germany and Belgium;• Strongly falling imports (between 5-10 %) in UK

and Austria; • Slowly falling imports (less than 5%) in Sweden and

Greece;• Slowly growing imports (less than 5%) in Italy,

France, The Netherlands, Denmark and Ireland;• Booming imports (more than 10%) in Spain.

Developments in imports of footwear vary strongly perEU country. This depends on several factors like sizeand structure of domestic production of footwear,the possibilities and size of re-exports anddevelopments in demand as described in chapter 3.1.

The growth in Spanish imports covered for animportant part leather shoes and special sports footwear.International brands came from other EU countries(mainly Belgium, Portugal, Italy and The Netherlands)while lower priced products came from developingcountries (mainly Vietnam, China and Morocco).Spanish production satisfies the demand for mediumand medium-high articles.

5 IMPORTS

0 1000 2000 3000 4000 5000 6000

Germany

UK

France

Italy

Netherlands

Belgium/Lux.

Austria

Spain

Denmark

Sweden

Portugal

Ireland

Greece

Finland

US$ million

2000

1998

1996

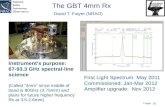

Figure 5.1 EU import of footwear by member states, 1996-2000

The fall in Portuguese imports was mainly caused bythe product group parts of footwear, of which importsfell from US$ 153 million in 1999 to 116 million in2000.

About 52 percent of the total value of EU imports camefrom other EU countries in 2000, mainly from Italy(17% of total EU imports and 32% of intra-EUimports). Other major suppliers to the EU market werePortugal (7%), Belgium (6%) and Spain (6%), followedby The Netherlands (5%). The total import share ofother EU countries decreased, this percentage being11.8 percent in 2000 and 12.5 percent in1998. Importsfrom the leading EU supplier Italy decreased by 20.9 percent in the period 1998-2000 to just under US$ 3 billion in 2000, while imports from Portugaldecreased 16.6 percent and imports from Spain 18.4 percent in the same period. This means thatPortugal ranked fourth (in terms of value) under Chinaand runner-up Vietnam. Imports from Belgium and The Netherlands increased respectively 2.1 and 28.5 percent in the period 1998-2000.

EU imports from developing countries increased interms of volume (+ 19%) and value (+ 11%) againstlower prices (- 6%). Developing countries gain from thedecreased intra-EU imports, just like other countriesfrom outside the EU: CEECs (mainly Romania) andAsian countries (mainly Taiwan). Italy remained the leading supplier to the EU market inthe category outdoor footwear with uppers of leatherwith 141 million pairs in 2000, above Portugal (61 million pairs). Vietnamn (55 mln pairs) passedSpain (44 mln pairs) in 2000, these countries ranked

27