2015 Investment Outlook (PDF) · PDF fileReal Asset Securities: ... environment similar to...

Transcript of 2015 Investment Outlook (PDF) · PDF fileReal Asset Securities: ... environment similar to...

2015 Investment Outlook

The information provided is for educational purposes only and does not constitute a recommendation of the suitability of any investment strategy for a particular investor. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Table of Contents

Global Economic Outlook: John Greenwood 2

US Growth Stocks: Juliet Ellis 6

US Value Stocks: Kevin Holt 10

International Growth Stocks: Clas Olsson 14

Real Asset Securities: Joe Rodriguez 18

Fixed Income: Rob Waldner 22

2

Global Economic Outlook: US Sets the Pace for Growth in 2015

As we begin the new year, there are certain key issues that I expect to dominate the macroeconomic conversation and to impact markets around the world. Here, I highlight a few of those issues.

Balance sheet repair and growth• United States. US gross domestic product (GDP) growth is

returning to past norms of 3% to 3.5% thanks to the near-completion of balance sheet repair by the household and financial sectors.

• United Kingdom. The UK is following the US, but with much less balance sheet repair accomplished, and its growth remains vulnerable to the continuing problems of the eurozone.

• Eurozone. The eurozone has seen balance sheet repair only in the periphery — notably Spain and Ireland — but these improvements are outweighed by the lack of deleveraging in France and Italy. I believe eurozone growth will continue to bump along the bottom; no indicators — monetary, fiscal or structural — point to the start of a genuine business cycle upturn.

• Japan. In Japan, Prime Minister Shinzo Abe’s economic policies and the Bank of Japan’s (BoJ) quantitative and qualitative easing have failed to generate balance sheet expansion for the commercial banks. On the fiscal side, the consumption tax increase in April has once again seriously damaged personal consumption expenditure (as it did in 1997). Consequently, consensus estimates place Japan’s 2015 real GDP growth at only 1.3%.

• China. I expect growth in China will continue to slow in 2015 as the economy continues to shift away from investment- and export-led growth.

John GreenwoodChief Economist,Invesco Ltd.

3

CurrenciesI expect the US dollar to continue to strengthen in 2015, based partly on:• Expectations that the Federal Reserve (Fed) will raise short-

term interest rates ahead of other central banks in the second half of 2015.

• The relative strength of the US current account. This is the first recovery in more than two decades when current account growth has not deteriorated as a percentage of GDP. This results partly from the fact that industrial production is keeping pace with GDP, suggesting that US manufacturing is maintaining its competitiveness.

I expect the euro and Japanese yen to weaken further, while the pound is likely to weaken against the dollar but strengthen modestly against the euro.

Monetary policyA striking feature of the next year or two will be the marked divergence in central bank monetary stance in the US and the UK on one hand and Japan and the eurozone on the other. While the Fed and the Bank of England are likely to raise rates from the second half of 2015, the European Central Bank and the BoJ will continue with asset purchases and zero interest rates.

However, we should distinguish between rising rates due to normalizing economies versus tighter monetary policy. If commercial banks expand bank credit more rapidly, rising rates may not mean tight money.

InflationMost analysts expect inflation to pick up as growth returns to normal, based on the output gap theory of inflation, which holds that as GDP returns toward trend and the output gap closes, inflationary pressures will resume. However, I believe this view is almost certainly mistaken.

Normally inflation falls in the first two years of a recovery as rising output absorbs excess purchasing power. If we consider that monetary and credit growth remain abnormally low, it is inconceivable that core inflation measures could rise — other than temporarily — in most developed economies in 2015.

In the eurozone, some months of deflation are highly likely because money and credit growth remain too low for long-term price stability. I believe Japan will only just avoid the re-emergence of deflation.

4

5

A striking feature of the next year or two will be the marked divergence in central bank monetary stance in the US and the UK on one hand and Japan and the eurozone on the other.– John Greenwood

6

US Growth Stocks: Poised for a Bull Market?

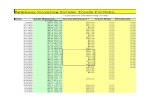

We believe that five years from now we will look back and see that we were in the early-to-middle stages of a secular bull market — defined as the S&P 500 Index rising 8% to 14% annualized with only short intervening declines. Sales and earnings growth of 4% to 6%, combined with price-to-earnings (P/E) multiple expansion adding 2% to 5% and dividends contributing 2% to 3% to total returns, could create an environment similar to previous secular bull markets. We see many positive secular and cyclical growth themes in the current market that may help us get there.

Similarities to past secular bull marketsThe current market has many parallels to the secular bull markets from 1942 to 1966 and from 1982 to 2000. All three periods followed a period of weakness in the US economy — the Great Depression, stagflation and the Great Recession — and an economic boom cycle occurred during each period:• 1940s to 1960s. Housing and suburban development, autos

and interstate highway construction, jet air travel and airport development, television and modern advertising, and the introduction of air conditioning to the Sun Belt states.

• 1980s and 1990s. The rise of technology, personal computers, cell phones, fax machines, laptops and the Internet.

• 2011 to present. The housing and consumer durable spending recoveries and the US manufacturing renaissance led by the shale energy revolution and need for energy infrastructure.

Common misperceptions With the Federal Reserve (Fed) winding down quantitative easing (QE) and potentially raising interest rates in 2015, many investors assume rising rates will negatively impact equity

Juliet Ellis, CFAChief Investment Officer of Invesco US Growth Equities andSenior Portfolio Manager

7

market valuations. But in reality, the historical relationship between equity market valuations and the 10-year yield illustrates that the 10-year yield can rise from current levels (2.16% on Dec. 10, 2014) up to 4.5%, with P/E multiples rising from 15x up to 25x, before P/Es begin to contract as the 10-year yield moves above 4.5%.1

Another common misperception is that a strong dollar is bad for US equity markets. Our research shows that during periods of rising dollar strength, the market has risen by an average of 14.4%.2

Some investors also think that corporate profit margins have peaked and will decline. We’ve observed that margins tend to peak following an inverted yield curve at the beginning of recession and following declines in capacity utilization. We believe capacity utilization will continue to rise, and the economy will continue to expand.

Growth opportunitiesWe see opportunity in two types of US growth: • Long-term secular growth. This includes biotechnology

innovation, new mobility product cycles, on-demand digital content, market share shifts to e-commerce and social media advertising, and demographic shifts as baby boomers retire and echo boomers begin to earn and spend.

• Near-term cyclical growth. This includes capital expenditure cycles for petrochemical plant expansion and nonresidential construction; the housing recovery and ripple effect of consumer durable spending; the development, production, transportation and processing of shale oil and natural gas; and the commercial aerospace cycle.

What are the risks?Several risks could negatively impact our secular bull market thesis:• The Fed tightening monetary policy too much too fast could

derail growth.• Deflation is a bigger risk than inflation, in our view, and could

send the economy back into recession.• Although profit margin compression could negatively affect

our earnings growth assumptions, we believe it’s unlikely due to structural shifts in productivity.

• Echo boomer unemployment could adversely impact consumer spending and gross domestic product growth.

• An oil price shock could create a headwind for consumer spending.

1 Sources: Royal Bank of Canada, Federal Reserve and Macrobond, December 20142 Sources: Bloomberg L.P. and Invesco Quantitative Group. Data from March 31, 1967, to Nov. 11, 2014.

8

Important informationA stock’s price-to-earnings multiple (also known as its price-to-earnings ratio) measures its valuation. It divides a stock’s share price by its earnings per share. When a multiple expands, it means that number increases. The Great Recession refers to the recession that lasted from December 2007 to June 2009. Echo boomers are the children of the baby boomers. The S&P 500 Index is an unmanaged index considered representative of the US stock market. Common stocks do not assure dividend payments. Dividends are paid only when declared by an issuer’s board of directors and the amount of any dividend may vary over time. Many products and services offered in technology-related industries are subject to rapid obsolescence, which may lower the value of the issuers. Businesses in the energy sector may be adversely affected by foreign, federal or state regulations governing energy production, distribution and sale as well as supply-and-demand for energy resources. Short-term fluctuations in energy prices may cause price fluctuations in an energy fund’s shares. Investments in real estate related instruments may be affected by economic, legal or environmental factors that affect property values, rents or occupancies of real estate. Real estate companies, including REITs or similar structures, tend to be small and mid-cap companies and their shares may be more volatile and less liquid. Investments in the aerospace sector are expected to be closely tied to conditions within that sector and can be more volatile than more diversified investments.

9

We believe we’re in the early-to-middle stages of a secular bull market, and we see many positive secular and cyclical growth themes.– Juliet Ellis

10

US Value Stocks: Rewriting the Market’s Playbook

The traditional playbook that investors have used to navigate market cycles has become outdated. Certain sectors usually become inexpensive after the type of market run that we’ve experienced during the past few years. But, because interest rates are so low, investors are chasing yield. That has kept certain stocks expensive when you wouldn’t normally expect them to be, based on past cycles. At the same time, other sectors look attractive when they would normally be out of favor.

For example, when you look at market history, value investors would not typically want to own financials at this point in the cycle. However, as we enter 2015, I believe financials have very attractive valuations, along with a surplus of capital that I expect to be returned to shareholders in the form of increased dividends and/or stock buybacks. Overall, I believe the quality of the financials sector is the best we’ve seen in at least a decade, and see this story playing out over the course of the next four or five years.

On the other hand, I believe that broadly, the consumer staples and telecommunications sectors are either fairly valued or expensive, as investors have driven up valuations in their search for yield. However, as bottom-up stock pickers, all of our value managers are focused on finding value opportunities wherever they may be — even within sectors that may be overvalued as a whole.

Kevin Holt, CFAChief Investment Officer of Invesco US Value Equities

11

Invesco’s US Value complex includes three broad strategies. There are many ways to be successful, and intellectual independence is a core value across our teams. Each strategy has a distinct approach to evaluating companies. Looking into 2015, here is where each approach is seeing the most attractive opportunities:• Our relative value strategies look for companies that are

inexpensive relative to their own history. In this space, we have a particular interest in energy stocks as we enter the new year. Often, market volatility can lead to value opportunities, as quality companies get swept up in the sell-off. The oil markets experienced significant volatility toward the end of 2014 that may result in such opportunities.

• Our deep value strategies look for companies that are trading at a discount to their intrinsic value. In this space, our managers are also emphasizing energy stocks as well as financials, for the reasons stated above.

• Our dividend value strategies closely evaluate companies’ total return profile, emphasizing appreciation, income and preservation over a full market cycle. Through this lens, they are finding stock-specific opportunities within the consumer area. Our dividend managers have a high confidence in the durability of margins and of free cash flow generation for their holdings over the next two to three years, and believe that expectations for top-line recovery embedded in street estimates are conservative.

So, while 2015 may feel like a very different year for the markets, our approach is the same as ever — across all three value sleeves, and across large-, mid- and small-cap stocks, we’re looking for opportunities that fit our philosophy, no matter what the typical market playbook says.

12

Important informationA value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets. Common stocks do not assure dividend payments. Dividends are paid only when declared by an issuer’s board of directors, and the amount of any dividend may vary over time. Stocks of small and mid-sized companies tend to be more vulnerable to adverse developments, may be more volatile, and may be illiquid or restricted as to resale.

13

Overall, I believe the quality of the financials sector is the best we’ve seen in at least a decade, and see this story playing out over the course of the next four or five years.– Kevin Holt

14

International Growth Stocks: Seeking Strong Companies Amid Mixed Macro Signals

Clas OlssonChief Investment Officer of Invesco International Growth Equities

Surveying the international landscape, we see a variety of bright spots, as well as concerns, in every region. Below, we offer a brief overview of some of the positives and negatives — and we highlight potential areas of opportunity.

Europe: Bright spots dot dimming economyAs the European economy and stock markets stalled in 2014, previously stretched valuations have become reasonably constructive. In addition, we expect that the benefits of a weaker euro will start to improve struggling corporate profits by mid-2015. However, while the European Central Bank (ECB) has introduced additional stimulus to fight deflation and spur growth, bank lending has yet to pick up in a meaningful way, and credit growth remains weak. It appears the stimulus measures have lowered the incentives to initiate much-needed reforms, and we expect fiscal battles to continue in 2015, as Germany’s focus on austerity conflicts with the more pro-growth fiscal stance of the ECB and other countries.

Potential opportunities:• Luxury goods companies often have a number of attractive “E”

(earnings) and “Q” (quality) characteristics, but historically their “V” (valuation) levels have been too high to offer attractive risk-reward profiles. Slower growth in China and the rest of the world has caused many companies in this industry to de-rate and, as a result, we are taking a closer look at this group.

• The energy and financials sectors have both been under pressure recently, and this may potentially create other investment opportunities.

15

Japan: Arrows missing their mark?We continue to believe that improving prospects for real long-term economic growth requires difficult changes. The important third phase of Prime Minister Shinzo Abe’s “three-arrow” economic revitalization program calls for structural reforms focusing on corporate governance, particularly as regulatory reforms have made slow progress.

Potential opportunities: • While mid-year price corrections have made valuations of

certain higher-quality companies more appealing, we remain cautiously selective about opportunities in Japan.

China: Structural reforms, corruption crackdown hinder economic growth but could prove positive over the long termReduced discretionary spending indicates that the government’s crackdown on corruption has inadvertently hindered economic growth. However, we believe these measures will be positive in the long term, and the pressure this campaign has placed on some consumption sectors may have already peaked.

Potential opportunities: • As long-term investors, we look to take advantage of short-term

events that may generate attractive investment opportunities. For example, student protests in Hong Kong negatively affected the retail, restaurant and hotel sectors in 2014, but they also resulted in some more attractive stock valuations.

Emerging markets: Negatives for one market may boost anotherThe downturn in the commodity cycle is having a negative impact on trade, and consequently economic growth, for resource-dependent countries such as Brazil, Russia and South Africa. However, lower commodity prices can benefit net importers of commodities — China, India and other Asian economies, for example — and also feed into lower inflation and raw material costs. Meanwhile, emerging market countries with large exposures to exports should benefit from weaker currencies against the US dollar.

In contrast, macro imbalances, including high current account deficits or inflation, have forced many economies — for example, those of Brazil and India — to tighten policies. Also, rising non-performing loans are causing tighter bank lending standards, slowing credit growth and consumption.

Potential opportunities:• Korea, Taiwan and Thailand could see benefits if global trade

improves.• With slower growth, corporates are cutting capital spending.

While this is a negative for job growth, it is also leading to increasing free cash flows and rising dividend payouts and yields.

• Valuations are becoming attractive in select markets.

16

Important informationThe risks of investing in securities of foreign issuers can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

17

Hong Kong shopping, street view

18

Real Asset Securities: As the Economy Normalizes, Development and MLPs Take Center Stage

Although the global economy is not past all the macro fears that have plagued it, there is clear evidence that the normalization process is continuing. We expect quantitative easing (QE) to be withdrawn in developed economies at a pace that does not undermine economic growth. During the normalization process, we would expect the market to return to rewarding real estate fundamentals, particularly in the US and the UK. In continental Europe, however, a more macro-oriented market prevails because European Central Bank actions are likely to dictate the outcomes, making balance sheet attributes such as high leverage, rather than real estate fundamentals, relevant.

Longer term, we see development-focused REITs — particularly in North America — that can drive growth by developing new properties or redeveloping existing properties as an opportunity. This is particularly important in areas of the market where acquisitions are becoming more competitive and costly. In most markets across the globe, newly developed real estate has been scarce for the past six years. Looking forward, we believe the development pipeline may start to increase in some of the fast-growing, supply-constrained markets and sectors in developed economies.

Another area of opportunity, in our view, is master limited partnerships (MLPs), which are driving construction of new energy infrastructure. With energy production projected to increase and an infrastructure underequipped to transport, process and store this energy, MLPs are creating new opportunities for investors to participate in the US energy renaissance. While oil prices tumbled toward the end of 2014,

Joe RodriguezManaging Director and Head of Global Real Estate Securities, Invesco Real Estate

19

it is important to remember that MLPs generally contract out their assets over long periods, and those that generate significant contract-based cash flows are not directly impacted by short-term movement in the price of oil.

Macro volatility, rising interest rates among risks for 2015While trends in the global macroeconomic environment continue to be broadly positive, recovery is likely to remain uneven across key economic regions, with historically unconventional means of economic stimulus still necessary in many parts of the world. A true economic recovery will have occurred only when such abnormal levels of stimulus have been removed. Investors shouldn’t expect this nascent process to occur without some further market uncertainty and periods of volatility for risk investments.

Although QE tapering may raise long-term interest rates, they won’t necessarily revert to long-term average levels. As the global economy proceeds through the next stage of its long, bumpy recovery, we believe that policy interest rates will likely remain low for some time.

Trending in 2015We’re focused on an emerging trend among investors: the increased adoption of real estate as an accepted asset class. Here are two examples that reflect this trend.

• European banks and insurance companies will be reducing their exposure to real estate over time because of Basel III, a voluntary regulatory standard governing capital adequacy that takes effect in 2019. We’re beginning to see demand in the markets for initial public offerings and commercial mortgage-backed securities ramping up in Europe, a positive development over the long term, in our view.

• In 2016, REITs are slated to become the 11th sector included in the Global Industry Classification Standard (GICS), instead of being grouped with the financials sector. While this may cause some short-term dislocation in the holdings of mutual funds and ETFs that focus specifically on financials stocks, removing REITs from the GICS financials sector may broaden participation as more investors seek pure REIT exposure.

Our 2015 outlook for property market fundamentals is quite positive. However, our optimism is tempered by the potential for capital market volatility due to occasional overreaction to interest rate movements. Regardless of trends, however, real estate remains an asset class driven by local market conditions, and investors should consider regional differences when developing real estate investment strategies.

20

Important informationInvestments in real estate related instruments may be affected by economic, legal or environmental factors that affect property values, rents or occupancies of real estate. Real estate companies, including REITs or similar structures, tend to be small and mid-cap companies and their shares may be more volatile and less liquid. Most MLPs operate in the energy sector and are subject to the risks generally applicable to companies in that sector, including commodity pricing risk, supply and demand risk, depletion risk and exploration risk. MLPs are also subject to the risk that regulatory or legislative changes could eliminate the tax benefits enjoyed by MLPs, which could have a negative impact on the after-tax income available for distribution by the MLPs and/or the value of the portfolio’s investments. The risks of investing in securities of foreign issuers can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

21

Trans Alaska Pipeline, Alaska, USA

22

Fixed Income: Diverging Monetary Policies Point Toward a Multi-Sector Approach

In 2015, we believe strategies that offer tactical asset allocation and discriminating security selection should provide investors with the best opportunities to generate income and return.

Such strategies, we believe, will be propelled by the differences in the growth dynamics of the world’s economies and the diverging policies of major central banks. This divergence was heightened by the ending of the quantitative easing (QE) program by the US Federal Reserve (Fed) in 2014, and we believe the Fed will likely normalize its policies in 2015 by raising short-term interest rates. On the other hand, low growth is likely to keep easy monetary policies ongoing in such places as Japan and Europe. We believe this divergence will keep the US dollar well supported and volatility elevated, and it will provide tactical opportunities across global fixed income markets. Nevertheless, we expect global inflation to remain modest with long-term interest rates contained across developed and many developing markets.

Opportunities exist in a variety of sectorsIn this environment, we advocate nontraditional and multi-sector fixed income management, specifically strategic income, multi-sector credit, absolute return and unconstrained bond strategies. The strategies are designed to take advantage of the wide range of opportunities fixed income markets offer, and they seek to provide income and return for investors while also controlling risk.

Rob WaldnerChief Strategist and Head of Global Macro, Invesco Fixed Income

23

We see opportunities in both investment-grade and high yield municipal bonds. These markets realized significant price appreciation in 2014, but our team still believes valuations are attractive relative to long-term history. Tax rates support demand, and positive US growth supports fundamentals for municipal bonds.

We also view senior secured bank loans as attractive, given valuations and fundamentals, and their floating rates would make them an attractive income source in a rising-rate environment. In addition, we look to invest opportunistically in high yield corporate bonds.

We are cautious on emerging markets generally, although we believe select countries will provide opportunities. Considerable opportunity exists in China, as the internationalization of the currency is implemented, opening up new opportunities for investor diversification, although we are monitoring growth carefully. We also believe India and Mexico look attractive.

Macro forces present potential risks Our outlook for 2015 includes the following risks:• A hard landing in China with growth slowing materially.• Policy errors on the part of the world’s central banks —

for example, too aggressive tightening by the Fed.• A default crisis in emerging markets.• Geopolitical issues that precipitate slower global growth

and market volatility.• Deflation in the eurozone that spills over to other regions.

We expect that the ending of QE in the US will have a limited impact on US bond yields, with most of any upward pressure occurring in short-to-intermediate maturities. We believe longer-term yields across most regions will be contained by modest growth brought about by the impact of aging demographics across the globe. In addition, US long-term yields are likely to be held down by demand from foreign investors, given relatively higher yields in the US.

24

Important informationFixed income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating. Junk bonds involve a greater risk of default or price changes due to changes in the issuer’s credit quality. The values of junk bonds fluctuate more than those of high quality bonds and can decline significantly over short time periods.

25

In 2015, we believe strategies that offer tactical asset allocation and discriminating security selection should provide investors with the best opportunities to generate income and return.– Rob Waldner

invesco.com/us IVZCIO-BOOK-1 01/15 Invesco Distributors, Inc. US14633