© Copyright by Sandra Constanza Gaitan Riaño, 2017

Transcript of © Copyright by Sandra Constanza Gaitan Riaño, 2017

1

© Copyright by Sandra Constanza Gaitan Riaño, 2017

All Rights Reserved

ii

ACKNOWLEDGMENT

I would like to express my sincere gratitude to my committee chair, Professor C.

Edward Fee, for his guidance, wise advice and patience that made this dissertation

possible.

I want to thank my committee members, Professor Venkat Subramaniam and

Professor William Grieser for their valuable comments and suggestions.

I would also like to express my gratitude to the group of professors of the doctoral

studies who gave me knowledge and encouragement I needed during my studies.

I am thankful to Universidad EAFIT for the financial support I received.

I thank my parents Leonor and Enrique for their love, concern and support, as well

as my spouse Carlos Jaime, my son Carlos Andres and my daughter Maria Clara

for always being there for me and for their unlimited patience, love and support.

In addition, I would like to thank my friend Charmane for her unconditional

support.

iii

How Do Monitoring Boards Perform in Financial Crises?

Abstract

This dissertation tries to examine the link between board type and

performance in financial crises. The topic is of interest because boards of

directors are considered a very important element in the corporate governance

system, and it is important to understand how the makeup of a firm’s board

affects the effectiveness of governance for the firm. Further, while recent

financial regulations have endorsed the presence of more independent members to

serve as monitors, the academic literature to date is not conclusive regards the

effects of performance on monitoring boards vs. advising boards. Thus, I use a

sample of U.S. firms (2004–2012) in the Standard and Poor’s (S&P) 1500 to test

the performance of monitoring boards before and after the subprime crisis. I

analyze this sample using a difference-in-differences approach that relies on the

exogenous variation in firm performance generated by the subprime financial

crisis. The results suggest that monitoring boards appear to have actually

performed worse than advising boards during the subprime crisis. In particular,

there is a decline in Tobin’s Q in monitoring boards compared to advising boards.

In addition, monitoring boards appear to have acted to reduce scale, measured as

the number of employees and capex following the crisis. These results,

suggesting poor performance of monitoring boards during the crisis, have

iv

important implications for the appropriateness of regulations mandating increased

reliance on independent directors.

v

Table of Contents

List of Tables ..................................................................................................................... vi

List of Figures .....................................................................................................................ix

1. Introduction ................................................................................................................. 1

2. Literature Review and Hypotheses Development ....................................................... 8

2.1. The regulation on board composition ............................................................... 13

2.2. Hypotheses Development ................................................................................. 15

3. Data ........................................................................................................................... 18

3.1 Sample selection ..................................................................................................... 18

3.2 Advisory Board Definition ..................................................................................... 18

3.3 The Definition of Control Variables ....................................................................... 19

3.4 Descriptive Statistics ............................................................................................... 20

4. Results ....................................................................................................................... 23

4.1 Comparison of firm characteristics ......................................................................... 23

4.2 Analysis of MB and Firm Performance .................................................................. 24

4.3 Analysis of MB and Measures of Firm Scale ......................................................... 28

4.4 Additional Robustness Test .................................................................................... 29

4.5 Performance, Investment, Leverage and Monitoring Boards: A Matching

Approach ....................................................................................................................... 30

5. Discussion ................................................................................................................. 35

Appendix ........................................................................................................................... 87

1. Variables Definitions ............................................................................................ 87

References ......................................................................................................................... 90

vi

List of Tables

Table 1 Descriptive Statistics for the Entire Sample .............................................39

Table 2 Descriptive Statistics before 2008 ............................................................41

Table 3 Descriptive Statistics after 2008 ...............................................................43

Table 4 Monitoring board Analysis .......................................................................45

Table 5 Correlation Matrix ....................................................................................46

Table 6 Comparison of Firm Characteristics by Monitoring Board ......................47

Table 7 Univariate Difference in Difference Analysis of Firm Performance ........49

Table 8 Multivariate Difference in Difference Analysis of Firm Performance .....50

Table 9 Multivariate Difference in Difference Analysis of Tobin’s Q ..................52

Table 10 Multivariate Difference in Difference Analysis of Revenues by

Employee ...............................................................................................................54

Table 11 Multivariate Difference in Difference Analysis of Number of

Employees ..............................................................................................................56

Table 12 Multivariate Difference in Difference Analysis of Change of Number of

Employees ..............................................................................................................58

Table 13 Multivariate Difference in Difference Analysis of Business Segments .60

Table 14 Multivariate Difference in Difference Analysis of Capital investment ..62

Table 15 Multivariate Difference in Difference Analysis for Firms with R&D ....64

Table 16 Multivariate Difference in Difference Analysis of Leverage .................66

vii

Table 17 Multivariate Difference in Difference Analysis of Firm Performance

before and after 2007 .............................................................................................68

Table 18 Multivariate Difference in Difference Analysis of Tobin’s Q before and

after 2007 ...............................................................................................................70

Table 19 Multivariate Difference in Difference Analysis of Firm Performance

before 2007 and after 2009 ....................................................................................72

Table 20 Multivariate Difference in Difference Analysis of Tobin’s Q before

2007 and after 2009 ...............................................................................................74

Table 21 Probit Model to Predict MB....................................................................76

Table 22 Propensity Score Matching: Balance Diagnostic....................................77

Table 23 Propensity Score Matching Results ........................................................78

Table 24 ROA Analysis Based on Propensity Score Matched Sample .................79

Table 25 Tobin’s Q Analysis Based on Propensity Score Matched Sample .........80

Table 26 Revenues by Employee Analysis Based on Propensity Score Matched

Sample....................................................................................................................81

Table 27 Number of Employees Analysis Based on Propensity Score Matched

Sample....................................................................................................................82

Table 28 Business Segments Analysis Based on Propensity Score Matched

Sample....................................................................................................................83

Table 29 Capital investment Analysis Based on Propensity Score Matched

Sample....................................................................................................................84

viii

Table 30 R&D Analysis Based on Propensity Score Matched Sample .................85

Table 31 Leverage Analysis Based on Propensity Score Matched Sample...........86

ix

List of Figures

Figure 1 Frequency of MB switching ....................................................................37

Figure 2 Performance of Monitoring Board vs. Not Monitoring Board ................38

1

1. Introduction

Boards of directors are of interest to a large number of institutions, regulators, and

investors. As Jensen (1993, p. 862) states, “The board, at the apex of the internal control

system, has the final responsibility for the functioning of the firm.” Moreover, the

purpose of this internal control mechanism is to gather the relevant information that

affects the equilibrium of the firm (Jensen, 1993). Given the importance of the board,

research into factors that increase or decrease firm performance is warranted. There has

been much debate on whether the role of the board enhances or diminishes firm

performance. This topic is of particular interest to regulators, since boards of directors as

important mechanisms of control within organizations can be affected by regulations and

laws that alter the way in which they function. They are also of interest to shareholders

because the board is responsible for the effective control of the agency problem caused

by the separation of residual risk bearing from decision management (Fama & Jensen,

1983).

The goal of this dissertation is to further our understanding of these issues by using

the 2007 financial crisis1 as a natural experiment to examine the decisions taken by a

monitoring board to maintain performance. As Jensen (1993, p. 862) states “Few boards

1 The 2007 subprime mortgage crisis is considered the worst since the Great Depression.

2

in the past decades have done this job well in the absence of external crises. This is

particularly unfortunate given that the very purpose of the internal control mechanism is

to provide an early warning system to put the organization back on track before

difficulties reach a crisis stage.” Thus, financial crisis provides a natural environment to

help understand board decisions such as assessing management, receiving relevant

information and using it, and looking at risk exposure among others. These board

decisions are particularly important for company sustainability especially when the firms

face economic meltdown.

An effective board’s function includes hiring, firing, compensating, and controlling

the top manager (Fama & Jensen, 1983). However there is no consensus in the literature

related with the role of boards (Adams et al, 2010). For instance, Mace (1971) describes a

board’s function as one of advice and counsel, as an element of discipline that should

take action in unstable periods.

Thus, the literature on boards points out that these are responsible for supervision,

control and reward but they are also there to offer high quality advice (Jensen, 1993). At

this point, although the natural conception of boards is to serve as an element of control

inside organizations, some studies focus on the effectiveness of this role (Jensen, 1986;

Weisbach, 1988; Borokhovich et al., 1996; Boone et al., 2007; Cornelli, et al., 2013) and

in some depth, on that control as an equilibrium solution. However, recent studies have

found negative effects on firm performance when the company has a control board

(Adams & Ferreira, 2007; Faleye et al., 2011; Holmlstrom, 2005).2 This brings us to the

2 For an extensive review of the literature see Hermalin and Weisbach (2003, 2010).

3

question of how the board’s role—monitoring or advising—affects firm performance and

in which circumstances the relationship between the board and the firm reaches an

equilibrium solution.

One of the concerns is the problem of asymmetric information that presents itself in

the interaction between the manager and the board as a result of what company

information the manager decides to communicate to the board. This information that the

CEO provides to the board is very important given that, it is precisely this that dictates

the quality of the counsel given to the CEO; however, it also increases the board’s

monitoring of the CEO.

So, the management and the board face a trade-off: on the one hand, the

management decides to either communicate information or not to the board and, on the

other, the board decides to either monitor or provide advice (Adams, 2007; Schmidt,

2015). One such example of this issue is the case of the Royal Dutch Shell scandal in

2004, in which some of the company’s high executives overstated the information about

the reserves estimates and kept it secret from the board; thus, in this situation, the board

did not take action to overcome the situation and allow the company to accomplish the

regulation.

This information is even more essential when the company runs into problems, so

the boards need to implement strategies to lead the company out of financial difficulties.

At this point, the board’s actions involve extremely important decisions that are critical

for company success.

A monitoring board is one that dedicate most of the time of its duties to monitoring

activities. Following Faleye et al. (2011), I define a monitoring intensive board as one in

4

which the majority of the independent directors (outsiders) serve in at least two of the

three principal monitoring committees (audit, compensation and nominating or corporate

governance).

The question of whether monitoring boards act differently to non-monitoring

boards when faced with a crisis has been difficult to test due to endogeneity issues. It is a

well known fact that Board Composition and Firm Performance are endogenous variables

(Hermalin & Weisbach, 1998) because a very well structured board would cause high

economical results, and a high performing firm would structure its board according to its

needs. A primary issue is that the MB status is itself endogenous. One possibility is that

firms with more agency problems have more monitoring boards. Thus, to overcome this

issue, this research uses the subprime crisis as a good experiment to test the link between

board type and firm performance in financial crises, and whether the actions taken by the

boards are different. As mentioned by Holmstron (2005), boards need to both acquire

information from management and use it effectively, so the subprime financial crisis

provides an opportunity to test the ability of the boards to be effective.

I present a test of the effect, in treated firms, of having a monitoring board on firm

performance compared to a control group after the subprime crisis. I use the 2007- 2008

period to control for the financial crisis. Beltratti and Stulz (2012) documented, the

period between July 2007 and December 2008, as the worst since the Great Depression.

The identification strategy is twofold. First, I estimate regressions in which I assess

the impact of the crisis on a specific group of firms by interacting an indicator variable

for these firms with an indicator variable for the crisis (Duchin, et al., 2010). I was able

to use the 2007 financial crisis as a natural experiment to test whether firms with

5

monitoring boards are associated with improve performance. I use the difference-in-

difference approach (Ashenfelter and Card, 1985) to test whether monitoring board are

associated with reduced firm performance and compare this to those firms that do not

have a monitoring board. This approach allowed me to overcome endogeneity issues that

can drive the relationship between board characteristics and firm performance

(Hermalin & Weisbach, 1998).

Second, I use a propensity score matching approach to attempt to address the

potential endogeneity mention above. I compare whether the monitoring boards are

related with firm performance of treated firms, with their control group during the

crisis (Almeida et al., 2011). I use this methodology to compare the performance of firms

with monitoring boards with their peers before and after the crisis to confirm that the

results are not driven by characteristics other than the fact of being monitoring boards.

The results suggest that firms with monitoring boards are associated with

reduction on performance measures as Tobin’s Q after a crisis compared to those firms

with advisory boards. I found that monitoring boards compared to advisory boards seems

to be costly to shareholders.

Then I am interesting to test how the investments and the leverage change in firms

with monitoring board compare to firms without monitoring board. For this propose, I

test different measures of investment (number of employees, number of business

segments, capital expenditure, R&D) and leverage affected by manager policies in these

two types of boards.

I found that firms with monitoring boards are associated with reduced the number

of employees and capital expenditure more than advisory boards, and they cut their

6

investment in an attempt to reach an optimal state. However, as I mentioned above, they

are not associated with value enhanced.

I also found that such firms are not associated with changes in the number of

business segments, R&D expenditure and leverage following the crisis. This result

suggests that, in general, firms in a market with a specific characteristics of business

environment follow stable debt policy that could be driven by the market discipline.

These results confirm that there is a possibility that the managers adopt a policy

that seem to be related with waste of investment for those firms with monitoring boards.

Overall, the results have shown that firms with monitoring boards appear to be

associated with not optimal equilibrium compared to firms without monitoring boards,

basically because the board’s decisions regarding cutting the number of employees and

making capital investment are not value enhanced.

This dissertation’s main contribution is to shed light on the theoretical debate on

whether monitoring boards are beneficial to the long-term survival of firms. The results

suggest negative effects of the recent policies that recommend firms with monitoring

boards.

This dissertation contributes to the literature on organizations and specifically, to

the theory of internal control. Jensen (1993) argues that the ineffective governance of a

board of directors—the head of the internal control mechanism—is responsible for the

financial disaster. The internal control system seldom acts in the absence of a crisis. One

such example is the case of the General Motors Company that reported losses of $6.5

billion in 1990 and 1991 as a result of decades of inaccurate strategy (Jensen, 1993). In

addition, with the recent automotive industry crisis of 2008-2009, GM filed bankruptcy

7

because it needed the protection be able to reorganize its debts. This research helps us

understand what a monitoring board does to overcome a crisis taking into account the

characteristics of the firms and their boards.

The rest of the dissertation is organized as follows. Section II presents the relevant

literature and develops the hypothesis. Section III describes the sample, measurement of

variables, and descriptive statistics. Section IV presents the results. Section IV concludes.

8

2. Literature Review and Hypotheses Development

This dissertation contributes to the theory of organizations, specifically to the

boards of directors, as a mechanism of internal control. Companies’ allocation of

resources to satisfy managers’ preferences instead of shareholder wealth has been a broad

field of study. Wasted investment, cash in excess, and a lack of effort are some of the

consequences of manager misbehavior that require an effective system of decision

control. Thus, the implementation and monitoring of mechanisms to control manager

behavior are the responsibility of the board of directors (Jensen, 1976; Fama & Jensen,

1983).

Boards of directors play an important role in organizations. They must ensure that

managers do not behave myopically and do not sacrifice long-term return investment for

short term profits. They must therefore, safeguard the adoption of the best corporate

strategy to improve the probability of survival.

Boards face a very important challenge when managers behave myopically and as

such sacrifice long-term benefits to increase short-term profits motivated by market

pressure (Jensen, 1986). Also, when managers decide between external and internal

financing, they face a trade-off between remunerating the shareholder and using external

funding that increase firm monitoring.

9

Monitoring by the firm’s internal control body is more important when the firm

yields a large amount of free cash flow. Conflicts of interest arise between the

shareholder and the manager because the managers tend to overinvest resources or use

them in organizational inefficiencies (Jensen, 1986). Thus, the generation of more cash

flow is associated with greater internal control.

Board duties serve as an important mechanism of control inside organizations. The

presence of agency costs is one of the reasons for shareholders to delegate the proper

functioning of mechanisms that ensure the company’s success to the board of directors.

For instance, in 1992, IBM failed to adjust its strategy according to the market

competition, which led to the loss of 65% of its value (Jensen, 1993).

However, Mace (1971) suggests that boards also serve as a counsel; hence, the

importance of knowing strategic information about the firm. Boards have to acquire

strategic information from insiders and use it effectively.

Some papers have found cross-sectional differences in board structure and firm

characteristics (Denis and Sarin, 1999; Boone et al., 2007, Coles, et al., 2008). For

example, Coles et al. (2008) found benefits in R&D firms when the insiders on the board

increase and when the firm’s specific knowledge of insiders is important.

The role of advisors has received less attention, as literature has focused on the

monitoring effects and the role that information plays in the decision process and the

effectiveness of the board duties. For instance, Raheja (2005) develops a model to

account for the ideal size and composition of the board for more effective monitoring. In

this model, strategic information about the company is important and plays a significant

role for the board’s success. She presents the importance of information shared by

10

insiders with outsiders. Similarly, Harris and Raviv (2008) present a model for the

optimal control of boards’ structures, highlighting the importance of information relative

to the agency cost. So, when information is relevant, it is best to have insiders in control

of the board that, in fact, allow outsiders to become informed.

With respect other board characteristics, Fich & Shivdasani (2006) found that the

monitoring function of the board is ineffective when they have busy outside directors,

and Faleye (2007) found that classified boards are costly to shareholders due to their

diminished wealth.

However, to my knowledge, few studies focus on the advisory role of the board.

For example, Adams and Ferreira (2007) model the consequences of the board’s two

roles: advisor and monitor. They suggest that an ideal board is one that, in Adams and

Ferreira’s words, is a friendly board, meaning that it plays the role of not monitoring too

much and implying that the board has more insiders. This dissertation is similar to that of

Adams and Ferreira’s. I examine the idea of the benefits of a board that does not monitor

intensively when firms are suffering financial pressure.

Similarly, Faleye et al. (2011) suggest that monitoring that is too intense leads to

lower firm value. They defined a board as monitoring intensive when the majority of the

independent directors serve at least two of the three principal monitoring committees

(audit, compensation and nominating or corporate governance). I extend this finding by

providing evidence of the importance of the advisory role when it is needed more. For

instance, Schmidt (2015) examines the cost and benefits to shareholders of having more

friendly boards—a measure of social connection—in a sample of M&A. This finding

11

supports the view that boards that monitor more are not always the most efficient. And

Linck et al. (2008) found empirical results that support the hypothesis that a firm’s

structure their board based on the costs and benefits of monitoring and advising. This is

particularly important because the regulations recommend more independent board;

however, there is no clear theory of whether an equilibrium model for boards works for

any aspect of the firm.

Additionally, Schwartz and Weisbach (2013), in a study for eleven business

companies in which the Israeli government is involved, categorized models of boards as

managerial models—when the boards play a role in managing the firm or a supervisory

model—when the boards monitor top management. They found that in general, boards

are more active as monitors.

Baldenius et al. (2014) model the interaction between the CEO and the board of

directors of a firm. They investigate the effect of CEO power and monitoring in the

information flow for the board. They show that shareholders choose a board that tends

more towards being advisory with entrenchment issues.

The financial crisis of 2007 - 2009, initially originated in the United States and is

considered the worst since the Great Depression of 1929 to 1932 (Bekaert et al., 2014). It

therefore provides an opportunity to study a number of firm characteristics that influence

the way in which companies face crises. It is imperative to understand, both during a

crisis and after it, how firms recover from crises and the effect of the board of directors in

leading the firms to overcome the crunch. For instance, it is important to study how the

policy choices change by the managers in terms of cash, dividends, capex, etc. during and

after a crisis that allow some firms to perform better than others.

12

Regarding corporate behavior during a crisis, Campello et al. (2010) study the

effect of companies’ plans, financial policies and company spending in firms that are

financially constrained. They found differences between decisions made by constrained

firms when compared to unconstrained firms in terms of company policies. The

management team is responsible for making such decisions. Thus, I argue that the board

of directors influences company behavior. For instance, companies’ plans are approved

by the board so the final decision to accomplish these plans depends on the information

shared by the CEO with the board in order to take the risk and either execute the

company strategy or not. So, my contribution is to add to the literature on corporate

policy debate in order to understand how the directors influence firm practice following a

crisis.

I have found scarce literature related with financial crises and corporate

governance. Particularly in the family context, Lins, Volpin and Wagner (2013) study the

effect of family control during the financial crisis. They found that the cost of family

controlled firms outweighs the benefits. However, firms with low expected agency costs

do not underperform in relation to other firms. In the context of the board, Beltratti and

Stulz (2012) investigated the performance of banks during crises. They found evidence

that banks with shareholder-friendly boards3 were associated with poor performance.

Also, Lemmon and Lins (2003) study the effect of ownership structure during the

financial crisis in East Asian countries. They found evidence that supported the view that

controlling shareholders expropriate minority shareholders during crises.

3 They construct and index to indicate whether the board is shareholder-friendly. Conventional wisdom considers such firms to be better governed.

13

It is important to understand whether the regulation related with the board could

potentially affect the study window and therefore the results. Then, in the next section I

present the major rules that could affect the variable of this study.

2.1. The regulation on board composition

Corporate governance rules have been focused on attention since the recent

financial crises that have affected the economic arena throughout the world. Institutions

like the NYSE and NASDAQ and the U.S. Government have adopted rules in order to

ensure high standards of conduct to protect investors wealth. In this section, I discuses

corporate governance rules regarding the board of directors that would impact the

composition of the board.

The Sarbanes-Oxley Act of 2002 (SOX) is a federal law enacted to respond to the

financial scandals of the beginning of the 21st century to protect financial investors. Title

I of this law is dedicated to establishing all the rules that account for the functioning of

the board. Section 101 (e) establishes that there must be 5 members to the board, and that

these members will work for the company on a full-time basis and adopt independent

standards and rules for the protection of all the investors.

Title 3 is related with corporate responsibility, and point 3 in Section 301

establishes that listed firms must have audit committees made up by independent

members of the board.4

4 According with SOX an independent member is one that may not “accept any consulting, advisory,

or other compensatory fee from the issuer”; or may not “be an affiliated person of the issuer or any subsidiary thereof.”

14

Also, national stock exchanges such as NYSE, NASDAQ and AMEX adopted

corporate governance standards for listed companies in order to ensure market efficiency

and investor protection. The corporate governance rules for the New York Stock

Exchange (2003) required listed companies to have a majority of independent directors,

to establish nominating/corporate governance committees, a compensations committee,

and an audit committee made up entirely of independent directors.

The Dodd-Frank Act of 2010 is the financial regulatory reform law that protects the

investor. Title IX of the Investor Protection and Securities Reform Act of 2010,

establishes the main principle as increasing investor protection and empowering

shareholder participation in the firm. Section 951 establishes that all listed companies

must have compensation committees made up by independent members of the board.

After reviewing the rules that could potentially affect the results of the main

variable of this study, which is monitoring intensive boards that account for those firms

where the majority of directors are classified as intensive directors (a director who serves

in at least two of the three main committees: audit, compensation and

nominating/corporate governance), meaning those firms where the majority of directors

are devoted to monitoring activities. It is clear that the regulations discussed above do

affect the inclusion of independent directors and the establishment of committees

however during the window of this study there were no significance changes that would

affect the results of the main variable.

15

2.2. Hypotheses Development

In addition to the fact that the previously mentioned institutions such as the New

York Stock Exchange and Nasdaq, and regulations such as the Sarbanes-Oxley Act of

2002 require the majority of independent directors to serve on the board. There is no clear

information in the literature on whether too much control exercised by the independent

directors benefits shareholder wealth (Adams and Ferreira 2007; Faleye et al. 2011;

Holmlstrom 2005). Moreover, the board’s duty to advise is one of the most important

function in setting up the right firm strategy (Mace 1971; Jensen 1993). Thus, the

interaction between the manager and the board would potentially be different when the

firms have a monitoring board compared with those firms with advisory boards for the

following reasons: first, the quality of the information provided by the manager to the

board would be lower, and second, the decisions made by the board to accomplish the

firm strategy plan would not be effective. On the other hand, firms with advisory boards

would enjoy some benefits such as receiving the relevant information from the manager

and adjusting the firm strategy plan as needed according to the economic environment.

Thus, one would expect a different performance from those firms with monitoring boards

compared to those without them, which would give rise to underperformance when the

firms face unstable periods. The above lead to the following hypothesis.

Hypothesis 1 Firms with a monitoring board of directors perform differently to firms

with non-monitoring boards.

16

There is scarce literature that directly analyzes the boards’ role and its effect on

corporate policies such investment and leverage, as well as how those firms respond to

economic downturn. In the board literature, Coles, Daniel and Naveen (2009), examine

the relationship between board structure and some firm characteristics; for example, they

study the optimal board structure of complex firms -firms that diversify their operations,

larger firms and high leverage firms-. Regarding corporate policies Almeida, Campello,

Laranjeira and Weisbenner (2011) use the 2007 credit crisis to analyse the implications of

debt maturity for firms’ financial policies. For firms with monitoring boards, I would

expect that the board would decide to cut investments measures as the number of

employees and capital investment as soon as the economic slowdown begins because the

directors would take action to control the administrators to a greater degree and as such,

guarantee the firm’s survival. On the other hand, different authors have shown that

different firms need to have a diverse board made up by a group of independent directors

with expertise and experience in different types of businesses (Coles et. al. 2009). Thus, I

expect that firms with monitoring boards would operate in more business segments. With

respect R&D investment, I consider that firms with monitoring boards would have a

significant effect on R&D investment mainly because CEOs would expend on risky

projects and, on the other hand, the advice and counsel provided by the board would not

be effective. The above discussion leads me to propose that firms with monitoring boards

of directors adopt different decisions regarding investment when compared to firms with

non-monitoring boards that affect performance. Therefore, I would expect change in

investment measures as the number of employees, number of business segments, capital

investment, and R&D expenditure following the crisis for those type of firms.

17

Hypothesis 2 Firms with a monitoring board change their investment when compared to

firms with non-monitoring boards.

Regarding leverage, the financial theory states that more leverage firms are less likely to

suffer from agency problems because of the market discipline so that firms with

monitoring boards would be no different to those firms with non-monitoring boards.

Hypothesis 3 Firms with a monitoring board do not change the leverage when compared

to firms with non-monitoring boards.

18

3. Data

3.1 Sample selection

To construct a sample for my analysis, I use data on board characteristics from the

Institutional Shareholder Services (ISS) database (formerly Risk Metrics) of 2,541 firms

between 2004 and 2012 that trade in the Standard and Poor’s (S&P) 1500. The

accounting data is from Compustat and the market data is from The Center for Research

in Security Prices (CRSP). I then exclude financial firms and utilities5 mainly because of

the differences in regulation. I also, exclude firms with assets of less than $ 10 million,

revenues of less than $5 million, return on assets (ROA) and equity of less than zero, and

stock prices of less than one dollar.6

3.2 Advisory Board Definition

The measure I use for advisory boards is as follows: A board is considered advisory

when it does not engage in intensive board monitoring. This measure requires

information about the committees that each director serves. Thus, I use an ISS database to

collect the number of directors that serve in the main monitoring committee—audit,

5 I use the Standard Industrial classification (SIC), SIC Code between 6000 to 6999 from the finance sector (3723 observations deleted) and SIC code 49 from the utilities sector (1342 observations deleted) are excluded. 6 By Assets < $ 10 million (I dropped 55 observations), Equity < $ 0 (315 observations), Price < $1 (22 observation), Revenues < $ 5 million (23 observations), ROA < 0 (698 observations).

19

compensation and nomination—for each firm in the study window. I then verify

odd data manually using an EDGAR database from SEC. I use the definition by Faleye et

al. (2011) for a monitoring intensive board, whereby most of the directors are monitoring

intensive. A director is considered monitoring intensive when he serves in at least two of

the three main committees. This measure provides a proxy to understand the devotion of

the director to play the role of monitor. Then, at board level, a monitoring intensive board

is one in which most of the members engage in monitoring duties.

Thus a board that is not devoted to excessive amounts of monitoring is one that I

define as providing counsel; i.e., an advisory board. Thus, an advisory board faces low

information asymmetry costs because for the CEO the cost of providing information to

the board is lower than not sharing information. Thus, an advisory board would provide

better advice for the CEO’s actions.

This proxy allowed me to identify the determinants of the companies with advisory

boards compared to those firms with monitoring boards.

3.3 The Definition of Control Variables

Following the Board literature, I control for a vector of firm and industry

characteristics that may affect firm performance. All variables are estimated for firm i

over its fiscal year t. The control variables include Firm Size, measured by the natural log

of market value, Stock Return is the annual stock price return, Board size measured by

the natural log of the total directors, and Board Ownership measured by the percentage of

ownership of the board members. In Appendix, I present a detailed definition of the

variables.

20

3.4 Descriptive Statistics

To minimize the effect of outliers, I winsorize all variables at the 1st and 99th

percentiles. Panel A of Table 1 provides descriptive statistics for board characteristics for

the entire sample. The unit of observation is the firm-year. On average, the board has 9

members of which 3 are monitoring intensive directors who sit on at least two of the three

main committees (audit, compensation, or nominating). About 48% of firms has a

monitoring intensive board in which the majority of the members are monitoring

intensive directors.

Panel B of Table 1 presents summary statistics of the firm characteristics. In our

sample, an average firm has a market value of $8,943 million, return on assets of 15%,

Capex scaled by sales of 7%, leverage of 16%, Tobin’s Q of 1.8, and number of business

segments of 2.5.

Table 2 provides descriptive statistics for the sample before 2008. The unit of

observation is the firm-year. On average, the board has 9 members of which 3 are

monitoring intensive directors who sit on at least two of the three main committees

(audit, compensation, or nominating). About 47% of firms has a monitoring intensive

board in which the majority of the members are monitoring intensive director.

Panel B of Table 2 presents summary statistics of the firm characteristics before

2008. In this sample, an average firm has a greater market value of $9,239 million,

greater return on assets of 16%, equal capex scaled by sales of 7%, equal leverage of

16%, greater Tobin’s Q of 1.95, and similar average of number of business segments of

2.5.

21

Table 3 provides descriptive statistics for the sample after 2008. The unit of

observation is the firm-year. On average, the board has 9 members of which 3.8 are

monitoring intensive directors who sit on at least two of the three main committees

(audit, compensation, or nominating). About 49% of firms has a monitoring intensive

board in which the majority of the members are monitoring intensive director.

Panel B of Table 3 presents summary statistics of the firm characteristics after

2008. In this sample, compared to the firm characteristics before 2008, an average firm

has a lower market value of $9,128 million, equal returns on assets of 15%, lower capex

scaled by sales of 6%, equal leverage of 16%, lower Tobin’s Q of 1.72, and similar

average of number of business segments of 2.49.

Table 4 presents the monitoring board analysis. In Panel A I show the average of

monitoring board by year for a different definition of the MB variable. On average, 53%

of the firms where identified with MB however only the 22% of the firms never changed

their MB status. Similarly, in the year of 2009 44% of the firms where MB but only 18%

of the firms never changed their MB status.

In panel B of Table 4, I present the results of a Probit model that estimate the

determinant of monitoring board switching. Firm Size is negative and economically

significant at 1%, Tobin’s Q base on average pre-crisis values is negative and significant

and Capex divided by sales pre-crisis values is negative and significant when I control for

industry and year characteristics.

Figure 1 shows the average frequency of firm that change its monitoring board

status during the study window. The frequency of switching is estimates as a dummy

22

variable that take the value of one if the firm change its monitoring board status zero

otherwise. On average 6% of the firms switch MB status after the crisis.

Table 5 presents the correlation matrix showing the relationship between the

variables used in this study. An MB board correlates highly with board size, board

composition and firm size and correlated only slightly with number of business segments

and board ownership. However, these last two variables are important to consider

because previous works have shown that different firms need a group of diverse

independent directors from a wide variety of industries and board ownership would allow

greater control over the CEO.

Variables such as Leverage, Capex/Sales, Firm Size, R&D/Total Assets and

Board Size correlate with ROA as it documented in the literature. In addition, for Tobin’s

Q, the variables used in the regression show the relationship between each one and the

dependent variable.

Since the regression between performance and MB could be endogenous, for

example, one can argue that an MB board would reduce performance, however it is

possible that low-value firms adopt more independent directors that devote most of the

time to monitoring activities. Then for addressing endogeneity issues encountered in the

relation between performance and MB, I use a difference-in-differences model and a

matching approach.

Figure 2 shows the average performance measure as ROA and Tobin’s Q of firms

with monitoring board and non-monitoring firm.

23

4. Results

4.1 Comparison of firm characteristics

Table 6 presents the comparison of means between firms with MB and advisory

boards. The results suggest that there is statistical significance difference at 5% or lower

between monitoring boards and advisory boards regarding firm characteristics such as

Tobin’s Q, ROA, Board Composition, Board Size, Leverage, Firm Size, Number of

Business Segments, and R&D divided by assets when the MB variable is defined based

on the last year prior to the crisis. These results suggest that MB and advisory boards

behave differently in terms of these characteristics that determine how firms decide to

implement their strategies. Thus, I am interested in understanding the influence of an MB

on a firm.

The results are similar, when the MB variable is defined based on the first sample

year for the firm except for ROA and R&D/Assets variable. Also when I defined the MB

variable based on a window of 3 years before the crisis when the MB status is in the three

years I find similar results with an exception in R&D/Assets variable.

In addition to the mention above, Panel D of Table 6 presents the comparison of

firm characteristics when the MB variable is defined base on a window of three years

before the crisis when the MB status is in the two of the three years and in Panel E I test

the mean difference when the MB status is in at least in one of the three years. Overall

the results remain similar with an exception of the following variables: Leverage, Firm

24

Size and R&D divided by Assets for the results in Panel D and Board Size, # of Business

Segment, Leverage and R&D divided by Assets for Panel E.

4.2 Analysis of MB and Firm Performance

In this section, I use the difference-in-differences (DID) approach to determine the

effect of MB on firm performance following a crisis. This methodology compares firm

performance output before and after the financial crisis of 2008 that caused a natural

shock to monitoring board versus advisory board. The DID methodology is convenient in

some aspects. First, the DID methodology excludes omitted trends that are

correlated with MB and firm performance in both the treatment and control groups.

Second, the DID approach helps establish causality as the experiment is conducted

surrounding financial crises that cause exogenous variation in the change in MB (the

main independent variable). And finally, as with the inclusion of firm fixed effects and

industry-year fixed effects in the OLS specifications, the DID approach controls for

constant unobserved differences between the treatment group and the control group.

I start by identifying the date of the financial crisis, and use 2007 to 2008 to control

for the financial crisis date. Beltratti and Stulz (2012) document the period from July

2007 to December 2008, the worst since the Great Depression.7

7 I carried out several tests in periods near to the Financial Crisis and I found similar results. The results are presented in the Robustness section.

25

For my purposes, “treatment” firms are those that have monitoring board (firms in which

most of the board’s members are monitoring intensive directors8), while “control” firms

are those that have an advisory board (firms that do not have a monitoring board). I

estimate the following model:

(1)

The dependent variable is either ROA, firms i’s operating performance in a given

year, or Tobin’s Q, firms i’s Q in a given year. MB is a dummy that equals one if a firm-

year observation has intense board monitoring and zero otherwise. Post Crisis is a

dummy that equals one if the year is greater than 2008, and zero otherwise. is a

vector of firms with board and industry characteristics that could affect firm performance.

I include industry-year fixed effects to account for industry and year variations that

may affect the relationship between firm performance and monitoring boards, and firm

fixed effects to control for omitted firm characteristics that are constant over time. I

cluster standard errors by firm to avoid inflated t-statistics (Petersen, 2009).

Table 7 presents the univariate DID analysis of firm performance and monitoring

intensive boards. In Panel A, the MB variable is defined based on the last year prior to

the crisis. In Columns (1) and (3), I use Tobin’s Q is estimated as the book assets minus

book equity plus market value of equity minus deferred taxes all divided by book assets.

The effect of market performance measured as the Tobin’s Q of a monitoring intensive

board compared to an advisory board is negative but not significant even when I control

for industry-year characteristics after the crisis.

8 A monitoring intensive director is a director that serves in at least two of the three main committees (audit, compensation and nominated).

0 1 2 3 + MB + MB +X + + + it it it it it it st i itPerform PostCrisis PostCrisis

X it

st

i

26

In Columns (2) and (4), the dependent variable is the operative performance estimated as

the operational income before depreciation divided by total assets “ROA”. The results

suggest that advisory board firms, on average, increase operating performance compared

with monitoring board firms after the crisis. However, after controlling by industry year

fixed effects the results remain negative but are not significant. To check the validity of

the study window and the sensitivity of the results, I test this model using different time

windows surrounding the crisis as the analysis and the results are similar.9

However, in panel B when the MB variable is defined based on firms which never

changed MB status at all over the sample period, Tobin’s Q became significant and

remain negative.

The greater increase in operative performance with an advisory board for some

firms reflects differences beyond being managed by an MB, such as differences in firm

size, capital structure, capital expenditure, or industry specific factors. Prior literature has

shown that board structure is defined by some observed firm characteristics (Boone et al.,

2007; Coles et al., 2007). Moreover, unobserved firm-level heterogeneity could account

for firms’ differential performance in crises. If firm size allows firms to respond better to

crisis, then MB might not be the only factor that drives the increase in firm performance

in advisory board firms. For this reason, I use a multivariate analysis to test MB and

advisory firms’ response to the shock of the financial crises.

I estimate a panel regression with firm fixed effects and industry-year fixed effects

to relate firm performance with monitoring intensive boards after the subprime crisis. The

dependent variable in each regression is the operating performance “ROA” estimated as

9In addition, I use the periods from 2007 to 2008 and 2007 to 2009 for the crisis time window, obtaining similar results.

27

the operational income before depreciation divided by total assets. In the regressions, the

main explanatory variable of interest is Monitoring Board (MB), a dummy equal to 1 if

most of the board’s members are monitoring intensive directors. I interact MB with Post

Crisis, a dummy variable equal to 1 for observations later than 2008. These interaction

terms capture the effect of MB firms after the subprime crisis on firm performance. I

account for time-invariant firm characteristics by including firm fixed effects in each

regression regardless of whether they are unobserved and of their correlations with the

variables of study. The regressions also include control variables for Firm Size, Board

Size and Board Ownership. Robust standard errors are clustered at firm level.

Table 8 reports the results of the fixed-effects regressions. The effect of intense

board monitoring of firm performance after the crisis compared to the control group is

negative and economically significant at 10% when the MB variable is defined based on

a window of 3 years before crisis when the MB status is in the three years. Thus,

consistent with the Hypothesis, the results suggest that firms with monitoring boards, on

average, reduce operative performance following the crisis when compared to advisory

board firms.

In Columns (3) and (4) of Panel B, I use industry fixed effects to account for

industry heterogeneity characteristics. The overall results are similar in economical and

statistical significance.

Table 9, reports the analysis of Tobin’s Q, the variables of interest are economic

and statistical significance. Thus, on average, Tobin’s Q of monitoring boards is lower

after crises than that of advisory board.

28

Table 10 shows the results of a multivariate analysis of revenue by employee. I

include firm fixed effects and industry-year fixed effects. The dependent variable is

Revenue by Employee. Our main variable of interest is “MIB x Post Crisis” which is

negative but no significant. This result suggests that monitoring boards do not change

revenue by employee after the crisis compared to advisory boards even after controlling

for industry year fixed effects. There is no difference in the change of Revenue by

employees among this two types of boards.

4.3 Analysis of MB and Measures of Firm Scale

Next, I present multivariate regressions to analyze how a monitoring board acts in

terms of scale. Thus, in Table 11 to Table 16, I examine different choices such as the

number of employees, number of business segments, capital investment, R&D and

leverage. This allowed me to examine the effect of scale in firms with MIB compared to

advisory boards before and after the crisis. For this effect, I estimate the following

baseline difference-in-differences specification:

(2)

The dependent variable Firm scale is either number of employees, number of

business segments, capital investment, R&D or leverage in a firm i in a given year. MB is

a dummy that equals one if a firm-year observation has a monitoring intensive board, and

zero otherwise. Post Crisis is a dummy that equals one if the year is greater than 2008,

and zero otherwise. is a vector of firm, board, and industry characteristics that could

affect firm performance. I include industry-year fixed effects to account for industry

and year variation that may affect the relation between firm performance and monitoring

0 1 2 3_ + MB + MB +X + + + it it it it it it st i itFirm scale PostCrisis PostCrisis

X it

st

29

board, and firm fixed effects to control for omitted firm characteristics that are

constant over time. Robust standard errors are clustered by firms.

The results in Table 11, Panel A and B suggest that firms with monitoring boards

tend to decrease the number of employees after a crisis. These results are consistent with

the point of view that when firms are in financial difficulties and need to reduce

expenses, one of the mechanisms is to reduce the number of employees. However, when I

test the change of number of employees I do not find any difference between this two

types of boards.

Then in Table 13, I study the number of business segments, another measure of

scale, so the results suggest that MBs do not change the number of business segments.

Regarding capital investment, Table 14 suggests that MBs tend to have less capital

expenditure divided by sales.

Then Table 15 suggests that MB firms do not differ in their R&D divided by sales when

compared to non MB firms following the crisis.

And finally, Table 16 presents that MBs, on average, do not differ in their leverage

decision when compared to advisory boards after the crisis.

Overall, the above results are consistent in terms of scale. On average, MBs reduce

scale, number of employees and capital expenditure. However, MB firms do not differ in

number of business segments, R&D expenditure and leverage.

4.4 Additional Robustness Test

I use different time windows to study and confirm the main hypothesis. First, I

analyze the sensitivity of MB firms to the definition of the financial crisis period. Table

17 to Table 20 present the results of the regressions. Table 17 and Table 18 present the

i

30

results when the control group is made up of firms before 2007, and the treatment group

is made up of firms after 2007.

Table 19 and Table 20 show the results when the treatment group is made up of

those firms reporting information after 2009 and the control group is made up of those

firms reporting information before 2007. Overall, the results for Tobin’s Q remain

economically similar and significant.

4.5 Performance, Investment, Leverage and Monitoring Boards: A Matching

Approach

This section addresses the issue that the results could be due to selection bias. Thus,

I consider several alternative hypotheses to explain the underperformance of monitoring

board firms, which could weaken the conclusion that a monitoring board is costly to

shareholders.

Adams and Ferreira (2007), and Faleye, Hoitash and Hoitash (2011) argue that

information provided by the CEO to the board is important to the performance of board

duties. However, when the board monitors the CEO too much, he does not share strategy

information with the board that could allow them to take better decisions about the

strategy and its implementation, therefore leading to extra costs for the investors. My

findings support this argument.

However, a second alternative is that monitoring board firms may be different from

other firms and such differences could make monitoring board firms more vulnerable to

financial breakdown. I found that monitoring board firms have different corporate

policies.

Another possibility is that firms with more agency problems have more monitoring

boards. In this case, the results might indicate how firms with agency problems

31

performed following the crises. The propensity score matching approach is an attempt to

address this endogeneity.

Now to test whether the results are driven by firm characteristics, other than being a

monitoring board firm, I use propensity score matching to generate samples of firms

without monitoring boards that have the same observables characteristics as monitoring

board firms. I follow Rosenbaum and Rubin (1983) to conduct a propensity score

matching method to account for the bias in the estimation of treatment effects.

The effect of a treatment on firm , , is estimated as the difference between

potential outcomes with a monitoring board and without a monitoring board:

Where states 0 account for non-treatment (advisory board) and states 1 correspond

to firms with the treatment effect (monitoring board).

The average treatment effect (ATE) is measured by , where is

the performance (or firm scale) in firm when the firm has a monitoring board and

when it does not. ATE measures the expected effect on the monitoring board firm had the

population been assigned randomly as treated firms (monitoring board firm).

ATE includes effects of firms for which the treatment (monitoring board status)

was never intended. I am interested in the average effect on the treated (ATT) which

estimates the expected outcome on those for whom the treatment (monitoring board

status) is intended. The average treatment effect on the treated is defined as ATT=

. Where refers to the treatment. The counterfactual mean

is not observed so that I need to define a substitute measure to estimate

the value. The use of the mean outcome of untreated (advisory board) is

ii

iii yy 01

)]0()1([ ii yyE )1(iy

i )0(iy

]1|)0()1([ DyyE ii1D

]1|)0([ DyE i

]0|)0([ DyE i

32

subject to a selection bias as the outcome (firm performance or firm scale) of the treated

(monitoring board firms) and untreated firms (advisory board firms) could differ even in

the absence of treatment (monitoring board status) as the covariates that influence the

treatment decision could also influence the outcome variable. The following equation

explains the estimation bias.

The selection bias is present if when the

performance or firm scale in monitoring board firm could differ from that of advisory

board firm even in the absence of treatment (monitoring board status) due to both

observable and unobservable factors. This bias could be eliminated if firms randomly

assign the monitoring board and not monitoring board status, so the propensity score

matching method using the nearest neighbor matching method minimizes the effect of the

selection bias. Regardless of the treatment status, observations with the same propensity

score must have the same distribution of observable and unobservable characteristics

therefore the exposure to the treatment can be considered random (Rosenbaum and

Rubin, 1983).

The propensity score based analysis is estimated following Dehejia and Wahba

(2002). I use a probit regression with a binary variable as a dependent variable that takes

the value of one if the firm has a monitoring board, and zero otherwise. The set of

pretreatment characteristics include the pre-crisis mean values of the variables Board

Size, Board Composition, Firm Size, and Revenue by Employees. I include industry and

]0|)0([]1|)1([ DyEDyE ii

]0|)0([]1|)0([]1|)0([]1|)1([ DyEDyEDyEDyE iiii

0]0|)0([]1|)0([ DyEDyE ii

33

year dummies to account for any heterogeneity between industry and time. The results

are shown in Table 21.

An MB has a negative and significant relationship at 1% with the board size. Board

Composition is negative and economic significance is at 1%. All those variables suggest

the importance of scale when the firm has an MB.

I present the propensity score matching in Table 22. I match each monitoring board

firm with a set of control firms that have comparable characteristics to the monitoring

board firm but they are not monitoring board firms. Monitoring board firms and matched

non-monitoring board firms are not significantly different across all the matching

dimensions for the matched sample. Additional, almost all the variables have a well-

balanced matched sample with a bias of less than 5% after matching.

Table 23 presents the average difference in the variable of this study between

treated (Monitoring Board Firms) and matched control firms (Advisory Board Firms). I

estimate the nearest available Mahalanobis metric matching within calipers defined by

the propensity score. I use dummies to account for heterogeneity between industry. The

results show than, overall, the monitoring board firms have lower Tobin’s Q than

matching control firms.

Then, I perform a regression analysis using the propensity score matched sample.

The results are shown in Table 24 to Table 31. I confirm the hypothesis that monitoring

board firms underperform measure as Tobin’s Q following the crisis period when

compared to the matched sample that suggest compelling results. However, in terms of

ROA, Revenues by Employees, the number of employees, Business Segment, Capital

34

Investment, R&D, and Leverage there is not difference in the changes of MB compare to

non MB firms.

35

5. Discussion

The board of directors as an organism responsible for the internal control of firms

has constituted a broad field of study. However, mixed results have not provided a

conclusive answer. This dissertation provides new evidence on the value of advisory

boards by studying their effect on performance and corporate policy after the financial

crisis of 2007-2008.

The dissertation tries to examine the link between board type and performance

following the crisis. I find evidence that MB is detrimental to shareholder. However,

there is endogeneity concerns that could weak this conclusion, for example one

possibility is that firm with more agency problems have more monitoring boards. For that

I try to address this issue with propensity score matching methodology. This paper

provides some unique an important evidence on how different types of firms performed

following the crisis.

The decisions made by the firm to overcome financial crisis shocks affect the

benefits and costs of the firms in having a monitoring or advisory board. The results show

that advisory board focuses in long term consequences while monitoring board discipline

more. For instance, a monitoring board may be detrimental to performance measure such

as Tobin’s Q, even after controlling for different periods of time and different tests

compared to advisory boards. On the other hand, monitoring boards reduced the number

36

of employees and capital expenditure following the crisis. MB firms tend to not differ of

the number of business segments and research and development expenditure.

Comparative to firms with monitoring boards, the actions taken by advisory boards

are in the interest of the shareholder. I found that in terms of leverage, there is no

statistical difference in the firm policy made between an MB and advisory board.

Notice that one of the mechanism when the companies expect low performance is

to reduce number of employees; however, this action does not reflect a better

performance in any of the variables proposed when compared to non-monitoring firm.

There is a cost associated with monitoring board firms that do not allow the

strategy and its implementation to be affective when the company faces financial failure.

This may, among other reasons, be due to the fact that so much oversight reduces the

flow of information shared by the managers with the board, so the board cannot execute

its function properly.

37

Figure 1 Frequency of MB switching

This figure shows the average frequency of firm that change its monitoring board status from three years

before the subprime financial crisis to three years after it. The frequency of switching is estimates as a

dummy variable that take the value of one if the firm change its monitoring board status during the study

window.

0,00

0,02

0,04

0,06

0,08

0,10

0,12

0,14

0,16

0,18

2004 2005 2006 2007 2008 2009 2010 2011 2012

From Advisory Board to MB

From MB to Advisory Board

38

Figure 2 Performance of Monitoring Board vs. Not Monitoring Board

This figure shows the average performance estimated by the mean ROA and Tobin’s Q for treatment and

control firms, from four years before the subprime financial crisis to four years after it. The vertical lines

from each of the annual nodes represent two standard errors. The MB variable is defined based on a

window of three years before crisis when the MB status is in the three years.

0,1

0,11

0,12

0,13

0,14

0,15

0,16

0,17

0,18

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

RO

A

Year

Performance

MB

Non MB

1,20000

1,40000

1,60000

1,80000

2,00000

2,20000

2,40000

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Q T

ob

in

Year

Performance

MB

Non MB

39

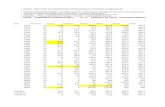

Table 1 Descriptive Statistics for the Entire Sample

The sample consists of 2,541 firms between 2004 and 2012. The number of Dependent Directors (DD) is

the number of inside directors. The number of Linked Directors (LD) is the number of affiliate external

directors. The number of Independent Directors (ID) represents the directors with no material connection to

the company. The Total Directors (TD) represent board size. The number of Independent Directors M.

Committees (IDC) is the sum of the number of members of the audit committee plus the number of

members of the compensation committee, and plus the number of members of the nominating or the

corporate governance committees. Monitoring Intensive Director (MID) is a dummy variable that takes the

value of one if a director serves in at least two of the three monitoring committees (audit, compensation and

nominating or corporate governance), and 0 otherwise. Monitoring Board (MB) is a dummy variable that

takes the value of one if most of the board’s members are monitoring intensive directors. Board

Composition refers to the number of independent directors divided by the number of the total directors.

Tobin’s Q is estimated as the book assets minus book equity plus market value of equity minus deferred

taxes, all divided by book assets. ROA is estimated as the operational income before depreciation divided

by total assets. Leverage is the long-term debt divided by total assets. Rev/Employ is the total revenue

divided by number of employees. Capex represents the capital expenditure in millions of dollars. Market

Value is in millions of dollars. R&D represents research and development. The number of Business

Segments is the number of segments. All continuous variables are winsorized at the 1st and 99th percentile

values.

Description Obs. Mean Median Min. 25th

%ile

75th

%ile

Max. SD.

Panel A

Board characteristics

# Dependent Director (DD) 8,409 1.480 1 0 1 2 7 0.780

# Linked Director (LD) 8,409 0.670 0 0 0 1 8 0.970

# Independent Director (ID) 8,409 6.890 7 0 5 8 18 2.120

Total Director (TD) 8,409 9.040 9 4 7 10 23 2.130

# Audit Committee Member 8,409 3.610 3 0 3 4 9 1.010

# Compensation Committee Member 8,409 3.500 3 0 3 4 9 1.130

# Nom./Corp.Gov Committee Member 8,409 3.460 3 0 3 4 13 1.570

# Independent Director M. Committees (IDC) 8,409 10.57 10 0 9 12 24 3.100

Monitoring Intensive Director (MID) 8,409 3.600 3 0 3 5 11 1.710

Monitoring Board (MB) 8,409 0.480 0 0 0 1 1 0.500

Board Composition 8,409 0.760 0.780 0 0.670 0.880 1 0.130

40

Table 1, continued

Description Obs. Mean Median Min. 25th %ile. 75th %ile Max. SD.

Panel B

Firm characteristics

Tobin’s Q 8,409 1.790 1.540 0 1.140 2.170 7.690 1.150

ROA 8,409 0.150 0.140 0 0.100 0.190 0.410 0.0800

Leverage 8,409 0.160 0.150 0 0.0100 0.260 0.600 0.140

Rev./Employ 8,409 423.4 276.0 24.73 184.8 442.7 3016 494.0

Capex/Sales 8,409 0.0700 0.0300 0 0.0200 0.0600 0.800 0.110

Market Value 8,409 8,943 2,007 86.25 801.2 6,240 159,298 22,309

Capex 8,409 366.1 63.47 0.730 20.62 221.8 7061 975.2

R&D/Total Assets 8,409 0.0300 0 0 0 0.0400 0.200 0.0400

# Business Segment 8,409 2.510 2 1 1 4 9 1.840

41

Table 2 Descriptive Statistics before 2008

The sample consists of 2,536 firms between 2004 and 2007. The number of Dependent Directors (DD) is

the number of inside directors. The number of Linked Directors (LD) is the number of affiliate external

directors. The number of Independent Directors (ID) represents the directors with no material connection to

the company. The Total Directors (TD) represent board size. The number of Independent Directors M.

Committees (IDC) is the sum of the number of members of the audit committee plus the number of

members of the compensation committee, and plus the number of members of the nominating or the

corporate governance committees. Monitoring Intensive Director (MID) is a dummy variable that takes the

value of one if a director serves in at least two of the three monitoring committees (audit, compensation and

nominating or corporate governance), and 0 otherwise. Monitoring Board (MB) is a dummy variable that

takes the value of one if most of the board’s members are monitoring intensive directors. Board

Composition refers to the number of independent directors divided by the number of the total directors.

Tobin’s Q is estimated as the book assets minus book equity plus market value of equity minus deferred

taxes, all divided by book assets. ROA is estimated as the operational income before depreciation divided

by total assets. Leverage is the long-term debt divided by total assets. Rev/Employ is the total revenue

divided by number of employees. Capex represents the capital expenditure in millions of dollars. Market

Value is in millions of dollars. R&D represents research and development. The number of Business

Segments is the number of segments. All continuous variables are winsorized at the 1st and 99th percentile

values.

Description Obs. Mean Median Min. 25th

%ile

75th

%ile

Max. SD.

Board characteristics

# dependent director (DD) 3526 1.560 1 0 1 2 7 0.810

# Linked Director (LD) 3526 0.920 1 0 0 1 8 1.150

# Independent Director (ID) 3526 6.540 6 0 5 8 16 2.140

Total Director (TD) 3526 9.020 9 4 7 10 18 2.190

# Audit Committee Member 3526 3.470 3 0 3 4 9 1.060

# Compensation Committee Member 3526 3.300 3 0 3 4 9 1.170

# Nom./Corp.Gov Committee Member 3526 3.110 3 0 2 4 13 1.650

# Independent Director M. Committees (IDC) 3526 9.880 9 0 8 12 23 3.220

Monitoring Intensive Director (MID) 3526 3.330 3 0 2 4 11 1.710

Monitoring Board (MB) 3526 0.470 0 0 0 1 1 0.500

Board Composition 3526 0.720 0.750 0 0.630 0.830 1 0.140

42

Table 2, continued

Description Obs. Mean Median Min. 25th %ile 75th %ile Max. SD.

Firm characteristics

Tobin’s Q 3,526 1.950 1.690 0 1.270 2.390 7.690 1.230

ROA 3,526 0.160 0.150 0 0.100 0.200 0.410 0.0800

Leverage 3,526 0.160 0.140 0 0.0100 0.250 0.600 0.140

Rev/Employ 3,526 392.0 253.7 24.73 172.3 404.5 3016 467.4

Capex/Sales 3,526 0.0700 0.0400 0 0.0200 0.0700 0.800 0.110

Market Value 3,526 9,239 2,164 86.25 896.4 6,629 159,298 22,363

Capex 3,526 353.1 65.41 0.730 21 224.3 7061 937.3

R&D/Total Assets 3,526 0.0300 0.0100 0 0 0.0400 0.200 0.0400

# Business Segment 3,526 2.540 2 1 1 4 9 1.850

43

Table 3 Descriptive Statistics after 2008

The sample consists of 2,541 firms between 2009 and 2012.The number of Dependent Directors (DD) is

the number of inside directors. The number of Linked Directors (LD) is the number of affiliate external

directors. The number of Independent Directors (ID) represents the directors with no material connection to

the company. The Total Directors (TD) represent board size. The number of Independent Directors M.

Committees (IDC) is the sum of the number of members of the audit committee plus the number of