YouTradeCoffee Market Report & Offer List 5.12.14

-

Upload

youtradecoffee -

Category

Documents

-

view

214 -

download

0

description

Transcript of YouTradeCoffee Market Report & Offer List 5.12.14

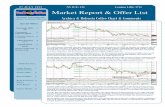

NY coffee futures faced firm resistance yesterday after selling off sharply the previous session. Prices closed around previous lows as intraday gains failed to take root. Activity early on this morning has seen further indecision with futures trading around 182 and any continuation of selling pressure could see losses extend back down towards 180.00 while protracted declines would then look to test an area of previous consolidation around 178. On the upside any gains building on near term support would first need to recover back above the 10 day MA before targeting resistance at the 40 day MA. Further moves would then potentially target resistance near 205.

London coffee futures traded with further indecision yesterday as resistance at both the 10 day and 40 day moving averages held firm once again. Tentative support levels towards 2050 seems to be holding up well this morning but moves on the upside remain limited which could squeeze price action into a tighter range. On the downside, any moves in breach of interim levels at 2030 could see lows towards 2000 tested. On the upside, a reversal back above the moving averages and subsequent building of mo-mentum could see futures target a close above 2100. Volumes have dropped off in recent sessions and a breakout in the near term in either direction on higher volume will be telling of the prevailing trend.

Arabica & Robusta Coffee Chart & Comments

Inside this issue:

Coffee Charts 1

Arabica Offers 2

Robusta Offers 3

Latam Report 4

Asia & Africa

Report

5

Futures Market 6

Market Report & Offer List

5 DE CE MBE R 20 14

Arabica Coffee Chart & Comments

NY ICE: 181.55 London Liffe: 2048

Facebook: YouTradeCoffee

Special Offers

Costa Rica SHB EP

Supremo 17/18

1

Costa Rica SHB EP

Tarrazu 16+

2

Brazil Santos

Peaberry Fine cup

3

China Simao Gr. 1 4

Vietman Gr.1/16 5

Vietman Gr.1/18 6

P A G E 2

Arabica Coffee Shipments from Origin We are pleased to

present for your

consideration our latest

coffee offer list on Full

Container Load basis,

for lots of about 300

bags (18 MT) per origin/

grade. Price ideas are

both on outright and

differential basis against

NY ICE & LIFFE

future markets. Price &

stock availability are

subject to confirmation

and unsold.

In case you should need to combine several ori-gins/grades in one ship-ment, we will be deligh-ted to quote on FOT/FOB/CIF basis and arrange mixed contai-ners or combined palle-tized shipments of mini-mum 20 bags, from cof-fee stocks warehoused in the main European & US ports. Therefore do not hesitate to contact us with your enquiries or firm bids, on the pro-ducts listed below and/or any other origin or grade available on the international market. Rest assured we will do our outmost to meet your highest expectative. We wish you a pleasant and profitable day!

Bags Grade Delivery Differential Outright

1800 Brazil Santos 17/18 NY 2/3 Good cup FOB – Santos/Vitoria/Rio NY ICE - 19 c/lb -

1800 Brazil Santos 14/16 NY 3/4 Good cup FOB – Santos/Vitoria/Rio NY ICE - 29 c/lb -

1800 Brazil Grinder screen 12 Good cup FOB – Santos/Vitoria/Rio NY ICE - 58 c/lb -

850 Brazil NY 2/3 MTGB SSFC FOB – Santos/Vitoria/Rio NY ICE - 16 c/lb -

1200 Colombia Excelso EP New crop FOB - Buenaventura NY ICE +7 c/lb -

1100 Nicaragua SHG - EP FOB – Atlantic or Pacific - USD 228/50Kg

825 Guatemala SHB - EP FOB - Atlantic or Pacific - USD 235/50Kg

825 Honduras HG - EP FOB - Atlantic or Pacific NY ICE +2 c/lb -

*825 Costa Rica SHB – EP “Supremo” 17/18 FOB - Atlantic or Pacific NY ICE +45 c/lb USD 232/50Kg

*825 Costa Rica SHB – EP Tarrazu 16+ FOB - Atlantic or Pacific NY ICE +48 c/lb USD 240/50Kg

1280 Tanzania AB FAQ 13/14 FOB - Dar Es Salaam NY ICE +11 c/lb -

960 Tanzania AA FOB - Dar Es Salaam - USD 248/50Kg

1080 Uganda Drugar FOB - Mombasa NY ICE - 36 c/lb -

320 Kenya AB FOB - Mombasa - USD 288/50Kg

320 Ethiopia Sidamo Washed Gr. 2 FOB - Mombasa - USD 293/50Kg

Arabica Coffee SPOT - EU & North America

Bags Grade Delivery Differential Outright

*5000 Brazil Santos Peaberry Fine cup FOT – Bremen NY ICE - 21 c/lb -

3000 Colombia Excelso European Prep FOT – Bremen NY ICE + 13 c/lb -

*1920 China Simao Gr. 1 FOT – Hamburg/Bremen NY ICE - 7 c/lb -

*1600 China Simao small beans FOT – Hamburg NY ICE - 30 c/lb -

275 Colombia Supremo 17/18 Instore - Pacorini Genoa - $ 228/50 Kg

400 Peru Chanchamayo wahed Instore - Genoa/Trieste - $ 214/50 Kg

320 Brazil Santos NY 2 screen 17/18 Instore - Romani Genoa - $ 223/50 Kg

500 Colombia Supremo 17/18 Instore – Norfolk USA NY ICE + 24 c/lb -

1100 Nicaragua SHG - EP Instore – Los Angeles USA NY ICE + 22 c/lb -

960 Brazil NY 2/3 MTGB SSFC Instore – Toronto Canada NY ICE - 6 c/lb -

*1100 Honduras HG - EP Instore – Toronto Canada NY ICE + 7 c/lb -

Today’s best buy marked with *

Today’s best buy marked with *

P A G E 3

Robusta Coffee Shipments from Origin Bags Grade Delivery Differential Outright

*3200 India Cherry AB New crop FOB - Cochin/Tuticorin LIFFE +230 -

960 India Cherry A New crop FOB - Cochin/Tuticorin - $ 2.530/MT

640 India Parchment AB FOB - Cochin/Tuticorin - $ 3.560/MT

640 India Kaapi Royal 18 FOB - Cochin/Tuticorin - $ 3.440/MT

3200 Vietnam Gr.1/18/2%BBB FOB - HCMC LIFFE + 20 -

*3200 Vietnam Gr.1/16/2%BBB FOB - HCMC LIFFE - 5 -

*3200 Vietnam Gr.2/13/5%BBB FOB - HCMC LIFFE - 65 -

2500 Java Rob. Semi Washed FOB - Surabaya LIFFE +550 -

640 EK1 Special ELB Gr.3/400 Bean Count FOB - Panjang - $ 2.380/MT

640 EK1 Special ELB Gr.2/350 Bean Count FOB - Panjang - $ 2.400/MT

960 EK1/80 defects FOB - Panjang LIFFE +20 -

960 Uganda screen 18 FOB - Mombasa - $ 2.490/MT

960 Uganda screen 17 FOB - Mombasa - $ 2.470/MT

960 Uganda screen 15 FOB - Mombasa - $ 2.450/MT

320 Tanzania Bukoba Superior screen 16/17 FOB - Dar es Salaam - $ 2.380/MT

Robusta Coffee SPOT - EU & North America

Bags Grade Delivery Differential Outright

1920 Vietnam Gr.1/16 Wet Polished Instore - Hamburg LIFFE +300 -

320 India Parchment AB Instore - Hamburg LIFFE +1020 -

600 Ivory Cost Gr.2 screen 14/16 Instore - Trieste Pacorini - $ 2.350/MT

320 Uganda screen 18 Clean Instore - Trieste Pacorini - $ 2.450/MT

3600 Cameroun Gros Grain screen 18/20 Instore - Genoa LIFFE +360 -

320 Vietnam Gr.1 screen 16 Instore - Miami LIFFE +280 -

320 Vietnam Gr.1 screen 18 Instore - Miami LIFFE +300 -

360 Uganda screen 15 Instore - New Orleans LIFFE +380 -

230 Indonesia Gr. 4 (60 defects) Instore - New York LIFFE +260 -

*4480 Brazil Conilon 5/6 screen 13 up Instore - New York LIFFE +180 -

600 Cameroun Gros Grain screen 18/20 Instore - New York LIFFE +460 -

Today’s best buy marked with *

Today’s best buy marked with *

We are pleased to

present for your

consideration our latest

coffee offer list on Full

Container Load basis,

for lots of about 300

bags (18 MT) per origin/

grade. Price ideas are

both on outright and

differential basis against

NY ICE & LIFFE

future markets. Price &

stock availability are

subject to confirmation

and unsold.

In case you should need to combine several ori-gins/grades in one ship-ment, we will be deligh-ted to quote on FOT/FOB/CIF basis and arrange mixed contai-ners or combined palle-tized shipments of mini-mum 20 bags, from cof-fee stocks warehoused in the main European & US ports. Therefore do not hesitate to contact us with your enquiries or firm bids, on the pro-ducts listed below and/or any other origin or grade available on the international market. Rest assured we will do our outmost to meet your highest expectative. We wish you a pleasant and profitable day!

P A G E 4

“Slowly but surely

the bullish euphoria,

the doom and gloom

scenarios dissipate.

The ones insisting on a

small carry in on a

small crop now and on

another small crop to

come in Brazil should

buy (more) coffee”

M A R K E T R E P O R T & O F F E R L I S T

Coffee Market Overview

Report from Brazil The rains continue in Brazil and with many positive reports coming forth to the market, in terms of

the condition of the trees and likewise, the development of the new crop cherries. These reports and

with very little in the way of qualified reports to counter the evidence of positive steps now being

taken towards the development of the next 2015 Brazil crop, continue to dampen speculative spirits

within the New York market.

Local market calm. Farmers tend to postpone sales to the new (tax) year time around. Export offer-

ings still looking attractively priced but overseas interest very small. Trade/exporters probably fairly

long and industry relaxed.

Would be nice to report good trades with additional interest

but sorry, no, the situation is still unclear in Brazil as well in

Vietnam ,so major buyers waiting for further news before

they get back into the ring and fight for better prices.

Slowly but surely the bullish euphoria, the doom and gloom

scenarios dissipate. The ones insisting on a small carry in on

a small crop now and on another small crop to come in Brazil

should buy (more) coffee. The huge amount of cheap Brazil-

ian offers, the ongoing Colombian campaign, the pressure

those put nearly all other countries differentials, offer great opportunities, don’t they?!? Carry is

there, but the pipelines are full already and industry’s approach remains rather cool. One would hope

that the next discussion about Arabica S&D will take place a little further out and then deal with Bra-

zil availability for Jan/Jun 2016 and the 2016 crop which could become quite a crop.

Report from Colombia The Coffee Growers Federation in Colombia have reported that the countries coffee production for

the month of November was 2,000 bags or 0.18% higher than the same month last year, at a total of

1,115,000 bags. This contributes to the countries cumulative production for the first two months of

the present October 2014 to September 2015 coffee year to be 45,000 bags or 2.07% higher than the

same period in the previous coffee year.

Meanwhile the Colombian Coffee Growers Federation have reported that the countries coffee exports

for the month of November were 78,000 bags or 7.1% lower than the same month last year, at a total

of 1,022,000 bags. This dip nevertheless follows a more active month of exports in October and

therefore the cumulative exports for the first two months of the present October 2014 to September

2015 coffee year are still 5,000 bags or 0.25% higher than the same period in the previous coffee

year, at a total of 1,988,000 bags.

Report from Costa Rica The National Coffee Institute of Costa Rica have reported that the countries coffee exports for the

month of November were 13,024 bags or 28.27% lower than the same month last year, at a total of

33,048 bags. This slow start to the new coffee year has contributed to the countries cumulative ex-

ports for the first two months of the present October 2014 to September 2015 coffee year to being

18,953 bags or 23.51% lower than the same period in the previous coffee year, at a total of 61,663

bags.

P A G E 5

M A R K E T R E P O R T & O F F E R L I S T

Report from Vietnam The new Vietnam harvest has experienced some light rain interruptions, which has slowed the deliv-

ery of the new crop Robusta coffees to the exporters, but with good carryover stocks in hand this has

not really disrupted a steady flow of Robusta coffees to the consumer markets. While approximately

40% of the new crop harvest now completed, one can expect that the flow of new crop coffees shall

start to build and for the present it is very much business as usual from this leading Robusta producer.

Meanwhile the traditional seasonal scare stories are coming forth from the Vietnam Coffee and Co-

coa Association, who talk about the new crop to potentially be up to 20% lower than the last crop.

Followed by the Vietnam governments Coordinating Board forecasting a new crop of only 21.67

million bags, which is a rather dramatically modest figure. But this differs little from the official

forecasts and reports in previous years that come to the market during and shortly post the harvest and

for the present and thus, such market manipulative reports are not taken seriously. While albeit early

in the month, the trade is talking of December exports of mostly robusta coffee from Vietnam of be-

tween 2 million and 2.5 million bags.

Report from Indonesia November exports only at 19.575 MT. that’s only two thirds of November 2013. Stocks in Lampung

reported at 84.000 MT. The only independent warehouse in Lampung announced the closure of their

operation soon. Asalan arrivals during this week seen at around 1.200 MT. Indonesian Rupiah trading

at 12.295 vs the US Dollar, 135 points down from last week.

Report from India With the new Arabica coffee crop well into its new crop harvest in India and the new Robusta coffee

crop soon to follow, the farmers are disputing the official new crop forecasts and indicate that they

foresee the new Arabica coffee crop to be 20% lower than the past crop. This unofficial forecast

does not however detract from many other private trade and industry forecasts who foresee that

while there has been the usual problems of white stem borer for the Arabica coffee farmers, that the

new crop shall potentially match the previous Arabica crop of approximately 1.6 million bags. While

the general view is that the new Indian Robusta crop shall be at least 20%larger than the past crop, at

approximately 4 million bags. Thus the unofficial trade forecasts presently are close to the official

Coffee Board of India forecast, which has forecasted a combined new Indian crop of approximately

5.74 million bags.

Report from Uganda UCDA Monthly Report for October 2014: The first monthly report for the coffee year 2014/15 states

that 229.438 bags were exported in October 2014. Coffee exports for 12 months (November 2013 to

October 2014) total 3.52 million bags comprising of Robusta 2.75 million bags and Arabica 0.77

million bags. In the month of October a total of 12.9 million seedlings were planted, benefiting

64.668 households. About 75% of the total export volume was shipped by 10 exporters, out of 29 that

performed in the month down from 80% in the previous month.

Report from Papua New Guinea The flow of coffee from the interior has further slowed down and the ongoing good de-mand from outside could not be satisfied.

The arbitrage between the markets narrowed yesterday to register this at 89.01 usc/Lb., while this equates to a relatively attractive 48.79% price discount for the London robusta coffee market. This arbitrage is continuing to inspire consumer market roaster interest in robusta coffees, which assist to take some of the bite out of the comparative firm arabica coffee prices. The Certified washed Arabica coffee stocks held against the New York exchange were seen to decrease by 13,610 bags yes-terday, to register these stocks at 2,322,870 bags. There was meanwhile a larger in volume 15,025 bags increase to the number of bags pending grading for this exchange; to register these pending grading stocks at 18,550 bags. The commodity markets tended to take a sideways track within many markets yesterday, but with little in the way of sup-portive economic news coming to the markets for the present, the overall commodity index struggled to maintain its modest buoyancy for the day. The Natural Gas, Sugar, Cocoa, Cotton, Copper, Wheat, Silver and Platinum markets had a day of buoyancy, while the Oil, Coffee, Orange Juice, Corn, Soybean and Gold markets had a softer day’s trade. The Reuters Equal Weight Continuous Commodity Index that is that is made up from 17 markets is 0.14% higher; to see this Index registered at 472.27. The day starts with the U.S. Dollar steady and trading at 1.564 to Sterling and 1.238 to the Euro, while North Sea Oil is steady in early trade and is selling at $ 68.50 per barrel. The London market predictably started the day yesterday on a softer track, but followed by a steady start for the New York market. This seemed to have its influence and the London market soon recovered to join the New York market on a thinly traded steady track into the afternoon. This did not last however and as the afternoon progressed and with trade remaining relatively thin and lacklustre, the New York market started to drift lower and with the London market likewise losing some weight. The London market continued to end the day on a modestly softer note but with only 30% of the ear-lier losses of the day intact and followed by the New York market that registered a partial recovery late in the day to never-theless end the day on a soft note and with 47.1% of the earlier losses of the day intact.

Futures Market Overview