Yoshino bkk-oecd-financial-education-december-2014

-

Upload

oecd-directorate-for-financial-and-enterprise-affairs -

Category

Economy & Finance

-

view

193 -

download

1

Transcript of Yoshino bkk-oecd-financial-education-december-2014

Financial Education in Japan and

Financial Inclusion

Naoyuki Yoshino

Dean, Asian Development Bank Institute (ADBI)

Professor Emeritus, Keio University, Japan

OECD-Thailand Seminar on Financial Literacy and Financial Inclusion, December 2014, Bangkok, Thailand

Outline 1, Bank dominated asset allocation

2, Financial Education to prepare for Ageing

3, Financial Education in Schools in Japan

Survey to 4462 teachers

Promotion of Financial Education, Council

4, Loan Sharks (Money Lenders)

5, SME (Small enterprises) education in finance

6, Hometown Investment Trust Funds

7, Macroeconomics Effects of Financial Education

2

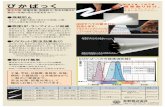

Cash ans Deposits, 567

Insurance and Pension Funds,

1049

Securities, 782

Stocks, 1170

Others, 147

USA

Total, 3715

Cash ans Deposits,

792

Insurance and

Pension Funds,

399

Securities, 92

Stocks, 87 Others, 58

Japan

Total, 1428

Cash ans Deposits,

221

Insurance and

Pension Funds,

189

Securities, 103

Stocks, 44

Others, 5

Germany

Total, 562

Households’ Asset Allocation Hometown Investment Trust Funds, 2013, Yoshino and Kaji, Springer

Bank-Dominated Financial Systems and the Economic Importance of SME

4

Population Ageing of Japan

5

(Dividends & Interest receipt)/(Income) Yoshino & Kaji (2013) Hometown Investment Trust Funds, Springer

Germany

UK

USA France

Japan

Financial Education to prepare for old age

1, Government Support --- Pension System

401K (Self protection for asset allocation)

2, Life Insurance --- long term savings by individuals

3, long term institutional investors

infrastructure investment (long-term funding)

4, Various financial products will be sold in Asia

5, Risks and Returns, individual financial education

Financial Education in Schools (Japan)

1, Secondary School (7th-9) and High School (10-12th)

taught in the courses of “Civics, Home-economics”

Many teachers are not well trained in the subject.

2, Financial education in Japan’s primary school

is taught at “Home making courses”.

3, Very few hours are allocated to financial education

4, It is regarded as a shame to make money

by financial investments.

5, Retiree from financial institutions could teach

financial economics to students. Video lectures 8

9

10

Why is it difficult to teach ? 4462

11

Financial Education Promotion Council What kind of subjects and items should be taught

at each level of school education ?

Chair Person, Naoyuki YOSHINO Central Bank of Japan Financial Services Agency (FSA) Ministry of Education Consumer Protection Agency (Government of Japan) Bankers Association of Japan Securities Dealers Association Insurance Association Trust Bank Association Investment Trust Association Financial Planners Association

12

Number of Households’ Default

13

(件数)

240,000

220,000

200,000

180,000

160,000

140,000

120,000

100,000

80,000

60,000

40,000

20,000

0 1990年 1992年 1994年 1996年 1998年 2000年 2002年 2004年 2006年 2008年 2010年 1986年 1988年

1991年 1993年 1995年 1997年 1999年 2001年 2003年 2005年 2007年 2009年 1985年 1987年 1989年

New Law – Microcredit Regulation consumer education

1, Total Amount of Borrowing < 1/3 of Income

2, Ceiling Interest Rate = 20%

more than 96% 29% 20%

3, Borrowers Information

Aggregated total individual borrowings

4, Paper examination to be a lender

5, Minimum capital requirement

6, Consumer complaints and advices 14

15

SMEs in Japan

SMEs in Thailand

16

SMEs (14.4million

data)

Defaults

(1.7million

data)

Financial

Institutions

200 Regional Banks

Credit Associations

Credit Cooperatives

Government Banks

Central Bank

Credit Guarantee

Corporations (Collect Data of SMEs)

52

1, Government Support

2, Reliability

3, Security of Information

CRD

SME Data base (CRD Data base)

17

There are 4 accounts by SMEs in Japan

1, Account to show bankers

2, Account to show Tax authority

3, SME owner’s own account

4, Account to show to his wife

18

19 Note: Ebit denotes Earnings Before Interest and Taxes

• 1363 SMEs of one Asian bank examined

• 11 most significant ratios(variables) selected

20

Cluster analysis: the average linkage method

21

Healthier Group

of SMEs

-1.5

-1

-0.5

0

0.5

1

1.5

2

2.5

3

3.5

4

-1.5 -1 -0.5 0 0.5 1

Z2-Z3 Group B

0

2

4

6

8

10

12

14

-1 -0.5 0 0.5 1 1.5

Z2-Z3 Group A-1

0

5

10

15

20

25

30

0 1 2 3

Z2-Z3 Group A-2

Financial Education for SMEs

1, Book Keeping

2, Daily revenue and expenses

3, Long term thinking

4, Accurate reporting of their business

5, Reduce default loan losses

6, Reduce information asymmetry

22

23

Start up businesses and SME financing by Hometown Investment Trust Funds

1, Bank Loans --- relatively safer borrowers

2, Hometown Investment Trust Funds -- SME

E-Finance, E-Fund Banking

Account

Hometown

Investment

Trust

Funds

Riskier Borrowers

Investors

Depositors

Safer borower

Banking

Account

Risks and Returns Financial Education

1, Hometown Investment Trust Funds

Supply of risk capital in rural region

Basel Capital Requirements -- safer borrowers

2, Agricultural farmers

3, Small business, Start-up companies

4, Individual Investors in the region

Mutual assistance, Creation of jobs

25

Donation and Investment to community

26

Agricultural Funds Beans and Wine

Dec 11 2013 , Tehran – I.R. of IRAN 27

28

Investors Community Type Infrastructure SME Hometown Trust Fund

Wind power Generator Funds

Japanese Wine Fund

Local Airport

Agricultural Sector

Large Projects and Professional Investors Pension Funds (Financial Education)

Insurance companies

Mutual Funds

Macroeconomic Effects of Financial Education

(1) Hoseholds’ Asset Allocation (Diversification)

Y-S = S + C = (D + B) + C …………(1)

(2) Aggregate Supply Curve (SME and corporation)

Y-Yf = a1(Pe-P) + a2 L + a3 (B + v) …………..(2)

(3) Aggregate Demand Curve (Corporate fund raising)

Y = b1 + b2 L + b3 (B + u) + b4 G ……………(3)

Increase of Expected Outputs

dE(Y)= -b2 dE(S) + b3 (dE(S) + du) ……………..(4)

Risks V(y) = b3 V(S+u) …………….(5) 30

Transmission of Financial Education

1, Efficient allocation of assets by households

2, Long term perspectives of households

3, Enhance wellbeing of individuals

3, Diversify corporate fund raising

4, Efficient cash management of corporation

5, Transparency of SMEs (Small enterprises)

6, Promotion of start up businesses

7, Enhance Economic Growth

8, Efficient time allocation of financial institutions

31

32

References McNelis, P. and N. Yoshino (2012) "Macroeconomic Volatility Under High Accumulation of Government Debt: Lessons from Japan", Advances in Complex Systems, Vol. 15, Suppl. No. 2. Yoshino, Suzuki, Maehara and Abe (2009) Development of Corporate Credit Information Database and Credit Guarantee System, ASEAN Secretariat, Feb. 2009. Yoshino, N. (2010) “Financing Transport Infrastructure Development in Southeast Asia” OECD, Southeast Asian Economic Outlook, 2010, Nov., Chapter 6, OECD, Paris. Yoshino N. (2012) “The Global Imbalance and the Development of Capital Flows among Asian Countries”, OECD Journal: Financial Market Trends, Volume 1, 2012 Yoshino N. Kaji, S. (2013) Hometown Investment Trust Funds, Springer, March 2013 Yoshino N. Taghizadeh-Farhad (2014) “Hometown Investment Trust Funds: An Analysis of Credit Risk” Working Paper, Asian Development Bank Institute (ADBI), No.505, November 2014