XY Planning Network: Helping Clients with Health …...Common mistakes your clients are making...

Transcript of XY Planning Network: Helping Clients with Health …...Common mistakes your clients are making...

December 2019

TakeCommandHealth.com

XY Planning Network: Helping Clients with Health Insurance

Let’s make this as much as a discussion as possible!

Ask questions on the “Q&A” feature

This webinar is being recorded by XYPN

Important Note: We’re not your or your client’s attorney. This discussion does not constitute legal advice.

A few logistics to get started

3

Today’s Agenda

4

Topics

Should financial professionals care about health insurance?

Common mistakes your clients are making

What’s new in health insurance:• Individual Clients• Small Business Clients/Owners

Coaching Tips and Resources

1

2

3

Let’s make this a discussionPlease write-in questions as we go!

4

Why you need to careHealth insurance is confusing your clients (and costing them money)

5

1

Health insurance is demanding more from individuals

Consumer Responsibility

HMOs EmployerSponsored

“High Deductible”Health Plans

Consumer-DrivenHealth Plans

Present

6

It’s becoming a larger expense

2Highest monthly household

AND small business expense

nd

7

90%Americans about to choose the

WRONG health plan

They will spend $1,000+ more this year than they should

Your clients desperately need help from a trusted advisor

Lonely Frustrating Hopeless Powerless

No one to helpExpensive,

politicalImpossible to

figure outLack of clarity, truth, and

trustworthiness

9

How your clients feel when dealing with health insurance:

This is a chance to step in and be the hero!

Common Health Insurance MistakesLet’s avoid these!

10

2

Biggest, most costly health insurance individuals make:

11

Individuals & Families

• They automatically renew their plan without shopping (especially “grandfathered” plans)

• Artificially limit their plan choice options (only look at Healthcare.gov or what a broker offers them)

• Overweight “deductible” and “primary visit copay” in their cost analysis• Ignore 26 other critical factors• Don’t consider actual out-of-pocket costs

• Overweight “what if” and “worst case” scenarios instead of practical needs

• Misunderstand doctor networks and pharmacy formularies (out of network is expensive!)

• Access expensive medical care when more affordable options are available

• Buying individual dental insurance (it’s a glorified payment plan with very high interest)

• Pay medical bills without reviewing or questioning (50% of bills with 2 or more codes have an error!)

Small business owners are prone to old ways of thinking

12

Small Business Owners

• Myth: Getting “on a group plan” will save us money• Fact: Individuals and small business plans share the same actuarial tables and underlying rates.

Custom underwriting doesn’t start until you’re over 50 employees. Note: Some markets do have different plans available as a small group plan versus individual plans, but the underlying rates are the same.

• Myth: Our broker says we’re on a special grandfathered plan we shouldn’t touch• Fact: Most of the time, a grandfathered plan isn’t the best option. Business owners should still shop

around and compare coverage!

• Myth: I can’t know my employees needs, so I’ll just get a plan that fits everyone• Fact: Plans that fit everyone fit no one! Look at new defined contribution models instead where

employees can personalize and optimize their own coverage.

• Myth: (Family Businesses) – I’ll get a better business plan if we purchase insurance through our business versus on our own.

• Fact: True “small group plans” require at least one non-related W-2 employee.

What’s new with health insurance?Better options to help your clients

13

3

Some big, new things for 2020

14

For your individual clients:

Two new types of “alternative” health plans

For your small business clients:

A new model of insurance

What’s new for individualsLet’s get your individual clients some better options and help them avoid junk!

15

What are “alternative plans” and how do they compare?

16

Plan types Major Medical (aka Obamacare) Sharing Short-Term Medical (STM)

Doctor Networks HMO, EPO, PPO PPO or open network (see any doctor)

PPO or open network (see any doctor)

Preventive Care $0 Not covered Not covered

Pre-Existing Conditions Covered Excluded for 2 years Not covered

Max Benefits Unlimited Depends($100k – Unlimited)

Depends($100k-$1M)

Tax Penalty No No $0

Monthly Premium $$$$ $$ $

Monthly Deductible $$$$ $$ $

Example Providers Blue Cross, Humana, Molina, Oscar

Medi-Share, Samaritan’s Purse, Liberty Share United, Pivot, IHC

Sharing and Short-Term plans are not for everyone, but could save some of your clients a ton of money

In some states, can renew 3x

times for 3 years of coverage

Alternative Plans Example: The Smith Family

17

Major Medical Sharing or STM

Plan Design Deductible/Max Limit $2,000/person $2,500/family

Doctor Visits

Primary Care $30 $35

Specialist $50 $35

Preventive No charge 100%

PrescriptionsGeneric $15 Counts towards

deductibleBrand $40/$60

EmergencyER $200 $135

Urgent Care $100 $135

Diagnostics, Hospital, Other 0% after ded. 0% after ded.

$1,500/mo $600/mo18

Alternative Plans Example: The Smith Family

Major Medical Sharing or STM

Plan Design Deductible/Max Limit $2,000/person $2,500/family

Doctor Visits

Primary Care $30 $35

Specialist $50 $35

Preventive No charge 100%

PrescriptionsGeneric $15 Counts towards

deductibleBrand $40/$60

EmergencyER $200 $135

Urgent Care $100 $135

Diagnostics, Hospital, Other 0% after ded. 0% after ded.

$1,500/mo $600/mo19

Alternative Plans Example: The Smith Family

Major Medical Sharing or STM

Plan Design Deductible/Max Limit $2,000/person $2,500/family

Doctor Visits

Primary Care $30 $35

Specialist $50 $35

Preventive No charge 100%

PrescriptionsGeneric $15 Counts towards

deductibleBrand $40/$60

EmergencyER $200 $135

Urgent Care $100 $135

Diagnostics, Hospital, Other 0% after ded. 0% after ded.

$1,500/mo $600/mo20

Alternative Plans Example: The Smith Family

Over $10k/yr in savings!

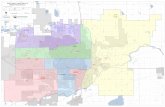

Where can my clients buy Short Term Medical (STM)?

21Source: https://www.healthinsurance.org/assets/img/landing_pages/stm_pdf/state-by-state-short-term-health-insurance.pdf

• In general, avoid plans that provide only “listed” benefits:• Fixed-Indemnity Plans• Mini-Med Plans

• Read the fine print!• Minimum coverage recommendation:

$1M/person/year• Always stay on the calendar year• If it sounds too good to be true, it is

Not all “alternatives” are the same. General rule: avoid “mini-med” and fixed-indemnity plans

22

Indemnity PlansMini-Med Plans

These “junk” plans will start to flood the market again as brokers make high commissions off of them. They look good but often exclude key needs.

What’s new with group insurance?A new model of insurance for your small business clients and owners!

23

Old Way (Group Plans) New Way (HRAs)

24

There is a new way for employers to provide health benefits to employees by reimbursing for individual insurance

Medicare

Small Group Plan(“Defined Benefit”)

Limited Choice

• Employees choose between 1-2 plans

• One doctor network and prescription formulary

Expensive

• Avg $400/employee/month

• Constant increases

• No “group” savings unless you’re over 100 employees

Clunky

• High admin burden

• Must meet participation rates, limited flexibility for part-time

Feels too complicated!

HRA(“Defined Contribution”)

More Choice for Employees

• Employees get more choices and can choose a plan with coverage they want—their doctors, prescriptions, and needs

More Affordable

• Optimized for each individual

• Employers can contribute less and employees get more

More Flexible

• Easy administration

• Works great for part-time staff

Potentially More Helpful

• Medical expense reimbursement feels like a real benefit!

HRAs offer a new way for employers to start offering benefits to their employees

25

Market Trends: This represents a broader trend in the employer benefits market

26

Benefit Type Employer Managed“Defined Benefit”

Employee Managed“Defined Contribution”

Retirement Pension Plans 401k

Retirees Retiree Health Benefits Medicare Private Exchanges

Health Insurance Group Health Plans(fully-insured, self-insured)

ICHRAs?

Employees get choice; Employers get to jettison risk

QSEHRAQualified Small Employer

Health Reimbursement Arrangement

ICHRAIndividual Coverage

Health Reimbursement Arrangement

Available Year 2017 2020

Works with Individual Plans Individual Plans

Reimbursement Options Individual Premiums + Expenses Individual Premiums + Expenses

Size Limits Limited to under 50 employees No Size Limits(can satisfy employer mandate)

Contribution Limits ~$5k for single;~$10k for family No Limits

Premium Tax Credit (PTC) Interaction Offsets If “Affordable”: No PTC;

If “Not Affordable”: Employees Choose

Employer Design Options Must offer all employees “same terms” Can vary terms by employee classes

Employee Requirements Maintain Minimum Essential Coverage (MEC)(can be spouse’s group plan)

Maintain Individual Coverage(cannot be spouse’s group plan)

Group Ancillary Not Allowed Allowed!

Comparing “Reimbursement” HRAs: ICHRA represents a major expansion on QSEHRA

27

• Special Enrollment• QSEHRA and ICHRA will trigger a “special enrollment”• Allows employees to enroll in an individual plan when gain eligibility for

ICHRA or QSEHRA• 60 day window

• Employee Classes• Employers could divide employees into multiple “classes”• Each class could have a different health benefits solution

(including group plans)• Note: Can only offer one solution to each class

Other Important Changes for HRAs

28

Employee Classes

• Full-Time • Part-Time • Seasonal• Collective Bargaining Agreement (CBA)• Waiting Period• Non-resident alien• Rating area• Salary vs Non-Salary (New!)• Staffing Firm Employees (New!)• New Hire Subclass (New!)

• Combo classes: can combine any of the above!

Minimum Class Sizes

If no classes have a group plan:• No minimum class size

If one or more classes have a group plan:• Some classes ( ) subject to minimums:

• Minimums apply to combo classes unless it’s the “waiting period” class

• Minimums only apply to “rating area” if designing a class smaller than a state

29

ICHRA Classes: Let’s get creative!

Employer Size (Employees) Minimum Class Size

< 100 10

100-200 10%

200+ 20

Understanding the Tax Waterfall• Expenses realized higher-up the

waterfall trickle down and save on taxes throughout

• Many people just take personal tax deductions on their 1040 form when they could take more

Note: We’re not CPAs! Make sure you or your client discuss any tax strategies with a professional (maybe that’s you) before implementing a strategy.

What about sole proprietor clients? Try to get as much of your client’s insurance as a “business expense” as legally possible

30

Summary of HRA Tax Strategies

31

Business Structure

CorporationC-Corp; Non-Profit; B-Corp;LLC taxed as a C-Corp

I Work by Myself(and have no plans to hire W-2 employees)

ProprietorshipSole Proprietorship; Single Member LLC

Other Pass-Through EntityS-Corp; Partnership; LLC taxed as an S-Corp or Partnership

I Have W-2 Employees(or plan to hire soon)

QSEHRA or ICHRA

Self-employed deduction

If you’re singleSelf-employed deduction

If you’re marriedHire spouse and setup QSEHRA

or ICHRA

QSEHRA or ICHRA for all

QSEHRA/ICHRA for W-2 employees, self-employed deduction for owners

QSEHRA/ICHRA for W-2 employees, self-employed deduction for owners

More Information: https://www.takecommandhealth.com/small-business-hra-guide

Coaching Tips and ResourcesHow you can help your clients

32

4

To fix health insurance, we need empowered consumers

Advocacy Empowerment Peace of Mind

A trusted source of truth

Tools for discernment

Products that protect

Healthcare is a significant opportunity for you tobuild credibility with your clients

33

We’re a software platform that turns ordinary people into savvy health insurance consumers

(and we love working with financial professionals)

34

XYPN + TCH: Let’s change the game

You look out for your clients’ overall financial well-being

We’ll be your “back-office” for health insurance

Coaching Tips: Individual Insurance Clients

• Choosing a Plan: Shopping• Shop every year before automatically renewing• Consider ALL of your options: on-exchange, off-exchange, sharing, alternative• Take time to check if your doctors are in network and your prescriptions on the

formulary

• IF considering an alternative plan:• Read the fine print• Minimum of $1M in annual coverage• Stay on the calendar year (so can flip back to major medical during Open

Enrollment if needed)

1

2

Automated Plan Choice Software

• Healthcare.gov

• “Off-exchange”

• Sharing & Alternative

COMPARE LIKE A PRO

• Universal doctor search

• Prescription search

• Cost of care estimates

AUTOMATIC ENROLLMENT

• Mobile friendlyweb form

• Automatic tax-credits

AWESOME ADVICE IN PLAIN LANGUAGE

Take Command guides clients with personalized, unbiasedhealth insurance shopping advice and helps them enroll online

DISCOVER MOREPLANS

TakeCommandHealth.com

Continue

37

We can help your individual clients in 14 states

38

Coaching Tips: Small Employers and Sole Proprietors

• Sole Proprietors• Try to get as much of your expenses as possible counted as a “business

expense”• If can’t do that, keep good records to take self-employment deduction• If really high expenses, consider changing to a C-Corp to setup QSEHRA or

ICHRA

• Small Employers• Consider QSEHRA and defined contribution

• Counted as a “business expense”• Control your budget• Let your employees choose

• Traditional Group Plans:• Beware of myths and pitfalls• Beware of getting oversold by aggressive brokers and agents

1

2

Employees request reimbursement for what they need

We make it easy and tax-free (and hassle-free)

We make HRA and “defined contribution” really simple for small business owners to setup and manage

40

How we work with XYPN advisors

How we can help you and your clients

Offer your clients special discounts-or-

Share a flat referral fee with you

Co-Branded Experience

Unbiased personalized advice

Resources, expertise, training, collateral

1

2

3

4

We’ll take care of your employees so you can run your business

We’ll take care of your employees so you can

run your business

Your logo and colors!

Health Insurance Tax Strategies:

https://www.takecommandhealth.com/small-business-hra-guide

QSEHRA Guide:

https://www.takecommandhealth.com/qsehra-guide

ICHRA Guide:

https://www.takecommandhealth.com/ichra-guide

Other questions?

Interested in learning more about Take Command Health?

https://www.takecommandhealth.com/financial-advisors

Additional Resources and Collateral

QSEHRA One-Page Flyer:Download

Thanks!Remaining Time for Q&A

43

Jack Hooper: CEO of Take Command Health

Jack Hooper is the CEO and founder of Take Command Health, a software company that empowers individuals and small business owners to make smart health insurance decisions. Founded in 2014, Take Command Health equips users with powerful, industry-first tools to help clients get the most out of their health insurance dollars.

Prior to Take Command Health, Jack was a strategy consultant for the Boston Consulting Group.

Jack earned his MBA from the Wharton School of Business where he focused on entrepreneurial management and has an engineering degree from Texas A&M University. Jack is married to his better half, Brittany, and has three boys and a dog named Moose.

44

![Welcome! []Examples of matching xy xy anywhere in string ^xy xy at beginning of string xy$ xy at end of string ^xy$ string that contains only xy ^ matches any string, even empty ^$](https://static.fdocuments.in/doc/165x107/60836582b1fa9828ec278d05/welcome-examples-of-matching-xy-xy-anywhere-in-string-xy-xy-at-beginning-of.jpg)