World real GDP growth in 2010 - Milken Institute · in five years As of Q1 2011 Rank Country...

Transcript of World real GDP growth in 2010 - Milken Institute · in five years As of Q1 2011 Rank Country...

World real GDP growth in 2010Annual percent change

Source: International Monetary Fund.

10% or more

6-10%

3-6%

0-3%Less than 0%No data

World real GDP growth in 2011Annual percent change

Source: International Monetary Fund.

10% or more

6-10%

3-6%

0-3%Less than 0%No data

Solid recovery

World real GDP grew by 5 percent in 2010

-6

-4

-2

0

2

4

6

8

10

1980 1985 1990 1995 2000 2005 2010 2015

Emerging and developing economies

Advanced economies

World

Real GDP growth, percent

Source: World Economic Outlook, International Monetary Fund, April 2011 update.

World output forecasts Percent change from previous year

2010 2011F 2012F

World 5.0 4.4 4.5

Advanced economies 3.0 2.4 2.6

United States 2.8 2.8 2.9

Japan 3.9 1.4 2.1

United Kingdom 1.3 1.7 2.3

Euro area 1.7 1.6 1.8

Emerging and developing economies 7.3 6.5 6.5

Brazil 7.5 4.5 4.1

China 10.3 9.6 9.5

India 10.4 8.2 7.8

Russia 4.0 4.8 4.5Source: World Economic Outlook, International Monetary Fund, April 2011.

Inflation risk ahead?Percent change in consumer prices (year-to-year)

0

1

2

3

4

5

6

7

8

9

10

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Emerging and developing economies

Advanced economies

World

Percent

Source: World Economic Outlook, International Monetary Fund, April 2010 update.

Inflation pressure rising in emerging countries

-2

0

2

4

6

8

10

12

14

16

18

2007 2008 2009 2010 2011

% change in consumer price index, 3-month rolling average

Brazil

China

IndiaRussia

Source: OECD, Milken Institute.

Inflation pressure rising in emerging countries

-2

0

2

4

6

8

10

12

14

16

18

2007 2008 2009 2010 2011

% change in consumer price index, 3-month rolling average

Brazil

China

IndiaRussia

Source: OECD, Milken Institute.

Emerging countries have tightened monetary policy

in fear of inflation

Target interest rates of central banks

0

2

4

6

8

10

12

14

16

2008 2009 2010 2011

Policy interest rates, percent

China

Brazil

India

India

Source: Bloomberg.

Implied volatility: U.S. vs. emerging markets

0

10

20

30

40

50

60

70

80

90

2004 2005 2006 2007 2008 2009 2010 2011

Chicago Board OptionsExchange Volatility

Index (VIX)

Implied volatility, percent

JPMorganEmerging MarketVolatility

Index (VXY)

Source: Bloomberg.

End of the era of cheap capital?Consensus forecasts: Central bank rates will increase in the next 12 months

0.0

0.5

1.0

1.5

2.0

2.5

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Percent

U.K.

U.S.

Eurozone

2.0

4.0

6.0

8.0

10.0

12.0

14.0

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Percent

Russia

China

Brazil

India

Source: Bloomberg.

Global imbalances on the rise againProjections after 2010

Sources: International Monetary Fund, Milken Institute.

Note: Discrepancies are not plotted.

-4

-3

-2

-1

0

1

2

3

1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016

U.S.

China

Emerging Asia

Oil exporting countries

Rest of world

Percent of world GDP

Performance of emerging bond marketsTotal return of JPMorgan EMBI Global indexes

Sources: DataStream, Milken Institute.

-1.7

22.4

-14.2

20.9

-6.7

17.3

-10.2

17.2

-11.1

16.7

-20

-15

-10

-5

0

5

10

15

20

25

2008 2009 to Q1 2011

Middle East Europe

Asia Africa

Latin America

Annualized total return, percent

The persistence of sovereign defaults

Argentina Ecuador Paraguay Uruguay Venezuela

• 1830

• 1890

• 1915

• 1930s

• 1982

• 2001

• 1832

• 1868

• 1911

• 1914

• 1931

• 1982

• 1999

• 2008

• 1827

• 1874

• 1892

• 1920

• 1932

• 1986

• 2003

• 1876

• 1891

• 1915

• 1933

• 1983

• 2003

• 1832

• 1878

• 1892

• 1898

• 1932

• 1998

Sovereign defaults in selected countries, 1824 to 2008

Sources: Sturzenegger and Zettelmayer (2006), Moody‘s, Milken Institute.

A map for world sovereign defaults

1932

1935

1932

1991

1991

19851983

2001

1812

18771892

19321981

1986

20041983

1983

1939

1972

2002

1932 2000

2008

19841982

2004

1984

2003

2003

‘87

1940

1932 1942

2002

1981

1982

1993

2000

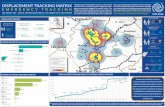

Sovereign debt most likely to default

in five years As of Q1 2011

Rank Country

Five-year cumulative

probability of default

(%) Rank Country

Five-year cumulative

probability of default

(%)

1 Greece 57.7 6 Ukraine 27.7

2 Venezuela 51.8 7 Dubai 24.7

3 Ireland 43.0 8 Lebanon 21.9

4 Portugal 40.1 9 Iraq 21.1

5 Argentina 34.7 10 Egypt 21.1Source: CMA Global Sovereign Credit Risk Report.

Note: Ranked by five-year cumulative probability of default.

Capital raised: Developing Asia attracts

the most funding after the crisis

Europe31%

Developing Asia27%

Western Hemisphere

24%

Middle East and North

Africa14%

Sub-Saharan

Africa4%

2002-2006

Developing Asia45%

Western Hemisphere

23%

Europe19%

Middle East and North

Africa10%

Sub-Saharan

Africa3%

2010

Source: International Monetary Fund.

Emerging markets: Equity markets have

returned to pre-crisis level

0

25

50

75

100

125

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

US$ index, 2007=100

Latin America

Eastern Europe

Emerging Asia

Source: Bloomberg.

Emerging market bond yield spreadsAs of April 8, 2011

9.57

5.534.88 4.61 4.55 4.49 4.27 3.88 3.47 3.19

2.59

0.62 0.52 0.32 0.210

2

4

6

8

10

12

Percent

Sources: Bloomberg, Milken Institute.

The education gap across regions

Source: Robert Barro and Jong-Wha Lee (2010).

9.2

61.2

88.1

77.1

45.9

67.1

76.1

16.1

2.3

17.424.5

32.6

7.7 7.9

33.2

1.30

10

20

30

40

50

60

70

80

90

100

Advanced

countries

Developing

countries

Middle East

and North

Africa

Sub-Saharan

Africa

Latin

America

East Asia

and the

Pacific

South Asia Europe and

Central Asia

1950

2010

Population with no schooling, percent of population age 15 and over

Average years of schooling increased dramatically

for developing countries in the past 60 years

6.22

2.05

0.761.28

2.571.77

1.02

4.83

11.03

7.09 7.12

5.23

8.26 7.94

5.24

9.65

0

2

4

6

8

10

12

Advanced

countries

Developing

countries

Middle East

and North

Africa

Sub-Saharan

Africa

Latin

America

East Asia

and the

Pacific

South Asia Europe and

Central Asia

1950 2010Average years of schooling

Source: Robert Barro and Jong-Wha Lee (2010).

Return on human capital

Source: Robert Barro and Jong-Wha Lee (2010).

12.1%13.3%

7.8%6.6% 6.5%

10.3%11.3%

8.5%

0%

2%

4%

6%

8%

10%

12%

14%

World Advanced countries

Middle East and North

Africa

Sub-Saharan Africa

Latin America

East Asia and the Pacific

South Asia Europe and Central Asia

Rate of return on an additional year of schooling, percent

Investment rates have increased across

all emerging market regions since 2000

21.4

n.a.

20.318.5

28.8

14.6

n.a.

19.321.4

19.623.6

35.2

23.620.2

24.126.4

21.9

26.4

43.939.5

22.1

05

101520253035404550

Africa Eastern Europe

Latin America Emerging Asia

excluding China and

India

China India Other emerging countries

1970

2000

2008

Investment,percent of GDP

Source: McKinsey Global Institute.

Emerging countries vs. developed countries

Investment in infrastructure as a share of GDP, nominal values

3.5

0.5

1.1

1.9

5.7

0.8

1.8

3.1

0 1 2 3 4 5 6

Total infrastructure

Telecom

Utilities

Transportation

% GDP Emerging economies

3.6

0.7

1.4

1.5

2.8

0.5

1

1.3

0 1 2 3 4

Total infrastructure

Telecom

Utilities

Transportation 2008

1980

Developed economies

Source: McKinsey Global Institute; McKinsey Global Economic Growth Database.

Ruben Vardanian slides

Population growth Percent

-1.0%

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

2007 2008 2009 2010 2011E

India

Brazil

China

Russia

Source: CIA 2010 World Factbook.

Birth and death ratesPro mille

0

5

10

15

20

25

Brazil India China Russia

Birth rate

Death rate

Source: CIA 2010 World Factbook.

Life expectancyYears

66.29

62 64 66 68 70 72 74 76

Russia

India

Brazil

China

Source: CIA 2010 World Factbook。

LiteracyPercent

99.40%

0% 20% 40% 60% 80% 100%

India

Brazil

China

Russia

Source: CIA 2010 World Factbook.

Quality of management schools

Source: Global Competitiveness Report 2007-2011.

Benchmark 2010 QATAR

Ran

kin

g

0

20

40

60

80

100

2007 2008 2009 2010

India

China

Brazil

Russia

Brain drain

30

40

50

60

70

80

90

2007 2008 2009 2010

India

China

Brazil

Russia

Source: Global Competitiveness Report 2007-2011.

Benchmark 2010 SWITZERLANDR

an

kin

g

Corporate spending on R&D

20

25

30

35

40

45

50

55

2007 2008 2009 2010

China

Brazil

India

Russia

Source: Global Competitiveness Report 2007-2011.

Benchmark 2010 SWEDEN

Ran

kin

g

Government spending on R&DPercent of GDP

1.1%

0%

1%

2%

3%

4%

Source: OECD, 2010.

Peter Dattels slides

less than 0

0 to 3

3 to 6

more than 6

no data

Average projected real GDP growth during 2011-2012(percent)

4.3

4.7

9.6

8.0

2.81.7

1.7

The two-speed global recovery posses challenges

Source: International Monetary Fund.

Will capital flowing into EMs create imbalances?

-1.5

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

1994 1996 1998 2000 2002 2004 2006 2008 2010

Z score

Capital flows

Real credit

Real equity prices

Asiancrisis

Russiacrisis

Start ofglobal

financialcrisis

Lehmancollapse

Source: International Monetary Fund.

EM banks expand lending while corporates

releverageReal credit and GDP growth(2008-10, in percent)

0

4

8

12

16

20Real credit growth

Real GDP growth

BRIC Countries: Debt-to-Equity

Ratios of the Corporate Sector (2005 = 100, Russia on right scale)

50

100

150

200

250

300

50

75

100

125

150

175

200

2005 2006 2007 2008 2009 2010e

Brazil: a) 182, b) 60

India: a)106, b) 21

Russia: a) 54, b) 21

China: a)108, b) 24

a) D/E ratio 2010, in percent

b) D/E ratio 2010, percentage points above average

1994-2009

Source: International Monetary Fund.

-5.0

-4.0

-3.0

-2.0

-1.0

0.0

1.0

2.0

South Africa

Russia Mexico Indonesia Chile India Brazil Malaysia China

2011 projected output gap

Emerging Economies

(percent of potential GDP)

Source: International Monetary Fund.

*Real policy rate is defined as current policy rate (Mar. 2011) minus 1-year ahead consensus inflation expectation normalized by its 5-year average (2005-10);

percentage points.

EM monetary policy: Falling behind the curve?

Country flags represent the real policy rate*

Advanced Economies

More structural policies

needed -- > Cleaning

• Banks:

• Mainly in Europe

• Transparency, Capital, Restructuring/Resolution

• Sovereigns:

• Most AEs

• Fiscal consolidation

• Households:

• Mainly in U.S., some European

• Reducing debt burdens

Emerging Markets

More macroeconomic policies

needed -- > Leaning

• Limit overheating and buildup of

financial risks:

• Tighten macro policies

• Use macro prudential/capital flow measures

• Absorb/channel inflows:

• Broaden and deepen local capital markets

Rebalancing the policy mix between AEs an EMs

Advanced Economies

More structural policies

needed -- > Cleaning

• Banks:

• Mainly in Europe

• Transparency, Capital, Restructuring/Resolution

• Sovereigns:

• Most AEs

• Fiscal consolidation

• Households:

• Mainly in U.S., some European

• Reducing debt burdens

More structural policies

needed -- > Legacy issues

Emerging Markets

More macroeconomic policies

needed -- > Leaning

• Limit overheating and buildup of

financial risks:

• Tighten macro policies

• Use macro prudential/capital flow measures

• Absorb/channel inflows:

• Broaden and deepen local capital markets

More macroeconomic policies

needed -- > Cyclical/growth challenges

Rebalancing the policy mix between AEs an EMs