Workshop on international accounting IV Conference on Insurance Regulation and Supervision in Latin...

-

Upload

mercy-collins -

Category

Documents

-

view

212 -

download

0

Transcript of Workshop on international accounting IV Conference on Insurance Regulation and Supervision in Latin...

Workshop on international accounting

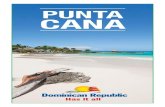

IV Conference on Insurance Regulation and Supervision in Latin America

Punta Cana, May 6-9 2003Makoto Okubo, Advisor

International Association of Insurance Supervisors (IAIS)

Workshop on international accounting 2 2 May 2003

Main itemsMain items

I. IASB Activities

II. IASB projects for insurance contracts

III. IASB projects for financial instruments (including contracts that do not qualify as insurance contracts)

IV. Existing accounting practices for insurers

V. Questions

Workshop on international accounting 3 2 May 2003

I. IASB ActivitiesI. IASB Activities• Why are international accounting standards in the limelight?

– Globalisation– Other standards setting activities, including other financial sectors– Convergence of accounting standards

• Seven liaison members (Australia & New Zealand, Canada, France, Germany, Japan, US, UK)

• The EU will require the use of IAS and IFRS for publicly traded companies by 2005 with some exemptions, after the EU assesses standards whether to endorse for use.

• FASB and IASB have issued a memorandum of understanding on October 2002 towards the harmonisation of US and international accounting standards.

• Many jurisdictions (including those in Latin America) approved IAS for use.

• Why is the role of the IAIS important in international accounting setting?

• Insurance regulators are key stakeholders in accounting setting. • Insurance regulators need to decide the extent to which regulatory reporting may be based

upon general-purpose financial statements. • Importance of the advice of the national insurance regulators in the implementation of

international accounting standards.

Workshop on international accounting 4 2 May 2003

I. IASB ActivitiesI. IASB Activities

• IASB Active Projects (examples) – Improvements to existing International Financial Reporting

Standards– Amendments to IAS 32, Financial Instruments: Disclosure and

Presentation, and IAS 39, Financial Instruments: Recognition and Measurement

– Activities of financial institutions: disclosures and presentation – Reporting performance – Insurance contracts, Phase I & Phase II – Concepts - revenue, liabilities and equity

• IASB Active Research Topics (examples)– Aspects of accounting for financial instruments – The application of international accounting standards to small and

medium-sized entities and in emerging economies

Workshop on international accounting 5 2 May 2003

FinancialAssets

And Liabilities

(other than insurance contracts)

JWG Launched

1997October

1997 1998 1999 2000 2001 2002 2003 20052004

Insurance contracts

Field Visit

Field Test?

Exposure Draft (2Q)

IFRS?

InsuranceSteering

Committee Launched

1997April

InsuranceIssues Paper

1999December

JWG Exposure

Draft

2000December

The Board starts

discussion on insurance

contracts 2001

November

Amendments to IAS39 Exposure

Draft 2002 June

IFRS?

ExposureDraft?

IFRS?

Phase I

Phase II

I. IASB activitiesI. IASB activities

Planned schedule of IASB projects on insurance

(Note) The international Joint Working Group of Standard Setters (JWG) was established by the IASC Board and other national accounting standard-setters to develop an integrated and harmonised standard on financial instruments, which proposed the full fair value model for financial assets and liabilities.

(Note) JWG was disbanded. Discussion on the full fair value approach for financial instruments was slowed down to an active research topic, while insurance project remains taking the approach.

(Note) On May 2002, the Board split its project on insurance contracts into two phases.

Workshop on international accounting 6 2 May 2003

Phase I Phase II

Scope - Accounting for insurance contracts - Accounting by policyholders is not addressed

in Phase I- It would not create a new category of financial

assets (financial assets held to back insurance liabilities) that could be held at amortised cost.

- Accounting for insurance contracts by both parties to those contracts (insurer and policyholder) and not other aspects of accounting by insurers or policyholder, such as investments held by insurers

Definition of insurance contract

- An insurance contract is defined as “a contract under which one party (the insurer) accepts significant insurance risk by agreeing with another party (the policyholder) to compensate the policyholder or other beneficiary if a specified uncertain future event (the insured event) adversely affects the policyholder or other beneficiary”;

- Some contracts that have the legal form of insurance are excluded from the definition of insurance contracts for accounting purposes (notably “investment contracts” under IAS39).

- This definition is used throughout IFRS and to change all scope exclusions in IFRS that refer to “insurance entities” to “insurance contracts” (for example, IAS18, IAS32, IAS37, IAS38 and IAS39)

Other issues - Scope exclusions- Embedded derivatives- Unbundling of some deposit-like components- Discretionary participating feature of an

investment contract

- Unbundling of individual elements of an insurance contract (to be discussed at a future meeting)- Discretionary participation feature of an insurance contacts (to be discussed at a future meeting)

II. IASB proposals for insurance contractsII. IASB proposals for insurance contracts

Workshop on international accounting 7 2 May 2003

Examples of items that are not insurance contracts under the proposed definition

Examples of insurance contracts under the proposed definitionInsurance against theft or damage to property

Insurance against product liability, professional liability, civil liability or legal expenses

Life insurance and prepaid funeral plans

Life-contingent annuities and pensions

Disability and medical cover

Surety bonds, fidelity bonds, performance bonds, bid bonds

Product warranties (Note: product warranties directly issued by manufactures and dealers are tentatively excluded)

Title insurance

Travel assistance

Some catastrophe bonds

Insurance swaps and other contracts that require a payment based on climatic, geological or other physical variables that cause an adverse effect on the holder of the contract

Reinsurance

Investment products that have the legal form of an insurance contract but do not expose the insurer to insurance risk

Contracts that have the legal form of insurance, but that pass all significant insurance risk back to the policyholders through mechanisms such as performance-linking

Self-insurance, in other words an entity’s decision to retain a risk that could have been covered by insurance

A contract (such as a gambling contracts) that requires a payment if a specified uncertain future event occurs, but does not require that the event adversely affects the policyholder or other beneficiary specified in the contract

Derivatives, in other words contracts that require one party to make payment based solely on financial risk, i.e. changes in one or more of a specified interest rate, security price, commodity price, foreign exchange rate, index of prices or rates, a credit rating or credit index or similar variable.

Contracts that require a payment based on climatic geological or other physical variables regardless of any adverse effect on the holder of the contract (commonly described as weather derivatives)

(Source International Accounting Standards Committee Foundation)

Note 1: Example of insurance contractsNote 1: Example of insurance contracts

Workshop on international accounting 8 2 May 2003

Phase I Phase IIRecognition and measurement

- The continuation of existing practices (national GAAP) with some exceptions

- A loss recognistion test should be included. - An insurer is prohibited from changing its

accounting policies that involve:- Measuring insurance liabilities on an

undiscounted basis- Creating or increasing a deliberate

overstatement of insurance liabilities - Reflecting future investment margins in

the measurement of insurance liabilities, for example, by using an asset-based discount rate

- Permitting subsidiaries to use non-uniform accounting policies for their insurance liabilities

- The asset-and-liability measurement model is used rather than a deferral and matching model.

- Full fair value approach: assets and liabilities arising from insurance contracts are measured at their fair value with two caveats (entity-specific assumptions / no recognition of net gain at inception for new contacts)

- Undiscounted measure is inconsistent with fair value. - Expectation about the performance of assets should

not be incorporated into the measurement of an insurance contract (unless the amounts payable depend on the performance of specific assets)

- Fair value measurement of an insurance contract reflects the credit characteristics of that contract, including the effect of policyholder protection schemes

- Policyholder behavior should be taken into account. - Acquisition cost recognised as expense when incurred

- An insurer should not recognise catastrophe or equalisation provisions- Offsetting reinsurance assets against the related direct insurance liabilities should be prohibited. - The same derecognition requirements for an insurer’s insurance liabilities as those for financial liabilities

Presentation and disclosure

- Fair value of insurance assets and insurance liabilities should be disclosed by 31 December 2006.

- All fair value changes in insurance assets and liabilities should be recognised in the income statement of the reporting year.

II. IASB proposals for insurance contracts (cont.)II. IASB proposals for insurance contracts (cont.)

Workshop on international accounting 9 2 May 2003

• The model is an asset-and-liability model in Phase II, rather than a deferral and matching model.

• An asset-liability-model would:– Measure the assets and liabilities that arise from insurance contract.– Define income or expense as an increase or decrease in economic

benefits during the accounting period, respectively.– Prohibit the recognition of assets or liabilities that do not meet the

Framework’s definition or recognition criteria, including deferred acquisition costs.

• A deferral and matching model would:– Recognise revenues and expenses from insurance contracts over time as

services are provided.– Premiums are deferred and recognised as revenues over the term of the

contract for short-term contracts and when received for longer-term contracts. – Acquisition costs are often deferred and amortised in order to match those

costs with related premium revenue over the term of the contract.

Note 2: Accounting models Note 2: Accounting models

Workshop on international accounting 10 2 May 2003

Income Statement

FV of current & future premiums XXXFV of current & future claims (XXX)Provision for risk and uncertainty XXXFV of current & future maintenance costs (XXX)Acquisition costs XXX Profit or loss from new business XXX

Changes to estimates for previous years’ business XXXProfit or loss from insurance business XXX

Changes by passage of time XXXChanges to discount rate XXXReturn on investments XXXProfit or loss from investing and XXXFinancing activities

Net profit or loss XXX

Balance Sheet

FV of assets XXXFV of liabilities XXX Equity XXX

A Simplified Example (Proposed Model): Asset-and-liability Measurement Approach

Income Statement Premium earned XXX Claims incurred (XXX) Amortisation of acquisition cost (XXX)Maintenance costs (XXX)Profit or loss from insurance business XXX

Investment income XXX(= Profit or loss from investing and Financing activities)

Net profit or loss XXX

Balance Sheet

Cash & Investments XXXDeferred acquisition cost XXXUnearned premiums XXXClaims payable XXX Claims incurred but not reported XXXEquity XXX

A Simplified Example (Traditional): Deferral and Matching Approach

Note 3: Accounting models (cont.) Note 3: Accounting models (cont.)

Workshop on international accounting 11 2 May 2003

IAS39 IAS39 Proposal JWG Proposal Financial assets Securities held for trading

- Fair value (P & L) Securities available for sale - Fair value (equity

or P&L)Securities held to maturity - Amortised costCash deposit - Amortised cost Loans - Amortised cost

Securities held for trading - Fair value (P & L) Securities available for sale - Fair value (equity only)Securities held to maturity - Amortised cost

or fair value (P&L)Cash deposit - Amortised cost

or fair value (P&L) Loans - Amortised cost

or fair value (P&L)

All financial assets - Fair value (P & L)

Financial liabilities -Amortised cost (except for liabilities arising from trading activities)

-Amortised cost or fair value (P&L)

All financial liabilities - Fair value (P & L)

Own debt (and insurance liabilities for contracts outside the scope)

-Amortised cost -Amortised cost or fair value (P&L, taking own credit risk into consideration)

- Fair value (P & L, taking own credit risk into consideration)

Hedge accounting Permitted under some conditions Permitted under some conditions Not permitted

III. IASB proposals for financial instruments III. IASB proposals for financial instruments (including contracts that do not qualify as insurance contracts)(including contracts that do not qualify as insurance contracts)

Workshop on international accounting 12 2 May 2003

Country Australia U.K. Canada U.S. France Germany Japan

Securities held by insurers

Stocks- Fair valueBonds- Fair value

[GAAP]StocksFair valueBonds-Fair value or Amortised cost

[SAP]Transferable within 97.5% of the market value - Fair valueOther transferable - Reasonably estimated value not exceeding the market valueNon-transferable - Reasonably estimated surrender or redemption value

Stocks- Acquisition cost adjustment (*1)

Bonds- Amortised cost

Assets held to cover specific policies ( i.e. universal life)- Market value

(*1) Adjustment reflects fair value change by 15% moving average method. Recognition in P&L by 15% of unrealized and capital gains each year.

[GAAP]Held for trading - Fair value (P&L) Available for sale- Fair value (equity)Held to maturity - Amortised cost

(Note)Shadow DAC adjustment

[SAP]Stocks- Fair valueBonds- Amortised cost(Note) For life, Asset Valuation Reserve (AVR)

Stocks- Acquisition cost (*2)

Bonds- Amortised cost or acquisition cost

(*2)Provision would be set up when overall realized value at current value falls below book value (for stocks and real estates)

(Note) Current value must be disclosed.

Stocks held for long-term (fixed assets) - Acquisition cost (*3)Stocks held for short-term (current assets)Lower of acquisition cost and current value

Bonds

- Amortised cost, notional amount, or lower of acquisition cost and current value (*3) Introduced by the legislation in 2002. Allowed only when fluctuation is deemed temporary.(Note) Current value must be disclosed.

Held for trading Fair value (P&L)

Available for saleFair value (equity)Held to maturity- Amotised cost

Bonds that correspond to policy reserves- Amortised cost

Technical provisions

Fresh startFor life, MOS (Margin on Service)

Prospective (prudent assumptions)Actuary has some discretion over the discount rate. FFA (Fund for future appropriations)

Fresh start

PAD (Provision for adverse deviation)

Actuarial report required

For non-life, a premium deficiency reserve needs to be booked if premiums do not cover future costs

Lock in Non-discountedActuarial report requiredPremium deficiency reserve needs to be booked if premiums do not cover future costs

Prospective (prudent assumptions)

Technical provisions cannot be below the surrender value

- Prospective (prudent assumptions)The maximum discount rate is fixedTechnical provisions cannot be below the surrender value

Lock in Additional reserves must be added, if deemed insufficient after the future cash flow analysis

IV. Existing accounting practice for insurersIV. Existing accounting practice for insurers

Workshop on international accounting 13 2 May 2003

Please discuss the following questions in your group and make a brief presentation. (5 minutes for each group)

1) Which of your jurisdictions have already used or plan to use international accounting standards?

(Note: The proposals may have an immediate impact in such jurisdictions. )

2) What are existing accounting practices for insurers in your jurisdictions?

3) What would be your implications if the proposed accounting changes should be adopted?

1) IAS39 and JWG

2) Phase I and Phase II

V. QuestionsV. Questions

Workshop on international accounting 14 2 May 2003

ReferencesReferences

• IASB Project summaries – IASB Project summary – Insurance Contracts (phase 1)

(Latest revision: 2003/04/07) – IASB Project summary – Insurance Contracts (phase 2)

(Latest revision: 2003/02/03)

• Use of IAS Around the World – http://www.iasb.org.uk

(Latest version 2002/07/11)

• IAIS comment letters to the IASB – http://www.iaisweb.org

Workshop on international accounting 15 2 May 2003

Country

Securities held by insurers

Stocks

Bonds

Stocks

Bonds

Stocks

Bonds

Stocks

Bonds

Stocks

Bonds

Stocks

Bonds

Stocks

Bonds

Technical provisions

Annex: Existing accounting practice for insurersAnnex: Existing accounting practice for insurers

![MAKOTO SAITO SCENE[0] · Makoto Saito and explore his yesterday, today, and tomorrow from multiple angles. Publication of the First Book of Makoto Saitoʼs Paintings In conjunction](https://static.fdocuments.in/doc/165x107/5f63fd3e28e8697dd12fd50b/makoto-saito-scene0-makoto-saito-and-explore-his-yesterday-today-and-tomorrow.jpg)