Working Capital Efficiency and Firm...

Transcript of Working Capital Efficiency and Firm...

Working Capital Efficiency

and Firm Profitability - A Quantitative Study of Listed

Swedish Firms 2000-2015

Master’s Thesis 30 credits

Department of Business Studies

Uppsala University

Spring Semester of 2017

Date of Submission: 2017-05-30

Oscar Gustén

Tobias Pahkamaa

Supervisor: Jan Lindvall

II

Abstract

This thesis examines the relationship between working capital efficiency and firm

profitability, and how this relationship is affected by economic fluctuations. In the existing

literature, the relationship between working capital efficiency and firm profitability has been

extensively researched. However, the impact of economic fluctuations on the relationship

between working capital efficiency and firm profitability is sparsely researched. To the best of

our knowledge, only Enqvist, Graham and Nikkinen (2014) have addressed the impact of

economic fluctuations on the relationship between working capital efficiency and firm

profitability. This thesis is a replication of their study in another geographical setting, another

time period and studying different types of firms.

Using a sample of 2,589 firm-year observations of listed Swedish firms for the years 2000-

2015, this thesis conducts multiple regression analysis to examine the relationship between

working capital efficiency and firm profitability. The findings of this thesis propose that firms

can enhance profitability by improving their working capital efficiency. However, the

relationship between working capital efficiency and firm profitability does not appear to be

significantly affected by economic fluctuations. This thesis contributes to the existing

literature by further strengthening the understanding of the relationship between working

capital efficiency and firm profitability. In addition, it also adds to the existing literature on

the relationship between working capital efficiency and firm profitability in a Swedish

context.

Keywords: working capital management, working capital efficiency, firm profitability, cash

conversion cycle, days of inventory, days of accounts receivables, days of accounts payables,

economic fluctuations

III

Table of Contents

Abstract ................................................................................................................................................. II List of tables ......................................................................................................................................... IV List of figures ....................................................................................................................................... IV List of abbreviations ............................................................................................................................. V 1. Introduction ....................................................................................................................................... 6 2. Literature review ............................................................................................................................... 8

2.1 Working capital management ........................................................................................................ 8 2.1.1 Strategies of working capital management ............................................................................ 9 2.1.2 Efficiency of working capital management .......................................................................... 11

2.2 Cash conversion cycle ................................................................................................................. 11 2.2.1 Inventory, accounts receivables and accounts payables ...................................................... 12

2.3 Working capital management and economic fluctuations ........................................................... 14 2.4 The original study: Frame, results, discussion and implications ................................................. 15 2.5 Hypotheses formulation .............................................................................................................. 17

3. Methodology..................................................................................................................................... 19 3.1 Replication................................................................................................................................... 19

3.1.1 The original study: Methodological review .......................................................................... 20 3.1.2 Thesis frame ......................................................................................................................... 21

3.2 Operationalization ....................................................................................................................... 22 3.3 Variable selection ........................................................................................................................ 23

3.3.1 Dependent variable .............................................................................................................. 23 3.3.2 Independent variables .......................................................................................................... 24 3.3.3 Dummy variables .................................................................................................................. 25 3.3.4 Control variables .................................................................................................................. 25

3.4 Regression models ....................................................................................................................... 26 3.5 Data ............................................................................................................................................. 27

3.5.1 Population and sample ......................................................................................................... 29 3.5.2 Statistical tools ..................................................................................................................... 30 3.5.3 Descriptive statistics ............................................................................................................. 30 3.5.4 Correlation matrix ................................................................................................................ 32 3.5.5 Data testing .......................................................................................................................... 33

4. Results .............................................................................................................................................. 35 4.1 Regression analysis: Return on assets ......................................................................................... 35 4.2 Regression analysis: Gross operating income ............................................................................. 38 4.3 Hypothesis testing ....................................................................................................................... 40

5. Discussion ......................................................................................................................................... 43 5.1 Working capital efficiency and firm profitability........................................................................ 43

5.1.1 Descriptive statistics and correlations ................................................................................. 47 5.2 Contributions to research ............................................................................................................. 47 5.3 Limitations of this thesis ............................................................................................................. 48 5.4 Replication as a scientific method ............................................................................................... 49

6. Conclusion ........................................................................................................................................ 51 6.1 Suggestions for future research ................................................................................................... 51

References ............................................................................................................................................ 53 Appendices ........................................................................................................................................... 58

Appendix A: Previous research ......................................................................................................... 58 Appendix B: Variable summarization and formulas ......................................................................... 62 Appendix C: Descriptive statistics .................................................................................................... 63 Appendix D: Statistical testing .......................................................................................................... 64

IV

List of tables

Table 1: Previous research on CCC and firm profitability .................................................................... 12 Table 2: Previous research on the individual components of CCC and firm profitability .................... 14 Table 3: Hypotheses group 1 ................................................................................................................. 18 Table 4: Hypotheses group 2 ................................................................................................................. 18 Table 5: Classification of economic downturns and economic booms ................................................. 29 Table 6: Descriptive statistics full sample ............................................................................................. 30 Table 7: Pearson’s correlation matrix.................................................................................................... 32 Table 8: Regression analysis ROA ........................................................................................................ 36 Table 9: Regression analysis GOI ......................................................................................................... 39 Table 10: Hypothesis testing group 1 .................................................................................................... 41 Table 11: Hypothesis testing group 2 .................................................................................................... 42

List of figures

Figure 1: Annual GDP growth (%) of Sweden 2000-2015 ................................................................... 28 Figure 2: Number of observations per year ........................................................................................... 30

V

List of abbreviations

AR Days of accounts receivables

AP Days of accounts payables

CCC Cash conversion cycle

CR Current ratio

DEBT Firm debt ratio

GDP Gross domestic product

GOI

INV

Gross operating income

Days of inventory

OLS Ordinary least squares

ROA Return on assets

SIZE

SMEs

Firm size

Small and medium-sized enterprises

6

1. Introduction

Working capital is a hot and ever-present topic in both business practice and research

(Arvidsson & Engman 2013 p. 9). It is an interesting and important topic because it affects the

operations and strategies of firms (Shin & Soenen 1998). Following the global financial crisis

in 2007-2008, working capital management has gained increased attention in business

practice due to its potential to free capital and cover the liquidity needs of firms (Kaiser &

Young 2009; PwC 2015). In business research, working capital management has been

suggested to impact firm profitability through its impact on firm liquidity (Wang 2002; Eljelly

2004) and a number of studies have concluded that firms can enhance profitability through

efficient management of working capital (e.g. Jose, Lancaster & Stevens 1996; Deloof 2003;

Garcia-Teruel & Martinez-Solano 2007).

The relationship between working capital efficiency and firm profitability has been suggested

to be dependent on country (Koralun-Bereźnicka 2014), industry (Jose et al. 1996) and firm

type (Howorth & Westhead 2003). In addition, working capital management has been

connected to the economic environment in different ways. Merville and Tavis (1973)

discussed how the economic environment affects the constituents of working capital, while

Filbeck and Krueger (2005) more precisely concluded that interest rates, innovation and

competition are the main determinants of working capital over time. Previous studies have

suggested that the working capital of firms is countercyclical (Einarsson & Marquis 2001) and

that firms with higher investments in working capital are hit harder in economic downturns

(Braun & Larrain 2005). However, how the relationship between working capital efficiency

and firm profitability is affected by economic fluctuations is barely researched.

Enqvist, Graham and Nikkinen (2014) studied the impact of business cycles on the

relationship between working capital efficiency and firm profitability among listed Finnish

firms for the years 1990-2008. They concluded that the importance of the relationship

between working capital efficiency and firm profitability varies with the economic

environment and, more specifically, increases in economic downturns. However, there is a

significant gap in the existing literature about the impact of economic fluctuations on the

relationship between working capital efficiency and firm profitability. To fill this gap, this

thesis is a replication study of Enqvist et al. (2014). This adds to the existing literature by

accumulating empirical knowledge to an under-researched field of working capital

management. Enqvist et al. (2014) suggested that their findings are generalizable to the

7

Nordic region as a whole. By drawing upon data from listed Swedish firms for the years

2000-2015, this thesis replicates their study in another geographical setting, another time

period and studying different types of firms. The relationship between working capital

efficiency and firm profitability is sparsely researched in the Swedish context, only addressed

by Yazdanfar and Öhman (2014) in their study of Swedish small and medium-sized

enterprises (SMEs) for the years 2008-2011. This approach will contribute to the

understanding of the relationship between working capital efficiency and firm profitability,

and how this relationship is affected by economic fluctuations in a Swedish context.

Additionally, this thesis contributes to the discussion about the importance of replication

studies in business research.

The aim of this thesis is to examine how the relationship between working capital efficiency

and firm profitability is affected by economic fluctuations among a sample of 2,589 firm-year

observations of listed Swedish firms for the years 2000-2015. Thus, the aim is two-folded.

Firstly, it examines the relationship between working capital efficiency and firm profitability.

In so doing, it contributes to the existing literature by adding findings from listed Swedish

firms. Secondly, it investigates how the aforementioned relationship is affected by economic

fluctuations. This thesis replicates the study of Enqvist et al. (2014) and tests their approach in

another context. The research question of this thesis is formulated:

What is the relationship between working capital efficiency and firm profitability, and

how is this relationship affected by economic fluctuations?

The findings of this thesis suggest that firms can enhance profitability by improving their

working capital efficiency. However, the relationship between working capital efficiency and

firm profitability does not appear to be affected by economic fluctuations among sampled

firms. Therefore, more research is encouraged in order to create an increased understanding of

how the economic environment impacts the relationship between working capital efficiency

and firm profitability.

The remainder of this thesis is structured as follows: in section 2 a review of the literature and

the hypotheses are presented; in section 3 the methodological approach is outlined; in section

4 the results of the statistical data analysis and hypothesis testing are presented; in section 5

the results are discussed, and in section 6 the main conclusions are discussed and suggestions

for future research are presented.

8

2. Literature review This thesis is a replication study of Enqvist et al. (2014). Replication studies are conducted

with the purpose to amass a cumulative body of knowledge. Therefore, it is crucial that the

replication study matches the research of the original study to the extent it is possible (Bettis,

Helfat & Shaver 2016). In this thesis, the study of Enqvist et al. (2014) is replicated in another

geographical setting, covering a different time frame and researching different types of firms

with a deeper discussion of the theoretical framework. In this section, a review of the

literature is presented in order to contextualize the research problem and provide the

theoretical background of this research field. Following the discussion of the literature, the

hypotheses of this thesis are formulated.

2.1 Working capital management

Working capital management is a key aspect of capital allocation because it has a direct

impact on the long-term growth opportunities of firms (Arvidsson & Engman 2013 p. 9).

Mauboussin and Callahan (2014) recognize capital allocation as the most fundamental

responsibility of top management. According to them, capital allocation is primarily

concerned with how capital is divided between business operations and claimholders. Within

business operations, capital allocation deals with the division of capital between capital

expenditure, research and development, mergers and acquisitions and working capital. As

such, working capital is a part of a wider business scope. This is an important notion because

working capital is not an isolated issue. By placing working capital in a wider context, its

importance for firms can be better understood.

Working capital is commonly defined as the excess of current assets over current liabilities

(Preve & Sarria-Allende 2010 p. 16). By this definition, working capital management is

concerned with how firms manage their current assets and current liabilities (Arvidsson &

Engman 2013 p. 9). These definitions of working capital and working capital management are

standard definitions in this field of research (e.g. Jose et al. 1996; Deloof 2003). As such,

working capital management has been viewed as all decisions made by management that

affect working capital (Kaur 2010). This means working capital management is a broad

concept including different managerial aspects. In early business research, working capital

was discussed as an analytical tool to analyze the financial position of firms (Guthmann 1934)

and later as an important information source for management (Park 1951). Sagan (1955)

suggested that active management of working capital is a determinant of firm strategy and

9

ultimately of firm performance. Following this discussion, Bierman, Chopra and Thomas

(1975) proposed that working capital serves two purposes. Firstly, working capital is a

financial buffer. This is important because it protects the firm from uncertainty and provides

the means necessary to act on opportunities that arise. Secondly, working capital is a means of

increased earnings. Through investment in working capital, firms can e.g. employ more

generous credit policies which are assumed to increase profits. Filbeck and Krueger (2005)

concluded that working capital management is a determinant of firm strategy and a crucial

success factor of firms. Working capital management has been suggested to be firm-specific

(Merville & Tavis 1973) but more often it has been discussed as dependent on firm type

(Howorth & Westhead 2003), industry-specific (Shin & Soenen 1998) or country-specific

(Koralun-Bereźnicka 2014).

Bierman et al. (1975) proposed working capital management to be concerned with both firm

liquidity and firm profitability. However, others have regarded working capital management

rather as a trade-off between firm liquidity and firm profitability (Raheman & Nasr 2007;

Eljelly 2004). Ebben and Johnson (2011) concluded that efficient utilization of working

capital can improve both firm liquidity and firm profitability. Capital has an opportunity cost

and working capital management is concerned with a balance between the components of

working capital in order to maintain firm operations, while not binding excessive capital in

working capital (Garcia-Teruel & Martinez-Solano 2007). As such, working capital

management is a crucial part of firm operations that ultimately affects firm profitability

through its effects on firm liquidity (Arunkumar & Radharamanan 2011). In recent years, a

growing body of research has connected increased efficiency of working capital management

to improved firm profitability (e.g. Jose et al. 1996; Deloof 2003; Garcia-Teruel & Martinez-

Solano 2007).

2.1.1 Strategies of working capital management

Garcia-Teruel and Martinez-Solano (2007) discuss how firms must consider a balance

between profitability and risk when deciding strategy of working capital management. They

argue that this is because decisions that tend to increase profitability tend to increase the risk

and vice versa. Following their discussion, they suggest that working capital management can

be divided in two principal strategies with direct impact on the working capital of firms.

Aggressive strategies are directed towards the minimization of working capital in order to

maximize profitability. Conservative strategies are accepting higher levels of working capital

10

in order to maintain stable and uninterrupted firm operations. These contrasting strategies will

impact firm operations through different effects on the relationship between risk and

profitability.

Aggressive and conservative strategies of working capital management affect firm operations

in different ways (Jose et al. 1996; Garcia-Teruel & Martinez-Solano 2007). All such

decisions affect the interaction between risk and profitability. More specifically, aggressive

strategies of working capital management actively seek a reduction in working capital in order

to maximize the efficiency of operations. This can be achieved through e.g. lower levels of

inventory holdings (Jose et al. 1996) or tighter credit policies (Garcia-Teruel & Martinez-

Solano 2007). Such decisions free capital for use elsewhere within firms (Arvidsson &

Engman 2013 p. 12) and can be seen as a flexible source of financing that lower the capital

costs of firms (Deloof 2003). It also comes with a potential risk of lower sales due to e.g.

stock-outs (Jose et al. 1996) or customers requiring credits buying elsewhere (Garcia-Teruel

& Martinez-Solano 2007). Conservative strategies of working capital management will accept

higher levels of working capital. This will bind more capital in working capital and increase

the capital cost of firms (Arvidsson & Engman 2013 p. 12). Such decisions will lower the risk

of operations but these benefits are often at the price of lower profitability due to higher

investment in current assets (Garcia-Teruel & Martinez-Solano 2007). Deloof (2003) discuss

that higher levels of working capital can be a result of increased sales or a necessity in order

to meet the demands from customers. He concludes that firm profitability will increase as

long as the costs of increasing sales do not exceed the benefits of the same.

Deloof and Jegers (1996) suggest that firms’ strategy of working capital management will be

affected by their positions in different networks. This has been discussed by Ng, Smith and

Smith (1999) who suggest that the credit policies of firms will affect their long-term

relationships with customers. Further, Deloof (2003) proposes that more profitable firms pay

their suppliers earlier, while Garcia-Teruel and Martinez-Solano (2007) argued that it makes

economic sense to keep capital within firms as long as possible in order to lower the capital

costs of firms. This must be put in relation to firms’ positions in networks and their long-term

relationship with suppliers. These perspectives have often been neglected in previous

research. However, it is possible that the benefits of long-term relationships may counter the

increasing costs of higher investments in working capital.

11

2.1.2 Efficiency of working capital management

How firms approach working capital will affect firm strategy through its effects on especially

the management of inventory, accounts receivables and accounts payables (Deloof 2003).

Filbeck and Krueger (2005) proposed that the purpose of the working capital management of

firms is to obtain and maintain the optimum of each of the components of working capital. In

their view, efficient management of inventory, accounts receivables and accounts payables are

crucial in order to reduce external and internal financing costs, and ultimately increase firm

profitability. Traditional measures of the financial health of firms, such as current ratio (CR)

or quick ratio, will focus attention on the wrong things (Hager 1976; Richards & Laughlin

1980). Instead of optimizing working capital, they will encourage firms to maintain higher

levels of inventory and accounts receivables in relation to accounts payables and these must

be financed by debt and equity (Ebben & Johnson 2011). Working capital efficiency is better

captured by the cash conversion cycle (CCC), as it measures the efficiency of firms’

management of inventory, accounts receivables and accounts payables, and not only the

relation between current assets and current liabilities (Gitman 1974).

2.2 Cash conversion cycle

The CCC is a dynamic measure of the ongoing liquidity management of firms that combines

both balance sheet and income statement data, to create a measure with a time dimension

(Jose et al. 1996). The CCC consists of days of inventory (INV), days of accounts receivables

(AR) and days of accounts payables (AP), and captures the time lag between the purchase of

input goods and services to the collection of payment from customers (Arvidsson & Engman

2013 p. 23). As such it is also an operating variable measuring the working capital efficiency

of firms (Garcia-Teruel & Martinez-Solano 2007). While the CCC has been regarded as a

better measurement of firm liquidity than traditional measures (Eljelly 2004), it must be clear

that it has its limitations. Cagle, Campbell and Jones (2013) note that the CCC does not fully

consider current liabilities. As an effect, constituents of current liabilities, such as interest,

payroll and taxes are not considered. These may also have a significant impact on firm

liquidity, and ultimately on firm profitability. Despite this limitation, the CCC is the most

commonly used measure of working capital efficiency in a vast research tradition of working

capital (e.g. Jose et al. 1996; Shin & Soenen 1998; Deloof 2003; Garcia-Teruel & Martinez-

Solano 2007).

12

In this research tradition, a lower CCC is an indicator of higher working capital efficiency. A

vast majority of previous research has found a negative relationship between CCC and firm

profitability (see table 1 below). To the best of our knowledge, there are only two studies

presenting a positive relationship between CCC and firm profitability. Lyroudi and Lazaridis

(2000) examined the relationship between working capital efficiency and firm profitability

among firms in the Greek food industry for the year 1997, and found a positive relationship

between CCC and firm profitability. However, other studies on specific industries have

consistently found a negative relationship between CCC and firm profitability (e.g. Padachi

2006; Ganesan 2007). Sharma and Kumar (2011) studied the effects of working capital

efficiency on firm profitability of Indian firms for the years 2000-2008, and found a positive

relationship between CCC and firm profitability. They suggest that the relationship between

working capital efficiency and firm profitability may be different in emerging markets.

However, other studies in emerging markets have consistently found a negative relationship

between CCC and firm profitability (e.g. Falope & Ajilore 2009; Mathuva 2010). While

Lyroudi and Lazaridis (2000) and Sharma and Kumar (2011) present a positive relationship

between CCC and firm profitability, a large number of studies present a strong case for a

negative relationship between CCC and firm profitability. Previous research is summarized in

table 1 below (for a more detailed presentation of previous research, see appendix A.1).

Table 1: Previous research on CCC and firm profitability

Effect →

Variable

↓

Significant negative relationship with firm

profitability

Significant positive relationship with firm

profitability

CCC Jose, Lancaster & Stevens (1996)

Shin & Soenen (1998)

Wang (2002)

Deloof (2003)

Eljelly (2004)

Lazaridis & Tryfonidis (2006)

Garcia-Teruel & Martinez-Solano (2007)

Falope & Ajilore (2009)

Gill, Biger & Mathur (2010)

Mathuva (2010)

Ebben & Johnson (2011)

Yazdanfar & Öhman (2014)

Lyroudi & Lazaridis (2000)

Sharma & Kumar (2011)

2.2.1 Inventory, accounts receivables and accounts payables

Jose et al. (1996) conceptualize how the strategy of working capital will affect a firm’s CCC.

An aggressive strategy will aim to minimize working capital through shortening of the CCC,

while a conservative strategy will accept higher levels of working capital. Expressed as the

13

function of CCC, an aggressive strategy will aim to achieve lower INV, lower AR and higher

AP in order to minimize the capital bound in working capital and thereby maximizing firm

profitability. A conservative strategy will accept higher levels of working capital in order to

maintain stable and uninterrupted firm operations. This view is problematized by Deloof

(2003) who suggests that a longer CCC might be a consequence of higher sales and thus

increasing profitability. However, if the costs of higher levels of working capital rise faster

than the benefits of e.g. larger inventory holdings or looser credit policies, firm profitability

will be negatively affected by a higher CCC.

Management of inventory, accounts receivables and accounts payables will affect the risk and

profitability of firm operations (Garcia-Teruel & Martinez-Solano 2007). Thus, the

optimization of the components of CCC must affect firm operations. Firstly, INV can either

be kept at a bare minimum or above minimum levels. Lower INV will decrease the cost of

holding inventory and therefore increase the efficiency of operations (Deloof 2003; Enqvist et

al. 2014). However, it will also increase the risk as firms are e.g. risking losing sales due to

stock-outs (Jose et al. 1996; Gill et al. 2010). Secondly, AR can be kept higher or lower.

Lower levels of accounts receivables will decrease the cost of capital and increase firm

efficiency (Deloof 2003; Lazaridis & Tryfonidis 2006). It can also increase the risk because

the firm might e.g. lose customers that require credits (Jose et al. 1996; Sharma & Kumar

2011). Thirdly, AP can be adjusted with different outcomes on the relationship between risk

and efficiency. The longer a firm delays their payments to suppliers, the lower the CCC. This

will decrease the cost of capital, because the capital is kept within the firm for as long as

possible. Higher AP might lead to e.g. negative responses from suppliers (Jose et al. 1996).

However, Deloof (2003) points out that accounts payables can be used as an inexpensive and

flexible source of financing which can be used to increase profitability.

In previous research, increased working capital efficiency has been regarded as lower INV,

lower AR and higher AP. INV and AR have consistently been found to have a negative

relationship with firm profitability. From a theoretical point of view, AP has been assumed to

have a positive relationship with firm profitability. However, previous research has more

often found a negative relationship between AP and firm profitability. Previous research is

summarized in table 2 below (for a more detailed presentation of previous research, see

appendix A.2).

14

Table 2: Previous research on the individual components of CCC and firm profitability

Effect →

Variable

↓

Significant negative relationship with firm

profitability

Significant positive relationship with firm

profitability

INV Deloof (2003)

Lazaridis & Tryfonidis (2006)

Garcia-Teruel & Martinez-Solano (2007)

Falope & Ajilore (2009)

Sharma & Kumar (2011)

Enqvist, Graham & Nikkinen (2014)

Mathuva (2010)

AR Deloof (2003)

Lazaridis & Tryfonidis (2006)

Falope & Ajilore (2009)

Gill, Biger & Mathur (2010)

Mathuva (2010)

Sharma & Kumar (2011)

AP Lazaridis & Tryfonidis (2006)

Falope & Ajilore (2009)

Sharma & Kumar (2011)

Enqvist, Graham & Nikkinen (2014)

Mathuva (2010)

2.3 Working capital management and economic fluctuations

Merville and Tavis (1973) suggest that the different components of working capital

management are in interplay with each other as well as with the economic environment.

According to them, working capital must be affected by economic fluctuations. A natural

consequence of this is that the optimization of the individual firm’s working capital

management must take economic fluctuations into consideration. Filbeck and Krueger (2005)

discussed how working capital management changes over time. They concluded that working

capital management change over time because of influences from interest rates, innovation

and competition. In addition, they found that many of the variations in working capital

practices and working capital performance may be caused by economic fluctuations. Different

types of firms are affected differently by economic fluctuations, which lead to different

influences on working capital management.

Einarsson and Marquis (2001) examined the relationship between working capital

management policies and business cycles. They focused on the degree to which firms rely on

external financing to finance working capital over business cycles in the US for the years

1960-1994. Their findings suggest that firms’ external financing of working capital is

countercyclical and that it increases in economic downturns. In line with this, Braun and

Larrain (2005) studied a sample of 57,538 observations from over 100 countries to investigate

15

the link between external financing and growth over business cycles for the years 1963-1999.

Their results suggest that industries that are more dependent on external financing are hit

harder in economic downturns. Industries with higher working capital also relied more on

external financing. An implication of this is that working capital management plays an

important role in the financing of firms, and the way that firms are financed will affect their

performance. Higher working capital efficiency will decrease the need of external financing

and ultimately increase firm profitability.

In previous research, working capital management has been connected to the economic

environment (e.g. Merville & Tavis 1973; Filbeck & Krueger 2005; Enqvist et al. 2014). The

economic environment has been discussed as economic uncertainty over time (Merville &

Tavis 1973) and changes across time due to the factors interest rates, innovation and

competition (Filbeck & Krueger 2005). In addition, Enqvist et al. (2014) discussed business

cycles on the basis of the variation in the annual growth of the gross domestic product (GDP)

in relation to the long-term growth trend of GDP. This is a narrow definition of business

cycles. This thesis is not concerned with understanding the business cycle, but rather

examining the effects of a changing economic environment on the relationship between

working capital efficiency and firm profitability. While there are different economic theories

making different claims regarding the origins and functions of business cycles, in this thesis it

is sufficient to conclude that economic fluctuations have persisted and forms unsystematic but

regular patterns of economic activity (Schön 2013 p. 24). Aggregated economic activity on a

national level is normally measured using GDP. GDP captures the market value of all final

goods and services produced within a nation for a given time period. Economic fluctuations

are normally measured as fluctuations in annual GDP growth (e.g. Neumeyer & Perri 2005;

Enqvist et al. 2014). For this reason, unlike Enqvist et al. (2014), this thesis does not

conceptualize economic fluctuations as business cycles. The same concept is measured in this

thesis but with a different definition in comparison to Enqvist et al. (2014).

2.4 The original study: Frame, results, discussion and implications

Enqvist et al. (2014) examined the role of business cycles, measured as GDP fluctuations, on

the relationship between working capital efficiency and firm profitability (for a

methodological review, see 3.1.1). Firm profitability was measured by return on assets (ROA)

and gross operating income (GOI). Using a sample of 1,136 firm-year observations of listed

Finnish firms for the years 1990-2008, they found a negative relationship between CCC and

16

firm profitability. In addition, the significance of this relationship increased in economic

downturns. Further, they examined the relationship between INV, AR and AP, and firm

profitability. Their findings suggest a significant negative relationship between INV and firm

profitability. This relationship was enhanced in economic downturns. They found a negative

but insignificant relationship between AR and firm profitability. This relationship was

enhanced in economic downturns but unchanged in economic booms. The relationship

between AP and firm profitability was significantly negative, but did not change with

economic fluctuations. Lastly, the relationship between the control variables and firm

profitability was tested. They found a significant positive relationship between CR and firm

profitability. Firm debt ratio (DEBT) was found to have a negative relationship with firm

profitability, however, this relationship was only significant in relation to ROA. Firm size

(SIZE) was found to be negatively related to firm profitability. For the dummy variables, they

found that firm profitability increased during economic booms and decreased during

economic downturns.

Enqvist et al. (2014) suggest there are optimal levels of working capital for firms and that this

optimum will vary with economic fluctuations. This leads them to conclude that quicker

inventory turnover, quicker collection of accounts receivables and shorter cycles of accounts

payables enhance firm profitability. Further, the business environment affects firm

profitability. In economic downturns the profitability of firms decreases, while in economic

booms it increases. In addition, the impact of efficient working capital management increases

in economic downturns because the importance of efficient inventory management and

efficient collection of receivables increases.

A practical business implication of this is that investments in working capital are crucial for

firms and firms should incorporate working capital management in their daily routines.

Enqvist et al. (2014) further suggest their findings have implications for national economic

policy. Firms generate income and employment opportunities, why they are important

functions of the economy. As such, national economic policy has an interest and opportunity

to boost the cash flow of firms. This would increase firms’ ability to finance working capital

internally, especially in economic downturns. Lastly, they suggest that their findings can be

generalized to the Nordic region as a whole.

17

2.5 Hypotheses formulation

There are two groups of hypotheses in this thesis. The first group, hypothesis 1-4, tests the

relationship between working capital efficiency and firm profitability. The second group,

hypothesis 5-8, tests how the relationship between working capital efficiency and firm

profitability is affected by economic fluctuations. Working capital efficiency has in previous

studies been measured using the CCC. The CCC captures the time lag between the purchases

of inputs to the collection of sales. As such, it adds a time dimension that static measurements

do not have. Working capital efficiency has been suggested to shorten the CCC (e.g. Jose et

al. 1996; Shin & Soenen 1998; Deloof 2003). This because a shorter CCC means less capital

is bound in working capital and therefore firms should aim to decrease their CCC through

lower INV, lower AR and higher AP (Arvidsson & Engman 2013 p. 11).

From a theoretical perspective, this is intuitive as less capital bound in working capital frees

capital to be used elsewhere within firms. As a result, firms will be less dependent on external

financing (Filbeck & Krueger 2005) which lower the cost of capital of firms (Deloof 2003).

Through increased working capital efficiency, firms can generate increased internal financing

as a means to e.g. increase profitability (Bierman et al. 1975). In addition, previous research

has found a negative relationship between CCC, INV, AR, AP, and firm profitability. As

such, there is a discrepancy between theory and empirical findings regarding the relationship

between AP and firm profitability. Deloof (2003) argues that more profitable firms pay their

suppliers earlier, while Garcia-Teruel and Martinez-Solano (2007) suggest that higher AP

should lead to increased firm profitability because capital will be kept within firms resulting

in lower capital costs and higher internal financing.

Therefore, in this thesis, there is an expected negative relationship between CCC and firm

profitability, an expected negative relationship between INV and firm profitability, an

expected negative relationship between AR and firm profitability, and an expected positive

relationship between AP and firm profitability. To examine the relationship between working

capital efficiency and firm profitability the same hypotheses as Enqvist et al. (2014) are

tested. The hypotheses are formulated:

18

Table 3: Hypotheses group 1

Hypothesis Prediction

Hypothesis 1 There is a negative relationship between CCC and firm profitability

Hypothesis 2 There is a negative relationship between INV and firm profitability

Hypothesis 3 There is a negative relationship between AR and firm profitability

Hypothesis 4 There is a positive relationship between AP and firm profitability

Working capital management has been discussed to be affected by economic fluctuations

(Einarsson & Marquis 2001; Braun & Larrain 2005). In addition, CCC, INV, AR and AP

have been suggested to depend on the economic environment (Merville & Tavis 1973;

Filbeck & Krueger 2005; Enqvist et al. 2014). An interpretation of this is that firms must take

economic fluctuations in consideration if they want to optimize their working capital

management. Enqvist et al. (2014) suggested that the relationship between working capital

efficiency and firm profitability is more pronounced in economic downturns. To examine the

impact of economic fluctuations on the relationship between working capital efficiency and

firm profitability the same hypotheses as Enqvist et al. (2014) are tested. The hypotheses are

formulated:

Table 4: Hypotheses group 2

Hypothesis Prediction

Hypothesis 5a The significance of the relationship between CCC and firm profitability increases

during economic downturns

Hypothesis 5b The significance of the relationship between CCC and firm profitability decreases

during economic booms

Hypothesis 6a The significance of the relationship between INV and firm profitability increases

during economic downturns

Hypothesis 6b The significance of the relationship between INV and firm profitability decreases

during economic booms

Hypothesis 7a The significance of the relationship between AR and firm profitability increases during

economic downturns

Hypothesis 7b The significance of the relationship between AR and firm profitability decreases during

economic booms

Hypothesis 8a The significance of the relationship between AP and firm profitability increases during

economic downturns

Hypothesis 8b The significance of the relationship between AP and firm profitability decreases during

economic booms

19

3. Methodology

The aim of the thesis is to examine the relationship between working capital efficiency and

firm profitability, and how this relationship is affected by economic fluctuations. In addition,

there is also a methodological discussion in regards to the use of replication in business

research. In this section, the methodological approach of this thesis is presented. Firstly,

replication as a research method is discussed in order to provide a foundation and

understanding for replication as a scientific method as well as motivating the relevance of

replication in this specific case. Secondly, a summarization of the methodology of Enqvist et

al. (2014) is presented. This is a necessity, as it provides the background of the frame of

replication of this thesis. Thirdly, the operationalization of the relationship between working

capital efficiency and firm profitability in regards to economic fluctuations is discussed.

Fourthly, the variables of the study are presented, defined and discussed. The variable

discussion is concluded with a presentation of the regression models. Lastly, the data is

presented and discussed.

3.1 Replication

Replication forms an essential part of the scientific method (Dewald, Thursby & Anderson

1986). While replication is common practice in the natural sciences, there has been a

reluctance to conduct replication studies in the social sciences (Evanschitzky, Baumgarth,

Hubbard & Armstrong 2007). Common arguments against replication studies, within the

social sciences, are that researchers will not be awarded for replicating other researchers’

findings, that researchers conducting replication studies lack imagination or that replication

studies are a reflection of lack of trust in the original study (Dewald et al. 1986; Bryman &

Bell 2015 p. 50). While these are valid concerns, they do not form enough support to discard

replication as a necessary part of the scientific method. Mittelsteadt and Zorn (1984) conclude

that what cannot be replicated is not worth knowing. They mean that both confirmation and

disconfirmations contribute to the existing knowledge. Confirmations increase the

generalizability of the findings of previous studies while disconfirmations propose that new

approaches must be tested.

Bettis et al. (2016) call for more replication studies for reasons based on both business

practice and research. What business practice is concerned, business research studies

oftentimes give implications for business practice. Single empirical studies are bound to the

specific context of the study and cannot establish whether the findings can be generalized to

20

other contexts. Replication, on the other hand, can amass an accumulated body of knowledge

that better supports the implications from business research to business practice. What

business research is concerned, replication in its nature, tests the replicability of prior studies

and if they can be reproduced in different contexts. An interpretation of those arguments holds

that, in order to accumulate knowledge, replication studies are crucial. If studies and findings

are not tested or replicated, there are only one-shot studies, and practitioners and researchers

alike should request more support before basing decisions on untested results (Evanschitzky

et al. 2007).

Evanschitzky et al. (2007) noted that replication studies saw an increasing trend during the

years 1974-1989 but that there was a slow down during the years 1990-2004. As a result, the

editorial policies of leading journals started to encourage more replication studies.

Duvendack, Palmer-Jones and Reed (2015) noted an up going trend in replication studies

from the early 2000s and forwards. However, they conclude that replication studies are still a

small element in the social sciences.

3.1.1 The original study: Methodological review

The study of Enqvist et al. (2014) “The impact of working capital management on firm

profitability in different business cycles: Evidence from Finland” was published in Research

in International Business and Finance. Research in International Business and Finance seek to

highlight the interaction between finance and broader societal concerns. This affects the focus

of the journal and the studies that are published. Research in International Business and

Finance is an American based journal, ranked 458 of 1370 by Scimago Journal & Country

Rank in the category of business, management and accounting (Scimagojr 2017).

Enqvist et al. (2014) used a quantitative method in their study. Using a sample of non-

financial listed Finnish firms, they examined the relationship between working capital

efficiency and firm profitability and how it is affected by business cycles. The data was

collected for the years 1990-2008 from the Research Institute of the Finnish Economy. The

sample consisted of an unbalanced panel of 1,136 firm-year observations. To study the

relationship between working capital efficiency and firm profitability, and how it is affected

by business cycles, multiple regression analysis was conducted. The variables used in the

study were ROA, GOI, CCC, INV, AR, AP, CR, SIZE and DEBT. Working capital efficiency

was operationalized as CCC and its individual components. Firm profitability was

21

operationalized as ROA and GOI respectively. CCC, INV, AR and AP were the independent

variables, while ROA and GOI were proxies of the dependent variable firm profitability. The

control variables in the study were CR, SIZE and DEBT. The regression models were also

controlled for influences of year and industry. Business cycles were captured using changes in

annual GDP growth, and the five years showing the lowest respectively the highest annual

GDP growth forms two different states of the economy used to capture the influences of

business cycles. As such, two dummy variables were included in the study to compare the

different states of the economy with the full time period. D1 captured economic downturns

and D2 captured economic booms. The hypotheses were formulated as in this thesis (see table

3 and table 4) and were tested at the 1%, 5% and 10% significance levels (Enqvist et al.

2014).

3.1.2 Thesis frame

In the original study, Enqvist et al. (2014) draw conclusions with implications for both

business practice and research. However, these findings must be tested further in order to

build a cumulative body of knowledge. With a focus on another geographical setting, another

time frame and different types of firms, this thesis contributes to the understanding of the

relationship between working capital efficiency and firm profitability. While the relationship

between working capital efficiency and firm profitability has been extensively researched,

how this relationship is affected by economic fluctuations is less researched. Therefore, it is

important to further examine the impact of economic fluctuations on the relationship between

working capital efficiency and firm profitability. By replicating the study of Enqvist et al.

(2014), the replicability of their study and the generalizability of their findings can be tested

in another context. This approach adds to the understanding of the relationship between

working capital efficiency and firm profitability and how this relationship is affected by

economic fluctuations.

Bettis et al. (2016) point at the importance to match the research design of the original study

as closely as possible. The reasoning behind is, that it is crucial to calibrate the replication

with the original study. If this cannot be done, it is difficult to build a cumulative body of

knowledge. For this reason, this thesis employs the same method as Enqvist et al. (2014) to

the extent it is possible. The same theoretical starting points are used, the same statistical

approach is conducted and the hypotheses are formulated and tested in the same manner.

22

However, in order to contribute to the cumulative body of knowledge, the replication is done

in another context. The replication is conducted in another geographical setting during another

time period studying different types of firms. In addition, there is a deeper theoretical

discussion of the relationship between working capital efficiency and firm profitability. This

will increase the understanding of how working capital efficiency affects firm profitability in

a broader context, and more specifically, how this relationship is influenced by economic

fluctuations.

3.2 Operationalization

In accordance with the reasoning of Bettis et al. (2016), this thesis tries to match the original

study to the extent it is possible. Therefore, the hypotheses in this thesis are formulated and

tested in the same manner as in the study of Enqvist et al. (2014). Multiple regression analysis

is conducted in order to examine the relationship between working capital efficiency and firm

profitability. Working capital efficiency is measured using the CCC and firm profitability is

measured by ROA and GOI respectively. More specifically, there are two groups of

hypotheses. The first group tests the relationship between working capital efficiency and firm

profitability for the entire time period. In so doing, the CCC and its individual components are

tested against ROA and GOI. The second group tests how this relationship is affected by

economic fluctuations. Economic fluctuations are captured as changes in annual GDP growth

around its long-term trend. Firm profitability is the dependent variable and ROA and GOI are

used as proxies of firm profitability. However, firm profitability may be explained by other

factors. For this reason, control variables are included in the analysis. The control variables

are CR, SIZE and DEBT. In addition, the regression models also control for the influence of

firm, year and industry. The independent variables are CCC, INV, AR and AP and thus

measures working capital efficiency.

In order to examine how the relationship between working capital efficiency and firm

profitability is affected by economic fluctuations, changes in annual GDP growth around its

long-term trend has been used to categorize different states of the economy. The states of the

economy are categorized by the five years showing the lowest respectively the highest annual

GDP growth, and are then compared to the entire time period. The five years showing the

lowest annual GDP growth are referred to as economic downturns. The five years showing the

highest annual GDP growth are referred to as economic booms. D1 is the dummy variable for

23

the conditions of economic downturns and D2 is the dummy variable for the conditions of

economic booms.

3.3 Variable selection

In regression analysis, the relationship between two or more variables is studied in order to

assess whether the variation in one can explain the variation in the other. In multiple

regression analysis, there is more than one independent variable. The independent variables

are the variables that explain the variation in the dependent variable. As such, multiple

regression analysis examines the causal relationship between the dependent variable and the

independent variables. In this section, each of the variables used in this study are presented.

For a summarization of the variables and how they have been defined, see appendix B.

3.3.1 Dependent variable

The dependent variable in this thesis is firm profitability. Firm profitability is measured as

both ROA and GOI. The variation in the dependent variable is assumed to depend on the

variation in the independent variables. ROA has been the most commonly used measure of

firm profitability in the research tradition of working capital efficiency (e.g. Wang 2002;

Garcia-Teruel & Martinez-Solano 2007). In addition, GOI has been used as an alternative

measure of firm profitability (Deloof 2003; Lazaridis & Tryfonidis 2006) or as a

complementary measure in combination with ROA (Enqvist et al. 2014).

3.3.1.1 Return on assets

ROA is an overall indicator of firm profitability (Padachi 2006). As such, ROA avoids capital

structure differences because it does not take into account how the assets of firms are

comprised (Enqvist et al. 2014). In line with the research tradition of working capital

efficiency (e.g. Padachi 2006; Garcia-Teruel & Martinez-Solano 2007; Enqvist et al. 2014),

ROA is calculated as the ratio between net income and total assets.

3.3.1.2 Gross operating income

Deloof (2003) argues that ROA is unfit as a measure of firm profitability in samples

containing firms with high levels of financial assets. Instead he used GOI1 as the measure of

firm profitability. Lazaridis and Tryfonidis (2006) suggested that GOI is a more suitable

1 Gross operating income has been used in the research tradition of working capital efficiency (e.g. Deloof 2003)

and the definition used in this thesis is in line with this research tradition. However, the authors of this thesis are

aware of a potential conceptual confusion as gross operating income has the characteristics of a margin.

24

measure of firm profitability in regards to working capital efficiency. This because GOI is an

operating variable. As such, GOI measures the operational performance of firms (Enqvist et

al. 2014). In line with the research tradition (e.g. Deloof 2003; Lazaridis & Tryfonidis 2006;

Enqvist et al. 2014), GOI is defined as revenue adjusted for cost of goods sold divided by total

assets minus financial assets.

3.3.2 Independent variables

The independent variables in this thesis are used in order to measure working capital

efficiency. Thus, working capital efficiency is operationalized as CCC, INV, AR and AP. The

variation in the independent variables is assumed to explain the variation in firm profitability.

This is the standard approach in previous research (e.g. Jose et al. 1996; Deloof 2003).

3.3.2.1 Cash conversion cycle

Gitman (1974) introduced the CCC as a measure of working capital efficiency. It is a dynamic

measure of working capital efficiency (Jose et al. 1996). In contrast to static measures, it

captures the time lag between the purchases of inputs to the collection of sales of finished

products (Eljelly 2004). The CCC consists of INV, AR and AP and, as such, is a measurement

combining data from both balance sheet and income statement with a time dimension (Jose et

al. 1996). The CCC is measured in days and is calculated as INV plus AR minus AP.

3.3.2.2 Days of inventory

INV measures the average number of days of inventory held by a firm. An interpretation of

this is that it captures how long it takes for a firm to turn its inventory into sales (Jose et al.

1996). Longer INV reflects more capital bound in inventory for a particular level of

operations (Garcia-Teruel & Martinez-Solano 2007). Therefore, lower INV indicates higher

working capital efficiency (Enqvist et al. 2014). INV is calculated as the ratio between

inventory and cost of goods sold multiplied with 365 days.

3.3.2.3 Days of accounts receivables

AR measures the average number of days it takes for a firm to collect payments for sales

outstanding. Higher AR means that more capital is bound in accounts receivables (Jose et al.

1996). Therefore, lower AR indicates higher working capital efficiency (Enqvist et al. 2014).

AR is calculated as the ratio between accounts receivables and revenue multiplied with 365

days.

25

3.3.2.4 Days of accounts payables

AP reflects the average time it takes for firms to pay their suppliers. The higher the AP, the

longer it takes for firms to settle their payment commitments with their suppliers (Garcia-

Teruel & Martinez-Solano 2007). From a theoretical point of view, higher AP is assumed to

enhance firm profitability because capital is kept within the firm and thus lowers the capital

cost (Jose et al. 1996). AP is calculated as the ratio between accounts payables and cost of

goods sold multiplied with 365 days.

3.3.3 Dummy variables

In line with Enqvist et al. (2014), dummy variables are used in order to analyze the impact of

economic fluctuations on the relationship between working capital efficiency and firm

profitability. Two dummy variables are used to distinguish how the relationship between

working capital and firm profitability is affected by economic fluctuations. Economic

fluctuations are measured as changes in annual GDP growth around its long-term trend for the

years 2000-2015. In line with Enqvist et al. (2014), the dummy variables used in this study

capture the five years with the lowest respectively the highest annual GDP growth. As such,

dummy variable 1 (D1) captures the five years with the lowest annual GDP growth and

dummy variable 2 (D2) captures the five years with the highest annual GDP growth.

3.3.4 Control variables

In order to control that the variation in the dependent variable do not depend on factors other

than the independent variables, control variables are included in all regression models. In line

with Enqvist et al. (2014), the control variables used in this study are CR, SIZE and DEBT.

These control variables have been shown to impact firm profitability (Shin & Soenen 1998;

Koralun-Bereźnicka 2014; Enqvist et al. 2014). In addition, the regression models control for

firm, year and industry.

3.3.4.1 Current ratio

Wang (2002) and Eljelly (2004) suggest that working capital management is concerned with

firm liquidity and that firm liquidity ultimately affects firm profitability. In addition, a number

of studies have shown that CR is associated with firm profitability (e.g. Shin & Soenen 1998).

For this reason, CR is included to control for the impact of liquidity on firm profitability. CR

is calculated as the ratio between current assets and current liabilities.

26

3.3.4.2 Firm size

SIZE is one of the most important determinants of working capital (Koralun-Bereźnicka

2014). In previous research in the field of working capital management, revenues or sales has

normally been used to capture SIZE. However, to make it comparable, previous research has

used the natural logarithm of sales (e.g. Deloof 2003; Enqvist et al. 2014). Therefore, in this

thesis SIZE is measured as the natural logarithm of sales.

3.3.4.3 Firm debt ratio

Working capital efficiency has been suggested to both impact and be impacted by the

financing of firms (Filbeck & Krueger 2005). In addition, how firms are financed has been

suggested to affect firm profitability (Braun & Larrain 2005). DEBT measures the relation

between external financing of the firm and its total assets (Lazaridis & Tryfonidis 2006).

DEBT is calculated as the sum of short term loans and long term loans divided by total assets.

3.3.4.4 Firm, year and industry

Using firm-year observations means using panel data in the regression analysis. For this

reason, firm and year effects have been controlled for. In addition, working capital has been

suggested to be dependent on industry (e.g. Jose et al. 1996; Shin & Soenen 1998; Niskanen

& Niskanen 2006). Therefore, industry has been controlled for. Industry was coded in

accordance with the industry categorization of the Stockholm Stock Exchange (Nasdaq 2017).

3.4 Regression models

To examine how the relationship between working capital efficiency and firm profitability

was affected by economic fluctuations, ordinary least squares (OLS) regression analysis was

conducted. The data used in this thesis consists of an unbalanced panel over a 16-year period.

Therefore, the regression models were specified with clustered robust standard errors around

firm ID. The dependent variable was measured as both ROA and GOI. Four independent

variables were tested, why four regression models are used for each firm profitability

measurement. In addition, the regression models are controlled for CR, SIZE and DEBT as

well as for year and industry effects. The regression models are used to assess if the variation

in the independent variables explain the variation in the dependent variable. The regression

models were formulated:

27

Firm profitability = β0 + β1 CCCti + β2 D1 + β3 D2 + β4 (D1*CCCti) + β5 (D2*CCCti) + β6 CRti + β7

SIZEti + β8 DEBTti + β9 YEARt + β10 INDUSTRYi + εti

Firm profitability = β0 + β1 INVti + β2 D1 + β3 D2 + β4 (D1*INVti) + β5 (D2*INVti) + β6 CRti + β7

SIZEti + β8 DEBTti + β9 YEARt + β10 INDUSTRYi + εti

Firm profitability = β0 + β1 ARti + β2 D1 + β3 D2 + β4 (D1*ARti) + β5 (D2*ARti) + β6 CRti + β7

SIZEti + β8 DEBTti + β9 YEARt + β10 INDUSTRYi + εti

Firm profitability = β0 + β1 APti + β2 D1 + β3 D2 + β4 (D1*APti) + β5 (D2*APti) + β6 CRti + β7

SIZEti + β8 DEBTti + β9 YEARt + β10 INDUSTRYi + εti

In the regression models above, the dependent variable, firm profitability, is measured by both

return on assets (ROA) and gross operating income (GOI). The constituents of working

capital efficiency, the independent variables, are measured by the cash conversion cycle

(CCC), days of inventory (INV), days of accounts receivables (AR) and days of accounts

payables (AP). The dummy variables are economic downturns (D1) and economic booms

(D2). The control variables are current ratio (CR), the natural logarithm of sales (SIZE) and

firm debt ratio (DEBT) while also controlling for year effects (YEAR) and industry effects

(INDUSTRY). β is coefficient term and ε is the error term.

3.5 Data

The data collection was done through Thomson Reuters Datastream. As such, the data used in

this thesis is secondary. By using secondary data, a satisfying amount of data can be collected

in order to fulfill the aim of the thesis. However, collecting secondary data from a database

has problems that need to be identified and understood in order to conduct a proper analysis

(Bryman & Bell 2015 p. 328-329). Thomson Reuters Datastream contains data from active

firms. This may lead to a survival bias, as the data sample will not include firms that no

longer exist, have been acquired by other firms, have merged with other firms or are no longer

publicly traded on the Stockholm Stock Exchange. An effect of this could be that the sample

is biased towards firms with higher performance. This effect should be greater the farther

back in time the data is collected because the available data is diminishing from year 2015

and downwards. In the regression models, this has been taken into consideration and the

potential impact has been limited through control for firm and year effects. In addition,

secondary data is not necessarily standardized and different accounting practices lead to

different definitions and reporting practices of financial data. This unavoidably leads to a

certain degree of errors in the collected data. For this reason, the data sample has been

28

screened and cleaned from missing values and extreme values. Real GDP data was collected

from Statistics Sweden for the years 2000-2015.

The time period of this thesis is the 16-year period between 2000-2015. The reason behind the

choice of these years is three folded. Firstly, the years 2000-2015 covers three economic

downturns with significant impact on the Swedish annual GDP growth. Secondly, the years

2000-2015 are as recent as possible as 2015 is the latest year with published accounting data

for listed Swedish firms. Thirdly, the survival bias discussed above increases the farther back

in time the data is collected. 2000-2015 is balancing economic fluctuations and the potential

survival bias in a satisfying manner. It provides the opportunity to examine the impact of

economic fluctuations on the relationship between working capital efficiency and firm

profitability, while also minimizing the impact of the survival bias in the database. However,

it must be noted that the firm-year observations diminish gradually from year 2015 down to

year 2000. As such, the data is an unbalanced panel over the 16-year period between 2000-

2015.

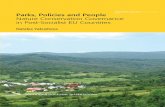

Figure 1: Annual GDP growth (%) of Sweden 2000-2015

Source: Statistics Sweden (2017)

The annual GDP growth for the years 2000-2015 is shown in figure 1 above. It provides the

data on which the different states of the economy are based. In line with Enqvist et al. (2014),

the five years with the lowest annual GDP growth are categorized as D1 and the five years

with the highest annual GDP growth are categorized as D2. These dummy variables are then

-6

-4

-2

0

2

4

6

8

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

29

compared to the results for the whole time period 2000-2015. Table 5 below shows how the

categorization of years in D1 and D2 has been done.

Table 5: Classification of economic downturns and economic booms

Economic downturns (D1) Economic booms (D2)

Year Annual GDP

growth (%)

Year Annual GDP

growth (%)

2001 1.6 2000 4.7

2008 -0.6 2004 4.3

2009 -5.2 2006 4.7

2012 -0.3 2010 6.0

2013 1.2 2015 4.1

Source of annual GDP growth (%): Statistics Sweden (2017)

3.5.1 Population and sample

The aim of this thesis is to examine how the relationship between working capital efficiency

and firm profitability is affected by economic fluctuations among listed Swedish firms. Thus,

the target population of the thesis is listed Swedish firms. More precisely, the constituents of

OMXSPI on the Stockholm Stock Exchange. OMXSPI consists of the firms listed on Large

Cap, Mid Cap and Small Cap on the Stockholm Stock Exchange. From Thomson Reuters

Datastream, financial data from the constituent firms of OMXSPI was collected. The

extracted database consisted of 325 yearly observations and a total of 5,200 observations. In

order to conduct proper statistical analysis, the data was screened and cleaned from missing

values and extreme values because these might distort the results (Pevalin & Robson 2009 p.

289). After adjusting for missing data, 2,666 observations remained in the sample. Thereafter,

the remaining sample was screened for outliers and extreme values. The screening was done

for all variables. From the sample 77 observations were excluded because of theoretically

unrealistic values that would have a significant impact on the results. As a result, the sample

used in the statistical analysis consists of 2,589 firm-year observations, which is 49.8% of the

original sample. The remaining sample constitutes an unbalanced panel of 2,589 firm-year

observations. Figure 2 below shows the yearly distribution of observations.

30

Figure 2: Number of observations per year

3.5.2 Statistical tools

The data was prepared and processed in Microsoft Excel 2016 and the statistical data analysis

was conducted in Stata 14. Microsoft Excel was used to prepare the extracted data into a

database usable in Stata. Stata was used to screen and clean the data and to conduct the

statistical data analysis. The statistical data analysis conducted in this study was descriptive

statistics, correlations and multiple regression analysis. In addition, the statistical testing of

the sample and the regression models were done in Stata. Descriptive statistics were used to

show the features and the characteristics of the variables in the sample, correlations were used

to show how the variables in the sample correlate and multiple regression analysis was

conducted to assess the causal relationship between the dependent variable and the

independent variables. Statistical testing was done to show that the data was appropriate to

use in the multiple regression analysis.

3.5.3 Descriptive statistics

Table 6: Descriptive statistics full sample

Variable Mean SD Min Max

CCC 87.485 74.121 -299.582 596.012

INV 69.407 64.739 0 439.379

AR 71.882 41.991 0.839 487.189

AP 53.803 46.049 0 393.451

ROA 0.028 0.164 -1.186 0.767

GOI 0.320 0.312 -1.023 4.662

CR 2.012 1.840 0.143 26.632

SIZE 14.422 2.143 6.921 19.560

DEBT 0.469 0.192 0.007 1.408 Notes: Descriptive statistics for the sampled variables for the years 2000-2015, for a total of number of 2,589 observations.

0

50

100

150

200

250

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

31

Table 6 above presents the descriptive statistics of the variables in the full sample used in the

statistical analysis. For the descriptive statistics of the economic states referred to as economic

downturns and economic booms, see appendix C.

For the period 2000-2015, the data shows an average CCC of 87.5 days for the sampled firms.

In contrast to Enqvist et al. (2014), the average CCC is considerably lower than listed Finnish

firms (108.8 days). In regards to other studies, the average CCC is higher than the findings of

Deloof (2003) among Belgian firms (44.5 days) and the findings of Yazdanfar and Öhman

(2014) among Swedish SMEs (47.3 days). However, the average CCC is considerably lower

than the findings of Jose et al. (1996) among listed US firms (164 days) and the findings of

Lazaridis and Tryfonidis (2006) among listed Greek firms (189 days). The average CCC is

somewhat matching the findings of Garcia-Teruel and Martinez-Solano (2007) among

Spanish SMEs (76.3 days) and the findings of Gill et al. (2010) among listed US firms (90

days).

INV, AR and AP in the sample are 69.4 days, 71.9 days and 53.8 days respectively. The

average INV is considerable lower than the findings of Enqvist et al. (2014) who found an

average INV of 117.6 days. The average AR too differs considerably from the findings of

Enqvist et al. (2014) who found an average AR of 47.6 days. Average AP is similar to the

findings of Enqvist et al. (2014) who found an average AP of 56.4 days. In regards to other

studies in different contexts, the average INV, AR and AP are somewhat matching (e.g.

Garcia-Teruel & Martinez-Solano 2007; Gill et al. 2010).

For the profitability measures, ROA is on average 2.8% and GOI is on average 32% for the

sampled firms for the years 2000-2015. Both profitability measures in this sample are

considerably lower than in the study of Enqvist et al. (2014) who found an average ROA of