William W. Mercer Michael P. Manning Holland & Hart LLP...

Transcript of William W. Mercer Michael P. Manning Holland & Hart LLP...

William W. Mercer Michael P. Manning Holland & Hart LLP 401 North 31st Street Suite 1500 P.O. Box 639 Billings, Montana 59103-0639 Telephone: (406) 252-2166 Facsimile: (406) 252-1669 Email: [email protected] Email: [email protected] ATTORNEYS FOR PLAINTIFF

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF MONTANA

BILLINGS DIVISION Western Minerals LLC, Plaintiff, vs. KCP, Inc.; Ambre Energy North America, Inc.; Ambre Energy Limited, Defendants.

) ) ) ) ) ) ) ) ) ) ) )

No. ______________________ COMPLAINT AND JURY DEMAND

Plaintiff Western Minerals LLC, by and through its counsel of record,

Holland & Hart LLP, for its Complaint against Defendants, states and alleges as

follows:

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 1 of 52

-2-

PARTIES

1. Plaintiff Western Minerals LLC (“Western Minerals”) is an Oregon

limited liability company with its principal place of business in Gillette, Wyoming.

2. Defendant KCP, Inc. (“KCP”) is a Delaware corporation with its

principal place of business in Broomfield, Colorado.

3. Defendant Ambre Energy North America, Inc. (“Ambre North

America”) is a Delaware corporation with its principal place of business in Salt

Lake City, Utah.

4. Defendant Ambre Energy Limited (“Ambre Limited”) is an

Australian entity with its principal place of business in Brisbane, Queensland,

Australia.

5. KCP, Ambre North America and Ambre Limited are collectively

referred to herein as the “Ambre Entities.”

JURISDICTION

6. This Court has subject matter jurisdiction over this action pursuant to

28 U.S.C. § 1332(a)(3) because the parties are citizens of different states or

citizens of a foreign country and the amount in controversy exceeds $75,000.

7. This Court has personal jurisdiction over KCP because, at all times

relevant to this Complaint, KCP was registered to do business in Montana and was,

in fact, conducting business in Montana.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 2 of 52

-3-

8. This Court has personal jurisdiction over Ambre North America

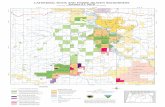

because, as further described below, Ambre North America has substantial and

continuous contacts with Montana and its contacts with Montana give rise to the

causes of action in this Complaint. More specifically, Ambre North America

directly participates in the Decker Coal Company’s production and sale of coal

from the property known as the “Decker Mine” in Montana and controls KCP to

such a degree as to render KCP a mere instrumentality of Ambre North America.

Members of Ambre North America’s Executive Management team, including its

President and CEO Everett King, Tracy Welch, Tay Tonozzi, and Tim Fagley

either serve as KCP’s representatives on the Decker Coal Company’s Management

Committee (“Management Committee”) or have attended and participated in

Management Committee meetings. Tim Fagley additionally serves as both the

Decker Mine General Manager and a member of the Ambre North America

Executive Management Team. Michael Mewing, Ambre North America’s

President from December 2008 to December 2010, also led the business

development efforts related to the other Ambre Entities’ acquisition of KCP and

the associated 50% interest in the Decker Coal Company in November 2011.

9. In addition, KCP serves as Ambre North America’s representative

because it performs services – the production and sale of coal from the Decker

Mine, subject to Management Committee approval – that are sufficiently important

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 3 of 52

-4-

to Ambre North America (as more fully described in Paragraphs 14-154 below)

that if KCP did not perform them, Ambre North America itself would undertake to

produce or sell coal from the Decker Mine or would do so via a new

representative.

10. This Court has personal jurisdiction over Ambre Limited because, as

further described below, Ambre Limited has substantial and continuous contacts

with Montana and its contacts with Montana give rise to the causes of action in this

Complaint. More specifically, upon information and belief, Michael Mewing, a

member of the Ambre Limited Board, is responsible for management of Ambre

North America, including oversight and development of the Decker Mine; Ambre

Limited has been involved in the unauthorized marketing of coal from the Decker

Mine and in making unauthorized business decisions related to the Decker Mine;

and the Ambre Limited Board authorized and directed Everett King to purchase a

tub for the Decker Mine dragline. Upon information and belief, Michael Mewing,

on behalf of Ambre Limited, on various dates in 2011 and 2012 also toured the

Decker Mine with prospective Ambre Limited customers from South Korea.

11. On or about February 15, 2012, Ambre Limited issued a press

release announcing plans related to its proposed initial public offering on the

Australian Stock Exchange. This press release quotes Ambre Limited’s CEO,

Edek Choros as saying, “our prime strategy is to optimize coal assets in the US. . .

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 4 of 52

-5-

” The press release then references Ambre Limited’s acquisition of the 50%

interest in the Decker Mine and represented that it had “assumed full operating

responsibilities” for the Decker Mine.

12. In addition, KCP serves as Ambre Limited’s representative because

it performs services – the production and sale of coal from the Decker Mine,

subject to Management Committee approval – that are sufficiently important to

Ambre Limited (as more fully described in Paragraphs 14-154 below) that if KCP

did not perform them, Ambre Limited itself would undertake to produce or sell

coal from the Decker Mine or would do so via a new representative.

VENUE

13. Venue is proper in the District of Montana pursuant to 28 U.S.C.

§ 1391(b)(2) because a substantial part of the events or omissions giving rise to

Western Minerals’ claims occurred in Montana and the Decker Mine is located in

Montana. This case is properly filed in the Billings Division pursuant to L.R.

1.11(a)(1).

SUMMARY OF DISPUTE

14. This is a dispute between two 50% owners of the Decker Mine:

(1) Western Minerals, owned indirectly by Cloud Peak Energy Inc. (“Cloud Peak

Energy”), which has held its interest in the mine since 1993; and (2) KCP, owned

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 5 of 52

-6-

indirectly by Ambre Limited, which has held its interest in the mine, under Ambre

Limited ownership, since November 2011.

15. Prior to the Ambre Entities’ involvement, management

arrangements for the Decker Coal Company generally worked constructively for

many years. During the almost 20-year tenure of Western Minerals’ ownership of

50% of the Decker Mine, Western Minerals made significant capital investments in

the mine and the mine produced approximately 160 million tons of coal.

16. As described further in this Complaint, since being acquired by the

other Ambre Entities, the relationship between KCP and Western Minerals has

taken a dramatic and negative turn. Under its new ownership and with the direct

involvement, direction and assistance from the other Ambre Entities, KCP is

significantly abusing its obligations and responsibilities as day-to-day Manager,

unilaterally acting outside the approved budget and underlying mine plan,

engaging in a campaign of public and other unauthorized communications to

pursue the Ambre Entities’ unapproved agenda for Decker, and engaging in

various self-dealing transactions among the Ambre Entities and their affiliates, all

of which are in breach of KCP’s legal duties and are causing ongoing substantial

harm to Western Minerals.

17. Stated simply, the Ambre Entities seek to unilaterally force a

significant change in the long-standing direction of the Decker Mine and its

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 6 of 52

-7-

associated business and financial risks by redeveloping and expanding the mine for

planned future Asian exports. However, among other significant concerns, the

Ambre Entities’ export redevelopment proposition is not that the Decker Coal

Company should sell coal from the Decker Mine to Asian utilities with an equal

return to both 50% owners. Rather they proposed that the Decker Coal Company

should sell coal from the Decker Mine to the Ambre Entities, so the Ambre Entities

can retain undisclosed revenues and profits from such coal, while Western

Minerals bears 50% of the expense and risk of redevelopment of the mine. When

Western Minerals expressed concern about an April 30, 2012 Ambre Limited press

release regarding an unauthorized Ambre Limited sales contract with Korean

utilities and explicitly mentioning the Decker Mine, Mr. Everett King brushed off

the inquiry, saying such activities “did not require a discussion” with Western

Minerals.

18. The Ambre Entities have engaged in such conduct despite the fact

that, when they purchased their 50% interest in the Decker Mine in November

2011, they knew that the mine owners and Management Committee, including the

Ambre Entities’ predecessor-in-interest, Level 3 Communications, Inc. (“Level

3”), had approved a “Life of Mine” plan that provided that the mine would

complete its then only-existing sales contract with Detroit Edison and, barring any

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 7 of 52

-8-

additional, approved economic sales that would justify continuing production

under a new sales contract, transition to full reclamation of the mine.

19. Further, when the other Ambre Entities purchased KCP, they knew

that the Decker Mine has historically operated at a loss. In 2011, the Decker Mine

represented a net loss of $21.1 million (100% equity interest basis) of which

Western Minerals recognized 50% of that operating loss in its earnings. The 2011

loss excludes all final reclamation costs incurred as that is charged to the balance

sheet liability. The approved 2012 budget projects a full year operating loss of

$11.9 million (100% interest) which assumes final reclamation costs incurred of

$13.2 million are charged to the balance sheet liability.

20. The principal document governing the management of the Decker

Coal Company is a 1970 agreement that has been supplemented and amended

twelve times, referred to hereafter as the “Joint Venture Agreement.” A true and

correct copy of the Joint Venture Agreement, together with all of its amendments,

is attached hereto as Exhibit A.

21. Under the structure of the Joint Venture Agreement, with the

purchase of KCP, the Ambre Entities became not only a 50% owner but also

assumed the obligations of the Manager of the Decker Mine. The Manager bears

responsibility for managing the day-to-day operations of the Decker Mine in a safe

and efficient manner, in accordance with regulatory requirements and pursuant to

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 8 of 52

-9-

the approved budget and decisions of the Management Committee and the 50%

owners. Under the Joint Venture Agreement, the conduct of the Manager and all

major decisions are subject to oversight and approval by the Management

Committee, which is appointed equally by each co-owner. Neither party is

permitted to unilaterally make decisions related to the operation of the mine or

disregard the objections or disapprovals of the other party. The Decker Mine is

owned 50/50 with a 50/50 Management Committee.

22. In November 2011, shortly after the Ambre Entities’ acquisition of

their 50% interest in the Decker Mine, the representatives of the Ambre Entities

met with representatives of Western Minerals. During this meeting, the Ambre

Entities’ representatives represented to Western Minerals that the Ambre Entities

would manage the Decker Mine in accordance with the Joint Venture Agreement,

in a collaborative and fair manner, with full transparency and consensus from both

owners and based on a fundamental premise that all value derived from the assets

of the Decker Coal Company would be shared relative to the 50/50 ownership of

the assets.

23. At this meeting, and repeatedly on other occasions, representatives

of the Ambre Entities assured Western Minerals that the Ambre Entities would

fully engage Western Minerals and that 2012 would be a “status quo” year in

which the companies could undertake an orderly process to evaluate and reach a

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 9 of 52

-10-

mutual decision on whether to modify the longstanding, previously agreed plan

calling for the Decker Mine to transition into reclamation after the existing Detroit

Edison sales contract was completed.

24. Contrary to these representations, and despite the Ambre Entities’

full knowledge of KCP’s legal obligations to Western Minerals when the other

Ambre Entities purchased KCP, the Ambre Entities have aggressively used KCP

and its responsibilities as Manager to act contrary to the approved budget, enter

into unauthorized contracts, enter into self-dealing business arrangements, make

unauthorized and inaccurate public and other statements about the future of the

Decker Coal Company and unilaterally redefine the future of the Decker Mine, all

without the consent of Western Minerals and despite repeated objections from

Western Minerals.

25. For example, the Ambre Entities – through various related party

transactions and arrangements involving their proposed west coast coal export

terminal and marketing arrangements by their affiliates – have made it clear that

they intend to keep for themselves a disproportionate share of any potential value

of the coal from the Decker Mine that would be sold by the Decker Coal Company

to the Ambre Entities as a result of the Ambre Entities’ proposed export

redevelopment.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 10 of 52

-11-

26. Further, despite numerous requests, the Ambre Entities have yet to

provide Western Minerals with a complete and transparent business proposal for

redevelopment of the mine, including the commercial terms for the Ambre

Entities’ proposed self-dealing transactions involving coal from the Decker Mine.

Instead, the Ambre Entities have sought to implement their unilateral strategy to

force Western Minerals to fund unapproved expenses in support of an unauthorized

and unsupported dramatic shift in the longstanding business plans for the Decker

Mine.

27. Without any approval of the Decker Management Committee and in

the face of Western Minerals’ specific and repeated objections to such unilateral,

unapproved conduct, the Ambre Entities have made decisions regarding the 2012

mining operations and reclamation plans that are inconsistent with the approved

2012 budget (which includes, among other things, the associated mine plans,

mining/staffing/equipment schedules, capital and operating cost plans, reclamation

plans, and line items for cost of mining, reclamation accrual expenses, as well as

other specific expenses).

28. As a result, the Ambre Entities’ operation of the Decker Mine is in

breach of the Joint Venture Agreement. As more fully detailed herein, the Ambre

Entities have negotiated unauthorized new coal sales, made public and other

unauthorized statements about plans for increased production from the mine and

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 11 of 52

-12-

additional jobs, deviated from the “Life of Mine” plan presented by KCP as part of

the annual budget approval process (“Mine Plan”) and spent significantly less on

reclamation and significantly more on production than was approved by the

Management Committee, made decisions on the deployment of major equipment

that deviates from the Mine Plan, and planned to and/or made major new

equipment purchases.

29. These actions constitute breach of contract and related duties by

KCP and the other Ambre Entities, and caused considerable damage to Western

Minerals’ economic and business interests. Further, the injury to Western Minerals

interests and reputation is ongoing and likely to increase unless the Court

intervenes to prevent the Ambre Entities ongoing unilateral actions concerning the

Decker Mine and the Ambre Entities’ efforts to force its various self-dealing

transactions involving coal from the Decker Mine.

FACTS COMMON TO ALL COUNTS

History of Western Minerals and Cloud Peak Energy

30. Western Minerals was originally incorporated as Josephine

Development Co., Inc. in Oregon on July 24, 1962, and was a wholly owned

subsidiary of Pacific Power & Light Company.

31. On October 22, 1970, Josephine Development Co., Inc.’s Articles of

Incorporation were amended to change the name of the company to Western

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 12 of 52

-13-

Minerals, Inc. At the same time, the Articles of Incorporation were amended to

emphasize that one of the purposes for which the entity was formed was to engage

in a joint venture or partnership.

32. Western Minerals filed Articles of Conversion on October 21, 2009,

converting the company from a corporation to a limited liability company known

as Western Minerals LLC.

33. Following various transfers of ownership and control, Western

Minerals became a wholly owned subsidiary of Cloud Peak Energy on

November 19, 2009.

34. Western Minerals, Cloud Peak Energy, and its predecessors-in-

interest have been a 50% co-owner of the Decker Mine and joint venture

participant in the Decker Coal Company since 1993.

35. Cloud Peak Energy is a long-standing and experienced operator of

coal mines in the Powder River Basin (“PRB”). In addition to its interests in the

Decker Mine held by its subsidiary Western Minerals, Cloud Peak Energy also

currently owns and operates three other surface coal mines in the PRB including

the Antelope and Cordero Rojo Mines in Wyoming, and the Spring Creek Mine in

Montana. In June 2012, Cloud Peak Energy acquired an undeveloped surface mine

project in North East Wyoming from Chevron U.S.A. Inc. and CONSOL Energy

Inc.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 13 of 52

-14-

History of KCP

36. KCP was originally incorporated in 1970 as Wytana, Inc. and has

since undergone a series of name changes. First, in 1986, Wytana, Inc. changed its

name to Kiewit Mining Group Inc. Then, in 1991, Kiewit Mining Group Inc.

changed its name to Kiewit Coal Properties Inc. Finally, in 1998, Kiewit Coal

Properties Inc. changed its name to KCP, Inc.

37. Through various transfers, ownership of KCP was eventually

transferred to Level 3.

38. On November 10, 2011, Level 3 entered into an agreement with an

affiliate of Ambre Limited to sell all of the common stock of the holding company

via which Level 3 ran its coal mining operations. The transaction between Level 3

and Ambre Limited closed on November 14, 2011, and the parties satisfied post-

closing conditions on November 23, 2011.

39. Following the closure of the transaction between Level 3 and Ambre

Limited, KCP became a wholly owned subsidiary of Ambre Limited.

The Ambre Entities Corporate Structure

40. Upon information and belief, KCP is a wholly owned subsidiary of

AE Coal, LLC, a Delaware limited liability company.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 14 of 52

-15-

41. Upon information and belief, AE Coal, LLC is a wholly owned

subsidiary of Ambre North America. Ambre North America is the principal

United States subsidiary of Ambre Limited.

42. Upon information and belief, Ambre North America is a wholly

owned subsidiary of AE Minerals Pty Ltd., an Australian entity.

43. Upon information and belief, AE Minerals Pty Ltd. is a wholly

owned subsidiary of Ambre Limited.

44. Ambre Limited’s United States operations, through various

subsidiaries, include: coal infrastructure facilities on the west coast including a

62% interest in the proposed Millennium Bulk Terminal and a proposed marine

terminal business known as the Morrow Pacific project; and interest in coal mines

including two operating coal mines - the Decker Mine (Montana) and the Black

Butte Coal Mine (Wyoming), and two non-operating reclaimed coal mines known

as Big Horn and Rosebud both in Wyoming.

45. As more fully described below, according to Ambre Limited’s

website, its ultimate goal is “to acquire and operate producing assets, with idle

production capacity, in a relatively undervalued domestic market and utilize that

idle capacity to service the booming export market, particularly Asia.” Further,

“[t]he company’s plan is to load barges at the Port of Morrow in Oregon and

transship to panamax sized vessels nearer the mouth of the Columbia River.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 15 of 52

-16-

[Ambre Limited] plans to ship first coal via transshipment in 2013 followed by

coal through [its] Millennium shore based terminal in 2014-15.”

Management of Joint Venture Between Western Minerals and KCP

Creation of the Decker Coal Company

46. On September 1, 1970, Western Minerals (then, Western Minerals,

Inc.), KCP (then, Wytana, Inc.), Montana Royalty Company, Ltd (a limited

partnership between Resource Development Co., Inc., a Washington corporation,

and Rosebud Coal Sales Company, a Wyoming corporation, as limited partners),

and Peter Kiewit Sons’, Inc., a Nebraska corporation, entered into the Joint

Venture Agreement creating the Decker Coal Company, a joint venture. The Joint

Venture Agreement was subsequently amended twelve times: by a supplement

dated as of January 1, 1974; by Amendment No. 2 dated December 1, 1977; by

Amendment No. 3, dated August 24, 1978; by Amendment No. 4, dated January 1,

1982; by Amendment No. 5, dated July 9, 1983; by Amendment No. 6, dated May

7, 1985; by Amendment No. 7, dated January 1, 1989; by Amendment No. 8, dated

January 1, 1989; by Amendment No. 9, dated December 13, 1990; by Amendment

No. 10, dated January 1, 1999; by Amendment No. 11, dated April 9, 2002; and by

Amendment No. 12, dated January 20, 2012.

47. Western Minerals and KCP are herein referred to as “Venturers.”

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 16 of 52

-17-

48. The Venturers entered the Joint Venture Agreement for the purpose

of mining and selling coal from the properties known as the Decker Properties (as

defined in the Joint Venture Agreement) (referred to herein as the Decker Mine).

49. Pursuant to Section 5 of the Joint Venture Agreement, the Venturers

recognize that each of them may have coal interests other than the Decker Mine

and that other coal interests may be developed independent of any obligation under

the Joint Venture Agreement.

The Management Committee

50. The Joint Venture Agreement vests all executive supervision,

control and management of the Decker Coal Company in the Management

Committee.

51. A majority of the Management Committee must consent to any

decision related to the Decker Coal Company. The Management Committee is a

50/50 committee; it is not controlled by either owner.

52. According to the terms of the Joint Venture Agreement, the

members of the Management Committee are to be appointed as follows: three

members to be selected by Western Minerals and three members to be selected by

KCP. In practice, however, the Management Committee is composed of two

members selected by Western Minerals and two members selected by KCP.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 17 of 52

-18-

53. Under the terms of Section 9 of the Joint Venture Agreement, “[n]o

decision with regard to the operation of Decker Coal [Company] regarding the

development of the Decker Properties, construction of improvements, mining

operations, reclamation plans, acquisition of equipment or property, or sales or

other disposition of coal mined by Decker Coal shall be made except by and

through the Management Committee.”

54. Under the terms of Section 9 of the Joint Venture Agreement, “[a]ll

decisions relating to the activities of Decker Coal [Company] shall be arrived at

solely upon the consent of the majority of the Management Committee.”

55. Under the terms of the Joint Venture Agreement, authorization for

the sale or disposition of coal must be consistent with the Joint Venture Agreement

and authorized by the Management Committee.

56. Under the terms of the Joint Venture Agreement, any contracts for

the sale or disposition of coal from the Decker Mine shall be in the name of the

Decker Coal Company.

The Manager

57. The Joint Venture Agreement also defines the duties of the

Manager, who has the responsibility of seeing that: the Decker Coal Company

performs its mining operation and performs its reclamation work; the Decker Coal

Company maintains the buildings and equipment used in connection with the

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 18 of 52

-19-

mining operation; all necessary personnel are hired and that operating and

maintenance expenses are paid for, including labor, payroll, fuel, water, power,

materials and supplies.

58. In addition, under the Joint Venture Agreement, “[t]he Manager at

all times shall supervise and be responsible for (subject to the direction of the

Management Committee) the mining, production, sale and delivery of coal and

reclamation activities in connection therewith, and shall keep the Management

Committee at all times advised as to the operations of [the Decker Coal Company]

in such detail as is requested” and “Subject to the direction of the Management

Committee over reclamation, the Manager shall have sole authority to supervise,

control and direct all … activities related to reclamation of stripped lands and

maintenance of the environment…” Finally, the Manager is responsible for

various financial accounting tasks, including but not limited to furnishing specific

financial information to the Management Committee, preparing the necessary

income tax returns, keeping books of account, keeping records of coal mining

operations, maintaining insurance coverage, and preparing the annual proposed

budget for the Management Committee’s consideration.

59. The original Joint Venture Agreement designated Peter Kiewit

Sons’, Inc. as the Manager of the Decker Coal Company. Kiewit Mining &

Engineering Co. replaced Peter Kiewit Sons’, Inc. as the Manager of the Decker

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 19 of 52

-20-

Coal Company by Amendment No. 4 to the Joint Venture Agreement dated

October 1, 1982. In 1988, Kiewit Mining & Engineering Co. was merged into

KCP, with KCP as the surviving entity. As a result of the merger, KCP became the

Manager of the Decker Coal Company, and has had the responsibilities of the

Manager since that time.

60. Prior to the acquisition of KCP by the other Ambre Entities, Kiewit

Mining Group Inc. (“Kiewit”) provided operation and management services for the

Decker Mine under a management services agreement with KCP.

61. KCP’s role as the Manager of the Decker Coal Company does not

give it unilateral decision making authority to the exclusion of Western Minerals.

To the contrary, under the terms of the Joint Venture Agreement, the Manager is

responsible on a day-to-day basis for carrying out the approved decisions and

direction of the Management Committee.

Mine Plan and Budget

62. Mines, such as the Decker Mine, are customarily administered

according to an established mine plan and budget.

63. Consistent with its responsibilities as Manager, KCP has presented a

Mine Plan to the Management Committee as part of the annual budget approval

process.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 20 of 52

-21-

64. The annual budget requires approval from the Management

Committee.

65. Similarly, modification of the budget and the associated Mine Plan

also requires approval from the Management Committee.

66. The 2012 Decker Coal Company budget, dated November 14, 2011,

was approved by KCP and Western Minerals at the December 2011 Management

Committee meeting (the “Approved 2012 Budget”). Such approval by KCP was

affirmed by email dated February 21, 2012, from Everett King to Nick Taylor

wherein King stated “It was not our intention to withhold approval [of the 2012

budget]…. The budget as presented is approved by KCP as the base case for

2012.”

67. The Decker Mine has historically been a customer-limited mine.

Prior to August 2011, the only existing coal sales contract for coal from the Decker

Mine was with Detroit Edison (“DE Contract”). The DE Contract is set to expire

at the end of 2013.

68. Due to a combination of operational and economic reasons, for the

last two years, the Mine Plan for the Decker Mine has been to cease all coal sales

upon termination of the DE Contract and transition to full final reclamation of the

Decker Mine at the end of 2013.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 21 of 52

-22-

69. The Approved 2012 Budget includes line items for cost of mining

(including total reclamation performed – both contemporaneous and final),

reclamation accrual expenses, as well as other specific expenses.

70. The Approved 2012 Budget document also includes an associated

Mine Plan forecast for the years 2013 through 2019. The Mine Plan calls for coal

sale tonnage to decline over time with no further significant coal sales beyond

2013 sales to Detroit Edison.

71. The Mine Plan also forecasts reclamation performed for the years

2013 through 2019. According to the Mine Plan, final reclamation costs increase

over time.

72. The significant increase in the reclamation budget from 2013 to

2014 reflects the Mine Plan’s call for coal mining to cease and the Decker Coal

Company to redeploy the remaining workforce to reclamation activities at the end

of 2013.

73. As communicated to the Ambre Entities numerous times, Western

Minerals has been and remains open to consideration of modifying the existing

Mine Plan to extend coal production beyond 2013 if an objective economic

analysis indicates that the potential economic benefits to be obtained outweigh the

associated costs and risks, and that the intended benefits for making such a

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 22 of 52

-23-

significant change and investment in the mine are shared based on the 50/50

ownership of the mine.

74. To date, no such opportunity has been presented to the Management

Committee and thus the current Mine Plan calls for transition to full final

reclamation at the end of 2013.

75. The Ambre Entities’ loosely defined export redevelopment proposal

lacks basic information and transparency and is built upon a foundation of self-

dealing among the Ambre Entities.

History of the Decker Mine

Cost of Operations

76. The Decker Mine has historically incurred higher costs to produce

coal than similarly situated competitors.

77. The factors in these higher costs were recognized by Ambre North

America’s predecessor in interest, Level 3.

78. Specifically, Level 3 disclosed the following in its 2010 and 2011

Form 10-K filings: the Decker Mine is served by a single railroad, whereas many

of its western coal competitors are served by two railroads and such competitors’

customers often benefit from lower transportation costs because of competition

between railroads for coal hauling business. Level 3 also disclosed that other

western coal producers – particularly those in the PRB of Wyoming – have lower

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 23 of 52

-24-

stripping ratios (the amount of overburden that must be removed in proportion to

the amount of minable coal) than the Decker Mine, often resulting in lower

comparative costs of production. Level 3 reported that, as a result of these factors,

production costs per ton of coal at the Decker Mine can be as much as four and

five times greater than production costs of certain competitors.

79. In a March 15, 2012 letter from Everett King, the President and

CEO of Ambre North America, to Nick Taylor, one of Western Minerals’

appointees to the Management Committee and Western Minerals’ Senior Vice

President, Technical Services, Ambre North America acknowledged that “the mine

has not been competitive and profitable in recent years.”

80. In 2011, Decker Mine represented a net loss of $21.1 million (100%

equity interest basis) of which Western Minerals recognized 50% of that operating

loss in its earnings. The 2011 loss excludes all final reclamation costs incurred as

that is charged to the balance sheet liability.

81. The Approved 2012 Budget projects a full year operating loss of

$11.9 million (100% interest) which assumes final reclamation costs incurred of

$13.2 million are charged to the balance sheet liability.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 24 of 52

-25-

Historical Coal Sales

82. The Decker Coal Company sold the following tons of coal in the

years indicated: 2007 – 7.0 million tons; 2008 – 6.6 million tons; 2009 – 4.6

million tons; 2010 – 2.8 million tons; and 2011 – 3.0 million tons.

83. The historical downward coal sales tonnage trend is a product of the

non-competitive nature of marketing coal from the Decker Mine on the domestic

market.

The Ambre Entities’ Acquisition of KCP

84. Prior to the other Ambre Entities’ acquisition of KCP, as part of

their due diligence, the Ambre Entities met with representatives from Western

Minerals on several occasions in 2010 and 2011 to discuss operations at the Decker

Mine and the potential acquisition of KCP by the other Ambre Entities.

85. In fact, by letter dated October 18, 2010, from Nick Taylor to

Michael Mewing, Taylor, on behalf of Western Minerals, stated “its opposition to

Ambre’s proposed redevelopment of the Decker Mine” and highlighted various

concerns and issues, including “the proposed structure of coal sales agreements

between Decker and an affiliate of Ambre, with the Ambre affiliate reselling to

third party customers. Such a structure would deprive Cloud Peak Energy of a fair

mutual benefit in the joint venture in favor of Ambre’s group of affiliates.”

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 25 of 52

-26-

86. According to Ambre Limited’s 2011 Annual Report, the Ambre

Entities spent "five years … evaluating US coal regions and deposits to identify

acquisition opportunities that would build a supply base for sale through the

company’s coal marketing business to domestic and international customers.” “In

particular, [Ambre Limited] conducted technical due diligence and market

assessments” over KCP’s assets including the Decker Mine.

87. The Ambre Entities acquired a 50% interest in the Decker Coal

Company after completing significant due diligence and with full knowledge of

Western Minerals and Cloud Peak Energy’s interest and with full knowledge of the

existing Mine Plan that provides for a transition to full final reclamation at the end

of 2013.

88. Immediately following the other Ambre Entities’ acquisition of

KCP, in November 2011, members of the Ambre Limited Board met with

members of the Management Committee from Western Minerals to discuss the

potential future operations of the Decker Mine (the “November 2011 Meeting”).

89. During the November 2011 Meeting, the Ambre Entities represented

that they would fully engage Western Minerals in transparent discussions, based on

sharing any potential benefits pursuant to the mine’s 50/50 ownership, and allow

time for the parties to collectively move forward in evaluating whether there was a

business case for redevelopment of the Decker Mine.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 26 of 52

-27-

The Ambre Entities’ Efforts to Force Redevelopment of the Decker Mine to Facilitate Unilateral Business Plan for Self-Dealing

The Ambre Entities’ Goal

90. The Ambre Entities’ goal with regard to operation of the Decker

Mine is in direct conflict with the current Mine Plan associated with the Approved

2012 Budget.

91. As described publicly on its website, Ambre Limited’s stated

strategy is to “acquire sustainable coal resources and develop long-term mining

and coal upgrading operations; acquire and develop coal-related infrastructure to

expand its markets and facilitate trading activities; … and develop and supply

domestic and international markets with our products.”

92. Among other public disclosures, the Ambre Entities have stated the

following:

a. “The Union Pacific transcontinental rail line, also historically

used by BNSF, provides the [Port of Morrow] with a direct rail link to coal mines

in Montana, Wyoming, Colorado and Utah, including Ambre Energy’s mining

operations at Decker and Black Butte . . . . Ambre Energy expects to make

significant progress on this development over the coming year with a goal to barge

and ship first coal to Asia in 2013/14.”

b. “Coals such as those at Ambre Energy’s newly acquired

Decker coal mine based in Montana are the best suited coals for the Asian export

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 27 of 52

-28-

market. In addition to the state’s geographical advantage to the US west coast, the

Montana coals have higher energy levels compared to the southern PRB in

Wyoming.”

c. “Successful negotiations during 2010/11 resulted in Ambre

Energy acquiring … 50% ownership of the [Decker Mine]. With [this acquisition]

complete, Ambre Energy is on track to becoming a major supplier of US thermal

coal to the international market”; and

d. “The Morrow Pacific project is being developed to provide a

coal export route to U.S. trade allies. The project will ship low-sulfur PRB coal to

the Port of Morrow by train.”

93. During the November 2011 Meeting, and repeatedly since then, the

Ambre Entities have assured Western Minerals that no discussions or negotiations

or decisions have taken place, or would take place, with third parties involving

redevelopment of the Decker Mine without the direct involvement and approval of

Western Minerals.

94. During the November 2011 Meeting, and repeatedly since then, the

Ambre Entities have assured Western Minerals that they would provide to the

Management Committee a detailed redevelopment proposal including:

a. engineering, including cost and productivity assumptions as

well as coal quality projections;

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 28 of 52

-29-

b. permitting issues, including effects on reclamation costs and

bonding;

c. capital expenditures, including a detailed schedule by item,

discussion of cost risks, and calculated net present value on the investments;

d. market assessment, including price forecast, customer

targeting, and competitive analysis;

e. commercial terms for all proposed domestic and export

marketing of coal from the Decker Mine, including indicative sales prices and

terms for domestic and Asian export sales;

f. schematic of shared costs and how all potential value derived

from coal from the Decker Mine would be shared between the 50/50 owners

(including their affiliated entities); and,

g. risk assessment, including key assumptions, market risk, credit

risk, competitive risk, transportation risk, terminal development risk, capital risk,

reclamation cost risk, and other sensitivities that could negatively impact the

redevelopment business model.

95. To date, KCP has not submitted a full redevelopment proposal to the

Management Committee.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 29 of 52

-30-

96. Since the other Ambre Entities’ acquisition of KCP, the

Management Committee has not approved any revision to the Mine Plan or

extension of the life of the Decker Mine.

97. KCP has failed to abide by the contractually agreed process for

decision-making, including providing the necessary information that would allow

Western Minerals to evaluate whether a proposed change in the Mine Plan or

future operations of the Decker Mine are economically viable or not and whether

the potential value of coal from the Decker Mine is being shared consistent with

the 50/50 ownership.

Costs and Risks Related to Redevelopment of the Decker Mine

98. Redevelopment of the Decker Mine would require significant capital

costs, and associated risk, for both Venturers.

99. Redevelopment of the Decker Mine would constitute a drastic

change from the long-standing Mine Plan.

100. Redevelopment of the Decker Mine would involve significant risks

for both Venturers related to future increased reclamation costs and liabilities.

101. The risks to Western Minerals are increased by the potential

financial instability of the Ambre Entities. As reported in The Australian on

April 2, 2012, according to Ambre Limited’s own auditor, “There exists significant

uncertainty whether [the Ambre Entities] would be able to continue as a going

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 30 of 52

-31-

concern” due to financial problems. The Australian article further noted that “the

group’s accounts highlight the risky nature of resources investments.”

Unauthorized Deviation from Approved 2012 Budget

102. The Decker Mine Manager prepares the Decker Coal Company

monthly financial statements showing expenditures of the Decker Coal Company

(“Financial Statements”).

103. The Financial Statement dated April 19, 2012, shows the financial

statements for the three months ending on March 31, 2012 (the “March 2012

Financial Statement”). The March 2012 Financial Statement indicates that KCP,

as Mine Manager, spent 167% of the amount allocated in the Approved 2012

Budget to Cost of Mining from January 1, 2012 through March 31, 2012.

104. KCP did not propose a budget modification to the Management

Committee, nor did the Management Committee approve KCP’s unilateral

decision to spend nearly twice the budgeted amount on Cost of Mining during the

period from January 1, 2012 through March 31, 2012.

105. The March 2012 Financial Statement indicates that KCP, as Mine

Manager, spent less than half of the amount budgeted for Reclamation Allocated to

Liability for the period January 1, 2012 through March 31, 2012.

106. KCP did not propose a budget modification to the Management

Committee and the Management Committee did not approve KCP’s decision to

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 31 of 52

-32-

spend less than half of the amount budgeted for reclamation expenses for the

period January 1, 2012 through March 31, 2012.

107. The Approved 2012 Budget projects a full year operating loss of

$11.9 million (100% interest) which assumes final reclamation costs incurred of

$13.2 million are charged to the balance sheet liability. Through March 2012

Decker has reported an operating loss of 142% of the year-to-date budgeted loss.

The majority of the operating loss variance is due to redirecting final reclamation

to predevelopment activities. Final reclamation completed year-to-date totaled less

than half of the amount budgeted.

108. KCP refuses to abide by the contractually agreed process for

decision-making, including providing the necessary information that would allow

the Management Committee to evaluate whether a proposed change to the annual

budget is in the best interest of the Decker Coal Company.

Unauthorized Pre-stripping

109. KCP represented to Western Minerals at the May 2, 2012,

Management Committee meeting in Salt Lake City that pre-stripping has been

taking place and more is underway to position the Decker Coal Company for future

redevelopment and pre-strip for coal that has not been contracted or approved for

any future sales.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 32 of 52

-33-

110. KCP did not propose additional pre-stripping activities to the

Management Committee, nor did the Management Committee approve KCP’s

decision to engage in pre-stripping for coal that had not yet been contracted or

approved for future sales. Tim Fagley, on behalf of KCP, admitted during the

May 2, 2012 Management Committee Meeting, that pre-stripping expenses were

not a budgeted item in the Approved 2012 budget.

111. KCP represented to Western Minerals at the May 2, 2012

Management Committee meeting that KCP intended to keep the 1300 dragline in

the West Decker section of the Decker Mine working through 2012, despite the

fact that it was not budgeted and imposed increased costs on the owners.

112. KCP did not propose such dragline activities to the Management

Committee, nor did the Management Committee approve KCP’s decision to keep

the 1300 dragline in the West Decker section of the Decker Mine working through

2012.

Unauthorized Mullinax Contract

113. On August 10, 2011, the Decker Coal Company – via the Decker

Mine Manager – entered a Coal Supply Agreement with Mullinax Concrete

Company Inc. for the purchase and sale of coal from the Decker Mine or such

other location mutually agreeable to the parties (“Mullinax Contract”).

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 33 of 52

-34-

114. KCP did not present the Management Committee with an

opportunity to vote on whether to enter the Mullinax Contract nor did the

Management Committee approve KCP’s decision to execute the Mullinax Contract

on behalf of the Decker Coal Company for stoker coal sales.

115. Despite subsequent repeated requests by Western Minerals for a

financial and risk analysis of the unauthorized Mullinax Contract, KCP has refused

to provide such an analysis.

116. The Mullinax Contract will terminate on May 31, 2016,

approximately three years after expiration of the only approved pending sales

contract (i.e., the DE Contract).

Unauthorized Purchase of a Dragline Tub

117. KCP represented to Western Minerals at the May 2, 2012

Management Committee meeting that, despite Western Minerals’ specific

objections, KCP intended to purchase a dragline tub at a cost of approximately $10

million to support redevelopment. Specifically, Everett King stated at the May 2,

2012 Management Committee meeting, that the Ambre Limited Board had

authorized and directed him to purchase a tub for the Decker Mine.

118. The Management Committee never approved the Ambre Entities’

decision to purchase a dragline tub at a cost of approximately $10 million to

support unauthorized redevelopment of the Decker Mine.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 34 of 52

-35-

Korean Contracts

119. Upon information and belief, Ambre Limited, through one of its

subsidiary business divisions, Ambre International Coal Marketing & Trading

(“AICMT”), has entered into two contracts with South Korean power generators,

Korea South East Power Co. Ltd (“KOSEP”) and Korea Southern Power Co. Ltd

(“KOSPO”), to supply up to 3.0 million metric tons of U.S. coal per year to

KOSEP and up to 2.0 million metric tons of U.S. coal per year to KOSPO for a

term of 10 years each (the “Korean Contracts”).

120. In its April 29, 2012 press release announcing the Korean

Contracts, Ambre Limited specifically referenced the Decker Mine and its plan to

barge coal down the Columbia River to a planned fully owned facility at Port of

Morrow.

121. KCP did not present the Korean Contracts to the Management

Committee for approval, nor did the Management Committee approve of the

Ambre Entities’ public statements referencing the Decker Mine as an asset to

provide at least a portion of the coal involved in the Korean Contracts.

Exploration License Application

122. On June 25, 2012, the Department of the Interior, Bureau of Land

Management (“BLM”), published a Notice of Invitation for Coal Exploration

License Application MTM-103852 (“Exploration Notice”) which invited members

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 35 of 52

-36-

of the public “to participate with Ambre Energy in a program for the exploration of

coal deposits owned by the United States” in lands immediately adjacent to and

surrounding the Decker Mine. In fact, a large proportion of the lands covered by

the Exploration Notice are owned by the Decker Coal Company.

123. According to the Exploration Notice, the Coal Exploration License

Application was submitted by “Ambre Energy” and not KCP and the address listed

in the Exploration Notice is that for Ambre North America.

124. The Coal Exploration License Application was submitted by the

Ambre Entities without approval of the Management Committee and without any

consultation with Western Minerals.

125. The Coal Exploration License Application submitted by Ambre

Energy North America and/or “Ambre Energy” is further evidence of that entity’s

direct involvement with KCP’s breach of its obligations to Western Minerals.

Western Minerals’ Attempts to Work with Ambre

126. Western Minerals has repeatedly attempted to address Western

Minerals’ concerns regarding the Ambre Entities’ actions related to the Decker

Mine at Management Committee meetings and in other communications with the

Ambre Entities.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 36 of 52

-37-

127. Western Minerals’ many attempts to have KCP treat Western

Minerals as an equal partner, as provided by the Joint Venture Agreement, have

been unsuccessful.

128. On May 30, 2012, Western Minerals sent Ambre Limited and

Ambre North America a letter detailing its concern and demanding that the Ambre

Entities – including KCP – take a number of specific actions consistent with the

Joint Venture Agreement.

129. In its May 30, 2012, letter, Western Minerals asked that KCP and

the other Ambre Entities agree to eleven items that KCP believed were necessary

to correct the ongoing disagreements with the operation of the Decker Mine.

130. Western Minerals asked KCP and the other Ambre Entities to

agree in writing to items such as comply with Management Committee decisions

and cease activities not approved by the Management Committee, provide an

accounting of expenditures related to the Decker Coal Company, provide a detailed

and transparent redevelopment proposal that the Ambre Entities had previously

promised but failed to deliver, and cease further unauthorized communications and

disclosures regarding the post 2013 production capabilities of the Decker Mine.

131. On June 8, 2012, Everett King, on behalf of Ambre North America

responded to Western Minerals’ May 30, 2012 letter.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 37 of 52

-38-

132. Ambre North America’s response letter failed to address the

specific requests made by Western Minerals and characterized them as “totally

unreasonable.”

133. Rather than provide any meaningful answer to Western Minerals’

concerns, in its response, Ambre North America questioned Western Minerals’

motives for sending its letter and attempted to insert the wholly unrelated issue of

Cloud Peak Energy’s longstanding, well-known ownership of another coal mine.

134. Under Section 5 of the Joint Venture Agreement, “each party

recognize[d] that the other party, or a corporation or corporations affiliated with

such other party, has interests in coal resources other than the Decker Properties,”

and that such other coal resources may be developed or disposed of without the

input of the other venturer and without obligation to the other venturer.

135. Thus, when the Ambre Entities purchased Level 3’s interest in

KCP, they expressly agreed that the development or disposition of non-Decker

coal resources by Western Minerals (or any corporation affiliated with Western

Minerals) was entirely separate from and irrelevant to issues related to the Decker

Coal Company.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 38 of 52

-39-

KCP and the Ambre Entities Disregard for Western Minerals’ Concerns

Public Statements by Tim Fagley, the Decker Coal Company General Manager and Member of the Ambre North America Executive Management Team

136. As evidence of KCP’s ongoing disregard for the concerns

expressed by Western Minerals as recently as June 13, 2012, Tim Fagley, the

Decker Coal Company General Manager and member of the Ambre North

America Executive Management team, gave a presentation at the Sheridan County

Chamber of Commerce’s monthly luncheon where he announced that the Decker

Coal Company intended to double production “in the next year.” This

announcement was made without consultation or approval of Western Minerals or

the Management Committee and occurred 14 days after delivery of Western

Minerals’ letter to the Ambre Entities requesting that they cease and desist.

137. As reported by The Sheridan Press, Mr. Fagley addressed the

Decker Coal Company’s “tough economic past, recent changes in the company’s

business model and future expectations for exports and jobs.”

138. Mr. Fagley elaborated on the Decker Coal Company’s new

economic plans and indicated the company: is “looking to export most of its coal

to Asia, specifically to South Korean and India”; “aims to increase exports,

revenue and jobs in the coming years”; “[expects] to be shipping 7.5 million tons

by sometime next year;” and “expects to add 60 to 80 new jobs over the next few

years.”

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 39 of 52

-40-

139. None of these “changes in the company’s business model” or “new

economic plans” have been properly presented to the Management Committee,

voted on by the Management Committee, or approved by the Management

Committee.

140. Mr. Fagley also reportedly acknowledged that, “in recent years,

Decker has been in ‘shut down’ mode, with the goal of eventually shutting down

the site” and gradually dropping off and going into “closure mode.”

141. On or about June 22, 2012, Mr. Fagley stated the following about

the Decker Mine, “next year, we were scheduled for 1.5 million. We’re

negotiating with several customers and expect that to be at least 3.5 million next

year, if not higher.”

142. Through these unauthorized statements, Mr. Fagley is raising the

expectations in the local community regarding jobs and economic development

where such expectations may not be justified.

143. During his statements, Mr. Fagley failed to disclose that a change

from the current Mine Plan to implement the “changes in the company’s business

model” or “new economic plans” and the supposed plans to double production will

require approval by the Management Committee and involve significant risk and

capital expenditures by the Venturers.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 40 of 52

-41-

144. Through Mr. Fagely’s unauthorized communications, the Ambre

Entities are creating a situation that could severely damage the reputation of

Western Minerals and Cloud Peak Energy by forcing it to chose between

disappointing the local workforce or agreeing to a new business plan for the

Decker Mine that has not been the subject of proper analysis and that is built on a

foundation of self-dealing among the Ambre Entities.

145. Recent actions by the Ambre Entities demonstrate their pattern of

conduct and disregard for their legal obligations to Western Minerals.

Damages Suffered by Western Minerals

146. Based on the actions of KCP and the Ambre Entities and their

refusal to address the past, present and future concerns of Western Minerals,

Western Minerals has suffered damages and faces certain additional damages in

the future.

147. Mr. Fagley’s unauthorized recent public statements about the

future planned operations of the Decker Mine are in direct conflict with the Mine

Plan, statements made by Western Minerals, and decisions of the Management

Committee. The fact that co-owners could be in a position of making conflicting

public statements about the business plans for the Decker Mine may result in

negative reputational impacts to Western Minerals and, by virtue of its ownership

interest, Cloud Peak Energy.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 41 of 52

-42-

148. Furthermore, the statements made by Mr. Fagley omit the material

fact that all the Ambre Entities planned operations of the Decker Mine are subject

to approval by the Management Committee and ignore the economic realities

related to such plans.

149. Increased reclamation obligations at the Decker Mine resulting

from KCP and the other Ambre Entities unilateral deviations from the Approved

2012 Budget may also result in negative reputational impacts to Western Minerals

and, by virtue of its ownership interest, Cloud Peak Energy. Increased reclamation

obligations threaten the strong reputations with regard to the companies’

environmental programs, enjoyed by Western Minerals and Cloud Peak Energy.

150. As noted above, by a letter dated May 30, 2012, Western Minerals

enumerated its concerns to KCP and made specific requests for information and

commitments regarding future operations of the Decker Mine.

151. In the Ambre Entities’June 8, 2012 response, the Ambre Entities

failed to respond to Western Minerals’ request, and instead, threatened that “KCP

will be making the case to the relevant governments that [final reclamation of the

Decker Mine] is destructive, unnecessary and an act of bad faith on Cloud Peak

Energy’s part.” Any statements regarding Western Minerals’ or Cloud Peak

Energy’s position with regard to the future operations of the Decker Mine could

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 42 of 52

-43-

potentially have negative reputational impacts to Western Minerals and, by virtue

of its ownership interest, Cloud Peak Energy.

152. Such reputational impacts could extend to and impact Western

Minerals’ and Cloud Peak Energy’s relationships with the community, regulators,

and existing and potential customers, and other commercial counterparties.

153. As a result of KCP’s deviations from the Approved 2012 Budget,

Western Minerals has incurred additional capital expenditures, increased operating

losses, and an increased reclamation liability for the Decker Mine.

COUNT I – (BREACH OF CONTRACT AGAINST KCP)

154. Western Minerals incorporates all preceding paragraphs as though

set forth fully herein.

155. By its actions described in the previous paragraphs, KCP has

committed one or more breaches of the Joint Venture Agreement.

156. Western Minerals has been damaged by KCP’s breaches of the

Joint Venture Agreement and faces additional damages if KCP continues in its

conduct.

157. Western Minerals’ damages as a result of KCP’s breach of the

terms of the Joint Venture Agreement, include, but are not limited to additional

reclamation liability and expenses, damage to business reputation and goodwill,

and lost business opportunities.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 43 of 52

-44-

158. Because of its multiple breaches of the Joint Venture Agreement,

KCP is a “defaulting party” under the terms of the Joint Venture Agreement.

159. As a defaulting party, the Joint Venture Agreement requires that

KCP shall cease to have any voice in the management of the Decker Coal

Company or the Management Committee.

160. Under the terms of the Joint Venture Agreement, as a result of

being a defaulting party, KCP’s interest in the capital of the Decker Coal Company

shall immediately and exclusively vest, in trust, in Western Minerals.

161. Under the terms of the Joint Venture Agreement, due to KCP

becoming a defaulting party, the Decker Coal Company shall be managed

exclusively by Western Minerals.

COUNT II – (BREACH OF IMPLIED COVENANT OF GOOD FAITH AND FAIR

DEALING AGAINST KCP)

162. Western Minerals incorporates all preceding paragraphs as though

set forth fully herein.

163. As a contract subject to Montana law, the Joint Venture Agreement

contained an implied covenant of good faith and fair dealing.

164. As more specifically set forth in the preceding paragraphs, KCP’s

breach of the terms of the Joint Venture Agreement, failure to adhere to the

Approved 2012 Budget, and failure to adhere to the Mine Plan and other actions

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 44 of 52

-45-

constitute breaches of the Joint Venture Agreement’s implied covenant of good

faith and fair dealing.

165. Western Minerals has been damaged by KCP’s breach of the Joint

Venture Agreement’s implied covenant of good faith and fair dealing.

COUNT III – (BREACH OF FIDUCIARY DUTY AGAINST KCP)

166. Western Minerals incorporates all preceding paragraphs as though

set forth fully herein.

167. Under Montana law, KCP owed fiduciary duties to Western

Minerals as a co-joint venturer.

168. As more specifically set forth in the preceding paragraphs, KCP’s

breach of the terms of the Joint Venture Agreement, failure to adhere to the

Approved 2012 Budget, failure to adhere to the approved Decker Mine Plan and

other actions constitute breaches of its fiduciary duties to Western Minerals.

169. Additionally, upon information and belief, Ambre Limited

anticipates fulfilling the Korean Contract by engaging in various self-dealing

transactions, by selling to itself coal from the Decker Coal Company through either

Ambre Limited directly or an affiliated subsidiary and then re-selling such coal at a

higher price to KOSEP and KOSPO.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 45 of 52

-46-

170. This type of arrangement would result in increased profits to the

Ambre Entities to the detriment of Western Minerals and constitutes impermissible

self-dealing, which is a breach of KCP’s duty of loyalty.

171. Western Minerals has been damaged by KCP’s breaches of its

fiduciary duties.

COUNT IV – (INJUNCTIVE RELIEF AGAINST KCP, AMBRE LIMITED, AND AMBRE

NORTH AMERICA)

172. Western Minerals incorporates all preceding paragraphs as though

set forth fully herein.

173. As detailed above, the Ambre Entities’ wrongful actions are

causing irreparable damage to Western Minerals’ business reputation and

goodwill.

174. If the Ambre Entities are not enjoined from continuing the

wrongful acts described above, Western Minerals will continue to suffer

irreparable harm.

175. In light of the Ambre Entities’ ongoing conduct, including but not

limited to, entering into new contracts, commitments and making public statements

without proper authority, Western Minerals does not have an adequate remedy at

law to protect against the loss of its business reputation and goodwill.

176. Any money damages awarded to Western Minerals may also be an

inadequate remedy due to the Ambre Entities’ risk of financial collapse.

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 46 of 52

-47-

177. The balance of equities favors an injunction.

178. Granting injunctive relief will be in the public interest.

179. Accordingly, the Court should enjoin KCP and the other Ambre

Entities from further breaches of their obligations under the Joint Venture

Agreement and remove KCP as Manager of the Decker Mine.

COUNT V – (ACCOUNTING AGAINST KCP)

180. Western Minerals incorporates all preceding paragraphs as though

set forth fully herein.

181. The Joint Venture Agreement provides that the Manager shall

(1) not later than the 20th of each month, furnish to the Management Committee a

job cost report showing the results of the prior month’s activities of the Decker

Coal Company, and (2) at the end of each calendar year, provide to the Venturers a

certified financial statement of the Decker Coal Company, including a balance

sheet and a statement of profit and loss for the preceding year.

182. The Joint Venture Agreement also provides that the Manager shall

keep books of account showing costs incurred in connection with the development

of the coal field, conduct of mining operations and sale and delivery of coal or coal

products, and all matters pertaining to the Decker Coal Company.

183. Under the terms of the Joint Venture Agreement, all such books of

account and other records of the Decker Coal Company shall be open for

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 47 of 52

-48-

inspection by authorized employees of Western Minerals, and by its auditors and

legal counsel at all times.

184. Under the terms of the Joint Venture Agreement, a periodic

certified audit of such books shall be made by such national accounting firm as

may be determined by the Management Committee, but not less than once a year.

185. Western Minerals is entitled to an accounting of all costs incurred

in connection with the development of Decker Mine and all contracts for the sale

or disposition of coal that KCP or the other Ambre Entities have entered into on

behalf of the Decker Coal Company, or otherwise, involving the sale of Decker

coal.

COUNT VI – (AIDING AND ABETTING BREACH OF FIDUCIARY DUTY AGAINST

AMBRE NORTH AMERICA)

186. Western Minerals incorporates all preceding paragraphs as though

set forth fully herein.

187. As described above, KCP’s conduct constitutes a breach or

breaches of its fiduciary duties to Western Minerals.

188. Ambre North America knew that KCP’s conduct constituted a

breach of its fiduciary duty.

189. As described in more detail in the preceding paragraphs, Ambre

North America has provided, and continues to provide, substantial assistance or

encouragement to KCP for its conduct. Such assistance or encouragement

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 48 of 52

-49-

includes, but is not limited to, members of the Ambre North America Executive

Management team – including Everett King, Tracy Welch, Tay Tonozzi, and Tim

Fagley – attending and participating in the Management Committee meetings and

participating in or being responsible for decisions made by KCP as Mine Manager.

For example, Tim Fagley, who is a member of the Ambre North America

Executive Management team, also serves as the Decker Mine General Manager

and has specifically authorized expenditures inconsistent with the Approved 2012

Budget and Mine Plan.

190. Accordingly, Ambre North America is jointly and severally liable

for any and all harm caused to Western Minerals as a result of KCP’s breaches of

its fiduciary duties.

COUNT VII – (AIDING AND ABETTING BREACH OF FIDUCIARY DUTY AGAINST

AMBRE LIMITED)

191. Western Minerals incorporates all preceding paragraphs as though

set forth fully herein.

192. As described above, KCP’s conduct constitutes a breach of its

fiduciary duties to Western Minerals.

193. Ambre Limited knew that KCP’s conduct constituted a breach of

its fiduciary duties.

194. As described in more detail in the preceding paragraphs, Ambre

Limited has provided, and continues to provide, substantial assistance or

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 49 of 52

-50-

encouragement to KCP for its conduct. Such assistance or encouragement

includes, but is not limited to, (1) members of the Ambre Limited Board –

including Michael Mewing – attending and participating in Management

Committee meetings; (2) Ambre Limited’s marketing of coal from the Decker

Mine; (3) Ambre Limited making business decisions related to the Decker Mine;

and (4) Ambre Limited’s involvement in events surrounding the Korean Contracts.

195. Accordingly, Ambre Limited is jointly and severally liable for any

and all harm caused to Western Minerals as a result of KCP’s breaches of its

fiduciary duties.

COUNT VIII – (CIVIL CONSPIRACY AGAINST ALL DEFENDANTS)

196. Western Minerals incorporates all preceding paragraphs as though

set forth fully herein.

197. KCP, Ambre North America and Ambre Limited had a meeting of

the minds as to the following object: maximizing long term profits for the Ambre

Entities from the sale of coal from the Decker Mine that the Management

Committee had not approved and taking actions that would maximize the benefits

to the Ambre Entities through various self-dealing transactions, but not Western

Minerals.

198. KCP, Ambre North America and Ambre Limited also had a

meeting of the minds as to the following unlawful course of action: operating

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 50 of 52

-51-

outside of the terms of the Joint Venture Agreement and in breach of KCP’s

fiduciary duties to Western Minerals as more specifically described above,

including but not limited to, entering into the Korean Contracts and authorizing

expenditures and activities inconsistent with the Approved 2012 Budget and Mine

Plan.

199. In furtherance of this objective, KCP, Ambre North America, and

Ambre Limited committed the following unlawful acts: operating outside of the

joint venture and in breach of KCP’s fiduciary duties to Western Minerals as more

specifically described above, including but not limited to entering into the Korean

Contracts and authorizing expenditures and activities inconsistent with the

Approved 2012 Budget and Mine Plan.

200. Western Minerals suffered damage as a result of the defendants’

unlawful actions.

PRAYER FOR RELIEF

Western Minerals prays as follows:

201. For removal of KCP as Manager of the Decker Coal Company and

appointment of Western Minerals as Manager of the Decker Coal Company.

202. For a court order requiring that KCP provide an accounting to the

Management Committee that: (1) itemizes all the Decker Coal Company

expenditures or commitments that (a) exceed or were inconsistent with the

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 51 of 52

-52-

amounts for such line items in the approved 2012 Budget, or (b) were not approved

by the Management Committee (including expenditures related to the Decker Mine

made by Ambre Limited, Ambre North America, or any affiliated entity, outside of

the Decker Coal Company governance structure); and (2) provides full disclosure

of all proposed transactions concerning coal from the Decker Mine between the

Ambre Entities and their affiliates.

203. For money damages in an amount to be proven at trial, but which

exceeds $75,000.

204. For any and all further relief that the court deems appropriate,

including injunctive measures to prevent further damages to Western Minerals.

JURY DEMAND

205. Western Minerals hereby requests a trial by jury of all claims or

causes of action set forth in this Complaint that are properly so tried.

Dated this 9th day of July, 2012.

/s/ William W. Mercer ATTORNEYS FOR PLAINTIFF

5647323_10

Case 1:12-cv-00085-RFC-CSO Document 1 Filed 07/09/12 Page 52 of 52

![IN THE UNITED STATES DISTRICT COURT ROCKY BIXBY, …media.oregonlive.com/environment_impact/other/kbr[1].pdf · Surety Co. v. Yeatts, 122 F.2d 350, 352-55 (4th Cir. 1941) (detailing](https://static.fdocuments.in/doc/165x107/5fce2d77c186794e9c618f7b/in-the-united-states-district-court-rocky-bixby-media-1pdf-surety-co-v-yeatts.jpg)