wide, and each store gets about 25 to 30. All the Rage Since...

Transcript of wide, and each store gets about 25 to 30. All the Rage Since...

, The Corporation Brand BuildinSOLESURVIVORNikelimits AFI runs topique demand

AlltheRageSinceReaganNike's Air Force 1,introduced in the '80s,stillgrabs attention-and huge margins

NCE THE WORD HITSthe street, hundreds ofteens start lining up atstores. So strong is de-mand that new releaseshappen only on week-ends-so kids won't

skip school. When the doors open, theysell out in hours. Tickets for the currentEminem tour? The new iPod music play-er? Nope. We're talking about a basic bas-ketball sneaker, Nike Inc.'s Air Force 1.

Launched in'1982, when Ronald Rea-gan was in the White House, the sneakeris almost pathetically low-tech. Yet the AirForce 1 remains the definition of urbancool. And while Nike Shox runners, Air,Jordans, and the Cole Haan and Conversebrands helped drive record earnings of$1.2 billion on sales of $13.7 billion in thefiscal year ended June 27,the AF1played abig role, too, helping Nike reach No. 48on the BusinessWeek 50 list of top corpo-rate performers. AF1 racked up an esti-mated $1 billion in sales and generatedprofit margins of70%, say analysts-dou-ble that of other hit sneakers. Says Tasha-la Spellman, a 16-year-oldAF1 devotee: "Ilike the style." She'd better: Spellmanowns 10 pairs.

How do you keep a basic sneaker hotfor a quarter-century? Nike's genius is

68 I BusinessWeek I July 25, 2005

that it has managed to market a classicwithout alienating teens. At the sametime, Nike creates COnsumer longing bykeeping supplies tight and releasing col-lectible versions with minimal hype. "AirForce 1 is maybe the most dominant bas-ketball franchise in this industry," GaryM. DeStefano, president of Nike U.S.,says. "But there's a way to keep it fresh."

The Air Force 1 hit the basketballcourts and urban play-grounds in the '80s andquickly caught on with blackyouth, thanks to basketballstarendorserCharlesBarkle~But soon Nike began buildingmystique-eschewing regularmarketing channels even as itrestricted supply. AF1 adver-tising is minimal today. Mostly, Nike letsthe customers-and the rappers-do thetalking. In 2002, for example, hip-hop'sNelly rapped about "my Air Force 1s" andgenerated a No.1 hit. And such is theshoe's cult status that teenagers hang outat NikeTalk.com and other chat rooms tofind out when the next AF1 is coming.

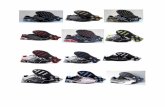

Every two months or so, Nike unleash-es a newly tweaked shoe-a camouflageversion, say, or one timed for Mardi Gras.Each release involves roughly 350,000 to500,000 pairs of shoes shipped nation-

wide, and each store gets about 25 to 30."Nike continues to control the market-place so diligently they create pent-up de-mand for the shoe," says John Shanley,analyst for Susquehanna FinancialGroup, an investment bank.

Analysts say retailers caught discount-ing Air Force 1s receive a smaller alloca-tion the next time or none at all. And re-tailers are happy to play ball: After all, theAir Force 1 makes money and drives traf-fic. Retailers get full price for the shoe, ba-sic versions of which sell for $85 to $100.Collectible versions, such as one designedby famed grafitti artist Mr. Cartoon, retailfor $180. And the AF1boosts demand forother Nike footwear, says Shanley. Nike'ssell-through rate-how fast a product fliesoff shelves in the first week-averages20%-plus of inventory, compared with anindustry average oflO%. The sell-throughrate for AF1s is 100%.

The Air Force 1 is a Nike profit ma-chine. Shanley estimates that the compa-ny sells each pair to retailers for about$48.50 but pays just $12 to make them in

Asia. Since the design has re-mained essentially un-changed, there are few devel-opment costs; all of the moldsand lathes have been fully de-preciated. And, of course,Nike no longer pays anyone topromote them. "It drives amuch richer margin because

it doesn't carry an endorsement fee,"Shanley says.

There's no telling how long the AirForce 1 will remain hot in the faddish

sneaker business. "If they ever get greedywith the Air Force 1,or ifkids feel they'rebeing manipulated, you can see a prof-itable business disappear in a hurry," saysJeffrey Bliss, president of sports marketerJavelin Group. Until then, take a numberand stand in line, as Nelly says, "So I canget to stompin' in my Air Force 1s." .

-By Stanley Holmes in Seattle

I~, 1

TheBestPerformers