Why Costa de la Luz - titan-properties.com Costa de la Luz.pdf · 3 0 1,000 2,000 3,000 7 8 9 0 9 1...

Transcript of Why Costa de la Luz - titan-properties.com Costa de la Luz.pdf · 3 0 1,000 2,000 3,000 7 8 9 0 9 1...

A specialist real estate advisory team focused on identifying, for our clients, property investment

opportunities in golf developments along the Costa de la Luz

Spanish residential property investment opportunity

Why Costa de la Luz?

3

0

1,000

2,000

3,000

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

é/m

2

1987-2003 CAGR 10.1%

0

1,000

2,000

3,000

UK

Irela

nd Italy

Net

herla

nds

Ger

man

yAus

tria

Franc

eD

enm

ark

Nor

waySwed

enG

reec

eSpa

inPor

tuga

lFin

land

€/m

2

0

1,000

2,000

3,000

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

é/m

2

1987-2003 CAGR 10.1%

0

1,000

2,000

3,000

UK

Irela

nd Italy

Net

herla

nds

Ger

man

yAus

tria

Franc

eD

enm

ark

Nor

waySwed

enG

reec

eSpa

inPor

tuga

lFin

land

€/m

2

Spanish House Prices remain affordable for northern European buyers

Spanish house prices have risen significantly, yet they remain cheap when compared to property prices across most of Northern Europe. The

differences are more acute when compared to key Northern European cities, home to our target market. The most important macroeconomic factor

affecting our business will be the purchasing power of foreigners (in particular Northern Europeans) who intend to purchase a property along coastal

Spain.

Property price evolution in Spain compared to property prices in EU countries

Spanish average house price evolution 1987-2003 Average property prices in EU countries - 2002

Spanish house prices and GDP relative to the EU - 2002 Average property prices of European cities - 2002

0

20

40

60

80

100

120

140

40 60 80 100 120 140 160

€/m2- Relative to EU average

2001 G

DP

per

capita -

Rela

tive t

o E

U a

vera

ge

FinlandSweden

Spain

NorwayIrelandDenmark

Italy

France

UKNetherlands

Germany

Austria

Greece

0

20

40

60

80

100

120

140

40 60 80 100 120 140 160

€/m2- Relative to EU average

2001 G

DP

per

capita -

Rela

tive t

o E

U a

vera

ge

FinlandSweden

Spain

NorwayIrelandDenmark

Italy

France

UKNetherlands

Germany

Austria

Greece

Sources: INE, UK land registry, HBOS, Department of Economy, Switzerland, RICS, Statistics Norway, Statistics Finland, Statistics Sweden, Denmarks Statistik, Gunne, Confédération

Européenne de l'Immobilier, Bulwein AG, Ministerio de Fomento, Titan research

0

1,000

2,000

3,000

4,000

Lond

on

Paris

Stock

holm

Amst

erda

mD

ublin

Frank

furt

Mad

ridBar

celo

naSev

illeM

alag

aVal

enci

a

€/m

2

4

Affordability

According to the OECD, Spain is 14% cheaper than the EU 15 average. Moreover, it is 17% cheaper than the UK and 13% cheaper than Germany,

countries that represent 40% of Spanish foreign visitors. The purchasing power of Spanish consumers is slowly converging with the EU average and,

at €15,000, it is still substantially below the average EU income per capita of €23,000.

Price Levels vs EU 15 Average

-30%

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

De

nm

ark

Sw

ed

en

Ire

lan

d

Fin

lan

d

Ne

the

rla

nd

s

Un

ite

d K

ing

do

m

Fra

nce

Be

lgiu

m

EU

15

Ave

rag

e

Ge

rma

ny

Au

str

ia

Lu

xe

mb

urg

Ita

ly

Sp

ain

Gre

ece

Po

rtu

ga

l

Source: OECD Main Economic Indicators 2003

5

Foreign Investment in Residential Housing

BBVA research indicates that residential property investment by foreigners reached €3.5 billion in the first half of 2003. Foreign demand has grown

between 20% and 40% per annum every year since 1999.

Foreign residential property investment

Source: BBVA, October 2003

6

Tourism trends fuelling a more permanent venture

• Spain received 79 million foreign visitors/tourists in 2002

• Northern Europeans are fascinated by Spain. 85% of the tourists who visited Spain in 2002 were “repeat” customers and 75% had been to

Spain three or more times, and more than 65% of them planned to return within 12 months. Coastal Spain attracted 86% of tourists in 2002

• Tourists spent € 38.5 billion in Spain in 2002

• August is the peak month

• 750,000 golfing tourists go to Costa del Sol each year, boosting tourism by 15%. Last 3 years 60% increase in spending on golf related

tourism

• British and German visitors represent 40% of the tourists visiting Spain. This figure has remained constant

• Tourists by origin (millions) – 2003 : England 14.5; Germany, 10; France, 8; Italy, 2.5; Netherlands, 2.4; Belgium, 1.8; Portugal, 1.7

• Andalucia is the region where tourists use hotels the least, staying mainly in rental properties or with friends and families

• The average stay is 10 days. Tourists who stay at hotels normally stay for shorter periods (8 days), while people who rent or stay with friends

stay for longer periods (16 days)

• 45% of tourists stay between 4 and 15 days

• 60% of English tourists come on “organized trips/holiday packages”

• Tourist arrivals via low-cost carriers grew 40%, reaching 2.6 million in 2002

• Hotel occupancy across Spain, during 2002 was 58%

Source: Anuario Estadistico, INE

7

Immigration trends

There are currently 1.45m registered foreigners in Spain (Ministerio del Interior). Coastal Mediterranean provinces have the largest number of

registered foreigners. Over the last eight years the number of registered foreigners in Spain grew at a CAGR of 52%, compared with 7.5% in the

previous decade (1985 – 1995). Forty percent of registered foreigners reside in coastal provinces, and represent approximately 5% of the local

population in these areas.

Approximately one third of registered foreigners are EU nationals. Many more EU citizens who live or have a second home in Spain choose not to

register. For example Deloitte & Touche estimates that more than 500,000 British nationals own a second home in Spain.

Foreigners in Spain 1975 – 2003 (June)

165,289 241,971

430,422

1,109,060

1,324,001

1,448,671

538,984

895,720

0

200

400

600

800

1,000

1,200

1,400

1,600

1975

1976

1977

1978

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

Re

gis

tere

d f

ore

ign

ers

(0

00

's)

Source: Ministerio del Interior, Delegacion del gobierno para la Extranjeria y la Inmigracion

8

Coastal property is surprisingly still cheaper than national average

According to Hamptons International, around 2.5 million people live on the coast. This number is expected to rise to 10 million by 2011. Average

property prices along the southern costas have historically traded at a discount to the national average.

Average price growth in focused costas versus the national average 2002 property price comparison

200

400

600

800

1000

1200

1987 1991 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

€/m

2

Costa de la Luz Costa del Sol Costa Almeria

Costa Calida Costa Blanca National average

0

200

400

600

800

1000

1200

1400

Costa de la

Luz

Costa del

Sol

Costa

Almeria

Costa

Calida

Costa

Blanca

National

average

€/m

2

Note: Titan’s definition of ‘Costa’ when analysing property prices, is to include any local municipality along the coastline, but not to include inland municipalities

Source: Ministerio de Fomento, Titan Investments research Source: Ministerio de Fomento, Titan Investments research

Convergence towards the national average has been most evident in Costa del Sol and Costa Almeria. In the period 1999-2002, Costa del Sol

property prices have risen 77% (CAGR 21%) according to the Ministerio de Fomento. This compares to a 54% (CAGR 15%) increase for the

national average. Other costas have risen in line with Spain’s average, with the exception of Costa Almeria, which rose 61% (CAGR 17%) since

1999. Costa de la Luz remains the cheapest costa.

9

Comparison of rental yield potential and principal appreciation

Our research indicates that the current rates of price appreciation in Costa del Sol are not sustainable. We believe that tourism will remain strong in

Costa del Sol, but other costas will have stronger price appreciation as they converge towards Costa del Sol prices over the next five years

5 year historical rolling CAGR %, based on regional house prices Indicative assessment of growth rates – 2003-2008

0%

5%

10%

15%

20%

1996 1997 1998 1999 2000 2001 2002

5 y

ea

r C

AG

R%

Costa de la Luz Costa del Sol Costa Almeria

Costa Calida Costa Blanca

Source: Ministerio de Fomento * Based on our analysis of current average prices for two bed/two bathroom

apartments in developments overlooking Frontline Golf or beachfront

Costa de la Luz Costa del Sol Costa Almeria Costa Calida Costa Blanca

Average rental yield* 5.9% 10.3% 6.5% 5.8% 7.6%

Principal appreciation

– Expected growth

until 2008 **

8.0-9.0% 3.0% 5.5-6.5% 11.0-12.0% 5.5-6.5%

*Rent is based on average seasonal weekly rents for a 2/3 bedroom apartment. High season is assumed to be 12 weeks, Low season 40; High season occupancy 80%, Low season occupancy

ranges between 40-60% depending on location

** Inflation assumption 3%

Source: Homes Overseas, Rental agencies, Titan Investments research

Average

price/m2* Price CAGR

2003 2003 2008 2003 - 2008

Costa de Sol 3153 0% 0% 3.0%

Costa de la Luz 1948 38% 15% 9.5-10.5%

Costa Almeria 1778 44% 35% 5.5-6.5%

Costa Calida 1501 52% 30% 11.0-12.0%

Costa Blanca 2178 31% 20% 5.5-6.5%

Discount to average

price in Costa del Sol

10

Section II: Overview of Costa de la Luz

Not only charming and beautiful, Costa de la Luz also has superb property investment opportunities

11

Where is Costa de la Luz

Costa de la Luz is the coastline of the two Spanish provinces of Huelva and Cadiz. It faces both the Atlantic and the Mediterranean.

Map of Europe illustrating Costa de la Luz Region of Huelva

Region of Cadiz

12

Costa de la Luz – Portuguese border to Sotogrande

Land is still attractively priced and developers are focusing their attention on this region. The leading real estate agencies of Costa del Sol

are starting to open offices in the Costa de la Luz. The region’s international profile will likely be enhanced in the immediate future.

Costa de la Luz is the western part of Andalucia’s coastline and borders both the Atlantic and the Mediterranean. The Andalucia tourist site

describes these 417 km of coastline as ‘beautiful golden sands and small seaside towns devoted to national tourism.’ The coast has been

guarded from over development by local municipalities, conscious of protecting the local seafood industry.

Nicknamed the Spanish Algarve, the Costa de la Luz occupies the significant stretch of Atlantic coastline between Portugal and the Gibraltar

Straits. The historical majesty of Seville and Huelva are within striking distance of the coast. It is also famous for the port of Cadiz and the

sherry region of Jerez. The white sandy beaches are often secluded and the area has a traditional ambiance.

The region’s capitals, Huelva and Cadiz, are easily accessible from international airports in Faro, Seville, Jerez, and Gibraltar. Huelva is

within 45 minutes driving distance from Faro and Seville. Similarly, Cadiz is less than 30 minutes away from Jerez’s international airport and

between 1 and 1 ½ hours from Seville’s and Gibraltar’s international airports.

Summer temperatures are more pleasant than in other costas due to the Atlantic’s cooler breeze. The province of Cadiz has one of the most

benign weather systems in Spain. Temperatures range between 22 and 14 degrees throughout the year, 300 days of sunshine are normal, and

the average sea temperature is 17 degrees. An average year round temperature of 20 degrees gives the Costa de la Luz the perfect

microclimate for an active holiday.

The people of the Costa de la Luz are proud of their quiet life and intend to keep it that way. The surrounding area offers residents a huge

array of activities and is regarded as the cultural hotspot within Spain.

Local municipalities are keen to avoid the over development mistakes incurred by neighboring regions like the Costa del Sol. In consequence

municipalities have strict planning restrictions. New developments have strict restrictions on building volume (typically 6-12% build on a plot set

aside for urbanization) and must adhere to environmental regulations. Yet in the same breath, local municipalities are eager to work with reputable

developers that suggest sensible projects.

13

Costa de la Luz

Costa del Sol

Costa AlmeriaCosta de la Luz

Costa del Sol

Costa Almeria

Property pricing in Costa de la Luz

Our research indicates that Costa de la Luz is still 30% cheaper than the national average. We believe that prices in the area will converge to the

national average, especially prices for high quality properties designed with the northern European buyer in mind.

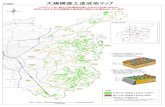

Andalucia – 2002 Price €/m2 for each municipality Pricing growth in Costa de la Luz versus national average

Source: Ministerio de Fomento Source: Ministerio de Fomento

Despite this discount, price appreciation within Costa de la Luz has been strong, growing on average 15% since 1998

400

600

800

1000

1200

1991 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

€/m

2

Costa de la Luz National average

29.6% discount to national average

14

Property pricing comparisons

Like-for-like price comparisons of apartments in Costa de la Luz versus Costa del Sol, confirm that Costa de la Luz is significantly cheaper.

According to our analysis apartments in Costa del Sol that overlook golf courses or beachside are on average 38% more expensive on a €/m2 basis

than Costa de la Luz equivalents.

Our like-for-like sample includes “2 bedroom - 2 bathroom” apartments on either frontline golf or frontline beach. Prices are analysed on a price per

m2 basis. Although properties are not homogenous products and their prices will vary depending on the interior qualities and surroundings, these

price comparisons provide useful insight into regional differences.

Price €/m2 for apartments currently advertised on estate agent websites*

0

10

20

30

40

50

60

<500

750-

999

1250

-149

917

50-1

999

2250

-249

927

50-2

999

3250

-349

937

50-3

999

4250

-449

947

50-4

999

5250

-549

957

50-5

999

Nu

mb

er

of

fla

ts

Costa de la luz Costa del Sol

Costa de la Luz sample size: 59

Costa del Sol sample size: 225

Costa de la Luz mean: €1,948

Costa del Sol mean: €3,153

* Market data is more readily available in Costa del Sol allowing for a greater sample size

Source: Company websites, Titan Investments research

15

Province of Cadiz

Costa de la Luz was a well-kept secret - Spanish tourists have known of this coast’s appeal for a long time - but it has finally come to the attention

European tourists and homebuyers. Germans, who have historically been the trendsetters in European tourist destinations, have started to move here

permanently. English tourism to Cadiz has increased significantly in recent years, and British estate agents are just starting to offer product in this

area. With a new daily flight service offered by Ryanair, the region of Cadiz will fast become a favoured tourist destination for the British.

Activities on offer in Cadiz Comments

Cadiz has hosted several international sporting events,

including the 2000 Tall Ships Regatta and the 2003

Olympic World Sailing Championships. Tarifa has

been transformed into the European kite-surfing capital

in recent years.

Cadiz is home to the “Real Escuela Andaluza de Arte

Ecuestre”, has more than 70 horse sporting facilities,

and hosted the World Equestrian Games in 2002.

It is also well known for its beautiful inland ‘pueblos

blancos’ (white villages) such as Arcos de la Frontera,

Medina Sidonia and Vejer de la Frontera, which are

built on impressive steep hilltops.

The region of Jerez is best known as the home of

Sherry. There are over 59 wine cellars including world

famous Domecq, Gonzalez Byass and Sandeman

bodegas.

Cadiz has 15 golf courses, and is home to three of the

top ten Spanish courses, Valderrama, Real Club de Golf

Sotogrande and Montecastillo in Jerez. The 1997

Ryder Cup and Volvo Masters have been hosted in

courses in this province.

Other activities include two casinos in San Roque and

Cadiz, flamenco shows, a Formula One race track, 47

museums, and 5 nature reserves.

Source: Patronato de Turismo, Titan Investments

16

Province of Huelva

Activities on offer in Huelva Comments

The playas de Huelva (the beaches of Huelva) are

made up by 15 long stretching golden sand beaches

broken up by national parks and small fishing

villages devoted to national tourism.

The small family owned seaside restaurants offer

what is considered the best seafood cuisine in Spain.

The beaches being in a cove shape are well protected

by the Atlantic winds (Las Ventas), although the area

is popular for wind and kite surfing.

As a measure of new demand between Punta Umbria

and El Rompido during 2003 there were 300 hotel

beds. This year there will be over 3,000.

Further inland the Sierra de Huelva is the land of

Jamon, Manzanilla and magical undulating forested

mountains. Small white villages are dotted around

with ancient crafts such as ceramics and wood

carving.

East of Matalascañas, is the Doñana national park –

the largest in Europe along with the largest

congregation of bird wildlife. One can take jeep or

bicycle safari’s to tour the national park.

Huelva has 7 existing golf courses and planning

permission exists for at least another 7 to be built in

the near future.

Source: Playas de Huelva website, Titan Investments

17

Flag

number Course Holes Par

Course

length Open date Designer Green fee

1

Club de Golf

Valderrama 18 + 9 72 6,234 1985 Robert Trent Jones 250 & 275

2

Club de Golf

Sotogrande 18 + 9 72 6,224 1964 Robert Trent Jones 150 & 160

3 Hotel-Golf Almenara 18 72 6,186 1998 David Thomas 60 & 85

4 The San Roque Club 18 72 6,440 1990 Tony Jacklyn 80

5 Club de Golf La Cañada 18 70 5,746 1982 Robert Trent Jones 48

6

Alcaidesa Links Golf

Course 18 68 4,924 1999 Peter Alliss 70

7

Dehesa de

Montenmedio Golf 18 71 5,897 1996 Alejandro Maldonado 75

8

Hotel Golf & Country

Club Benalup 18 72 6,000 2001 Paul Rolin 53

9 Club de Golf Campano 9 70 6,050 1985 Robert Trent Jones 31

10 Golf Novo Sancti Petri 36 72

6,466 -

6,510 1990

Severiano

Ballesteros 54

11

Club de Golf Vista

Hermosa 9 72 5,746 1975 Progolf 38 & 76

12

Club de Golf Costa

Ballena 18 72 6,187 1996 Jose Maria Olazabal 50

13

Hotel Golf & Resort

Montecastillo 18 72 6,424 1992 Jack Nicklaus 90

14 Golf El Puerto 18 72 6,314

2001 &

2003 Manuel Pinero 50

World-class golf facilities – the region of Cadiz

Two thirds of all European golf tourists choose Andalucia as their favourite Spanish golf destination. Approximately 60% of golf tourists are British,

15% Scandinavian, 12% German and 5% French. Although Malaga is still the main golf destination within Andalucia, Cadiz is becoming an

increasingly attractive region as is evidenced by it hosting major tournaments such as the Volvo Master’s golf tournament in both Montecastillo and

Valderrama.

Golf course details Golf courses in Cadiz region*

Source: Patronato de Turismo, Cadiz * Blue flags indicate golf courses in the pipeline

1312

11

10

9 8

7 4

3 6

21

5

14

131312

1111

1010

9 8

7 4

3 6

221

55

14

18

World-class golf facilities – the region of Huelva

The region of Huelva is the fastest growing golf tourist destination within Andalucia. There are 7 golf courses in existence and no less than 7 courses

in the pipeline that have received planning permission

Golf course details Golf courses in Huelva region*

Source: Real Federacion Espanola de Golf * Red flags indicate golf courses in the pipeline

Flag

number Course Holes Par

Course

length Open date Designer Green fee

1 Isla Canela 18 72 6,248 1993 Juan Catarineu 62

2 Islantilla 27 72 5,697 1992

Enrique Canales &

Luis Recasens 57

3 El Rompido 18 72 5,834 2003 Alvador Arana 50

4 Nuevo Portil 18 71 5,528 2001 Alfonso Vidaor 45

5 Club de Golf Bellavista 18 69 5,688 1976 Luis Recasens 35

6 Dunas de Donana 18 72 6,136 2002 Fernando Menaya 50

7 Corta Atalaya 9 68 4,730 1982 n/a 6

1&2 Costa Esuri 36 n/a n/a 2005/06 Jose Canales n/a

3 Isla Canela II 18 n/a n/a 2006/07 n/a n/a

4 Nuevo Portil II 18 n/a n/a 2006 n/a n/a

5 Unnamed 18 n/a n/a n/a n/a n/a

6 Unnamed 18 n/a n/a n/a n/a n/a

7 Unnamed 18 n/a n/a n/a n/a n/a

12 3

4

5

6

7

1&2

34 5

6

7

1122 33

44

55

66

77

1&2

3344 55

66

77

19

Spoils of the Atlantic – the region of Cadiz

Cadiz has a large number of beautiful golden sand beaches, many of which are backed by beautiful and rugged cliff faces. There are several national

parks that stretch down to the beaches making for an impressive backdrop when blended with the cliff faces

Attractions along the coast of Cadiz Blue flag beaches and Marina’s

• 38 beaches of which 16 are Blue Flag quality

• Water sports offered at all beaches

• 4 Marinas

• 23 yacht clubs

• Commercial port of Cadiz, a key destination

for European cruise ships

• 10 locations for deep-sea fishing

• 6 scuba diving & underwater sites

• 11 recommended sites for windsurfing and

kite surfing, including Tarifa – regarded as

the European capital of windsurfing

Source: Cadiz Turismo Source: Cadiz Turismo

20

Spoils of the Atlantic – the region of Huelva

The beaches along Huelva are truly breathtaking, often backed by long sand dunes and dense national forests of pine trees. They are all fine grain

golden sand beaches.

Attractions along the coast of Huelva Blue flag beaches and Marina’s

• Pretty and quaint seaside fishing villages,

populated by family run restaurants with

exquisite seafood cuisine

• 15 beaches of which 8 are Blue Flag quality

• Water sports offered at all beaches

• 5 Marinas

• 1 commercial port at Huelva

• 8 yacht clubs

• 5 fishing ports

• 6 scuba diving & underwater sites

• 6 recommended sites for windsurfing and

kite surfing

Source: Playas de Huelva website Source: Blue Flag

21

0

5

10

15

100

105

110

Germany UK Belgium France Netherlands

(000's

)

0

5

10

15

100

105

110

Germany UK Belgium France Netherlands

(000's

)

0

10

20

30

40

50

60

Condor

(Thomas

Cook)

Hapag-

Lloyd (IC)

Aero Lloyd

(IC)

Ryanair

(KLM UK)

City Bird

(Sabena)

(00

0's

)

Airport infrastructure

Costa de la Luz is easily accessible through the four international airports that operate in the region: Faro, Gibraltar, Jerez and Seville

Cadiz

Ryanair announced on 2nd December 2003 that it is going to make Stansted-Jerez a daily service (previously it was only weekends). They expect to

fly 100,000 passengers to Jerez during 2004, a six fold increase in passenger traffic versus 2003. The number of passengers flying into Jerez airport

grew at a 58% CAGR between 1997 an 2001, totaling 159,700 arrivals in 2001. Germans accounted for 69% of all passengers flying into Jerez

airport – ‘Holiday destination trend setters’. August was the busiest month with 35,069 passenger arrivals. Flights from the EU accounted for 99.3%

of all international flights into Jerez airport during 2001. Charter flights accounted for the bulk of flights with Thomas Cook’s German charter flight,

Condor, flying just under 50,000 passengers. Ryanair has continued the Stansted-Jerez flight path following the acquisition of Buzz from KLM.

For travelers flying from the UK and visiting the region of Cadiz, Gibraltar airport is very convenient being at the southern tip of the region.

Currently over 140,000 UK travelers fly into Gibraltar annually

Flights to Jerez airport – 2001

Top ten EU arrivals into Jerez airport – by passenger Top EU airlines flying to Jerez airport – by passenger

Source: Aeropuertos Espanoles y Navegacion Aerea Note: IC = Independent Charter

Huelva

The local government intends to build an international airport in the province of Huelva in a town called Gibraleón. The closest international airport

is in Faro, Portugal, a short driving distance away, which caters 4.7 million passengers annually. Seville’s airport, only forty five minutes away from

both Jerez and Huelva, offers relatively easy access to Costa de la Luz.

22

Flight paths to Costa de la Luz

Main European flight paths to airports in proximity to Costa de la Luz Comments

Jerez

• Ryanair is expecting to fly over 300 flights

to Jerez during 2004

• German cities account for 3 of the top 5

EU cities flying to Jerez

• During 2001 there were 159 flights to

Jerez from London – more than any other

individual city.

Seville

• Seville is not yet open to international

charters and low cost airlines

• Currently London and Paris have the most

number of flights to Seville

• Brussels and London feature in the top 5

EU cities flying to both Seville and Jerez

Gibraltar

• 140,000 British tourists use Gibraltar as an

entry point to mainland Spain every year.

The airport is unlikely to see any

expansion until the sovereignty issue is

resolved.

Faro

• Faro airport is the second most popular

airport in Portugal after Lisbon. Faro

handles approximately 4.7 million

passengers per year. Easyjet expects a

50% rise in traffic from Britain to Portugal

in 2004.

Source: AENA, ANA

361+250

499

317

148

159

145 142

133

118

536

= Number of flights during 2001

159

>20,000 from

EU countries

361+250

499

317

148

159

145 142

133

118

536

= Number of flights during 2001

159

>20,000 from

EU countries

23

Road & Rail

Major road extensions:

- Linking Algerciras with Jerez (completion date; 2006-07). This highway will reduce current journey time of 2 ½ hours down to just 45 minutes

- Huelva to Sevilla (complete)

- Extension of Cadiz highway towards Tarifa

Extensions of the high-speed train, AVE, from Seville to Huelva and Cadiz are expected for 2007

Source: Patronato de Turismo, Ministerio de Fomento

24

Why golf in Costa de la Luz?

In 1993 only 22% of golfers playing in Costa de la Luz were foreign compared to over 70% for both Costa del Sol and Costa Almeria. Foreign golf

players in Costa de la Luz now account for 53% of total golfers. Foreigners are becoming increasingly interested in golfing in Costa de la Luz.

In 1994 over 90% of all golf rounds played by foreigners in Andalucia were played in Costa del Sol. This figure has dropped to 81% as foreigners

are looking to other costas for new challenges.

Rounds of golf played by foreigners as a percentage of total

rounds played

Average number of rounds played per course during 2001

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

90.0%

1993 1994 1995 1996 1997 1998 1999 2000 2001

Costa del Sol* Costa Almería Costa de la Luz

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

Costa del Sol* Almería Cádiz Huelva

Source: Golf Federation of Andalucia Source: Golf Federation of Andalucia

* Costa del Sol includes golf courses in the Sotogrande area which although in the region

of Cadiz, are labelled as part of Costa del Sol

* Costa del Sol includes golf courses in the Sotogrande area which although in the region of

Cadiz, are labelled as part of Costa del Sol

25

Why golf in Costa de la Luz?

Growth of rounds of golf played in Costa del Sol Growth of rounds of golf played in Costa de la Luz and Costa

Almeria

Source: Golf Federation of Andalucia Source: Golf Federation of Andalucia

Growth of rounds played by foreigners in Costa del Sol Growth of rounds of golf played by foreigners in Costa de la Luz

and Costa Almeria

`

Source: Golf Federation of Andalucia Source: Golf Federation of Andalucia

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

1,800,000

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

8.8% CAGR

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

1,800,000

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

8.8% CAGR

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1993 1994 1995 1996 1997 1998 1999 2000 2001

8.2% CAGR

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1993 1994 1995 1996 1997 1998 1999 2000 2001

8.2% CAGR

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

Costa Almería Costa de la Luz

17.1% CAGR – Costa de la Luz

14.6% CAGR – Costa Almeria

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

Costa Almería Costa de la Luz

17.1% CAGR – Costa de la Luz

14.6% CAGR – Costa Almeria

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

Costa Almería Costa de la Luz

17.1% CAGR – Costa de la Luz

14.6% CAGR – Costa Almeria

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

1993 1994 1995 1996 1997 1998 1999 2000 2001

Costa Almería Costa de la Luz

28.4% CAGR – Costa de la Luz

10.4% CAGR – Costa Almeria

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

1993 1994 1995 1996 1997 1998 1999 2000 2001

Costa Almería Costa de la Luz

28.4% CAGR – Costa de la Luz

10.4% CAGR – Costa Almeria

![FAX —JL. 2020] 3,000 1,000 3,000 B 1,000 SNSc:et; r With 9/5 … · 2020. 7. 31. · FAX —JL. 2020] 3,000 1,000 3,000 B 1,000 SNSc:et; r With 9/5 Youtube TEL E-mail 2020 With](https://static.fdocuments.in/doc/165x107/6002fac5a6b86343ba526a5d/fax-ajl-2020-3000-1000-3000-b-1000-snscet-r-with-95-2020-7-31-fax.jpg)