Why banks disappear: a forward intensity model for default and … · 2012-07-23 · Why banks...

Transcript of Why banks disappear: a forward intensity model for default and … · 2012-07-23 · Why banks...

Why banks disappear: a forward intensity model fordefault and distressed exits

Oliver Chena, Elisabeth Van Laerea,∗

aRisk Management Institute, National University of Singapore, 21 Heng Mui Keng Terrace,Singapore 119613

Preliminary version: June 2012†

Abstract

In this paper we present a new early warning model for bank default. An impor-tant challenge when predicting bank failures that has hitherto been largely ignoredis the fact that banks in distress might exit through, for example, an acquisition ornationalization rather than a default. To distinguish between these different exitpaths, we extend the forward intensity model by introducing a triply stochasticprocess. We show that including distressed exits as a separate path increases theprediction accuracy of bank default prediction in addition to producing an addi-tional credit risk benchmark. Without imposing dynamics on the covariates, ourmodel can predict default and distressed exits up to 5 years in the future. Thispaper shows that all previous empirical studies on bank failure that ignore bankdistressed exits are incomplete and hence less able to predict bank default accu-rately at a reasonable length of time. The potential spill-over effects and damageof bank failure to different parts of the economy make this paper highly relevantin the current macro-economic environment. Furthermore, this study is likely tohelp regulators and supervisors in different regions to construct a more healthybanking system.

JEL classification: G33,G21,G01,G18

∗Corresponding author. Tel.: +65 8428 4089; Fax: +65 6874 5430.E-mail addresses:, [email protected] (E. Van Laere).

†Please do not distribute this version of the paper and do not quote without explicit permissionfrom the authors.

June 29, 2012

Keywords: Bank default; Bank distress; Probability of default; Financial crisis;Financial distress; Forward intensity

1. Introduction

The latest financial crisis has created a new interest in the health of financial

institutions and systemic risk; even more so after the demise of Bear Stearns and

Lehman Brothers in 2008 and the European sovereign debt crisis of 2011-2012.

The recent turmoil has once again emphasized the way banks’ risk and financial

health affect financial and economic fragility, while governments around the world

have been forced to bail-out, privatize and rescue important banks (e.g. Bear

Stearns in the US, Dexia in Belgium, Bankia in Spain) to avoid more adverse

outcomes.

Due to the fact that the financial system is highly interconnected, illiquidity,

insolvency and losses of one financial institution are likely to contaminate other

financial institutions, especially in times of distress (Billio et al., 2012). The risk

of contagion implies that the default of one financial institution can lead to the

default of many more players in financial markets, through a snowball effect in

the interbank market, the payment system, asset prices, ALM management etc.

(Allen, 2009, 2012). In a recent paper, Billio et al. (2012) show that banks play a

much bigger role in transmitting shocks than any other financial institution. Also,

recent empirical evidence strongly supports the theoretical stance that a healthy

banking system is a necessary condition for economic growth and that banking

crises can seriously disrupt an economy (Levine, 2005; Hoggarth et al., 2002).

2

Hence, understanding the drivers of bank default and identifying high-risk banks

accurately at a reasonable length of time prior to default is crucial to restore and

maintain financial stability. Having such a model in place should help prevent

future crisis of similar magnitude and will prove useful for regulators and policy

makers around the world.

In this paper we present a new early warning model for bank default for a

sample of over 2000 listed banks in North America, Asia and Europe covering

the period 1990 to 2011. An important challenge when forecasting bank fail-

ures that has hitherto been largely ignored is the fact that a distressed bank might

exit through, for example, an acquisition or nationalization rather than a default.

Whether bank distress results in default or a distressed exit will likely be a de-

cision of a supervisory and/or regulatory body who have a number of alternative

measures at their disposal. The most extreme measure is to close the bank and

force it into to default, which in principal is possible as soon as the bank is insol-

vent. However, not every insolvent bank is closed and governments might prefer

to intervene and, for example, force an acquisition of the distressed bank. This

paper shows that all previous empirical studies on bank failures (with the excep-

tion of Brown and Dinc (2011)) that ignore bank distressed exits are incomplete

and hence unable to provide a comprehensive risk measure for bank creditors and

shareholders.

Brown and Dinc (2011) are the first to consider government acquisitions in

addition to bank failures, in investigating why and when governments intervene

3

and empirically confirm the too-many-to-fail effect. More specifically, they show

that a government is less likely to either take over or close a failing bank if other

banks in that country are weak. In this study, we focus on the difference between

default and distressed exits in predicting bank default, but we do not distinguish

between the types of distressed exits. We believe that for a bank failure model

to be complete all types of distressed exits should be accounted for disregarding

the level of government envolvement. In line with Brown and Dinc (2011) we

consider that the government makes the ultimate decision to let a bank fail. Hence

to allow our model to differentiate between banks that default and those that ex-

perience a distressed exit, we include variables that measure the likelihood that a

government will let a distressed bank fail.

Our main methodological contribution to the existing default literature is the

fact that our model allows us to include four possible paths for each bank simulta-

neously: (1) survival, (2) default, (3) distressed exit and (4) other non-distressed

exits. Traditional default models typically only include default (Altman, 1977;

Cole and White, 2012) do not account for non-default distressed exits (Duan et al.,

2012), or do not model these different paths simultaneously (Duffie et al., 2007).

More specifically, where Duffie et al. (2007) and Duan et al. (2012) suggest a

doubly stochastic Poisson intensity model to describe the occurance of default,

we are the first to specify a triply stochastic formulation to distinguish between

bank default and distressed exits. This extension allows us to capture early warn-

ings of bank default and/or distressed exit with reasonable accuracy as early as

4

5 years before the distressed event. Furthermore, in line with Duan et al. (2012)

we achieve this without having to impose dynamics on the covariates. The latter

implies that while estimating forward probabilities of default (PD), distressed exit

(PDE) or probability of default and distressed exit (PDDE) we only use the known

data at the time of prediction. A pseudo maximum likelihood is used to calibrate

the parameters that allow us to produce the term structure of PD and PDE.

We find evidence of significant dependence of the level and shape of the term

structure of conditional future default and distressed exit probabilities on a banks’

distance to default (a volatility-adjusted measure of leverage adjusted for finan-

cial institutions), the traditional CAMELS and the macro-economic environment.

Variation in distance-to-default has a much bigger effect on the term structure of

future default hazard rates than a comparable change in any of the other variables.

When modelling the difference between default and distressed exits we find that

a government is less likely to force a bank into default when the macro-economic

and the banking environment is weak. We interpret this finding as a confirmation

of the too-many-to-fail channel of regulatory forbearance first identified in Brown

and Dinc (2011). In addition to our contribution to the general default literature,

we add significantly to any other prior work in bank default prediction, which

despite a recent revival (Brown and Dinc, 2011; Cole and White, 2012) remains

scarce compared to the corporate default literature. Our results show that includ-

ing distressed exits as a seperate path increases the prediction accuracy of bank

default prediction. The prediction is particularly accurate for a horizon up to 2

5

years, and although the performance deteriorates for longer horizons, the model

performance remains reasonable and clearly outperforms other existing studies.

In addition, our model produces the probablity of distressed exit and distressed

exit or default as extra risk benchmarks up to 5 years in future. Furthermore, most

existing studies focus on US (DeYoung, 2003; Cole and White, 2012) or on a

number of countries or a particular region (Brown and Dinc, 2011) making us the

first to adopt a real multi-country approach.

The potential spill-over effects and damage of bank failure to different parts

of the economy, make this paper highly relevant in the current macro-economic

environment. From an academic perspective, this paper goes beyond previous

empirical studies in a significant way as we show that including distressed exits

improves the accuracy of PDs and introduces additional credit risk benchmarks.

Furthermore, this study is likely to help regulators and supervisors in constructing

a healthy banking system. Having a model in place that allows accurate default

prediction between 1 month and 5 years provides supervisors and regulators with

sufficient lead time to take the necessary action to prevent the bank’s default or

mitigate spill-over effects to other banks and the economy as a whole.

This article is further organized as follows. In the next section we review the

literature most closely related to our work and elaborate on our research setting.

The third section discusses the applied methodology and in section 4, we describe

the data. Section 5 presents the main empirical results. In section 6 we discuss the

performance of our model. Our concluding remarks are summarized in section 7.

6

As this is a preliminary draft, results and analysis are not provided in complete

detail.

2. Research setting

Although the bank default literature is scarce compared to the corporate de-

fault literature, the first paper ever to be published on bank failure dates back to

Sprague in 1910. The first type of models relied on one period ahead logit and

multiple discriminant analysis (Sprague, 1910; Sinkey, 1975; Martin, 1977; Barth

et al., 1985; Avery and Hanweck, 1984). For a long time, these first generation

models have dominated the bank failure prediction literature. However, in line

with corporate default literature, later bank models evolved to more advance lo-

gistic regression models, duration type analysis using Cox proportional hazard

models and dynamic models (Avery and Hanweck, 1984; Whalen, 2000; Whee-

lock, 2000; Torna, 2010; Ng. and Roychowdhury, 2011). For example, Cole and

Wu (2009) apply a dynamic hazard model and show that the out-of-sample fore-

casting accuracy of bank failure relative to using a static probit model improves

significantly.

In general, a bank’s financial health is likely to depend on bank-specific, sector

wide and macro-economic state variables. Although the methodology to forecast

bank default has changed significantly over time, the variables included in the

models are still comparable to the ones used in the earlier studies. Most studies

stick to the traditional combination of balance sheet inputs and ratios to build a

7

model that distinguishes between banks that are likely to default and those that are

not (Secrist, 1938; Meyer and Pifer, 1970; Sinkey, 1975; Altman, 1977; Avery and

Hanweck, 1984; Barth et al., 1985). For a complete overview of the early bank

failure literature, we refer to Torna (2010) and Demyanyk and Hasan (2010). Ac-

tually, most previous studies on bank failures include variables related to or even

reliant on supervisory rating systems of banks. More specifically, previous stud-

ies often include the CAMEL(S) rating or proxies for it. CAMELS stands for

Capital adequacy, Asset quality, Management, Earnings, Liquidity and Systemic

risk. The use of these variables is widely accepted by users of early warning

systems such as the US Fed and by academics (Whalen, 2000; Wheelock, 2000;

DeYoung, R.; Oshinsky and Olin; Cole and Gunther, 1995; Cole and Fenn, 2008;

Cole and Wu, 2009; Cole and White, 2012). In addition to CAMELS data, au-

thors also rely on other variables such as proxies for real estate lending (Cole and

White, 2012; Cole and Gunther, 1995; Cole and Fenn, 2008; Canbas, 2005). Fur-

thermore, Demirguc-Kunt and Detragiache (2002) show that banks operating in

jurisdictions with explicit deposit insurance are more fragile than banks operat-

ing in jurisdictions without such an explicit guarantee. Beaver et al. (2005) build

on Shumway (2001) and show that adding market driven variables into the haz-

ard model, increases the predictive ability of models. Agrawel and Taffler (2009)

however find little evidence between accounting based and market based models

in terms of accuracy.

Having a dynamic setting also allows macro-economic variables to enter the

8

model. Prior studies find correlation between macroeconomic conditions and de-

fault, using a variety of macroeconomic variables such as industrial production

growth (McDonald and Van de Gucht, 1999), the rate of corporate bankruptcies

(Hillegeist et al., 2003), business cycle downturn (Fons, 1998; Blume and Keim,

1991; Jonsson and Fridson, 1996), industrial production, interest rates, recession

indicator and aggregate corporate earnings Keenan et al. (1999); Helwege and

Kleiman (1997). In general, both GDP and interest spread have a record for pre-

dicting default rate variation over stages of the business cycle (Bangia et al., 2002;

Nickell et al., 2000)

Most existing studies rely solely on US data (Whalen, 2000; Wheelock, 2000;

DeYoung, R.; Oshinsky and Olin; Cole and Gunther, 1995; Cole and Fenn, 2008;

Cole and Wu, 2009; Cole and White, 2012). The fact that we build a global

model can be considered to be an important contributions and makes it even more

necessary to include macro-economic variables.

Lately, among other factors due to the latest financial crisis and increased

amount of data, academics have regained an interest in bank failure prediction

(Cole and White, 2012; Ng. and Roychowdhury, 2011; Aubuchon and Whee-

lock, 2010). Torna (2010) empirically investigates whether and how engagement

in non-traditional banking activities caused healthy banks to become troubled and

troubled banks to fail during the 2007-2009 period. Although his results are prone

to misclassification as he only uses one bank financial health dimension (leverage)

to identify troubled banks, using a proportional hazard and conditional logit model

9

he shows that business models for healthy banks becoming troubled (e.g. broker-

age services) differ from those that push banks to fail (e.g. investment banking

activity). Aubuchon and Wheelock (2010) mainly focus on regional economic

characteristics when explaining bank and thrift failures between 2007 and 2010

and show that bank failures during 2007-2010 were concentrated in regions of

the US that experienced the most distress in real estate and biggest declines in

economic activity. Ng. and Roychowdhury (2011) use a Cox proportional hazard

model and find that bank failures during the 2007-2010 were positively related to

additions in loan loss reserves in 2007 and confirm that that declines in economic

activity contribute to the level of distress. In their most recent bank failure paper,

Cole and White (2012) analyze why commercial banks failed during the recent fi-

nancial crisis. Using a logistic regression, they confirm that traditional proxies for

CAMELS components as well as measures for commercial real estate investments

do an excellent job in explaining failures during 2009. They show that banks with

more capital, better asset quality, higher earnings and more liquidity are less likely

to fail. Consistent with Cole and Fenn (2008) they find that CAMELS become less

important for early indicators of failure whereas bank portfolio indicators become

more important. In line with the Cole and Fenn (2008), we also attempt to predict

bank failures 5 years before default.

It is important to take note of the fact that an insolvent bank can continue

to do its business and issue new deposits to meet its obligations as long as the

government does not intervene. Although this is the first paper to include dis-

10

tressed exit as an explicit path in bank default model, there is an extensive strand

of literature that investigates the difference between bank insolvency and failure

(Gajewski, 1988; Demirguc-Kunt, 1989). Gajewski (1988) was the first to include

the distinction between insolvency and failure using a two equations model, a first

to model insolvency and a second to model administrative failure. (Demirguc-

Kunt, 1989) uses a simultaneous-equation model to model insolvency and failure

simultaneously, treating economic insolvency as only one of the various factors

that influence the failure decision. Thomson (1992) proposes to model the failure

decision of the regulator as a call option. These studies show that the distinction

between failure and insolvency is necessary.

Especially for banks it is important not only to distinguish between economic

insolvency and regulatory foreclosure, but also to distinguish between default and

distressed exits. Although it is clear that if a government were to never allow a dis-

tressed bank to fail, this would cause several moral hazard issues (Gale and Vives,

2002; Dam and Koetter, 2012). In principle, the government can always close

a distressed bank as soon as the bank becomes insolvent and empirical evidence

suggests that different factors are taken into consideration. Some recent papers

investigate this issue and show that the number of options that are available to the

government will likely depend on the level of distress (Brown and Dinc, 2011;

Hoggarth et al., 2004; Barth et al., 2002). They argue that when a regulatory body

is faced with an individual bank that suffers minor problems, they will grant time

for a bank turn-around and may request that the bank adopt particular measures to

avoid a default. However, when problems are severe, prudent regulation requires

11

a change in bank status through nationalization, liquidation, acquisition or other

means. Especially in times of crisis, such actions might be necessary in order to

reduce disruption in the payments system (Hoggarth et al., 2004), to prevent fire

sale prices to foreign banks (Acharya and Yorulmazer, 2008), to prevent bank runs

(Diamond and Dybvig, 1983) and to reduce the social cost of bank failures (Gropp

et al., 2011).

Theoretical research argues that when many banks are weak, this could trig-

ger regulatory intervention to address concerns about systemic risk (Allen, 2000).

However, others argue that regulators may choose not to intervene (Acharya and

Yorulmazer, 2007). In a recent paper Brown and Dinc (2011) provide a thorough

analysis of the criteria that are used when a government decides to intervene. For

a sample of emerging market economies, they show that a government is less

likely to take over or close a failing bank if the banking system is weak. Further

more, governments will avoid too many banks failing simultaneously (O’Hara and

Wayne, 1990; Acharya and Yorulmazer, 2007; Brown and Dinc, 2011), and will

avoid sufficiently important banks to default (Freixas and Rochet, 2011).

3. Methodology

In this section, we describe the triply stochastic model in detail as well as

describe the pseudo likelihood function that is used to calibrate the model. The

forward intensity description here follows the description in ?, which in turn is a

modification of the description in Duan et al. (2012). The major contribution of

this paper is the Bernoulli random draw that distinguishes separate paths between

12

defaults and distressed exits.

3.1. Model description

The input variables associated with the ith bank at the end of the nth month (at

time t = n∆t) is denoted by Xi(n). This is a vector that can consist of a mixture of

bank specific variables and variables that are shared by several banks (usually, all

banks that are domiciled in the same jurisdiction).

At each month, there are a total of four possibilities for each bank which need

to be modelled. A bank can either (i) survive to the next month; (ii) suffer a

default; (iii) suffer a distressed exit; or (iv) have some other form of exit. Note that

these four possibilities are mutually exclusive. Hereafter, the fourth possibility

which includes any exit that is not classified as a default or a distressed exit will

be referred to as a non-distressed exit.

As the variables preceding the second and third possibilities are highly cor-

related, these two paths are driven by the same Poisson process, and the fourth

possibility is driven by a second, independent Poisson process. In other words,

if the the default/distressed exit Poisson process jumps, then a Bernoulli random

variable will be drawn to determine whether the bank defaults or instead experi-

ences a distressed exit.

The probabilities of each branch are, for example: pi(m,n) the conditional

probability viewed from t = m∆t that bank i will default or have a distressed exit

before (n+ 1)∆t, conditioned on bank i surviving up until n∆t. In the event that

the bank has a default or distressed exit in this period, the probability that it will

13

be a default is qi(m,n) and the probability that it is a distressed exit is 1−qi(m,n).

pi(m,n) is the conditional probability viewed from t = m∆t that bank i will have a

non-distressed exit before (n+1)∆t, conditioned on bank i surviving up until n∆t.

It is the modeler’s objective to determine pi(m,n), qi(m,n) and pi(m,n), but

for now it is assumed that these quantities are known. With the conditional de-

fault, distressed exit and non-distressed exit probabilities known, the correspond-

ing conditional survival probability of bank i is 1− pi(m,n)− pi(m,n).

The probability that a particular path will be followed is the product of the

conditional probabilities along the path. For example, the probability at time t =

m∆t of bank i surviving until (n−1)∆t and then defaulting between (n−1)∆t and

n∆t is:

Prob t=m∆t [τi = n,τi < τi, τi] (1)

= qi(m,n−1)pi(m,n−1)n−2

∏j=m

[1− pi(m, j)− pi(m, j)] .

Here, τi is the default time for bank i, τi is the distressed exit time, and τi is the

non-distressed exit time, all measured in units of months. Also the product is

equal to one if there are no terms in the product. The condition τi < τi and τi < τi

is the requirement that the bank defaults before it has any other form of exit. Note

that by measuring exits in units of months, if, for example, a default occurs at any

time in the interval ((n−1)∆t,n∆t] then τi = n.

Using (1), cumulative default probabilities can be computed. At m∆t the prob-

ability of bank i defaulting at or before n∆t and not having any other form of exit

14

before t = n∆t is obtained by taking the sum of all of the paths that lead to default

at or before n∆t:

Prob t=m∆t [m < τi ≤ n,τi < τi, τi] (2)

=n−1

∑k=m

{qi(m,k)pi(m,k)

k−1

∏j=m

[1− pi(m, j)− pi(m, j)]

}.

Likewise, the cumulative distressed exit probabilities are given as:

Prob t=m∆t [m < τi ≤ n,τi < τi, τi] (3)

=n−1

∑k=m

{[1−qi(m,k)] pi(m,k)

k−1

∏j=m

[1− pi(m, j)− pi(m, j)]

}.

While it is convenient to derive the probabilities given in equations (1), (2)

and (3) in terms of the conditional probabilities, expressions for these in terms

of the forward intensities need to be found, since the forward intensities will be

functions of the input variable Xi(m). The forward intensity for the default or

distressed exit of bank i that is observed at time t = m∆t for the forward time

interval from t = n∆t to (n + 1)∆t, is denoted by λi(m,n) where m ≤ n. The

corresponding forward intensity for a non-distressed exit is denoted by λi(m,n).

Because a default or distressed exit is signaled by a jump in a Poisson process, the

conditional probability is a simple function of the forward intensity:

pi(m,n) = 1− exp[−∆t λi(m,n)]. (4)

Since joint jumps in the same time interval are assigned as defaults or distressed

15

exits, the conditional non-distressed exit probability needs to take this into ac-

count:

pi(m,n) = exp[−∆t λi(m,n)]{1− exp[−∆t λi(m,n)

]}. (5)

The conditional survival probabilities in equations (1), (2) and (3) are computed

as the conditional probability that the bank does not have any form of exit:

Prob t=m∆t [τi, τi > n+1| τi, τi > n] = exp{−∆t[λi(m,n)+ λi(m,n)

]}. (6)

It remains to specify the dependence of the forward intensities and qi(m,n) on the

input variable Xi(m). The forward intensities need to be positive so that the con-

ditional probabilities are non-negative. A standard way to impose this constraint

is to specify the forward intensities as exponentials of a linear combination of the

input variables:

λi(m,n) = exp[β (n−m) ·Yi(m)], (7)

λi(m,n) = exp[β (n−m) ·Yi(m)].

Here, β and β are coefficient vectors that are functions of the number of months

between the observation date and the beginning of the forward period (n−m), and

Yi(m) is simply the vector Xi(m) augmented by a preceding unit element: Yi(m) =

(1,Xi(m)). The unit element allows the linear combination in the argument of the

exponentials in (7) to have a non-zero intercept.

16

qi(m,n) needs to be between zero and one so that the probabilities are well-

defined. The logit function is used in this case:

qi(m,n) =exp[β (n−m) ·Yi(m)

]1+ exp

[β (n−m) ·Yi(m)

] . (8)

The maximum forecast horizon is 60 months and there are # input variables

plus the intercept. So there are 60 sets of each of the coefficient vectors denoted

by β (0), . . . ,β (59) and β (0), . . . , β (59) and β (0), . . . , β (59) and each of these co-

efficient vectors has # elements. While this is a large set of parameters, as will be

seen in the next section, the calibration is tractable because the parameters for each

horizon can be done independently from each other, and the default/distressed

exit intensity coefficients, the non-distressed exit intensity coefficients, and the

default/distressed exit Bernoulli coefficients and be calibrated independently.

We introduce a notation for the forward intensities that makes clear which

parameters are needed for the forward intensity in question:

Λ [β (n−m),Xi(m)] := exp[β (n−m) ·Yi(m)]. (9)

This is the forward default intensity. The corresponding notation for other exit

forward intensities is then just Λ[β (n−m),Xi(m)

]. Also, the probability of the

17

default/distressed exit Bernoulli variable will be denoted by:

Q[β (n−m),Xi(m)

]:=

exp[β (n−m) ·Yi(m)

]1+ exp

[β (n−m) ·Yi(m)

] . (10)

3.2. Pseudo-likelihood function

The empirical dataset used for calibration can be described as follows. For

the economy as a whole, there are N end of month observations, indexed as

n = 1, . . . ,N. Of course, not all banks will have observations for each of the N

months as they may start later than the start of the economy’s dataset or they may

exit before the end of the economy’s dataset. There are a total of I banks in the

economy, and they are indexed as i = 1, . . . , I. As before, the input variables for

the ith bank in the nth month is Xi(n).

In addition, the default times τi, distressed exit time τi and non-distressed exit

times τi for the ith bank are known if the default or other exit occurs after time

t = ∆t and at or before t = N∆t. The possible values for τi, τi and τi are integers

between 2 and N, inclusive. If a bank exits before the month end, then the exit time

is recorded as the first month end after the exit. If the bank does not exit before

t = N∆t, then the convention can be used that these three values are infinite. If the

bank has a default type of exit within the dataset, then τi and τi can be considered

as infinite. If instead the bank has a distressed exit within the dataset, then τi and

τi can be considered as infinite. Likewise if the bank has a non-distressed exit

within the dataset. The first month in which bank i has an observation is denoted

by t0i. Except for cases of missing data, these observations continue until the end

18

of the dataset if the bank never exits. If the bank does exit, the last needed input

variable Xi(n) is for n = Ti−1.

The notation: Ti = min(τi, τi, τi) will be used. If the bank has an exit within

the dataset, then this value will be finite. Otherwise, it will be infinite. The exits

are categorized in a mutually exclusive way, so the three possibilities of {Ti = τi},

{Ti = τi} and {Ti = τi} and mutually exclusive.

The set of all observations for all banks is denoted by X , the set of all default,

distressed exit and non-distressed exit times for all banks is denoted by T , and

the set of all of the associated parameters are denoted by B = {β , β , β}.

The calibration of the parameters B is done by maximizing a pseudo-likelihood

function. The function to be maximized violates the standard assumptions of like-

lihood functions, but Appendix A in Duan et al. (2011) derives the large sample

properties of the pseudo-likelihood function.

In formulating the pseudo-likelihood function, the assumption is made that the

banks are conditionally independent from each other. In other words, correlations

among the probabilities of default arise naturally from sharing common factors

and any natural correlations there are between different banks’ bank-specific vari-

ables, but defaults are not correlated. The calibration will be for a horizon of H

months. Later in the implementation, H = 60 months so that five year default

probabilities can be estimated. With this assumption, the pseudo-likelihood func-

tion for a set of parameters B and the dataset (T ,X ) is:

LH(B;T ,X ) =I

∏i=1

min(N−H,Ti)

∏m=t0i

PH(B;T ,Xi(m)). (11)

19

Notice that the inner product is over the valid monthly observations for a company

for which it can be determined that an exit has occurred within the horizon H. In

(11), PH(B;T ,Xi(m)) is a probability for bank i, with the nature of the probability

depending on what happens to the bank during the period from month m to month

m+H. This is defined as:

PH(B;T ,Xi(m))

= exp

{−∆t

H−1

∑j=0

[Λ(β ( j),Xi(m))+Λ

(β ( j),Xi(m)

)]}1{m+H < Ti}

+exp

{−∆t

Ti−m−2

∑j=0

[Λ(β ( j),Xi(m))+Λ

(β ( j),Xi(m)

)]}×{1− exp [−∆t Λ(β (Ti−m−1),Xi(m))]}

×Q(

β (Ti−m−1),Xi(m))1{Ti = τi ≤ m+H}

+exp

{−∆t

Ti−m−2

∑j=0

[Λ(β ( j),Xi(m))+Λ(β ( j),Xi(m))]

}×{1− exp[−∆t Λ(β (Ti−m−1),Xi(m))]}

×{

1−Q(

β (Ti−m−1,Xi(m))}

1{Ti = τi ≤ m+H}

+exp

{−∆t

Ti−m−2

∑j=0

[Λ(β ( j),Xi(m))+Λ(β ( j),Xi(m))]

}×{

1− exp[−∆t Λ(β (Ti−m−1),Xi(m))]}

×exp [−∆tΛ(β (Ti−m−1),Xi(m))]1{Ti = τi ≤ m+H} (12)

Here, 1{A} is the indicator function which is equal to 1 if the statement A is true

and zero otherwise.

In words, if bank i survives from the observation time at month m for the

20

full horizon H until at least m +H, then PH(B;T ,Xi(m)) is the model-based

survival probability for this period. This is the first term in (12). The second

term handles the cases where the bank has a default within the horizon, in which

case the probability is the model-based probability of the bank defaulting at the

month that it ends up defaulting. The third term handles the cases where the

bank has a distressed exit within the horizon, in which case the probability is the

model-based probability of the bank having a distressed exit at the month that the

exit actually does occur. The last term handles the cases where the bank has a

non-distressed exit within the horizon, in which case the probability is the model-

based probability of the bank having a non-distressed exit at the month that the

exit actually does occur.

The pseudo likelihood function given in (12) can be numerically maximized to

give estimates for the coefficients B. Notice though that the sample observations

for the pseudo-likelihood function are overlapping if the horizon is longer than

one month. For example, when H = 2, default over the next two periods from

month m is correlated to default over the next two periods from month m+1 due

to the common month in the two sample observations. However, in Appendix A

of Duan et al. (2011), the maximum pseudo-likelihood estimator is shown to be

consistent, in the sense that the estimators converge to the “true” parameter value

in the large sample limit.

It would not be feasible to numerically maximize the pseudo-likelihood func-

tion using the expression given in (12), due to the large dimension of the B. No-

tice though that each of the terms in PH(B;T ,Xi(m)) can be written as a product

21

of factors that are a function of only β , factors that are a function of only β and

factors that are a function of only β . Only one of the terms of (12) will be non-

zero for a particular firm and month, which means that PH(B;T ,Xi(m)) can be

likewise factored, with

PH(B;T ,Xi(m)) = Pβ

H (β ;T ,Xi(m))Pβ

H (β ;T ,Xi(m))Pβ

H (β ;T ,Xi(m)).(13)

Thus, it is possible to conduct separate maximizations with respect to β , with

respect to β and with respect to β . The β only factor on the right hand side of

(13) is:

Pβ

H (β ;T ,Xi(m))

= exp

{−∆t

H−1

∑j=0

Λ(β ( j),Xi(m))

}1{m+H < Ti}

+exp

{−∆t

Ti−m−2

∑j=0

Λ(β ( j),Xi(m))

}{1− exp [−∆t Λ(β (Ti−m−1),Xi(m))]}

×1{(Ti = τi ≤ m+H)∪ (Ti = τi ≤ m+H)}

+exp

{−∆t

τi−m−2

∑j=0

Λ(β ( j),Xi(m))

}exp [−∆tΛ(β (τi−m−1),Xi(m))]

×1{Ti = τi ≤ m+H}. (14)

22

The β only factor on the right hand side of (13) is:

Pβ

H (β ;T ,Xi(m))

= exp

{−∆t

H−1

∑j=0

Λ(β ( j),Xi(m)

)}1{m+H < Ti}

+exp

{−∆t

Ti−m−2

∑j=0

Λ(β ( j),Xi(m)

)}×1{(Ti = τi ≤ m+H)∪ (Ti = τi ≤ m+H)}

+exp

{−∆t

Ti−m−2

∑j=0

Λ(β ( j),Xi(m))

}(15)

×{

1− exp[−∆t Λ(β (Ti−m−1),Xi(m))]}1{Ti = τi ≤ m+H}.

The β only portion of (13) is:

PH(β ;T ,Xi(m))

= 1{(m+H < Ti)∪ (Ti = τi ≤ m+H)}

+Q(

β (Ti−m−1),Xi(m))1{Ti = τi ≤ m+H}

+{

1−Q(

β (Ti−m−1,Xi(m))}

1{Ti = τi ≤ m+H}. (16)

Then, the β , β and β specific versions of the pseudo-likelihood function can

23

be separately maximized:

L β

H (β ;T ,X ) =I

∏i=1

min(N−H,Ti)

∏m=t0i

Pβ

H (β ;T ,Xi(m)) (17)

L β

H (β ;T ,X ) =I

∏i=1

min(N−H,Ti)

∏m=t0i

Pβ

H (β ;T ,Xi(m))

L β

H (β ;T ,X ) =I

∏i=1

min(N−H,Ti)

∏m=t0i

Pβ

H (β ;T ,Xi(m)),

whence:

LH(B;T ,X ) = L β

H (β ;T ,X )L β

H (β ;T ,X )L β

H (β ;T ,X ). (18)

A further important separation for β and β is a separation by horizons. Notice

that we can decompose Pβ

H and Pβ

H as:

Pβ

H (β ;T ,Xi(m)) =H−1

∏h=0

Pβ (h)(β (h);T ,Xi(m)), (19)

Pβ

H(β ;T ,Xi(m)

)=

H−1

∏h=0

Pβ (h) (β (h);T ,Xi(m)

).

24

Where:

Pβ (h)(β (h);T ,Xi(m))

= 1{t0i ≤ m,min(τ, τ)> m+h+1}exp[−∆t Λ(β (h),Xi(m))]

+1{t0i ≤ m,τi ≤ τi,τi = m+h+1}{1− exp[−∆t Λ(β (h),Xi(m))]}

+1{t0i ≤ m, τi ≤ τi, τi = m+h+1}exp[−∆t Λ(β (h),Xi(m))]

+1{t0i > m}+1{min(τi, τi)< m+h+1},

Pβ (h)(β (h);T ,Xi(m))

= 1{t0i ≤ m,min(τ, τ)> m+h+1}exp[−∆t Λ(β (h),Xi(m))]

+1{t0i ≤ m,τi ≤ τi,τi = m+h+1}

+1{t0i ≤ m, τi ≤ τi, τi = m+h+1}{1− exp[−∆t Λ(β (h),Xi(m))]}

+1{t0i > m}+1{min(τi, τi)< m+h+1}. (20)

Thus, the β and β specific pseudo-likelihood functions can be decomposed as:

L β

H (β ;τ, τ,X) =H−1

∏h=0

L β (h)(β (h);τ, τ,X) (21)

L β

H (β ;τ, τ,X) =H−1

∏h=0

L β (h)(β (h);τ, τ,X),

25

where

L β (h)(β (h);τ, τ,X) =N−H

∏m=1

I

∏i=1

Pβ (h)(β (h);T ,Xi(m)) (22)

L β (h)(β (h);τ, τ,X) =N−H

∏m=1

I

∏i=1

Pβ (h)(β (h);T ,Xi(m)).

Thus, for every horizon h, L β (h)(β (h);τ, τ,X) and L β (h)(β (h);τ, τ,X) can be

separately maximized.

In the final variable select, 10 variables are chosen resulting in 11 sets of co-

efficients. The horizons are taken from one to 60 months, meaning that there is

a 2× 60× 11 dimensional maximization that is turned into an 11 dimensional

maximization done 2×60 times, making the calibration problem tractable.

4. Data

We rely on a number of different datasources to construct our model. Our bank

specific financial statement data and market data is obtained from Bloomberg,

while the macro-variables are retrieved through Datastream. An important chal-

lenge in constructing our model is the identification of default and distressed exits.

Both events are mainly retrieved through manual data collection. For the default

cases we start from the CRI default dataset1 and correct the default cases for our

definition (see Table 1). Press sources provided by Bloomberg, Factiva, Wall

Street Journal and other online media are used to identify whether a delisting in

1The CRI dataset is a dataset constructed by the Risk Management Institute at NUS that covers90,000 listed companies and contains, amongst others, default and other exit events.

26

case of no default involves a distressed exit. We categorise exits as distressed in

case we can find material evidence that the bank was in financial distress before

the exit. An count of all exit events by year is presented in Table 2.

Banks from 30 different economies are included. These are the economies

that are covered by the CRI in order that the DTD (described later) is available. In

Asia-Pacific, the economies are: Australia, China, Hong Kong, India, Indonesia,

Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan and Thailand. In

North America, the economies as Canada and the US. In Western Europe, the

economies are Austria, Belgium, Denmark, Finland, France, Germany, Greece,

Iceland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and

the United Kingdom.

4.1. Covariates

The selection of variables included in our forward intensity model is based on

literature. Knowing the usual benefits of parsimonious models, we chose not to

include too many variables in our model.

For our bank specific variables we include variables that proxy the different

CAMELS dimensions. For each CAMELS dimension, we have tested different

proxies, we only list down the ones included in our final model. For capital: com-

mon equity to total assets (-), liability to customer deposits (-); for asset quality:

reserves for loan losses to total loans (+); for management quality: efficiency ra-

tio (+), asset growth (-); for earnings: return on common equity(-); for liquidity:

27

customer deposits to total loans(-); for systemic risk: relative size(-). The ex-

pected signs are indicated after each of the variables. The intuition should be

clear from the literature review.

Another important input in our model is distance-to-default (DtD), a market-

based measure of default risk that is calculated as a volatility-adjusted measure

of leverage and is adjusted for financial institutions. Although we do not include

market returns, including DtD allows us to incorporate the most current informa-

tion in our model. Harade et al. (2010) examine the evolution in DtD for eight

failed banks and show that in many cases DtD became smaller in anticipation of

failure. They claim that data quality prevents them from obtaining conclusive re-

sults on the use of DtD in bank default prediction. However, we believe that this

lack of evidence can also be explained by the fact that Harade et al. (2010) rely

on the standard Merton DtD compution (1974), which as shown in Duan (2010)

is not meaningful for financial institutions. Hence, the distance-to-default (DtD)

computation used in our model is based on Duan (2010) who extends the standard

Merton DtD computation in order for it to be meaningful for financial institutions.

To properly account for the debt of financial institutions, Duan (2010) includes a

fraction δ of a firm’s other liabilities. The other liabilities are defined as the firm’s

total liabilities minus both the short and long-term debt. The debt level L then

becomes the current liabilities plus half of the long-term debt plus the fraction δ

multiplied by the other liabilities, so that the debt level is a function of δ . The

standard KMV assumptions are then a special case where δ = 0. The DtD at the

28

end of each month is needed for every bank in order to calibrate the forward inten-

sity model. A moving window, consisting of the last one year of data before each

month end is used to compute the month end DtD. Daily market capitalization

data based on closing prices is used for the equity value in the implied asset value

computation of equation.

In order to account for the country and economic specific variables we also

test using GDP growth, yield curve and stock index volatility.

The variables are commonly found in the literature and are mostly self-explanatory

except for our measure of relative size. We use the logarithm of the bank’s total

assets over the economy’s aggregate total assets in the banking system. While the

Bloomberg data set allows us to compute this aggregate for listed banks in each

economy, certain economies (for example, Germany) have significant non-listed

banks. Thus, we find the factor between the aggregate assets of listed banks and

the aggregate assets of all banks in an economy (obtained from Bankscope) for

2011, and apply this factor throughout the history.

We refer to Table 3 for descriptive statistics of the variables that were selected

as inputs to the intensity functions.

We believe that the ultimate decision to let a bank fail will likely be country

and government specific (Brown and Dinc, 2011; Dam and Koetter, 2012). Hence

to allow our model to differentiate between banks that default and those that ex-

perience a distressed exit, we include the following bank and country specific

29

variables. First we include a proxy for the relative size of the bank: asset rank,

a ranking of the size of all banks. The sign for this variable is difficult to pre-

dict. Big banks are often claimed to be too-big-to-fail and hence less likely to

default. On the other hand, big banks are typically more complex which might

imply that they are more likely to experience distress. Second, we include prox-

ies to measure the propensity of governments to act when a bank is in distress:

distressed exits to distressed exits and default, number of past distressed exits,

number of past defaults. These last two variables also measure the capacity of

a government to avoid default and number of past defaults is also a proxy for

the too-many-to-fail effect. Finally we test the following variables as proxies for

the financial environment: number of defaults and distressed exits, stock index,

three month treasury rate.

5. Empirical Results

With 60 months of forecast horizons, three sets of parameters (default, dis-

tressed exits and non-distressed exit), the parameter estimates are quite extensive

and are not included in this paper and we just discuss the most important results.

Recall that if a parameter for a variable is estimated to be positive, an increasing

value in that variable, will lead to an increasing value of forward intensity and thus

means an increasing value for the conditional probability of default and distressed

exit. We find evidence of significant dependence of the level and shape of the term

structure of conditional future default and distressed exit probabilities on a banks’

distance to default, the traditional CAMELS and the macro-econ environment.

30

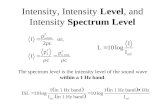

The parameter estimates including standard errors are plotted in Figure 1.

DtD coefficients are significantly negative for horizons out to over three years.

All of the CAMELS have the expected sign for short prediction horizons, with

varying degrees of significance. The explanatory power of customer deposits to loans,

return on common equity and relative size remains high even up to 5 years before

default. Including the stock index volatilities as a proxy for the macro-economic

environments results in the best model, with other macro-economic variables not

having significance when the stock index volatilities are included.

For our logit model that estimates whether a bank will eventually default or

experience a distressed exit the following variables are significant: the macro-

economic environment measured by stock index return (-) and 3 month treasurary rate

(+), asset rank (+) and number of past distressed exits (-). Recall that if a param-

eter for a variable is estimated to be positive, a higher value implies a higher prob-

ability of default versus distressed exit. So, we find that a governemnt is less likely

to force a bank into default when the macro-economic and the banking environ-

ment is weak. We interpret this finding as a confirmation of the too-many-to-fail

channel of regulatory forbearance first identified in Brown and Dinc (2011). Fur-

thermore, the sign of the coefficient of asset rank suggests that the too-big-to-fail

effect does not hold for our sample. However, these are only preliminary results

and additional variables (e.g. a proxy for interconnection between banks) still

need to be tested before we can draw any meaningful conclusions in this respect.

31

6. Prediction accuracy

In this section, we provide an overview of the model performance by com-

menting on the accuracy ratios.2 The accuracy ratio, sometimes referred to as the

Gini coefficient, is a commonly used measure for the discriminatory power of a

default model. It summarizes the forecasting quality of a model in one number

by examining the correct ordering of the risk rankings produced by the model. If

a defaulter had been assigned by a model among the highest risk ranking firms

before its default, the model has discriminated well. The accuracy ratio takes its

value between 0 and 1, representing perfect and no discriminating power, respec-

tively. The performance of our model is compared to the default prediction model

developed by Duan et al. (2012). More specifically, we apply the model of Duan

et al. (2012) to our bank sample and compare it to (1) the accuracy of our model

when distressed exits are also classified as default and (2) our model distinguishes

between default and distressed exits. It is clear that redefining default and includ-

ing distressed exits as default does not improve the prediction accuracy. However,

distinguishing between both exit paths clearly improves the prediction accuracy

and results in ARs of about 90% at 1 year. Although the prediction accuracy

drops for longer horizons, it is still at around 75% for 2 years and around 60%

for 5 years. Furthermore our model allows us to forecast distressed exits as an

additional risk measure.

2As this is only a preliminary version of the paper, we do not include any AR tables, we onlyprovide a high level discussion that is indicative of our major, albeit preliminary findings.

32

7. Conclusion

In this paper we address an important gap in the bank default literature. More

specifically, by extending the traditional forward intensity model, we are the first

to present a triply stochastic process to explicitly distinguish between default and

distressed exits when estimating the probability of default for a sample of listed

banks. We show that including distressed exits as a seperate path increases the

prediction accuracy of bank default prediction. In addition, the model allows us

to produce the probablity of distressed exit and distressed exit or default as extra

risk benchmarks. Without imposing dynamics on the covariates, our model al-

lows us to predict default and distressed exits up until 5 years. The prediction is

particularly accurate for a horizon up until 2 years, and although the performance

detorirates for longer horizons, the model performance remains reasonable. We

find evidence of significant dependence of the level and shape of the term structure

of conditional future default and distressed exit probabilities on a banks’ distance

to default, the traditional CAMELS and the macro-econ environment. Variation

in distance-to-default has a much bigger effect on the term structure of future de-

fault hazard rates than a comparable change in any of the other variables. When

modelling the difference between default and distressed exits we find that a gov-

ernemnt is less likely to force a bank into default when the macro-economic and

the banking environment is weak. We interpret this finding as a confirmation of

the too-many-to-fail channel of regulatory forbearance.

This paper shows that all previous empirical studies on bank failure that ignore

33

bank distressed exits are incomplete and hence less able to predict bank default

accurately at a reasonable length of time. The findings presented in this paper will

help regulators and supervisors in different regions to construct a more healthy

banking system.

34

Acharya, V., Yorulmazer, T., 2007. Too many to fail - An analysis of time-inconsistency in bank closure policies. Journal of Financial Intermediation 16,1–31.

Acharya, V., Yorulmazer, T., 2008. Cash-in-the market pricing and optimal reso-lution of bank failures. Review of Financial Studies 21, 2705–2742.

Agrawel, V., Taffler, R., 2009. Comparing the performance of market-based andaccounting-based bankruptcy prediction models. Journal of Banking & Finance32, 1541–1551.

Allen, F., B.A.C.E., 2009. Financial crises: theory and evidence. Annual Reviewof Financial Economics 1, 97–116.

Allen, F., B.A.C.E., 2012. Asset commonality, debt maturity and systemic risk.The Journal of Financial Economics 104, 519–534.

Allen, F., G.D., 2000. Financial contagion. The Journal of political Economy 108,1–33.

Altman, E., 1977. Predicting performance in the savings and loan associationindustry. Journal of Monetary Economics 3, 443–466.

Aubuchon, C., Wheelock, D., 2010. The geographic distribution and charac-teristics of US bank failures, 2007-2010: Do bank failures still reflect localeconomic conditions?

Avery, R., Hanweck, G., 1984. A dynamic analysis of bank failures. BAnk struc-ture and Competition, Federal reserve Bank of Chicago , 380–395.

Bangia, A., Diebold, A., Kronimus, A., Schagen, C., Schuermann, T., 2002. Rat-ings migration and the business cycle, with application to credit portfolio stresstesting. Journal of Banking & Finance 26, 445–474.

Barth, J., Brumbaugh, R., Wang, G., 1985. Thrift institution fialures: Causes andpolicy issues. Federal Reserve Bank of Chicago, Proceedings, pp. 184-216.

Barth, J., Caprio, G., Levine, R., 2002. Rethinking bank regulation: till angelsgovern. Cambridge University Press,New York.

35

Beaver, W., McNichiols, M., Rhie, J., 2005. Have financial statements be-come less informative? Evidence from the ability of financial ratios to predictbankruptcy. Review of Accounting Studies 10, 93–122.

Billio, M., Getmansky, M., Lo, A., Pelizzon, L., 2012. Econometric measures ofconnectedness and systemic risk in the finance and insurance sector. Journal ofFinancial Economics 104, 535–559.

Blume, M., Keim, D., 1991. Realized reurns and volatility of low-gradebonds:1977-1989. Journal of Finance 46, 49–74.

Brown, C., Dinc, I., 2011. Too many to fail? Evidence of regulatory forbearancewhen the banking sector is weak. The Review of Financial Studies 24, 1378–1405.

Canbas, S., 2005. Prediction of commercial bank failure via multivariate statis-tical analysis of financial structure: The Turkish case. European Journal ofOperational Research 166, 528–546.

Cole, R., Fenn, G., 2008. The role of commercial real estate investments in thebanking crisi of 1985-92. Working Paper.

Cole, R., Gunther, J., 1995. Seperating the likelihood and timing of bank failures.Journal of Banking & Finance 19, 1073–1089.

Cole, R., White, L., 2012. Deja vu all over again: the causes of US commercialbank failures this time around. Journal of Financial Services Research Forth-coming.

Cole, R., Wu, L., 2009. Improving bank failure prediction using a simple dynamichazard model. Working Paper.

Dam, L., Koetter, M., 2012. Bank bailouts and moral hazard: Evidence fromGermany. Review of Financial Studies forthcoming.

Demirguc-Kunt, A., 1989. Modeling large commercial-bank failures: Asimultaneous-equation analysis. Federal Reserve Bank of Cleveland WorkingPaper.

Demirguc-Kunt, A., Detragiache, E., 2002. Does deposit insurance increase bank-ing system stability? An emprical investigation. Journal of Monetary Eco-nomics 49, 1373–1406.

36

Demyanyk, Y., Hasan, I., 2010. Financial crises and bank failures: A review ofprediction methods.

DeYoung, R., title = The failure of new entrants in commercial banking markets:a split population duration analysis, y...p...v...j..R., .

Diamond, D., Dybvig, P., 1983. Bank runs, deposit insurance and liquidity. Jour-nal of Political Economy 91, 401–419.

Duan, J., 2010. Clustered Defaults. NUS-RMI Working Paper.

Duan, J., Sun, J., Wang, T., 2012. Multi-period corporate default prediction- Aforward intensity approach. Journal of Econometrics forthcoming.

Duffie, D., Saita, L., Wang, K., 2007. Multi-period corporate default predictionwith stochastic covariates. Journal of Financial Economics 83, 635–665.

Fons, J., 1998. An approach to forecasting default rates. Moody’s Investor ServicePaper.

Freixas, X., Rochet, J., 2011. Taming sifis. Zurich University, Working Paper.

Gajewski, G., 1988. Bank risk, regulator behavior, and bank closure in the mod-1980s: A two-step logit model. PhD dissertation, The George WashingtonUniversity, 1988.

Gale, D., Vives, X., 2002. Dollarization, bailouts and the stability of the bankingsystem. Quarterly Journal of Economics 117, 467–502.

Gropp, R., Hakenes, H., Schnabel, I., 2011. Competition, risk shifting and publicbailout policies. Review of Financial Studies 24, 2084–2120.

Harade, K., Ito, T., Takahashi, S., 2010. Is the distance to default a good mea-sure in predicting bank failures? case studies. WP 16182, National Bureau ofEconomic Research.

Helwege, J., Kleiman, P., 1997. Understanding aggregate default rates of highyield bonds. Journal of Fixed Income 7, 55–62.

Hillegeist, S., Keating, E., Cram, D., Lundstedt, K., 2003. Assessing the proba-bility of bankruptcy. Working Paper, Northwestern University.

37

Hoggarth, G., Reidhill, J., Sinclair, P., 2004. On the resolution of banking crises:Theory and evidence. Bank of England, Working Paper No. 229.

Hoggarth, G., Reis, R., Saporat, V., 2002. Cost of banking system instability:some empirical estimates. Journal of Banking& Finance 26, 825–855.

Jonsson, J., Fridson, M., 1996. Forecasting default rates on high-yield bonds.Journal of Fixed Income 6, 69–77.

Keenan, S., Sobehart, J., Hamilton, D., 1999. Predicting default rates: a forecast-ing model for moody’s issuer-based default rates. Working Paper.

Levine, R., 2005. Finance and growth: Theory and evidence. in Handbook ofEconomic Growth, Eds: Aghion Ph. and Durlauf S., Elsevier Science, TheNetherlands .

Martin, D., 1977. Early warning of bank failures: A logit regression approach.Journal of Banking & Finance 1, 249–276.

McDonald, C., Van de Gucht, L., 1999. High-yield bond default and call risks.Review of Economics and Statistics 81, 409,419.

Meyer, P., Pifer, H., 1970. Prediction of bank failures. Journal of Finance 25,853–868.

Ng., J., Roychowdhury, S., 2011. Loan loss reserves, regulatory capital and bankfailures: evidence from the 2008-2009 economic crisis. Working Paper.

Nickell, P., Perraudin, W., Varotto, S., 2000. Stability of rating transitions. Journalof Banking & Finance 24, 203–227.

O’Hara, M., Wayne, S., 1990. Deposit insurance and wealth effects: The value oftoo big to fail. Journal of Finance 45, 1587–1600.

Oshinsky, R., Olin, V., . Troubled banks: why don’t they fail? .

Secrist, H., 1938. National bank failures and non-failures: An autopsy and diag-nosis. Principia Press, Bloomington, IN.

Shumway, T., 2001. Forecasting bankruptcy more accurately. Journal of Business74, 101–124.

38

Sinkey, J., 1975. A multivariate statistical analysis of the characteristics of prob-lem banks. Journal of Finance 30, 21–36.

Sprague, O., 1910. History of crises under the national banking system. Wash-ington, DC: National Monetary Commission.

Thomson, J., 1992. Modeling the bank regulator’s closure option: A two steplogit regression approach. Journal of Financial Services Research 6, 5–23.

Torna, G., 2010. Understanding commercial bank failures in modern banking era.Financial Management Association, annual meeting 2010.

Whalen, G., 2000. A proprtional hazards model of bank failure: An examinationof its usefulness as an early warning tool. Economic Review, Federal ReserveBank of Cleveland , 21–31.

Wheelock, D.C., W.P., 2000. Why do banks disappear? The detrminants of USbank failures and acquisitions. Review of Economics and Statistics 82, 127–138.

39

8. Tables

Action type SubcategoryBankruptcy Filing Filing Type: UnknownBankruptcy Filing Filing Type: AdministrationBankruptcy Filing Filing Type: Chapter 11Bankruptcy Filing Filing Type: Chapter 15Bankruptcy Filing Filing Type: Chapter 7Bankruptcy Filing Filing Type: LiquidationBankruptcy Filing Filing Type: ProtectionBankruptcy Filing Filing Type: ReceivershipBankruptcy Filing Filing Type: RehabilitationBankruptcy Filing Filing Type: InsolvencyBankruptcy Filing Filing Type: ConservatorshipDelisting Reason for delisting: BankruptcyDefault Corporate Action Reason: UnknownDefault Corporate Action Reason: Bankruptcy

Table 1: The different types of default events for banks in our sample.

Year Defaults Distressed Exits Non-Distressed Exits1992 0 0 01993 0 0 41994 0 0 51995 0 0 141996 0 0 231997 1 0 451998 5 2 741999 13 0 582000 0 3 792001 1 3 892002 2 1 552003 1 1 472004 2 2 582005 0 0 482006 0 1 542007 2 7 662008 12 8 602009 20 7 222010 6 12 382011 3 15 452012 0 2 10

Table 2: The number and type of exit events in each year.

40

Variable Min 25% Median 75% Max Mean Std Dev #common equity to total assets 0.013 0.059 0.080 0.102 0.500 0.090 0.062 318447liability to customer deposits 1.005 1.070 1.171 1.399 21.221 1.651 2.292 310962reserves for loan losses to total loans 0.000 0.011 0.014 0.022 0.130 0.020 0.019 290145efficiency ratio 16.905 55.462 63.938 73.179 161.374 65.457 19.538 317744asset growth -0.260 0.016 0.091 0.197 1.183 0.132 0.211 290106return on common equity -67.770 4.781 10.099 14.463 32.250 7.992 13.402 291318customer deposits to loans 0.000 0.960 1.155 1.357 3.488 1.181 0.484 311367relative size -13.075 -10.934 -8.813 -5.944 -1.458 -8.281 3.060 317252DTD -1.413 0.842 1.906 2.981 7.082 1.983 1.640 229743Stock index volatility 0.004 0.007 0.010 0.013 0.034 0.011 0.006 364732

Table 3: Summary statistics of input variables

41

02

04

06

0−

8

−6

−4

−20

inte

rce

pt

02

04

06

0−

30

−2

0

−1

00

10

20

rese

rve

s−

for−

loa

n−

losse

s−

to−

tota

l−lo

an

s

02

04

06

0−

0.0

2

−0

.010

0.0

1

0.0

2e

ffic

ien

cy r

atio

02

04

06

0−

2

−10123

asse

t g

row

th

02

04

06

0−

2.5−2

−1

.5−1

−0

.50

0.5

cu

sto

me

r−d

ep

osits−

to−

loa

ns

02

04

06

0−

20

0

−1

50

−1

00

−5

00

50

10

0sto

ck in

de

x v

ola

tilit

y

02

04

06

0−

2

−1

.5−1

−0

.50

0.5

DT

D

02

04

06

0−

0.0

5

−0

.04

−0

.03

−0

.02

−0

.010

0.0

1re

turn

−o

n−

co

mm

on

−e

qu

ity

02

04

06

0−

0.2

5

−0

.2

−0

.15

−0

.1

−0

.050

rela

tive

siz

e

02

04

06

0−

20

−1

5

−1

0

−505

co

mm

on

−e

qu

ity−

to−

tota

l−a

sse

ts

02

04

06

0−

1

−0

.8

−0

.6

−0

.4

−0

.20

0.2

0.4

liab

ility

−to

−cu

sto

me

r−d

ep

osits

Figu

re1:

Def

ault

para

met

eres

timat

esan

dst

anda

rder

rors

.

42

![STRESS-SINGULARITY AND GENERALIZED FRACTURE ......disappear and the generalized stress-intensity factor assumes the physical dimensions of stress, [F][L] -2 On the other hand, when](https://static.fdocuments.in/doc/165x107/6065d7b211cf5f3d9202a4ef/stress-singularity-and-generalized-fracture-disappear-and-the-generalized.jpg)