What is takaful by jamil akhtar

-

Upload

alhudacibe -

Category

Economy & Finance

-

view

4.141 -

download

12

description

Transcript of What is takaful by jamil akhtar

Presentation onPresentation on

TakafulTakaful An emerging niche market

By:

Capt. M. Jamil Akhtar Khan ACII, MCIT, Master Mariner

Managing Director

The Universal Insurance Company Ltd.

International Conference on Islamic Banking & Finance

KABUL; June 8 & 9, 2010.

Outline of PresentationOutline of Presentation

Introduction to TakafulIntroduction to Takaful Difference b/w Conventional Difference b/w Conventional

Insurance & Takaful Insurance & Takaful Takaful Through Time Takaful Through Time Takaful ModelsTakaful Models Takaful TypesTakaful Types BancaTakafulBancaTakaful ReTakafulReTakaful Takaful Prospects in AfghanistanTakaful Prospects in Afghanistan Challenges to TakafulChallenges to Takaful The Universal Insurance Company The Universal Insurance Company

Ltd.Ltd.

Introduction to Introduction to TakafulTakaful

Takaful comes from the Arabic root-Takaful comes from the Arabic root-word ‘word ‘kafalakafala’ — guarantee.’ — guarantee.

Takaful means mutual protection Takaful means mutual protection and joint guarantee.and joint guarantee.

Operationally, takaful refers to Operationally, takaful refers to participants mutually contributing participants mutually contributing to a common fund with the to a common fund with the purpose of having mutual indemnity purpose of having mutual indemnity in the case of peril or loss.in the case of peril or loss.

Meaning of TakafulMeaning of Takaful

Reference — Al Quran:Reference — Al Quran: ““Help (ta’awan) one another in Help (ta’awan) one another in

furthering virtue (birr) and Allah furthering virtue (birr) and Allah consciousness (taqwa) and do not consciousness (taqwa) and do not help one another in furthering evil help one another in furthering evil and enmity”. Al Maidah: verse 2 and enmity”. Al Maidah: verse 2 (5:2).(5:2).

Takaful is a form of mutual help Takaful is a form of mutual help (ta’awun) in furthering good/virtue (ta’awun) in furthering good/virtue by helping others who are in need / by helping others who are in need / in hardship .in hardship .

Reference – Hadith:Reference – Hadith: ““tie the camel first, then submit tie the camel first, then submit

(tawakkal) to the will of Allah”(tawakkal) to the will of Allah”

The hadith implied a strategy to The hadith implied a strategy to mitigate/reduce risk.mitigate/reduce risk.

Takaful provides a strategy of risk Takaful provides a strategy of risk mitigation/reduction by virtue of mitigation/reduction by virtue of collective risk taking that distributes collective risk taking that distributes risks and losses to a large number of risks and losses to a large number of participants. This mitigates the participants. This mitigates the otherwise very damaging losses, if otherwise very damaging losses, if borne individually. borne individually.

Basic Elements of TakafulBasic Elements of Takaful Mutuality and cooperation. Mutuality and cooperation. Takaful contract pertains to Takaful contract pertains to Tabarru’atTabarru’at as as

against against mu’awadat mu’awadat in case of conventional in case of conventional insurance.insurance.

Payments made with the intention of Tabarru Payments made with the intention of Tabarru (contribution)(contribution)

Eliminates the elements of Gharrar, Maisir Eliminates the elements of Gharrar, Maisir and Riba.and Riba.

Wakalah/Modarabah basis of operations.Wakalah/Modarabah basis of operations. Joint Guarantee / Indemnity amongst Joint Guarantee / Indemnity amongst

participants – shared responsibility.participants – shared responsibility. Constitution of separate “Participants’ Constitution of separate “Participants’

Takaful Fund”.Takaful Fund”. Constitution of “Shariah Supervisory Board.” Constitution of “Shariah Supervisory Board.” Investments as per Shariah.Investments as per Shariah.

Main drivers of TakafulMain drivers of Takaful Piety (individual purification)Piety (individual purification)

Brotherhood (mutual assistance)Brotherhood (mutual assistance)

Charity (Tabarru or contribution)Charity (Tabarru or contribution)

Mutual Guarantee Mutual Guarantee

Community well-being as Community well-being as opposed to profit maximization.opposed to profit maximization.

Objections to Objections to Conventional Conventional

InsuranceInsurance

Insurance DefinedInsurance Defined Definition of an Insurance ContractDefinition of an Insurance Contract

““An An agreementagreement whereby one party, whereby one party, the the insurerinsurer, in return for a consideration, , in return for a consideration, the the premiumpremium, undertakes to pay to the other , undertakes to pay to the other party, party, the insuredthe insured, a sum of money or its , a sum of money or its equivalent in kind on the happening of a equivalent in kind on the happening of a specified event, which is contrary to the specified event, which is contrary to the insured’s financial interest”insured’s financial interest”

Subject-matter of an Insurance Subject-matter of an Insurance ContractContract “… “… what is it that is insured in a fire policy? what is it that is insured in a fire policy?

Not the bricks and materials used in building Not the bricks and materials used in building the house, but the the house, but the financial interestfinancial interest (i.e. (i.e. money) of the insured in the subject-matter of money) of the insured in the subject-matter of insurance …” (Lord Justice insurance …” (Lord Justice Brett in Castellian v. Preston – 1883)Brett in Castellian v. Preston – 1883)

Objections to Conventional Objections to Conventional InsuranceInsurance

Scholars view the insurance contract as Scholars view the insurance contract as an exchange contract – money is being an exchange contract – money is being exchanged for money over time.exchanged for money over time.

This brings about the problem of This brings about the problem of gharrargharrar (which leads to (which leads to maisirmaisir) and in ) and in investments aspect, investments aspect, ribariba..

Elements of:Elements of:• Uncertainty – Uncertainty – GharrarGharrar • Gambling – Gambling – MaisirMaisir• Interest – Interest – RibaRiba• UW + Investment Profit belongs to the UW + Investment Profit belongs to the

CompanyCompany Note that the Scholars do not object to Note that the Scholars do not object to

insurance insurance per se per se but only to certain but only to certain weaknesses in the insurance contract.weaknesses in the insurance contract.

Uncertainty – GharrarUncertainty – Gharrar Conventional insurance contract is Conventional insurance contract is

basically a contract of exchange basically a contract of exchange (mu’awadaat) i.e. buying and selling (mu’awadaat) i.e. buying and selling whereby policy (indemnity) is sold as whereby policy (indemnity) is sold as goods, with the premium as the price or goods, with the premium as the price or consideration.consideration.

The consideration must be certain for The consideration must be certain for exchange contract.exchange contract.

GharrarGharrar in insurance contracts pertains to in insurance contracts pertains to “deliverability” of subject matter, i.e. “deliverability” of subject matter, i.e. uncertainty as to:uncertainty as to: Whether the insured will get the Whether the insured will get the

compensation promised?compensation promised? How much the insured will get?How much the insured will get? When will the compensation be paid?When will the compensation be paid?

Thus, it involves an element of uncertainty Thus, it involves an element of uncertainty in the subject matter of the insurance sales in the subject matter of the insurance sales contract, which renders it void under the contract, which renders it void under the Islamic law.Islamic law.

Gambling – MaisirGambling – Maisir ““Insurance is a contract upon speculation. Insurance is a contract upon speculation.

Good faith forbids either party from Good faith forbids either party from concealing what he privately knows, to concealing what he privately knows, to draw the other into a bargain, from his draw the other into a bargain, from his ignorance of that fact, and his believing to ignorance of that fact, and his believing to the contrary” the contrary” (Lord Mansfield in Carter (Lord Mansfield in Carter v. Boehm – 1766).v. Boehm – 1766).

The insured loses the money paid for the The insured loses the money paid for the premium when the insured event does not premium when the insured event does not occur. occur.

The company will be in deficit if claims The company will be in deficit if claims are higher than premium.are higher than premium.

Interest – RibaInterest – Riba

“ …“ …. Allah has permitted trading . Allah has permitted trading and forbidden riba” (Al Baqarah and forbidden riba” (Al Baqarah 2 : 275).2 : 275).

Insurance funds are invested in Insurance funds are invested in financial instruments which financial instruments which contain the element of Riba. contain the element of Riba.

Comparing Takaful to Conventional Comparing Takaful to Conventional InsuranceInsurance

IssueIssue Conventional Conventional InsuranceInsurance

TakafulTakaful

Organization PrincipleOrganization Principle Profit for shareholdersProfit for shareholders Mutual for participantsMutual for participants

BasisBasis Risk TransferRisk Transfer Co-operative risk sharingCo-operative risk sharing

Value PropositionValue Proposition Profits maximizationProfits maximization Affordability and spiritualAffordability and spiritual

satisfactionsatisfaction

LawsLaws Secular/RegulationsSecular/Regulations Sharia plus regulationsSharia plus regulations

OwnershipOwnership ShareholdersShareholders ParticipantsParticipants

Management statusManagement status Company ManagementCompany Management OperatorOperator

Form of ContractForm of Contract Contract of Sale Contract of Sale Cooperative,Cooperative,

Islamic contracts of Wakala orIslamic contracts of Wakala or

Mudarbah with Tabar’ruMudarbah with Tabar’ru

(contributions)(contributions)

InvestmentsInvestments Interest basedInterest based Sharia compliant, Riba-freeSharia compliant, Riba-free

SurplusSurplus Shareholders’ accountShareholders’ account Participants’ accountParticipants’ account

TakafulTakaful Through Time Through Time

Takaful through TimeTakaful through Time

Origins in the First Constitution of Madina.Origins in the First Constitution of Madina.

It evolved and continued in one form or the It evolved and continued in one form or the other throughout the Abbaside period and other throughout the Abbaside period and even later during the Ottoman empire.even later during the Ottoman empire.

Serious efforts were made in modern times, in Serious efforts were made in modern times, in 1970s to come up with an Islamic alternative 1970s to come up with an Islamic alternative to the conventional insurance.to the conventional insurance.

The first Takaful company was set up in Sudan The first Takaful company was set up in Sudan in 1979, almost simultaneously followed by in 1979, almost simultaneously followed by another one set up in Bahrain.another one set up in Bahrain.

Takaful through Time… Takaful through Time… (Cont’d.)(Cont’d.)

There are now around There are now around 180180 Takaful companies Takaful companies in over 40 countries. in over 40 countries.

The total insurance premium of OIC countries The total insurance premium of OIC countries for 2006 was USD 75 Billion; of this, Takaful for 2006 was USD 75 Billion; of this, Takaful contribution accounts for 5% (i.e. USD 3.5 contribution accounts for 5% (i.e. USD 3.5 Billion). This is expected to increase to USD Billion). This is expected to increase to USD 12 Billion by 2015.12 Billion by 2015.

Poor Insurance penetration in the Muslim Poor Insurance penetration in the Muslim countries (<1% of GDP).countries (<1% of GDP).

Average growth rate higher than conventional Average growth rate higher than conventional insurance companies (around 25%).insurance companies (around 25%).

Non–Muslims increasingly opting for Takaful Non–Muslims increasingly opting for Takaful products for commercial benefits.products for commercial benefits.

Takaful Takaful ModelsModels

MudarabaMudaraba Model Model

The surplus is shared between the The surplus is shared between the participants with a takaful operator. participants with a takaful operator. The sharing of such profit (surplus) The sharing of such profit (surplus) may be in a ratio 5:5 , 6:4 etc. as may be in a ratio 5:5 , 6:4 etc. as mutually agreed between the mutually agreed between the contracting parties. Generally, these contracting parties. Generally, these risk sharing arrangements allow the risk sharing arrangements allow the takaful operator to share in the takaful operator to share in the underwriting results from operations underwriting results from operations as well as the favourable performance as well as the favourable performance returns on invested premiums. returns on invested premiums.

Profits attributable

to Shareholders

Company’s Admin. & Mangt.

Expenses

Takaful Contribution

paid by Participant

General TakafulFund

General TakafulFund

Operational Cost ofTakaful

Surplus(Profit)

Participant’sShare

from Surplus

Company’s Share from

Surplus

Investment By

Company

Profit From

Investments

Company

Participant

Mudaraba Model

Wakala ModelWakala Model

Cooperative risk sharing occurs among Cooperative risk sharing occurs among participants where a takaful operator participants where a takaful operator earns a fee for services (as a Wakeel or earns a fee for services (as a Wakeel or Agent) and does not participate or Agent) and does not participate or share in any underwriting results as share in any underwriting results as these belong to participants as surplus these belong to participants as surplus or deficit. Under the Al- Wakala model, or deficit. Under the Al- Wakala model, the operator may also charge a fund the operator may also charge a fund management fee and performance management fee and performance incentive fee. incentive fee.

General TakafulFund

OperationalCost ofTakaful/

ReTakaful

Surplus(Profit)

SurplusDistribution

toParticipants

Participants’

Takaful Fund

Wakala Model

Takaful

Contribution

paid

by Participant

Company

(Capital)

Mudarib's’Share

of PTF’s Investment

Income

ManagementExpense

of the Company

Profit/Lossattributable toShareholders

WakalaFee

(30% to 35%)

ProfitFrom

Investments

InvestmentIncome

Reserves

Investment bythe Company

Investment Income Sharingon Mudaraba Basis

Wakala -Waqf ModelIt is a WAKALAH model with a separate legal It is a WAKALAH model with a separate legal

entity of WAQF in-between.entity of WAQF in-between.

The relationship of the participants and the The relationship of the participants and the operator is directly with the WAQF fund. The operator is directly with the WAQF fund. The operator is the ‘Wakeel’ of the fund and the operator is the ‘Wakeel’ of the fund and the participants pay contribution to the WAQF fund participants pay contribution to the WAQF fund by way of Tabarru.by way of Tabarru.

The contributions received would also be a part The contributions received would also be a part of this fund and the combined amount will be of this fund and the combined amount will be used for investment and the profits earned used for investment and the profits earned would again be deposited into the same fund would again be deposited into the same fund which also eliminates the issue of Gharar.which also eliminates the issue of Gharar.

Losses to the participant are paid by the Losses to the participant are paid by the company from the same fund.company from the same fund.

Operational expenses that are incurred for Operational expenses that are incurred for providing Takaful services are also met from providing Takaful services are also met from the same fund.the same fund.

InvestmentIncome

Operational Cost of Takaful

/ ReTakaful

Claims &Reserves Surplus

(Balance)

P A R T I C I P A N T S’ T A K A F U L F U N D (P.T.F.)

Mudarib’s Share of PTF’s

Investment Income

Wakalah Fee

InvestmentIncome

Management Expense of

the Company

Profit/Loss

S H A R E H O L D E R S’ F U N D (S.H.F.)

Participant

WAQF

Takaful Operator

Share Holder

Wakala-Waqf Model

Investment by the Company

Models – The beauty of Islam lies Models – The beauty of Islam lies in itsin its

plurality … !plurality … !

ISLAM

AQIDAHFaith & Belief

SHARIAHPractices & Activities

AKHLAQMoralities & Ethics

IBADAHMan-to-God Worship

MUAMALATMan-to-Man Activities

SocialActivities

EconomicActivities

PoliticalActivities

Risk ManagementTakaful

General Takaful TypesGeneral Takaful Types

General Takaful –General Takaful – offers all offers all kinds of non-life risk coverage. It kinds of non-life risk coverage. It is normally divided into following is normally divided into following classes:classes:

Property Takaful Property Takaful Marine Takaful Marine Takaful Motor TakafulMotor Takaful Miscellaneous Takaful Miscellaneous Takaful

Types of Family TakafulTypes of Family Takaful

Term Life TakafulTerm Life Takaful

Whole Life TakafulWhole Life Takaful

Endowment Takaful Endowment Takaful

Universal TakafulUniversal Takaful

Marriage Plan Marriage Plan Education PlanEducation Plan

BANCATAKAFULBANCATAKAFUL

BackgroundBackground Range of ProductsRange of Products

Savings Savings → → Personal Accident, Personal Accident, Homeowners’ Comprehensive, Credit Homeowners’ Comprehensive, Credit Cards, etc. Cards, etc.

Financing, Individuals Financing, Individuals → Car Ijarah, → Car Ijarah, Housing Musharika, Mortgage Takaful.Housing Musharika, Mortgage Takaful.

Financing, SMEs Financing, SMEs → Trade Credit → Trade Credit Takaful, Business, Office, Equipment, Takaful, Business, Office, Equipment, Assets.Assets.

E-CommerceE-Commerce

BANCATAKAFUL (…Cont’d.)BANCATAKAFUL (…Cont’d.)Advantages of BancaTakaful:Advantages of BancaTakaful:

Facilitation Desk / Equipment. Facilitation Desk / Equipment. Fast Turnaround Time.Fast Turnaround Time. One-Stop shop for Clients.One-Stop shop for Clients. Concept of Islamic Financial Supermarket.Concept of Islamic Financial Supermarket. Value Added Services.Value Added Services. Law of Large Numbers.Law of Large Numbers.

Lower Contribution Rates.Lower Contribution Rates. Attraction for Depositors.Attraction for Depositors.

Synergy.Synergy.

ReTakafulReTakaful Currently few ReTakaful companies worldwide Currently few ReTakaful companies worldwide

offering a relatively small capacity:offering a relatively small capacity: Sudan (1979) National Reinsurance. Sudan (1979) National Reinsurance. Sudan (1983) Sheikhan Takaful Company. Sudan (1983) Sheikhan Takaful Company. Bahamas (1983) Saudi Islamic Takaful and Bahamas (1983) Saudi Islamic Takaful and

ReTakaful Company.ReTakaful Company. Bahrain/Saudi Arabia (1985) Islamic Insurance Bahrain/Saudi Arabia (1985) Islamic Insurance

and Reinsurance Company. and Reinsurance Company. Tunisia (1985) Tunisia (1985) B.E.S.T. ReB.E.S.T. Re Malaysia (1997) Malaysia (1997) ASEAN ReTakafulASEAN ReTakaful

International.International. Dubai (2005) Dubai (2005) TakafulRe TakafulRe by ARIG. by ARIG. Lloyds of London to have a ReTakaful Syndicate Lloyds of London to have a ReTakaful Syndicate

in 2007.in 2007. SwissRe has formed a separate ReTakaful PoolSwissRe has formed a separate ReTakaful Pool MunichRe to form a separate ReTakaful PoolMunichRe to form a separate ReTakaful Pool Provision in Takaful Rules – 2005.Provision in Takaful Rules – 2005.

Objectives Resolution

1949 1992

1983

Review by Council of

Islamic Ideology

Report by the Council

2000

Insurance

Ordinance

2005

Takaful Rules

T I M E L I N E – T A K A F U L I N P A K I S T A N

Takaful Prospects in Takaful Prospects in AfghanistanAfghanistan

99% Muslim population.99% Muslim population.

Demand for insurance shall increase with Demand for insurance shall increase with increase in per capita income.increase in per capita income.

Personal lines insurance business (leasing, Personal lines insurance business (leasing, health, Medicare) expected to grow at a health, Medicare) expected to grow at a higher rate than other conventional classes.higher rate than other conventional classes.

Prospects of Islamic banking in near future.Prospects of Islamic banking in near future.

People who do not insure due to People who do not insure due to religious reasons.religious reasons.

People who insure and are People who insure and are insensitive to religious reasons. insensitive to religious reasons.

People who currently do not People who currently do not insure at all.insure at all.

TAKAFUL - TARGET MARKETTAKAFUL - TARGET MARKET

Challenges to TakafulChallenges to Takaful Skepticism. Skepticism.

Lack of uniformity in Shariah decisions. Lack of uniformity in Shariah decisions.

‘‘Windows’ issue. Windows’ issue.

Regulatory issues.Regulatory issues.

Capacity constraints due to inadequate Capacity constraints due to inadequate ReTakaful.ReTakaful.

Limited Investment avenues.Limited Investment avenues.

H.R. issues.H.R. issues.

THE UNIVERSAL INSURANCE THE UNIVERSAL INSURANCE COMPANY LIMITEDCOMPANY LIMITED

The Company has entered The Company has entered 5050thth year of its operations. year of its operations. Majority shares are held by the prestigious ‘BIBOJEE Majority shares are held by the prestigious ‘BIBOJEE

Group of Companies’.Group of Companies’. The Company is listed in all the stock exchanges of The Company is listed in all the stock exchanges of

Pakistan.Pakistan. It is an ‘A’ rated general insurance company.It is an ‘A’ rated general insurance company. Duly certified as ISO 9000 compliant.Duly certified as ISO 9000 compliant. Managed by dedicated insurance & finance professionals, Managed by dedicated insurance & finance professionals,

the Company has an extensive country-wide branch the Company has an extensive country-wide branch network.network.

The Company is now planning to expand its operations The Company is now planning to expand its operations overseas by setting up Islamic insurance overseas by setting up Islamic insurance windows/branches in strategic regions.windows/branches in strategic regions.

In addition to dealing in all classes of general insurance In addition to dealing in all classes of general insurance business, we are focusing on providing Micro-insurance business, we are focusing on providing Micro-insurance at grass-roots level.at grass-roots level.

ConclusionConclusion

Takaful defined. Takaful defined.

Comparison with conventional Comparison with conventional

insurance.insurance.

Takaful Models. Takaful Models.

Takaful Types.Takaful Types.

BancaTakaful.BancaTakaful.

ReTakaful. ReTakaful.

Takaful prospects in Afghanistan.Takaful prospects in Afghanistan.

Thank YouThank You

CENTER OF ISLAMIC BANKING & ECNOMICS

Head Office: 192- Ahmad Block, New Garden Town , Lahore, Pakistan Ph: +92-42-35913096-8, 35858990, 38407850 Fax: +92 -42-35913056E-mail : [email protected]: http://www.alhudacibe.com

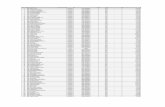

![[XLS] · Web viewHouse of Md. Jamil Akhtar alias Boha, At-Sangram, PO-Tulapatganj, Block-Jhanjharpur 847 201 288222, 9472804737 @bankofindia.co.in 592, MAIN ROAD, GR.FL., 453 331 rangwasa.indore@](https://static.fdocuments.in/doc/165x107/5aaeac817f8b9aa8438c5bd5/xls-viewhouse-of-md-jamil-akhtar-alias-boha-at-sangram-po-tulapatganj-block-jhanjharpur.jpg)