Westway Trust Annual Report

-

Upload

neville-raven -

Category

Design

-

view

24 -

download

0

Transcript of Westway Trust Annual Report

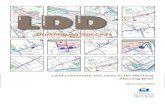

Ladbroke Grove

Ladbroke Grove

Bram

ley

Rd

Portobello Road

Portobello Road

A40

Cambridge Gardens

Oxford Gardens

Cambridge Gardens

Oxford Gardens

Thorpe Close

Malton Road

St Marks Road

St Marks Road

Bartle Road

Tavistock Road

Tavistock Close

Acklam Road

Blagrove Road

Bram

ley

Rd

Crowthorne Rd

Latimer R

d

Darfield Way

St Marks Road Industrial Estate

Stable Way

21 charities & non-profit organisations

7 organisations promoting the arts

3.5 acres of green spaces

p18p13

p37

p41

32 shops

p36

2 sport and leisure facilities

34 office spaces

48 light industrial units

4 organisations promoting learningp34

p21

p32

p33p32

p17

p43

p38

Westway Trust is a charity committed to enhancing the 23 acres of space under the Westway flyover in Kensington & Chelsea, in order to benefit local people, making it a great environment to live, work, play and visit.

Celebrate our culture and

heritage, supporting local diversity

and talent

Promote a cleaner, greener

Westway

Champion education skills and

employment

Encourage a healthy, more active,

community

Manage the Westway estate to ensure long-term

delivery for the community

We strive to harness the creativity, heritage and diversity of the area to maintain and improve the places and spaces we look after. Through good stewardship and collaboration with all parts of the community we work to support this vibrant part of London as it continues to thrive.

We already receive more than one million visitors each year to the estate, and we want to expand the

community, cultural, retail, sporting and enterprise opportunities here together with improvements to public spaces so that it continues to be a place the community is proud of.

There are five key pillars of our work which support our ambitions for the area. Those pillars are:

CONTENTS4 Letter from the Chair

8 Chief Executive’s Welcome

13 Arts, Culture and Heritage

17 Westway Stories – Shirine Osserian, Artist

19 Environment

23 Westway Stories – Colin Ellis, Gardener

24 Year in Review

27 Enterprise and Economic Wellbeing

31 Westway Stories – Ella Marak-Freeman, Apprentice

33 Health, Sports and Fitness

37 Westway Stories – Roderick McDougall, Gym user

39 Stewardship

43 Westway Stories – Charlotte Cox, Tenant

45 Member organisations of the Trust

46 Our Partners

49 Strategic Report Incorporating Financial Review

59 Structure, Governance and Management

69 Auditors’ Report

73 Financial Statements

32

Families enjoying Portobello Green during the Summer Festival.

Letter from the ChairAlan reflects on the legacy of one of

Westway Trust’s foundersThis, my first full year as Chair of Westway Trust, has taught me a lot about the incredible passion that exists for this special part of London and about the challenges that face us.

Before I speak about those challenges I want to pay tribute to Anthony Perry, the Trust's first Director who sadly passed away this year. Anthony was an important figure in the local community, not least for his work during the early days of the Trust after its establishment in response to the blight and destruction brought about by the construction of the A40 flyover. In his role at the Trust he also played an important part in helping the modern carnival find its feet, providing office space and land to the first carnival committee.

Anthony’s legacy is keenly felt in the Trust and his death was a source of great sadness. In response we must redouble our efforts to build on his work supporting the dynamism of the area.

However, as we witnessed at the Annual General Meeting, some groups within the community feel excluded from our work and not listened to. The strength of feeling from those present about past grievances brought home to our Board the importance of open, continuing dialogue with all groups in the community. We shall continue to

review, and where necessary, adjust the balance of our activity so that when we make commercial decisions, to ensure funding for our charitable work, they are not divorced from their social and cultural impacts. We have given great consideration to those groups who feel let down, listening to grievances and responding as appropriate. I believe we have made good progress and I hope we will continue the positive dialogue into the year ahead. While some of what we learn is challenging or uncomfortable I firmly believe that it improves what we do and pushes us to be more inventive and responsive.

Mutual trust is important if Westway Trust is to support communities in the best way we can. We strive to be open in our decision making and we will continue to hold our annual meetings in public as long as we can be sure that we are able to fulfil the obligations contained within our constitution.

Embracing dynamism means that we have to adapt to the shifting population patterns of our new and existing communities and be constantly aware of the reality that the make-up of our neighbourhood is not the same as when we formed in the 1970s.

The Supplementary Schools Partnership we support provides an excellent example of how we as a Trust have adapted. The newer migrant groups putting down their roots near the Westway are part of its rich welcoming heritage. Unlike many of those that arrived in previous decades English is often not their mother tongue. Supplementary schools offer targeted groups extra-curricular help with maths, English and science. Lessons are also taught in the pupils’ mother tongue removing barriers to learning and helping them keep in touch with their cultural origins.

Alan Brown talking to an adult education learner.

While some of what we learn is challenging, I firmly believe that it improves what we do and pushes us to be more inventive.

54

A lack of flexible childcare has been one of the barriers for local women wanting to move into work so Westway Pop-Up Crèche, which we helped to establish, has addressed that challenge by taking childcare to the work places, training venues and other locations where it is needed rather than making parents go to it. One of the first events I attended was a celebration of the crèche and I am proud of the work it has done to support local people to get on in life and make the most of these opportunities.

In the way we are governed we need to respond to the changing make-up of the North Kensington local community. We have made progress in reflecting local diversity and connection to our local community on our Board of Trustees, and this work continues. We have had some great additions to our Board and I would like to welcome Fiona Ramsay, Sheraine

Williams, Angela Spence and Cllr Monica Press as trustees. My sincere thanks also goes to Joanna Farquharson, James Caplin and Cllr Pat Mason who stepped down this year. Their hard work and guidance made a lasting impact on the Trust.

Increased scrutiny of charity operations and new regulations as a result of issues elsewhere in the charity sector makes it more important than ever that trustees are fully trained and supported to fulfil their responsibilities and duties to the charity, and we are making sure we provide our trustees with lots of opportunities for training and development, so we can be as strong a governance group as possible.

I am always impressed by the richness and diversity of life in and around the Westway and this year has provided a reminder that to support it needs passion,

imagination and resilience. Cultivating these qualities is a challenge that we are determined to continue to rise to in the year ahead.

Alan Brown Chair

I am always impressed by the richness and diversity of life in and around the Westway and this year has provided a reminder that to

support it needs passion, imagination and resilience.

The Science Professor delighted local children at the Festival of Light.

76

Chief Executive’s WelcomeAngela introduces a year of major progress

and close collaboration at Westway TrustThis year is the Trust’s 45th anniversary and the ambitions we have for this distinctive place are as unwavering as those of our forbearers of the early 70’s. Looking back on the achievements of the past year we have taken some significant strides forward - making tangible progress on major projects, significantly improving our operational affairs and expanding the services we offer. Westway Trust is an industrious organisation that constantly seeks improvement and innovation. I am incredibly proud of what we have achieved this year as a charity working ever more collaboratively with the local community.

This document aims to highlight the Trust’s achievements over the last year – both in our stewardship of the Westway estate and in our partnerships with local people and local groups. It is also a celebration of all the people who make up the Westway community; it is a summary of our work and plans for the future; it is an opportunity for us to give an account of our work to all of our beneficiaries and stakeholders; and it is a statement of our financial position in the year and how we allocated our charitable funds.

There is a real sense of optimism within the Trust that has driven three important

projects this year - the strengthening of our approach to community engagement and consultation, transforming how we deliver our sports and fitness provision, and enhancing and improving the Trust’s estate in and around Portobello.

Our first priority has been strengthening and diversifying our engagement with the people who live and work here. We have set up a Community Engagement team and have recruited new staff dedicated to listening to and understanding concerns, sharing information, and building relationships with groups and individuals.

We expanded and improved the way we make sure that those who want to can contribute to all our major projects. I personally found the series of coffee mornings and one-to-one meetings I held in the year with the leaders of our member organisations hugely valuable. Their challenges and feedback, as well as their support, reinforced my view that the Trust must be a progressive and open organisation as we seek to support the many valuable causes and important work members are committed to. Our engagement work is still developing, and will continue to do so in the years ahead.

We are building relationships with experts in this area, such as the Consultation Institute, so we can learn from others and develop excellent practice. This is all so we can serve the local community successfully and build what I hope will be deep, trusting and long-lasting relationships.

Our second priority has been transforming how we deliver sports and fitness services. We have undertaken an extensive process to set out precisely the impact we want to make on improved health and wellbeing within the local community and to find

Our first priority has been strengthening and diversifying our engagement with the

people who live and work here. Angela McConville listens to apprentice Lillie King and intern Chloe McFarlane.

98

lessons for Westway Trust in how we bring flexibility and spirit to the Westway estate as we create new kiosks, stalls and larger work spaces so entrepreneurs can find the right space at the right cost depending on where they are in the business cycle. We are committed to making the spaces on the Westway estate work efficiently and to recycling the opportunity these spaces create as much as we can.

I would like to close with a number of thank yous. Firstly the Trust’s ever-creative, resourceful and professional staff team and volunteers who work hard every day to make a difference. Thank you to Transport for London and the Royal Borough of Kensington & Chelsea who have responded so supportively to the Trust’s future plans for the estate. And finally to the many local people, groups and organisations who have demonstrated

ardently across the year their passion for, and commitment to the Westway estate and the work of the Trust. It is our privilege to serve the community and I look forward to future collaboration and partnership.

Angela McConville Chief Executive

a delivery partner to work alongside us in realising this impact. Helping many more people find ways to get active and participate in sport, encouraging healthy behaviours and creating more jobs and training opportunities for local people in sport and fitness have been the guiding parameters in our search.

The benefits of working with a delivery partner include upgrading our aging leisure facilities, creating exciting new facilities, and increasing investment in staff training and career development for our sports and fitness workforce.

Our third priority is the area around Portobello Green and we have spent much of this year listening to, and collaborating with local people to help us crystallise what the scheme can deliver. Once complete, it will make the whole area more attractive, productive and inviting. We want to build new infrastructure to support the market with new storage and amenity facilities, as well as create a double height market hall providing flexible new space for trading and enterprise. There will also be more artisan retail units and affordable

workspaces so there are more reasons for visitors to come, in turn creating opportunities for enterprising local people. At the heart of the scheme we are proposing a significant new space for arts and culture. There is much-needed housing planned and we recognise that the affordability of housing is a pressing concern for local people. From consultation we have clarified what makes Portobello distinctive and our watchwords are: markets, arts, heritage, community and entrepreneurialism.

We are hoping to be in a position to secure planning permission for the scheme later this year, with work starting on site in 2017. In anticipation of that, we will see the launch of a pop-up high street initiative on Thorpe Close, reinvigorating the link between Ladbroke Grove and Portobello Road, as well as extending the trading environment to the days of the week when the street market is not trading. I joined a number of co-design workshops earlier this year with local people and partners for this project and was struck by the passion, ideas and talent that can be shared within this experiment on Thorpe Close.

The relaunch of our Community Grants Programme was another dimension of our renewed commitment to local grassroots activity. We awarded £100,000 to 47 organisations this year and the activities planned for the events, programmes, projects and celebrations we were able to support was inspiring. I look forward to the continued success and growth of the grants programme this year, and in the years ahead.

I have taken some time throughout the year to visit other exemplar social enterprises in London and beyond. What I’ve seen across the sector is agility, a need to change and respond to a tough economic climate and a determined commitment to safeguard the future flow of unrestricted income to support social goals. It is imperative that Westway Trust continues to achieve sound and sustainable returns from its property portfolio so we can continue to support the many programmes and local priorities we are deeply committed to.

I have particularly valued learning about how other organisations support new and growing local businesses. I think there are

We have set out precisely the impact we want to make on improved health and wellbeing within the local community.

We awarded £100,000 to 47 organisations this year and the activities planned for the events, programmes, projects and

celebrations we were able to support was inspiring.

Two local children playing tennis during the annual tennis festival at Westway Sports and Fitness Centre.

1110

ARTS, CULTURE AND HERITAGE

“Portobello Film Festival has been a free festival for 21 years. We have proved that, even in this day and age, providing free art can be done. The festival is a people's one and a London festival and it has been a development ground for the best in the British film industry for the last two decades.”

Jonathan Barnett is festival director

at the Portobello Film Festival

which showcases new and emerging

filmmaking talent. The festival

receives partnership funding from

Westway Trust and uses venues on

the Westway estate.

Founder of the Portobello Film Festival Jonathan Barnett.

1312

Local children enjoying the Festival of Light.

There is rich creativity within the Westway community and we increasingly see our role as an enabler for creative people and organisations in the area. This year we have adjusted the focus of our flagship events to promote local talent and provide opportunities for local curators, producers and artists to be part of the process of developing events and performances.

Increasingly we are creating partnerships with existing organisations, or figures in the local arts scene to make sure our resources support a broad-range of artistry and genres and help them be the best events that they can. To that end, as well as organising our own Summer and Christmas Festivals and a Festival of Light, we have partnered with a series of renowned arts and cultural festivals including Carnival Pioneers Community Day, Golborne Festival, InTransit (Urban Beach and Akala

Presents: Ruins of Empires), Notting Hill Nurseries Carnival, and Portobello Film Festival. Events that we have supported were attended by over 13,000 people in the year.

As well as supporting arts organisations we provide opportunities for individuals. Our team’s successful bid for £140,000 from the Arts Council allowed us to develop #CultureMakers, a programme that funds young people to run creative projects that benefit their communities. Since its launch this year #CultureMakers has welcomed its first group of 12 young people. Ideas have ranged from the development of a creative girls group, a fashion show to showcase Somalian culture and a film exploring stereotypes.

Celebratingthe culture and heritage of the area and making

the most of local diversity and talent

Consulting with local communities

on the design and development of future

physical spaces for arts and cultural practice

Supporting a vibrant local creative economy that benefits

local people

Showcasing talent through

commissioning and collaborating on

creative events and festivals

Building partnerships that give local young people a range of high quality, creative opportunities

We will celebrate the area’s culture and heritage,

making the most of local diversity and talent by

Over 13,000 people attended local

events supported by Westway Trust6,500 people taking part Community

Grants Programme funded projects Partnered with 44 organisations

on creative projects

Support to 6 flagship

local events and festivals

47 grants for local arts,

culture and community projects

1514

WESTWAY STORIESArtist Shirine Osseiran, who lives in Kensington, is making the best possible use of her new workplace in the converted Maxilla Nursery building under the Westway.

She said: “It’s very difficult to have an artist space here because it is an expensive area so the fact Westway Trust is working with ACAVA and have provided the studio at a subsidised rate is a great opportunity. I’m excited about the space because I’m not limited to the studio. I can use the inner courtyard to do workshops outside in the summer. Very few buildings allow this.

“We accommodated eight children from Fox Primary School, a local school my daughter

attends. In the future I want to incorporate fitness and martial arts – an innovative way to mix physical action with art.”

The space is operated by ACAVA, a charity with roots in North Kensington that establishes affordable studios for artists and gets them working in the community.

Duncan Smith, ACAVA’s long-standing Artistic Director, said: “We are an educational charity which sets up studios and develops a whole variety of projects engaging those artists with the communities around them.”

“The shape of the city has changed from a point when there were industrial buildings everywhere to the present day when the

charity has depended on a whole variety of failing, ailing or obsolete buildings. We have artists in the Westway getting on with a whole variety of practises which would have been extremely difficult in the current environment in West London where artists are being excluded from the more affluent areas.”

Shirine added: “I come from the Middle East and grew up in war. Across the world you see lot of tension between religious groups and people from different backgrounds. I use art as an opportunity to show that not all people are antagonistic, the majority are peaceful and love diversity.”

Artist Shirine Osseiran.

Our Community Grants programme has enabled 47 cultural and wellbeing projects to be delivered by local voluntary organisations for the benefit of the community. Projects include a celebration of the artistic contribution of older people, alternative sports and a community lunch. All together these events reached nearly 6,500 local people.

We have spent much of the year listening to the views of the local community about our plans for the Portobello and Acklam areas of the estate. What is clear is that in addition to space for small independent shops and businesses there is a need for new flexible space for arts and culture and that has become a central part of the proposal, with the addition of at least 5,000 square feet of space for this use.

Plans for the future

The first cohort of

#CultureMakers will present their work and a

second cohort will be recruited

We will create a new digital and

print platform to promote the arts, culture

and community activity

happening throughout the area,

not just on the Westway estate

We will continue to develop partnerships with local

curators, producers, artists and performers to put on

high quality events and festivals that animate the area

We will bring forward plans for new

pop-up cultural and enterprise units on Thorpe Close

We will establish a new arts and cultural space

on Acklam Road

1716

I use art as an opportunity to show that not all people are antagonistic, the majority are peaceful and love diversity.

We will develop a plan with local

arts groups for artists and makers to occupy

spaces under the Westway

ENVIRONMENT“I spent two days a week helping in the garden and glasshouses. I get a real sense of achievement from volunteering. I enjoy meeting new people and being involved with the local community is great.”

Maria Brown has volunteered

throughout the year helping

maintain green spaces on the

Westway estate.

Gardening volunteer Maria Brown. 1918

We will promote a cleaner, greener Westway by

Establishing the Trust’s first

sustainability team and developing an estate-wide environmental sustainability plan

Ensuring inefficient buildings

are upgraded or gradually replaced with

new, environmentally efficient buildings

Building partnerships with other leading London estates to tackle the challenges

of air quality

Empowering local people to get involved in tackling

environmental issues

Protecting and enhancing the

green and open spaces on the Westway estate

While some in the area have affection for the design and engineering of the Westway, it continues to cast a literal and figurative shadow over us. It is one of the most polluting roads in the country and contributes to the Royal Borough of Kensington and Chelsea having some of the worst air in London.

In the last 12 months we have started to build the expertise in our team to do what we can to tackle local environmental concerns, in addition to scaling up our plans to make the estate greener and more environmentally sustainable.

This year we have submitted a series of funding bids for programmes that, if successful, will help us better understand the scale of the environmental challenge and what can be done to mitigate it.

Working with Transport for London and the Royal Borough we have seen the installation of an 80-metre section of pollution filtering ivy along one of the most affected parts of the estate.

We gathered evidence from local individuals and organisations to submit a response to Transport for London’s Cycle Superhighway consultation and the Royal Borough’s consultation on cycle quiet ways. We broadly support both proposals but have argued for a more joined-up approach to cycling infrastructure.

3.5 acres

of green space maintained by our team1,000 hours of support from

gardening volunteers

A local resident at a charity sale of surplus plants grown by the Westway gardening team.

276 Trees nurtured and protected

60 varieties of tree

across the estate

2120

80 metres of pollution

filtering green wall

Colin Ellis discussing ideas for Portobello Green. WESTWAY STORIES

Plans for the future

Colin Ellis was appointed as Grounds and Gardens Manager for Westway Trust in 2016 – a very different challenge from his previous role managing vast private estates.

He leads a team of five gardeners supported by 1,000 hours of volunteer support looking after Westway’s 3.5 acres of green space, which includes Portobello Green and Maxilla Gardens, as well as children’s play areas and a wildlife garden.

Colin has loved gardening from childhood and devoted his career to it, gaining a qualification in horticulture before training at Windsor Great Park.

He said: “The challenges at Westway are that all the parks are open to the public 24 hours a day, whereas with a private estate you know who and what you are dealing with. There are a lot of people walking through and I like the energy and vibrancy that creates. When you put a tree, shrub or flowerbed in to the garden you have to consider how resilient it will be over the years, and whether it's feasible and cost-effective.”

“Local people are going to the gardens at lunchtime or children coming in to play. Some local people haven't got gardens or balconies so their nearest green space is on the estate.”

Colin has ambitious plans for these green spaces, which involve planting to give year-round colour to the gardens and looking to the long-term.

He said: “I think about what can I put in that will flower in early autumn, winter or early spring. As well as evergreens, you want a variety of flowers and shrubs. You are always looking up to five years into the future when plants mature and how to maintain, reduce or replace them as the years go by.”

Colin has begun visiting local schools to show pupils how to plant their own school gardens and teach them about green sustainability, sowing the seeds of environmental awareness in the community.

23

We will develop green

opportunities on

Thorpe Close as part of the

animation project

Our new sports and fitness operating

partner will strengthen the

standards of environmental practice throughout the delivery

of sport as part of their contract

Where possible we will add greenery

throughout the Westway estateWe will conclude community

consultation on the use of

Portobello Green and

will bring forward a plan for

improvements

We are committed to ensuring that new developments will replace inefficient properties with more advanced and environmentally friendly ones. For the non-residential part of the Portobello Scheme our intention is to achieve a BREEAM “very good” standard, and for the residential development we will aim to surpass the fuel and powers building regulations. We have also recently commissioned a study that will help us draw up a sustainability strategy for our let buildings, and are collaborating with the local community to make Portobello Green a more inviting place for everyone.

There are a lot of people walking through and I like the energy and vibrancy that creates.

We plan to bring forward a more extensive strategy

that sets out our long term vision and plans for our

environmental work

22

25

May June August SeptemberApril

Four athletes receive Tim Davis scholarships

Adult Learners’ Week including taster sessions

Westway Trust launches a sports and horse riding survey

70 Westway Trust volunteers attend celebration of their support

Schools’ Tennis Festival sees 900 children visit

the sports centre

InTRANSIT Festival Akala presents, part sponsored by Westway Trust

attended by 50 people

More than 1000 people visit Westway Trust and National Trust created beach at

Acklam Village for InTRANSIT Festival

Golborne Festival takes place with help from Westway Trust grant

Community Festival featuring local performers takes place and is attended

by 1,200 people

July

Notting Hill Nurseries Carnival 2015 takes place with support from Westway Trust

£100,000 Community Grants Programme is launched

Carnival Pioneers Community Day take place with support from Westway Trust

First stage of independent horse riding

review is completed

34 organisations receive a share of £58,000 in the first round of

Community Grant awards

Portobello Film Festival takes place with support from Westway Trust

Westway Trust is awarded Investors in People Gold Award

Westway Sports and Fitness achieves Quest award

30 Lloyds Banking Group staff spend a day as gardening volunteers

Esah Hayat, a deaf tennis player who trains at

Westway, wins world Deaf Tennis Championships

October November December January February March

Supplementary School awards attended by 276

people

Tim Davis Scholar and squash player Adam DeSouza

wins local competition

Inclusive Sport Festival for people with disabilities

takes place

Westway Barbell Club have great success at World Weightlifting Championships

YEAR IN REVIEW

24

Festival of Light takes place Late Night Shopping at Portobello Green Designers arcade

10 organisations and five councillors attend Pop Up Crèche first anniversary

celebration

More than 70 learners commended at adult learners celebration event

Second round of consultation on the revised Portobello scheme proposals launched

Around 50 people attend co-design workshops for Thorpe Close take

place with Studio TILT

Sheraine Williams appointed to the

Board of Trustees

Westway Trust responds to TfL Cycle Superhighway consultation

Be Online sessions at local libraries help 122 older

people to get online

Around 50 people attend boxing fitness sessions under the

market canopy

11 apprentices complete year one of the Creative Employment Programme

Second round of Community Grants supports 13 more local organisations

Westway Trust responds to consultation on RBKC’s Silchester Estate plans

Studio TILT appointed to work with community on Thorpe Close

improvements

Fiona Ramsay elected to the Board

of Trustees

80-metre green screen installed between sports

pitches and Westway

Qualification for supplementary school volunteers launched

£140,000 funding received for #CultureMakers programme

Creative Apprentices visit Shazam, the Roundhouse

and Sony Music

Christmas Festival sees music and celebration under the Westway

ACAVA opens studios in former Maxilla Nursery building

The Grove Trust awards £40,000 towards the Supplementary Schools Partnership.

29 Westway Trust staff given Mental Health First Aid training

£44,000 funding received for the second year of the Creative

Employment Programme

Announcement of plan to find a partner organisation

for Sports and Fitness

Westway Trust becomes the first employer in RBKC to achieve

Healthy Workplace status

Pimento Supplementary School and V&A summer project supported by

Westway Trust is performed Westway Trust Annual General

Meeting takes place

Alan Brown appointed as Chair of Westway Trust

Forest School launches in the former Maxilla Nursery Gardens

“We have visited seven supplementary schools in Kensington to check the standards of governance and delivery and we are delighted that all seven have achieved Quality Framework Awards. The work of Westway Trust’s Learning team has been a beacon of best practice that we have been able to promote to other local authorities and partnerships around the country.”

Pascale Vassie is Executive

Director at the National Resource

Centre for Supplementary

Education which has worked with

Westway Trust for nearly 20 years.

ENTERPRISE AND ECONOMIC WELLBEING

27

Children take part in a performance project with Pimento Supplementary School and V&A.

26

We will support education, skills and employment by

Our supplementary school programme continues to thrive. It supports 14 groups throughout the Royal Borough of Kensington and Chelsea to provide extra tuition for pupils aged between 15 and 19. Often these pupils cannot afford to pay for extra help. The schools also cater for particular cultural or language needs.

To enhance our supplementary school support this year we began to offer a ‘Working as a Teaching Assistant’ Open College Network qualification for those working in supplementary schools in addition to the one we have offered since 2014 for those working in adult learning. During the year 46 people completed one of the two courses which enable volunteers to better help the pupils they teach. In total teaching volunteers contribute more than 1,000 hours of support in the adult learning classes alone. Volunteering has benefits for the individual too. It can provide a pathway to paid work and 8 of our volunteers progressed into employment this year.

Our adult education programme continues to go from strength-to-strength. 642 learners completed more than 25,000 hours of English language learning in the year with an 77% course success rate. We have developed the programme this year by offering a series of digital education sessions at local libraries. 122 older people completed 862 online learning packages through this course, giving them greater confidence to get online.

Away from adult education in 2015 we worked with a group of local partners to launch a Creative Employment Programme of apprenticeships for young people. In the first year we placed 15 apprentices with 11 local creative employers, including three at Westway Trust itself. For the second year of the programme we are extending the programme to include flexible creative internships.

Creating an innovative childcare

programme for organisations who need

affordable crèches to ensure inclusive access

to their programmes

Developing routes to employment

and career development opportunities for the

local community

Providing a first step for learners for whom more formal

teaching is not suitable

Leading a partnership of

supplementary schools that provide extra

learning opportunities to children and young

people who face cultural and language challenges

Increasing the uptake of

employment and apprenticeship

opportunities for young people in the creative

industries

Exploring and offering innovative workspace solutions for

creative businesses

29

122 older people completed 862 digital education packages11 creative apprentices in the

second year of the project

675 students attended supplementary schools

77% adult education course overall

success rate in 2014/15 academic year

2,118 hours of training accessed by

parents because of mobile crèche

642 adult learners accessed 25,000

hours of English language learning

8 volunteers progressed into employment

1,000 hours of teaching volunteer support

28

Children designing a poster for their dance performance as part of a supplementary school.

Plans for the future

We will introduce new courses

for those wanting to start businesses

or social enterprises

31

This year, Ella Marak-Freeman completed an apprenticeship on the Creative Employment Programme which helps young people into jobs in the arts.

Ella said that thanks to her year at the Carnival Village Trust - which helps prepare for the Notting Hill Carnival and runs two local venues, The Yaa Centre and The Tabernacle - she feels better prepared to take the next step in her career.

She gained a wealth of experience, and cites among the highlights, taking charge of the marketing and promotion of an open day at The Yaa Centre showcasing Carnival Arts, which resulted in its biggest ever turnout.

Ella, who lives near the Westway, attended the BRIT school for performing arts in Croydon before deciding she would rather work behind the scenes.

After an unhappy stint working in retail, she took up the creative apprenticeship in arts administration.

She said: “The apprenticeship opened so many doors to me. I’m more confident in my own skills and I realise what I’m capable of, aside from performing arts, because there was so much scope in where I wanted to take the apprenticeship. I’m more employable and can do administration, organisation and management.”

“When I started at the BRIT school I wanted to be on stage in the West End but after two years I realised it was very intense and I realised I wasn’t competitive enough because of the constant knockbacks.”

On the benefits of her apprenticeship she added: “I’ve learnt a lot and developed skills, such as the power of networking in a tight community. In Carnival everything can depend on who you know so it is important to foster relationships and make sure they are kept alive. I’ve also learnt the value of marketing and social media.”

Since completing her apprenticeship with the Carnival Village Trust, Ella has set up her own online TV station.

Ella (far right) with some of the other creative apprentices.

“The apprenticeship opened so many doors to me. I’m more confident

in my own skills and I realise what I’m capable of...”

WESTWAY STORIES

In its second year of operation Westway Popup Crèche, which provides mobile crèche facilities in and around the Royal Borough of Kensington and Chelsea, exceeded all of its targets, providing more than 750 hours of care to support 190 parents and carers.

The development plans we have been working on include exciting opportunities to create new spaces for creative entrepreneurs to flourish. The area is already home to many artists, makers and creatives and where they want to turn their creativity into employment we want to support them. Our property portfolio already accommodates an impressive range of creative entrepreneurs and organisations with a vested interest in the cultural success of the area. In addition we are proposing new pop-up cultural and enterprise spaces on Thorpe Close and new arts and cultural spaces, as well as more shops and workshops as part of the Portobello Scheme.

30

We will offer part-time nursery places for two-year-olds

We will extend the Creative Employment

Programme to offer

We will join a scheme that trains people to be reporters

telling their community’s story

We will support creative entrepreneurs through new

spaces and programmes that help grow

their businesses

HEALTH, SPORTS AND FITNESS“We give opportunities to young

people some of whom didn’t make the grade at college or who left school early. There are opportunities within football but also to become an apprentice with us.”

Kevin Lema works for Let Me Play, a

youth training provider that uses the

sports pitches at Westway Sports and

Fitness Centre.

33

Kevin Lema (left) coaching under the Westway.

32

Providing excellent and accessible

sports and fitness facilities in the heart of

the community

Developing a vibrant sports

engagement programme that encourages more

people to get active and promotes healthy

behaviours

Focusing on priority groups who experience the greatest

health challenges

Building partnerships that

promote good health and wellbeing in our

community beyond our estate-based facilities

Making sure our sports

enterprise offers jobs and training pathways

for local people

We will promote a healthy, more active, community by

This year our sports and fitness centres received nearly 600,000 visits. That includes nearly 250 people who were referred to our award-winning GP exercise referral scheme for people with a variety of physical and mental health conditions. Referred patients get a 12-week programme of analysis and support and most achieve their health goals and tell us it has increased their wellbeing.

Our plans to widen access to under-represented groups saw nearly 1,500 visits to the fitness centres by 13-17 year olds, over 5,000 visits by carers and over 5,500 visits to women-only classes and sessions.

We have improved our facilities wherever possible, including adding 60 new climbing routes to over 200m2 of refurbished climbing walls, refreshing what we offer for one of our core sports.

This year we concluded a feasibility study which demonstrated that it would be possible to create new horse riding facilities on the estate. We hope that an improved and more sustainable riding centre will bring the benefits of riding under the Westway to many more people. We are exploring a number of options for how to bring this about, including supporting a local group to build the capability to run such a facility sustainably.

34 35

600,000 visits

to the sports and

fitness facilities

90% of people on GP exercise

referral built exercise into their

daily lives

2,000 members

of the fitness centre

1,500 fitness visits

by 13-17-year-olds

5,500 visits to

women only classes

60 new climbing routes

Westway Sports and Fitness staff member Koroush Nikpour-Valiseh speaking to customers.

5,000 visits by carers

Plans for the future

We will continue the feasibility

and development work on a new

community stables and riding school

We will complete the process of appointing an

operating partner and

hand over the day to day running of

the services to them.

36 37

In January 2015 local resident Roderick McDougall had a heart attack and had to have a double heart bypass. He was also diagnosed with high blood pressure and type 2 diabetes.

“After a bypass you lose a lot of weight and it’s all muscle. They have to open you right up and you lose upper body strength so it’s not just about getting fit and being healthier but rebuilding all that muscle.”

Three months later, as his rehabilitation began it was recommended he get a referral to the Westway Sports & Fitness Club on Thorpe Close.

“Getting to the rehabilitation classes I was first set up with was a nightmare but the gym is just round the corner from me and takes less than ten minutes to walk to.”

Roderick, now 73, had never visited a gym before but he was taken through a comprehensive assessment by Westway Trust Community Sports Engagement Manager and trained exercise specialist Warren Albrecht who set up an exercise plan for him and gives him regular advice and assistance.

Warren and Roderick have formed a great partnership over a year of twice weekly gym visits. “You can’t underestimate the impact Warren has had. You need an expert to make sure you’re making progress without pushing too hard. He makes sure I’m working within my limits and doing things like ensuring I take a good rest between sets of exercises or that I slow down if I’m feeling tired.”

“My motivation to keep up the work came from two places. I’ve got two young

grandchildren I want to see grow up and I want to be able to play a full-round of golf on my own. The girls are changing every day which I love to see and this summer I went on a four-day golf holiday.”

“I feel a real responsibility to keep it up because of all the money the NHS invested in putting me back together and all the time people, not least Warren, have put in to helping me get better.”

Roderick is now in the second phase of his rehabilitation and building up the strength he lost after the operation and is delighted with the progress he’s making.

“Nothing will ever be quite the same but I’m now able to do things again that I’d previously taken for granted and as Warren says, I’m probably fitter now than I’ve ever been.”

You can’t underestimate the impact Warren has had. You need an expert to make sure you’re making progress without pushing too hard.

Resident Roderick McDougall with Community Sports Engagement Manager Warren Albrecht.WESTWAY STORIES

For the past two years we have offered a scholarship fund of £5,000 to support young athletes of outstanding potential to help with costs such as coaching, competition expenses and training fees. The scholarships are made in memory of Tim Davis, a former Westway Trust trustee who sadly passed away in 2014. This year’s athletes have come on in leaps and bounds and one, weightlifter Adrian Cañaveral, is training with a regional development squad and aiming for the 2020 Olympics.

Looking to the future and the sustainability of the sports operation, this year we made the decision to appoint a partner organisation to help us achieve our ambitions for sports and fitness. This decision was the culmination of nearly two years’ work to identify a way of operating our sports facilities that best serves the community. The result is one of the most significant and exciting changes at the Trust in some years. Sports and other active pursuits have always been a big part of life under the Westway and our new delivery partner will bring scale and experience that will help even more people to be active and will lead to millions of pounds of much-needed investment in the facilities themselves.

We will increase the numbers of local people

taking part in sports and

physical activity

We will start to build a vision of

enhanced urban sports provision in partnership

with the community

We will begin the process of

planning significant new investment in the

facilities with our partner organisation

“I love the local area, having worked here for over 30 years. In addition to providing employment locally, we offer a local professional service to a diverse mix of customers, mostly local residents.”

Declan McBride runs Kensington

Autocare, an independent garage

who lease a bay under the Westway

on Malton Road. They carry out

MOT testing, repairs and servicing

and employ five people.

STEWARDSHIP

3938Hassan El Hourani an apprentice

with Kensington Autocare.

The Westway estate has a dual purpose in enabling us to support the local community – it provides space for activity and generates income that we can invest back into the estate and into the range of programmes we support.

Through careful and considered management we have been able to maintain an occupancy level of 98% across the estate throughout the year as well as providing 25 units for charity use and space for pop-up events. Over 100 businesses, ranging from music promoters and designers to luxury lingerie and bike repairs have established their practice here. In addition, charity tenants, who provide support for people with mental health challenges, older people, migrant and refugee communities, artistic organisations and organisations supporting people through bereavement to name a few, all reside under the Westway.

Undoubtedly, there are parts of the estate that are in need of investment. We have embarked on a programme of engagement around three development projects – the Portobello scheme, animating Thorpe Close and reimagining the Maxilla site. Using door-knocking,

surveys, workshops and a presence at community meetings we are making sure we understand local needs and desires for the Westway estate.

Through engagement during February and April, coupled with the consultation in 2015, we have re-thought parts of the Portobello scheme and made some important changes.

The principles of the scheme (more support and improved facilities for market traders and retailers, more open and accessible public spaces, space for arts and community activities and much needed housing), the footprint and plan for next stage of engagement has been agreed by the Board and a set of drawings and computer-generated images are being developed for the public to consider in the Autumn 2016. Plans are being developed to understand the financial viability of the whole development, which will be undertaken in phases. Included in the drawings in the Autumn will be a vision for the public realm and Portobello Green, informed by feedback from the community from drop in sessions held on the Green in June and July 2016.

Undertaking an annual programme of

planned investment in the estate and facilities

Managing the property portfolio in a responsible and

responsive way

Seeking to maximise the

community return from the Trust’s land

and spaces

Actively planning and managing the future development

of the estate

Safeguardingand promoting the area as a great place to live,

work, play and visit

We will actively and responsibly manage the Westway estate

to ensure it can deliver in the long term for the local community by

40

13 charity tenants in 25 units

98% occupancy across the estate

30 sole traders or small businesses 15 additional new shops and

workspaces

More than 2,000 square

feet of market storage space6 visitor toilets

At least 5,000 square feet of

flexible arts and culture space

Knocked on the doors of over 700 local residents

Had conversations with over 160 people on the door step

41

150 jobs created

Re-thinking the Portobello scheme:

Studio TILT leading workshops attended by 50 local residents to develop plans for Thorpe Close.

Some 1,100 veterans have got their lives back on track thanks to the work of the Warrior Programme, which rents office space on Thorpe Close at a reduced rent.

The charity was set up by former chartered accountant Charlotte Cox and has been a lifeline to those who have struggled to re-adjust to civilian life.

Many of those it has helped have served in Afghanistan or Iraq but they have also come to the aid of veterans of conflicts in the Falkland Islands, Northern Ireland and Bosnia.

Charlotte said: “The charity is basically for individuals who are not able to cope. They may have a mental health problem,

alcohol issues, be unemployed or a relationship has broken down. A lot of it stems from what they went through in the services or, not being able to cope when they left the services.”

Trainers at Warrior teach visualization techniques – known as ‘timeline therapy’ – to help veterans come to terms with their past and plan for the future.

Charlotte said: “It teaches people to deal with what happens in the future and ensures they are focused, motivated and have the resilience and confidence to go and build the life they want.”

The NHS refers patients to Warrior and the charity also has links to the Royal

British Legion and military charities Combat Stress and SSAFA.

A small staff team is based under the Westway, and Warrior also runs residential courses in the southwest as many veterans prefer rural areas.

Funding comes from the National Lottery, the Royal British Legion and Warrior had a £1m windfall out of the fines imposed on banks for the Libor scandal.

Veterans typically stay on the course for up to nine months, Charlotte said, “After 12 months we make sure they have flown the nest but they will always be Warriors so they can come back whenever they need to.”

Charlotte Cox Co-Founder of the Warrior Programme.

42 43

Plans for the future

Maintain at least 95% occupancy across the estate

Last year we secured £125,000 from the Mayor of London’s High Street Fund with the Royal Borough of Kensington and Chelsea as our partners to bring life to Thorpe Close with a series of pop-up units, providing more opportunities for start-ups, entrepreneurs and small businesses. We held a series of co-design workshops with fifty people who live and work locally about what they would like to see in the space and how that would look. All feedback has been collected by the architect, Studio TILT, to develop a vision for animating the street.

In May 2016 we started the process of reimagining the Maxilla site. Nearly 300 people provided us with views. There was widespread support for facilities and spaces that support young people, the community at large, artists and the creative industries. People want improved public realm with safer, greener, cleaner more connected spaces all of which will be built into the vision and principles for any proposal that is brought forward.

This year we have been negotiating with the Royal Borough and Transport for London to achieve greater security of our lease agreement by increasing our remaining lease term to 150 years. This would be an extension of 65 years and would guarantee that the land will stay in community hands until at least 2167. This negotiation is a priority as it will not only protect a valuable community asset, but also give confidence to potential partners wishing to invest with us.

WESTWAY STORIES

“We teach people to deal with what happens in the future so they have the resilience and confidence

to build the life they want.”

Using community feedback we will

share a draft vision for Thorpe Close and seek

planning permission later in the year

Conclude negotiations

with the Royal Borough and Transport

for London on our head lease

Findings from the Maxilla survey will be used to develop a

vision for the site that we can discuss

with the community

We will finalise plans for the

Portobello scheme, showing the plans publicly, with the

aim of securing planning permission

and beginning work next year

Abundance ArtsAge UK Kensington and ChelseaAssociation for Cultural Advancement of Visual ArtAzza Supplementary School*Catalyst Housing LimitedCatholic Children’s Society (Westminster)Chelsea TheatreChelsea & Westminster Swimming ClubChildren’s & Parents Carnival AssociationCommunity Accountancy Self HelpCorner Nine Arts ProjectDadihiye Somali Development OrganisationDalgarno Neighbourhood TrustDalgarno Supplementary School*Earl’s Court Community TrustEbony Steelband TrustEchoes of Spain 1936-39 ProjectEPIC ELM CIC*Eritrean Cultural Support Group & African Refugee ProjectEritrean Gheez-Rite Community AssociationEthiopian Women’s Empowerment GroupGate Theatre*Gloucester Court Reminiscence GroupThe Golborne ForumHammersmith & Fulham Mind Hand In Hand GroupHarrow Club W10HELP Counselling & Support

The Hip-hop Shakespeare Foundation Ltd Kensal Community AssociationThe Kensington & Chelsea FoundationKensington & Chelsea Mental Health AssociationKensington & Chelsea Social CouncilLancaster West Children’s Community Network*Latymer Christian CentreMaking Communities Work and Grow*Notting Hill Housing TrustNOVA New OpportunitiesNucleus Earl’s Court Community ActionOctavia Housing and CareOpen AgePepper Pot Day CentreRegeneration TrustResponse Community ProjectsShahrzad OrganisationSilchester Residents’ Association*Sion Manning RC Girls SchoolSt Helen’s ChurchSt Helen’s Residents’ AssociationSwinbrook Estate Residents’ AssociationTavistock Crescent Residents’ AssociationVenture Community AssociationVolunteer Centre Kensington & Chelsea*West 11 Housing Co-operative*West London Bowling ClubWest London CitizensWestway Community Transport

Member Organisations of the Trust The Trust would like to acknowledge and thank the following organisations for their support throughout the year:

4544

A stallholder and their stall at the Portobello Vintage Market.

* Indicates member organisations who have joined the Trust in2015-16.

44

Our PartnersDadihiye Somali Development OrganisationDalgarno Supplementary SchoolDance WestDandADDeloitteDesign MuseumDisability Arts OnlineDisability Sports CoachDogs TrustEngland Squash and RacketballEnglish Federation of Disability SportEPIC ELM CICEqual People MencapEritrean Parents’ and Children’s AssociationEton Fives AssociationFerArtsThe First Georgian Supplementary School in the UKThe Football AssociationFreesport Fund LGAFuture of LondonGate Theatre Gheez-Rite Supplementary SchoolGolborne FestivalGolborne Youth Community CentreGoldfinger FactoryGood Stock ShopGreater London AuthorityGriffin Gallery/Windsor & NewtonThe Grove TrustGumball 3000 FoundationGypsies and Traveller’s Group (RBKC)Hip Hop Honours UKThe Hip-hop Shakespeare CompanyI Love MarketsImperial CollegeIntermission Theatre

Institute of EducationJohn Lyon’s CharityK.W.A.M.E projectKensington & Chelsea CollegeThe Kensington and Chelsea FoundationKensington and Chelsea Social Council Kensington & Chelsea TMOKindred StudiosLancaster Road Youth CentreLawn Tennis AssociationLet Me PlayLloyds Banking GroupLondon Basketball AssociationLondon Youth GamesLord’s TavernersLyric HammersmithMaking Communities Work and Grow - Al-Amaana Supplementary SchoolMeanwhile Gardens Community AssociationMetro BlindMichael SpeechleyMidaye Somali Development NetworkMINDMoroccan Supplementary SchoolMuse GalleryMuseum of BrandsNational GalleryNational Resource Centre for Supplementary EducationNICOLA (New International Company of Live Arts)Nottii Hill SalonNotting Hill Visual Arts FestivalOpen AgePanthea LeadershipPimento Community ProjectPortobello DancePortobello Film Festival

Portobello Photography GalleryQuestInTransit FestivalNOUR FestivalResponse Community ProjectsRhythm StudioRoyal Borough of Kensington & ChelseaSerious MusicShaftesbury PLCShane Connolly & CompanyShape ArtsSkills ActiveSkylark ConsultancySomali Women’s AssociationSport EnglandSteve Mepsted PhotographyStreet LeagueTennis FoundationTinder Foundation UK OnlineThird Sector Potential / Equal People MencapTransport for LondonTrapstarTriborough ASC Commission TeamTriborough Public Health ServiceUK ActiveUK WallballV&A MuseumVenture Community AssociationvInspiredVital RegenerationVolunteer Centre Kensington and ChelseaWest London Bowling ClubWest London Moroccan WidadiaWest London Turkish SchoolWestbank GalleryWorld’s End Under Fives CentreZnaniye

46 47

Westway Trust could not have achieved what we did in 2015-16 without the collaboration and support of these organisations.

A New DirectionAcklam VillageActivateAfropolisAge UK Kensington & ChelseaAlbanian School “KOSOVA”All Star Youth Tennis ScholarshipAl-Noor Youth AssociationAn-Nisa Women’s EmpowermentArt MovementArts CouncilAssociation of British Climbing WallsAzza Supplementary SchoolBaraka Community AssociationBattersea Arts CentreBountsBritish Equestrian FederationBritish Mountaineering CouncilBritish WeightliftingCampden CharitiesChildren & Parents Carnival AssociationCapel ManorCarnival PioneersCarnival Village TrustCatalyst HousingChange4LifeChelsea TheatreCity Bridge TrustThe Clement James CentreCommunity Sport and Physical Activity NetworkCorner 9 ArtsCountrywide MarketsCreative and Cultural Skills

A local group helping children with sewing skills.

46

48 49

STRATEGIC REPORTINCORPORATING FINANCIAL REVIEW

48The plant room at Westway Sports & Fitness Centre.

Financial reviewIncome and expenditure summary

2016 2015 £’000 £’000

Total income 8,078 8,162

Expenditure on charitable activities (6,966) (7,012)

Property costs (910) (835)

Operating result 202 315

Property revaluations - 6,868

Pension gains and losses 302 (228)

Net movement in funds 504 6,955

IncomeWestway Sports & Fitness generates the largest part of our income: at £4,425,000 it is 55% of total income and showed growth of 2% over the previous year. Football and tennis maintained their strong performances. Climbing showed some pressure from increased competition and we have responded by refurbishing a substantial part of the climbing walls and income has already picked up in the current year. Memberships at the Fitness Club are also under pressure and there is a need to invest in the facilities to meet the expectations of users. All this reinforces our view that we need to work with a sports operation delivery partner to lead on investment in our facilities to grow and maintain participation in sports and fitness.

Income from rentals has not changed significantly. We are now offering short leases or short lease extensions on properties that comprise the redevelopment zone around the Portobello Road and Acklam Road junction. While we recognise that short-term tenancies could have provided a disincentive to some potential tenants, we have maintained an occupancy rate of 98%.

The Royal Borough of Kensington and Chelsea’s decision to close the Maxilla Nursery in the Summer of 2015 was not only disappointing for us because of the loss of a valued local facility but had the additional impact of a loss of income for us. The process of consultation with local

residents about the future uses for the Maxilla area is underway. Given the scale of the challenge we expect that the Trust will need to identify suitable partners if it is to develop the site in the future. ACAVA, a local organisation has taken up temporary tenancy which is providing a small income to Westway Trust in addition to studio space for local artists.

With the transfer of the Health Trainers project last year there is a reduction in grant income from the project’s funder, contributing to an overall decrease in the Trust’s income of £84,000 (1%).

50 51

Charitable expenditureExpenditure on Sports & Fitness grew by £71,000 (1.5%). We fund a number of targeted sports and fitness initiatives and ensure our fitness provision remains well- priced for the local community. The amount we spent on providing those facilities and services was £433,000 higher than our income from Sports & Fitness, very similar to last year’s net cost. Spending on Learning, Futures and Presents…. all grew (by £55,000 in total), but the significant shift was the reintroduction of the Trust’s community grants programme for local charities and community groups, with a £100,000 grant pool and that programme will be continued in 2016/17.

Property costsThe costs of running and maintaining our estate rose by £75,000 during the year (15%). The increasing number of short-term lets has put added pressure on our Property team and we hired some interim help to deal with the workload. We have also been seeking to resolve a number of complex tenancy issues where we have identified that we need to update or amend the formal basis on which our land is occupied; this has involved a great deal of management time with some technical and legal advice that has led to an increase in costs during the year. Part of that work has involved two studies for equestrianism (a review of the provision and a feasibility study) and we are continuing to examine a wide-range of options in this area, which include continuing discussions with a newly-established community interest company.

Children playing on one of the Westway sports pitches.

Balance sheetFollowing the introduction of Financial Reporting Standard 102 (see Accounting Policy 1.1), the trustees have looked again at how they value the property portfolio each year, and will generally only seek an external valuation every five years, unless they believe that there has been a material movement in the underlying value of the investment portfolio, or if there is a good reason to seek external appraisal more regularly. Whereas the trustees do not consider there was a material change in the value of the portfolio over the year, there is now considerable uncertainty in the property market following the UK Referendum result to leave the European Union. Neither our professional advisors nor the trustees are yet able to state what impact this has had on the balance sheet. However, it is not the intention of the trustees to dispose of the Trust’s Estate and any fluctuation in value will be a book entry.

The deficit recorded on the Trust’s final salary pension scheme fell to £156,000 at the end of the year, against a deficit last year of £443,000. That represents an actuarial gain of £302,000 against a loss last year of £228,000, These movements are actuarial estimates that do not affect the cash flow of the Trust.

Ahead of significant development works, the Trust continues to hold healthy cash reserves. Those funds will almost certainly be reduced over the coming two to three years as we start work to provide new opportunities for arts and small businesses around Portobello Green and hopefully to improve our Sports & Fitness facilities and provisions.

Business planningWe have created a 15-year plan to improve the Westway estate, drive significant social, economic and environmental benefits and to refocus our charitable delivery into areas of greatest need, where we believe we can make significant impact.

Leading up to the development of that plan, we worked closely with the local planning authority to influence the planning framework that covers the estate. We undertook public consultation on the implications of that framework and, in parallel, we worked with our legal advisers to resolve many of the highly complex land title issues that may affect future development and maintenance. We have prioritised five broad development areas on the estate and have taken concept designs for the first of these at the junction of Portobello Road, Acklam Road and Thorpe Close out to consultation with local residents and businesses. We have revised the plans for the Portobello scheme following that consultation and will complete our assessment of the financial viability of the options before presenting the updated plans for final consultation and then for planning permission.

All potential developments will be assessed in light of the planning framework, the economic viability of the schemes and their inherent risk. We have established the Trust’s capacity to fund development from commercial borrowing and will progress work if we consider the funding is affordable. Scheme

by scheme we also consider opportunities to generate income to ensure the Trust’s risk exposure is contained. As part of our overall approach to business planning, we also consider the ongoing need to fund a number of projects at the same time and, as such, we will not want to exhaust our capacity to borrow solely on one part of the estate.

We have established an ambition to ring-fence a minimum of 10% of our net rental property income for grant giving to the local community and charity sector. However, we also need to make adequate allowance within our property budgets to maintain the estate. We recognise that there is a significant amount of work for us to do to improve parts of the estate in terms of public realm, safety, environmental impact and vibrancy, in turn safeguarding the economic wellbeing of the area. This is a priority for us over the next 15 years, and is at the fore of our stewardship commitment.

We have worked with Deloitte over the last two years to assess the efficiency and effectiveness of both our property management and sports operations. We have used the learning from that consultancy and have now made the decision to a partner to work with us to deliver high-quality, high-impact services in our sports facilities. We have established a suite of charitable programmes aligned to our strategy which span health, wellbeing, environment, culture, economic prosperity and community which are covered in detail throughout this report. We completed the restructure of the Trust team to be focused on those new programme models during the next year.

We set annual revenue budgets, centred on our strategic programmes, to ensure we continue to manage the Trust in a sustainable way. We will complete detailed asset management plans in line with our development ambitions, to safeguard the potential of the estate to deliver value for the community.

Achievements and performanceOur strategy and performance against charitable objectives is discussed in detail on pages 13 to 43 of this Annual Report.

52 53

Local residents enjoying the Christmas Festival.

Our approach to sustainabilityUnderpinning our work are three pillars of sustainability – economic, environmental and social sustainability. Economic sustainability is demonstrated in two ways: in ensuring the estate generates enough income to be able to provide for significant charitable activity as well as reinvest in the development of the estate; and by creating vibrant employment and enterprise opportunities for local people. Environmental sustainability is not just about how we respond to the impact of the motorway (although our response to the impact of the motorway is important and central to our environmental strategy), it is much broader than that. Environmental sustainability supports initiatives across the estate and in our own organisation for example lowering our energy consumption and being energy efficient, tree planting and greening, reducing our carbon footprint, recycling and better waste management. Finally, playing a role in building social sustainability locally is at the heart of our charitable objectives. Our charitable objects set out clearly our focus on improving people’s life chances and tackling social inequality by supporting those in need in our area of benefit through education, employment, skills and through celebrating culture and heritage.

Risk and controlWestway Trust has long-standing financial controls that are authorised by the trustees and periodically reviewed and updated. We have a comprehensive organisational risk assessment and have identified the principal risks, both financial and operational, to which we consider the Trust is exposed. The trustees have put in place the controls they consider to be realistic and practical to mitigate the risks identified. The main risks include: the Trust’s exposure to the property rental market, as the Trust’s rental income underpins the costs of its targeted, charitable activities; the condition of the Trust’s property estate; the potential disruption that may be caused by maintenance works to the elevated highway; and the delivery of safe, high-quality services to the public, including young people and vulnerable adults.

Reserves policyThe trustees set aside available funds for foreseeable needs and for planned refurbishment and environmental improvements. The trustees also set aside a small amount each year, when rental income is strong, to allow for some flexibility in periods of economic downturn. Although grant funding for projects is less than 10% of the Trust’s income, our strategy is placing greater emphasis on non-trading projects that will make those activities more vulnerable to changes in the external funding environment. In order to protect such projects from the loss of short-term funding, a target for a minimum level of free reserves has been set at three months’ grants receipts for project delivery, together with three months’ expenditure on the Trust’s infrastructure. That currently equates to £533,000. Free, undesignated reserves now stand at £479,000 as at 31 March 2016. The difference between target and actual free reserves is not considered significant and the Trust holds a number of additional designated funds that are available to draw upon should the need arise. Note 18 to the financial statements gives greater detail on the purposes of the designated funds of the Trust and the reasons for holding those funds.

Investment policyThe trustees have set aside 15% of Trust land for commercial development to provide shops, offices, light industrial units and other suitable buildings that fit within the Trust’s property strategy. As the Trust is looking to invest significant funds in improvements to its estate, the trustees do not consider any other form of long-term investment to be relevant and surplus cash is placed on bank deposit, so that it is then available to draw down in the short term as the need arises. In parallel to those improvement works, the trustees are now looking to create a longer-term investment policy as part of the Trust’s financial sustainability strategy.

Treasury policyThe Trust deposits its cash funds in UK-based financial institutions authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority. The Trust only deposits funds in institutions with acceptable credit ratings. A variety of instant access, short-term and medium-term deposits will be made to allow funds to be drawn down according to the needs of the Trust’s forecast cash flow.

Whilst the Trust plans and undertakes multi-million-pound development opportunities, it will seek to hold treasury reserves in the order of £500,000 to protect the ordinary activities of the Trust from unforeseen events during those developments.

Accounting policyThe Trust adopts suitable accounting policies to ensure its published financial accounts show a true and fair view of the income, expenditure, unrealised gains and losses and state of affairs of the Trust. This includes complying with the requirements of FRS102: the Financial Reporting Standard applicable in the UK and the Republic of Ireland and the Charities SORP (Accounting and Reporting by Charities: Statement of Recommended Practice), modified as necessary to provide a true and fair view of the Trust’s financial results and financial position.

Going concernThe trustees have reviewed the financial position and financial forecasts, taking into account the levels of reserves and cash, and the systems of financial control and risk management. As a result of this review, the trustees believe that we are well placed to manage operational and financial risks successfully. Accordingly, the trustees consider that the Trust has adequate resources to continue in operation for the foreseeable future. They continue to believe it is appropriate to adopt the going concern basis of accounting in preparing the annual accounts.

54 55

Grant distribution

5756

Westway Trust runs a number of different grant making programmes that support organisations and individuals within the Royal Borough of Kensington & Chelsea. These include:

Rent subsidiesWe provide 25 separate offices within our property portfolio that are available for rent by local charities at one-third of market rent.

Apprenticeship schemesWe currently run a scheme that promotes apprenticeships within the creative industries and we provide employer grants through funds that are contributed by the Creative and Cultural Skills Council and private funders.

Small grants to local charitiesOur current schemes provide a total of £100,000 to local organisations through bi-annual grant schemes.

Partnership grantsWe also make partnership grants to local organisations as part of our cultural events programme.

Grants to Supplementary SchoolsWe provide allocations to Supplementary Schools and other education providers from funds provided by both statutory and private funders.

Sports grantsA small number of grants are given to individuals to help them develop their sporting potential, including the Tim Davis Scholarships, which provide funding for local individuals to progress to excellence in their chosen sports.

Total grants made£401k

Adult and Community learning

Local charities

Supplementary schools

Sports bursariesEvent sponsorship

Creative Apprenticeships

Charity rent subsidies

72 organisations supported

More than 15,000 people reached through grant supported work.

22% increase in grant funding from 2014/15

Where we giveEach dot represents the location of one or more organisations who received funding

RBKC

£58k

£9k£27k

£180k£88k

£21k

£18k

58 59

STRUCTURE, GOVERNANCE AND MANAGEMENT

58

An adaptive yoga class at Westway Sports and Fitness Club.

Kensington & Chelsea, and of the intention when the Trust was established to make a local impact. In response to conversations with trustees, Member Organisations, local people and other interested parties, this year we have created and published a policy on our area of benefit which clarifies our areas of work and renews our commitment to a local focus.

The policy stipulates that when managing the Westway Estate, we shall develop and maintain the land for the benefit and enjoyment of everyone who lives and works in the Royal Borough of Kensington & Chelsea. The greatest impact of the Trust’s work will be felt within the five northern wards of the Royal Borough of Kensington & Chelsea (North Kensington) and the area within about a quarter of a mile of the Westway Estate.