Wells Fargo Private Bank Enrique, Henry Balderas Vice President, Sr. Wealth Management Consultant...

-

Upload

mercy-hudson -

Category

Documents

-

view

226 -

download

0

Transcript of Wells Fargo Private Bank Enrique, Henry Balderas Vice President, Sr. Wealth Management Consultant...

Wells Fargo Private Bank

Enrique, Henry BalderasVice President, Sr. Wealth

Management Consultant

Phone: 213-253-3620

Mobile: 213-280-0466

HOPE – 2009 Financial Success Program

2

Topics of Discussion:

Living The Life of Your Dreams

Determine Your Net Worth

Define Your Monetary Values

Set Financial Goals

3

Living The Life of Your Dreams (Financially)

A Financial dream is something you hope for; a financial goal is something you've planned for. And it's the planning, not the hoping , that turns financial desires into financial reality.

Rules to Live by and help you get started to achieve success:

Credit – Always protect your credit and always try to keep it in good standing

401K – Try and maintain a committed monthly amount towards retirement

Savings – Try and maintain a savings account for those rainy days

Credit Cards – Set rules for yourself to keep your debt in check

Lifestyle – Live within your means, try not to get involved in keeping up with the Jones

4

Living Your Life Dreams - Continued

Do you have access to the skilled advice of your own personal banker?

Private Banker

Does your asset manager advise as to the tax and estate implications of different buy/sell/hold Real Estate?

Real Estate Agent

Does your current broker manage your portfolio with your total wealth and future plans in mind?

Broker

~ Who is giving you proactive advice about growing your business through prudent credit planning? What about succession planning?

~ Who is helping you evaluate your retirement plan options?

~ Who is providing you with hedging or monetizing strategies to minimize the risk in your investment portfolio?

Investment Manager

Estate PlanningAttorney CPA

Are your investment manager, estate planning attorney and CPA communicating effectively with each other? Are they coordinating your plan’s financial, tax, and legal aspects?

Does your agent understand all of the ins and outs of using insurance to replace wealth that may be lost to estate taxes?

InsuranceProfessional

Key to Success: Always work with reputable professionals in their field of expertise!

5

Determine Your Net Worth

How Can you determine your net worth:

Cash, money held in bank accounts, money market accounts or Certificates of Deposit (CDs)

Personal property, including homes, cars, boats and recreational vehicles, furniture, art, antiques, collectibles and

jewelry

Investments, including stocks, bonds, mutual funds, annuities, the cash value of any life insurance policies and real

estate

Retirement savings, including employee pension plans, 401(k) or 403(b) accounts and IRAs

Tips:

Use antique and collectible books to assess the value of your collections. Use Kelley Blue Book to determine the value of

your vehicles.

Update your net worth yearly or whenever there is a major change to your finances

How is Net Worth Calculated?

Net Worth is calculated by subtracting your liabilities (debts) from your assets. Depending on your finances, the resulting

figure can be positive (desirable) or negative (not so desirable).

6

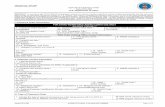

Personal Financial Statement – PFS Copy attached

7

Financial Blueprint

Life Stages

Single Married Child Birth School College Empty Nest Retire

Different needs… Different priorities…

Define Your Monetary Values

8

Define Your Monetary Values - Continued

Define what is most important to you:

Comfort

Stability

Pleasure

Happiness

Protection

Retirement

9

Define Your Monetary Values - Continued

Define what is most important to you:

Wealth

Lifestyle

Image

Philanthropy

Legacy

Business Ownership

10

Set Financial Goals

List your financial goals by how long you think it will take to achieve them. Place goals that can be accomplished in under six months under "Short-Term Goals," goals that can be accomplished in six months to a year under "Medium-Term Goals," and goals that will take more than a year to accomplish under "Long-Term Goals."

Some examples of Financial Goals

Buy a car

Purchase first home

Education (college)

Get married

Have children

Start a business

Invest (stocks, mutual funds)

Pay off Credit cards

Send kids to college

Travel for pleasure

Retirement

Leave a family legacy (Life insurance and living trust)

11

Set Financial Goals - Continued

Tips:

Be realistic about how much time and money it will take to accomplish each goal –

an estimate that is too low will only frustrate you.

Keep your motivation by revisiting your list frequently to check on your progress.

Setbacks will happen. If something throws you off of your target date, don't give up

– set a new date.

Have more goals than you can work on at once? Then, determine which ones are

most important to you, and make those your first priority.

12

It All Starts with You

Current Situation

Ongoing Liquidity Needs

Ongoing Income Needs

Key Tax Considerations

Long-term Investment Horizon

Unique Family Circumstances

Investment Return Goals

Risk Orientation

Managing your wealth is more than simply putting your money to work. It requires taking a step back and looking at the big picture -- your life, your priorities, your desires for the future -- and assembling financial management tools that are consistent with your plans and life goals.